#markettrends

Explore tagged Tumblr posts

Text

𝐒𝐨𝐲 𝐏𝐫𝐨𝐭𝐞𝐢𝐧 𝐈𝐧𝐠𝐫𝐞𝐝𝐢𝐞𝐧𝐭𝐬 𝐌𝐚𝐫𝐤𝐞𝐭: 𝐀 𝐆𝐫𝐨𝐰𝐢𝐧𝐠 𝐓𝐫𝐞𝐧𝐝 𝐢𝐧 𝐍𝐮𝐭𝐫𝐢𝐭𝐢𝐨𝐧

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐑𝐄𝐄 𝐒𝐚𝐦𝐩𝐥𝐞: https://www.nextmsc.com/soy-protein-ingredients-market/request-sample

The 𝐒𝐨𝐲 𝐏𝐫𝐨𝐭𝐞𝐢𝐧 𝐈𝐧𝐠𝐫𝐞𝐝𝐢𝐞𝐧𝐭𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 is gaining momentum as consumers and manufacturers alike seek healthier and sustainable protein sources. With its diverse applications and nutritional benefits, soy protein is making a significant impact across various industries:

𝙃𝙚𝙖𝙡𝙩𝙝 𝙖𝙣𝙙 𝙒𝙚𝙡𝙡𝙣𝙚𝙨𝙨 𝙁𝙤𝙘𝙪𝙨: Soy protein is valued for its high-quality protein content and benefits such as supporting muscle growth and managing cholesterol levels.

𝙀𝙭𝙥𝙖𝙣𝙙𝙞𝙣𝙜 𝘼𝙥𝙥𝙡𝙞𝙘𝙖𝙩𝙞𝙤𝙣𝙨: From plant-based food products and dietary supplements to animal feed, soy protein ingredients are increasingly being incorporated into a wide range of products.

𝙎𝙪𝙨𝙩𝙖𝙞𝙣𝙖𝙗𝙞𝙡𝙞𝙩𝙮 𝘾𝙤𝙣𝙨𝙞𝙙𝙚𝙧𝙖𝙩𝙞𝙤𝙣𝙨: As a plant-based protein source, soy protein is contributing to more sustainable food systems by reducing reliance on animal-based proteins.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.nextmsc.com/report/soy-protein-ingredients-market

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬

Dupont Ei De Nemours & Company

ADM

Cargill

Benson Hill

Now Foods

Burcon NutraScience Corporation

Farbest Brands

Wilmar International

CHS Inc.

With its growing popularity and versatility, soy protein ingredients are set to play a crucial role in the future of nutrition.

7 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

29 notes

·

View notes

Text

𝐃𝐫𝐢𝐯𝐢𝐧𝐠 𝐏𝐫𝐨𝐠𝐫𝐞𝐬𝐬: 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬 𝐢𝐧 𝐀𝐧𝐢𝐦𝐚𝐥 𝐓𝐡𝐞𝐫𝐚𝐩𝐞𝐮𝐭𝐢𝐜𝐬 𝐚𝐧𝐝 𝐃𝐢𝐚𝐠𝐧𝐨𝐬𝐭𝐢𝐜𝐬 𝐌𝐚𝐫𝐤𝐞𝐭

As the landscape of animal health continues to evolve, we’re thrilled to see the remarkable advancements in Animal Therapeutics and Diagnostics!

𝐆𝐞𝐭 𝐚 𝐅𝐑𝐄𝐄 𝐒𝐚𝐦𝐩𝐥𝐞: https://www.nextmsc.com/animal-therapeutics-and-diagnostics-market/request-sample?utm_source=sanyukta-14-may-2024&utm_medium=sanyukta-tumblr&utm_campaign=sanyukta-animal-therapeutics-and-diagnostics-market

𝐃𝐢𝐚𝐠𝐧𝐨𝐬𝐭𝐢𝐜 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬:

Cutting-edge diagnostic tools are revolutionizing how we understand and address animal health concerns. From rapid testing kits to advanced imaging technologies, these innovations empower veterinarians and researchers to make informed decisions quickly and accurately. By detecting diseases earlier and with greater precision, we're enhancing the well-being of our furry friends and contributing to a healthier world.

