#GrowthInvesting

Explore tagged Tumblr posts

Text

Teilt eure Growth-Investing-Erfahrungen!

Hey Tumblr-Community!

Ich hoffe, ihr hattet alle eine fantastische Woche! In letzter Zeit habe ich einige Berichte über die GROWTH-Strategie von Marcus Kitzmann geteilt und wie es viele Privatanleger geschafft haben, ihre Renditen zu erhöhen. Aber heute möchte ich das Gespräch etwas erweitern und von euch hören!

Teilt eure Growth-Investing-Erfahrungen!

Growth-Investing kann auf viele verschiedene Arten angegangen werden, und ich bin sicher, dass viele von euch einzigartige und wertvolle Erfahrungen gemacht haben. Ob ihr eure eigenen Strategien entwickelt habt oder ob ihr einem bestimmten Ansatz folgt, ich würde gerne wissen:

Welche Growth-Investing-Strategien habt ihr ausprobiert?

Welche Unternehmen oder Sektoren habt ihr als besonders vielversprechend empfunden?

Welche Erfolge und Herausforderungen habt ihr erlebt?

Warum Growth-Investing?

Für diejenigen, die neu im Thema sind: Growth-Investing konzentriert sich darauf, in Unternehmen zu investieren, die schneller als der Durchschnitt wachsen. Diese Unternehmen reinvestieren oft ihre Gewinne, um weiter zu expandieren, was langfristig zu erheblichen Kurssteigerungen führen kann.

Was ich von euch wissen möchte:

Erfolgsstories: Erzählt uns von euren größten Erfolgen im Growth-Investing! Welche Investitionen haben sich als besonders profitabel erwiesen und warum?

Lernmomente: Manchmal lernen wir mehr aus unseren Fehlern als aus unseren Erfolgen. Welche Lektionen habt ihr auf die harte Tour gelernt?

Strategien und Tipps: Habt ihr spezielle Techniken oder Ansätze, die ihr anwendet? Vielleicht einen besonderen Indikator oder eine Methode zur Unternehmensbewertung?

Wie könnt ihr teilnehmen?

Reblog diesen Beitrag und fügt eure Geschichten und Gedanken hinzu.

Kommentiert direkt hier, um eine Diskussion zu starten.

Verfasst euren eigenen Beitrag und taggt ihn mit #GrowthInvesting und #InvestmentExperience, damit wir ihn leicht finden können.

Eure Erfahrungen können anderen helfen, ihre eigenen Investmentstrategien zu verbessern und vielleicht den nächsten großen Erfolg zu erzielen. Ich freue mich darauf, von euch zu hören und gemeinsam mehr über die spannende Welt des Growth-Investings zu lernen!

Lasst uns diese Community wachsen lassen – im wahrsten Sinne des Wortes!

Bis bald

#InvestmentExperience#GrowthInvesting#growth investing#marcus kitzmann#Anlagestrategie#Aktien#Geldanlage#Geld#Wachstumsstrategie

2 notes

·

View notes

Text

Buy and Sell Unlisted Shares in India- the real story

Buying and selling unlisted shares offers unique opportunities to invest in high-growth companies before they go public. With platforms like Bharat Unlisted, you can access promising startups, negotiate prices, and ensure secure, transparent transactions. It’s a great way to diversify your portfolio and potentially achieve significant returns by capitalizing on early-stage investments.

#unlistedshares#privateequity#startupinvesting#preipo#earlystageinvestments#alternativeinvestments#bharatunlisted#investmentopportunities#growthinvesting#startupopportunities#privatemarket#unlistedstocks#highgrowthcompanies#venturecapital#smartinvesting#financialfreedom#secureinvestments#ipoinvesting

0 notes

Text

🚀 **Top US Companies by Net Profit** 🚀 Here's a snapshot of the largest US companies producing the highest net profits: 1. **Apple:** $94B (-3% YoY) 2. **Nvidia:** $63B (+234% YoY) 3. **Microsoft:** $91B (+17% YoY) 4. **Amazon:** $50B (+148% YoY) 5. **Alphabet:** $94B (+41% YoY) 6. **Meta:** $56B (+87% YoY) 7. **Tesla:** $13B (+18% YoY) 8. **Berkshire Hathaway:** $107B (+39% YoY) 9. **TSMC:** $33B (+16% YoY) Who do you think will dominate by 2030? --- In my experience, tracking these leading companies can provide insights into market trends and investment opportunities. 📈 It's crucial to stay informed about their growth patterns and adapt investment strategies accordingly. Remember, being proactive in your financial planning can make all the difference in building wealth over time! 🌟

