#loan calculator

Explore tagged Tumblr posts

Text

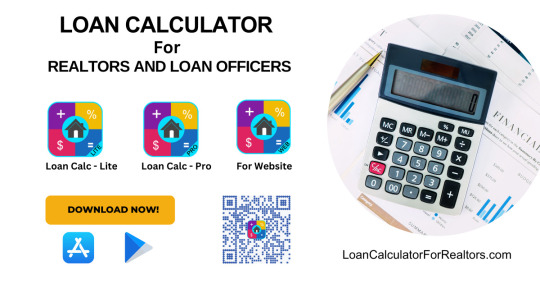

We are offers a powerful loan calculator tool tailored specifically for realtors and loan officers. This handy online calculator provides quick and accurate calculations for various types of loans, including mortgage loans, refinancing, and down payment estimates.

2 notes

·

View notes

Text

#EMI Calculator#Loan EMI Calculation#Financial Calculator#Loan Calculator#Easy Loan Calculation#EMI Calculation Tool#Personal Loan Calculator#EMI Loan Tool#Financial Tools#Loan Management#Budgeting Tools#Loan Planning#Easy Loan EMI#Simple Loan Calculator#Finance Solutions#Debt Management

1 note

·

View note

Text

How to Use a Gold Loan Calculator to Estimate Your Loan Per Gram Value?

A gold loan calculator is a powerful financial tool that helps you determine the estimated loan amount you can avail against your gold ornaments or coins. By calculating the gold loan per gram value, you can make informed decisions regarding your borrowing needs. This guide will walk you through the process of using a gold loan calculator effectively and understanding key factors that influence your loan amount.

What is a Gold Loan Calculator?

A gold loan Per Gram calculator is an online tool that helps you determine the potential loan amount based on:

The weight of your gold (in grams)

The current market price of gold

The loan-to-value (LTV) ratio set by financial institutions

This tool simplifies complex calculations and provides instant results, allowing you to plan your finances efficiently.

How Does a Gold Loan Calculator Work?

Using a gold loan per gram calculator is simple and requires minimal information.

Step 1: Enter the Gold Weight

Input the total weight of your gold in grams. Most calculators allow you to specify individual gold item weights or provide a cumulative total.

Step 2: Select the Gold Purity Level

Gold purity significantly affects your loan value. Common purity levels include 24K, 22K, and 18K. The higher the purity, the greater the loan amount you can secure.

Step 3: Check the Current Gold Rate

Most calculators automatically fetch the latest market rate for gold. However, some may allow you to manually input the rate for personalized calculations.

Step 4: Review the Loan-to-Value (LTV) Ratio

The RBI allows lenders to offer up to 75% of the gold's value as a loan. Ensure the calculator reflects this ratio for accurate results.

Step 5: Calculate Your Loan Amount

The calculator will instantly display your estimated loan amount based on the provided details.

Example Calculation Using a Gold Loan Calculator

Suppose you have 50 grams of 22K gold with a market rate of ₹6000 per gram. Assuming an LTV ratio of 75%, the calculation would be:

(50 grams x ₹6000) x 75% = ₹22,50,000

This estimated amount helps you plan your borrowing efficiently.

Benefits of Using a Gold Loan Calculator

Quick and Accurate Results: Get instant loan estimates without complex manual calculations.

Informed Decision-Making: Helps you assess how much you can borrow and plan your repayment accordingly.

Transparency: Provides clarity on loan value and EMI payments before applying.

Convenience: Online access ensures you can use the tool anytime, anywhere.

Key Factors Affecting Gold Loan Per Gram Value

Several factors influence the value you receive from a gold loan, including:

Gold Purity: Higher purity offers greater loan value.

Gold Weight: More gold equals a higher potential loan.

Market Gold Rate: Fluctuations in gold prices can impact your loan amount.

LTV Ratio: The lender’s maximum permissible percentage directly affects the total loan value.

Tips to Maximize Your Gold Loan Value

Ensure Gold Purity Certification: Certified gold fetches better value.

Choose the Right Lender: Compare lenders for competitive interest rates and LTV ratios.

Monitor Gold Prices: Apply for a loan when gold rates are high to maximize your loan amount.

Conclusion

Using a gold loan calculator is a smart way to estimate your loan per gram value accurately. By entering key details like gold weight, purity, and the current market rate, you can easily determine your potential loan amount. This tool empowers you to make informed decisions, ensuring you borrow within your capacity and manage repayments effectively. For best results, always use a trusted gold loan EMI calculator alongside the per gram calculator to plan your repayment strategy efficiently.