��𝐡𝐞𝐫𝐚𝐩𝐞𝐮𝐭𝐢𝐜 𝐁𝐫𝐞𝐚𝐤𝐭𝐡𝐫𝐨𝐮𝐠𝐡𝐬:

The realm of animal therapeutics is witnessing unprecedented breakthroughs, with novel treatments emerging to address a diverse range of conditions. Whether it's targeted therapies for chronic diseases or innovative approaches to pain management, these advancements are improving the quality of life for animals across the globe. It's inspiring to see how science and compassion intersect to create solutions that make a tangible difference.

𝐆𝐥𝐨𝐛𝐚𝐥 𝐈𝐦𝐩𝐚𝐜𝐭:

The impact of these advancements extends far beyond individual animals; it influences entire ecosystems and strengthens the bond between humans and animals. By promoting the health and well-being of our animal companions, we're safeguarding biodiversity, supporting sustainable agriculture, and enhancing public health. Together, we're shaping a brighter future for all living beings.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

The animal therapeutics and diagnostics industry consist of a number of major players including BioNote Inc, Heska Corp, IDEXX Laboratories Inc, IDvet, Randox Laboratories Ltd., SWISSAVANS AG, Teco Diagnostics, Thermo Fisher Scientific Inc., Virbac SA, Zoetis Inc., Thermo Fisher Scientific, Inc., bioMérieux S.A., Zoetis Inc., Bio-Rad Laboratories, Inc., Medical Bioscience GMBH, and Agrolabo SpA

Let's continue to champion innovation, collaboration, and compassion in the field of Animal Therapeutics and Diagnostics!

Together, we can create a world where every animal receives the care and attention it deserves.

#animalhealth#innovation#veterinarycare#healthcare#technology#markettrends#businessinsights#marketresearch#marketanalysis

10 notes

·

View notes

Text

Commercial real estate in Los Angeles County is one of the most lucrative and dynamic investment markets in the United States. With its diverse property types and thriving industries, Los Angeles offers exceptional opportunities for investors looking to build wealth and diversify their portfolios.

#CommercialRealEstate#LosAngeles#InvestmentAdvisor#RealEstateInvesting#PropertyManagement#MarketTrends#InvestmentOpportunities#PortfolioDiversification#RealEstateNegotiation#FinancialGrowth#CommercialProperties#RealEstateMarket#LosAngelesCounty#InvestmentStrategy#WealthBuilding#RealEstateExpertise

3 notes

·

View notes

Text

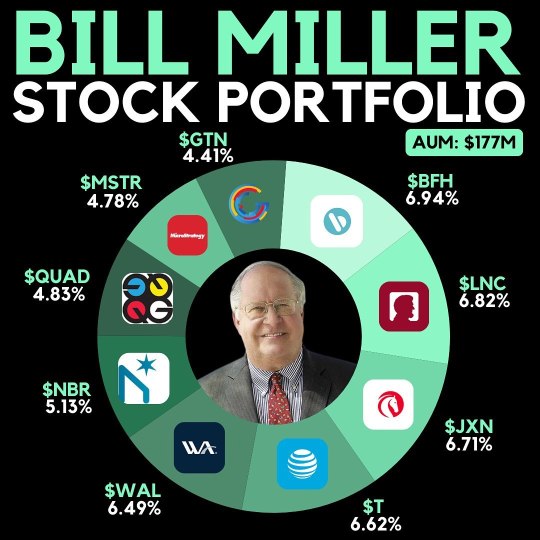

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

Bitcoin #CryptoAnalysis #BitcoinPrice #Cryptocurrency #Bitcoin2024 #Investing #FinancialFreedom #MarketTrends

