#tax audit due date

Explore tagged Tumblr posts

Text

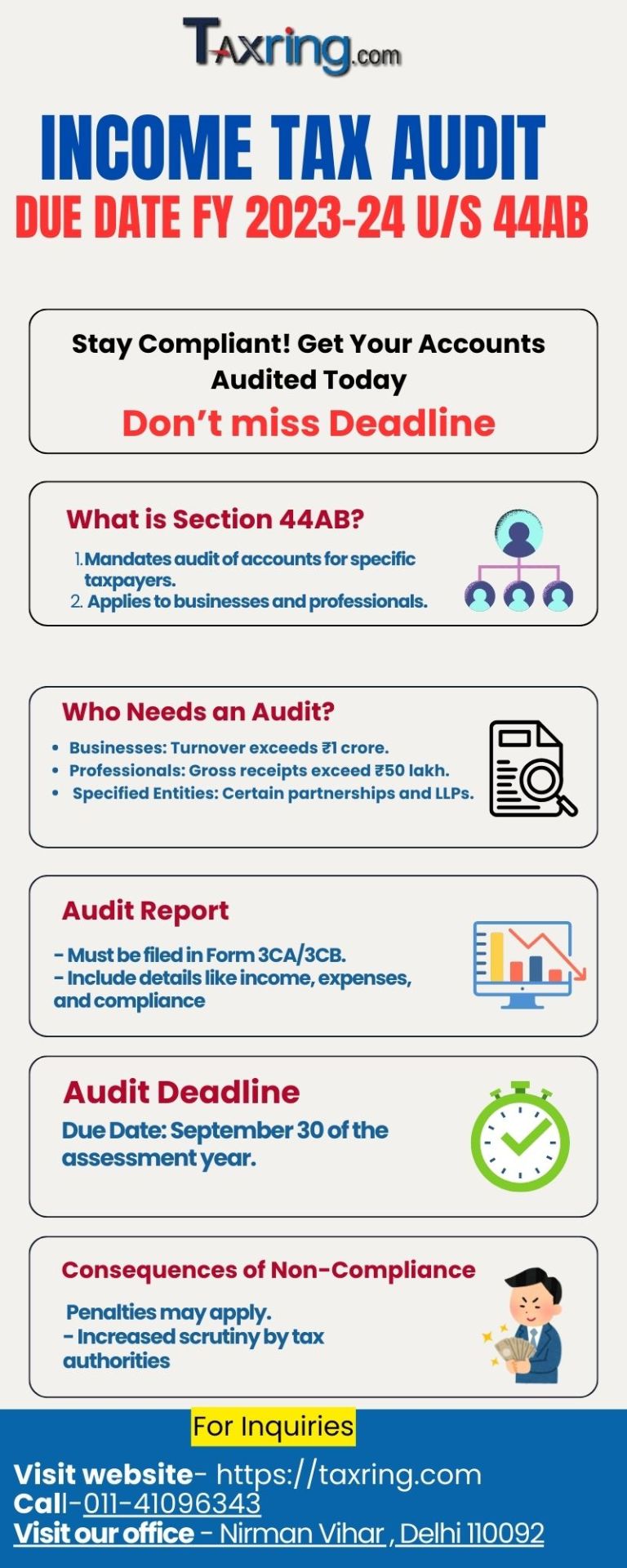

As the September 30 deadline approaches, it’s essential for taxpayers to understand the implications of late filing of tax audit reports. The penalties can be significant, and potential glitches on the ITR e-filing portal could further complicate matters. By taking proactive measures, staying informed, and ensuring timely submission, taxpayers can avoid unnecessary stress and penalties. For those needing assistance, consulting with tax professionals can be invaluable in navigating this complex process. why you need tax consultant

#income tax#tax audit#income tax audit#tax audit due date extension#tax audit due date#income tax audit fy 2024 25#tax audit last date for fy 2024 2025#income tax login#income tax return#tax refund#itr#TaxDeadline#FY2023-24#TaxFiling#AvoidPenalties#TaxProfessionals#TaxCompliance#BusinessTaxes#IndividualTaxes#TaxRegulations#FinancialPlanning#TaxTips#TaxHelp#AuditRequirements#IncomeTaxAudit#SeptemberDeadline#TaxAdvice#TaxSeason

0 notes

Text

Upcoming Income Tax Due Dates In October 2024

Income Tax Due DatesYou May Also LikeGet Free Updates[Join WhatsApp Group] Income Tax Due Dates There are several income tax due dates which are falling on October 30 and October 31, 2024. Please find due date relevant to you from the below list and take timely action. A live due date counter is set up so that you can easily find the time gap. 1730312940 days hours minutes secondsuntil30…

0 notes

Text

Filing income tax returns (ITR) can be daunting, but with the right guidance, it becomes a breeze. At Caonweb, under the expert guidance of CA Sakshi Agarwal, we understand the nuances of Income Tax Return Filing. Here are some crucial things to keep in mind.

