#InvestingWisdom

Explore tagged Tumblr posts

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

Warren Buffett, often referred to as the "Oracle of Omaha," is a giant in the world of finance and investing. His incredible rise, from a young investor to becoming the fifth richest person in the world, is a testament to his timeless wisdom. With a staggering net worth of $164.2B, Buffett's influence extends far beyond his wealth. He is a deep thinker whose views on money, wealth, and the stock market resonate with investors and non-investors alike.

At the core of Buffett’s investing strategy is the concept of ‘value investing,’ a principle he learned from his mentor Benjamin Graham. This strategy involves buying stocks at a price lower than their intrinsic value, emphasizing long-term growth over short-term profits. His patient, disciplined approach and profound understanding of business fundamentals have allowed him to triumph in the market for decades.

#BestWarrenBuffetQuotes#WarrenBuffett#BuffettQuotes#InvestingWisdom#FinancialLiteracy#MotivationalQuotes#SuccessMindset#WealthBuilding#BusinessInspiration#QuoteOfTheDay#BillionaireMindset

0 notes

Text

Investing is an art, and Warren Buffett has mastered it. His timeless wisdom teaches the importance of patience, protecting capital, and trusting your instincts.

The best opportunities come when others hesitate. Learn how to navigate equity investing with confidence—watch the full video now!

#WarrenBuffett#InvestingWisdom#StockMarket#EquityInvesting#PersonalFinance#InvestmentStrategy#FinanceEducation#WealthBuilding#LongTermInvesting#ValueInvesting#FinancialFreedom#MoneyManagement#SmartInvesting#StockMarketTips#InvestorMindset#MarketTrends#1lakhbankersby2030#InvestmentTips#BusinessSuccess#FinancialGrowth#InvestingForBeginners

0 notes

Text

The Psychology of Investing in the Stock Market: Understanding Mindset for Success

Investing in the stock market is about more than just numbers, charts, and analysis; it’s also about psychology. The emotional and cognitive elements that influence an investor’s decision making can have a significant impact on their success or failure. Understanding investment psychology enables traders and investors to avoid mistakes, remain reasonable, and achieve their long-term financial objectives. This blog digs at the major psychological ideas that influence stock market investors, as well as solutions for overcoming typical biases and emotional barriers. read more

#InvestorMindset#StockMarketPsychology#FinancialFreedom#MindsetForSuccess#InvestingWisdom#StockMarketTips#PsychologyOfInvesting#BehavioralFinance#WealthBuilding#SmartInvesting

0 notes

Text

How Did Ray Dalio’s Net Worth Reach $14 Billion?

Have you ever wondered how some people turn their passion into a $14 billion fortune? Ray Dalio’s net worth says it all! A financial genius who started investing at the age of 12 and went on to build Bridgewater Associates, the largest hedge fund in the world, managing a massive $150 billion in assets.

Dalio’s story isn’t just about numbers—it’s about vision, persistence, and a unique approach to success. In this blog, we’ll discover the key moments and strategies that pushed Ray Dalio’s net worth to an incredible $14 billion as of 2024. Excited? Let’s understand the fascinating journey of this self-made billionaire.

Read more: https://theusaleaders.com/blog/ray-dalios-net-worth/

#RayDalio#InvestingWisdom#EconomicInsights#LeadershipLessons#HedgeFundGuru#PrinciplesForSuccess#FinancialAdvice#BusinessStrategy#MarketAnalysis#WealthManagement

0 notes

Text

Sam Higginbotham's Insider Tips for Financial Success

In this podcast, Sam Higginbotham shares insider tips for achieving financial success. He provides practical and insightful advice on successful investing strategies and effective budgeting techniques. This podcast offers valuable financial wisdom for listeners at any stage of their financial journey, whether just starting or looking to grow their wealth.

#SamHigginbotham#FinancialSuccess#EntrepreneurshipTips#MoneyManagement#InvestingWisdom#FinancialFreedom#BudgetingTips#WealthBuilding#FinancialAdvice#SmartInvesting#PersonalFinance

