Don't wanna be here? Send us removal request.

Text

Compliance Calendar: Key Deadlines for FY 2024–25

Navigating the complex web of compliance requirements can be a daunting task for businesses in India. Missing deadlines can lead to hefty penalties and legal repercussions. To help you stay on top of your compliance obligations, we’ve compiled a comprehensive calendar of important due dates for the financial year 2024–25.

Understanding the Importance of Compliance

Adherence to regulatory norms is not just about avoiding penalties; it’s about maintaining a strong corporate governance structure, protecting your business reputation, and ensuring long-term sustainability.

Key Compliance Deadlines for FY 2024–25

To help you stay organized, we’ve outlined some of the most critical compliance deadlines below. It’s essential to note that this is not an exhaustive list, and specific requirements may vary based on your business structure and nature of operations.

MSME-1 (Half Yearly Form for Outstanding Payment to MSME): Due dates: April 30, 2024 (for the period October 2023 to March 2024) and October 31, 2024 (for the period April 2024 to September 2024).

LLP 11 (LLP Annual Return): Due on May 30, 2024.

PAS-6 (Reconciliation of Share Capital Audit Report): Due on May 30, 2024 (for the half-year ending March 31, 2024) and November 29, 2024 (for the half-year ending September 30, 2024).

DPT-3 (Return of Deposits): Due on June 30, 2024.

AOC-4 (OPC) (Form for Filing Financial Statements): Due on September 27, 2024.

DIR-3 KYC (KYC of Directors/Partners): Due on September 30, 2024.

ADT-1 (Notice to Registrar for the Appointment of Auditor): Due within 15 days of the General Meeting.

MGT-14 (Resolution Filing): Due within 30 days of passing the board resolution.

AOC-4 (Form for Filing Financial Statements): Due within 30 days of the Annual General Meeting.

LLP 8 (Statement of Account and Solvency of LLP): Due on October 30, 2024.

MGT-7A (OPC) (Annual Return): Due on November 28, 2024.

MGT-7 (Annual Return): Due within 60 days of the Annual General Meeting.

Tips for Effective Compliance Management

Maintain a Compliance Calendar: Create a customized calendar with all relevant deadlines for your business.

Set Reminders: Use digital tools or reminders to stay on top of approaching deadlines.

Seek Professional Help: Consider consulting with a legal or tax professional for guidance.

Stay Updated: Regularly monitor changes in regulations and compliance requirements.

By staying informed and proactive, you can ensure your business remains compliant and avoids potential penalties.

#businessstartup#newbusiness#startup#legal#finance#fundraising#companyincorporation#mca#MCA#compliances

0 notes

Text

Freelancing freedom comes with financial foresight. Stay ahead of the game by budgeting wisely for your taxes! 📊💼

#businessstartup#newbusiness#startup#dpiitregistration#companyincorporation#finance#legal#gstregistration#crowdfunding#fundraising

0 notes

Text

File Your Tax Early with us.

https://www.ensurekar.com

#businessstartup#newbusiness#startup#dpiitregistration#legal#companyincorporation#crowdfunding#finance#fundraising#gstregistration#Tax#taxes#income tax#incometaxreturnonline

0 notes

Text

SIP (Systematic Investment Plan) is the good EMI! Start a SIP as soon as you get your first salary & reach your financial goals faster.

#SaveForLater #Finance #TaxPlanning

0 notes

Text

Filing Income Tax Returns in India: A Comprehensive Guide with Ensurekar

Introduction

Filing your income tax return (ITR) in India can seem daunting, but with the right information and guidance, it can be a smooth and efficient process. This guide provides a comprehensive overview of e-filing income tax returns in India, including registration, types of returns, filing procedures, and crucial details for the Assessment Year (AY) 2023-24.

What is eFiling Income Tax Return?

The Income Tax Department of India offers a convenient online platform for electronically filing your ITR. This e-filing portal eliminates the need for physical visits to tax offices and streamlines the entire process.

Why File Your ITR?