#TopCompanies#NetProfit#InvestmentOpportunities#FinancialPlanning#WealthBuilding#MarketTrends#StockMarket#FinanceTips#GrowthInvesting#TechStocks#BusinessInsights#ProsperityMindset#FutureOfInvesting#FinancialLiteracy#MarketSuccess

0 notes

Text

youtube

#InvestmentJourney#YearEndFinance#BuildingWealth#SmartMoneyMoves#TaxSavingsTips#FinancialSuccess#InvestingForBeginners#StockMarketInsights#WealthManagement#StrategicInvesting#Q4FinanceGoals#MarketOpportunities#MoneyTips#GrowthInvesting#EndOfYearPlanning#FinancialFreedomTips#FutureInvestments#PortfolioGrowth#TaxSmartInvesting#MoneyMatters#Youtube

0 notes

Text

Best Food and Beverage Stocks to Invest in for 2024: Top Picks for Growth

Craving the best food and beverage stocks to fuel your portfolio? 2024 is shaping up to be a great year for investors seeking growth in this essential sector. From fast-growing food brands to innovative beverage companies, discover the top food and beverage stocks with strong potential for the future. These stocks blend consumer demand with healthy growth, making them a must-have in your stock picks. Don't miss out on the next big trend in the food and drink industry!

For more information visit at : https://kalkinemedia.com/us/stocks/consumer

#FoodStocks#BeverageStocks#TopStocks2024#InvestmentOpportunities#ConsumerStocks#GrowthInvesting#StockMarketTips#BestStocksToBuy#FoodAndDrinkInvesting#TopStockPicks

0 notes

Text

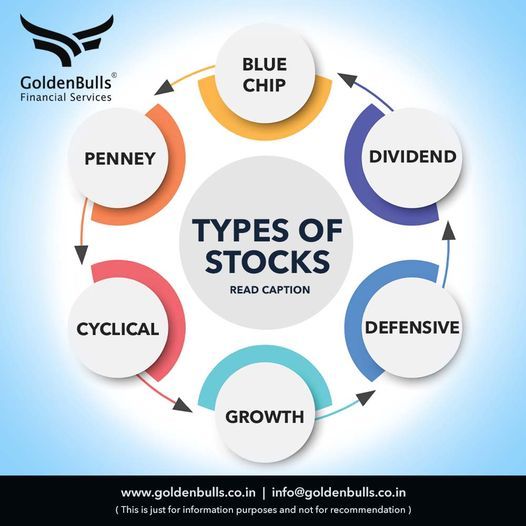

Blue Chip Stocks: These are shares of well-established, financially stable, and reputable companies with a history of consistent performance. Blue chip stocks are generally considered safe and reliable investments.

Dividend Stocks: Companies that distribute a portion of their earnings to shareholders in the form of dividends. These stocks are often favored by investors seeking regular income.

Defensive Stocks: Companies that tend to remain stable even during economic downturns. They are less sensitive to economic cycles, and their products or services are considered essential.

Growth Stocks: These are shares of companies expected to grow at an above-average rate compared to other companies. Investors in growth stocks are typically focused on capital appreciation rather than dividends.

Cyclical Stocks: Companies whose performance is closely tied to the economic cycle. These stocks often do well when the economy is booming but may suffer during economic downturns.

Penny Stocks: Stocks with a low market price, usually trading at less than $5 per share. Penny stocks are often associated with smaller, riskier companies and can be more volatile than stocks of larger, more established companies

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

#BlueChipStocks#DividendInvesting#DefensiveStocks#GrowthInvesting#CyclicalStocks#PennyStocks#InvestmentStrategies#DiversifyYourPortfolio#StockTips#MarketTrends#EconomicCycles#RiskManagement#Financialservices#FinancialWellness#Goldenbulls

0 notes

Text

Video: NVIDIA and its Price-to-Earnings ratio

We look at #NVIDIA and its #pricetoearnings or #PE ratios, and #growthinvesting. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada. Visit: http://www.canadianmoneytalk.caThe Advanced Investing: Stock Analysis Course is at http://canadianmoneytalk.ca/advanced-investing-stock-analysis-course/My Investing & Personal Finance Basics course is at…

View On WordPress

0 notes

Link

#dividendyield#earningsgrowthrate#growthinvesting#investingstrategies#long-terminvesting#marginofsafety#P/Bratio#P/Eratio#Stockmarket#Valueinvesting