0 notes

Text

What is a Home Loan Calculator?

A Home Loan Calculator is an online tool that helps you estimate your Equated Monthly Installment (EMI), total interest payable, and the overall cost of your home loan. You can get a clear picture of your financial obligations before taking out a loan by inputting detailed information like loan amount, interest rate, and loan tenure.

If you want to calculate any loan or EMI, please click this source link.

#newcalculators#online free calculator#home loan#car loan calculator#personal loan calculator#EMI calculator#Loan calculator#Age calculator#GST calculator#Investment calculator#Online calculation tools

0 notes

Text

Loan Against Property vs. Personal Loan: Which One Should You Choose?

What is a Loan Against Property (LAP)?

A Loan Against Property (LAP) is a secured loan where you pledge your residential, commercial, or industrial property as collateral. This type of mortgage loan allows you to borrow a high loan amount at a lower interest rate compared to personal loans.

Key Features of a Loan Against Property

Loan Amount: Based on the property’s market value, you can get up to 60-70% of its value as a loan.

Lower Interest Rates: Compared to unsecured loans, LAP interest rates start from 8-12% per annum.

Flexible Tenure: Repayment tenure ranges from 5 to 20 years, making EMIs manageable.

No Restrictions on Fund Usage: Use the funds for business expansion, medical emergencies, education, or debt consolidation.

High Loan Eligibility: Salaried and self-employed individuals, as well as businesses, can apply.

Loan Against Property Interest Rate in 2024

The interest rate on LAP depends on factors like loan amount, property type, and applicant profile. Here’s an approximate range:LenderInterest RateLoan TenureBank A8.5% - 10.5%Up to 15 yearsBank B9.0% - 12.0%Up to 20 yearsNBFC C10.0% - 13.5%Up to 18 years

Loan Against Property EMI Calculator

Using an EMI calculator helps you estimate your monthly repayments. Formula:

EMI = [P × R × (1+R)^N] / [(1+R)^N-1]

Where:

P = Loan amount

R = Monthly interest rate

N = Loan tenure in months

Example Calculation

For a ₹50 lakh loan at 9% interest for 15 years, EMI would be around ₹50,713. Use our Loan Against Property EMI Calculator Click Here to check your EMIs instantly.

Eligibility Criteria for LAP

Age: 21 to 65 years

Income Proof: Salary slips, bank statements, or ITR

Property Ownership: Clear title and ownership

Credit Score: 700+ preferred for best rates

Documents Required

KYC Documents (Aadhaar, PAN, Passport)

Property Papers (Title deed, Tax receipts)

Income Proof (Salary slips, ITR, Business turnover proof)

How to Apply for a Loan Against Property

Check Eligibility using a Loan Calculator.

Compare Lenders for the best LAP interest rates.

Gather Required Documents to ensure smooth processing.

Apply Online or Offline with your preferred bank or NBFC.

Property Valuation & Loan Approval takes 5-10 days.

Loan Disbursement happens after signing the agreement.

Benefits of Taking a Mortgage Loan

✔ Lower interest rates than personal loans

✔ Higher loan amounts for large expenses

✔ Long repayment tenure reduces EMI burden

✔ Retain property ownership while getting liquidity

Conclusion

A Loan Against Property is a great option for getting large funds at lower interest rates without selling your property. Use our Loan Against Property Calculator to check your EMI and find the best loan deals.

Get the Best Loan Against Property Today! Apply Now

#mortgage loan#lap#loans against property#loan against property#property mortgage loan#loan against property interest rate#loan calculator#loan against property calculator#emi calculator#loan against property emi calculator

0 notes

Text

Home Loan EMI Calculator: Simplify Your Home Financing

A Home Loan EMI Calculator is a useful tool for anyone looking to purchase a home through a loan. It helps you estimate your monthly EMI (Equated Monthly Installment), which is the amount you need to repay the lender each month. By using this calculator, you can plan your budget effectively and understand how different loan amounts, interest rates, and tenures impact your monthly payments.

Here’s how it works:

Input Your Loan Details: Enter the loan amount, interest rate, and tenure (loan period) into the calculator.

Calculate EMI: The calculator computes the EMI based on the provided details.

View Results: It shows you the EMI amount, along with a breakdown of principal and interest payments.

Using a Home Loan EMI Calculator helps you make informed decisions about your loan and manage your finances better.

