#but mico in absolute fear

Explore tagged Tumblr posts

Text

#not posting the others I have because they’ve been posted many times before already#but mico in absolute fear#luke truly getting into character#and jay slowly becoming ody#epic the musical#epic ithaca saga#epic#epic cast#jorge rivera herrans#epic livestream

228 notes

·

View notes

Text

Thoughts on the Ithaca Saga!

Spoilers under the cut, obviously

The Challenge

I'd listened to all the snippets beforehand and they did not come CLOSE to capturing the glory of the final song

Anna absolutely killed it, every note she sang was so stunning

And the instrumental? The way it built?? I'm still going nuts over it

10/10 very strong contender for my favorite song in the saga, which I was not expecting

Hold Them Down

Made me very uncomfortable

Which of course was the point so like it was effective

But I have no desire to talk about it more than I have to

(I will say though that I was not expecting Antinous's death to be in that song and so sudden, the gasp I let out was unreal)

Odysseus

Speaking of things that made me gasp: I audibly choked at the open arms bit. I thought I was used to Polites haunting the narrative but NOT LIKE THIS

I listened to this one before watching the stream so that I could be prepared in case the violence got really intense and boy am I glad I did

Like I knew SOMETHING bad was going to happen because of how intense the song got at the end but. I was. Not expecting that

Everyone who sang absolutely killed it though like Jorge's exhaustion and anger? So palpable. The suitors' performance? Incredible

And TELEMACHUS

THE INSTRUMENTAL WHEN HE SHOWED UP WAS SO COOL

And he sounded just like Ody when he sang "get off me, get off me"... my heart

I Can't Help But Wonder

I'll admit I was still too in shock from the end of Odysseus to really process this one at first

But the hug made me lose it

(Both Odysseus and Telemachus's and Jorge's and Mico's I was fully sobbing)

(Also the way Odysseus sang "Telemachus" in the familiar motif. I still can't listen to it without crying frankly)

I will say though literally the only thing in the saga I have any complaint about is Odysseus's reunion with Athena

We had a whole saga about how her friendship with him was still very much on her mind, and buildup to their reunion with Hermes's little hint at the end of Dangerous, and to have them talk about morality for a bit and then for Ody to skeddadle to go find Penelope was... realistic, I guess, but not very satisfying

It's not a huge issue or anything I just wish we could have gotten more of them

Would You Fall in Love With Me Again

Another moment that had me in tears: Drawing_Angie's animatic with all the other animatics in the background. Look how far we've come

I love that Penelope's test with the bed was to help Odysseus realize that he was the same person, that was such a cool twist

Also again, Anna killed it. The raw emotion in her voice at the "I guess that makes him you"? The two decades of anger and fear in the "waiting"s? Unmatched power

GIGI'S ANIMATIC. I WAS LOSING IT IT WAS SO GOOD

Also, the livestream in general was SO much fun. I genuinely can't remember the last time I laughed as hard as I did at the cast's antics. What a wonderful group of people

#epic the musical#epic: the musical#epic the ithaca saga#ithaca saga spoilers#epic odysseus#epic penelope#epic telemachus#epic athena#epic antinous#ray rambles

