#mortgage calculator

Explore tagged Tumblr posts

Text

Make smart prepayments with Altgage

Save $100,000 in mortgage interest and pay off your mortgage up to 10 years faster, with Altgage’s smart prepayment plan. Link your mortgage to start saving automatically and take control of your financial future. See your savings Visit us to know more: https://www.altgage.com/prepay

#financial#home loan#mortgage#mortgage broker#mortgage agent#mortgage calculator#mortgage lenders#mortgage loans#mortgage payments#mortgage rates

2 notes

·

View notes

Text

How to Teach Children About Business and Finance Through Free Online Browser Games

Financial education is often overlooked in the education system, much like other crucial life skills such as home maintenance and tax filing.

This oversight poses a significant problem as children grow up to become financially illiterate adults. As a result, they face ongoing financial struggles, limited opportunities for economic growth, and vulnerability to scams and predatory practices.

Ted Beck, the president and CEO of the National Endowment for Financial Education, emphasizes the importance of financial literacy for children, as it is a skill that will serve them throughout their lives.

"We all need to know how to manage our money," asserts Beck, noting that while some fortunate students learn about it in schools, it is essential to ensure that all children are equipped to handle their financial futures.

Beck even suggests that parents should begin teaching financial literacy to their toddlers, as this skill should be progressively nurtured throughout childhood. An effective way for children to grasp the concept of money as a "medium of exchange" is through educational games and activities.

How to Teach Children About Business and Finance Through Free Online Browser Games

It's a well-known fact that children are drawn to video games because they find them exciting and rewarding. Building on this, you can motivate your child to learn while having fun by introducing them to free online finance and business browser games available on Mortgage Calculator.

These games provide an entertaining and interactive platform through which your child can develop essential financial literacy skills.

Free Money Games on Mortgage Calculator

Mortgage Calculator is a versatile website that caters to both adults and children. While adults can use it to budget for their mortgage, children can engage in educational play.

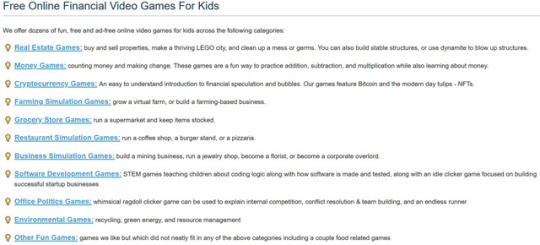

The website offers a wide range of interactive money games, covering topics such as grocery shopping, cryptocurrency, software development, and real estate. This diverse selection ensures that children can learn not only about financial literacy but also explore areas like software development and block coding.

No Downloads, No Ads, No Worries

The games available on Mortgage Calculator are conveniently hosted directly on their website, allowing your children to play them directly in the browser without any need for downloading.

These games are completely free of in-game advertisements, ensuring that your children can focus on playing and learning without any distractions. Moreover, these games are also compatible with mobile devices, allowing you to enjoy them on the go.

Additionally, after careful analysis of the website, it can be confirmed that there are no advertisements present on the entire site. Therefore, you can rest assured that your children would not accidentally click on any unwanted ads while browsing the website.

Money Game – Grocery Cashier

I highly recommend children give Grocery Cashier a try, as it is an engaging finance game that immerses players in the role of a cashier at a grocery store. In this game, players are responsible for processing payments from customers, allowing them to practice and improve their basic mathematics skills, such as addition and subtraction while using a virtual cash register that doubles as a calculator to input the correct amounts.

To add an element of challenge, each customer has a time limit, which progressively decreases as the game progresses. This feature encourages players to think quickly and make accurate calculations within a limited timeframe.

I appreciate the fact that players have the opportunity to learn more about the game before deciding to play it. Additionally, the inclusion of basic tutorials in every game ensures that players have a clear understanding of how to play and maximize their learning experience.

Overall, Grocery Cashier not only provides an entertaining gaming experience but also helps children strengthen their mathematical skills and develop quick thinking in a simulated real-world scenario.

Software Development Game - Code Panda

Mortgage Calculator goes beyond financial games. It also features block coding games, a prominent part of modern school curricula. These games help children understand basic concepts of coding and improve their cognitive functions.

