#INCOME TAX DUE DATES

Explore tagged Tumblr posts

Text

Income Tax Due Dates In January 2025

Income Tax Due Dates In January 2025 Here are details of income tax due dates in January 2025, which will help you in doing timely compliance under the Income Tax Act. 7 January 2025 – Due date for deposit of Tax deducted [except under section 194-IA, section 194-IB, section 194M, or section 194S (by specified person)] or collected for the month of December, 2024. However, all the sum…

0 notes

Text

You know what really sucks? If you know that something is important and has real consequences if you don't do it or if you do it wrong, but you have no idea how to actually do the thing. It's scary and can make doing the thing very intimidating.

You know what's a really common thing everyone has to do but very few people are taught about?

Income taxes.

This infuriates me. So I sat down to write a brief and basic breakdown of how US federal income taxes work. It ended up being less brief than I originally envisioned, but the headers are in all caps so you can skip ahead to the questions you are interested in. But first here's my disclaimer. Do your own research, talk to a tax professional if you have questions, I'm not speaking on behalf of any tax return preparation company, don't sue me if you screw up your taxes, etc, etc. If you want to dig deeper into anything here, go to irs.gov and search for whatever you're looking for. The IRS website is actually pretty useful.

Alright. Let's go. Here's like, the basic, most over-simplified explanation of federal income taxes.

WHAT IS TAXES?

When a bunch of people get together and decide that they want to operate under the same set of rules, they form a government. That government takes money to run. They use it to hire people and fund programs that do things for their country and sometimes other countries. Sometimes the things the government spends money on are good things. Sometimes they are bad things. Sometimes they are good ideas executed poorly.

We're not going to get into that right now.

The point is, the government gets its money from the people it governs. I mean. Not all of it, probably. But the parts that are important for this conversation it does.

You, if you are a US citizen or someone living in the US, are required to pay a percentage of your income to the federal government. The amount is not a flat percentage. People who make more money get taxed on higher percentages of that money*. Somebody has to add up all the money you made during the year to figure out how much you should have paid in taxes. You do this sometime between January and mid-April (barring national disasters or ill-timed holidays that push back the due date) by filing a tax return. The normal due date is April 15.

*Look. Explaining exactly how tax brackets work requires pictures and/or hand gestures. You don't need to worry about it now.

HOW DOES A TAX RETURN WORK?

If you (and your spouse if you have one) work "normal" jobs, you'll get a form called a W-2 from any employers you worked for during the year. They contain info about how much money you made and how much of it was already sent to the government on your behalf. The most important boxes are box 1 (wages, tips, and other compensation) and box 2 (federal withholding). This shows 1. what you made before taxes were taken out and 2. how much of it was sent to the government for your federal tax payments. Filling out your tax return (Form 1040) will add up all your income, calculate how much you should have paid in taxes (AKA your tax liability), and compare that to what you DID pay. If you overpaid, you get a refund. If you underpaid, you have to make up the difference. If you underpaid by a LOT, there may be an underpayment penalty. (Note: the failure to file penalty, for not filing a tax return, is always more than the failure to pay penalty! If you owe the IRS it's better to go ahead and file on time. If you can't pay what you owe at once there are payment plan options. If you can't file on time you can file an extension which pushes your due date for filling back to October 15, usually. You can send a payment with your extension if required.)

If you're not using a professional, I highly reccommend using some kind of tax software to fill out your tax return. You'll get tax forms from your sources of income, and a few other select places. If it came in the mail or email and says "IMPORTANT TAX DOCUMENT ENCLOSED" you should save it and have it with you when you start preparing your tax return. Your software/tax professional should ask what you have, and then you or they will plug it into the software. You should just have to plug in basic info about yourself (legal name, date of birth, social security number, address, etc) and the data from any tax forms you received, and let the software do the work!

So that's basically it. You use the 1040 to figure out how much income you made, if you're elligible for any credits, and what you should have put into withholding. If you overpaid, you get a refund. If you underpaid, you will owe the IRS. All you really need to do is collect your tax documents and do some data entry. If you don't have any tax credits and you're not self-employed or retired and you don't have any kids or investment money, you can skip to the WHERE DO I FILE section.

WAIT WHAT ARE TAX CREDITS?

Tax credits are money that the government credits to you because you meet certain criteria. They can either be nonrefundable or refundable. Nonrefundable tax credits can reduce your tax liability (tax liability is the money you should have paid in income tax throughout the year, based on your total yearly income). Basically, if you had a tax liability of $3000 and you get a nonrefundable tax credit of $1000 it brings your tax liability down to $2000. But if you had a liability of $3000 and a nonrefundable tax credit of $4000 it can only bring your liability down to $0.

Refundable tax credits can give you money back, though. If you had a tax liability of $2000 and a refundable tax credit of $3000, that's $1000 the IRS owes YOU, baby.

