#cash out your home equity

Explore tagged Tumblr posts

Text

What Do You Mean by Cash Out Home Equity?

Opting to cash out your home equity should be a strategically made decision grounded in a solid understanding of your financial health, goals, and the current housing market. Before you leap, consider consulting with a financial advisor, and scrutinize every angle to ascertain that this move aligns with your long-term financial plans.

1 note

·

View note

Text

Buying A Second House Without Selling The First 2024

Thinking about buying a beach house or a mountain getaway? Buying a second House can be a great investment for many reasons. Maybe you want to spread out your investments in real estate, have a place to relax on vacation, or even rent it out and make some extra money. There can even be tax advantages! But buying a second House while still holding onto your first one can be tricky. This article…

View On WordPress

#2nd homes#buying a second home and renting out the first#buying a second home and renting the first#buying a second home in another state#buying a second home renting the first#buying a second home to rent#buying a second house and renting the first#buying a second house without selling the first#buying second home as primary residence#can i rent my home and buy another#can i rent my house and buy another#cash out refinance#conventional loans#financial advisor#financing options#hiring a property manager#home equity loans#home into a rental#homeowners insurance#how can i rent my house and buy another#how to buy a 2nd home and rent the first#how to buy a second home and rent the first#how to buy a second home to rent#how to buy a second home without selling the first#how to buy second home and rent first#how to rent my home and buy another#how to rent my house and buy another#how to rent out house and buy another#how to rent out your home and buy another#how to rent out your house and buy another

0 notes

Text

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities.— Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily.

. . .

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper.

That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”This trend is massive.

. . .

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

. . .

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street

.”It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

. . .

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

. . .

Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

. . .

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

To address the housing shortage and bring down prices for renters and homeowners alike, the Harris campaign’s plan calls for a historic expansion of the Low-Income Housing Tax Credit (LIHTC) and the first-ever tax incentive for homebuilders who build starter homes sold to first-time homebuyers. Building upon the Biden-Harris administration’s proposed $20 billion innovation fund, the campaign proposes a $40 billion fund that would support local innovations in housing supply solutions, catalyze innovative methods of construction financing, and empower developers and homebuilders to design and build affordable homes.

To cut red tape and bring down housing costs, the plan calls for streamlining permitting processes and reviews, including for transit-oriented development and conversions. The agenda also proposes making certain federal lands eligible to be repurposed for affordable housing development. Collectively, these policy proposals seek to create 3 million homes in the next four years.

The campaign plan cites the Biden-Harris administration’s ongoing actions to support the lowest-income renters, including its actions to expand rental assistance for veterans and other low-income renters, increase housing supply for people experiencing homelessness, enforce fair housing laws, and hold corporate landlords accountable.

Building upon these commitments, the Harris agenda calls upon Congress to pass the “Stop Predatory Investing Act,” which would remove key tax benefits for major investors who acquire large numbers of single-family rental homes (see Memo, 7/17/23), and the “Preventing the Algorithmic Facilitation of Rental Housing Cartels Act,” which would crack down on algorithmic rent-setting software that enables price-fixing among corporate landlords.

To make homeownership attainable, Vice President Harris’s proposal would provide up to $25,000 in downpayment assistance for first-time homebuyers who have paid their rent on time for two years. First-generation homeowners – those whose parents did not own homes – would receive more generous assistance.

Vice President Harris’s economic agenda also includes proposals to lower grocery costs, lower the costs of prescription drugs and relieve medical debt, and cut taxes for workers and families with children. The plan would restore the American Rescue Plan’s expanded Child Tax Credit, which provided up to $3,600 per child for low- and middle-income families for one year before it expired in 2022, and would enact a new $6,000 tax credit for families in the first year after their child is born. These measures to reduce expenses and boost household income would also improve housing security for low-income families, who often face impossible tradeoffs between paying rent and affording food, medical care, and other basic needs.

-----

Sorry for the length, but I thought this was really important.

26 notes

·

View notes

Note

I was reading your buying a home tag because I am in the process of buying my first home and just like. How do you not feel every second you are about to make some huge mistake??? I have found something I think I really like but it was way faster than everyone I know who owns a house has said they found something and I don’t know how to tell if I am settling or if I will regret it!

Oh, I mean, I absolutely felt like I was about to make a huge mistake the whole entire time. I just had to do it anyway in the knowledge that my anxiety ramps up about anything uncertain and I have to ignore my brain in favor of the facts.

I know I'm a bit late replying to this, but if you found something you like, take it. You'll just compare everything else you see to the thing you like and the odds of regret are pretty high. The only caveat to that is make sure that you get a good thorough home inspection and you listen to any red flags that pop up (that's the "in favor of the facts" part).

I went for a home with "good bones but bad skin" -- it was an older build and hadn't been renovated, had ugly kitchen cabinets and terrible paint, in part because I knew I wouldn't be able to afford a home that had been renovated more recently. I am actually glad I did; I have friends who bought "flipped" homes and while most of them have still been happy with their purchase, even having to invest extra to fix shit the flippers did shoddily, I do know one or two people who ended up with absolute nightmares. I'd love to renovate my place, but I'd need to save pretty significant cash -- but the only way to do that was to be an owner instead of a renter so that I had equity.

Like yeah I just dropped almost ten grand on a new HVAC and some plumbing repairs, but I was five years into the home and both were things I had already intended to do when I bought. Once that's all paid off I'm going to start putting feelers out about having the kitchen redone and start saving/investing for that.

So, I guess my advice is, acknowledge that you're afraid you're making a mistake, be realistic about seeing any signs you're making a mistake, but also remind yourself that anxiety is designed to keep us safe from getting eaten by tigers, and so we tend to overreact to ambiguity. You'll do great! Good luck to ya.

138 notes

·

View notes

Text

Even, or perhaps especially, when everything is turbofucked, I think it's important to try to imagine realistic proposals for how things COULD be NOT shit. To that end I have a few policy proposals:

Housing: All housing becomes rent-to-own by default, with sale to the council incentivised.

Why: Funding social housing, tackling unaffordable rents, lowering house prices, improving tenant's rights, discouraging commercial landlords and the financialisation of housing.

How?

