#TaxRegulations

Explore tagged Tumblr posts

Text

Maximizing Efficiency, Minimizing Risks: The Value of VAT Compliance Services

Navigating VAT compliance can be a labyrinth of complexities for many businesses, making it imperative to have a seasoned team managing these responsibilities while you concentrate on your core operations. Our VAT Compliance Services offer a lifeline, ensuring your adherence to regulations in a timely, accurate, and efficient manner.

When it comes to VAT registration, showcasing compliance with the laws is paramount. This entails meticulous record-keeping of financial transactions, timely filing of VAT returns, and fulfilling VAT liabilities as per UAE regulations. While not mandatory, availing of VAT compliance services is highly recommended to streamline the process and mitigate potential challenges during filing.

Our experts delve deep into your financial dealings, offering invaluable insights and benefits:

Understanding and managing current VAT requirements specific to your business.

Unlocking financial benefits while avoiding penalties and fines.

Enhancing your company's credibility by fostering compliance and trustworthiness.

Our VAT Compliance Services entail a thorough examination by our experts, aimed at optimizing your company's financial health, addressing non-compliance issues, and fortifying against potential fraud. With a reliable team at your disposal, navigating the ever-evolving landscape of VAT laws becomes a seamless endeavour.

Our seasoned professionals specialize in claim filing, ensuring accuracy and compliance every step of the way. With us by your side, you can rest assured that all your VAT-related needs and requirements will be met with precision and efficiency. Our goal is to simplify the process, ensuring your adherence to regulations to steer clear of hefty penalties and legal entanglements.

To kickstart your journey towards VAT compliance, registration with the FTA is the initial step. Our team facilitates a smooth implementation and transition process, providing professional support round the clock. For further insights and assistance regarding VAT Compliance Services, don't hesitate to reach out to us. We're here to provide comprehensive guidance tailored to your business's unique needs.

#VATComplianceUAE#BusinessSuccess#GoviinBookkeeping#UAEBusiness#TaxCompliance#BusinessGrowth#FinancialSuccess#VATRegistration#ConsultingServices#TaxRegulations#ComplianceMatters#FinancialHealth#uaeaccounting#uaefinance#financialservicesdubai#vatcompliance#dubaibusiness