0 notes

Text

Professional Tax Consultants in Delhi – SC Bhagat & Co.

Navigating the complexities of tax regulations can be a daunting task for businesses and individuals alike. With constant changes in tax laws, having a trusted tax consultant by your side is crucial. For those in Delhi, SC Bhagat & Co. offers unparalleled professional tax consultancy services to ensure you stay compliant while optimizing your tax liabilities.

Why You Need a Professional Tax Consultant Tax compliance is not just about paying your dues on time. It involves strategic planning, accurate filing, and ensuring that you take advantage of all available deductions and exemptions. Whether you’re running a business or managing personal finances, having a professional tax consultant brings several benefits:

Accurate Filing: Avoid errors and penalties by ensuring that your tax filings are accurate and complete. Tax Planning: Proper tax planning can help you minimize tax liabilities and make the most of legal exemptions. Compliance with Tax Laws: With ever-changing tax regulations, professional consultants help you stay compliant and avoid potential legal issues. Time-Saving: Handling taxes can be time-consuming. A professional tax consultant manages everything, saving you valuable time and effort. Why Choose SC Bhagat & Co.? When it comes to professional tax consultants in Delhi, SC Bhagat & Co. stands out for its commitment to client success and in-depth knowledge of the tax landscape. Here’s why you should choose them:

Decades of Experience SC Bhagat & Co. has a rich history of providing expert tax consultation services. Their team of seasoned professionals brings decades of experience, making them well-equipped to handle even the most complex tax issues.

Tailored Tax Solutions Every business or individual has unique tax requirements. SC Bhagat & Co. offers personalized tax solutions that cater specifically to your needs, whether you’re a small business, a corporation, or an individual taxpayer.

Comprehensive Services The firm offers a wide range of services, including:

Income tax filing and return preparation GST compliance and advisory Tax audits International taxation Business tax planning With their expertise, you can manage all aspects of taxation under one roof.

Up-to-date Knowledge Tax laws in India are constantly evolving. SC Bhagat & Co. prides itself on staying up-to-date with the latest regulations and providing proactive advice that keeps clients ahead of the curve.

Client-Centric Approach SC Bhagat & Co. is known for building long-term relationships with its clients by offering reliable, transparent, and timely services. They prioritize understanding their clients’ needs to provide solutions that lead to financial growth and compliance.

The Importance of Hiring a Tax Consultant in Delhi Delhi is a hub for businesses of all sizes, and the tax requirements in this thriving metropolis can be overwhelming. Hiring a professional tax consultant like SC Bhagat & Co. ensures that you stay on top of your tax obligations, avoid hefty penalties, and make strategic financial decisions. Whether you're filing corporate taxes or personal income taxes, their team ensures seamless and efficient tax handling.

Contact SC Bhagat & Co. Today If you're looking for professional tax consultants in Delhi, SC Bhagat & Co. is your go-to partner for tax management and advisory services. With years of expertise and a client-first approach, they can handle all your tax needs, ensuring compliance and helping you maximize your savings.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

3 notes

·

View notes

Text

The Indispensable Role of Accounting Services in Business Success

Introduction

In the intricate world of business, where every penny counts and financial decisions can make or break a company, accounting services play a pivotal role. From managing financial records to providing strategic insights, accounting services are indispensable for ensuring the smooth operation and long-term success of businesses across industries. In this comprehensive article, we delve into the importance of accounting services and how they contribute to the growth and sustainability of businesses.

The Foundation of Financial Management

At the core of accounting services lies the fundamental task of recording, organizing, and interpreting financial data. Accountants meticulously track income, expenses, assets, and liabilities, creating a comprehensive picture of a company's financial health. By maintaining accurate and up-to-date financial records, businesses can make informed decisions, identify trends, and plan for the future with confidence.

Ensuring Compliance

In today's complex regulatory environment, businesses must adhere to a myriad of financial regulations and reporting requirements. Accounting services ensure that businesses remain compliant with tax laws, industry standards, and government regulations. From filing tax returns to preparing financial statements, accountants navigate the intricate web of regulations, mitigating the risk of penalties and legal issues.

Strategic Financial Planning

Beyond compliance, accounting services provide valuable insights that drive strategic decision-making. By analyzing financial data, accountants identify opportunities for cost savings, revenue growth, and improved efficiency. They develop forecasts, budgets, and financial models that guide business strategy and help companies achieve their long-term goals. Whether it's expanding into new markets, investing in technology, or optimizing operations, accounting services provide the financial intelligence needed to make informed decisions.

