#mortgage payments

Explore tagged Tumblr posts

Note

Hi Bitches! I think you wrote a piece a while back about investing vs paying off debt, and based on current market volatility I've been focusing on paying down my mortgage. To make sure I'm actually making a solid assessment here, does it make sense that the power of compounding interest means extra principal payments fairly early in the loan term are approximately doubling my money over time? I.e. I pay 2k in early principal and it both knocks out that principal amount *and* also saves a bit over 2k in interest I would have had to pay. Or is either my brain or my spreadsheet messing up here?

Neither your brain nor your spreadsheet is messing up! You're right: if you can make extra payments to the principal in the early days of your debt, it will benefit you the most in the long run. So knocking down that principle as quickly as possible is a very wise thing to do if you can afford it!

Here's more for those who don't know how the math works:

Kill Your Debt Faster With the Death by a Thousand Cuts Technique

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

The Debt-Killing Power of Rounding up Bills

If you found this helpful, consider joining our Patreon.

19 notes

·

View notes

Text

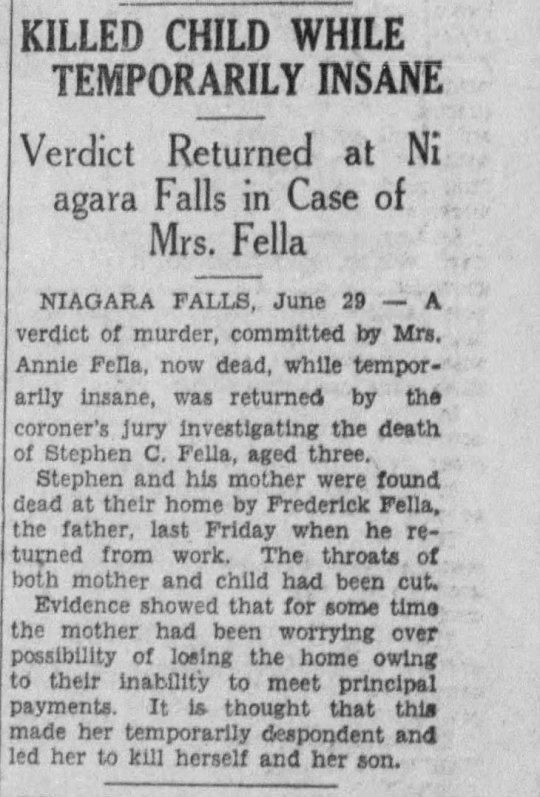

"KILLED CHILD WHILE TEMPORARILY INSANE," Kingston Whig-Standard. June 29, 1933. Page 4. ---- Verdict Returned at Niagara Falls in Case of Mrs. Fella ---- NIAGARA FALLS, June 29 - A verdict of murder, committed by Mrs. Annie Fella, now dead, while temporarily insane, was returned by the coroner's jury investigating the death of Stephen C. Fella, aged three.

Stephen and his mother were found dead at their home by Frederick Fella, the father, last Friday when he returned from work. The throats of both mother and child had been cut.

Evidence showed that for some time the mother had been worrying over possibility of losing the home owing to their inability to meet principal payments. It is thought that this made her temporarily despondent and led her to kill herself and her son.

#niagara falls#coroner's jury#murder investigation#mortgage payments#poverty crimes#pressures of the great depression#housing#housing is a human right#dead child#murder suicide#filicide#desperate woman#not criminally responsible#great depression in canada#crime and punishment in canada#history of crime and punishment in canada#italian canadians

2 notes

·

View notes

Text

Mortgage Partner for Real Estate Agents | Altgage

Grow your real estate business with a dedicated mortgage advisor. Help your clients qualify for lower rates and bigger budgets. Close more deals in 15 days. Visit us to know more: https://www.altgage.com/refinance

#financial#home loan#mortgage#mortgage agent#mortgage broker#mortgage calculator#mortgage rates#mortgage loans#mortgage lenders#mortgage payments

0 notes

Text

Different Types Of U.S. Federal Tax Forms

You're not alone if you're confused about what a W-2, W-4, or 1040 is and isn't. Everybody must know the purposes and usage guidelines for each IRS tax form. When filing your taxes, there are numerous forms available. Choosing the correct one the first time is important to avoid an expensive error. (There are, however, some situations when you can make changes to a previous tax return to fix specific mistakes.)