#home loan calculator#home loan emi calculator#housing loan emi calculator#emi calculator#emi calculator online#home loan#house loan emi#loan calculator#home loan interest rate calculator#home emi calculator#house loan calculator#home loan emi#how to calculate emi#home loan emi calculator india#home loan calculator india#plot loan calculator#home loan interest calculator#loan emi calculator#housing loan interest#house emi calculator#how to calculate home loan emi#loan interest calculator#online home loan calculator#Home Renovation Loan#Home Loan Interest Rate#Home Loans#Home Loan Interest Rates#Home Loan Eligibility Calculator#Home Loan Interest#Home Loan Interest Calculator

0 notes

Text

A Land Mortgage Calculator is an online tool that helps you calculate monthly payments, total interest and total cost of the loan when buying land or property. Whether you’re buying land for personal use, business expansion or investment purposes this calculator simplifies the complex mortgage calculations. It’s useful for all types of properties – residential, commercial, rental and investment properties. With options to customize loan term, interest rates, down payment and property use this calculator is a must have for anyone buying land or property.

When it comes to real estate big decisions! Use a land mortgage calculator or any property calculator.

1 note

·

View note

Text

How To Take Bahrain Loan Calculator

How To Take Bahrain Loan Calculator the appropriate tools can make a big difference when it comes to financial planning. Here’s the loan calculator, a priceless tool for anyone thinking about taking out a loan in Bahrain. The purpose of this page is to offer clear, complete guidance for using and using loan calculators in the Bahraini context. Come along as we explore the world of loan calculators and provide you with the knowledge you need to make wise financial decisions, from deciphering the nuances of different loan kinds to providing helpful advice for maximizing the efficiency of these instruments.

0 notes

Text

Loan comparison and guidance services help individuals and businesses navigate the complex landscape of borrowing options. These platforms provide detailed insights into various types of loans available, such as personal, business, mortgage, auto, and payday loans. By comparing factors like interest rates, repayment terms, fees, and eligibility requirements, borrowers can make informed decisions tailored to their financial needs. Additionally, these services often offer expert advice and user reviews, empowering borrowers to choose the most suitable loan for their circumstances while understanding all terms and conditions before committing. With NairaCompare.ng, you can make informed borrowing decisions and find the right loan quickly and easily.

Understanding Loan Comparison and Guidance in Nigeria

0 notes

Text

#gold loan#gold loan calculator#smart gold loan calculator#gold loan EMI calculator#loan calculator#online gold loan calculator#gold loan emi calculator online#sahibandhu#sahibandhu gold loan calculator

0 notes

Text

Calculating Your Monthly Payments with a Home Loan EMI Calculator

It's easy to figure out your monthly payments using a home loan EMI calculator. Based on variables like the loan amount and interest rate, this tool assists you in estimating the monthly payment amount for your home loan. You can see the total amount you'll repay over the loan term by entering these details into the calculator. To get an accurate EMI calculation, it is imperative to use the home loan interest rate. This aids in your efficient budget planning and helps you comprehend the cost of your house loan.

0 notes

Text

Loan Calculator For Realtors, Loan Officers and Everyone else

2 notes

·

View notes

Text

Loan Calculator | Freecalculatorsite.com

Discover how easy it is to manage your finances with our Loan Calculator. Calculate your loan payments, interest rates, and repayment schedules effortlessly to plan your financial future effectively.

Loan Calculator

1 note

·

View note

Text

Financial Calculator is a free web app that can help you estimate the future value (FV) of your investments, the number of compounding periods (N), the interest rate (I/Y), the periodic payment amount (PMT), and the present value (PV).

#Online Web Tools#Web Tools#Free Web Tools#Online Tools#Free Online Tools#Free Online Toolbox#A.Tools#Web Apps#Free Online Tools Collection#Online Calculator#Finance Calculator#Loan Calculator

0 notes

Text

Streamline your mortgage calculations with our FHA loan mortgage calculator and simple mortgage payment calculator. Visit our website for intuitive tools to help Realtors accurately project mortgage payments for clients. Access Lite and Pro versions for comprehensive insights.

0 notes

Text

In India, EMI calculators help you estimate monthly loan payments for education and home loans. This free tool allows you to compare loan options, plan your finances, and manage expectations. By entering loan amount, interest rate, and tenure, you can see how changes impact your EMI. Remember, EMI calculators provide estimates and don't account for all loan fees. Consider your overall financial situation and explore tax benefits before applying for a loan.

#best emi calculator#emi calculator#online emi calculator#emi#loans#financial calculators#Loan Planning#Manage Your Budget#loan calculator#financial tools#Estimate Your EMI#Smart Borrowing

1 note

·

View note