4 notes

·

View notes

Text

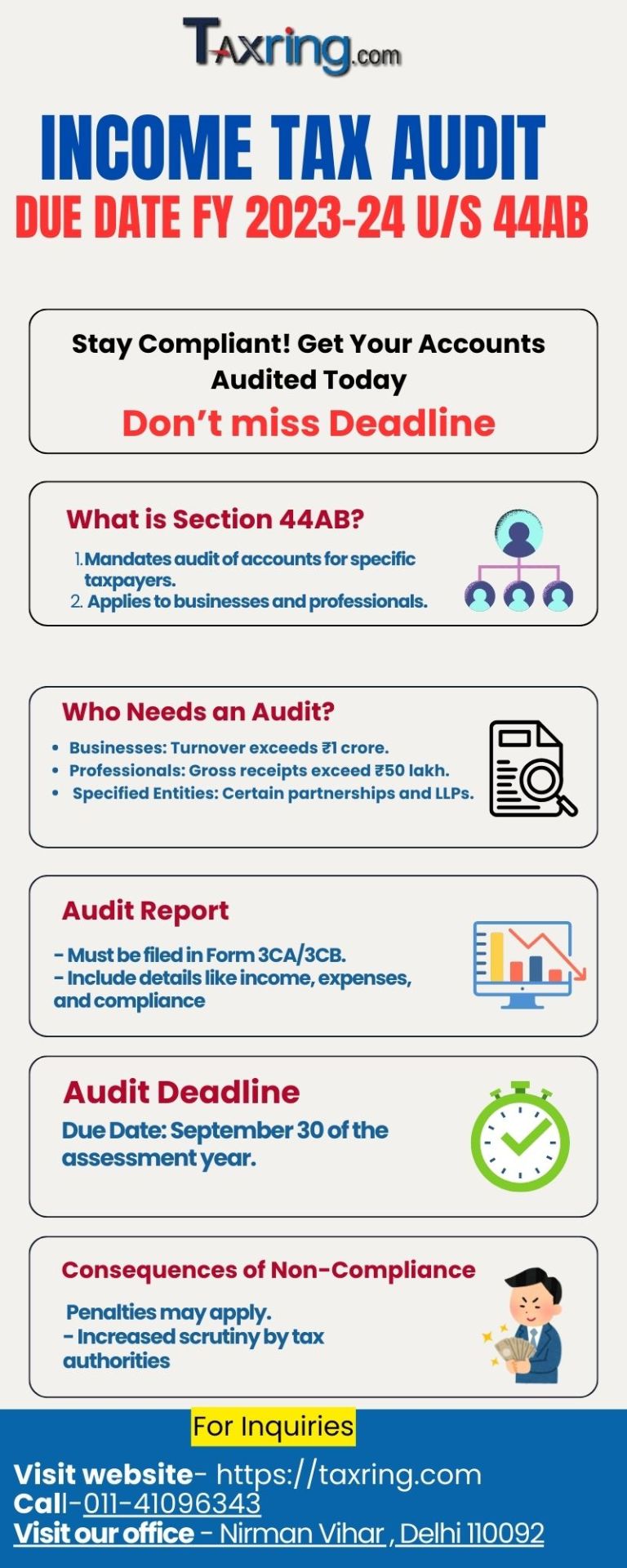

Income Tax Audit: Full Concept, Guidelines, and Key Revisions

Understanding the full concept of Income Tax Audit is essential for businesses and individuals to ensure compliance. Taxgoal provides expert revision and guidelines, covering key aspects like audit procedures, documentation requirements, and statutory compliance. Stay updated with the latest tax norms to avoid penalties and optimize your financial strategies. Consult us (+91 9138531153) today for Income Tax Audit Near Me.

#Taxgoal#IncomeTaxAudit#TaxAuditGuidelines#Tax#AuditCompliance#FinancialAudit#TaxFiling#BusinessTax#IncomeTaxRules#AuditRevisions#TaxRegulations

0 notes

Text

Professional Tax Act Compliance for Corporates in India

Introduction

The Professional Tax Act is a state-imposed tax on individuals earning an income through employment, profession, trade, or business. It is a mandatory tax that corporates in India must deduct from employee salaries and remit to the respective state government. Though regulated by state laws, it follows a common compliance framework across different regions.

Key Provisions of the Professional Tax Act

1. Applicability of the Act

Professional tax is levied by state governments on salaried employees, professionals, and business owners.

The tax structure varies across states; some states have exemptions, while others impose a graded tax system.

The employer is responsible for deducting and depositing the tax for employees.

2. Registration & Compliance

Companies must register for professional tax with the respective state government.

Employers need to obtain a Professional Tax Registration Certificate (PTRC) to deduct tax from employees.

Businesses must also acquire a Professional Tax Enrollment Certificate (PTEC) for payment of professional tax on their earnings.

3. Rate and Payment of Professional Tax

The tax rate varies from state to state, with a maximum cap of ₹2,500 per year.

Deduction is typically on a monthly or half-yearly basis, depending on state rules.

Timely payment is crucial to avoid penalties and interest charges.

4. Filing of Returns

Corporates must file periodic professional tax returns as per the respective state's regulations.

Filing frequency varies, with some states requiring monthly, quarterly, or annual returns.

Employers need to maintain accurate records of deductions and payments.

5. Penalties for Non-Compliance

Failure to register, deduct, or remit professional tax on time can result in hefty fines and legal action.

Non-payment or late payment may attract interest penalties ranging from 1% to 2% per month.