The rent is set at home value + X (for private landlords, up to 10% of that to cover admin, repairs etc, or for social landlords the average cost per household of finding and matching tenants to homes) divided by the length of the lease.

That is then rent-locked for the duration of the lease.

At the end of the lease, you own the home.

If you don't want to own the home, you can at any time take back the capital you invested as cash (so if you're halfway through the lease, you subtract the amount that you paid to cover costs (X) and get half the original home value in liquid capital.) You can also pay it off early or readjust the terms of the lease, by mutual agreement.

All funds collected in this way by social landlords are ringfenced for spending on increasing the housing stock (buying or building property).

Additionally, increases in high-end marginal income tax will cover other costs of social housing (short term emergency accommodation, upgrading housing stock, covering grants and loans, increased admin costs, casework, outreach, etc)

To discourage commercial landlording, council tax on additional properties increases exponentially (so you pay regular council tax on your home, double tax on a second property, 4x tax on a third property etc), with additional amounts due from the landlord, not the tenant. In lieu of payment, you can sell on your additional properties to the council in exchange for a 6-month pause on your main property council tax.

If your property is found to be left unused for over 3 years, you have a grace period of up to 6 months to begin repairs/find an occupant; if you do not, the council can force a sale of your house for an amount equivalent to the estimated sale value of the property/land following work, minus the cost of repair/demolition. That bottoms out at zero (ie at worst you lose the property you weren't losing and get no recompense) so people who can't afford to fix up a property aren't being financially punished - however, there may be fines for serious repeat offenders.

All this will result in the price of housing dropping significantly, which is good and what we want but does negatively impact existing mortgage holders who may be dealing with negative equity and no way to recoup the price of their house if they need to move. So if people need to default on a mortgage, their personal debt is written off, the bank claims the property, and the bank is then required to consider an offer from the council (probably for the current sale value of the house) before taking their chances on the open market. As the transition is the key thing, there's a 6-18 month amnesty after introducing these policies where defaulting on your mortgage does not affect your credit rating. Beyond that point, the idea of rent-to-buy is to effectively have a non-interest-based mortgage system which cuts out the banks, so hopefully the issue of negative equity goes away as the new system establishes itself.

12 notes

·

View notes

Text

Help! My Girlfriend Bought Me A Million Dollar House And Raised My Kids And All I Got Was This Million Dollar House And Someone To Raise My Kids, When Is It Finally Going To Be My Turn To Get A Break??????

Pay Dirt, Slate, 17 April 2023:

Dear Pay Dirt, My longterm girlfriend and I disagree about whether a $30,000 inheritance left to her by her great-aunt should be “her” money or “our” money. She wants to spend a large part (almost a third!) of it on expensive supplies for her hobby. I think that we should save most of it and use some of it on a vacation since we both find traveling extremely romantic. My argument is: 1) I don’t care about her hobby, but we’ll both enjoy a trip abroad; 2) we’ve lived on only my (admittedly low, since it’s academia) income for over a decade, so according to her own rule about entitlement to “her” windfall, shouldn’t she technically have been entitled to none of my wages all these years? Her argument is: 1) she had to put aside her hobby for many years to raise our children (it’s not a safe art form for young kids to be around) and yearns to return to it; 2) she paid entirely in cash for our $950k house at the beginning of our partnership (though my income pays the property taxes and maintenance costs), therefore she alleges that we haven’t actually been living on solely my income because I’ve been saving on rent all these years. I feel resentful of the double standard about control over finances and hurt that she would rather prioritize her own joy over our shared joy. She feels impatient to reconnect with her hobby and hurt that her contributions to our lifestyle are unseen. How do we reconcile our different viewpoints? How should the money be allocated? Is there something that we’re missing? —I’m About to Glass(Blow) a Fuse

Dear About to (Glass)Blow a Fuse,

I hope you don't mind that I corrected your very clever parenthetical sign-off! You're understandably dealing with a lot of hurt right now at the hands of the cruel and self-absorbed girlfriend who bought you a million-dollar home and abandoned her beloved hobby to raise your children, so I totally get why a brilliant, overworked, and under-appreciated academic genius such as yourself would fuck up something so incredibly simple and obvious, you poor thing. Really speaks to the distress you're in as the victim of this woman's sordid scheme to steal every ounce of joy from your life by experiencing some of her own after decades of managing your household for you for free.

Great relationships are built on the exactly equal division of all resources, and it sounds like your girlfriend has trouble grasping this because she seems to believe that the home you live in and the time she has invested raising your children for you have value, when of course they do not. The only thing that has value in this world is cash money, which is why we call it money. If parenting were valuable, you'd be able to trade it on the stock market! And what was your girlfriend going to do, not live in a house? These are things she'd have done with her life anyway, and they don't get to count toward her contribution to the household just because she did them for and with you instead of expressly and specifically pursuing her art. Whereas who knows what you could have done with your life if you hadn't been locked into a free house and a partner dedicating herself full-time to keeping your children alive for you?

Now, after all these years of being nothing but a worthless freeloader whom you support out of the generous goodness of your kind heart, your girlfriend has finally acquired something of value, and she wants to keep an entire third of it for herself? To do something that doesn't directly benefit, enrich, or entertain you personally? That's not equity, and it's certainly no way to repay you for periodically writing checks to the plumber. Isn't it about time you finally got something out of all of this for your trouble?

What benefit is there for you in having a partner who enjoys the sweet satisfaction of creative fulfillment after years of yearning to express herself? What kind of weirdo wants their girlfriend to have her own interests? And what kind of ungrateful hussy doesn't jump to spend thousands of her own money on a romantic vacation with someone who actively resents even entertaining the possibility of the idea of her doing something that makes her artistic spirit sing?

The balance sheet of this relationship is indeed all out of whack, and it's too bad that it's taken this long for your girlfriend to see just how uneven your bargain has been. If we're going to get technical about what has "value" in a relationship — and it does seem like your girlfriend is an inveterate bean-counter in the worst way around this stuff — the best way to reconcile your mutual account, as it were, is to present your girlfriend with an itemized bill for all the services you have provided her over the years, such as allowing her to buy you a home, permitting her to forego a wage-earning career, and gifting her with the opportunity to abandon her favorite hobby. That should pretty swiftly put everything you're "missing" in stark relief, and solve the question of how she should allocate her money in the future.