COMMON TAX CREDITS

Child Tax Credit

If you supported a descendant of yours who is under age 17 and lived with you more than half the year, you get a credit for that! The "normal" use of this credit is for your kids, but grandkids, step kids, and young siblings and niblings can count too if you are the one supporting them. If you split custody of your kids with their other parent to whom you are not married, only one of you gets to claim them. If the two of you can't peacefully decide who that is going to be, and you want to claim them, you need to be able to prove that you supported the kid(s) and they lived with you. Notes from the kid's school and/or doctor are often used for this.

As of the time of this writing (2023), the Child Tax Credit is $2000/kid. If you make a ton of money this credit may be phased out. The Child Tax Credit is one of those nonrefundable credits that we talked about. It can only take your tax liability down to $0. BUT if you had some of the credit "left over" after your tax liability was wiped out, you may qualify for the Additional Child Tax Credit, which is a refundable credit, but it maxes out at $1500/kid instead.

Other Dependent Credit

This is a credit you can get if you supported a dependent who doesn't fit the criteria for the Child Tax Credit. This can be a child age 17 or older, a parent who you support, your live-in girlfriend who doesn't work (if she lived with you ALL YEAR), etc. (Please note: your spouse is NOT your dependent. Even if they don't work.) Not sure if someone qualifies as your dependent? The IRS website has a tool for that. The Other Dependent Credit is currently $500/person.

"Daycare Credit" AKA Child and Dependent Care Expenses Credit

If you send your kid or disabled dependent or spouse to daycare so you can work, go to school, or look for work, you can get a percentage of that money back as a credit. The exact percentage depends on your income.

The facility where you send your kid should provide you with an end of year statement showing the expenses you paid that year. You'll also need their EIN (Employer ID Number) and basic info like their name, address, and phone number. If you paid an individual you'll need their social security number instead.

Earned Income Credit

This is a credit for people who have worked during the year but who haven't made what the government considers to be "enough" money. You were trying. But you probably need some help. The amount you can receive depends on how much money you made and how many kids you have. Any tax software should calculate this automatically. It can be a real life-save for some families.

"Solar Panel Credit" AKA Residential Energy Credit

I'm only going to talk about the solar panel part here because it's most common. Basically, if you install solar panels, you can get a credit for up to (currently; it changes year to year) 30% of what you spent/financed. BUT a VERY IMPORTANT thing that the solar salespeople often don't tell you is that this is a NONREFUNDABLE credit. If you only have a tax liability of $2000, this credit will only give you $2000 for this year even if it's a $16,000 credit! Don't count on the whole 30% to go towards your solar loan principal if you don't usually have a big tax liability! The good news is that the unused portion of your credit will "carry forward" to next year, meaning it can help reduce your next year's liability if you don't use it all up this year. And the next, etc. Keep up with your old tax returns so you can put any carryforward credit onto the next year's return!

"Higher Education Credits" AKA American Opportunity Tax Credit and Lifetime Learning Credit

The short version is that if you spent money out of your pocket or if you took out a loan to pay for higher education for you, your spouse, or your dependent (or your kid that their other parent claims), you can get a percentage of that back as a credit. The AOTC is better but you can only take it for a total of 4 years, then you get bumped down to the Lifetime Learning Credit. You'll need to get the 1098-T from the school to see what you paid, and you may be able to also include expenses for things like textbooks.

Other Credits

There's also a credit if you're adopting a kid, but I'm not going to get into it here. Just know to look it up if you ever adopt!

There is a small credit for people who contribute to a retirement plan and have income under a certain amount. This is the Saver's Credit.

I'm not listing every credit that exists, just the ones I see the most. A lot of people don't know about the college credits, which sucks, because they can really help!

HANG ON I'M SELF-EMPLOYED WHAT DO I DO?

Congrats on being your own boss! If you are self-employed/freelance/contract labor, you get a 1099 at the end of the year instead of a W-2. Usually a 1099-NEC (NEC for non-employee compensation). This means that instead of your employer sending money to the government to pay your taxes for you, you have to do it yourself! The parts that go to Social Security and Medicare taxes are called "Self-Employment Taxes" and they get calculated at the end of the year in addition to your Income Taxes.

WHAT DOES THAT MEAN FOR ME?

When you are filing your tax return, you'll have to fill out a Schedule C for each business. Do you drive for Doordash and you also clean your aunt's house every week? Congrats. You have two businesses. One as a delivery driver and one as a housekeeper. But if you drive for Doordash and Uber Eats, you just have one job as a delivery driver.

During the year, you need to do 2 basic things:

1. Save back money to pay your taxes, and send it to the IRS quarterly. These are called Quarterly Estimated Tax Payments and you can do it by mail or online. The IRS has a tool to help you calculate how much you should be sending.