One such game is Code Panda, where children are encouraged to use block codes to guide a panda through a grid and reach the bamboo. With 32 unique stages available, the game offers ample opportunities for children to engage and delve deeper into the world of block coding.

By playing Code Panda and similar games, children not only have fun but also develop essential problem-solving skills and logical thinking. These games provide a hands-on experience in a playful environment, making it easier for children to grasp coding concepts.

STEM Game – We Bare Bears Develobears

We Bare Bears Develobears is one of my top picks from the game list. It's an engaging STEM (science, technology, engineering, and mathematics) game designed to educate children about the various elements involved in creating a video game.

What I particularly enjoy about this game is the inclusion of a diverse range of mini-games that enable players to progress through different stages. As you play, you'll witness the bears' environment gradually improving, which adds to the overall experience. Moreover, the fact that it revolves around my favourite cartoon characters makes it even more appealing.

I strongly believe that this game has immense value for children as it helps enhance their critical thinking and problem-solving abilities. By immersing themselves in the game, they'll acquire valuable skills that can be applied beyond the virtual world.

How to Teach Children About Business and Finance Through Free Online Browser Games

The education system often overlooks financial education, resulting in many adults lacking financial literacy. It is vital to expose children to money management at an early age.

Mortgage Calculator addresses this issue by providing free online finance and business browser games that combine learning with enjoyment.

The games on Mortage Calculator empower children to acquire practical knowledge and develop valuable skills beyond the virtual realm. Ultimately, they equip children for a financially secure future by enabling them to make informed financial decisions.

Start your child's financial education journey today by exploring the games on Mortgage Calculator and helping them build a strong foundation for a lifetime of financial literacy.

#Mortgage Calculator#money games#games#online games#tech#game#short games#finance games#coding game#block coding

2 notes

·

View notes

Text

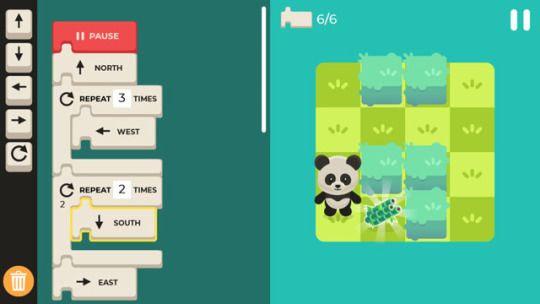

We are offers a powerful loan calculator tool tailored specifically for realtors and loan officers. This handy online calculator provides quick and accurate calculations for various types of loans, including mortgage loans, refinancing, and down payment estimates.

2 notes

·

View notes

Text

Money games for kids and kids at heart

I’ve been checking on the mortgage calculator site for the computation of my finances but I’ve been in a state of limbo lately (aka burnout), the reason why I’ve been doing so many things lately – more work, recreation on my free time, while still balancing my finances for my major upcoming move, which I’ll be posting soon. As for my me time, I’m looking for games that keep me interested, one of…

View On WordPress

2 notes

·

View notes

Text

Do you find yourself perplexed while choosing the best mortgage ratefor your Mortgage loan?Both the rates cater to different financial goals and loan repayment period. Let’s break itdown to understand the pros and cons of both mortgage rates to make your best choice!

Fixed-Rate Mortgages: Stability First

Generally, Fixed-Rate Mortgagelocks in your interest rate and monthly payments for the entire loan period. Usually, a long-term loan lasts for 15-30 years. The Fixed-rate loans often begin with a higher interest rate in comparison tothe variable interest rate.The striking feature of a Fixed interest ratemortgage is its predictability. There will be no change in the mortgage interest rate, even when the market rates rise. This makes FRM’s ideal for homeowners who prioritize budgeting consistency and like to hold the purchased property for a long term.

Adjustable-Rate Mortgage: Flexibility with Risk

The Variable mortgage rateoperates with a low introductory rate for a set period, say 5,7, or 10 years, after which the rates are adjusted annually based on market trends.The variable rate mortgageis suitable for short-term homeowners and borrowers who prefer to refinancemortgagewithin 3-7 years. Real estate investors can make the most of this mortgage rate to minimize upfront costs to flip properties. However, the initial interest rate discounts can save money upfront, once the fixed period ends, your repayment amount can rise significantly.