#advice#bad advice#money#financial advice#slate#pay dirt#vacations#inheritances#finances#this goofy chucklefuck

330 notes

·

View notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

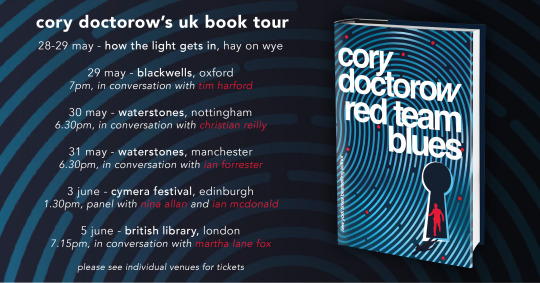

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

People on Tumblr are always hyping these news articles about some rich wanker out there, buying up single family homes.

It sucks. Rich wankers are terrible yadda-yadda. Not the point of this conversation. (Burn them)

The thing is that you have some of the worst ideas on how to fix the housing crisis!

Simply because most people aren't super educated on why the housing market is this way.

Ironically, and this might tick a lot of you off. One of the causes of the housing crisis is likely you, or your co-workers, parents, siblings ect...ect.

https://www.investopedia.com/articles/credit-loans-mortgages/090116/what-do-pension-funds-typically-invest.asp

Are you saving money! (I am!)

Do you have a 401K/Pension/Superannuation? (I Do)

Are you invested in a Real Estate Investment Trust?!

Probably.

Most funds have a little bit of REIT in them. The S&P500 is 2.8% REIT,

These mega trusts own vast amounts of American housing.

https://www.reit.com/research/nareit-research/170-million-americans-own-reit-stocks

Yay. Look at this happy graphic that came from a site really stocked about the great returns on real estate investment.

Now. It should be clear REIT actually own a very small portion of American housing, around 1%. Individual owners make up a far larger portion of the housing market.

REIT live in the happy red space.

The problem with REIT is that they are often terrible.

They are bastions of widespread community gentrification. Sweeping into minority communities like Herongate in Canada and bulldozing the lot. All to make way for shinny condos they can turn a profit on.

https://acorncanada.org/news/leveller-rein-reits-tenants-demand-action-against-real-estate-investment-trusts/

REITs have been accused of slumlord like behaviour. Letting houses decay with mold and refusing repair ect. Ect.

https://www.cbc.ca/news/canada/tenants-lose-as-landlord-transglobe-racks-up-charges-1.1246084

https://doctorow.medium.com/wall-streets-landlord-business-is-turning-every-rental-into-a-slum-b15b81f18612

Essentially my point is....

You could be invested in the very Real Estate Investment Trust that acts as your landlord. You could be invested in the source of your own suffering and gentrification.

The pension investment in REITs for domestic housing is growing. It is too profitable. It is an easy source of growth.

If you are in a bad situation, you should want your pension invested in an REIT. It will help grow your savings (whatever they be). But, that very same REIT might own your home and be the very evil trying to wring cash out of you.

This isn't a call to action. This is more an observation about the neoliberal shit oroborus we are stuck in. You can choose not to invest in REITs, or try and find a good one.

But in doing so, you are worsening the housing crisis. REITs are sophisticated. They use rent increase software and have quantitative analysis of the market used to drive prices up.

If the housing market ever tanks, a good portion of your savings might tank with it.

Now. You might have no savings. You might not have elderly relying on social security. You might be fine.

But. Society is run by trashfire electoralism. If people don't see their investments going up they freak out and vote for the other party.

The pension investment into real estate, allowed in 2001 (thanks Bush), has created people whose retirements and future are dependent on housing prices always going up. Around 51% of Americans are invested in REITs. It is essentially a nightmare that will never be fixed unless people who are smarter than anyone on Tumblr actually put an effort in.

Thanks for reading my depressing rant.

(Also. Sorry if you are in Canada. It is bad in AUS but it seems like REITs can steal newborns over there. Like some articles are like wtf.)

https://www.reit.com/news/blog/market-commentary/reit-allocations-pension-funds-increase

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-pension-funds-up-real-estate-exposure-to-offset-rising-risks-71610560

https://www.benefitsandpensionsmonitor.com/investments/alternative-investments/real-estate-has-become-a-cornerstone-asset-class-for-pension-fund-investors/383790

#housing#anti capitalism#fuck neoliberals#neoliberal capitalism#neoliberalism#fuck capitalism#housing crisis

2 notes

·

View notes

Text

I've been meaning to write some posts explaining basic accounting principles for curious laypeople. I've finally started!

The Fundamental Law of Debit and Credit

Equity

The fundamental laws of any field of study often seem unrelated to the final result. To discover why mixing baking soda and vinegar makes bubbles, you must learn atomic theory. To understand why a map never needs five colors, you must study triangles. To read a 10-K, you must know what the word "equity" means.

If you've heard the word "equity" (in a context where it doesn't mean "being equal"), you have probably heard of home equity loan—a way of obtaining cash based on the value of your house, assuming you could somehow afford one.

Home equity is quite simple; it's the difference between the current value of your house and the amount you owe to the bank. In a sense, it's the amount of house you own.

Assets, Liabilities, and Equity

Imagine that you are not only rich enough to own a house, but rich enough to own two houses. You took out a separate bank loan for the new house, but that's fine—you're ready to become a landlord, and rent payments are going to exceed loan payments.

This second house is essentially a small business. The house is a resource for which you expect to receive a future benefit, or in business terms, an asset. The loan is an obligation to fork over assets (specifically cash) in the future, or a liability. And the difference between them, as with your actual home, is your equity.

Houses don't literally just sit there and print money. You might take out a smaller loan to add a swimming pool to the lot, for instance. Or you might build a tree house, or realize you forgot to pay your handyman's fees. This complicates the situation slightly, but not by that much.

Total Equity = Total Assets - Total Liabilities

A real estate corporation managing hundreds of houses and loans, plus a bank account and salaries it hasn't paid yet and so on, its ownership split among dozens of shareholders, follows this same equation. But stating it like this isn't helpful for most accounting purposes; more commonly, you'll see it stated like this:

Total Assets = Total Liabilities + Total Equity

This highlights another perspective on what liabilities and equity represent. Liabilities are, in a sense, the portion of the company owned by (or at least owed to) its creditors, while equity is the portion of the company owned by its owners.