0 notes

Text

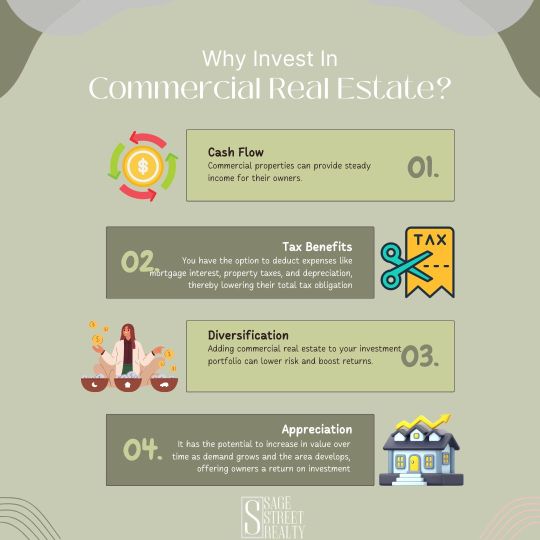

Unlocking the potential of bricks and mortar 💼🏢 Investing in commercial real estate isn't just about owning property, it's about securing your financial future. From steady income streams to long-term appreciation, #CommercialRealEstate offers stability and growth in an ever-changing market. 💰✨ #InvestingWisdom #FutureProof #SageStreetRealty

0 notes

Text

Is Your Money Working as Hard as You are?

It's a question that prompts us to reflect on how effectively we're managing our finances. Encourages us to take a proactive approach to financial management, ensuring that we're maximizing the potential of our hard-earned resources to create a secure and prosperous future.

Learn more at https://reps.modernwoodmen.org/slong

#FinancialPlanning#InvestingWisdom#MoneyManagement#SmartSpending#SavingsGoals#PassiveIncome#FinancialGrowth#WealthBuilding#MoneyMatters#FinancialWellness

0 notes

Text

Unlocking Financial Freedom: ipobrains' Guide to Top Debt-Free Stocks

Top Debt-Free Stocks

Welcome to the ipobrains blog, where we empower investors with insights and strategies for financial success. In this post, we’ll explore the world of top debt-free stocks and how they can pave the way to a secure financial future. Join us as we uncover the key characteristics of these stocks and how they align with ipobrains’ commitment to intelligent investing.

Understanding Debt-Free Stocks: Debt-free stocks are companies that have managed to eliminate their debt obligations, positioning them as strong contenders in the stock market. These companies boast robust financial health, as they are not burdened by interest payments and can allocate more resources towards growth and shareholder returns. At ipobrains, we recognize the value of investing in such companies, as they offer stability and long-term growth potential.

Key Characteristics of Top Debt-Free Stocks:

Strong Balance Sheet: Debt-free stocks typically have a strong balance sheet with ample cash reserves and minimal or zero long-term debt. This financial stability allows them to weather economic downturns and capitalize on growth opportunities.

Consistent Profitability: Companies that are debt-free often demonstrate consistent profitability, indicating their ability to generate sufficient cash flows to support their operations and expansion plans.

Sustainable Growth: Debt-free stocks focus on sustainable growth strategies, avoiding excessive leverage and financial risks. This approach fosters long-term value creation for shareholders.

Dividend Potential: With lower financial obligations, debt-free companies have the flexibility to return capital to shareholders in the form of dividends, making them attractive for income-oriented investors.

ipobrains’ Approach to Investing in Debt-Free Stocks:

At ipobrains, we believe in a disciplined and research-driven approach to investing in debt-free stocks. Our team of experts conducts thorough analysis and due diligence to identify companies with strong fundamentals and growth prospects. By focusing on companies that prioritize financial health and stability, we aim to build resilient portfolios that withstand market fluctuations and deliver sustainable returns over time.

Conclusion: Investing in top debt-free stocks can be a prudent strategy for investors looking to build wealth and achieve financial freedom. At ipobrains, we believe in the power of intelligent investing and are committed to guiding our clients towards opportunities that align with their financial goals. By focusing on companies with strong fundamentals and a debt-free status, we aim to create value and drive long-term success for our investors. Join us on this journey towards financial independence and unlock the potential of top debt-free stocks with ipobrains.

#FinancialFreedom#DebtFreeInvesting#SmartStocks#ipobrainsInsights#WealthBuilding#InvestingWisdom#StablePortfolios#IntelligentInvesting#FinancialSuccess#TopStockPicks#MoneyMatters#SecureInvestments#WealthCreation#SmartFinance#StockMarketInsights

1 note

·

View note

Text

Mastering your investments

Surges might elicit strong emotions, but successful investing requires keeping a cool mind! ❄️ Have you explored the power of 'The Zen Swing Tecnique'? 😉

or visit TheProInvest

1 note

·

View note

Text

Navigating the Golden Years: The Crucial Link Between Financial Literacy and Retirement Planning

Hey Tumblr fam! 👋✨ Today, let's dive into a topic that's not only relevant but also essential for everyone looking to create a secure and comfortable future: financial literacy and its impact on retirement planning. 🌐💰

🔍 The Foundation: Financial Literacy

Financial literacy is like the compass guiding us through the maze of personal finance. It's all about understanding how money works, making informed decisions, and building a solid financial foundation. When it comes to retirement planning, being financially literate is the key that unlocks a world of possibilities.