Ultimately, prioritize choosing a mortgage interest rate based on your financial goals, risk tolerance, and financial flexibility. Consult a mortgage broker expert from bestow for expert advice to choose the right mortgage interest rate. To know more : https://blog.bestowmortgage.com/fixed-rate-vs-adjustable-rate-mortgages-which-one-is-for-you/

#mortgage rates#refinance#mortgage brokers#home loans#mortgage lenders#mortgage calculator#home loan pre-approval#fha loans#best mortgage lenders#current mortgage rates

0 notes

Text

Mortgage Recast Calculator

Calculate Now

Calculate Now

A Mortgage Recast Calculator is a handy financial tool that helps homeowners estimate the new monthly payments and potential savings when they make a large lump-sum payment toward their mortgage principal. Unlike refinancing, which often involves closing costs and changing your loan terms, a mortgage recast simply recalculates your monthly payments based on the reduced principal balance while keeping the same interest rate and loan term. This can significantly lower your monthly burden and save you thousands in interest over the life of the loan. By inputting key details like your current loan balance, interest rate, monthly payment, and the amount of the lump sum you plan to pay, the calculator quickly shows you what your new payment will look like. It's an excellent resource for those who come into extra funds—like a bonus, inheritance, or savings-and want to improve their financial position without the hassle of refinancing.

#Mortgage Recast Calculator#Mortgage amortization calculator#Mortgage payment calculator#Mortgage calculator#Mortgage payoff calculator#Mortgage refinance calculator

0 notes

Text

Looking for a reliable Home Loan EMI Calculator in Dubai? Money Maestro provides an easy-to-use tool to help you estimate your monthly payments based on loan amount, interest rate, and tenure. Whether you're planning to buy a new home or refinance an existing loan, our calculator gives you accurate insights into your repayment plan. Make informed financial decisions and manage your budget effectively. Try the Money Maestro Home Loan EMI Calculator today and take the first step towards owning your dream home in Dubai! Contact us for expert guidance on the best mortgage options.

#mortgage estimator#mortgage calculator#home loan calculator#sharia mortgage calculator#islamic mortgage calculator#Home Loan Mortgage Calculator#Home Loan Emi Calculator

0 notes

Text

Unlocking Your Homeownership Dream with Elite Mortgage: Your Trusted Mortgage Lender in Yuma

Introduction

Buying a home is one of the most significant decisions and investments you will ever make. The dream of homeownership brings both excitement and challenges, and having the right support can make all the difference. At Elite Mortgage, we are committed to making the process smoother for you. Whether you are a first-time homebuyer or looking to refinance, understanding mortgage rates, using a mortgage calculator, and finding the right Yuma lender are essential steps to getting the best deal for your home loan. Our expert team is here to guide you through each step, ensuring that you make well-informed decisions that align with your financial goals.

Why Choosing the Right Mortgage Lender Matters

When it comes to securing a home loan, the right mortgage lender can save you time, money, and stress. Elite Mortgage understands the complexities involved in the home buying process, and we work tirelessly to ensure you get the best possible financing options. As a leading Yuma lender, we pride ourselves on delivering personalized services tailored to meet the unique needs of each of our clients.

Choosing the right mortgage lender is crucial because it directly impacts your monthly payments, the total interest paid over the life of the loan, and the flexibility of your loan terms. At Elite Mortgage, we provide transparent information about various mortgage rates available and help you determine the best loan option that fits your budget and lifestyle.

Understanding Mortgage Rates and Their Impact

Mortgage rates play a critical role in the overall cost of your home loan. These rates can vary significantly depending on a range of factors such as your credit score, loan term, and the overall state of the economy. Mortgage rates may fluctuate daily, so it’s essential to stay informed and work with a reliable mortgage lender like Elite Mortgage to lock in the best rates possible.

Typically, mortgage rates can be either fixed or adjustable. A fixed-rate mortgage means that the interest rate remains the same for the entire term of the loan, providing stability and predictability for your monthly payments. On the other hand, an adjustable-rate mortgage (ARM) typically starts with a lower interest rate, but the rate can change over time based on market conditions.