If you only own one or two houses, the exact numbers don't matter much. As long as you make enough money to pay all the bills, you're doing fine. But a big company has obligations to dozens of people—its owners, its creditors, possibly the SEC and similar agencies. A company needs to keep careful track of its assets and liabilities.

Double-Entry Bookkeeping

The origin of the most fundamental accounting technique has been lost to the sands of time. Some say it was invented in Israel under the early Roman Empire, or in Korea during the 11th century, or in Italy during the 13th century, or in India during a century not listed on Wikipedia.

It wouldn't surprise me if it was invented more than once, because the basic concept is dead simple. Your page has two columns. Write assets on the left, write liabilities on the right. Equity goes on the right, too, or something equivalent.

Modern accounting has a lot more rules. But they're all about what you write in each column; this structure has remained constant for almost as long as we have detailed accounting records that haven't crumbled to dust.

The Balance of Debit and Credit

Debits and credits are just the name we give to entries in those books. Increases to assets are called "debits"; increases to liabilities and equity are called "credits". But decreases to assets are credits, and decreases to liabilities or equity are debits.

Speaking very loosely: Debits are things the company wants, while credits are what it pays to get those things.

Remember that equation I showed you earlier? Assets equal liabilities plus equity? If an asset increases, one of three other things happened: Another asset shrank, or a liability or equity grew. If you acquire a new liability, you got rid of another, lost equity, or gained an asset. And so on.

This is the immutable axiom of accounting. 1 × a = a, ΔU = Q - W, debit equals credit. Or to put it another way:

Every transaction must have an equal balance of debit and credit.

What's up with the cards?

Might as well explain this real quick.

From a bank's perspective, your savings account is literally a liability. When you deposit your paycheck, the bank recognizes both cash and an obligation to return that cash. When you withdraw money, the bank reduces its cash, and also your account. Reducing your bank account is a debit, and that's true whether you're withdrawing physical cash or using a plastic card to pay for groceries electronically. It's a card that debits your account.

As for credit cards...well, that's just a case of one word having multiple meanings. "Credit" has its accounting definition, and also the definition of "letting someone borrow money". They're not unrelated—a business borrowing money credits some liability to represent that debt—but credit cards aren't related to accounting credits.

4 notes

·

View notes

Photo

Book Recommendations: More Financial Literacy Month Picks

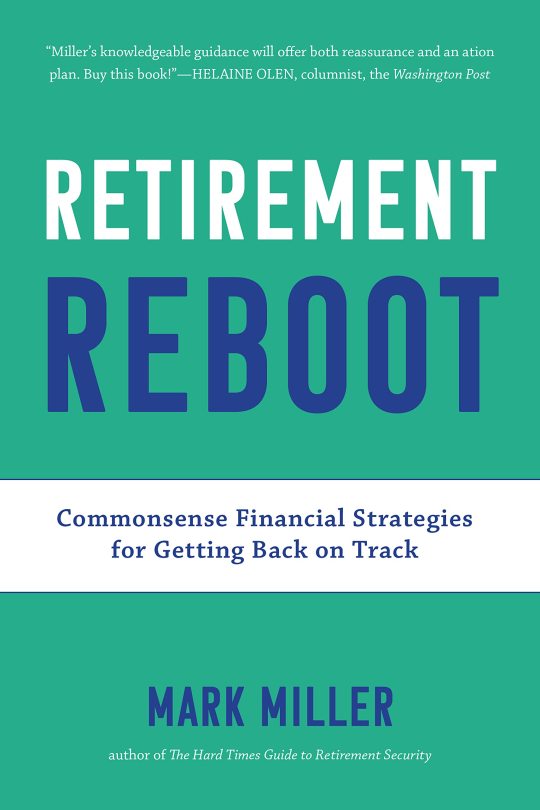

Retirement Reboot by Mark Miller

Even before the pandemic, a large share of households by Americans over age 50 faced the threat that their living standards would decline sharply in retirement. In the wake of COVID-19, these numbers will surely worsen. In Retirement Reboot: Commonsense Financial Strategies for Getting Back on Track, finance writer and regular New York Times retirement contributor Mark Miller offers practical strategies for Americans to improve their retirement prospects.

If you're nearing retirement age and worry you haven't saved enough, Retirement Reboot will walk you through the core decisions to make now to improve your retirement outcomes--even if retirement is just a few years away. You'll learn how to make a plan, think through the timing of retirement, optimize Social Security, navigate Medicare, build savings, and tap home equity. You'll also explore ongoing strategies, such as careful budgeting, generating income from work even after retirement, planning for long-term care, and leveraging special assistance aimed at low-income workers. If you have low savings, or none at all, Miller's simple steps can help you make the most of your remaining working years and reboot the retirement you always imagined.

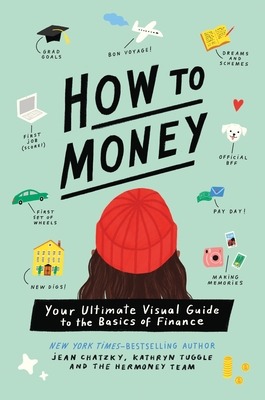

How to Money by Jean Chatzky

There’s no getting around it. You need to know how to manage money to know how to manage life — but most of us don’t! This illustrated guidebook from New York Times bestselling author and financial expert Jean Chatzky, Kathryn Tuggle, and their team at HerMoney breaks down the basics of money—how to earn it, manage it, and use it—giving you all the tools you need to take charge and be fearless with personal finance.

How to Money will teach you the ins and outs of: -creating a budget (and sticking to it) -scoring that first job (and what that paycheck means) -navigating student loans (and avoiding student debt) -getting that first credit card (and what “credit” is) -investing like a pro (and why it’s important!)

All so you can earn more, save smart, invest wisely, borrow only when you have to, and enjoy everything you've got!