0 notes

Text

Crypto Mining makes Happy :-)

Crypto mining makes us happy because it’s an unconventional and awesome way to earn passive income. At http://www.cryptominersale.com you dive into the world of crypto mining and make great monthly profits. Let’s be happy together and unleash your potential as a crypto miner! #CryptoMining #Cryptocurrency #Blockchain #BitcoinMining#EarnMore #Mining #Miners #BTCHashRate #CloudMining#Profitable…

View On WordPress

#BitcoinEquipment#bitcoinmining#Blockchain#btchashrate#CloudMining#Cryptocur#cryptocurrency#CryptocurrencyInvesting#cryptomining#CryptoMiningFarming#GentleMoney#GrowthInvestment#miners#Mining#MiningTools#NewMining#PassiveIncome

0 notes

Text

How to Invest in Tech Stocks with High Growth Potential

How to Invest in Tech Stocks with High Growth Potential #TechStocks #InvestingTips #GrowthInvesting #StockMarket #FinancialLiteracy #InvestmentStrategy #TechInvestments #WealthBuilding #MarketTrends #FutureOfFinance

Investing in tech stocks with high growth potential can be one of the most rewarding strategies for building long-term wealth. However, it requires a deep understanding of the market, careful research, and a well-thought-out investment plan. In this comprehensive guide, we will explore actionable steps, strategies, and tips to help you navigate the world of tech stocks and make informed…

0 notes

Text

How I Invested For 300% Growth (and You Can Too)

Want to achieve explosive growth and retire rich? In this video, we break down the strategies behind 300% growth investing and how to capitalize on high-potential opportunities. Learn the secrets to building wealth through smart investments and making your money work harder for you. Your journey to financial freedom starts now! #GrowthInvesting #RetireRich #FinancialFreedom #InvestSmart…

View On WordPress

0 notes

Text

Islamic Trust: A Pillar of Community Development and Empowerment

Islamic trust, known as waqf in Arabic, have played a pivotal role in the social, economic, and educational development of Muslim communities for centuries. Rooted in Islamic principles, these trusts are a unique form of charity designed to create sustainable benefits for individuals and society. Today, Islamic trusts continue to serve as vital instruments for addressing contemporary challenges and fostering long-term community empowerment.

What Is an Islamic Trust (Waqf)?

An Islamic trust, or waqf, is a philanthropic endowment established by dedicating a property or asset for a charitable cause. The benefits derived from the asset are used to serve the community, while the asset itself remains intact.

Key Features of an Islamic Trust:

PerpetuityThe endowment is meant to provide benefits indefinitely, ensuring its sustainability over generations.

Ownership by AllahOnce established, the asset is considered the property of Allah, managed for the benefit of society.

Specified PurposeA waqf must serve a clear purpose, such as education, healthcare, or social welfare, aligning with Islamic values.

Historical Significance of Islamic Trusts

Centers of LearningIslamic trusts have historically funded educational institutions, such as madrasas and libraries, fostering knowledge and intellectual growth.

Social WelfareTrusts provided food, shelter, and healthcare for the poor and vulnerable in medieval Islamic societies.

Economic DevelopmentThrough investments in agriculture, infrastructure, and trade, waqfs contributed to economic stability and growth.

Modern Applications of Islamic Trusts

Education and ScholarshipsIslamic trusts fund schools, universities, and scholarship programs, enabling access to education for underprivileged students.

Healthcare ServicesMany waqfs finance hospitals, clinics, and medical aid programs to ensure affordable healthcare.

Community DevelopmentTrusts support initiatives such as housing projects, vocational training, and community centers to improve the quality of life.

Relief for Refugees and Displaced PersonsIslamic trusts often provide emergency relief and support to refugees and those affected by conflicts and natural disasters.

Benefits of Islamic Trusts

SustainabilityThe perpetual nature of a waqf ensures that its benefits extend across generations.

Social EquityBy addressing key areas like education, healthcare, and poverty alleviation, Islamic trusts help reduce social disparities.

Faith-Based ResponsibilityEstablishing or contributing to a waqf fulfills the Islamic principle of sadaqah jariyah (ongoing charity).

Economic GrowthInvestments made through trusts create jobs and stimulate local economies, benefiting entire communities.

Challenges Facing Islamic Trusts

Management and GovernanceEfficient management is crucial to ensure that the benefits of a trust are maximized. Lack of transparency or expertise can hinder its effectiveness.