2. Keep track of your expenses and milage! If you spend money on things that you use exclusively for business, you can count those as expenses. (I'll get to expenses in a minute.) If you use something mostly for work, like a cell phone, you can count a fraction of that expense. If you drive your personal vehicle for work (not TO work; commuting doesn't count for this), keep track of the miles you drive! You get to count that as expenses, a certain number of cents/mile. It adds up. If any of this applies to you, please do more research, maybe download an app to keep track of things. This is just to let you know what you need to know so you can look up in depth what applies to you.

HOLD ON GO BACK. WHAT ARE EXPENSES?

Okay. Basically, to calculate what money is taxable if you're self-employed, you add up your income (what you got paid), and then total all your expenses (the money you spent to run your business). Income - Expenses = Profit or Loss. You only get taxed on the profit (called a "gain" on the form). A loss can offset some of your "regular" income, but please do more research if that applies to you.

If you got paid $10,000 for the year in your home bakery business but spent $8000 on things like flour, cake boxes, and renting a catering van, you only made a profit of $2000 and that's all that counts for your income and self-employment taxes. That's why it's important to keep track of your expenses and mileage! Less profit = less taxes. But you know. Don't make crap up. Assuming that you will be audited eventually will help keep you out of trouble!

OKAY, THIS IS ALL NICE, BUT I GET RETIREMENT MONEY

That's cool! If you get social security, you'll get an SSA-1099. If you get money from IRAs or other pensions, you'll get a 1099-R. Just plug 'em into your tax software and it will calculate everything automatically. If you tend to owe money at the end of the year and you don't want to, you can have more withholding taken out of either your social security or your pension by talking to whoever oversees your account.

WHAT IF I HAVE INVESTMENT MONEY?

Look. If you have investment income and you came here for tax advice, you are in the wrong place, buddy. I'm happy for you but we do not have time for that right now. If you get like $20 in interest from your checking account or whatever, fine. Just plug that 1099-INT into your software and you're good to go. If you have, like, dividends, or you trade stock or whatever? You're the kind of person who leaves your documents with your tax pro and they get back to you next week.

WAIT YOU HAVEN'T EVEN TALKED ABOUT SHORT FORM VS LONG FORM

That's because it's not a thing anymore, sweetie. There are only two forms for personal tax returns: the 1040 and the 1040-SR. The only difference is that the 1040-SR, for seniors, has a bigger font. Really. That's it.

What you are thinking of is itemizing vs taking the standard deduction.

Basically, you add up your total income for the year and then subtract either the standard deduction or your itemized deductions. Gross income minus standard or itemized deductions = taxable income. So the more you can deduct here, the less tax liability you have. For this year (tax year 2022 since I'm writing this in 2023), the standard deduction for single is $12,950, $25,900 for married filing jointly, and $19,400 for Head of Household (an unmarried adult who has at least one dependent). If you itemize deductions instead of taking the standard deduction, you can add up various deductions and subtract that from your gross income instead. Common things you can itemize include

* unreimbursed medical expenses that exceed 7.5% percent of your total income

* charitable giving

* interest on your mortgage

* state or local income or sales tax

Itemizing is only useful if the total of all the deductions you can take is higher than the standard deduction. For most people, it isn't, so I'm not going to go any deeper into this and waste everyone's time.

WHERE DO I FILE?

If all of this has made you tired, and you still just want to pay someone else to do it for you, and you can afford that, great! Professionals exist to do hard stuff for you in exchange for money. Ask about the price up front. It may vary depending on how complicated your return is. Some places will let you take your fees out of your refund, if you get one, usually for an additional fee.

I'D REALLY RATHER NOT PAY MONEY TO DO THIS ACTUALLY

Good news! If your total income was $73,000 or less (as of this writing), there are places you can do your taxes online for free! Just go to IRS.gov, click "File Your Taxes for Free," and use their tools to find a program that will work for you. You may have to pay a small fee to file a state return, if you lived or worked in a state that collects state income taxes.

GEE, THANKS FOR THE EXPLANATION. IS THERE ANYTHING ELSE YOU WANTED TO TELL US?

Why, yes, there is! Thanks for asking!

A TAX RETURN IS NOT A TAX REFUND.

Please stop saying "return" when you mean "refund." Yes, I know, that they are kind of synonyms in regular English but a tax return is the form you file when you file your taxes. If you get money back, that is a refund. Thank you.

JUST BECAUSE YOU WORKED HARD DOESN'T MEAN YOU GET A BIG REFUND

That's like... not how it works at all. Did I include this just because one man stormed out of my office because he was mad that he was getting only a couple hundred dollars back instead of the several thousand dollars that his underemployed girlfriend with two kids got? Maybe. Credits are for people who the government decided need help (like people with kids or low incomes) OR for things the government is bribing you to do (like install solar panels). If none of these things apply to you and you still want a big refund, you could have your employer hold more withholding out of your paychecks, but that means you'll get smaller paychecks and that the government is just using your money interest free until they give it back to you when you file your tax return. Some people like to do that, though. They treat the IRS like a savings account they're not allowed to tap into except once a year.

