#Tax audit due date fy 2024

Explore tagged Tumblr posts

Text

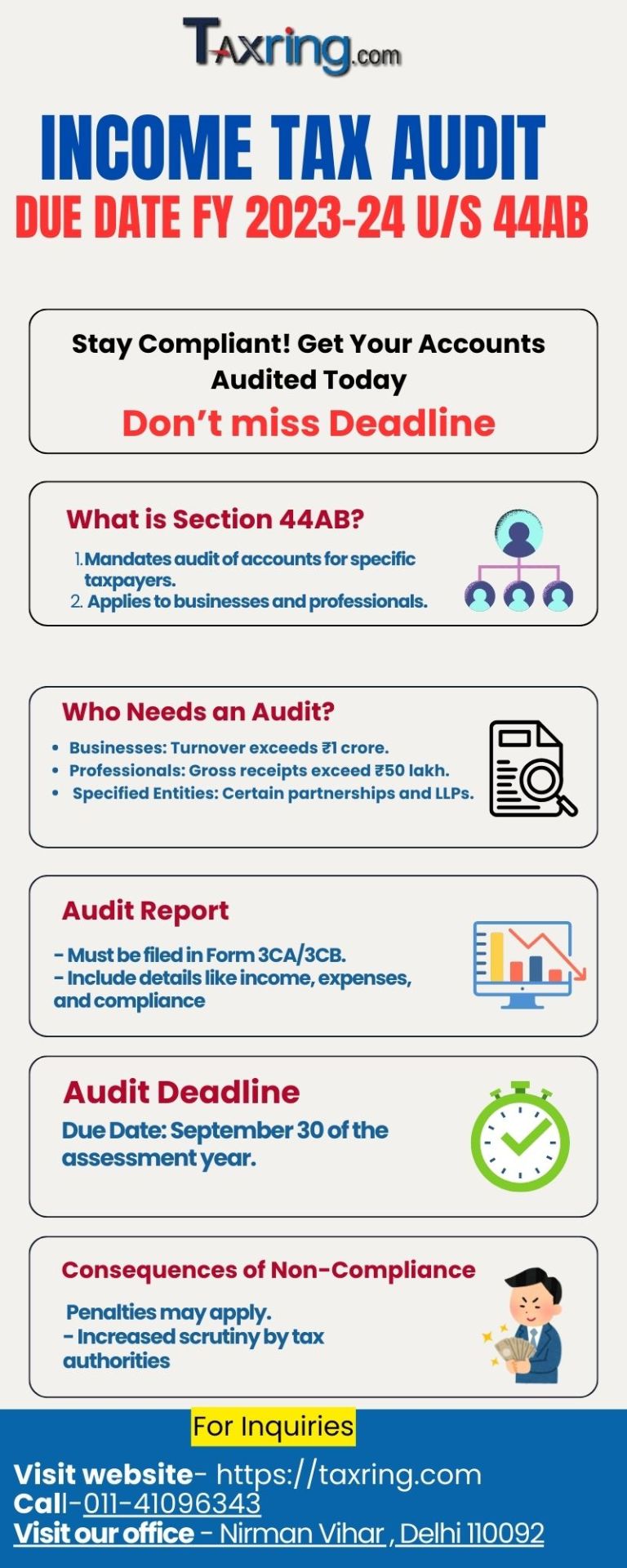

Tax audit: The deadline for submitting an income tax audit report is October 7, 2024, for fiscal year 2023-24 (AY 2024-25). If you fail to submit your tax audit report by October 7, 2024, you will face a penalty. The penalty is Rs 1.5 lakh, or 0.5% of total sales, whichever is lesser.

The income tax audit deadline is October 7, 2024, for fiscal year 2023-24 (AY 2024-25). However, this is an extended deadline, so if you were counting on it, don't. The intended deadline for submitting an income tax audit report through the e-filing ITR portal was September 30, 2024. The government is unlikely to extend the date again.

click here - get Professional help

#income tax#audit#Tax audit#income tax audit report#tax audit fy 2023 2024#missed audit deadline#income tax login#e filing portal#taxrinng#tax consultant#professional tax consultant service#ca#tds rate#tax filing#belated return#audit report filing#GST#Tax audit due date fy 2024#audit extention

0 notes

Text

Compliance Calendar: Key Deadlines for FY 2024–25

Navigating the complex web of compliance requirements can be a daunting task for businesses in India. Missing deadlines can lead to hefty penalties and legal repercussions. To help you stay on top of your compliance obligations, we’ve compiled a comprehensive calendar of important due dates for the financial year 2024–25.

