#finances ///

Explore tagged Tumblr posts

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#polls about money#submitted june 5#money#salary#finances#income

33K notes

·

View notes

Text

This summer will be a financially satisfying time for you. You won't have to worry about not having enough money. You will have more than enough money to enjoy your desired experiences. You will be able to see new and beautiful places without the burden of stressing over money. You will eat the foods you want to eat and go on all the adventures that call out to you. You will enjoy all the luxuries this summer has to offer you, and money will never be a factor. Claim it.

2K notes

·

View notes

Text

BUDGETING + SAVING MONEY FOR TEENS 𐙚

For many of us, we are entering an age when we can work casual jobs such as retail or fast food. It’s not a lot of money that we receive, depending on how often you get paid, but it can go a long way in the long term.

In this post, I’ll be discussing how to budget for your needs/wants and save money for future goals.

CREATING GOALS, you may want to save a certain amount of money in a time frame, want to make a big purchase (like a car) or buy everything off your wishlist. It is entirely up to you what your goals are, so I can’t say too much. However, the more specific it is, the better.

HOW MUCH? Determine how much money you need to save to achieve your goal. In total, and monthly.

There are three types of saving goals that may apply to you;

Short-term goals >1 year (outings, latest gadget, buying your cart)

Medium-term goals 1-2 years (road trips, shopping spree)

Long-term goals 2-4 years (higher education, car)

It’s very important to set a realistic time frame, as teens we don’t get paid much and we also don’t work as much. You don’t want to overwhelm yourself as well, as it takes patience and self-control to achieve these goals.

NO LOOONG-TERM GOALS! This may sound aggressive, but any money that just sits in your account for years on end is dead money. Even though the amount of money is increasing, its value is slowly decreasing. Keep your goals achievable within a time frame of less than four years. It's much more useful if this money is put into some type of investment instead.

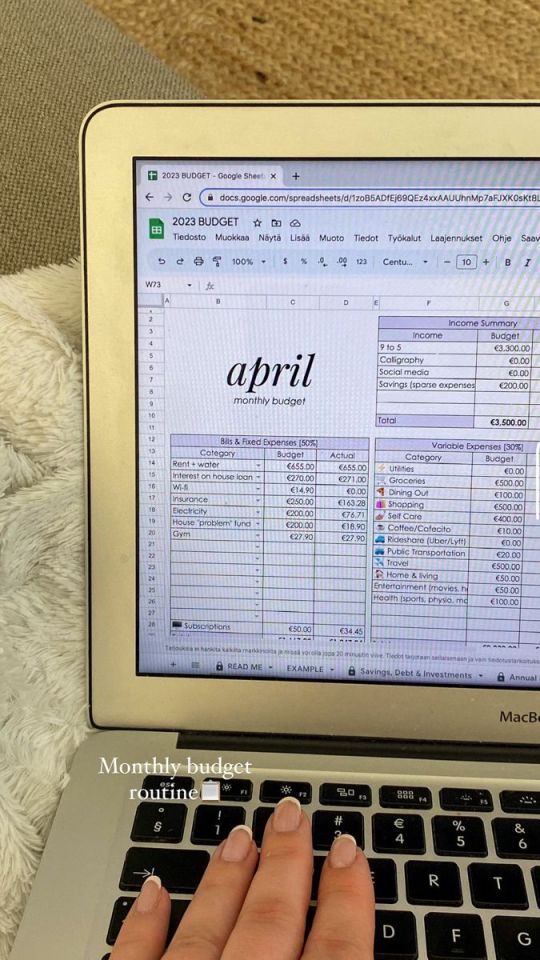

CREATING A BUDGET

Calculate how much money you receive every month, and how much money you spend every month.

You have two types of expenses. Fixed and variable. Fixed are any expenses required in your day-to-day life or it’s an amount of money that doesn’t change e.g. subscriptions or transportation costs. Variable costs are expenses that may fluctuate, like food, or any other recreational activities.

Record the average you’re spending monthly with these two categories.

There are many ways people choose to budget, but you have to choose a system that works for you.

Work out how much money you need to save each month to achieve your goal.

However, for anyone who’s starting in budgeting, I would say to allocate your costs using a percentage system. Your percentages for each category are going to differ from mine; e.g. 60% = savings, 20% = wants, 20% needs. Make sure it reflects the end goal.

Track your progress. This is the major part of budgeting, you want to be recording and regularly reviewing how much money you’re spending and comparing it to how much you’re earning. It allows for space to reflect on the flow of your money like if some purchases are worth it, if you’re impulsively spending, or if you’re frequently withdrawing money from your savings.

Adjust if needed. Maybe you want to put more money in savings and less into wants, or you want to put more into wants and less into needs.

SAVING TIPS

SAY NO! This is probably my biggest struggle at the moment, but say no to things that will cause you to go off track. Whether its outings, getting fast-food or anything similar, say no. You have to be firm with your financial boundaries, as these opportunities will always arise again.