LET'S TALK ABOUT FILING STATUSES FOR A SECOND

There are five filing statuses:

Married Filing Jointly. This is for two people who are legally married. If you live in a state that allows for common law marriage, you can be common law married and file jointly. But if you ever decide you don't want to be married anymore you are supposed to get a divorce if you want to go back to filing single. MFJ has the highest standard deduction. One spouse will be listed as "taxpayer" and the other as "spouse." It doesn't matter which is which. Sex doesn't matter. Income doesn't matter. The IRS just wants you to do it the same every year for record-keeping purposes.

Married Filing Separately. This is for two people who are married but don't want to file jointly. It is usually the worst way to file because several credits are not available to MFS people, but sometimes your spouse won't cooperate with you or maybe they have weird financial crap going on and you don't want it tied up with your financial crap. Approach with caution. It's half the standard deduction, but if your spouse itemized, you must itemize too.

Single. This is for people who aren't married and don't have any dependents. It's half of what the MFJ standard deduction is.

Head of Household. Forget whatever you think you know about how normal people use this phrase normally. Head of Household, for tax purposes, is for an unmarried adult with one or more dependents (if you're married and your spouse has abandoned you and you have kids you can use this status though! As long as the spouse didn't live with you for the last half of the year). It's one and a half times the single standard deduction.

Qualifying Widow(er). This is an uncommon filing status. If someone was married with kids and their spouse died, they get to file as MFJ with that spouse the year that their spouse died, as long as they don't remarry that same year. For the next two years, the surviving spouse can file QW. The Qualifying Widow(er) deduction is the same as MFJ. After that, providing they still have dependents, they get bumped back down to Head of Household.

WOW, THANKS. TAXES DON'T SEEM SO SCARY ANYMORE.

I'm glad to hear it! Go forth with more knowledge.

3 notes

·

View notes

Text

#gstr-3b due date#GSTR3B download#GSTR-3B format#GSTR-3B login#How to file GSTR-3B#what is gstr-3b with example#gstr-3b means sale or purchase#gstr-3b turnover limit#gst return filing service#gst return#gst accounting software for retail#income tax return#income tax audit#gst registration#income tax login#tax refund#income tax#accounting services#gst compliance#gst return filing online#gst services#tax#concerns#profit#usd#taxation#gst billing software#tax audit#taxring#itr filing

0 notes

Text

UK Streets are littered with Tax Bills

Photo by nattanan23 What do I mean by the “UK streets are littered with tax bills?” Last week we looked at the obvious taxes around income and the cost of living. This was written hoping that the people planning to come to the UK thinking going from zero to hero will be easy are made aware that it is so far from the truth. Here is something that I read on Facebook that, to be honest, sums up…

#business tax bill#council tax bill#Filipina magic#Income Tax Bill#late tax bill#property tax bill#self-assessment tax bill#tax bill assessment#tax bill breakdown#tax bill disputes#tax bill due dates#tax bill enquiry#tax bill explained#tax bill FAQs#tax bill instalments#Tax Bill Payment#tax bill relief#tax bill reminders#UK tax bill changes#VAT Bill

0 notes

Text

Filing income tax returns (ITR) can be daunting, but with the right guidance, it becomes a breeze. At Caonweb, under the expert guidance of CA Sakshi Agarwal, we understand the nuances of Income Tax Return Filing. Here are some crucial things to keep in mind.

0 notes

Text

Check What is ITR-3 form, who can file ITR-6, and how to file ITR-3 online. click here to know everything related to ITR-3 Form filing at CA Divya.

#ITR-3 form Filing#who can use ITR-3 Form#Due Date for filing ITR-3 Form#Income Tax Return Filing in Raipur

0 notes

Text

youtube

#income tax return#income tax return filing#itr filing#itrfiling#itr filing due date#taxguidenilesh#nilesh ujjainkar#itr forms#Youtube

0 notes

Text

Playing cards project going well! Quality is amazing. I am currently familiarising myself with the logistics portals some of the fulfilment centers/warehouses I work with use to notify them of incoming shipments. The software is very detailed/complicated for something so simple 😁 Estimated arrival times* US: mid-nov, dec Europe, UK: dec/early jan AU, NZ: early jan ROW: varies, but definitely by early jan *All the playing cards need to go past customs before they arrive at the (LGBTQ+ friendly(!); unfortunately in my quest to look for partners, not all emails I sent out got a reply) fulfilment centers. I work with a company that looks into all the legal aspects of this project (logistics, taxes), so that should go smoothly. Unfortunately there will be lots of volume at the ports and fulfilment centers due to stores preparing for Black Friday and Christmas; all parties involved in this project would like me to inform you that delivery dates cannot be guaranteed but are very likely to be met. We are all excited and doing our best for you to hold these cards in your hands soon! (: Stay proud! ⚔️🌈 ~ Roderick

1K notes

·

View notes

Text

Bill HR 9495 still remains a threat to nonprofits and independent news

Bill H.R. 9495, aka the “Stop Terror-Financing and Tax Penalties on American Hostages Act,” was meant to protect US Hostages from tax penalties; the problem is that the bill received an add-on that would give the Treasury Secretary the power to strip any non-profit of their tax-exempt status based on the idea that the nonprofit is a “terrorist supporting” organization, all without due process or a justification.