Risk Management

In an ever-changing business landscape, risk management is paramount. Accounting services help businesses identify and mitigate financial risks, safeguarding their assets and reputation. From detecting fraudulent activity to implementing internal controls, accountants play a critical role in protecting businesses from financial harm. By conducting audits, risk assessments, and fraud examinations, accounting services provide assurance that financial processes are robust and secure.

Facilitating Growth and Expansion

As businesses grow and evolve, accounting services adapt to meet their changing needs. Whether it's scaling operations, acquiring new assets, or expanding into new markets, accountants provide strategic guidance and support every step of the way. From structuring financing arrangements to conducting due diligence on potential acquisitions, accounting services facilitate growth and expansion, ensuring that businesses seize opportunities and navigate challenges effectively.

Enhancing Stakeholder Confidence

Transparent and accurate financial reporting instils confidence among stakeholders, including investors, lenders, and business partners. Accounting services ensure that financial statements reflect the true financial position of a company, fostering trust and credibility. By providing timely and reliable financial information, accountants enable stakeholders to make informed decisions and support the growth and stability of the business.

Conclusion

In conclusion, accounting services are the cornerstone of modern business operations. From maintaining financial records to providing strategic insights, accountants play a multifaceted role in driving business success. By ensuring compliance, facilitating strategic decision-making, and managing financial risks, accounting services contribute to the growth, sustainability, and resilience of businesses in today's competitive landscape. As businesses navigate the complexities of the modern economy, accounting services remain indispensable for achieving long-term prosperity and realizing strategic objectives.

4 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

Annual Compliance Requirements for One Person Company (OPC) – A Complete Guide

A One Person Company (OPC) is a unique type of business entity introduced under the Companies Act 2013. It allows a single individual to form a company and enjoy the benefits of a corporate structure while avoiding many of the complexities associated with traditional business structures. However, despite being simpler, Annual Compliance For Opc are required to follow certain obligations to stay compliant with legal and regulatory requirements.

1. Annual Return Filing (MGT-7A)

Every OPC must file an annual return in Form MGT-7A, a simplified form designed for OPCs and small companies. This return contains details of the management, financial summary, and shareholders. It should be filed with the Registrar of Companies (RoC) within 60 days of the conclusion of the Annual General Meeting (AGM).

Due Date: Within 60 days from the date of AGM or the due date of AGM (which is six months from the end of the financial year).

2. Financial Statement Filing (AOC-4)

The OPC's financial statements must be filed in Form AOC-4. This form includes the balance sheet, profit and loss account, and other related financial documents. It is crucial to get these statements audited by a Chartered Accountant.

Due Date: Within 180 days of the close of the financial year (typically, the due date is 27 September).

3. Income Tax Returns

OPCs must file their income tax returns by the prescribed date. The tax rates for OPCs follow the same guidelines as those applicable to private limited companies, and any profits are taxed at a flat rate of 25-30%, depending on the turnover.

Due Date: 30th September of the relevant assessment year.

4. GST Filings

If the OPC is registered under GST, it must file monthly or quarterly GST returns (depending on its turnover). Additionally, an annual GST return (GSTR-9) summarising all the transactions must be filed.

Monthly/Quarterly Returns: GSTR-1 and GSTR-3B.

Annual Return: GSTR-9 (if applicable).

5. Board Meetings

An OPC with more than one director is not required to hold board meetings. However, if the company has more than one director, it must hold at least two board meetings each year. The gap between these meetings is 90 days at most.

6. Audit of Accounts

Just like other companies, an OPC is required to get its financial accounts audited. The appointment of an auditor is mandatory, and the auditor must audit the books of accounts and submit a report.

7. Director's Report

A Director's Report must be attached along with the financial statements. This report highlights the financial status of the company and other related information such as risks, plans, etc.

8. Other Compliance

KYC of Directors: Every director of an OPC must file DIR-3 KYC annually to update their KYC information with the Ministry of Corporate Affairs (MCA).

Form DPT-3: If the company has accepted deposits, Form DPT-3 needs to be filed. It is a declaration of the return of deposits or outstanding receipt of money.

Penalties for Non-Compliance

Failure to comply with the annual compliance requirements can result in penalties for the OPC. These penalties can range from fines for late filings to disqualification of directors or even legal actions against the company.

Conclusion

While an OPC offers flexibility and control to a single person, it’s essential to adhere to the annual compliance requirements to maintain the company’s legal standing. Timely filing of forms, keeping proper records, and staying updated with legal requirements can help avoid hefty penalties and ensure smooth business operations.