Understanding the Importance of Compliance

Adherence to regulatory norms is not just about avoiding penalties; it’s about maintaining a strong corporate governance structure, protecting your business reputation, and ensuring long-term sustainability.

Key Compliance Deadlines for FY 2024–25

To help you stay organized, we’ve outlined some of the most critical compliance deadlines below. It’s essential to note that this is not an exhaustive list, and specific requirements may vary based on your business structure and nature of operations.

MSME-1 (Half Yearly Form for Outstanding Payment to MSME): Due dates: April 30, 2024 (for the period October 2023 to March 2024) and October 31, 2024 (for the period April 2024 to September 2024).

LLP 11 (LLP Annual Return): Due on May 30, 2024.

PAS-6 (Reconciliation of Share Capital Audit Report): Due on May 30, 2024 (for the half-year ending March 31, 2024) and November 29, 2024 (for the half-year ending September 30, 2024).

DPT-3 (Return of Deposits): Due on June 30, 2024.

AOC-4 (OPC) (Form for Filing Financial Statements): Due on September 27, 2024.

DIR-3 KYC (KYC of Directors/Partners): Due on September 30, 2024.

ADT-1 (Notice to Registrar for the Appointment of Auditor): Due within 15 days of the General Meeting.

MGT-14 (Resolution Filing): Due within 30 days of passing the board resolution.

AOC-4 (Form for Filing Financial Statements): Due within 30 days of the Annual General Meeting.

LLP 8 (Statement of Account and Solvency of LLP): Due on October 30, 2024.

MGT-7A (OPC) (Annual Return): Due on November 28, 2024.

MGT-7 (Annual Return): Due within 60 days of the Annual General Meeting.

Tips for Effective Compliance Management

Maintain a Compliance Calendar: Create a customized calendar with all relevant deadlines for your business.

Set Reminders: Use digital tools or reminders to stay on top of approaching deadlines.

Seek Professional Help: Consider consulting with a legal or tax professional for guidance.

Stay Updated: Regularly monitor changes in regulations and compliance requirements.

By staying informed and proactive, you can ensure your business remains compliant and avoids potential penalties.

#businessstartup#newbusiness#startup#legal#finance#fundraising#companyincorporation#mca#MCA#compliances

0 notes

Text

Simplifying Your TDS Compliance: Important Deadlines for FY 2024-25

As we navigate through the financial year 2024–25, timely compliance with Tax Deducted at Source (TDS) return filing has become essential for the businesses as well as individuals. If you stay updated with the due dates of TDS Return Filing, you can make sure about the smooth operations and avoids unnecessary penalties & fines. Here, in this article we will provide you a comprehensive guide to the important deadlines. Don’t forget to mark these dates in the calendar.

Important Deadlines for TDS Return Filing of FY 2024–25

For Quarter 1 which is April 2024 to June 2024, the due date will be July 31, 2024.

For Quarter 2 which is July 2024 to September 2024, the due date will be October 31, 2024.

For Quarter 3 which is October 2024 to December 2024, the due date will be January 31, 2025.

For Quarter 4 which is January 2024 to March 2024, the due date will be May 31, 2025.

Why Timely TDS Return Filing is Important?

Avoid Penalties: If you don’t file the TD Return on time, then it will attract a late fee of Rs. 200/- under section 234E of the Income Tax Act until the return has been filed. The maximum penalty can go up to the total amount of TDS.

Ensure Compliance: If you stay compliant with the due dates, you can make sure about maintaining a clean financial record. It is essential for audits and future financial planning.

Smooth Processing: If you file TDS return on time, you can make sure that there are no delays in processing returns and refunds as it can impact the cash flow.

Some Tips for Filing TDS Return on Time

Set Reminders: You can use the digital calendars and reminders, so that you can keep track of due dates.

Consult Professionals: If you take the regular consultation with the expert tax professionals, you can get the clarity and can also make sure about the compliance with all regulations.

Organize Records: It would be best to maintain a systematic record of all TDS transactions and relevant documents.

Conclusion

If you stay updates about the TDS Return Filing Due Date for FY 2024–25, it not just keeps your compliant but also helps in smooth financial management of your business. It is advisable to you to mark these dates in your calendars, stay organized, and also make sure that your TDS returns are filed timely to avoid any last-minute rush or penalties.

Timely action today can save you from the unnecessary hassles tomorrow!

#Tds return#File TDS Return#tds return filing#tds due date#tds return filing due date#tds e filing#tds return due date extended#online tds return#etds return

0 notes

Text

📊 File Your Audit Report Under Section 44AB Before the Deadline! ⏰

Attention taxpayers! The due date for filing your audit report under Section 44AB is approaching fast—September 30, 2024!