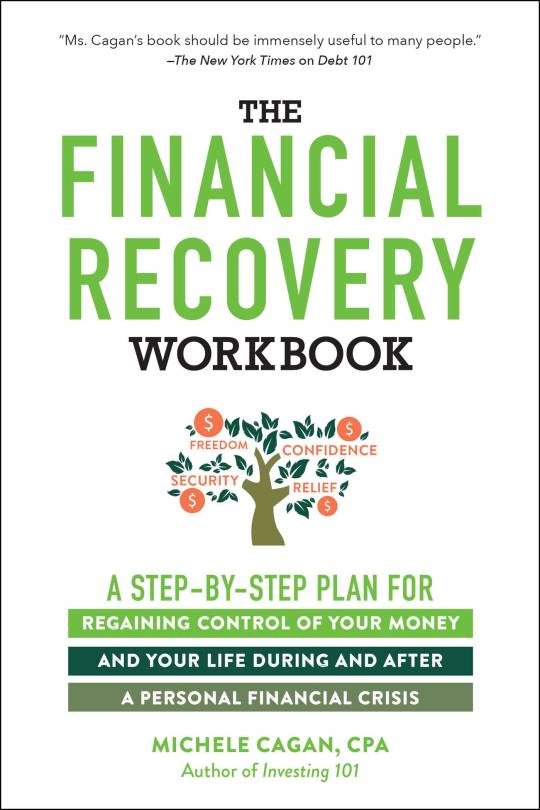

The Financial Recovery Workbook by Michele Cagan

It can happen to anyone: no matter how well you’ve planned or saved, an emergency—job loss, a severe illness or accident, divorce, or weather disaster—can put a big hit on your finances. The steps you take to stay afloat can have a huge effect on how you and your finances recover from disaster.

The Financial Recovery Workbook provides a step-by-step guide to help you make a plan to get your financial life back on track. You’ll learn which bills to prioritize, whether or not you use credit cards—and which cards are most beneficial—how to find quick cash to pay for necessities, whether or not you should dip into your retirement fund, and more! With expert financial advisor Michele Cagan as your guide, discover how to regain control of your finances and change your relationship with money for good.

How to Pay for College by Ann Garcia

Providing your children with a good education is one of the best gifts you can give. But it’s not straightforward. Education costs and student loan debt are skyrocketing. In some cases, college costs upwards of $300,000 for four years. And calculations for financial aid and merit awards are complex and opaque. How do you find the best education options that fit your budget and are absolutely right for your child? And how do you save for your kids’ college without wrecking your own retirement, or putting your other goals completely out of reach?

In How to Pay for College, Ann shows you how to develop a financial plan for college that really works, including:

-How to save and how much to save. -How to find good college choices that fit your budget. -How to get scholarships and tax benefits. -How to talk to your kids about the costs and benefits of going to college.

Detailed explanations of the key elements in planning for college—the FAFSA’s methodology, merit awards, 529 plans, AP credits, student loans, financial aid awards, budgeting, and more—are paired with worksheets and exercises to give you a full picture of your family’s college financial position.

#nonfiction#finance#self help#personal finance#money#financial literacy#nonfiction books#nonfiction reads#Nonfiction Reading#Library Books#Book Recommendations#book recs#reading recommendations#Reading Recs#TBR pile#tbrpile#tbr#to read#Want To Read#Booklr#book tumblr#book blog#library blog

14 notes

·

View notes

Text

youtube

Business Name: Compare My Equity Release

Street Address: Airport West, Lancaster Way

City: Leeds

Zip Code: LS19 7ZA

Country: United Kingdom

Business Phone: 0800 246 5228

Website: https://comparemyequity.co.uk/compare-my-equity-release/

Business Description: Lifetime mortgages for the over 60s can provide a tax free cash injection for financial security. Interest rates can be fixed for life for peace of mind and you can raise money for any purpose.

Compare My Equity puts you directly in touch with a qualified expert who will explain your options, with no obligation.

We take the hassle out of the process by cutting out the call centres.

You deal with a fully qualified adviser, who will speak ‘plain English’ and tell you what you need to know, without any hassle.

Straightforward information, guaranteed!

Request Your Mortgage Quotes And Access Your Free Home Valuation & Review With An Expert.

Google My Business CID URL: https://www.google.com/maps?cid=224167832296737327

Business Hours: Sunday Closed Monday 9am-6pm Tuesday 9am-6pm Wednesday 9am-6pm Thursday 9am-6pm Friday 9am-6pm Saturday 9am-3pm

Services: Compare Equity Release

Keywords: best equity release interest rates, equity release comparison, compare equity release Yorkshire, equity release interest calculator, equity release comparison uk, best equity release calculator, equity release calculator interest, equity release near me, best equity release companies, equity release martin lewis, lifetime mortgages martin lewis, equity release and inheritance taxs

Location:

Service Areas:

9 notes

·

View notes

Text

Your Guide to Financing Your Property Purchase in Dubai

Dubai is known for its luxurious lifestyle and impressive skyline, making it a dream destination for many property investors. However, if you are unfamiliar with the options available for financing your property purchase in Dubai, you might end up getting stuck with a bad lending experience. With so many residential projects and real estate property developers in Dubai, it's important to research and compare before making any decisions.

In this guide, we will take you through the best practices to finance your property purchase in Dubai so that you can make an informed investment decision!

Financing options for property purchases in Dubai

When it comes to financing your property purchase in Dubai, several options are available. One of the most common methods is taking out a mortgage loan from a bank or financial institution. They offer various types of mortgages, such as fixed-rate, adjustable-rate, and interest-only loans.

Another option for financing your property purchase is through developer's payment plans. This method allows buyers to pay for their property over an extended period with minimal upfront costs and no interest charges. However, it's important to note that not all developers offer this option, and the terms can vary significantly.

Investors may also consider using their existing assets or investments as collateral for a loan by applying for an equity release scheme. This option is ideal for those who already own a property in Dubai and are on the lookout for another one. Additionally, some investors prefer cash transactions if they have enough savings on hand, which allows them to negotiate for a better deal with the seller since they’re not dependent on financing options.

Regardless of which financing option you decide on, it's crucial to do extensive research beforehand and compare rates offered by different lenders or developers. It's also advisable to consult with reputable real estate agents who can provide valuable insights into the market trends and best investment opportunities in Dubai!

Best Practices for Financing Your Property Purchase in Dubai

When it comes to financing your property purchase in Dubai, there are a few things you should keep in mind. Here are some best practices that could help you secure the funding you need.