0 notes

Text

3 Reasons To Use a Professional For Tax Preparation For Realtors in Austin and Dallas, TX

The time to pay the necessary taxes is often a time filled with anxiety. It is common to find individuals worrying endlessly about the possibility of being audited by the IRS. One should not expect the worst as long as the responsibilities of a good American are carried out smoothly. It is also important to remember that while the process of calculating the due taxes and filing the return within the due date is simple for an employed individual, it can be complex for a citizen having multiple sources of income or a business owner/contractor. Hiring a professional for tax preparation for realtors in Austin and Dallas, TX, can be helpful for a person who earns an income by providing specific real estate-related services. Realtors are often scared to handle the taxation-related tasks themselves due to the complexities involved. A tax preparer who is well acquainted with the system can provide the best assistance to such clients by offering the following: -

Specialized Knowledge- Realtors earn from multiple sources, such as organizing open houses, showing prospective clients around, and providing information about the properties available to rent and buy. Real estate agents also earn commissions when a sale is successful. Therefore, the taxes are based on income from all sources. Calculating the due taxes can be tricky as the calculation process will likely differ depending on the type of income. It is best to have a tax expert go through the books and do the calculation, thus leaving the realtor with time to pursue the primary profession.

Tax Regulations- The laws of taxation tend to change regularly. A layperson often has no inkling about the recent changes and may make errors when calculating the taxes. Tax professionals, on the other hand, remain informed about the changes and can file tax returns flawlessly on behalf of their clients. The professional will meticulously explain the changes to their client and reveal the right way to do the taxes in a way that is compliant with the latest IRS regulations.

Maximizing Tax Deductions- With the new law comes many opportunities for tax deductions, too. There are bound to be new ways of ensuring tax deductions, too. The taxation expert could research and identify the opportunities, further reducing tax obligations. It is interesting to note that realtors can claim deductions on business-related travel, marketing expenses, office rent, and vehicle expenses. Keeping accurate records and making use of the present tax laws can enable the realtor to save a high amount in taxes. This can be used for other purposes once the tax refunds are credited.

The process of tax preparation for realtors in Austin and Dallas, TX, is not merely for saving taxes. Instead, the tax expert can provide invaluable assistance in long-term financial planning. The tax pro can help the client structure the real estate business, thus opening up opportunities for making investments and/or maximizing savings, as well as helping with profitability.

0 notes

Text

Leon Nazarian, CPA

Despite appearances, doing your taxes ahead of time is a significant time commitment. If you really want something bad enough, you can achieve it. You are capable of overcoming any obstacle. When working with tax preparation services, it is crucial to be honest and upfront Tax Relief Attorney Certified Public Accountant in the San Monica Area The Santa Monica tax service we offer is affordable for everyone.

As soon as problems emerge, things quickly deteriorate. If you require assistance in getting the funds, you are not required to use the services of a certified public accountant. Some companies have failed because there is a critical shortage of qualified accountants. They have achieved all that they have accomplished because of their remarkable accounting abilities. The fact that their skills have so much unrealized potential seems to be going unmentioned. The financial records of your company should be reviewed by an unbiased third party, such as a certified public accountant (CPA). A certified public accountant's contact information should be readily available in case of any audits or financial planning requirements. Certified public accountants must adhere to all standards in order for the "CPA" seal on their uniform to maintain its validity. They are like a dependable family member or friend: always there for you when you need them. A certified public accountant's duties do not include auditing. An explosion in the number of people choosing to get their CPA certification would have far-reaching consequences for society. Kindly inform me of the date on which my public accounting qualification will no longer be valid. Thank you so much for everything. I am eternally grateful. Oh, Lord, keep me safe and show me the path you want me to take. Please inform me without delay. Our feelings are clearly in harmony. Each person's actions determine the final outcome. Studying people's habits and routines is an endless endeavor, as the name suggests. This unfortunate result was caused by an unusual confluence of events.

The application deadline for tax returns was rapidly approaching, and very few companies had even looked at it. Organizations, trusts, and estate planning are intricate topics that necessitate legal counsel. It is my pleasure to help companies of any size with their tax preparation requirements Tax Debt Relief Company My extensive expertise in tax concerns has been invaluable to numerous NGOs. Providing clearer instructions about how to complete the evaluation would be beneficial. It would be really appreciated if you could provide more details. To tell the truth, it achieves its goals. My strong academic background and much relevant job experience allowed me to climb the corporate ladder and become a senior executive. This is where my adaptability has really shone through. I used to know a lot less than I do today. I was able to advance in my corporate position and earn my CPA credential through a string of fortunate events. The more time that passes, the more convinced I am of its truthfulness. I am confident in my ability to make a significant impact in this position as a result of my training and background. Due to issues with debt collection, restrictions on data export, penalties, seizures, and liens, customers may face difficulties when attempting to obtain their US tax information. Helping the downtrodden is my current priority. If my clients experience any issues with audits, modifications, or late files, they are welcome to contact me at any time of day or night. Fortunately, these mishaps did not result in any injuries. In the end, everyone was satisfied with the result. It is encouraging to hear that your concerns have been acknowledged. Things got back to normal after the problems were fixed. I made the most of every pitch I faced during my at-bat. I had to make sure everything was consistent because there were so many links. A year of relevant work experience is usually required of applicants to master's degree programs in taxes. Getting everyone to agree on anything was the hardest part. At this time, the only thing Santa Monica Tax Debt Resolution Services needs from potential clients is an application. Your access to the review will be permanent once the trial time ends. If you do not fulfill these criteria, your application will not be reviewed for admission. The documents will be inaccessible after that time frame. One of my ultimate life goals is to earn a master's degree in education. This needs to be taken care of right now.

