#charity contributions

Explore tagged Tumblr posts

Text

Different Types Of U.S. Federal Tax Forms

You're not alone if you're confused about what a W-2, W-4, or 1040 is and isn't. Everybody must know the purposes and usage guidelines for each IRS tax form. When filing your taxes, there are numerous forms available. Choosing the correct one the first time is important to avoid an expensive error. (There are, however, some situations when you can make changes to a previous tax return to fix specific mistakes.)

Some of the more complicated tax forms are ones you might never need, but there are others you'll probably encounter annually.

1. U.S. Individual Tax Return Form 1040

The most often used IRS tax form for annual tax returns in the United States is Form 1040. Depending on your age, filing status, and gross income, you may need to use this form. This form may be appropriate for you even if you have no taxable income but are qualified for a tax credit or refund. You can also claim several tax credits and costs and itemize deductions.

A shorter version of this form, Form 1040-EZ, Income Tax Return for Single and Joint Filers Without Dependents, was formerly accessible. However, the IRS no longer utilizes this form, which was eliminated in the 2018 tax year.

2. Wage and Tax Statement, Form W-2

Form W-2 and Form W-4 are sometimes confused. At the end of the year, your employer provides you with Form W-2, which details the total amount of taxes deducted from your paychecks.

Your employer also sends a copy of the Form W-2 to the Social Security Administration, the Internal Revenue Service, and some state taxing agencies. The amounts you report as income and the amounts your employer says they paid you are matched by these taxing authorities. You do not need to file this form with your tax return because your employer delivers it to the IRS, but doing so will help you report your taxable income accurately.

However, if need be, you may get preprinted Federal tax forms with their respective envelopes from a reputed facility and file them yourself.

3. Employee's Withholding Allowance Certificate, Form W-4

Form W-4 is not sent to the IRS or filed with your yearly tax return. Instead, you give it to your employer so they can decide how much tax to deduct from your gross salary and send it to the appropriate tax authorities. A worksheet is included with Form W-4 to assist you in calculating the amount. Try the W-4 calculator if you need help figuring out how much tax to deduct from your paycheck based on your objectives.

If your employment changes, you have to file a new W-4. In the event that your circumstances change—for instance, if you get married or have a child and wish to claim an additional dependent—you can also file a new Form W-4 with your current employer.

4. Form 1040, Schedule A: Itemized Deductions

It's possible that you've heard that you can "deduct" some personal expenses from your gross income to potentially pay less in taxes.

That is accurate.

You can itemize your deductions using Schedule A if the total amount of your deductible personal expenses is greater than the IRS standard deduction.

The seven spending categories on Schedule A include mortgage payments, medical costs, and charity contributions. However, there are strict guidelines for figuring out and claiming these deductions. You may not always be able to deduct the entire amount.

Additionally, you are not required to finish every line on the program. Just go on to the next category if you don't have any expenses in that one. Complete Form 1040 by adding your entire deduction amount when you're done.

5. Form 1099-INT: Income from Interest

If banks or other financial organizations pay you a specified amount of interest on your deposits, you might receive a Form 1099-INT from them. You'll often need to file an income tax return and pay tax on the interest.

You must include all the amounts shown on the form in your return. If the total taxable interest exceeds the $1,500 threshold, Schedule B is usually used to detail the players' names and the interest amount received.

6. Profit or Loss From Business (Sole Proprietorship) Schedule C to Form 1040

If you work for yourself, you might have to file Schedule C to disclose your company's gross profit or loss. Insurance, travel, business lunches, taxes, office supplies, pay, and other expenditures related to the business are all considered expenses.

7. Non-Employee Compensation Form 1099-NEC

Typically, Form 1099-NEC is sent to self-employed individuals by every customer who pays them annually. It details the total amount of money received, which you must include on your tax return. This form substitutes the Form W-2 you would receive as an independent contractor or freelancer when employed by a regular employer.

Self-employed taxpayers used Form 1099-MISC to report non-employee compensation prior to 2020. While it still exists, this form is no longer used to report compensation to non-employees. Instead, other forms of sporadic income like rent, prizes, awards, health and medical payments, and fishing boat revenues are all lumped together under Form 1099-MISC.

In the end!