Individuals falling under specific tax slabs are mandated to file their returns. Here are some reasons why filing your ITR is important:

Fulfilling Tax Obligations: It ensures compliance with tax regulations and avoids potential penalties for non-filing.

Claiming Refunds: If you've paid excess taxes through TDS (Tax Deducted at Source), filing your ITR is necessary to claim a refund.

Loan and Visa Applications: Many financial institutions and embassies require a clean tax filing history for loan approvals and visa processing.

Carrying Forward Losses: If you've incurred losses under a specific income head, filing your return allows you to carry them forward and offset future income.

Building a Credit History: A consistent record of timely ITR filing can positively impact your creditworthiness.

Types of eFiling Income Tax Returns

There are two main ways to file your ITR electronically:

Self-e-Filing: This involves filing your return directly through the Income Tax Department's e-filing portal. You'll need to fill out the ITR form with all necessary information, attach required documents, and submit it online.

Assisted ITR Filing: You can opt for assistance from authorized professionals like tax consultants, chartered accountants, or online tax-filing platforms. These intermediaries will handle the entire filing process, from collecting information to submitting your return online.

Benefits of eFiling Income Tax Return (ITR):

Convenience: Eliminates the need for physical visits and saves time and effort.

Security: The online process protects sensitive information with secure protocols.

Timely Processing: E-filing leads to faster processing and quicker refunds compared to paper returns.

Accuracy: The online platform helps with accurate tax calculations and reduces the chances of errors.

Environmentally Friendly: E-filing reduces paper usage and contributes to a greener environment.

How to File an eFiling Income Tax Return

Step 1: Registration

New users need to register on the Income Tax Department's e-filing portal using their PAN card details.

Step 2: Gather Documents

Collect all relevant documents like PAN card, Aadhaar card, Form 16 (salary certificate), TDS certificates, bank statements, investment proofs, and any other income or deduction-related documents.

Step 3: Choose the Right ITR Form

The appropriate ITR form depends on your income sources and category. Common forms include ITR-1 (for income up to ₹50 lakhs) and ITR-2 (for income with capital gains or foreign assets). For AY 2023-24, ensure you use the most recent versions of the forms.

Step 4: Fill and Verify the ITR Form

Fill out the chosen ITR form with accurate details about your income, deductions, and exemptions. Carefully review the entries to avoid errors. You can verify the return electronically using Aadhaar OTP or EVC (Electronic Verification Code), or by sending a signed physical copy of ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

Step 5: File the Return Online

Log in to the e-filing portal, navigate to the 'e-File' section and select 'Income Tax Return.' Upload the prepared ITR form or XML file and submit it.

Step 6: Keep Records for Reference

Maintain copies of the filed return, acknowledgment receipt, and supporting documents for future reference.

How Ensurekar Can Help

At Ensurekar, we understand the complexities of tax filing. We offer a comprehensive range of services to ensure a smooth and efficient ITR filing experience:

Expert Guidance: Our experienced tax professionals can guide you through the entire process, from choosing the right ITR form to maximizing deductions and claiming refunds.

Accurate Calculations: We ensure accurate tax calculations to minimize any tax liabilities or penalties.

Timely Filing: We help you meet all deadlines and avoid late filing penalties.

Stress-Free Experience: We take the stress out of tax filing, allowing you to focus on other important matters.

Additional Information:

Penalty for Late Filing of ITR: Filing your ITR after the due date can attract penalties and interest charges on the tax payable.

Steps to File ITR without Form 16: If you don't have Form 16, you can still file your ITR by gathering income proofs from various sources, calculating your TDS using Form 26AS, and claiming eligible deductions.

Conclusion:

Filing your income tax return is a crucial responsibility. By leveraging the benefits of e-filing and potentially seeking professional assistance from Ensurekar, you can ensure a smooth, accurate, and timely filing process.