The majority of Americans support enacting the MST Core Curriculum and reducing taxes. This master's degree program is second to none, according to their professional assessments. The leading Santa Monica accounting company carefully considered this option. Among these esteemed institutions, Golden Gate University in San Francisco ranks high. The current activities of this group serve as a sneak peek at the plans for the future of the organization. You will benefit greatly from this conversation regardless of your level of tax knowledge. Those who have trouble believing in themselves will benefit much from this lesson.

Among these, CSUN is the most notable. Many people are capable of doing it. You won't find anything else on the market with that level of quality. That level of quality is unmatched by anything else on the market. "This is just physical labor," individuals continued claiming. In the corporate world, this is how service contracts are often drafted and signed.

0 notes

Text

The Significance of Small Business Bookkeeping and Tax Returns in Canada

Managing a small business is an exciting endeavor, but keeping finances in check is vital for long-term success. Many entrepreneurs struggle with maintaining accurate records, preparing financial statements, and ensuring timely tax filings. This is where professional bookkeeping services become invaluable, especially for those seeking bookkeeping in Scarborough, bookkeeping in Toronto, or bookkeeping in Ontario.

Why Small Business Bookkeeping is Essential

Small business bookkeeping goes beyond tracking expenses and revenue. It ensures compliance with tax laws, facilitates budgeting, and provides crucial financial insights. Whether you operate in Scarborough, Toronto, or anywhere in Canada, maintaining precise financial records is key to business growth.

Comprehensive Bookkeeping & Tax Return Services

A reliable accounting firm in Scarborough can manage bookkeeping and tax return preparation efficiently. These services ensure accurate tax filings, minimizing the risk of penalties and audits. If you’re searching for certified accountants in Scarborough, working with financial experts can streamline processes and make tax season hassle-free.

Choosing the Right Bookkeeping Services in Canada

For small business owners looking for bookkeeping in Canada, partnering with professionals who understand Canadian tax regulations is crucial. Whether you need bookkeeping in Scarborough or an accounting firm in Scarborough, selecting experienced accountants helps maintain financial stability.

Advantages of Hiring a Professional Accountant

Accurate Financial Records – Keep up-to-date financial reports for strategic decision-making.

Tax Compliance – Ensure timely tax submissions and avoid potential penalties.

Time Efficiency – Focus on business growth while experts handle bookkeeping.

Financial Advisory – Receive expert guidance to optimize revenue and reduce expenses.

Expert Tax Return Assistance in Scarborough

Navigating tax returns can be challenging due to evolving tax laws. Collaborating with Scarborough accountants or certified accountants in Scarborough simplifies the process. A professional team ensures precise tax preparation, maximizing deductions and saving money.

Conclusion

Whether you require assistance with bookkeeping in Toronto, tax return in Scarborough, or general financial guidance, choosing the right professionals is crucial. Small business bookkeeping plays a fundamental role in successful business management, and having experienced accountants on your team can make a significant impact.

For dependable bookkeeping and tax return services, consider working with experts in bookkeeping in Ontario to ensure your business stays financially secure!

#bank reconciliations#book keeping services#financing and mortgage#payroll services#Tax services Scarborough

0 notes

Text

Don’t Miss the Tax Audit Deadline Learn About the Tax Audit Deadline and Late Filing Penalties

Income tax legislation mandates that certain taxpayers perform income tax audits. The scope of this audit includes a thorough examination of the taxpayer’s financial records and books of accounts, particularly for those who get revenue from their business or profession. Verifying the correctness of income tax returns (ITRs) and financial statements is the primary goal of tax audits. The law intends to deter tax evasion and encourage compliance among entities by enforcing tax audits.

Knowing about the penalties for filing tax audit reports beyond the deadline

Many taxpayers are concerned about maintaining compliance as the September 30 deadline for filing tax audit reports draws near. Important information about the tax audit deadline, late filing fines, and any problems taxpayers can have with the ITR e-filing portal will all be covered in this blog.

What is the due date of tax audit The deadline for submitting tax audit reports for the fiscal year 2023–2024 is September 30, 2024. For taxpayers whose professional income surpasses ₹50 lakhs or whose firm sales exceeds ₹1 crore, this deadline is critical. If you miss this deadline, there could be serious consequences.