First and foremost, research and compare different financing options available from banks or financial institutions to get the best possible deal with the lowest interest rate. Don't settle for the first offer you receive - take time to shop around and compare your options.

Step 1: Research and Compare

Before making any big financial decision, it's crucial to do your research. When it comes to financing a property purchase in Dubai, this is no exception. Start by researching the different types of loans available from various lenders, including banks and mortgage brokers.

Once you have an understanding of the types of loans offered, compare interest rates and terms across multiple providers. Don't just settle for the first lender that crosses your path - take time to shop around and find the best option for you.

Another important factor to consider during this step is reputation. Look into reviews or ask friends who may have also financed their property purchases in Dubai about their experiences with specific lenders.

Make sure to educate yourself on any fees associated with each type of loan as well as potential penalties for early repayment or missed payments. This knowledge will help you choose a lender that works best for your unique situation while avoiding costly surprises down the road.

Few property developers in Dubai, like Shapoorji Properties, help out the buyers in their loan process as well.

Step 2: Know Your Budget

Knowing your budget is a crucial step in financing your property purchase in Dubai. Before you start looking for your dream home or investment property, it's important to determine what you can afford.

Start by calculating your total monthly income and subtracting all of your regular expenses, such as rent, utilities, car payments, and food costs. This will give you an idea of how much money you have left over each month that could go toward mortgage payments.

It's also important to consider any additional costs associated with buying a property in Dubai, such as closing costs, DLD fees, other government fees, insurance fees, and maintenance fees. These expenses can add up quickly, so make sure they are factored into your overall budget.

If the numbers aren't adding up or if you find that you don't have enough money saved for a down payment on the type of property you want to buy, then it may be time to reassess your financial goals and make some adjustments.

Remember that getting pre-approved for a mortgage is not the same as knowing how much house you can afford. Understanding your budget before making big decisions can help ensure that you're making smart financial choices when purchasing real estate in Dubai.

Step 3: Check Your Credit Score

The better your credit score, the higher the chances of getting approved for a loan and availing yourself of more favourable terms. So before applying for a property loan in Dubai, checking your credit score is essential.

Your credit score is an indication of how responsible you are with money and how likely you are to repay debts on time. It takes into account factors like payment history, length of credit history, types of credit used, and amounts owed.

In Dubai, banks have their own unique way of calculating your credit score based on various parameters such as income levels or existing loans. Therefore it's important to obtain your report from the relevant authorities before applying for a loan.

If your current rating is below par due to previous unpaid debts or missed payments, don't worry! You can still improve it by paying off any outstanding balances and ensuring timely payments moving forward. With a good enough rating, you may even be eligible for lower interest rates, saving you thousands over the life of the mortgage!

Step 4: Frame out how to handle Unexpected Expenses

When it comes to financing your property purchase in Dubai, you need to ensure that you have a solid plan in place for handling unexpected expenses. Even with thorough research and budgeting, unforeseen costs can arise during the buying process or after moving into your new home.

One way to prepare for these unexpected expenses is by including a contingency fund as part of your overall budget. This buffer should be set aside specifically for emergencies such as repairs, replacements, or maintenance that might come up unexpectedly.

Another important consideration is understanding the terms of your mortgage or loan agreement. Be sure to review any clauses relating to late payments carefully or missed payment penalties so that you are aware of additional fees that may apply if something goes wrong financially.

It's also worth considering purchasing insurance coverage specifically designed for homeownership, such as property damage protection, liability insurance, and even title insurance which provides added peace of mind against potential legal issues down the line.

By taking proactive measures like creating a contingency fund and reviewing all contractual agreements and insurances available at hand, you’ll be much better equipped to handle any unexpected expenses that arise while financing your property purchase in Dubai.

Step 5: Get the Pre-Approval letter

Having pre-approved financing gives you an advantage when negotiating with sellers. It shows that you’re serious about buying a property and have the required finances to purchase the property.

Whereas it also gives you an idea of how much you can spend on a property purchase. That not only narrows down your search but also speeds up the buying process once you find the right property.

Conclusion

By following these five steps, you can successfully finance your property purchase in Dubai. Remember to research and compare financing options, know your budget, check your credit score, frame out how to handle unexpected expenses, and get the pre-approval letter. It may seem like a lot of work upfront, but taking these necessary steps will not only make the financing process smoother but also help you find the best deal for your dream home or investment property.

So go ahead and start exploring residential projects in Dubai offered by various real estate developers in Dubai. With proper planning and guidance from experts, buying a property in Dubai is an achievable goal that offers great returns on investment while providing a luxurious lifestyle experience.

#apartments facing burj khalifa#imperial avenue downtown dubai#residential property for sale in dubai#property developers in dubai#top developers in dubai#luxury apartments in dubai#property developers in uae#Shapoorji properties

2 notes

·

View notes

Text

Advice On How To Get A Renovation Loan For Your Project In Houston

Do you need a loan for a renovation project you have coming up? We must have thought of you. While many people find the process of applying for a remodeling loan to be tedious, we make it very simple in this post.

This article discusses the numerous loan requirements, different forms of renovation loans in Houston, and expert suggestions for a successful project if you didn't know you could receive a loan for your restoration work or believed it would be difficult to secure a loan.

A 203(K) FHA loan

The most well-liked and reasonably priced loans in the US are FHA 203(L) loans. And the reason for this is because they are supported by the government and have the most favourable qualification standards. You can refinance or purchase a primary residence using an FHA 203(k) loan, and you can add the whole cost of the modifications to your mortgage to pay for them over time.

Loans for Home Equity

You can borrow money based on the value of your property with a renovation home equity loan. Your equity house payment will need to be made separately if you already have a mortgage because it doesn't cancel off the previous loan. Applying for a home equity loan may make sense if you have accumulated a considerable amount of home equity or if you need to finance a significant one-time project.

Individual Loan

A personal loan is yet another option to pay for your home remodeling. Using an unsecured home renovation loan has the benefit of not requiring security for the loan. They are also the easiest loans to obtain because of this. Despite having higher interest rates, personal loans can be repaid over durations of two to five years and have flexible rates (fixed and adjustable). in order to be eligible for an unsecured personal loan.