0 notes

Text

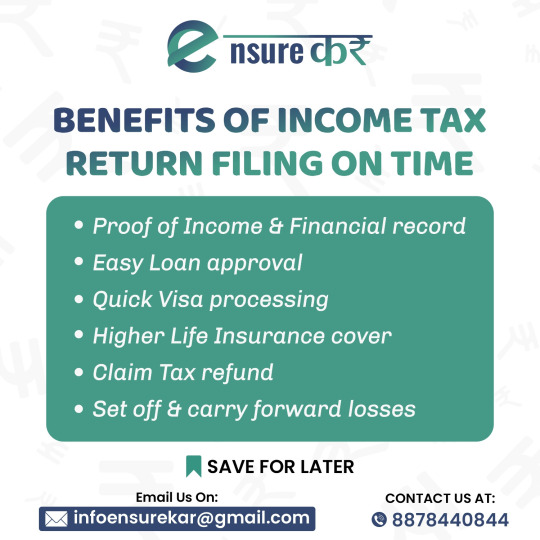

Don’t Miss Out: Unveiling the Benefits of Timely Income Tax Return Filing with Ensurekar

Tax season can be a stressful time, but it doesn’t have to be. Here at Ensurekar, we understand the importance of filing your income tax return on time and want to empower you with the knowledge of the many benefits that come with doing so.

Unlocking the Rewards of Timely Filing

While meeting deadlines might seem like the only reason to file on time, there’s a treasure trove of advantages waiting for you. Let’s delve into some of the key benefits:

Embrace the Power of Refunds: One of the most enticing rewards is the potential for a hefty tax refund. Filing promptly ensures you receive any tax credits or deductions you’re eligible for, putting that hard-earned money back in your pocket.

Streamline Loan Approvals: A timely tax return filing history demonstrates financial responsibility and stability. This can significantly improve your chances of securing loans for future endeavors, whether it’s a car loan, a mortgage, or a business loan.

Visa Applications Made Easy: For those seeking travel or work visas abroad, a clean and compliant tax record can be a crucial factor in the approval process. Timely filing demonstrates financial transparency and adherence to regulations, smoothing your path to international opportunities.

Avoid Penalties and Interest: Procrastination comes with a price. Delaying your tax return filing can result in penalties and accumulating interest on unpaid taxes. Filing on time allows you to avoid these unnecessary financial burdens.

Peace of Mind and Reduced Stress: Knowing your tax obligations are fulfilled gives you a sense of accomplishment and reduces the stress associated with looming deadlines and potential penalties.

Ensurekar: Your Partner in Timely Tax Filing

At Ensurekar, we are committed to simplifying the tax filing process for individuals and businesses. Our team of experienced professionals can guide you through the intricacies of tax regulations, ensuring your return is filed accurately and on time.

Benefits Beyond Timely Filing

In addition to the advantages mentioned above, Ensurekar offers a range of services to make your tax filing experience even smoother:

Tax Planning and Optimization: Our experts can help you strategize your finances throughout the year to minimize your tax burden and maximize potential refunds.

Investment Guidance: We can provide valuable insights on tax-efficient investment options to help you grow your wealth while minimizing your tax liability.

Audit Support: In the unlikely event of an audit, our team can provide dedicated support and representation, ensuring your rights are protected.

Don’t wait until the last minute. Take control of your tax filing today and unlock the numerous benefits of timely compliance. Contact Ensurekar and let us help you navigate the tax season with confidence.

Ready to file? Visit our website or call us at ENSUREKAR and connect with us over the phone at 8778440844 to schedule a consultation.

Ensurekar — Simplifying Taxes, Empowering Your Future!

#businessstartup#newbusiness#startup#dpiitregistration#companyincorporation#crowdfunding#legal#finance#fundraising#gstregistration#ensurekar.com#ensurekar

0 notes

Text

Financial Transparency: Audits and Annual Reports

Financial transparency is crucial for both individual taxpayers and businesses. It ensures accountability and helps identify any discrepancies. In India, the Income Tax Act and the Companies Act play a vital role in maintaining this transparency.

The Income Tax Act and Audits

The Income Tax Act mandates audits for taxpayers whose financial records comply with legal requirements. These audits are conducted by authorized professionals who meticulously examine financial documents to ensure accuracy and compliance with tax regulations.