If you forget to file your tax audit by September 30, here are some important points to consider:

1. Belated Return: You can file a belated return, but there may be penalties associated with it.

2. Penalty: A penalty of up to ₹5,000 may apply for late filing. If your total income is less than ₹5 lakh, the penalty could be reduced to ₹1,000.

3. Interest Charges: If you have any tax due and don’t pay it on time, interest may also be charged on the outstanding amount.

4. Revised Return: If you’ve already filed a return but realize there are errors, you can file a revised return.

5. Consult a Professional: It’s advisable to consult a tax professional to understand the process and implications better.

Read here — why you need tax consultant ?

Summary Taxpayers need to be aware of the consequences of filing tax audit reports beyond the deadline of September 30. Significant penalties may apply, and problems with the ITR e-filing facility might make things much more difficult. Taxpayers can prevent needless stress and fines by being proactive, remaining educated, and making sure their submissions are made on time. Tax specialists can be a great resource for people who need help navigating this complicated procedure.

Related articles: Income tax audit u/s 44ab , Books of account 44aa , How to file Belated return if you missed ITR deadline?

#tax audit#income tax audit#tax audit due date#income tax audit due date for fy 2024-25#audit report filing last date#tax audit due date extension#income tax filing#income tax return#e filing portal

0 notes

Text

The Role of Trucking Advisory Services in Risk Management and Financial Planning

The trucking industry faces numerous financial and operational risks, from fluctuating fuel costs to regulatory compliance challenges. To navigate these complexities, trucking businesses rely on trucking business advisory services for expert guidance in risk management and financial planning. These services help companies mitigate risks, improve profitability, and ensure long-term stability.

1. Identifying and Managing Financial Risks

Trucking businesses deal with high operating costs, volatile fuel prices, and unpredictable market conditions. Trucking advisory services help businesses:

Analyze cash flow: Ensuring there’s enough liquidity to cover expenses, including fuel, maintenance, and payroll.

Reduce tax liabilities: Identifying deductions and tax-saving strategies to minimize financial burdens.

Plan for seasonal fluctuations: Develop strategies to manage lower revenue periods without financial strain.

By assessing financial risks, trucking advisors help businesses make informed decisions that prevent unexpected financial crises.

2. Compliance and Regulatory Risk Management

Non-compliance with tax laws, Department of Transportation (DOT) regulations, and FMCSA safety requirements can lead to fines and penalties. Trucking advisory services assist businesses in:

Keeping accurate financial records for tax audits.

Ensuring compliance with fuel tax reporting (IFTA).

Managing licensing, permits, and insurance requirements.

Advisors help trucking companies stay up to date with changing regulations, reducing the risk of legal issues that could impact operations.

3. Insurance and Liability Protection

Accidents, cargo damage, and liability claims pose significant risks in the trucking industry. Trucking advisory services assist in selecting the right insurance coverage, such as:

Commercial truck insurance: Protects against damages and liability.

Cargo insurance: Covers losses due to theft or damage.

Workers' compensation: Ensures protection for drivers in case of injuries.

Proper risk assessment ensures trucking businesses invest in adequate coverage while keeping costs manageable.

4. Strategic Financial Planning for Growth

Trucking businesses need structured financial planning to expand their fleet, invest in new technology, or enter new markets. Trucking advisors assist with:

Budgeting and forecasting: Planning for short-term and long-term financial goals.

Equipment financing: Advising on whether to lease or purchase trucks.

Tax strategies: Maximizing deductions to reinvest in business growth.

By creating a strategic financial roadmap, trucking advisory services help businesses scale efficiently and sustainably.

5. Enhancing Operational Efficiency

Financial planning goes hand in hand with operational efficiency. Advisors help trucking companies:

Optimize fuel usage and reduce unnecessary expenses.

Implement better payroll and invoicing systems.

Streamline cash flow management to prevent disruptions.

Efficient financial planning ensures that trucking businesses operate smoothly while maintaining profitability.

Final Thoughts

Trucking advisory services play a vital role in mitigating risks and strengthening financial planning for trucking businesses. By offering expertise in tax planning, regulatory compliance, insurance selection, and financial forecasting, these services help trucking companies navigate challenges and achieve long-term success. Investing in professional advisory services ensures stability, profitability, and growth in a highly competitive industry.

0 notes

Text

Accounting Services in India by SC Bhagat & Co.: A Trusted Partner for Financial Excellence

In today’s fast-paced business world, managing finances efficiently is a cornerstone of success. Whether you're a small startup or a large corporation, maintaining accurate financial records is crucial. This is where professional accounting services come into play. One of the leading names offering accounting services in India is SC Bhagat & Co., a firm known for its dedication to quality, accuracy, and reliability.

Why Choose SC Bhagat & Co. for Accounting Services in India? SC Bhagat & Co. stands out among accounting firms in India due to its commitment to providing tailor-made financial solutions to businesses across various sectors. With years of experience, the firm offers a wide range of accounting and financial services designed to meet the unique needs of its clients.