At Elite Mortgage, we make it our priority to help you navigate through the options and understand how each will affect your monthly payments and the overall cost of your home. With our experience and expertise, we can provide you with the information you need to make the best decision based on your financial situation.

The Importance of Using a Mortgage Calculator

A mortgage calculator is an invaluable tool that allows you to estimate your monthly payments based on loan amount, interest rate, loan term, and other factors. By using a mortgage calculator, you can get a clear picture of how much you can afford and what your future payments may look like.

At Elite Mortgage, we provide easy-to-use mortgage calculators on our website, allowing you to get a preliminary idea of your potential mortgage payment before meeting with one of our specialists. This tool helps you visualize your finances and ensures that you are prepared when it’s time to start the application process.

Home Loan Options with Elite Mortgage

At Elite Mortgage, we offer a variety of home loan options to cater to the diverse needs of our clients. Whether you are purchasing your first home, refinancing your existing mortgage, or looking to invest in a property, we have a solution that works for you. Some of the common home loan options we offer include:

1. Conventional Loans

Conventional loans are the most common type of home loan. These loans are not insured or guaranteed by the federal government, but they typically offer competitive mortgage rates. They are ideal for individuals with a strong credit history and financial stability.

2. FHA Loans

FHA loans are backed by the Federal Housing Administration and are designed for first-time homebuyers or those with lower credit scores. These loans require lower down payments, making them an excellent choice for individuals who may not have significant savings for a down payment.

3. VA Loans

For eligible veterans, active-duty service members, and their families, VA loans offer significant benefits, including zero down payment and competitive interest rates. Elite Mortgage is proud to offer VA loans to those who have served our country.

4. Jumbo Loans

For homebuyers looking to purchase a high-value property that exceeds the limits set by the Federal Housing Finance Agency (FHFA), jumbo loans are an ideal option. These loans offer competitive mortgage rates but typically require a higher credit score and larger down payment.

5. Refinancing

If you already own a home and are looking to lower your monthly payments or reduce your interest rate, refinancing may be the right option for you. Refinancing allows you to replace your existing mortgage with a new one, ideally at a better rate and with better terms. At Elite Mortgage, we work with you to determine if refinancing is right for you and to ensure you get the best deal available.

How to Choose the Right Mortgage for You

Selecting the right home loan depends on a variety of factors, including your financial situation, the type of property you want to buy, and how long you plan to stay in the home. To help you navigate through this process, we recommend following these steps:

Assess Your Financial Situation Before applying for a mortgage, take a good look at your income, debt, and savings. Your debt-to-income ratio will play a significant role in the types of loans you qualify for.

Understand the Loan Terms Consider the loan amount, interest rate, and repayment terms. A lower interest rate may seem attractive, but it's important to understand the long-term impact of the loan, including fees and other associated costs.

Use a Mortgage Calculator Take advantage of our mortgage calculator to see what you can afford and to get an estimate of your monthly payments based on various loan options.

Work with a Trusted Lender The right mortgage lender will help you understand the options available to you and guide you through the process. At Elite Mortgage, our team of experts is here to help you make informed decisions and secure the best possible deal for your home loan.

Why Choose Elite Mortgage?

As a trusted Yuma lender, we bring a wealth of experience and personalized service to the table. Our team is committed to making your homeownership dream a reality by offering the most competitive mortgage rates and a variety of loan options that cater to your needs.

At Elite Mortgage, we understand that buying a home is not just about the numbers; it’s about your future and financial well-being. We take the time to listen to your goals and tailor our solutions accordingly, ensuring that you feel confident every step of the way.

Get Started with Elite Mortgage Today

When you’re ready to take the next step towards homeownership, Elite Mortgage is here to help. Our team is dedicated to providing you with exceptional service, clear communication, and access to the best possible financing options. Whether you're looking for a first-time home loan or exploring refinancing options, we have the tools, expertise, and resources to assist you.

Start today by using our mortgage calculator to get an estimate of your monthly payments and explore the variety of loan options available. Contact us to schedule a consultation with one of our experienced mortgage specialists, and let us help you secure the best mortgage rates and financing terms available.