Legal and Regulatory IssuesIn some countries, outdated or restrictive laws limit the potential of Islamic trusts.

Modern NeedsAdapting traditional waqf structures to meet contemporary challenges, such as digital education and environmental sustainability, requires innovation.

Prominent Islamic Trusts and Their Impact

Al-Azhar Trust (Egypt)A centuries-old waqf supporting one of the world’s oldest and most respected centers of Islamic learning.

Islamic Relief Waqf FundA modern example of how waqfs address global issues like disaster relief, education, and sustainable development.

Awqaf South AfricaFocuses on education, healthcare, and poverty alleviation, showcasing how trusts can impact local communities.

Establishing an Islamic Trust: How to Contribute

Property or Asset DedicationA trust can be established with assets like land, buildings, or funds dedicated for charitable purposes.

Choosing a PurposeSpecify a cause aligned with Islamic values, such as education, healthcare, or social welfare.

Management and OversightAppoint trustworthy individuals or organizations to manage the trust and ensure accountability.

Partnerships and CollaborationCollaborating with established charities or organizations can maximize the impact of a new waqf.

Conclusion

Islamic trusts are a testament to the enduring power of faith-based philanthropy. By promoting sustainable development, social justice, and economic growth, they remain a cornerstone of Muslim communities worldwide.

In an era of increasing global challenges, reviving and modernizing the concept of waqf can provide innovative solutions to pressing issues. For those seeking to make a lasting difference, supporting or establishing an Islamic trust offers an opportunity to leave a legacy of compassion, knowledge, and empowerment.

0 notes

Text

Momentum Trading: 1. Pros: Ride the trend for short-term profits; quantitative tools for analysis.

2. Cons: High volatility; overcrowded trades; market timing risks.

#ValueInvesting #GrowthInvesting #DividendInvesting #MomentumTrading #InvestmentProsCons #RiskVsReward #MarketStrategies #InvestmentDiversity #FinancialPlanning #WealthManagement