ethereum

bitcoin price analysis

crypto news today

bitcoin

btc prediction

bitcoin price

btc price

bitcoin analysis today

buy bitcoin

bitcoin analysis

cryptocurrency news

altcoins

btc

crypto news

btc price prediction

bitcoin prediction

cardano

crypto today

bitcoin news today

altcoin daily

finance

bitcoin technical analysis

btc news today

bitcoin news

bitcoin crash

bitcoin btc price prediction

crypto market

crypto

bitcoin price prediction

btc technical analysis

cryptocurrency

bitcoin price today

cryptocurrencies

btc bitcoin price prediction

btc news

ripple

stock market

bitcoin halving

xrp

bitcoin today

eth

altcoin

bitcoin btc price

crypto crash

investing

bitcoin bull run

price prediction

btc today

bitcoin price analysis 20

#Bitcoin#CryptoAnalysis#BitcoinPrice#Cryptocurrency#Bitcoin2024#Investing#FinancialFreedom#MarketTrends#ethereum#bitcoin price analysis#crypto news today#bitcoin#btc prediction#bitcoin price#btc price#bitcoin analysis today#buy bitcoin#bitcoin analysis#cryptocurrency news#altcoins#btc#crypto news#btc price prediction#bitcoin prediction#cardano#crypto today#bitcoin news today#altcoin daily#finance#bitcoin technical analysis

2 notes

·

View notes

Text

Microblog: Non-NFT Trading Cards Market on the Rise 🚀

The Non-NFT Trading Cards Market is booming, driven by nostalgia and investment potential. From sports cards to entertainment collectibles, these physical treasures are making a strong comeback. Stay tuned for more insights on this growing market!

For More Details Click Here

2 notes

·

View notes

Text

Staying the Course: The Power of Patience in the World of Bitcoin

In the ever-evolving landscape of Bitcoin, it's easy to get caught up in the daily price action. Whether it's soaring to new highs or dipping into the red, Bitcoin's volatility is something that can test even the most seasoned of investors. But what happens when the price movement is more... sideways?

For me, staying the course has always been about the long-term vision. Bitcoin isn't just a short-term play—it's a strategy for building lasting wealth and financial freedom. No matter what the market is doing today, tomorrow, or next month, my approach remains the same: stack SATs, and keep stacking. This is the strategy. It’s simple, yet powerful, and it’s what keeps me grounded during these times of uncertainty.

Learning from History

History has shown us that Bitcoin often moves in cycles. Consider the periods in 2013, 2016, and even as recently as 2020. During these times, Bitcoin seemed to be moving sideways, causing doubt among some investors. However, each of these periods was followed by significant price surges that rewarded those who held on. For example, after the 2016 halving, Bitcoin’s price remained relatively stable for months, only to skyrocket in 2017. This pattern is a reminder that periods of quiet can be a precursor to something much bigger.

The Power of Patience

This strategy works because Bitcoin has shown time and time again that it rewards patience. Looking back at its history, we see a pattern: after periods of sideways movement, Bitcoin often experiences significant upward momentum. Those who have held strong through the lulls have been rewarded for their resilience. It’s not just about timing the market; it’s about time in the market.

This mindset requires discipline, especially when the market seems stagnant. It's easy to feel discouraged when Bitcoin isn't making headlines or breaking records. But it's during these quiet times that the real progress is being made. Behind the scenes, development continues, adoption grows, and the foundations of the future financial system are being laid.

The Psychology of Staying the Course

Emotionally, sticking with your plan when the market feels flat can be challenging. The constant noise from skeptics, the temptation to shift focus, and the impatience that naturally arises can all test your resolve. This is where understanding the psychology of investing becomes crucial. Fear, Uncertainty, and Doubt (FUD) are ever-present in the world of Bitcoin, often amplified during periods of sideways movement. However, recognizing these emotions and managing them is key to maintaining a long-term perspective. One way to combat FUD is to focus on the fundamentals of Bitcoin—its decentralization, scarcity, and growing adoption.

But that's when it's most important to remember your reasons for investing in Bitcoin in the first place. For me, it's about more than just price—it's about being part of a financial revolution, one that I believe will reshape the world.

A Long-Term Play

Comparing Bitcoin to traditional investments like stocks, real estate, or gold, we see a similar principle at work: long-term investing typically yields the best results. However, Bitcoin stands out because of its unique properties—its finite supply, resistance to censorship, and ability to transfer value globally with ease. These qualities make Bitcoin not just an investment, but a form of insurance against the uncertainties of the traditional financial system.