0 notes

Text

How to Open a Business Bank Account in Kenya: Top Banks & Benefits of Mobile Online Banking

Opening a business bank account is an essential step for any entrepreneur. In Kenya, finding the best bank to open a business account ensures that your business needs are met. Whether you are looking for the best business bank account for startups or established businesses, there are plenty of options available. Business bank account Kenya provides access to tailored solutions for managing your company’s finances. With the rise of mobile online banking apps, managing your business finances has never been easier. Business mobile banking allows you to access your accounts, make transactions, and track financial activities at your convenience.

#Banking from Mobile App#Banking Mobile App#Personal Loan Calculator#Top Bank in Kenya#Best Bank in Kenya#Home Loan Calculator#Mortgage Calculator

0 notes

Text

Mortgage Partner for Real Estate Agents | Altgage

Grow your real estate business with a dedicated mortgage advisor. Help your clients qualify for lower rates and bigger budgets. Close more deals in 15 days. Visit us to know more: https://www.altgage.com/refinance

#financial#home loan#mortgage#mortgage agent#mortgage broker#mortgage calculator#mortgage rates#mortgage loans#mortgage lenders#mortgage payments

1 note

·

View note

Text

Loan Calculator For Realtors, Loan Officers and Everyone else

2 notes

·

View notes

Text

Want to level up your #RealEstate investing? 📈 Master your Rental Cash Flow calculation with step-by-step guidance! From mortgage interest to maintenance costs, learn how to maximize passive income and build financial freedom. 💰

👉 Explore the ultimate guide with #MoneyEva now!

https://blog.moneyeva.com/how-to-calculate-rental-cash-flow-a-step-by-step-guide-using-money-eva/

#real estate#cash flow#rental income#mortgage calculator#passive income#financial freedom#landlords#rental properties#wealth building

0 notes

Text

What is the Use of a Mortgage Calculator?

A mortgage is often the largest financial commitment most people will ever make, so understanding how much it will cost each month is essential. A mortgage calculator is a powerful and helpful tool for anyone planning to purchase a home or refinance an existing loan. It can give you a clearer picture of your potential mortgage payments, helping you make informed decisions before committing to a loan.

In this blog, we'll explore the various uses and benefits of a mortgage calculator. Whether you are a first-time homebuyer, someone looking to refinance, or just curious about mortgage costs, a mortgage calculator can offer valuable insights into your financial situation.

1. Estimate Monthly Mortgage Payments

The most common use of a mortgage calculator is to estimate your monthly payments. By entering the loan amount, interest rate, and loan term (usually 15, 20, or 30 years), you can quickly determine how much you’ll need to pay each month for the principal and interest portions of your mortgage.

Principal & Interest: The calculator factors in the amount you borrowed and the interest charged on that amount.

Loan Term: Mortgage calculators help you understand the impact of different loan terms, such as 15-year or 30-year loans, on your monthly payment.

This estimate gives you a sense of how much you can afford and whether a particular home loan fits your budget.

2. Compare Different Loan Options

A mortgage calculator allows you to experiment with different loan terms and interest rates, helping you determine which option suits your financial situation best.

Interest Rate Comparison: By changing the interest rate, you can see how it impacts your monthly payments. A higher interest rate means higher monthly payments, while a lower interest rate will reduce your payments.

Loan Term Comparison: Try different loan terms, such as 15, 20, or 30 years, to see how the length of your loan affects your payment. A shorter loan term usually leads to higher monthly payments but less interest paid over the life of the loan, while a longer term may result in lower monthly payments but more total interest.

This ability to compare options allows you to tailor the loan to your needs and choose the most cost-effective solution for your situation.

3. Determine How Much You Can Afford

A mortgage calculator is a valuable tool for helping you determine how much home you can afford based on your income, debts, and other financial obligations.

Income and Debt Considerations: You can enter your monthly income, current debts, and other expenses to see how much of your budget is available for a mortgage payment.

Affordability: Mortgage calculators often incorporate general affordability guidelines, such as the 28/36 rule (spending no more than 28% of your gross monthly income on housing costs and no more than 36% on all debt), to help you understand how much house you can afford without stretching your finances.

By using a mortgage calculator to estimate how much you can afford, you’ll avoid overcommitting to a loan that may strain your finances in the future.