0 notes

Text

The Ultimate List of Budget Categories

Are you tired of feeling like your finances are spiralling out of control? Worried about overspending and unsure where your money goes each month? Look no further! In this article, we present the ultimate list of budget categories that will help you take control of your financial life. From essentials like housing and groceries to leisure activities and unexpected expenses, we've got you covered. Let's dive into the world of budgeting and discover how you can achieve your financial goals. The Ultimate List of BUDGET CATEGORIES Creating a budget that covers all aspects of your life is the first step towards achieving financial stability. By allocating your income into specific categories, you can track your spending, save more, and make informed financial decisions. Below, we've outlined the ultimate list of budget categories to consider incorporating into your budgeting strategy. CategoryDescriptionHousingCovers expenses related to your primary residence, including rent or mortgage payments, property taxes, home insurance, utilities, and maintenance costs.TransportationIncludes costs associated with getting around, such as fuel, public transportation fares, car insurance, maintenance, and parking fees.GroceriesBudget for your weekly or monthly grocery shopping, including food, beverages, household supplies, and personal care items.UtilitiesAllocate funds for essential services like electricity, water, heating, and internet or phone bills.Debt PaymentsIf you have outstanding loans or credit card debt, allocate a portion of your budget to make regular payments and reduce your debt over time.SavingsPrioritize saving by setting aside a portion of your income for emergency funds, retirement accounts, and other future goals.InsuranceCover various types of insurance, including health, life, auto, and home insurance premiums.EntertainmentPlan for leisure activities, such as dining out, movies, hobbies, and vacations.Personal CareBudget for personal grooming and self-care expenses, such as haircuts, skincare products, and wellness treatments.EducationAllocate funds for ongoing learning, whether it's taking courses, attending workshops, or purchasing educational materials.HealthcareAccount for medical expenses, including doctor visits, prescriptions, health insurance premiums, and medical supplies.ClothingSet aside money for clothing and accessories, considering both everyday wear and special occasions.Charitable GivingInclude a category for donations to charitable organizations or causes that you support.Home MaintenanceBudget for unexpected repairs and upkeep for your home, such as fixing appliances, renovating, or replacing essential items.Personal GrowthInvest in personal development activities, such as coaching, self-help books, and attending seminars or conferences.GiftsAccount for gifts for family, friends, and special occasions throughout the year.ChildcareIf you have children, allocate funds for childcare services, school-related expenses, and extracurricular activities.Pet CareBudget for expenses related to your pets, including food, veterinary care, grooming, and supplies.ElectronicsPlan for technology-related purchases, such as smartphones, laptops, and other electronic devices.TravelSet aside funds for travel expenses, whether it's for business trips or leisure vacations.Home OfficeIf you work from home, consider expenses related to your home office setup, including furniture, equipment, and supplies.MiscellaneousCreate a catch-all category for unexpected or irregular expenses that don't fit into other predefined categories.Leisure ActivitiesBudget for hobbies, recreational activities, and memberships to clubs or fitness centers.Dining OutSet a specific budget for eating out at restaurants or ordering takeout.Emergency FundAllocate funds to build and maintain an emergency fund to cover unexpected financial setbacks. Housing: Finding Financial Stability in Your Shelter Finding the right balance between a comfortable living space and financial stability is crucial. Housing is often the largest expense in a budget, encompassing various costs that can impact your overall financial health. Whether you're renting an apartment or paying off a mortgage, consider these tips to manage your housing expenses effectively: - Rent vs. Buy: Before making a decision, evaluate whether renting or buying a home is more financially viable for you. Calculate the costs involved in each option, including mortgage payments, property taxes, and maintenance. - Roommates: If you're comfortable with it, having a roommate can significantly reduce housing costs, making it easier to allocate funds to other categories. - Utilities: Be mindful of your energy consumption to reduce utility bills. Consider energy-efficient appliances and practices to lower costs. - Maintenance: Regular maintenance can prevent costly repairs in the long run. Set aside a portion of your budget for home maintenance and repairs. - Downsizing: If your current housing situation is stretching your budget, consider downsizing to a smaller space that better suits your financial capabilities. Transportation: Navigating Your Budget on the Go Transportation expenses can add up quickly, affecting your overall financial picture. Whether you rely on public transit or own a car, managing transportation costs is essential for maintaining a balanced budget. Here are some strategies to help you stay on top of your transportation expenses: - Public Transit: If available, consider using public transportation to save on fuel and parking costs. Monthly passes or discounted fares can provide significant savings. - Carpooling: Share rides with friends, coworkers, or neighbours to split the costs of commuting. - Fuel Efficiency: If you own a car, choose a fuel-efficient model and practice fuel-saving habits, such as avoiding unnecessary idling and maintaining proper tire pressure. - Maintenance: Regular vehicle maintenance can prevent breakdowns and costly repairs. Schedule routine check-ups to catch any issues early on. - Biking/Walking: For short distances, consider biking or walking to save on transportation costs and promote a healthier lifestyle. Groceries: Feeding Your Body and Budget Grocery shopping is a routine expense that can significantly impact your budget over time. By adopting smart shopping habits and meal planning strategies, you can save money while still enjoying delicious and nutritious meals. Here are some tips to make the most of your grocery budget: - Meal Planning: Plan your meals for the week ahead and create a shopping list based on your planned recipes. This prevents impulsive purchases and reduces food waste. - Coupons and Sales: Take advantage of coupons, discounts, and sales to save money on your grocery purchases. Be cautious, however, not to buy items solely because they're on sale. - 3. Bulk Buying: Consider buying non-perishable items in bulk to take advantage of lower unit prices. Just be sure to only purchase items you'll use before they expire. - Store Brands: Opt for store-brand products instead of name-brand items. Often, the quality is comparable, but the price is lower. - Avoid Convenience Foods: Pre-packaged convenience foods tend to be more expensive. Opt for whole ingredients and prepare meals from scratch to save money. Debt Payments: Conquering Debt and Regaining Control Debt can weigh heavily on your financial well-being, making it challenging to achieve your goals. By prioritizing debt payments and adopting a strategic approach, you can gradually reduce your debt and improve your financial situation. Consider these strategies to tackle your debt effectively: - Create a Repayment Plan: List all your debts, including credit cards, loans, and outstanding bills. Prioritize them based on interest rates and start paying off high-interest debts first. - Snowball Method: Pay off your smallest debts first and then use the money you would have paid toward them to tackle larger debts. This approach builds momentum as you see quick wins. - Negotiate Interest Rates: Contact your creditors to negotiate lower interest rates, especially if you have a good payment history. Lower rates can significantly reduce the amount of interest you pay over time. - Consolidation: Consider consolidating your debts into a single loan or credit card with a lower interest rate. This can make managing payments more straightforward. - Avoid New Debt: While paying off existing debt, avoid accumulating new debt. Use cash or your debit card instead of credit cards to control spending. Savings: Securing Your Financial Future Building a robust savings plan is essential for achieving your short-term and long-term financial goals. By consistently setting aside money and making wise investment decisions, you can create a strong financial foundation for yourself. Here are some steps to kickstart your savings journey: - Emergency Fund: Start by building an emergency fund that covers three to six months' worth of living expenses. This fund provides a safety net in case of unexpected financial challenges. - Automate Savings: Set up automatic transfers from your checking account to a dedicated savings account. Treating savings as a non-negotiable expense ensures consistent contributions. - Retirement Accounts: Contribute to retirement accounts like a 401(k) or IRA. These accounts offer tax advantages and can help you grow your wealth over time. - Invest Wisely: Research different investment options and consider diversifying your portfolio to mitigate risk. Consult with a financial advisor if needed. - Short-Term Goals: Allocate savings for short-term goals like a vacation, buying a car, or making a down payment on a home. Having specific targets keeps you motivated to save. FAQs (Frequently Asked Questions) Q: How do I decide on a budget for each category?A: Start by tracking your current spending for a few months to identify patterns. Then, allocate funds to each category based on your priorities and financial goals. Q: What if my income varies from month to month?A: If you have irregular income, consider using a zero-based budgeting approach. Assign every dollar a specific purpose, including saving and covering irregular expenses. Q: Should I budget for entertainment and leisure activities?A: Absolutely! Budgeting for leisure activities is essential to maintain a healthy work-life balance and prevent burnout. Q: Is it okay to adjust my budget as circumstances change?A: Yes, flexibility is key to successful budgeting. Life is unpredictable, so be prepared to adjust your budget when necessary. Q: How can I stick to my budget and avoid overspending?A: Regularly review your budget, track your expenses, and use tools like budgeting apps to stay on track. Avoid impulse purchases and focus on your financial goals. Q: Is it possible to save money while paying off debt?A: Yes, it's possible. Create a balanced plan that allocates funds to both debt repayment and savings. Having an emergency fund can prevent new debt during unexpected situations. Conclusion: Empower Your Financial Journey Congratulations! You've now explored the ultimate list of budget categories that can transform your financial management approach. By allocating your income strategically and making informed spending decisions, you'll be well on your way to achieving your financial goals. Remember, budgeting is a continuous process that requires diligence and adaptability. Keep refining your budget as your circumstances evolve, and always prioritize your financial well-being. Now that you're equipped with valuable insights on budgeting, you can confidently take control of your finances and work towards a more secure and fulfilling future. Read the full article