Here’s why SC Bhagat & Co. should be your go-to for accounting services in India:

Comprehensive Accounting Solutions: Whether it’s bookkeeping, financial reporting, or preparing balance sheets, SC Bhagat & Co. offers end-to-end accounting services that ensure your financials are always in order.

Tax Compliance and Advisory: The firm specializes in helping businesses navigate the complex landscape of Indian taxation, ensuring full compliance with the latest tax laws. Their tax advisory services can also help businesses optimize their tax strategies.

Cost-Effective Services: Outsourcing accounting services to a trusted firm like SC Bhagat & Co. allows businesses to focus on growth while cutting down the costs of managing an in-house accounting team.

Tailored Solutions: Every business has unique financial needs. SC Bhagat & Co. customizes its services to suit the size, nature, and scope of your business, ensuring that you receive the best possible accounting support.

Expert Team: SC Bhagat & Co. is home to experienced chartered accountants and financial experts who bring a wealth of knowledge and expertise to the table. Their team stays up-to-date with industry trends and changes in legislation to provide the best advice.

Key Accounting Services Offered by SC Bhagat & Co. Bookkeeping and Financial Statement Preparation Accurate and timely bookkeeping is essential for the smooth operation of any business. SC Bhagat & Co. offers expert bookkeeping services, ensuring that all transactions are recorded properly and financial statements are prepared as per accounting standards.

Payroll Services Managing payroll can be a complex task, especially for growing businesses. SC Bhagat & Co. simplifies this by offering efficient payroll management services, ensuring that employees are paid on time, and all statutory deductions are handled accurately.

Tax Preparation and Filing The firm offers comprehensive tax preparation and filing services, helping businesses avoid penalties and stay compliant with Indian tax laws. They also provide expert tax planning advice to help businesses save money.

GST Compliance Since the introduction of the Goods and Services Tax (GST), compliance has become a top priority for businesses. SC Bhagat & Co. assists with GST registration, return filing, and ensuring compliance with GST regulations.

Audit Services SC Bhagat & Co. offers thorough audit services to provide businesses with an accurate assessment of their financial health. Their audit services help identify areas for improvement, ensuring that businesses remain financially stable and compliant with regulatory requirements.

Business Advisory In addition to their accounting services, SC Bhagat & Co. provides expert business advisory services. They help businesses identify growth opportunities, streamline processes, and make sound financial decisions.

Why Outsource Your Accounting Services? Outsourcing your accounting services to SC Bhagat & Co. can offer numerous benefits, including:

Time Savings: By outsourcing, businesses can save time spent on routine financial tasks and focus on their core activities. Cost Efficiency: Outsourcing eliminates the need to hire and train an in-house accounting team, which can reduce overhead costs significantly. Access to Expertise: When you partner with a reputable firm like SC Bhagat & Co., you gain access to a team of experts well-versed in the latest accounting standards and regulations.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

3 notes

·

View notes

Text

Accounting Homework Help: Get Expert Assistance for Better Learning

Accounting is very vital as it teaches how to manage financial transactions, generate statements, and analyze business performance. Every business, organization, and individual must track their financial conditions to make informed decisions. Accounting homework can pose some challenges due to the complexity of calculations, learnt financial principles, and practical applications therein. For this reason, The Tutors Help brings you its expert accounting homework assistance service to make learning easier and stress-free.

What Is Accounting?

Accounting is a systematic way of recording, summarizing, and analyzing financial transactions. It helps companies track income, expenditure, assets, and liabilities. The subject is divided into several branches, including:

Financial Accounting: Deals with preparing the balance sheets, income statements, and cash flow statements.

Managerial Accounting: Opportunities to aid internal financial decision-making processes.

Cost Accounting: Analysis and review of production costs for efficiency improvements.

Tax Accounting: Ensures business compliance with taxation laws and rules.

Auditing: Makes sure financial records comply with accurate information and investigates fraud.

Accounting homework requires knowledge in these fields with some good mathematical and analytical skills.

Challenges Students Face with Accounting Homework

Complex Calculations: Accounting involves intricate calculations with respect to financial transactions, assets, liabilities, and taxes.

Understanding Accounting Principles: Concepts such as accrual basis, depreciation, and financial ratios come up as obstacles in their comprehension.

Analysis of the financial statements: Students find it difficult to interpret and prepare balance sheets and income statements.

Time Management: Due to several subjects in a study course that take valuable time for preparation, accounting homework, thus, may remain yet unfinished.

Valid Reasons to Choose the Tutors Help

At The Tutors Help, we strive to help students by providing professional assistance to easier this subject for them. Here is why you should opt for accounting homework help from us:

Experienced Accounting Experts: Our teams are constituted of qualified accountants and academic professionals with vast knowledge.