22 notes

·

View notes

Text

The Ithaca Saga PT 2 👑🏹

I had to make this in two parts because of text limits. Ok, like I was saying JORGE AND MICO DID “I can’t help but wonder” SO WELL. the longing on both sides of wanting to know the other and not really knowing what to say because it’s been so long. For Telemachus, it’s almost this fear of like what if I’m not what he expected or wanted, and for Odysseus it’s like I’ve missed so much time, how do I make it up to you. ODYSSEUS TALKING ABOUT MAKING STORM CLOUDS CRY AND CAPTURING THE WIND AND SKY FOR HIS SON HAS ME BAWLING LIKE AHHHH 😭🥺. And the soft guitar in the background, while Odysseus is comforting him and then the “My son I’m finally home!” And “Father, how I’ve longed to see you!” AND THEN THEY HARMONIZE LIKE WHAT THE HELL JORGE. AND THEN ATHENA COMES BACK AND ITS LIKE A REPRISE OF WARROR OF THE MIND. THEYRE MEETING AGAIN BUT IDEAS HAVE SWITCHED, ATHENA BEING EMPATHIC AND ODYSSEUS HAVING NONE LEFT IN HIS HEART EXCEPT FOR HIS FAMILY. ODYSSEUS ACKNOWLEDGES THAT ATHENA HAS THE CHANCE TO CHANGE THE WORLD BUT ITS TOO LATE FOR HIM. AND HIS ONLY GOAL IS TO SEE PENELOPE AGAIN 😭. THEN ITS “Can you fall in love with me again” and Penelope notices all the differences between the Odysseus with all those years ago and Odysseus tries to explain that he has changed and isn’t the person she fell in love with but he wants her to. He basically confesses all his wrongs but they were to get back to her and that he knows she has been waiting for him for such a long time. Penelope then sings her final “challenge” for him to move their wedding bed and get rid of it. Odysseus is obviously hurt by this because he’s like “but like I made that of the tree where we first met, our palace is built around it?” And Jorge’s voice carries this emotion of like sadness but also with anger. Until Odysseus realizes that is wife, who matches him in wit had to put him through one last test. And then Anna comes in strong, and the whole scene is very emotional and Penelope says she’ll fall in love with Odysseus again and again wherever, whenever, and it’s just a very sweet song. They bring back the waiting Motif as she says he’ll always be her husband. Anna has such a beautiful voice on the higher notes as she sings waiting (which I think she does 8 times to represent each of the Sagas she has waited for him) and all of the instruments swell and it sounds like JUST A MAN. Still, instead of “Forgive me” SHE SAYS “For you” and it’s just so good with the just a man melody with the piano and what I think is a viola and guitar. THEN THEY HARMONIZE ON I LOVE YOU LIKE 😭😭😭😭 It is such a good way to end the show or Odysseus's Odyssey, and I’m so glad I got to come along for the ride. I have been here since the very beginning, and Everyone involved in every aspect of the show has done such a wonderful job and I appreciate all the time and effort that has gone into making Epic: The Musical. I absolutely cannot wait to see what will come next.

#epic the musical#jorge rivera herrans#epic the troy saga#epic the cyclops saga#epic the ocean saga#epic the circe saga#epic the underworld saga#epic the thunder saga#epic the wisdom saga#epic the vengeance saga#epic the ithaca saga

24 notes

·

View notes

Text

Undead Unluck ch.204 thoughts

[Lord Forgive Me But It's Time to Go Back to The Old Me]

(Contents: Parallels - Nico/Feng/Ichico, Character development - Feng, Power system development/speculation - Souls, Character speculation - Sun/Luna)

Well! I guess we didn't need to worry about Nico staying a non-Negator after all, now did we? So much for keeping Nico "Unforgettable-free" eh, Ichico? Still, I feel better knowing that my prediction that they'd trigger it on purpose was correct, even if the exact method was a bit off

As usual, Tozuka continues to impress me with his ability to compose iconic panels. Nico's face when he absorbed all of the memories from Acopalypse is simply Unforgettable, particularly since it so immediately reverted him to his classic L100 appearance. What's really fun about that is that it's probably not that his body just suddenly remembered all of the stress and sleepless nights of Unforgettable, but rather it's the logical extreme of Artifact-based memory influx. We've seen characters develop headaches and nosebleeds from it before, most notably from Fuuko digging through an huge box full of Artifacts, so for Nico to absorb presumably ALL of Apocalypse's stored memories (stated to be the most of any Artifact), it makes sense that even the capillaries under his eyes would all burst at once from the pressure

The question now is whether or not this is a permanent change. I imagine not, since his previously haggard appearance was indicative of his suffering, the haunting knowledge that his most sacred memories would soon fade and be permanently replaced with the most wretched. L100 Nico had the opportunity to create new pleasant memories but actively rejected the possibility out of fear of losing the old, while in this world Nico is going to be able to embrace the support of others as he won't have lost Ichico this time. Honestly, no wonder Tozuka waited to introduce Mico to this world; he wanted to make sure Nico would be able to make room for her in his heart rather than keeping her at a distance