And although another exemption was added to the bill that would "protect" Non-profits from this by exempting Non-Profits that have approval from the Office of Foreign Assets Control(OFAC). This would still target non-profit organizations since all it would take to attack them is to just rescind that prior approval

This would give the upcoming Trump administration the power to kill any non-profit org, from AO3 to the ACLU. Even local nonprofits and independent news sources could be stripped of their status and be unable to receive funding to stay open, all because they had different views than the government.

Unfortunately, the bill passed the House and is headed toward the Senate, but there hasn't been any update regarding the bill or a date to vote on it; it's probably best to find your Senator and call, email, or fax them to tell them to vote no if it comes to a vote.

Below are some tools and a list of Senate leaders you should call in addition to your senator:

Democrat Senate Leaders:

Chuck Schumer:

Phone: (202) 224-6542

Fax: (202) 228-3027

Dick Durbin:

Phone: 202-224-2152

Debbie Stabenow:

Phone:(202) 224-4822

Elizabeth Warren:

Phone: (202) 224-4543

Mark R. Warner:

Phone: 202-224-2023

Amy Klobuchar:

Phone: 202-224-3244

Fax: 202-228-2186

Bernie Sanders:

Phone: 202-224-5141 Fax: 202-228-0776

Catherine Cortez Masto:

Phone: (202) 224-3542

Joe Manchin:

Phone: 202-224-3954 Fax: 202-228-0002

Cory A. Booker:

Phone: (202) 224-3224

Fax: (202) 224-8378

Tammy Baldwin:

Phone: (202) 224-5653

Brian Schatz:

Phone: (202) 224-3934

Republican Senate Leaders:

Mitch McConnell:

Phone: (202) 224-2541 Fax: (202) 224-2499

John Thune:

Phone: (202) 224-2321

Fax: (202) 228-5429

John Barrasso:

Main: 202-224-6441 Fax: 202-224-1724

Joni Ernst:

PHONE: (319) 365-4504

FAX: (319) 365-4683

Shelley Capito:

Phone: 202-224-6472

Steve Daines:

p: (202) 224-2651 f: 202-228-1236

Find Your Senator:

Or you can call the Congressional switchboard today and ask to be connected with each of your Senators’ offices. Demand they vote against this bill: (202) 224-3121

If you don’t like talking to people, you can call after their offices close so you can leave a message

you can also Text RESIST to 50409 to send your message into a fax and email to your senator

Fax tool:

Here are some call scripts that you can use as fax and email as well:

If you have a Democrat Senator, you can use this script:

“I am calling Senator [THEIR LAST NAME] as a constituent to urge them to vote against the Stop Terror-Financing and Tax Penalties on American Hostages Act, when it comes to the Senate floor. This bill would give the Treasury the power to kill non-profit organizations without evidence, and will be used as a sledge hammer to destroy any organization that speaks out against the incoming President’s agenda. No matter who was in power, this bill would be authoritarian and ripe for abuse. Handing this power to a President known to be vindictive, and who has promised to be a “day one” dictator, would be a failure of congressional leadership. Please share my thoughts with the Senator, urging them to vote against this dangerous legislation. Thank you”

If you have a Republican Senator, you can use this script:

“As your constituent, I urge you to vote NO on H.R. 9495. This bill poses a dangerous threat to the fundamental freedoms guaranteed by the First Amendment and must not pass the Senate. It grants any incoming administration unchecked authority to revoke the tax-exempt status of non-profit organizations without oversight or due process. Such government overreach is not what the Founding Fathers envisioned for our democracy. This bill undermines the principles of free speech and freedom of association, cornerstones of American liberty.

H.R. 9495 threatens to pave the way for political suppression, allowing the government to selectively target and shut down organizations based on ideological disagreements. This could affect any non-profit, including churches and conservative groups, as well as organizations that champion human rights and civil liberties. Regardless of political leanings, this bill sets a chilling precedent that no American patriot should support.

While situations relating to the hostages deserve careful attention, they can and should be addressed in a separate, narrowly tailored bill. H.R. 9495, however, is a broad, unconstitutional overreach that strikes at the heart of free speech and freedom. It is unpatriotic and incompatible with the values we hold dear as Americans.

I implore you to stand as a defender of liberty and uphold the rights of your constituents. Be a patriot, listen to the voice of the people, protect our God given right to free speech as Americans, and reject this dangerous legislation. Vote NO on H.R. 9495. Thank you, God Bless and God Bless America.”