Some of the more complicated tax forms are ones you might never need, but there are others you'll probably encounter annually.

1. U.S. Individual Tax Return Form 1040

The most often used IRS tax form for annual tax returns in the United States is Form 1040. Depending on your age, filing status, and gross income, you may need to use this form. This form may be appropriate for you even if you have no taxable income but are qualified for a tax credit or refund. You can also claim several tax credits and costs and itemize deductions.

A shorter version of this form, Form 1040-EZ, Income Tax Return for Single and Joint Filers Without Dependents, was formerly accessible. However, the IRS no longer utilizes this form, which was eliminated in the 2018 tax year.

2. Wage and Tax Statement, Form W-2

Form W-2 and Form W-4 are sometimes confused. At the end of the year, your employer provides you with Form W-2, which details the total amount of taxes deducted from your paychecks.

Your employer also sends a copy of the Form W-2 to the Social Security Administration, the Internal Revenue Service, and some state taxing agencies. The amounts you report as income and the amounts your employer says they paid you are matched by these taxing authorities. You do not need to file this form with your tax return because your employer delivers it to the IRS, but doing so will help you report your taxable income accurately.

However, if need be, you may get preprinted Federal tax forms with their respective envelopes from a reputed facility and file them yourself.

3. Employee's Withholding Allowance Certificate, Form W-4

Form W-4 is not sent to the IRS or filed with your yearly tax return. Instead, you give it to your employer so they can decide how much tax to deduct from your gross salary and send it to the appropriate tax authorities. A worksheet is included with Form W-4 to assist you in calculating the amount. Try the W-4 calculator if you need help figuring out how much tax to deduct from your paycheck based on your objectives.

If your employment changes, you have to file a new W-4. In the event that your circumstances change—for instance, if you get married or have a child and wish to claim an additional dependent—you can also file a new Form W-4 with your current employer.

4. Form 1040, Schedule A: Itemized Deductions

It's possible that you've heard that you can "deduct" some personal expenses from your gross income to potentially pay less in taxes.

That is accurate.

You can itemize your deductions using Schedule A if the total amount of your deductible personal expenses is greater than the IRS standard deduction.

The seven spending categories on Schedule A include mortgage payments, medical costs, and charity contributions. However, there are strict guidelines for figuring out and claiming these deductions. You may not always be able to deduct the entire amount.

Additionally, you are not required to finish every line on the program. Just go on to the next category if you don't have any expenses in that one. Complete Form 1040 by adding your entire deduction amount when you're done.

5. Form 1099-INT: Income from Interest

If banks or other financial organizations pay you a specified amount of interest on your deposits, you might receive a Form 1099-INT from them. You'll often need to file an income tax return and pay tax on the interest.

You must include all the amounts shown on the form in your return. If the total taxable interest exceeds the $1,500 threshold, Schedule B is usually used to detail the players' names and the interest amount received.

6. Profit or Loss From Business (Sole Proprietorship) Schedule C to Form 1040

If you work for yourself, you might have to file Schedule C to disclose your company's gross profit or loss. Insurance, travel, business lunches, taxes, office supplies, pay, and other expenditures related to the business are all considered expenses.

7. Non-Employee Compensation Form 1099-NEC

Typically, Form 1099-NEC is sent to self-employed individuals by every customer who pays them annually. It details the total amount of money received, which you must include on your tax return. This form substitutes the Form W-2 you would receive as an independent contractor or freelancer when employed by a regular employer.

Self-employed taxpayers used Form 1099-MISC to report non-employee compensation prior to 2020. While it still exists, this form is no longer used to report compensation to non-employees. Instead, other forms of sporadic income like rent, prizes, awards, health and medical payments, and fishing boat revenues are all lumped together under Form 1099-MISC.

In the end!

The IRS may update forms annually, so be sure to utilize the appropriate tax year versions of any forms you must complete. Additionally, keep in mind that your circumstances may vary and that you may need to file more or fewer forms annually, depending on your circumstances.

Pin or save this post for later!