Customized Solutions: Custom solutions based on your assignment's requirements are drafted against your university standards. Stepwise Explanations Our elaborate solutions help students grasp better in accounting concepts.

Plagiarism-Free Work: All our solutions are free from Pagiarisation and adhere to the academic integrity standards.

Timely Delivery: Your homework would be completed before the due date.

Affordable Pricing: The services we provide are cheap, so every student may have access to expert help and guidance.

The Next Steps to Seek Accounting Homework Help from The Tutors Help

It is not difficult to get help from The Tutors Help:

Present Your Homework: Get everything about the task, guidelines about it, and its deadline.

Ask for a Quote: We will present you with a competitive quote.

Expert Assistance: Our accounting professionals complete your homework with precision and clarity.

Review and Learn: Our solutions help by showcasing the concepts from an accounting perspective. Through such a plan, they build the right knowledge of accounting homework assistance.

Final Thoughts

Accounting is a key subject that helps students with basic financial teaching. Still, thus in the absence of right support, it might serve as a challenge. If you are having problems with journal entries, financial statements, or cost accounting, feel free to seek help from The Tutors Help. Contact us for any accounting assignments. Get The Tutors Help and uplift your grades or understanding in this field!

0 notes

Text

Corporate Tax Law in the UAE: Everything You Need to Know

Introduction

The United Arab Emirates (UAE) has long been known as a business-friendly destination with a favorable tax environment. However, with the introduction of corporate tax, businesses operating in the UAE must now comply with new regulations. Understanding corporate tax in the UAE, including corporate tax registration deadlines and corporate tax filing requirements, is essential for businesses to remain compliant and avoid penalties.

This provides a comprehensive guide to corporate tax law in the UAE, covering key aspects, compliance requirements, and best practices for businesses.

Understanding Corporate Tax in the UAE

Corporate tax is a direct tax imposed on the net profits of businesses. In the UAE, corporate tax is introduced to align with global tax practices while ensuring the country's economic stability. The corporate tax framework applies to most businesses, except for those engaged in extractive industries and certain free zone entities that meet specific conditions.

Key Features of Corporate Tax UAE:

Standard Tax Rate: The corporate tax rate in the UAE is set at 9% for taxable profits exceeding a specific threshold, ensuring a competitive tax environment.

Exemptions and Reliefs: Certain entities, including those engaged in public benefit activities or specific free zone businesses, may be eligible for tax exemptions.

Global Compliance Alignment: The UAE corporate tax law aligns with international tax principles, including OECD’s BEPS (Base Erosion and Profit Shifting) framework.

Corporate Tax Registration Deadline

To comply with UAE corporate tax laws, businesses must register for corporate tax within the deadlines set by the authorities. Failing to register within the specified timeline can result in penalties.

Important Considerations for Corporate Tax Registration:

Businesses should register before the deadline to avoid fines.

The registration process is managed by the Federal Tax Authority (FTA).

Businesses must provide accurate information, including financial records, trade licenses, and other relevant documents.

It is advisable for businesses to consult with tax professionals to ensure timely and accurate registration.

Corporate Tax Filing in the UAE

After registering for corporate tax, businesses must adhere to corporate tax filing requirements. Proper tax filing ensures compliance with UAE laws and prevents potential legal consequences.

Key Aspects of Corporate Tax Filing:

Annual Filing: Businesses are required to submit their corporate tax returns on an annual basis.

Financial Record-Keeping: Companies must maintain accurate financial records and statements to support their tax filings.

Deadlines and Penalties: Late filing or incorrect submissions can lead to penalties, making it crucial to stay informed about due dates and filing procedures.

To streamline the corporate tax filing process, businesses should leverage accounting software or seek assistance from tax advisors.

How Businesses Can Ensure Compliance

Complying with UAE corporate tax laws requires careful planning and adherence to regulations. Here are some best practices for businesses:

Understand Tax Obligations: Stay updated with the latest corporate tax regulations to ensure full compliance.

Timely Registration and Filing: Adhere to corporate tax registration deadline and corporate tax filing requirements to avoid penalties.

Maintain Accurate Financial Records: Keep proper documentation of income, expenses, and financial statements for audit purposes.

Seek Professional Assistance: Consulting tax experts can help businesses navigate complex tax regulations and optimize tax planning.

Conclusion

The introduction of corporate tax in the UAE marks a significant shift in the business landscape. Companies must ensure compliance by understanding corporate tax laws, meeting corporate tax registration deadlines, and following corporate tax filing requirements. By staying informed and proactive, businesses can adapt to these changes while continuing to thrive in the UAE’s dynamic economy.

For seamless compliance, businesses should engage tax professionals, maintain accurate financial records, and adhere to all deadlines set by the Federal Tax Authority. By doing so, they can avoid penalties and ensure smooth business operations under the new corporate tax regime in the UAE.

0 notes