Here’s that petition again:

#kosa#stop kosa#fuck kosa#us politics#censorship#ngo#nonprofits#nonprofit#aclu#american civil liberties union#civil society#civil rights#fuck trump#stop project 2025#we will not go back#donotobey#do not obey in advance#resistance#resist#fuck elon musk#keep fighting#keep going#stand and fight#senate#usa news#contact your senators#raiseawareness#senators#bad internet bills#owl house

158 notes

·

View notes

Text

@atsoraasayoma "But I am curious now. In your opinion who do you think Taichi feels better about entrusting to his sister now? Do you think He feels more comfortable if she is with Team Daisuke or Team Takeru shipping wise? I know it doesn’t say outright."

Personally, while Taichi absolutely is an overprotective brother, I am still convinced that he's not the type of brother that gives EVERY person a death glare who approached Hikari. I still feel like that's more Tailmon's role... Sure, we have the audio drama in which he, an 11 year old boy, says "I wouldn't allow their relationship anyway" in regards to the possibility of Koushirou dating Hikari (which one may interpret either way, really). However, he NEVER gave any indication towards disapproving either Takeru or Daisuke.

I've talked to @jamesthedigidestined about this last night and we both agree that Taichi likes and appreciates both Takeru and Daisuke, but for different reasons - as mentioned in the other post. In 02 onwards, he treats Takeru even more as an equal than he already did in Adventure due to the experiences they went through together - whereas he still feels like he has to watch over Daisuke every now and then so he doesn't make a move he may regret later. However, he has also canonically known Daisuke longer than he has known Takeru, since they had been in the same football club together.

My personal stance on Taichi is that he is more observant of others than people give him credit for, because he is not particularly good at voicing that, so he may use words that are uncalled for in the particular situation. And while he would fight off ANY OTHER of his football club mates if they even dared to look at Hikari the wrong way - I don't think he'd do that with either Takeru or Daisuke.

Everyone and their mothers KNOWS how naturally close Takeru and Hikari have become through the years, nobody bats an eye at them being glued together by the hip. Heck, people might not even be surprised if they found out that they had gotten married years ago solely for the purpose of getting tax benefits (because let's be real, working as novelists and kindergarten teachers may not provide the biggest stable income in comparison to a few other career paths). Taichi is aware of their closeness, he knows how much they can relate to one another in similar ways he himself can relate to Yamato (it's a sibling thing after all), it's just natural and whether it's romantic, platonic or something in between, he would not disapprove of it.

In terms of Daisuke, the problem is that we don't see how their dynamic developed between 02 and Kizuna/The Beginning, because they don't even actually interact in these movies. As of 02, we know that when Daisuke is NOT focused on impressing Hikari, they actually have very open and thoughtful conversations and Hikari absolutely values Daisuke for his kindness that comes through more and more once he stops putting on a mask. And I feel like Taichi is aware of that, because he knows what it feels like to mask your insecurities - and like I said, he may see parts of himself in Daisuke anyway. He knows Daisuke would be just as protective of Hikari and try his best to take care of her.

I made a joke about Taichi joking along the lines of "If you ever hurt her, I’ll personally disown you!”, but that'd basically be only half serious. In the end, he would not mingle in whoever Hikari may chose, even if he'd have to adjust to the idea of it.

Actually, I'd find the reversed situation a lot more interesting, seeing how Hikari would react depending on whom Taichi ends up with, but... I guess they'd both have this aura of half-fake passive aggressiveness and play that for laughs, even if deep down inside, they would not interfere if they knew the chosen person means well. And I think Taichi would feel that way about both Takeru and Daisuke.

#that was a whole lot of rambling about nothing i feel#my two cents#meta#takari#daikari#taichi yagami#hikari yagami

28 notes

·

View notes

Text

Income Tax Due Dates In November 2024

Income Tax Due Dates It is important to know due dates applicable to you, as it help in timely compliance. By doing timely compliance, one can escape from the burden of late fees, interest etc. So, in order to help in doing timely compliance, we have gathered various Income Tax Due Dates in November 2024. These are as under: 7 November 2024 Due date for deposit of Tax deducted/collected for…

0 notes

Text

No one has a right to destroy art.

Not even the people that "own" it. Because we don't own the art we make. We own a temporary patent on that work. Culture belongs to everyone, and the only reason IP exists is to encourage the production of cultural artifacts by making it a viable income stream.

So when it comes to things like the Batgirl movie, or Coyote Vs ACME, or the Micronauts cartoon, or the Capcom Alien Vs Predator beat-em-up, or any other piece of media that is destroyed or made unavailable due to rights issues or because it's being sacrificed for a tax break, there should be protections for that work.

Either a national database must be maintained to hold those works until their public domain dates are reached (a project that would at this point span a century) or, a much simpler correction should be applied.