Looking Ahead

As the market moves sideways, I’ll continue to stay the course, confident in the knowledge that patience, persistence, and a long-term perspective are the keys to success in the world of Bitcoin. With upcoming technological advancements, increasing institutional adoption, and the potential for regulatory clarity, the future looks bright. The quiet periods, like the one we’re in now, are merely the calm before the next wave of innovation and growth.

So, as the market moves sideways, I’ll continue to stay the course, confident in the knowledge that patience, persistence, and a long-term perspective are the keys to success in the world of Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#Crypto#Cryptocurrency#Investing#FinancialFreedom#Blockchain#LongTermInvesting#StayTheCourse#BitcoinStrategy#HODL#SidewaysMarket#MarketTrends#DigitalCurrency#BitcoinCommunity#PatiencePays#financial experts#unplugged financial#globaleconomy#financial empowerment#financial education#finance

4 notes

·

View notes

Text

https://seekingalpha.com/user/59709217/profile

2 notes

·

View notes

Text

Market Update: Key Indices and Stocks Show Mixed Movements Amidst Economic Projections

Index Futures Overview

As the trading day commenced, the major U.S. stock index futures exhibited modest fluctuations. Dow Jones Futures traded largely unchanged, indicating a neutral market sentiment. Meanwhile, S&P 500 Futures edged up by 2 points, representing a 0.1% increase. The Nasdaq 100 Futures also climbed by 20 points, or 0.1%, reflecting slight optimism in the tech sector.

Economic Projections: Job Market Insights

Economists are keeping a close watch on the U.S. labor market data, anticipating the addition of 189,000 jobs in June. This follows a stronger-than-expected increase of 272,000 jobs in May. The employment figures are crucial as they provide insights into the health of the economy and can influence Federal Reserve policy decisions. A robust job market typically signals economic strength, while any shortfall could raise concerns about a potential slowdown.

Stock Movements: Highlights and Lowlights

Tesla (NASDAQ: TSLA): Tesla's stock saw a premarket boost of nearly 2%, continuing its trend of strong performance. This increase may be attributed to positive investor sentiment surrounding the company's ongoing innovations and expansion plans in the electric vehicle market.

Macy’s (NYSE: M): Macy’s stock surged by 4% premarket. This rise could be due to positive retail sector performance or specific company news that has bolstered investor confidence. Macy’s, as a major player in the retail industry, often reflects broader consumer spending trends.

Coinbase Global (NASDAQ: COIN): In contrast, Coinbase Global experienced a significant drop, with its stock falling 6.5% premarket. The decline in Coinbase's stock price may be linked to recent regulatory scrutiny or market volatility impacting the cryptocurrency sector.

Commodity Market Movements

Crude Oil: U.S. crude futures (WTI) rose slightly by 0.1% to $83.98 a barrel, suggesting steady demand despite global economic uncertainties. Conversely, the Brent crude contract saw a marginal decline, trading at $87.40 a barrel. These movements indicate mixed market sentiments influenced by factors such as supply concerns and geopolitical developments.

Cryptocurrency Update

Bitcoin: The world's leading digital currency, Bitcoin, faced a downturn, falling to its lowest level since February. This decline reflects broader market trends affecting cryptocurrencies, including regulatory pressures and changes in investor sentiment.

Conclusion

Today's market snapshot presents a mixed picture with minor gains in major indices and varied performances among prominent stocks. Economic projections, particularly job market data, will play a crucial role in shaping market movements in the near term. Investors are advised to stay informed about ongoing economic indicators and company-specific developments to navigate the dynamic market landscape effectively.

This article provides a comprehensive overview of the current market trends, highlighting key indices, stocks, and economic projections. It offers valuable insights for investors and market watchers looking to understand the factors driving today's financial landscape.

#MarketTrends#StockMarket#IndexFutures#EconomicProjections#JobMarket#TeslaStock#MacyStock#CoinbaseGlobal#CrudeOil#BitcoinUpdate#FinancialMarkets#InvestingInsights#MarketAnalysis#CommodityMarkets#CryptocurrencyTrends

2 notes

·

View notes

Text

Big news for Dubai property! Over 8,000 new units entered the market in Q1, but experts say there's no need to worry about oversupply.