Non-filing of returns may lead to additional penalties and cancellation of registration.

Compliance Challenges for Corporates

Corporates often face difficulties in adhering to professional tax regulations due to:

State-wise Variations: Different tax rates and rules across states.

Frequent Updates: Changes in tax slabs, deadlines, and return filing requirements.

Multi-State Operations: Managing compliance across different states with separate registrations.

Penalty Risks: Delays in filing or payment leading to financial liabilities.

How Corporates Can Ensure Compliance

Automate Payroll Deductions: Implement payroll software that automatically deducts professional tax based on state rules.

Track State Regulations: Stay updated with notifications and changes in professional tax laws.

Timely Filing & Payments: Ensure timely remittance of professional tax to avoid penalties.

Seek Expert Guidance: Partner with labour law consultants to manage multi-state compliance.

Maintain Accurate Records: Keep proper documentation of tax deductions, payments, and return filings.

Compliance with the Professional Tax Act is essential for corporates to avoid legal repercussions and maintain a seamless payroll system. With state-specific variations, businesses must stay vigilant about applicable rules and timely compliance. Implementing an automated system and seeking expert assistance can help corporates efficiently manage their professional tax obligations.

For expert assistance on Professional Tax compliance, contact Sankhla Corporate Services Pvt. Ltd. at www.sankhlaco.com.

#ProfessionalTax#CorporateCompliance#TaxRegulations#PayrollManagement#EmployeeTax#LabourLaw#BusinessTax#IndiaTaxLaws#LegalCompliance#ProfessionalTaxAct#CorporateTaxation#EmploymentTax#TaxFiling#StateTax#SankhlaCorporateServices

0 notes

Text

GST Raids ICICI Premises: A Closer Look at the Recent Investigation

In a recent operation, the Mumbai GST department raided three related premises of ICICI Bank. The operations were conducted as the authorities proceeded with the probe into possible violations in the tax laws. State banks of India are currently in the process of preparing these accounts and ICICI Bank, a top Indian bank has committed its support to the authorities fully. It’s about time to give a detailed overview of what has happened and what can come of it.

Understanding the Context

The system of indirect taxation called the GST was implemented in India in order to make new changes in line with the concept of compliance. But, still, cases of tax fraud and malpractice continue to be reported even though the concepts have been provided under a broad framework. The most recent confrontation with ICICI Bank proves that the government pays careful attention to the requirements of even the major institutions regarding taxation.

This is in tandem with the GST operations conducted by the GST department during the raid conducted at the ICICI Bank premises. Although the details of the alleged discrepancies have not been revealed it is common for such actions to include checking some records, examining business balance sheets and determining if the GST returns were completed correctly.

Key Highlights of the Raid

Locations Raided: The raids were affected at three important locations namely the three floors of ICICI Bank in Mumbai. These are said to be important in the operation of the bank.

Reason for the Investigation: Though specifics have not been revealed by the authorities, such operations often arise as a result of the doubts involving wrong GST returns, inconsistency in tax credits or any form of tax anomalies.

Bank’s Response: The effect of Goods and Services Tax on ICICI Bank is also a topic of this paper: ICICI Bank has openly declared that it would fully support the GST authorities. It can be seen that the bank has taken anticipative measures in handling the situation, which shows its confidence in handling the matters and avoiding the perpetration of something that is against the law and brings shame to the institution.

Implications of the Raid

For ICICI Bank

While it is going on, such actions can at times affect the bank’s image in one way or the other even if only for a short while. However, cooperative management of ICICI Bank and its well-developed procedures, which existed from an early stage of the company's growth, will probably prevent long-term consequences. The customers and other stakeholders might seek the bank to provide them with appropriate clues of transparency and ethical business conduct.

For the Banking Sector

As for the result, the above case reminds other financial institutions to comply with the taxes laws more strictly. As it will be seen, the rules of operating under the GST framework entail very strict compliance with the filing regulations, credits, and reports. Banks and financial institutions need to do periodic checks on their processes to prevent such occurrences.