Share in the comments below: Questions go here

#federal tax forms#individual tax return#social security administration#internal revenue service#tax agencies#withholding taxes#tax deductions#personal expenses#mortgage payments#medical costs#charity contributions

0 notes

Text

Smart Home Mortgage Tips To Help You

TIP! Avoid getting into new debts while you are getting a home mortgage loan. When your consumer debt is low, you will qualify for a higher mortgage loan. Many people want to have a home of their own. Purchasing your first home is a huge life moment. A lot of people get a home mortgage out so they can purchase a home. If you are in the market for a mortgage, the advice and tips below will be a…

View On WordPress

0 notes

Text

5 Benefits of Loan Modifications

Loan Modifications With the pandemic that shook the world and the economy, many people have found themselves in a financial hardship that has made it difficult to make payments on their loans. Loan modifications have become a popular option for those struggling to make ends meet. A loan modification is a way to change the terms of your loan to make it more affordable for you and your family. Here…

View On WordPress

0 notes

Text

Mortgage Payments Increased 17% Annually In July

The Mortgage Bankers Association Says Mortgage Payments Increased 17% Annually As Homebuyer Affordability Becomes More Challenging The Mortgage Bankers Association says homebuyer affordability remained unchanged in July from June. However, mortgage payments increased 17% from last year. The MBA’s Purchase Applications Payment Index (PAPI) measures how new monthly mortgage payments vary across…

View On WordPress

#banking#banks#debt#FHA loan applicants#foreclosure#foreclosure defense#foreclosures#homeowner affordability#increased mortgage payments#liens#MBA#mortgage bankers association#mortgage fraud#mortgage lending#mortgage payments#mortgages#PAPI#Purchase Applications Payment Index#real estate

0 notes

Text

rdj going back to the mcu that’s how you know the economy is in shambles for real

3K notes

·

View notes

Text

Is Your Home Keeping Up with Your Growing Family?

As your family grows, so do your needs for space, comfort, and functionality. The house that was once perfect for a couple may start feeling cramped as children come into the picture, bringing their toys, activities, and unique requirements. Knowing when to consider upgrading your house size is essential to ensure that your family’s changing needs are adequately met. When Should You Upgrade Your…

View On WordPress

#bigger house#budgeting#comfortable living#family bonding#family home#family needs#family size#financial stability#growing family#home expansion#home investment#home upgrade#ideal house size#managing mortgage#mortgage calculator#mortgage calculator uk#mortgage checker#mortgage payments#real estate#real estate growth#space requirements#upgrade house

0 notes

Text

it’s nice to know that they’ve split up the work on the phortgage so dan does all the stressing about it and phil is the one who actually pays it

#‘phil gets the sponsors and dan thinks about the mortgage payment’ is even better to me now that we know phil pays the taxes#a relationship should be 50/50 one of you stresses about everything while the other gets shit done#dan and phil#phan

323 notes

·

View notes

Text

Make smart prepayments with Altgage

Save $100,000 in mortgage interest and pay off your mortgage up to 10 years faster, with Altgage’s smart prepayment plan. Link your mortgage to start saving automatically and take control of your financial future. See your savings Visit us to know more: https://www.altgage.com/prepay

#financial#home loan#mortgage#mortgage broker#mortgage agent#mortgage calculator#mortgage lenders#mortgage loans#mortgage payments#mortgage rates

1 note

·

View note

Text

0 notes

Text

The Ins And Outs Of Home Mortgages

TIP! Only borrow the money you need. Lenders can tell you the amount you qualify for, however, that isn’t based on your actual life. Obtaining financing can be confusing and a little scary. There is quite a bit of information that you’ll need to understand before you sign on the dotted line. This article has the information you need to get a quality mortgage. TIP! In order to be approved for a…

View On WordPress

0 notes

Text

theyre so married

144 notes

·

View notes

Text

Fucking Christ man. Could someone send me like. 50 bucks. So that I can get a few groceries on Friday. Please

PayPal

Ko-fi

#phoebe be quiet#faith still isnt paying her bills :))) she owes me 700 :))))))))#all of the money i have right now went to the mortgage payment and has to be saved for gas money#like i just. cant. afford groceries literally at all#and faith btw decided on a payments plan BY HERSELF I DIDNT AGREE TO IT to pay me back with#which is 100 per paycheck paid to me until she pays kff what she owes me#guess what happened ONCE on December 21st and then NEVER AGAIN#i haven't gottrn a SINGLE PENNY from her since#8))))))

14 notes

·

View notes