#homestation#dubai real estate#investindubai#dubai#property buying in uae#MarketTrends#RealEstateNews#Dubailife

2 notes

·

View notes

Text

📉 Big News in the Smartphone World! 📱🌍 Apple's reign as the top smartphone seller ended in Q3 2023, with Samsung seizing the throne in Q1 2024! 🍏➡️🔝 Despite lower shipments, Samsung's market share soared, says IDC analysis.

#AppleVsSamsung#MarketBattle#TechNews#SamsungWins#MarketShift#TechRivalry#AppleDefeat#SamsungSupremacy#MarketUpdate#TechGiant#AppleLoss#SamsungDominance#MarketLeadership#TechIndustry#AppleVsSamsungBattle#SamsungVictory#MarketTrends#TechCompetition#AppleDownfall#SamsungSuccess#world news#breaking news#global news#news#usa news

2 notes

·

View notes

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Text

#localrealestate#luxuryhomes#orange county fl#market trends#dream home#markettrends#moving tips#movingtips#neighborhoodspotlight#propertyinvest

3 notes

·

View notes

Text

Fundamental Analysis of Maruti Suzuki

Established in February 1981 as Maruti Udyog Limited, Maruti Suzuki India Limited (MSIL) is now the largest passenger car manufacturer in India. A joint venture between the Government of India and Suzuki Motor Corporation of Japan, the latter currently holds a 58.19% stake in the company. With a diverse portfolio of 16 car models and over 150 variants, Maruti Suzuki caters to various consumer segments, from entry-level small cars like the Alto to the luxury sedan Ciaz.

Sales and Industry Trends

Indian passenger vehicle industry saw record sales of 4.1 million units in 2023, becoming the third largest market globally

Share of utility vehicles in the industry increased to 53% in Q3, with SUVs contributing to about 63%

CNG vehicles saw a share increase to about 16.5% in the industry, with CNG sales reaching an all-time high of ~30%

Company crossed annual sales milestone of 2 million units in 2023 and had highest ever exports of about 270,000 units

Q3 FY23–24 saw total sales of 501,207 vehicles, with net profit rising over 33% year-on-year

Retail sales in Q3 were higher than wholesales, with discounts of INR 23,300 per vehicle

Maruti Suzuki Financials

Revenue and Net Profit: In FY23, Maruti Suzuki witnessed a YoY increase of 33.10% in revenue, reaching Rs. 1,17,571.30 crore, with a net profit of Rs. 8,211 crore, marking a 111.65% YoY increase.

Profit Margins: Operating Profit Margin (OPM) and Net Profit Margin (NPM) improved in FY23, standing at 9% and 6.83%, respectively.

Return Ratios: Return on Equity (RoE) and Return on Capital Employed (RoCE) showed improvements in FY23, reaching 13.28% and 16.02%, respectively.

Debt Analysis: The Debt to Equity ratio slightly increased to 0.02 in FY23, with a healthy Interest Coverage ratio of 70.37.

#StockMarket#Investing#TradingTips#FinancialFreedom#InvestmentStrategy#MarketAnalysis#StockPicks#PortfolioManagement#EconomicIndicators#StockResearch#RiskManagement#MarketTrends#DividendInvesting#TechnicalAnalysis#FundamentalAnalysis

3 notes

·

View notes

Text

Master Your Marketing: Avoid These 5 Crucial Mistakes for Business Success 🚀

#MarketingMistakes#BusinessSuccess#MarketingTips#DigitalMarketing#ROI#TargetAudience#CustomerFeedback#DiversifyMarketing#TrendAnalysis#MarketingStrategy#SmallBusiness#Entrepreneurship#OnlineMarketing#SocialMediaMarketing#ContentMarketing#SEO#PPCAdvertising#BrandOptimization#MarketTrends#BusinessGrowth#EffectiveMarketing#MarketingStrategies#SuccessGuide#YouTubeTips#LearnMarketing

2 notes

·

View notes