For Regulatory Authorities

The raid supports the GST department’s stand on stability as far as taxation integrity is concerned. This raises a concern that no organization is big enough to be away from investigation. They can prevent non-compliance where necessary and help maintain compliance through everyone.

Ways through Which GST Compliance Can Be Achieved

1. Regular Audits

It is thereby necessary that institutions need to engage in internal and external audit checks regularly for anomalies in GST returns.

2. Employee Training

This paper projected that training employees on the GST regulation can go a long way in ensuring institutions do not fall foul of the law while implementing the act.

3. Leveraging Technology

The various GST compliant advanced tax software and automation utilities can make some GST associated procedures more effective by lowering the possibility of mistakes.

4. Seeking Expert Advice

Tax consultants and lawyers can be hired to assist institution managers in such legal regulations in relation to taxes.

Conclusion

The GST raids on ICICI Bank’s premises highlight the importance of stringent compliance with tax regulations. While the investigation continues, ICICI Bank’s commitment to cooperation is a positive step toward resolving the matter. This incident serves as a wake-up call for the banking sector to prioritize robust tax compliance mechanisms.

As the GST regime continues to evolve, businesses and financial institutions must adapt to ensure adherence to its provisions. In doing so, they not only avoid legal repercussions but also build trust among their stakeholders and contribute to the nation’s economic stability.

FAQs

Q1. Why did the GST department raid ICICI Bank's premises?

The raid was part of an ongoing investigation into potential violations of tax laws, including discrepancies in GST returns and tax credits.

Q2. What is ICICI Bank's response to the GST raid?

ICICI Bank has pledged to fully cooperate with the GST authorities and is committed to ensuring transparency during the investigation.

Q3. How could this raid affect ICICI Bank?

While the raid may impact the bank’s image temporarily, ICICI’s established compliance procedures are expected to minimize any long-term consequences.

Q4. What can other financial institutions learn from this incident?

The raid serves as a reminder for financial institutions to strengthen their tax compliance processes and undergo regular audits to avoid potential issues with tax authorities.

For more updates, check this site GST Raids ICICI Bank Premises in Mumbai.

0 notes

Text

GST Compliance in Accounts Payable for Indian Businesses

Navigate the complexities of GST compliance in accounts payable for Indian businesses. This guide covers essential regulations, best practices, and practical tips to ensure accurate tax reporting and timely payments, helping organizations maintain compliance and avoid penalties while optimizing their financial operations.

0 notes

Text

Learn about the Foreign Account Tax Compliance Act (FATCA) and its impact on international banking. Get key insights and compliance tips.

0 notes

Text

As the September 30 deadline approaches, it’s essential for taxpayers to understand the implications of late filing of tax audit reports. The penalties can be significant, and potential glitches on the ITR e-filing portal could further complicate matters. By taking proactive measures, staying informed, and ensuring timely submission, taxpayers can avoid unnecessary stress and penalties. For those needing assistance, consulting with tax professionals can be invaluable in navigating this complex process. why you need tax consultant

#income tax#tax audit#income tax audit#tax audit due date extension#tax audit due date#income tax audit fy 2024 25#tax audit last date for fy 2024 2025#income tax login#income tax return#tax refund#itr#TaxDeadline#FY2023-24#TaxFiling#AvoidPenalties#TaxProfessionals#TaxCompliance#BusinessTaxes#IndividualTaxes#TaxRegulations#FinancialPlanning#TaxTips#TaxHelp#AuditRequirements#IncomeTaxAudit#SeptemberDeadline#TaxAdvice#TaxSeason

0 notes

Text

Corporate Tax Law in UAE : A Comprehensive Guide

Explore the latest updates and insights on corporate tax law in UAE. In this blog we covers changes, implications, and strategic considerations for businesses.