RESTRICT IMPULSIVE SPENDING. We all have our moments when we see a product and we instantly think ‘I’ve got to have this’. Giving in once or twice is okay, but it shouldn’t become a habit at all. Its unnecessary spending (most of the time!) and leads to buyers remorse.

IS IT WORTH IT? Always remember to work out which products you’re getting the most value out of.

PAYING FOR THE NAME, a lot of brands will cut down on quality to save a few dollars, so essentially the customer is only paying for the name of that brand. Just because a store is more expensive, doesn’t mean its better.

#prettieinpink#becoming that girl#that girl#clean girl#green juice girl#dream girl#dream girl tips#it girl#vanilla girl#glow up#pink pilates princess#dream girl journey#dream girl life#dream girl vibes#dream life#wealth#old money#money#finances#invest#wonyoungism#it girl tips#it girl energy#winter arc#abundance#becoming her#that girl lifestyle#that girl routine#glow up era#feminine journey

740 notes

·

View notes

Text

I try really hard not to do this because I feel so guilty over asking for any type of help, but I am in a really desperate position. I know I recently asked for help when our bank screwed us over, but my living situation has changed. And I am desperate to get out of it. I’m in so much debt I can’t actively change anything at this moment but I really need to.

I really, really hate to ask but I would really appreciate any help spreading the word about my business @flappyhappystim. This is an advertising post that I share on that blog.

I also have a ko-fi .

I also have some digital books I wrote on Etsy for $1 CAD. This is a book about my healing, and this is a poetry book. As well as a digital workbook for $6 CAD

I really appreciate any spreading of this post, or my post about my business.

Edit: I got an ask about my PayPal and I think this is the link for it.

#i know this won't stop the haters#but i am in a really bad place#and i am really emotional fragile#and if you could please think twice before sending me hate about this#i'd really appreciate it#because i just feel emotionally broken and tired#i've been crying about this since i discovered it an hour ago#personal#finances#idk what else to tag this as so people can blacklist#but tumblr won't come after my post

482 notes

·

View notes

Text

Study Trick That No One Told Me.

Division of subjects:

Every subject is learnt and graded in a different way. You can't use the same study techniques for every subject you have. You have mostly 3 types of subjects:

Memorization based

Practical/Question based

Theory/Essay based

Memorization based:

Mostly Biology, Sciences, Geography etc are fully based on memorization and so you'll use memory study techniques like flash cards and active recall.

Practical/Question based:

Maths, Physics, Chemistry, Accountancy etc are practice subjects. The more you do your questions and understand how a sum is done, the better you can score.

Theory/Essay based:

English, history, business studies etc are theory based. The more you write, the way you write and the keywords you use are the only things that will get you your grades. So learn the formats and the structure on how to write your answers

Note: Some subjects are a combination of the three. Like Economics etc

The reason we divide the subjects is because you can adopt the right study methods for the right subject. Like ex: business studies is mostly based on how you write your answer and the keywords, if you're gonna spend your time memorizing in this, it's a waste of time and energy.

Hope this helps :)

#studyblr introduction#studyblr#study motivation#school#study blog#student#studyspo#studying#study aesthetic#high school#study tips#study buddy#studybrl#study break#study goals#goals#academic goals#academic girly#it girl#senior year#self improvement#student life#studyblr community#high school studyblr#high school tips#study hard#study#accounting#finances#economics

445 notes

·

View notes

Text

From the article:

For Brother Xavier Boutiot, treasurer of a Benedictine abbeyin central France, pulling the abbey's investments from fossil fuels was an obvious step. Committed to the “Green Church” initiative for four years, the Olivetan monks aimed for consistency in all aspects of their community life. “Financial investments have an ecological impact that is 25 times greater than our daily actions!” emphasized the treasurer. To embark on this ecological and financial transition, the abbey had to scrutinize its investments, which was not straightforward. “The financial world is so opaque for basic investors like us, who don’t have access to all the information,” explained Boutiot. “We called our banks that were not on board with this direction, explained our reasoning, and applied some pressure by saying, ‘Either you support us in this approach, or we’ll switch banks.’” [...] The reasons to divest from fossil fuels are not only ethical but financial: the International Energy Agency predicts fossil fuel use will peak before 2030 and then decline. Religious institutions, managing $3 trillion globally, have divested from fossil fuel companies more than any other sector, aligning their investments with their values.

#divestment#finances#global warming#climate change#climate anxiety#good news#hope#sustainability#environment#ecoanxiety#christianity cw#religion cw#divest

173 notes

·

View notes

Text

#financetips#finances#finance#money#make money online#income#rich#wealthy#rich girl#luxury aesthetic#rich aesthetic#wfh#aesthetic#affirmations#abundance#abundance affirmations#money affirmations

191 notes

·

View notes

Text

Hour after hour, it went on, with a patience that at first terrified and then bored. It was the warfare of clerks, and it harried the enemy through many columns and files. Moist could read words that weren't there, but the clerks found the numbers that weren't there, or were there twice, or were there but going the wrong way. They didn't hurry. Peel away the lies, and the truth would emerge, naked and ashamed and with nowhere else to hide.