The Companies Act and Annual Reports

The Companies Act mandates that all businesses, regardless of their financial performance, must submit annual reports. These reports provide a comprehensive overview of a company’s financial health, including its income, expenses, and assets. This requirement fosters transparency and helps stakeholders make informed decisions.

Benefits of Financial Transparency

Financial transparency offers numerous benefits for both individuals and businesses:

Reduced Risk of Errors: Proper record-keeping and audits help minimize errors in tax filings.

Improved Decision-Making: Financial transparency allows individuals and businesses to make sound financial decisions based on accurate data.

Increased Trust: Transparency builds trust with stakeholders, including investors, creditors, and the government.

By complying with the Income Tax Act and the Companies Act, individuals and businesses can ensure financial transparency, promoting accountability and fostering a healthy financial environment.

0 notes

Text

🚨 Taxpayers Alert! File Your Income Tax Returns Now to Avoid Penalties

Taxpayers, take heed! The Income Tax Department is intensifying its efforts to enforce regulatory compliance. Individuals who have neglected to file their Income Tax Returns (ITR), including those with taxes deducted at the source, will soon receive notifications. It's crucial to remain compliant by submitting your updated ITR for the preceding three years. Avoid the hassle of penalties—stay proactive in managing your taxes

#newbusiness#businessstartup#startup#companyincorporation#dpiitregistration#income tax#finance#taxes#ensurekar#ensurekar.com

0 notes

Text

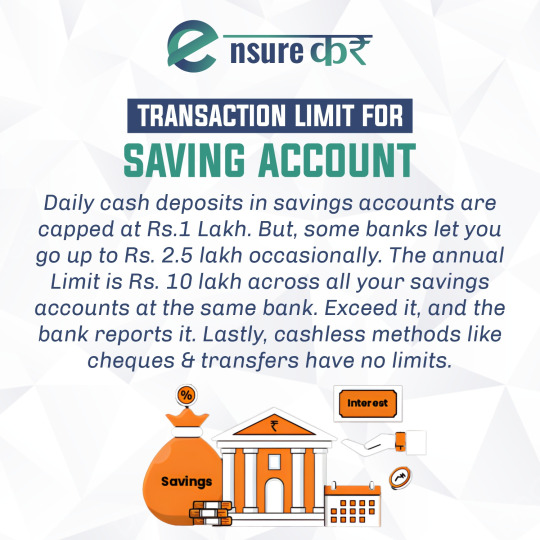

"Understanding Transaction Limits for Savings Accounts 💼💰 Did you know? Daily cash deposits are capped at Rs. 1 Lakh, but some banks offer flexibility up to Rs. 2.5 Lakh occasionally. Stay informed to manage your finances effectively! #Banking #FinanceTips #SavingsGoals #MoneyManagement"

#businessstartup#newbusiness#companyincorporation#startup#dpiitregistration#crowdfunding#gstregistration#saving account#ensurekar

0 notes

Text

Navigating Amendments to a Registered Trademark

Understanding the Process of Amending a Registered Trademark

Securing trademark registration involves a meticulous process spanning approximately a year. Ensuring error-free submissions is pivotal for comprehensive trademark protection. Delve into the intricacies of amending a registered trademark in this informative piece.

Authority for Modifying Trademarks:

Oversight of trademark amendments falls under the jurisdiction of the Registrar for Trademarks, appointed by the Controller-General of Patents Filings, Designs & Trademarks. Applicants seeking alterations must engage with the Registrar to effect necessary changes.

Scenarios for Amendment or Rectification:

Amendments may arise due to various factors, including inaccuracies in the registered proprietor's details, changes in ownership following assignment, incorrect classification of goods, or the need to cancel certain goods or services. Additionally, amendments may address figurative elements, similarity issues with other marks, or minor cosmetic adjustments.

Rectification in the Certificate of Registration:

For minor discrepancies in the registration certificate, applicants can file the appropriate form along with supporting documentation. Conversely, major discrepancies necessitate proceedings initiated by the Tribunal.