Don’t wait until the last minute! Ensure compliance and avoid penalties by getting your audit done on time. Our experienced tax professionals are here to help you navigate the complexities of the audit process.

🔍 Why Choose Us?

Expert guidance on audit requirements

Comprehensive file audit report preparation

Timely submission to meet the deadline

💼 Let us handle your audit, so you can focus on what you do best—running your business!

📞 Contact us today for professional assistance and peace of mind!

#TaxAudit#Section44AB#TaxProfessionals#FileYourAudit#DeadlineReminder#TaxCompliance#income tax return#income tax audit#tax refund#income tax#itr filing#income tax login#audit due date fo fy 2024 25#audit last date#tax filing last date in audit case#taxring

0 notes

Text

Audit Deadline 2023-24: Are You Prepared to File?

For the financial year 2023-24, the due date for filing tax audit reports is September 30, 2024. This deadline is crucial for taxpayers whose business turnover exceeds ₹1 crore or whose professional income exceeds ₹50 lakhs. Failing to meet this deadline can lead to significant repercussions.

#tax#tax audit#income tax audit#audit report#audit report filing#tax audit due date extension#audit due date#income tax audit due date for fy 2024 2025#business tax#tax consultant#free itr filing#income tax return#income tax login#income tax#audit last date#tax audit limit#tax audit applicability

0 notes

Text

As the September 30 deadline approaches, it’s essential for taxpayers to understand the implications of late filing of tax audit reports. The penalties can be significant, and potential glitches on the ITR e-filing portal could further complicate matters. By taking proactive measures, staying informed, and ensuring timely submission, taxpayers can avoid unnecessary stress and penalties. For those needing assistance, consulting with tax professionals can be invaluable in navigating this complex process. why you need tax consultant

#income tax#tax audit#income tax audit#tax audit due date extension#tax audit due date#income tax audit fy 2024 25#tax audit last date for fy 2024 2025#income tax login#income tax return#tax refund#itr#TaxDeadline#FY2023-24#TaxFiling#AvoidPenalties#TaxProfessionals#TaxCompliance#BusinessTaxes#IndividualTaxes#TaxRegulations#FinancialPlanning#TaxTips#TaxHelp#AuditRequirements#IncomeTaxAudit#SeptemberDeadline#TaxAdvice#TaxSeason

0 notes

Text

Don’t Miss the Tax Audit Deadline Learn About the Tax Audit Deadline and Late Filing Penalties

Income tax legislation mandates that certain taxpayers perform income tax audits. The scope of this audit includes a thorough examination of the taxpayer’s financial records and books of accounts, particularly for those who get revenue from their business or profession. Verifying the correctness of income tax returns (ITRs) and financial statements is the primary goal of tax audits. The law intends to deter tax evasion and encourage compliance among entities by enforcing tax audits.

Knowing about the penalties for filing tax audit reports beyond the deadline

Many taxpayers are concerned about maintaining compliance as the September 30 deadline for filing tax audit reports draws near. Important information about the tax audit deadline, late filing fines, and any problems taxpayers can have with the ITR e-filing portal will all be covered in this blog.

What is the due date of tax audit The deadline for submitting tax audit reports for the fiscal year 2023–2024 is September 30, 2024. For taxpayers whose professional income surpasses ₹50 lakhs or whose firm sales exceeds ₹1 crore, this deadline is critical. If you miss this deadline, there could be serious consequences.

If you forget to file your tax audit by September 30, here are some important points to consider:

1. Belated Return: You can file a belated return, but there may be penalties associated with it.

2. Penalty: A penalty of up to ₹5,000 may apply for late filing. If your total income is less than ₹5 lakh, the penalty could be reduced to ₹1,000.

3. Interest Charges: If you have any tax due and��don’t pay it on time, interest may also be charged on the outstanding amount.

4. Revised Return: If you’ve already filed a return but realize there are errors, you can file a revised return.

5. Consult a Professional: It’s advisable to consult a tax professional to understand the process and implications better.

Read here — why you need tax consultant ?

Summary Taxpayers need to be aware of the consequences of filing tax audit reports beyond the deadline of September 30. Significant penalties may apply, and problems with the ITR e-filing facility might make things much more difficult. Taxpayers can prevent needless stress and fines by being proactive, remaining educated, and making sure their submissions are made on time. Tax specialists can be a great resource for people who need help navigating this complicated procedure.

Related articles: Income tax audit u/s 44ab , Books of account 44aa , How to file Belated return if you missed ITR deadline?

#tax audit#income tax audit#tax audit due date#income tax audit due date for fy 2024-25#audit report filing last date#tax audit due date extension#income tax filing#income tax return#e filing portal

0 notes