#sabindia#corporatetaxlaw#uae#taxregulations#businesslaw#taxation#taxadvisory#taxplanning#legalguidance#financialcompliance#corporatefinance#uaebusiness#taxationrules#businessguidance#taxlaw

0 notes

Text

FPSEs in India: Navigating Tax and CSR Laws for Sustainable Social Impact

Explore the challenges and opportunities faced by for-profit social enterprises (FPSEs) in India. Learn how they navigate tax regulations, CSR laws, and leverage government initiatives to unlock funding and achieve social impact.

0 notes

Text

Future Trends and Innovations of E-way bills:

As we gaze into the crystal ball of logistics, what does the future hold for e-way bills? One emerging trend is the integration of e-way bill systems with emerging technologies such as blockchain and artificial intelligence.

These innovations promise to enhance the efficiency and security of e-way bill management, ushering in a new era of digitized logistics. Moreover, with the advent of smart transportation solutions and IoT-enabled tracking devices, the monitoring and management of e-way bills are set to become even more streamlined and automated.

Indeed, the future of e-way bills is brimming with possibilities, poised to revolutionize the way we transport goods across borders.

#gstfiling#businesstaxes#gststructure#gstreturns#businesscompliance#businesssupport#financialhealth#taxcompliance#financialmanagement#taxregulations

0 notes

Text

What Tax Forms Do You Need to Collect From a 1099 Independent Contractor?

Ensure you obtain Form W-9 from each 1099 independent contractor, gathering crucial details like their name, address, and taxpayer identification number (TIN). Collect Form 1099-NEC or 1099-MISC from contractors, providing a comprehensive overview of their earnings for accurate IRS reporting purposes. Additionally, gather any pertinent state tax forms required based on the contractor's location, ensuring compliance with state-specific reporting regulations.

#IRS#2024taxes#form1099online#fines#deadlines#filingrequirements#taxregulations#taxcompliance#taxforms

0 notes

Text

Who has to File an Income Tax Return Mandatorily in Delhi?

In the bustling metropolis of Delhi, navigating the maze of income tax regulations can be daunting. Understanding who is obligated to file an income tax return is crucial for every resident. Let's delve into the criteria that make income tax return filing mandatory in Delhi and explore key considerations to streamline the process effectively.

Criteria for Mandatory Income Tax Return Filing in Delhi

Resident Status: Individuals residing in Delhi, whether citizens or non-citizens, are required to file an income tax return if their total income exceeds the prescribed threshold set by the Income Tax Department.

Income Thresholds: The income thresholds vary depending on the age and residential status of the individual. For instance, for the assessment year 2023-24, individuals below 60 years of age with an income exceeding ₹2.5 lakhs are required to file returns. For senior citizens aged 60 to 80, the threshold is ₹3 lakhs, and for super senior citizens above 80 years, it stands at ₹5 lakhs.

Understanding Income Thresholds and Eligibility

Age-based Thresholds: The income tax slabs and thresholds are categorized based on age to provide relief to different segments of taxpayers. It's essential to ascertain the correct slab applicable to your age group to determine your tax filing obligations accurately.

Types of Income: Apart from salary income, various sources such as rental income, interest income, capital gains, and income from business or profession contribute to the total income. Individuals must consider all sources of income to assess whether they meet the mandatory filing criteria.

Implications of Residential Status on Tax Filing Obligations

Resident vs. Non-Resident: The residential status of an individual greatly impacts their tax liabilities. Residents are taxed on their global income, including income earned abroad, whereas non-residents are taxed only on income earned in India. Understanding your residential status is crucial for determining your tax filing obligations accurately.

Double Taxation Avoidance: Individuals who qualify as residents in more than one country may be subjected to double taxation. It's imperative to leverage double taxation avoidance agreements, if applicable, to prevent paying taxes on the same income in multiple jurisdictions.