The IRS may update forms annually, so be sure to utilize the appropriate tax year versions of any forms you must complete. Additionally, keep in mind that your circumstances may vary and that you may need to file more or fewer forms annually, depending on your circumstances.

Pin or save this post for later!

Share in the comments below: Questions go here

#federal tax forms#individual tax return#social security administration#internal revenue service#tax agencies#withholding taxes#tax deductions#personal expenses#mortgage payments#medical costs#charity contributions

0 notes

Text

honoured to share a preview of the piece I made for the @soapjournalzine in a fic/art collaboration with prettyunhinged - we brought our best and fluffiest A-game on this one!

You can pre-order the zine here (proceeds will be donated to Doctors without Borders).

#special thanks to the team behind this project for their effort and time on setting up this charity event!#i'm very thankful I was able to contribute.#john soap mactavish#simon ghost riley#cod mw2#ghostsoap#soap journal zine

2K notes

·

View notes

Text

Link to my friend Emilio’s campaign (@emiliosandozsequence)

Some verified campaigns that have reached out to me: Bilal Abed Rabou (@bilalassadabedrou), Tahseen Alkhazendar (@tahseenkhazen), Nadaa (@nedaapalestine), Musab (@musababed), Mohamed Mikki (@mohamed-mikki), Osama Basil (@osama-basil-ps / @lets-help-osama), Ola (@olagaza), Yousef Hussein (@adham-89), Waseem Abusafi (@waseem4gaza), Nour Alanqar (@noor-family), Fidaa (@fidaa-family2), Abdelrahman (@anqar), Mahmoud Helles (@hillesmahmoud)

Unvetted but likely legit (will be accepting donations to these): Osama Al-Anqar (@osama-family), Ahmed (@save-ahmed-family1), Ehab Ayyad (@ehabayyad23)

(The blog listed in the photo is my creations blog but you can reach out to me on here too.)

#commissions#poetry commissions#writing commissions#signal boost#charity commissions#artists for Gaza#artists for palestine#Gaza#Palestine#gfm#i don’t have any time for work anymore so hope I can contribute this way 🫶#any bit counts. pay what you want will get the poem dedicated to you still#poetry#poem#poems#mutual aid

56 notes

·

View notes

Text

sometimes I’m reminded that this website forgets that there are in fact people who do not in fact have tons of disposable income lying about

#like. people who are on disability are not going to be able to donate much money to a cause#If I donated five pounds to every fundraiser on here I’d be flat broke in 60 and there’s way more than 60#and like. I also need that money Because I Am Disabled and can’t fucking walk or work#I would like to not starve to death actually#if I am able to donate it’s to big organisations and that’s not bc I have anything against small ones#It’s just. I Do Not Have Enough To Meaningly Contribute Unless I Arbitrarily Decide Who Lives Or Dies#whereas with charity organisations I can at least know it’s doing fucking something

22 notes

·

View notes

Text

*

#daniel ricciardo#anyways people on Daniel’s charity post telling him to retire#have you no shame?#grow up?????#be a productive member of society???#telling him to bow out at monaco like he’s getting fired tomorrow#shut up and contribute to society

24 notes

·

View notes

Text

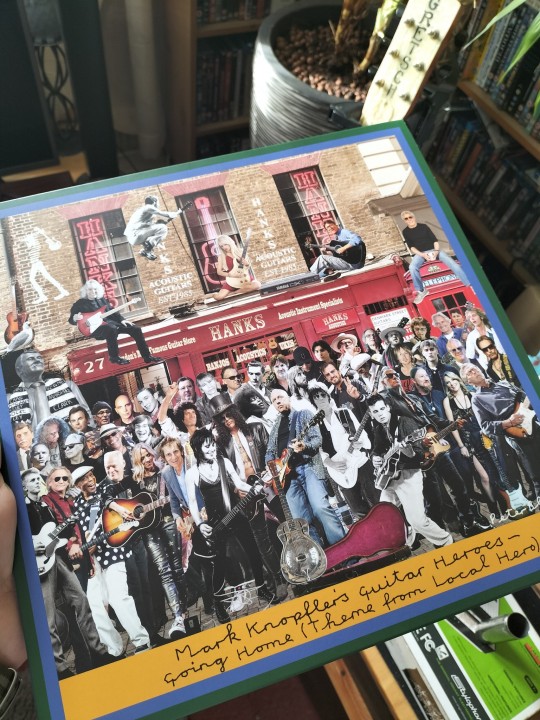

Aaaaa it arrived the day after getting my resonator 😭😭😭😭

#music#mark knopfler#local hero#going home#going home charity single#should i tag all the artists that contributed ahahaha#vinyl#vinyl records#12 inch#single#dire straits