Employ Qualified Personnel

Your remodeling expense can easily balloon and spiral out of control without a proper plan. Working with experts is beneficial in this regard. At Smart Remodeling, we make an extra effort to develop a plan that works for your circumstances and make sure we stick to that plan throughout the remodeling process to get the desired outcomes. Additionally, we'll work with you to prevent unforeseen catastrophes and ensure that the project is completed successfully and under budget.

Select the Best Loan for You

Make important to search around and become familiar with the conditions of each loan before applying for any home renovation loan. You shouldn't take out a loan that will take you a lifetime to pay back or, worse yet, one that you're likely to fail on. Should you refinance your mortgage or combine your savings with your remodeling loan, or would you want to cash them out? Compare the many financing options and choose the one that best suits your needs.

Cove Security - Always here to get the door. All of our cameras include intercom features and mobile controls that enable you to sit back, watch, listen, greet friends, warn lurkers, or arrange to meet surprise visitors at a better time. Try one—or four—and see what a new level of connection feels like.

#cove#covesecurity#covesmart#homesecurity#diyhomesecurity#loan#rates#remodeling#expenses#equity#mortal kombat#financial#finance#security#budget

2 notes

·

View notes

Text

Benefits Of Investing in Real Estate

Are you on the hunt for a savvy investment that will yield advantageous long-term benefits? Look no further because the current king on the throne of investments is real estate! Investing in real estate is guaranteed to yield far superior results in comparison to any other investment opportunity out there.

Capital Appreciation

Let's be candid, when investing in any asset, we all have hopes that the value will increase. However, many depreciate with time, such as automobiles, bikes, and technological gadgets like mobile phones or laptops. But, with real estate, the opposite is true! The value of a property purchased today is projected to increase over the coming years due to rental incomes and the appreciation of residential real estate. The icing on the cake is that if you decide to sell your property in the future, chances are you'll make a profit!

2. Easily Build Equity

Have you ever reflected on how buying a home could pave the way to building equity? Let's break it down for you. Once you complete your final mortgage payment, your assets begin to accumulate, and your property transforms into a firm foundation for expanding your monetary worth. As your equity increases, you gain the freedom to purchase additional properties and receive a higher cash flow. This situation is beneficial for all parties, resulting in a symbiotic outcome.

3. Long Term Security

In our fast-paced world, we often crave the instant gratification of easy money without any entanglements. But we mustn't forget that such money can be flimsy and fleeting. On the other hand, putting down roots in residential real estate at a young age can provide you with lifelong stability. Renting out these properties as co-living spaces offers a profitable opportunity to dip your toes into the world of commercial or residential real estate.

4. Tax Benefits

Worried about the harsh taxes that plague real estate investments? Fear not, as co-living spaces can act as your knight in shining armor. You don't have to fret about property taxes, mortgage rates, property management interest, repairs, or insurance policies when your property is a soaring success story. Say goodbye to tax worries and welcome extra income with open arms!

5. Diversification

Investment opportunities come in all shapes and sizes - from trading stocks to buying luxury cars. However, we must remember that life is an unpredictable rollercoaster, and stocks may plummet in value overnight. During such episodes of market turmoil, real estate remains our reliable companion, steadily appreciating in value and serving as a steady and dependable fallback option. Placing all our eggs in one basket is unwise and risky. Therefore, diversification is key - and investing in REAL ESTATE is certainly one of those doors worth knocking on!

6. Multiple Income Source

Transforming your dwelling into a co-living utopia is a masterful strategy to cultivate myriad money making channels. Infusing your residence with communal vibes taps into the burgeoning trend of shared living, satisfying the needs of renters seeking flexible and budget-friendly accommodations. Converting your personal space into a co-living hub is a stellar opportunity to optimize your investment and broaden your fiscal horizons.

7. Leverage

Investing in real estate during your youth is a stroke of brilliance. You see, your CIBIL score tends to be at its prime during this time, and if you've got a hefty chunk of change for the down payment, you can take out a loan to cover the rest. The cherry on top? You don't have to wait until the debt is paid off to call yourself a property owner. It's a wise decision, indeed. But hold on, what if you're no spring chicken? Fret not, because it's never too late to hop on the real estate bandwagon!

8. Tangible Asset

Real estate investing is akin to holding a tangible treasure. You can physically touch it, see it's worth firsthand, and enjoy the feeling of absolute ownership. It's not some abstract, intangible investment like stocks or bonds. Nay, it's a concrete, solid asset that can provide stability and financial security. Owning property not only means you have a roof over your head, but it's also an investment that always has the potential to grow. Whether you opt to rent it out or sell it later, your investment continues to be a beacon of peace and security. All in all, if you're on the hunt for a reliable, smart long-term investment plan, real estate is a savvy bet.

Are you seeking to make your mark in the real estate game? Well, listen up because your 20s is prime time to make that happen! Investing in property can be a seriously shrewd financial decision, and converting your real estate into a co-living hub is the savvy choice to make. Luckily, companies like 'Xtra Income Homes' have streamlined the process, making it simple for you to get started on your investment journey. Simply head to their website via the link below, and discover all the tools and knowledge you need to make your mark on the property ladder:

Remember, with so many options out there, it's all about taking your time and finding the property that truly speaks to you. The perfect investment home is waiting just for you!

2 notes

·

View notes

Text

Advantages of Multifamily Real Estate Investing

Investing in multi-family real estate is a favored asset class among both seasoned and novice commercial real estate investors. This category of real estate comprises properties specifically developed to accommodate multiple families, including apartment buildings and townhouses. These properties are typically owned by a single entity and rented out to multiple tenants. Multifamily investment properties for sale in New York can be a lucrative investment opportunity for individuals and companies looking to generate income from rental properties. Here are the many benefits of multifamily investing:

Help Pay Mortgage

One of the key advantages of investing in multi-family real estate is the ability to lease out multiple units, generating rental income that can be used to offset or even pay off your mortgage. With this strategy, you can enjoy the financial benefits of property ownership while maximizing your returns. This can significantly reduce your monthly housing costs and help you build equity in your property faster.