Importance of Aadhaar Linking and PAN Verification

Aadhaar Linking: Linking Aadhaar with PAN is mandatory for filing income tax returns. It streamlines the verification process and helps in curbing tax evasion by ensuring transparency and authenticity in financial transactions.

PAN Verification: Verifying PAN details ensures that the information provided in the tax return is accurate and matches the records with the Income Tax Department. Any discrepancies in PAN Registration details can lead to delays or rejections in the filing process.

Streamlining the Process With Taxgoal: Online ITR Filing in Delhi

Simplified Online Filing: Taxgoal provides a user-friendly platform for individuals to file their income tax returns seamlessly. With step-by-step guidance and intuitive interfaces, taxpayers can navigate through the filing process effortlessly.

Expert Assistance: Taxgoal offers expert assistance to address queries and provide personalized tax advice. Whether you're a salaried individual, a freelancer, or a business owner, Taxgoal caters to diverse tax filing needs with precision and reliability.

Conclusion

Navigating the intricacies of regulations For Income Tax Return Filing in Delhi requires a clear understanding of the criteria for mandatory filing and compliance with verification procedures. By leveraging technology-driven solutions like Taxgoal, taxpayers can streamline the filing process and ensure adherence to regulatory requirements, thus fostering a culture of tax compliance and transparency.

Final Words

As Delhi continues to evolve as a dynamic economic hub, staying abreast of tax regulations is paramount for individuals to fulfill their civic responsibilities and contribute to the nation's growth story. With the right tools and knowledge at their disposal, taxpayers can navigate the tax landscape with confidence and efficiency.

#Taxgoal#IncomeTax#TaxFiling#DelhiTax#TaxRegulations#Aadhaar#PANVerification#TaxCompliance#ResidentialStatus#TaxThresholds#OnlineFiling#DoubleTaxation#TaxationLaws#FinancialCompliance#TaxAdvice

0 notes

Text

Understanding the Professional Tax Act in India

In India, taxes are a significant part of the financial system, funding government activities and public services. Among the many forms of taxes, one unique levy is the Professional Tax. Unlike income tax, which is a direct tax, professional tax is levied by individual state governments and applies to professionals, tradespeople, and employees based on their earnings. Here's a comprehensive overview of the Professional Tax Act in India and how it works.

What is Professional Tax?

Professional Tax is a tax imposed on individuals engaged in professions, trades, callings, or employment. It is primarily aimed at generating revenue for state governments, helping them fund public services. This tax is applicable to people working in various sectors, including private employees, business owners, and professionals like doctors, lawyers, and chartered accountants.

Legal Framework: The Constitution of India and State Laws

The Professional Tax Act is governed under Article 276 of the Indian Constitution, which allows state governments to impose a tax on professions, trades, callings, and employments. However, the tax structure, rates, and the manner in which it is collected vary from state to state, as the authority to impose and administer the professional tax lies with the state governments.

While the Professional Tax Act is designed by each state individually, it follows a broad framework to ensure uniformity in basic principles.

Who is Liable to Pay Professional Tax?

Professional Tax applies to:

Employees: Every individual working in a profession, trade, or calling, whether in the private or public sector, is liable to pay professional tax if their income exceeds a certain threshold, which is determined by the state government.

Professionals: Independent professionals, such as doctors, lawyers, chartered accountants, and consultants, must also pay professional tax.

Employers: In most cases, the responsibility for paying professional tax on behalf of employees lies with the employer, who deducts the tax from the salary and remits it to the state authorities.

Business Owners and Self-Employed Individuals: Individuals who run their own businesses, like shopkeepers, traders, or contractors, must also pay professional tax as per the tax slabs defined by the state.

How is Professional Tax Calculated?

The calculation of professional tax varies according to the state in which the individual or business is based. Each state has its own set of rules for professional tax calculation, which usually takes into account the income of the individual or business.

Taxable Income Brackets: States have defined income brackets for different levels of income, and tax is levied based on the salary or income of the individual or business.