Terry Pratchett, Going Postal

#moist von lipwig#the clerks#going postal#discworld#terry pratchett#warfare#auditors#accountants#auditing#accounting#forensic accounting#finances#words#administration#numbers#math#embezzlement#patience#boredom#hurry#truth#lies#the warfare of clerks#nowhere to hide#a pune or play on words

207 notes

·

View notes

Text

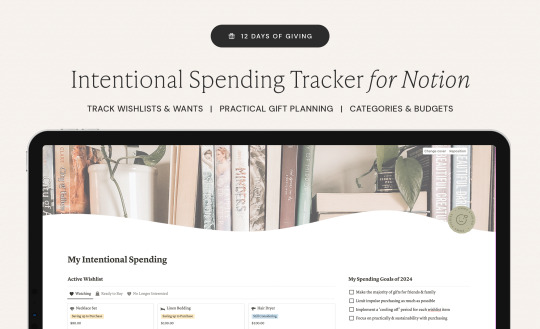

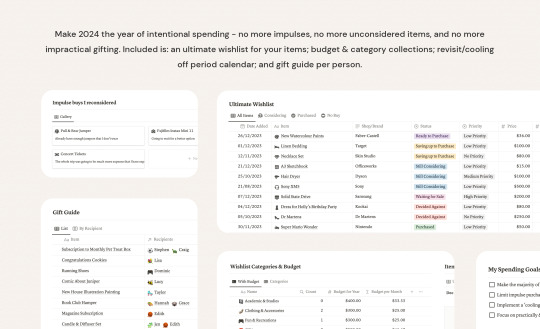

Free Intentional Spending Tracker for Notion

It's Day 8 of the 12 Days of Giving!

Track your wishlist and fill in details to help make more informed decisions regarding your purchases. Comes with an comprehensive way to categorise your wants & seeing the impact on your budgets. Whilst this has budgeting features, it's more about how you're spending and making sure those purchases are considered. Features include:

spending goals for 2024

active wishlist & watching space

detailed digital wishlist and budget impact

wishlist categorises & year budgeting

pre-populated dates with calendar view for revisiting items after "cool off period"

gift gifting ideas (by idea, rather than recipient for more intentional gifting!)

recipient database

Download Free Here

Check back in each day for a new free item! Hopefully they're all useful and a fun way to end the year 🥰🎁

#download#free#wallpaper#studyspo#studyblr#emmastudies#studying#freebie#notion#notion template#spending#money#finances#old money#intentional spending#intentional living#gift guide

583 notes

·

View notes

Text

397 notes

·

View notes

Text

This is your regular reminder that if you live in the US*, you should search missingmoney.com for unclaimed funds. I just found $36 from my insurance company, and over the years I've found literal thousands of dollars that friends and family had forgotten or never known about.

The site is run by the National Association of Unclaimed Property Administrators (NAUPA). Here's an article about it (and several other links for places to look for forgotten cash):

Want some cash? Here are five places to look for unclaimed money (free WaPo link)

Using the site is entirely free, and if you ever get asked to pay money to recover unclaimed funds, it's a scam!

*or Alberta, Canada, but not Hawaii or Georgia

164 notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#miscellaneous polls#submitted nov 28#finances#personal finance#money

5K notes

·

View notes

Text

This is your sign. You will manifest the money you need to meet your monetary needs and make your desired shifts in life. The money is on its way to you, and quicker than you think. Give thanks for its arrival now.

1K notes

·

View notes

Text

Now that student loans are starting back up-

(The following is absolutely not art related at all)

Hey guys! Posting this here because I find it important-

Money is super scary shit and can cause a lot of anxiety, but please please for the love of god-

Do not avoid looking at your finances.

I cannot stress this enough. I'm in no real position to give any meaningful advice other than that. Keeping an eye on your finances and looking at them at least once a week will help break the cycle of money avoidance.

I spent most of my life being super money avoidant due to how I was raised and it caused me to get into a really rough patch because I straight up missed nearly a year of student loan payments. It very nearly fucked over my whole financial life. Thankfully it has a happy ending- I paid off my loans in 2019 and have effectively repaired my credit score (after a lot of work.)

I am currently helping some family members budget for student debt repayments because I had both fucked around and found out, so I'm trying to use that recovery and lessons learned to help the people in my life.

Please please please keep up to date with your own finances. Budget (it's honestly really easy even though it sounds intimidating.) Gamify it if you gotta. Just be sure you are looking at your account and are aware of your money situation at all times.

712 notes

·

View notes

Text

70 notes

·

View notes