If the law says it can't be made available for profit, it becomes public domain.

You write off your movie as a tax break? Fine, that movie is available for anyone to enjoy, remix or alter for free.

You can't work out a deal between the film company and the game company to keep the classic video game available? You're both willing to chop the baby in half rather than let the other one have it? King Solomon says the baby belongs to everyone.

And to close the loophole for companies employing more than X number of people, if you can't buy it, or stream it, then you can't enforce copyright on it. There's no excuse for any major media company not to have its entire catalog available to the public at least as a burned-DVD-on-request system.

These companies want to sit on piles of culture like dragons and reap the rewards. In the case of the oldest and largest, in many cases they claim ownership over what can only be called our modern folklore. The idea that a company can own Batman should be as insane as the idea of a company owning Hercules, Paul Bunyan or the Archangel Michael.

But if that isn't going to be insane, if we're going to give that kind of power to corporations, that power should come with responsibilities.

91 notes

·

View notes

Text

Tax audit: The deadline for submitting an income tax audit report is October 7, 2024, for fiscal year 2023-24 (AY 2024-25). If you fail to submit your tax audit report by October 7, 2024, you will face a penalty. The penalty is Rs 1.5 lakh, or 0.5% of total sales, whichever is lesser.

The income tax audit deadline is October 7, 2024, for fiscal year 2023-24 (AY 2024-25). However, this is an extended deadline, so if you were counting on it, don't. The intended deadline for submitting an income tax audit report through the e-filing ITR portal was September 30, 2024. The government is unlikely to extend the date again.

click here - get Professional help

#income tax#audit#Tax audit#income tax audit report#tax audit fy 2023 2024#missed audit deadline#income tax login#e filing portal#taxrinng#tax consultant#professional tax consultant service#ca#tds rate#tax filing#belated return#audit report filing#GST#Tax audit due date fy 2024#audit extention

0 notes

Text

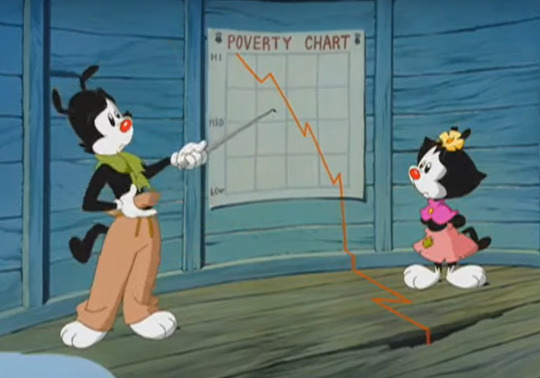

The Warner Tax Rant.

Being “So far below the poverty line, they’re off the graph”, doesn’t seem to be a statement only true in the movie after all. This is almost 1k words. Sit tight.

OG RANT DATE: 3/22/2023 We know the Warners pay taxes. We know they pay income tax from the “We pay tons of income tax” line from the 90s intro. Tons is subjective, but we also know based on many instances of the Warners gaining some sort of monetary wealth(even to be immediately taken away) that money is something they care about(1). There’s been jokes(2) about how little they’re paid by the studio, one of which from a cut song about tiny things where the smallest thing of all was their paychecks. We know in the comics they also just. Don't have money to treat themselves to nice outings and so they have a separate thing they call “The Cute Fund”(3) where the Warners allow people to pay to pinch their cheeks, and they use that money for things like trips. Not only are the Warners like wicked underpaid and taken advantage of for being children, but since they were originally from the 30s, when they were released from the tower for the 90’s show they didn't know what the base wage was at the time.

So even with all their fame in the 90s (on the level that would make it a cultural phenomenon, eg: clothes, games, theme park partnerships, school supplies) they were not fairly compensated for it.

But even with them being such a household name, if they had to talk over their own contracts, they were likely tricked into thinking they were getting a better wage just by holding it up to what they were paid for their very few paychecks for their 30s films, even if they’re smart kids, they’re just kids, and between desperation and relief of being released, their judgement may have been clouded on their own contracts. They were probably also just thankful to be getting the opportunity to get them at all because it meant that they would get time outside the tower for the first time in 60 years Anyway these thoughts brought me to thinking about Yakko having to calculate their paychecks and do taxes every year since they have an income.

But based on how little the three of them make together and how expensive California is, i assume tax season is pretty stressful for poor Yakko.

In the 90s when there wasn't a ton of tech going around it meant he'd have to do all their taxes by hand with a calculator and a bunch of notes and i am thinking of this poor boy pouring over then at like 12 in the morning after Wakko and dot have gone to bed under the guise of practicing his lines.

For assistance programs that exist for humans that the warners making so little money might qualify for, e.g. food stamps, would they even be approved?