Procedure for Rectifying Trademarks:

Upon submission of the requisite form and fee, the Registrar evaluates the trademark's validity and the applicant's eligibility for rectification. Affidavits may be filed in case of disputes over ownership or title. Thorough application submissions facilitate a smooth rectification process.

Modification of a Registered Trademark:

Even post-receiving the registration certificate, alterations that do not significantly alter the trademark's essence are permissible. The Registrar may advertise such alterations if necessary, allowing for opposition within a specified period.

Forms for Altering a Trademark:

Various forms cater to specific alteration requirements, including minor changes in proprietorship details, changes in proprietor name, address modifications, trademark cancellations, changes in classification, and alterations in the trademark itself.

Permitted Adjustments or Amendments:

Certain adjustments, such as changes in the proprietor's name or address on the trademark label, are permitted. However, alterations impacting the representation of the company's name require scrutiny. Opposition to alterations can be lodged, and the Registrar follows prescribed procedures for resolution.

Ensuring Flawless Trademark Registration:

While corrections are feasible, aiming for error-free trademark registration initially is advisable. Leveraging online trademark registration services ensures meticulous scrutiny of documents and error-free submissions, minimizing processing delays.

By grasping the intricacies of amending a registered trademark and harnessing expert assistance, businesses can navigate the process effectively, safeguarding their intellectual property rights.

#newbusiness#businessstartup#startup#companyincorporation#crowdfunding#legal#dpiitregistration#gstregistration#trademarkrenewa#trademarkregistration#trademarkobjection#trademark

0 notes

Text

Ensuring Patent Success with Ensurekar: Evaluating Risks and Rewards

Innovation lies at the heart of progress, and patents serve as the guardians of inventive endeavors, providing creators with exclusive rights to their creations. However, the journey from idea to patent can be fraught with both promise and peril. Let's explore the risks and benefits of patent searching through the lens of Ensurekar's expertise.

Understanding Patents

Patents bestow inventors with the exclusive privilege to exploit their inventions commercially for a limited duration. Yet, obtaining a patent is not a given; stringent criteria must be met to secure this coveted protection.

Benefits of Patenting

Patents offer a multitude of advantages:

Protection Against Infringement: Safeguard your invention from unauthorized use.

Monetary Opportunities: Gain revenue through licensing and commercialization.

Competitive Edge: Establish dominance in the market with exclusive rights.

Investment Magnet: Attract investors by showcasing the value of your innovation.

Company Valuation: Enhance the worth of your enterprise through patented assets.

Assessing Risks

However, the path to patenting is not without its risks:

Approval Uncertainty: Your patent application may face rejection due to various factors.

Enforceability Challenges: Even granted patents can encounter hurdles in legal enforcement.

Validity Disputes: Challenges to patent validity can undermine its protective scope.

Financial Burden: The cost of patent registration and defense can be substantial.

Intellectual Theft: Risks of idea misappropriation before securing patent protection loom large.

Public Exposure: Patent filings expose innovations to competitors, potentially aiding imitation.

Exclusivity Limitations: The expiration of patents opens the floodgates to free usage by others.

Protecting Your Innovation

To shield your invention from infringement, proactive measures are essential:

Patent Registration: Establish a legal basis for defending your rights.

Vigilant Monitoring: Regularly scan the market for potential infringers.

Swift Enforcement: Pursue legal recourse against suspected violators.

Strategic Licensing: Consider licensing agreements to monetize your invention while retaining control.

Conclusion

In the intricate landscape of patenting, informed decision-making is paramount. A meticulous patent search, facilitated by Ensurekar's expertise, empowers innovators to navigate the risks and reap the rewards of their creative pursuits. With comprehensive insights and proactive strategies, Ensurekar ensures that your intellectual property journey is marked by success and security.