9 notes

·

View notes

Text

United Soulmates - Relationship Flow for Chanukah and beyond by Eli Goldsmith - Joy of Living in Chaos etc... Even in London…

United Soulmates – by Eli Goldsmith – Joy of Living in Chaos, Flood of Truth, Love & Kindness, Hardest of Tests, Even in London… United Souls – Section 2 by Eli Goldsmith – A Journey towards Real Unification Everyway Continued – Healthy Happy Chanukah 2025 5785 Blessings All – Check out all the Parts especially 43 for the Intro… The Latest Flow –…

#"Believers"#"The Spiritual Guide to our Husband to make a happy Wifey"#1.The big Guide of souls#19th Kislev#A zivug is a life partner#Aliya#Amazon.com#Artist#Bless#Blessing#Bnei Akiva#Chabad#charity#Chassidus#Comedian#Connect#Contribute!#education#Efrat#Emuna#Emunah#Faith#Family#Gaza#Gratitude#Gush#Hamas#Happy#Happy Wifey#Har Etzion

2 notes

·

View notes

Text

The job search is sucking the soul out of me. I've started looking into various online gigs/work from home opportunities and it is a sea of slop that I'm drowning in. It pisses me off so much because like, I know I have valuable skills, I have two degrees, I speak three languages, and even after burnout I still have a decently functioning brain. I just have no idea how to apply any of it to a paid job -_-

I literally need like. 500$ a month to survive. That's it. I'd be fine doing 20 hours a week at minimum wage of my country. I just cannot find anything suitable for myself. I still have time to find something but jesus christ, it is exhausting.

#random#personal#was looking into science/medical writing today#but looks like you need experience for that#and there's not a lot of part time opportunities#tutoring is probably out because the sites i've checked are super crowded and i doubt i would get consistent hours#i was looking in AI training as well which is like. i'd hate contributing to the industry but it's money i guess#but all the websites that are legit are not open for EU citizens#i was thinking about going back to writing commissions but it's not gonna make me enough money probably#there are so many options and i feel like i have no chance at getting any of them#do i go to a recruiter or something? i already had a mentor for the job search from an autism charity and they did not help me much#we just worked on my CV and strategies for job search but it didn't go anywhere#anyway. i am so tired#and i haven't been looking for very long at all

3 notes

·

View notes

Text

“What compels people to risk their lives to leave their homes for Europe and ignore offers for help that they fear will send them back to the place they just left” is not the same question as “why did rich person take stupid risk for tourism��

#some of the ancaps who are dismissing these people as subhuman filth are within the logic of their evil thinking#but if you have any pretense at all of being a Christian your religion has a long tradition challenging you to have mercy on migrants#you might have some reason for why you don't think this counts#but I don't think you can be so flip about it#I am unaware of any biblical qualification that limits charity to women and children#and furthermore#this notion that they fucked up their own country and have to deal with it?#we do not apply that standard to ourselves#posts that shed right wing followers and contribute to my negative image among them

22 notes

·

View notes

Text

insane how people can give heartfelt and logical reasoning as to why you should donate to Palestinians and give resources and how tos and show like just how disturbing the conditions people are living in are and get crickets and then a YouTuber can just auction a bunch of shit he already owns and raise almost 20k in a few hours

#ven.txt#this is not hate to drew gooden btw I’m really glad he’s doing this#and I think ambivalence isn’t the only factor like people not knowing where to donate like which charities or not knowing how ti decide all#probably contributes but like. holy shit. this many people have this much money to spare and what gets them to move#is an auction for useless junk 😭#for total transparency I have only donated like $10 between two gofundmes but I’m also unemployed and it’s very hard for me to like#become employed because of the whole. physical and mental disability stuff#but the point is like. I’m not the most generous person in the world I’m not donating my life savings#or dedicating every bit of my time and effort into helping#I am not superior to these people you know like not at all#it’s just an observation

3 notes

·

View notes

Text

instead of getting the cool gamedev autism, i got the functional systems of presenting information and calculators autism

#ayano was here#ayano.txt#right now i use my powers for pokemon#one day i want to contribute tech work to charities#it's on the bucket list

14 notes

·

View notes

Text

I interrupt my regular programing to ask for some help for one of my closest friends. I've been helping her out when I can but I definitely can't afford to cover all her medical and living costs.