Flat Rate or Progressive Rates: Some states impose a flat rate of professional tax, while others use a progressive rate system where higher-income earners pay a higher amount of tax.

Maximum Limit: The Indian Constitution sets the maximum professional tax payable by any individual at Rs. 2,500 per year.

Deductions for Employers: For salaried individuals, employers usually deduct the professional tax amount from their monthly salary and deposit it with the state government. For self-employed professionals, the individual is responsible for self-assessment and payment.

Professional Tax Rates in Different States

As mentioned, professional tax rates and slabs differ from state to state. Here are some examples of how it varies:

Maharashtra: In Maharashtra, professional tax is levied on monthly income, with rates ranging from Rs. 175 to Rs. 2,500 per year.

Karnataka: The professional tax in Karnataka varies from Rs. 150 to Rs. 2,500 annually, depending on income.

West Bengal: West Bengal follows a progressive rate system with annual professional tax varying from Rs. 600 to Rs. 2,500.

Tamil Nadu: Tamil Nadu also imposes professional tax based on income slabs, with the maximum tax being Rs. 2,500 annually.

Filing and Payment of Professional Tax

Employers' Responsibility: In most cases, employers are responsible for deducting professional tax from employees' salaries and remitting the amount to the state authorities. They must file periodic returns with the relevant state government to ensure compliance.

Self-Employed Individuals: Professionals and business owners who are not salaried employees need to pay professional tax directly to the state government. These individuals must file their returns and ensure timely payment.

Penalties: Non-payment or delayed payment of professional tax can attract penalties, interest, and legal actions by the state government.

Professional Tax Exemption

Some categories of individuals are exempted from paying professional tax under the Act. These may include:

Salaried individuals earning below a certain income threshold.

Senior citizens, in some states, may also be exempt.

Individuals with disabilities.

Each state government defines exemptions, so individuals need to consult the specific state rules.

Why is Professional Tax Important?

Revenue Generation for States: Professional tax is a significant source of revenue for state governments, which is used to fund infrastructure and public services such as education, healthcare, and public welfare.

Simplified Taxation: Professional tax offers a simplified method of taxation for the government. It helps maintain a balance between different types of workers, professionals, and businesses, with states managing their own tax rates.

Public Services: The money collected from professional tax is reinvested in public services, contributing to the development of local infrastructure and enhancing the quality of life in communities.

The Professional Tax Act in India is an essential component of the country’s fiscal structure, enabling state governments to raise funds for public welfare and services. While its framework is similar across states, the rates and collection methods vary based on state-specific laws. Whether for salaried employees, professionals, or business owners, understanding the nuances of professional tax is crucial for compliance and avoiding penalties.

#ProfessionalTax#TaxInIndia#TaxCompliance#IndianTaxSystem#StateTaxes#IncomeTax#BusinessTaxes#TaxRegulations#EmployeeTax#SelfEmployedTaxes#FinanceIndia#TaxFiling#TaxDeductions#LegalCompliance#TaxEducation

0 notes

Text

GST Compliance: Requirements, Invoice, Audit

Explore essential insights into GST compliance, covering requirements, invoicing practices, and audit procedures. Stay informed to ensure smooth adherence to GST regulations.

Read Our Detailed article in the below link 👇- https://www.mygstrefund.com/GSTCompliance-Requirements-Invoice-Audit/

THANKS FOR READING! We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com Join Our Community: community.mygstrefund.com Contact Us: +91 9205005072 Mail- [email protected]

#GSTCompliance#Requirements#Invoice#Audit#GSTInsights#ComplianceEssentials#InvoicingWisdom#AuditReadiness#StayInformed#TaxRegulations

0 notes

Text

Comprehensive Tax Return Filing Services in the UK

Experience seamless tax compliance with our comprehensive tax return filing services in the UK. Our expert team ensures accurate and timely submissions, helping you navigate complex regulations while maximizing deductions.

0 notes