#ensurekar #ensurekar.com #startup #startupindia #patent #trademarkregistration #trademarknamesearch #trademarkobjection #trademarkrenewal #trademarkrenewal #trademarkandip #india

#businessstartup#newbusiness#startup#companyincorporation#crowdfunding#dpiitregistration#fundraising#ensurekar#ensurekar.com#startupindia#patent#trademarkregistration#trademarknamesearch#trademarkobjection#trademarkrenewa#trademarkandip

0 notes

Text

Highlights of 2024 Budget. #budget2024 #india #indiafm #Ensurekar #indiafinance

0 notes

Text

Navigating the Compliance Landscape: A Checklist for Businesses.

In today's dynamic and ever-evolving business environment, compliance has become a critical aspect of successful operations. Businesses of all sizes are subject to a multitude of laws, regulations, and standards, and adhering to these requirements is essential for protecting the company's reputation, avoiding legal and financial penalties, and maintaining a competitive edge.

While the compliance landscape can seem daunting, there are practical steps businesses can take to navigate this complex area effectively. Here's a comprehensive checklist to help businesses stay compliant and minimize risks:

1. Identify Applicable Regulations

The first step in ensuring compliance is to identify the specific laws and regulations that apply to your business. This may vary depending on your industry, location, and type of business entity. Consulting with legal or compliance professionals can help identify the relevant regulations and ensure you are not overlooking any critical requirements.

2. Establish a Compliance Program

Implementing a structured compliance program provides a framework for managing and overseeing compliance activities within the organization. A well-defined program should include clear policies and procedures, regular training for employees, and a system for monitoring and evaluating compliance efforts.

3. Assign Compliance Responsibilities

Designate specific individuals or teams within the organization to oversee compliance responsibilities. This could involve a dedicated compliance officer, a committee of relevant departments, or a combination of both. Clearly define roles and responsibilities to ensure accountability and avoid confusion.

4. Conduct Regular Risk Assessments

Periodically assess your organization's compliance risks. Identify potential areas of non-compliance and evaluate the likelihood and impact of potential violations. Use this assessment to prioritize compliance efforts and focus on areas that pose the greatest risk.

5. Implement Preventive Measures

Based on your risk assessment, implement preventive measures to minimize the likelihood of non-compliance. This may involve developing internal controls, providing training to employees, and conducting regular audits or reviews.

6. Stay Updated on Regulatory Changes

Compliance regulations are constantly evolving, and it's crucial to stay informed about changes that may impact your business. Subscribe to relevant regulatory updates, monitor industry news, and seek guidance from legal or compliance professionals to ensure you are adhering to the latest requirements.

7. Document Compliance Efforts

Document your compliance activities, including policies, procedures, training materials, and audit reports. This documentation provides evidence of your commitment to compliance and can be valuable in the event of legal or regulatory inquiries.

8. Seek Professional Assistance

When dealing with complex compliance matters, don't hesitate to seek assistance from experienced legal or compliance professionals. Their expertise can help you navigate the nuances of regulations, identify potential risks, and develop effective compliance strategies.

9. Foster a Culture of Compliance

Instill a culture of compliance within your organization by emphasizing the importance of adhering to laws and regulations. Encourage open communication, provide regular training, and recognize employees for their commitment to compliance.

10. Continuous Monitoring and Improvement

Compliance is an ongoing process, not a one-time event. Continuously monitor your compliance efforts, evaluate the effectiveness of your program, and make adjustments as needed. Stay vigilant about emerging risks and adapt your strategies to stay compliant in the ever-changing regulatory landscape.

By following these steps and prioritizing compliance, businesses can minimize risks, protect their reputation, and operate with confidence in a competitive marketplace. Remember, compliance is not just a legal obligation; it's a strategic decision that can safeguard your business's future success.

#companyincorporation#businessstartup#crowdfunding#legal#startup#newbusiness#dpiitregistration#finance#fundraising#gstregistration

0 notes

Text

Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023: A Comprehensive Overview

On October 27, 2023, the Ministry of Corporate Affairs (MCA) notified the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 (the "Amendment Rules"), which amended the Companies (Prospectus and Allotment of Securities) Rules, 2014 (the "Rules"). The Amendment Rules came into force on the same date.