She has multiple things going on health wise, including:

Endometriosis that has spread unto bowels, kidney, liver, lungs

Chronic nerve degeneration and chronic pain

Ruptured ACL + damage to PCL and MCL

Brainstem cyst

Breast lump (soon to be surgically removed)

Plus chronic mental health concerns

She has high ongoing medical costs and due to her poor health as well as frequent hospital admissions she is unable to have regular income. It's also been surprisingly difficult to access disability payments. I worry so much about her, as this is taking such a constant toll on her due to stress, and being unable to afford basic needs such as food or medication.

Obviously, please don't give if you are unable to for your own finances, but if you are able to help out we would really appreciate it. Feel free to share this around also if you are able.

#donate#donation#charity#go fund me#gofundme#health#contribute#contribution#assistance#illness#hospital#hospital fees#medical costs#endometriosis#nerve degeneration#chronic pain#chronic illness

29 notes

·

View notes

Text

would it be worth it to sign up offering mbav for a fic charity auction?

#i would LOVE to offer mbav i love the fandom and i love writing them but if it's not going to get any bids i would rather devote the#space to a fandom that will#(it's only 3 fandoms per person)#let me know what you think ! it's for a charity that's REALLY important to me so i want to be able to contribute 🥺

4 notes

·

View notes

Text

#link to article for more information & link to where you can get tickets#alaska thunderfuck#willam belli#here’s another opportunity to donate and contribute to the cause#shoutout to Alaska and Willam#and race chaser and mom podcasts#for always using their platforms to promote charities and important causes#they’ve done a lot of live streams and have raised a lot of money#so I appreciate that they always step up when needed#it’s important

10 notes

·

View notes

Text

One of the people I allow to live with me isn't allergic to peanuts but will break out into acne clusters for two weeks if he eats any so I frequently have big 3.5lb buckets of Planters brand Mixed Nuts with all of the brazils, almonds, cashews, hazelnuts and pecans removed and let me tell you 27 oz by weight of peanuts is ballsy for your "less than 50% peanuts!" claim

#i know me putting it as one of the people I allow to live with me sounds pretentious#but you don't live with him‚ i do‚ so cut me some slack#all brought to you by the time he referred to me as his roommate and for some reason that bothered me#i will never hold over his head that I pay for all of the bills in this house#(he contributes by grocery shopping {that I still pay for} and cooking all of our meals‚ and that is more than enough)#but at the same time#he has a ton of bad habits I struggle with‚ some I let go others that create contention#i know he is grateful for my charity and does not take it for granted#but we aren't roommates. I allow him to live here. A privilege I have denied even my siblings.

3 notes

·

View notes

Note

Also because people feel the need to defend him with "but he donated to lgbt+ charities!" I would love to remind people that a good chunk of that charity work wouldn't need to be done if we could stop having so many fucking politicians who hate us.

Watch your ugly animatronic movie and play your ugly animatronic games if you feel it's that important to you but don't fucking dare defend this shit.

Wait… did FNAF profits go to anti-gay legislation?!

Scott Cawthon, the creator of Five Nights at Freddy's, is very open about being a pro-life conservative and has donated significant amounts of money to republican politicians, including Donald Trump. This has been publicly available info for a while now. Despite saying that he would "step away" from his role in the games after this was brought to light in 2021, he still owns the IP and is profiting from all media associated with the franchise to this day.

#I have said this before and I will say it again because I saw it so many fucking times when this came to light#I was never into the series myself because I do in fact think it's hideous as fuck#but I don't judge people for liking things I think are ugly (though I often blacklist those things)#I *do* judge people for trying to justify spending money on things with 'but charity' as if that even cancels it out (it doesn't)#while ignoring the policies that make people like him support politicians like that#not just voting for them but *financial* contributions

8K notes

·

View notes