Easy to Finance

When considering obtaining a mortgage, multi-family loans are comparatively simpler to qualify for than single-family homes. This is because rental income can be considered as a source of income, enabling you to secure a larger loan. Nonetheless, it is crucial to meticulously examine your credit report and make enhancements to your credit score to secure the most favorable mortgage interest rate. By doing so, you can ensure that your mortgage application is successful and you receive the best possible terms.

Scope of Real Estate Portfolio Construction

Investing in multi-family properties presents an excellent opportunity for creating a rental property portfolio. By acquiring more multi-family units, you can generate sufficient rental income to offset your mortgage payments, thereby freeing up funds to acquire additional properties. This approach enables you to grow your real estate investment empire steadily. Over time, you can build a portfolio of properties that generates significant monthly income.

Easier Control

When you own Multifamily buildings for sale in Yonkers New York, you have greater control over your investment. You can handle the day-to-day issues that arise, collect the rent, and save on property management costs. Additionally, many renters treat multi-family units better because they know the owner is nearby.

Tax Benefits

Another significant benefit of multifamily real estate investing is tax benefits. You can write off the costs of maintenance and repairs on your rental unit, deduct insurance premiums and property/facility management fees, and reduce the value of your home over time. All these tax incentives lead to many tax savings.

Simplicity

Multi-family real estate investing is also a much easier way to become a real estate investor. You only need one mortgage and one insurance policy to cover your building, which makes it simpler to manage and reduces the need for property managers.

Reduce the Risk

Owning multiple units reduces risk. If one unit is vacant, you still have rental income from the other units to cover your expenses. Additionally, owning multi-family properties can help you weather economic downturns and other challenges that can impact the real estate market.

Conclusion

Multifamily investments offer compelling risk-adjusted return profiles. Different financing options are available for family offices and property trusts for individuals and partnerships. However, the complexity and diversity of the structural features of each loan create opportunities for failure in the financing process. Investigate not only the financing options but also the structural characteristics of the loan and be aware of the limiting factors early in the process. This creates the foundation for a successful path that increases cash flow. It is advisable to rely on seasoned brokers specializing in multifamily real estate investment to assist you in navigating the intricacies and pinpointing suitable prospects. Investing in multi-family properties can potentially yield substantial rental income, enhance equity, and foster financial security.

3 notes

·

View notes

Text

The post thread goes deeply into "this is literal, it is not a metaphor" and at some point mentions that no one had offered advice on how to buy a condo.

This blog is "not financial advice" and this is not financial advice it is... more of... a general list... of suggestions... on how to buy a condo. In the United States.

At no point am I considering this easy, simple, fair, possible widespread.

It sucks. It is expensive. It is hard. It is confusing.

I'm hoping to take at least a tiny bit of sting out of it.

Look around your area. Go to real estate offices, they often have postings in the window. Go to their websites. Go on to Zillow or whatever but understand those prices are, hm, spicy and high, frequently. You want to get a gauge of "this is how much a condo of that size is in my area." Or the area you want to move into.

Mortgages are typically 3 - 5% downpayment, up to 20%.

If you put down less than 20%, you will very likely have to pay something called "private mortgage insurance" (PMI)

Names aside -- it's an extra payment with your mortgage payment.

It covers the lender in case you can't make the payments.

It goes away once you've made enough payments to have gained 20% equity.

Downpayment

This is the the hardest part. It sucks. I'm not going to sugar coat it.

3% of a $100,000 condo is $3,000.

Your mortgage is $97,000.

Your payment is going to be just under $600 + property taxes + PMI (probably 1.5 - 2% of the mortgage) + insurance + association costs.

Here is a basic calculator to play with numbers.

One of the things you should do when looking for a condo is look for first time home buyer's programs.

Google "first time home buyer's program {city}."

Go to City Hall. Go to your bank.

Hell, if you work for a giant company, check your benefits.

I've seen that before with folks -- it's rare, yeah, but check everywhere.

15 Year versus 30 Year Mortgage

This question is academic while you're starting out. Go with a 30 year. It keeps your cost of entry cheaper.

In time, you can refinance. You can (almost always) pay more monthly too.

Unless your mortgage lender is offering you a crazy-good-deal on a 15 year mortgage, plan on 30. Shorter mortgages exist because when you have money, you can get a better deal. If you're following this ramble, it is unlikely to apply. Plan on 30. Figure out a better plan later.

Property Tax

You'll hear a term called "escrow" bandied about. You'll pay an amount on top of your mortgage payment, this amount varies based on your mortgage, property taxes, insurance too probably, and it sits in a savings account.

You cannot touch this savings account.

Your bank will say "For easy math of this ramble, your mortgage is $500/month. Your insurance is $100/month, your property taxes are $600/twice a year... which is $100/month.

"So your total bill is $500 + 100 + 100. Of this amount, $500 goes to your mortgage. $200 goes to this escrow savings account.

"Twice a year, as your bank, we'll withdraw the cash for your insurance and pay them directly. We'll withdraw the cash and pay the property taxes."

Your bank is in touch with the insurance company and the property tax folks regularly to ensure they have enough in your escrow. Your mortgage will fluctuate slightly accordingly.

Association Fees

These vary wildly from area-to-area and even building-to-building so keep this in mind while you're hunting.

This pays for maintenance, the building's improvements, the building's property taxes... etc.

Some condo buildings are self-managed by the owners. Some have hired an agency to do the managing. Some blend.

While you are condo hunting, ask about the association fee. Try to get details "How much was it last year? 3 years ago? 5 years ago?" You want to see how often they are raised and by how much.

Also ask about "special assessments." This is an out-of-the-blue and/or long-term-planned "The condo association needs everyone to pay up $X."

They should be rare. Once every handful of years... like, once or twice every 10 years. That is a very rough guide, not a tight guideline. The more common they are? The worse shape the building and/or association is in.

Check what the association fees cover. Will someone come to your condo and handle emergency plumbing? Do they handle landscaping?

What rules do they have?

"This feels impossible."

It sucks. It's expensive.

There are closing costs on top of all this crap (money you pay during the initial purchase to handle a billion things.) It's more complicated than it feels like it should be.

As you start planning "I want to live here, I can pay $X, that fits within the basic numbers" go talk to a bank. Multiple banks. Community banks, big banks, credit unions, shop around.

"Is this a hard pull on my credit?"