4. Factor in Property Taxes, Insurance, and PMI

Many mortgage calculators allow you to include property taxes, homeowners insurance, and private mortgage insurance (PMI) in your monthly payment estimate. These additional costs can significantly impact your total payment, so it's important to factor them in when determining what you can afford.

Property Taxes: These are typically collected by your lender and added to your mortgage payment through an escrow account. The calculator can include these taxes in the total monthly payment estimate.

Homeowners Insurance: Most mortgage lenders require homeowners insurance to protect your property. Including this in your mortgage payment estimate will give you a more accurate picture of your total monthly payment.

Private Mortgage Insurance (PMI): If you put down less than 20% on your home, your lender will likely require you to pay for PMI. A mortgage calculator will add this cost to your estimated monthly payment, helping you understand how PMI impacts your budget.

Having these costs included in the estimate helps you get a complete picture of what your monthly mortgage payment will be.

5. Plan for Future Rate Changes (for Adjustable-Rate Mortgages)

If you are considering an adjustable-rate mortgage (ARM), a mortgage calculator can help you understand how potential changes in the interest rate could affect your payments in the future.

Initial Rate vs. Future Rate: ARMs often offer a lower initial rate for a set period (e.g., 5, 7, or 10 years) before adjusting to market rates. A mortgage calculator can simulate future rate changes based on the current market and give you an idea of how your payments might increase once the initial fixed-rate period ends.

Rate Cap Simulation: Many ARMs have rate caps that limit how much the interest rate can increase over time. You can use the calculator to model these changes and get an idea of how much your mortgage payment might rise.

This can help you plan for potential rate increases and determine if an ARM is the right choice for you, given your financial situation and risk tolerance.

6. Understand the Impact of Extra Payments

Some mortgage calculators allow you to factor in extra payments toward your principal, which can help reduce the amount of interest you pay over the life of the loan.

Principal Reduction: By adding extra payments (such as making an additional payment each year or paying a little extra each month), you can see how much faster you could pay off your mortgage and how much interest you could save.

Accelerated Loan Payoff: You can experiment with different extra payment amounts to see how they impact your mortgage balance and the time it will take to pay off the loan.

This feature is especially useful for homeowners who want to pay off their mortgage early and save on interest payments.

7. Refinance Options

Mortgage calculators are also useful for homeowners considering refinancing their mortgage. Refinancing can help lower your interest rate or shorten your loan term, but it's important to understand how it will affect your payments and long-term financial goals.

Lowering Interest Rates: If interest rates have dropped since you took out your original mortgage, refinancing might lower your monthly payments. The calculator can show you how much you could save with a lower rate.

Shortening the Loan Term: Refinancing to a shorter loan term (e.g., from 30 years to 15 years) could result in higher monthly payments but could save you significant amounts in interest over the life of the loan.

Cash-Out Refinancing: If you have built equity in your home, you may be able to refinance for a larger loan amount and take cash out for other expenses. A mortgage calculator can help you estimate the new loan amount and how it affects your monthly payment.

By using a mortgage calculator to compare refinance scenarios, you can determine if refinancing makes financial sense for you.

8. Make Informed Decisions and Avoid Surprises

Ultimately, the primary use of a mortgage calculator is to help you make informed decisions. It empowers you with the knowledge of what your mortgage payments might be, allowing you to:

Avoid Financial Stress: By understanding your mortgage payment from the outset, you can avoid surprises and ensure that your loan fits within your budget.

Plan for the Future: Whether you're planning for future interest rate hikes or considering refinancing, a mortgage calculator can help you foresee potential changes and plan accordingly.

With this information, you can confidently choose the right mortgage for your situation without risking financial strain.

Conclusion: Why You Should Use a Mortgage Calculator

A mortgage calculator is an invaluable tool for anyone navigating the home-buying or refinancing process. It helps you:

Estimate your monthly payments based on loan terms, interest rates, and other factors.

Compare different loan options to find the best fit for your budget.

Understand your affordability based on your income and debts.

Account for extra costs like property taxes, insurance, and PMI.

Plan for future changes in interest rates, especially with ARMs.

See the effects of extra payments on your loan balance and timeline.

Compare refinancing options to determine if refinancing makes sense.

By taking advantage of this tool, you can make more informed financial decisions, avoid surprises, and ensure that you’re on the right path toward homeownership.

0 notes