📈 The Connection to Retirement Planning

Imagine retirement as a beautiful journey you've been planning for years. Financial literacy acts as the roadmap, helping you navigate through the twists and turns. Here's why it matters:

Budgeting Brilliance: Financially literate individuals are adept at budgeting. Knowing how to allocate funds for daily expenses, savings, and investments is crucial for a stable retirement.

Investment Insight: Understanding different investment options, risks, and returns empowers you to make sound investment choices. This knowledge plays a vital role in growing your retirement nest egg.

Debt Dexterity: Financial literacy also helps in managing and reducing debt. Less debt means more funds available for retirement savings, ensuring a smoother transition to your golden years.

Social Security Savvy: Knowing the ins and outs of Social Security benefits is a part of financial literacy. Maximize your entitlements by making informed decisions about when to claim them.

💡 Tips for Boosting Financial Literacy:

💻 Online Courses: Dive into online resources and courses that cover personal finance, investing, and retirement planning.

📚 Read Widely: Explore books and articles written by financial experts. Blogs, podcasts, and financial news are also great sources.

👥 Community Engagement: Join financial forums, attend seminars, and participate in discussions. Learning from others' experiences can be invaluable.

💳 Hands-On Practice: Apply your knowledge in real life. Create a budget, invest wisely, and monitor your progress.

🔄 Conclusion:

In the grand tapestry of life, retirement is a significant chapter. By weaving financial literacy into the fabric of our understanding, we empower ourselves to create a retirement story that's not just secure but truly golden. 🌟✨ Let's embark on this journey together, armed with knowledge and ready to embrace the beauty of our future. 🚀💚

#InvestingWisdom#MoneyMatters#FutureReady#RetirementPlanning#financial literacy#finance#payment system#thefinrate#financialinsights#100 days of productivity

0 notes

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Text

.

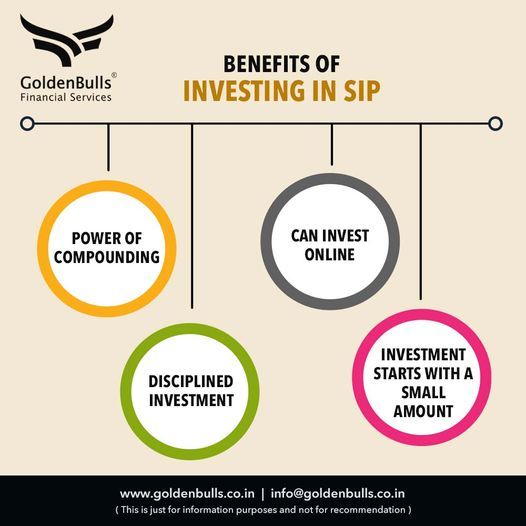

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

.

#SIP#SmartInvesting#FinancialFuture#ProfessionalInvestor#savings#financialplanning#InvestingWisdom#WealthBuilding#FinancialSuccess#LongTermInvesting#RetirementPlanning#Investing#Wealth#Goldenbulls

0 notes

Text

🌟 Discover the Financial Secret of Success

🚀 Uncover the hidden gem that can supercharge your investment portfolio and secure your financial future. Dive into the intriguing world of value stocks and learn why they outshine their flashy growth counterparts in our exclusive feature at Global Banking and Finance. 💰 "Why Value Stocks Beat Growth Stocks: The Benefits of Boring" is your ticket to unlocking untapped potential and achieving your financial dreams. 🔑 Explore the untold stories of companies that quietly accumulate wealth, providing consistent returns while the world chases the latest trends. 📈 Don't miss out on the financial wisdom that can transform your life. Click now and embark on your journey to financial prosperity! 💼🌆 #InvestingWisdom #ValueStocks #FinancialSuccess #GlobalBankingandFinance

0 notes

Text

Sam Higginbotham Guide to Effective Money Management

Sam Higginbotham is an experienced entrepreneur and successful financial advisor! 💡 Join us as we dive into the world of personal finance, covering everything from budgeting basics to savvy investment strategies. 💰 Whether you're a finance newbie or a seasoned pro, our podcast has something for everyone. Get ready to level up your financial game and achieve your money goals with Wealth Wisdom! 🚀

#MoneyManagement#FinancialPlanning#BudgetingTips#InvestingWisdom#EmergencyFund#DebtManagement#FinancialGoals#WealthBuilding#PersonalFinance#FinancePodcast

0 notes

Text

"Elevate your financial future with our tailored planning services. 🚀💼

0 notes