The Amendment Rules introduce several important changes, including:

Requirement for public companies to dematerialize share warrants issued before the Companies Act, 2013: Public companies must now dematerialize all share warrants that were issued before the commencement of the Companies Act, 2013. This requirement is intended to improve the transparency and efficiency of the securities market, as well as to protect the interests of investors.

Requirement for private companies to issue securities in dematerialized form: All private companies, except small private companies, must now issue all securities in dematerialized form. This requirement is intended to improve the efficiency of the securities market and to make it easier for investors to track and manage their investments.

Introduction of new forms: The Amendment Rules have introduced two new forms: Form PAS-7, which is to be used to report details of pending share warrants to the Registrar, and Form PAS-8, which is to be used to notify the bearers of pending share warrants to surrender them for dematerialization.

Implications for Public Companies

The Amendment Rules have several implications for public companies.

Dematerialization of share warrants: Public companies must now dematerialize all share warrants that were issued before the commencement of the Companies Act, 2013. This requirement applies to all share warrants, regardless of whether they are listed on a stock exchange.

Compliance timeline: Public companies have 3 months from the commencement of the Amendment Rules to inform the Registrar about the details of their pending share warrants, and 6 months to require the bearers of such warrants to surrender them for dematerialization.

Penalties for non-compliance: Failure to comply with the requirement to dematerialize share warrants could result in penalties, including fines and imprisonment. Additionally, public companies that fail to comply with this requirement may be unable to raise capital by issuing new shares.

Implications for Private Companies

The Amendment Rules also have several implications for private companies.

Dematerialization of securities: All private companies, except small private companies, must now issue all securities in dematerialized form. This requirement applies to all securities, including equity shares, preference shares, debentures, and warrants.

Compliance timeline: Private companies have 18 months from March 31, 2023, to comply with the requirement to issue all securities in dematerialized form.

Penalties for non-compliance: Failure to comply with the requirement to issue securities in dematerialized form could result in penalties, including fines and imprisonment. Additionally, private companies that fail to comply with this requirement may be unable to raise capital by issuing new shares.

Conclusion

The Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023 are a significant development for the Indian securities market. The new requirements for public and private companies to dematerialize share warrants and issue securities in dematerialized form will help to improve the transparency, efficiency, and safety of the market.

Public and private companies should carefully review the Amendment Rules and take steps to ensure compliance with the new requirements.

Key Points

The Amendment Rules require all public companies to dematerialize all share warrants that were issued before the commencement of the Companies Act, 2013.

The Amendment Rules also require all private companies, except small private companies, to issue all securities in dematerialized form.

The Amendment Rules have introduced two new forms: Form PAS-7, which is to be used to report details of pending share warrants to the Registrar, and Form PAS-8, which is to be used to notify the bearers of pending share warrants to surrender them for dematerialization.

The Amendment Rules came into force on October 27, 2023. Public companies have 3 months from this date to inform the Registrar about the details of their pending share warrants, and 6 months to require the bearers of such warrants to surrender them for dematerialization. Private companies have 18 months from March 31, 2023, to comply with the requirement to issue all securities in dematerialized form.

You can connect with us to learn more about startups, legal, finance, tax.

#businessstartup#companyincorporation#crowdfunding#dpiitregistration#newbusiness#legal#startup#finance#fundraising#gstregistration

0 notes

Text

Get your funds from startup India. contact us to get a chance to get a grant up to 50 lakh.

#crowdfunding#businessstartup#companyincorporation#dpiitregistration#newbusiness#legal#startup#finance#fundraising#gstregistration

0 notes

Text

How Startup India Can Help Your Business Grow.