0 notes

Text

Enroll in Our Courses Now!

Welcome to Organa's School - Where Learning is Fun and Effective! Discover Our Courses Today!

Empower Your Future

Unlock Your Potential: Practical Skills, Flexible Learning, and Long-Term Growth with Organa's Courses

Valuable Career SkillsOur courses provide practical skills and knowledge that are highly valued in today's job market, giving you a competitive edge in your career.

Flexible Online LearningWith flexible online learning options and a supportive community of instructors and peers, you can fit your studies into your busy schedule and achieve your goals.

Education for GrowthInvesting in your education can lead to long-term personal and professional growth, opening up new opportunities and improving your overall quality of life.

#digitalmarketing#onlineclasses#entrepreneur#jobs#programming#english#academy#institute#les#marketing#classes#uk#beauty#studyabroad#school#kursus#lesson#hobbies#javascript#covid#drumcoursebali#denpasar#drumcourse#balirudiment#kursusdrumbali#drummer#instagram#certification#growth#professional

0 notes

Video

tumblr

Robinhood Weekly Top 10 Adds

$NIO jumps into the top 10 this week. Investors are hoping that every EV company is the next Tesla.

But for this investment it’s better to bet on the jockey, not the horse.

There will be a bunch of #EV companies to come, as there were a bunch of combustion engine car companies that followed Ford.

To make a great investment in the space, bet on the Jockey. #Musk, #Bezos, #Gates, #Jobs, even #Zuckerberg are at the top of the food chain when it comes to CEOs and leadership. Bet on that type of CEO, not just the next EV company.

To learn more about investing, traditional investments and alternative investments stay connected with The Seville Report: eepurl.com/dBYI8T

#Robinhood#RobinhoodTop10#Stocks#Investing#Money#Investments#WallStreet#WallStreetMoney#ValueInvesting#GrowthInvesting#FinancialEducation#FinancialFreedom#StockMarket#InvestmentEducation#FinancialEducatoin#Research#Electric Vehicles#Tesla#Nio

1 note

·

View note