Maybe toons get rejected for that since "they don't need to eat" regardless of toons like wakko who are designed differently to eat more and always be hungry and also hypoglycemic(4). (5)So in the 30s, minimum wage was .25 an hour, which translates to a little over $4 an hour now

In 1990, the minimum was was 4.75 ($9.19 as of 2024)

HOWEVER

We can assume toon labor laws would be different since they didn't even have the right to vote until 2020 bc of Dot, and the way animals are paid for their “acting” in 2020s.

So for the sake of this exercise in taxing we’ll assume that they were convinced being paid $1 an hour for each of them was a really REALLY good deal because it was 4x the wage in the 30s.(during the great depression)

This next part was calculated with help from my friend allowing me to use his California pay stub. Thank you Mickael. <3

Toons are probably paid less because they "have less necessities" and get rigorously overworked because their bodies “don't work like humans”. If we assume that they've been tricked in this way and calculate this off a 4 week paycheck, while also saying that they're pulling 40-60 hour work weeks due to overwork, with no overtime pay, that puts their GROSS pay for a MONTH at around ($480 for 40 hours) ($720 for 60 hours).

Taking out California and Federal withholding, and healthcare on through the studio all together at around 12%, net take home would be ($422.40 at 40 hours) ($633.60 at 60) Now let’s assume the Warners get the tower as free room and board. That includes rent, electricity and running water ONLY, so we still have to calculate their wifi and phone bills (since we know for a fact that it’s relevant in the reboot. For the state of California, I used Mint unlimited at $60 a month since all three of them have phones. ($64.35 after tax) Internet needing to be somewhere around 100mbps for all their device’s wifi in the Burbank area, the least expensive option with wiggle room for Wakko(the Gamer) would be Starry Internet ($32.18 after tax). Yakko would be able to get a (LIFE) LA Metro tap card for low income, which would also give him a certain amount of free bus rides per month,after that each metro ride is $1.75 one way, and each bus ride is $1 one way. Let’s give all three Warners together a Budget of $50. This leaves them at ($275.87 for 40 hours of work) ($487.07 at 60) Much, if not all remainder would go to food or clothes depending on your headcanons for that. It’s no wonder they can’t afford expensive picture frames! ---

I'm sure there was more stuff I could have linked back to like the amounts and how I got them, and if people want more info they're welcome to dm me, but I've been impatiently wanting to share my thoughts lol.

Back in march of last year, I first spoke to my friend @help-the-lesbian in DM's about the warner's monetary situation. As I made more friends, I roped more of them into listening to me and now it's kind of an in-joke, but I just like thinking about Yakko getting stressed out about taxes and doing them because he cares about his siblings and he needs to take care of their family.

1[Animaniacs "Temporary Insanity" 1993] 2[Rob Paulson, “Animaniacs in Concert”, 2023] 3[Animaniacs Comic #2, 1995] 4[Wakko Warner Wiki] 5[Department of Industrial Relations, state of California] 6[California state tax is x1.0725]

57 notes

·

View notes

Text

0 notes

Text

Burkina Faso renounces its Non-Double neocolonial Taxation Treaty with France, a pact that has been in place since 1967.

Burkina Faso under the leadership of Captain Ibrahim Traoré has withdrawn from the Non-Double neocolonial Taxation Treaty with France that was established in 1967.

The Burkina Faso government announced the termination of the double taxation agreement, signed on August 11, 1965, which had been in effect since February 15, 1967, along with its subsequent amendment signed on June 3, 1971, which took effect on October 1, 1974.

The decision comes as a result of France's refusal to renegotiate the terms of the agreement. Olivia Rouamba, head of Burkina Faso’s diplomatic service, explained that this action is necessary due to France's lack of response to requests for negotiations made in January 2020 and late 2021. The denunciation will become effective within three months from the date of notification.

This move is seen as significant, as it will impact French multinationals in Burkina Faso, who previously benefited from tax exemptions under the treaty.

A “huge blow” for France

Phillipe Traoré, a tax expert from Burkina Faso, explained that the double taxation treaty, among other things, allows individuals and companies to avoid paying taxes on the same income in two different countries.

He believes that this measure is “very serious for French multinationals” established in Burkina, adding that “all French income derived from activities carried out on Burkinabe soil will now be taxed.”

“In fact, with the convention signed, the Burkinabè did not deduct any withholding tax on income from services provided by French people (individuals and/or companies) in Burkina,” he said.

The tax expert pointed out that French companies, in particular, are exempt from many taxes in Burkina by virtue of the double taxation treaty.

In his opinion, this gives them a competitive advantage over all other companies operating in Burkina Faso.

“It is a real blow for France and a financial windfall for Burkina,” insisted Phillipe Traoré.

This denunciation comes 48 hours after France suspended all development aid and budgetary support to Burkina following the support given by the Burkinabe military junta to the National Committee for the Defence of the Homeland (CNSP), which overthrew Mohamed Bazoum in Niger on July 26.

60 notes

·

View notes