The Startup India program is a flagship initiative of the Government of India that aims to build a strong and inclusive ecosystem for innovation and entrepreneurship in the country. The program offers a wide range of benefits to startups, including:

- Tax breaks: Startups that are recognized by the government are eligible for a three-year exemption from income tax. - Funding: The government has set up a fund of funds to invest in startups. - Incubation and acceleration: The government supports incubators and accelerators that help startups develop and grow. - Government procurement: The government gives preference to startups in government procurement. - Legal support: The government provides legal support to startups, such as fast-tracking patent applications. - We can help you with all of your legal needs, from registering your company to filing patent applications. We also have a team of experienced lawyers who can advise you on government policies and regulations.

If you are a startup, the Startup India program can be a valuable resource for you. we can help you take advantage of the program and grow your business. Here are some additional tips for startups on how to use the Startup India program to their advantage: - Get recognized by the government: This will make you eligible for all of the benefits that the program offers. - Network with other startups and mentors: The Startup India ecosystem is a great place to meet other entrepreneurs and get advice from experienced professionals. - Attend events and workshops: The government and other organizations regularly hold events and workshops for startups. These events are a great way to learn about new opportunities and connect with other entrepreneurs. - Apply for government grants and loans: The government offers a variety of grants and loans to startups. These can be a great way to finance your business. The Startup India program is a valuable resource for startups. By following these tips, you can take advantage of the program and grow your business.

In addition to the benefits mentioned above, the Startup India program also provides startups with access to a variety of other resources, such as: - Mentorship: The program connects startups with mentors who can provide guidance and advice. - Training: The program offers training programs on a variety of topics, such as business planning and marketing. - Networking: The program provides opportunities for startups to network with other entrepreneurs and investors.

The Startup India program is a great way for startups to get the support they need to succeed. If you are a startup, I encourage you to learn more about the program and take advantage of the benefits it offers.

We are proud to be a part of the Startup India ecosystem. We are committed to helping startups succeed, and we believe that the Startup India program is a valuable tool for achieving that goal.

Our company is helping a lot of startups in India. in their finance, legal, and tax things.

#businessstartup#companyincorporation#crowdfunding#dpiitregistration#legal#startup#newbusiness#finance#fundraising#gstregistration

1 note

·

View note

Text

What is brand registration?

Brand registration is the process of registering a trademark with a government agency. A trademark is a word, phrase, symbol, or design that identifies the source of goods or services. By registering a trademark, you can protect your brand from being used by others without your permission.

Why is brand registration important?

Brand registration is important for a number of reasons. First, it gives you exclusive rights to use your trademark in commerce. This means that you can prevent others from using your trademark without your permission. Second, brand registration can help you build a strong brand identity. A registered trademark is a valuable asset that can help you attract customers and increase sales. Third, brand registration can help you protect your brand from counterfeiters. By registering your trademark, you can make it more difficult for counterfeiters to sell counterfeit goods or services under your brand name.

How to register your brand

To register your brand, you need to file an application with the United States Patent and Trademark Office (USPTO). The USPTO will review your application and determine whether your trademark is eligible for registration. If your trademark is eligible for registration, the USPTO will publish your trademark in the Official Gazette of the United States Patent and Trademark Office. This gives other people the opportunity to oppose your trademark registration. If there is no opposition to your trademark registration, the USPTO will issue you a certificate of registration.

Brand registration tips for Redditors

Here are a few brand registration tips for Redditors:

Choose a strong trademark. A strong trademark is one that is distinctive and easy to remember. It should also be relevant to the goods or services that you offer.

Do your research before you file a trademark application. Make sure that your trademark is not already registered by someone else. You can use the USPTO's Trademark Electronic Search System (TESS) to search for registered trademarks.

File your trademark application early. The sooner you file your trademark application, the sooner you can start using your trademark and building brand recognition.

Consider hiring a trademark attorney. A trademark attorney can help you choose a strong trademark, file your trademark application correctly, and respond to any oppositions to your trademark registration.

Conclusion

Brand registration is an important step for businesses of all sizes. It can help you protect your brand and build a strong reputation. If you are thinking about registering your brand, be sure to do your research and consider hiring a trademark attorney.

#businessstartup#companyincorporation#crowdfunding#dpiitregistration#legal#startup#newbusiness#fundraising#finance#gstregistration

0 notes