I wonder if that's another reason Tozuka chose Feng for this fight; not only is Feng's current focus on making himself unforgettable to future generations, but he's also a good parallel to Nico's role as a father. Both L100 Nico and Feng prevented themselves from properly forming attachments with their children, and L101 has given both of them the chance to make right on that. Shen explicitly acknowledges that he loves Feng as his father, and Feng even calls Shen his son, so while Feng may not be the best or even a good role model for fatherhood, he does make a compelling argument for parental redemption. If Nico really does have complete knowledge of the previous Loops now, the significance of this change won't be lost on him, and he'll be certain to make sure Mico can grow up happy and loved

Speaking of, Ichico's final speech in this chapter remind me a lot of Nico's in L100. She tells Nico that she knows he can save her because he's the first person she's ever loved, while as Nico was dying in L100, Ichico asked if he thought Mico could handle saving Fuuko's life and he replied "she's our daughter. She doesn't make mistakes." Both of them have absolute faith in their loved ones to pull through when the chips are down, and both of them hold each other in extremely high regard. These two really have such strong chemistry, I'm excited to see the sorts of interactions they have now that the cat's out of the bag

Now that I think of it, Nico's refusal to let Mico into his heart was pretty ironic since Ichico explicitly wanted to make sure that Nico wouldn't ever feel alone. Just like Leila asked Rip and Latla to find love in each other, Ichico wanted Nico to fill the void she left with Mico, and just like them, he couldn't let go of the past and move on. Leila and Ichico were also both in poor health and believed that since their lives were short they held less value, and instead sought to leave as much of an impact as possible in the time that they had, even if it was just to make the people closest to them happy

Looking at Ichico in that light, we can see another fun parallel to Feng! Feng's Unfade made him believe that he had all the time in the world and that he didn't need to leave anything behind because he'd always be there, while Ichico's Unsleep made her believe she had no time and had to leave as much behind as she could. Both of them, however, had adverse effects on their families, as Feng believed his children to exist for him to become stronger and Ichico believed her child to be an adequate replacement for herself, when in reality Feng should have focused on raising someone to surpass him and Ichico should have focused on preserving her life to be present for her family. Heck, Unforgettable manifested in Nico both times specifically because he saw Ichico's last moments and thought something to the effect of "I don't want her to die, I want to remember her." Doomed by the narrative, indeed!

Man, I'm so glad Tozuka used Feng here, I had no idea there was so much connective tissue between all these folks! I bet we still would have gotten something cool if it were Tella, but damn this is such juicy stuff!! I hope Tozuka keeps throwing all of his toys together in fun combos that get me to think this deeply in the other Master Rule fights too

Feng's inclusion here also continues to demonstrate how far he's developed, forcing him to put his money where his mouth is and sacrifice himself for someone else for a change. He was a bit incredulous at first that Ichico was suggesting he should die, which is pretty hypocritical coming from the guy who just last chapter said "you should sacrifice your wife to get stronger, it'll be cool." Once he realized that dying would help him understand souls better and that Nico could save him AND bring him back to life, Feng was all for it, and may well come to understand that being with people provides more opportunities for growth than treating them as expendable ever could

I am very interested in seeing how his death will improve his understanding of souls, though. The damage he took from Luna's soul blast as well as the damage he dealt to Sun (who Language stated has a physical body) with his knock-off Kamehameha both prove that souls can directly interact with the physical plane, something that Ghost previously stated couldn't be done. This may be a matter of interpretation, though, as Ghost also stated that Andy only couldn't move his limbs after having those parts of his soul cut off because he believed he could move his body using his soul. Ghost's interpretation was that souls couldn't touch physical matter and vice versa, so only a physical attack coated in soul could harm him by ensuring it didn't matter which form he was in

Luna's attack seems to be pure soul, so by that logic, she shouldn't have been able to deal damage to Feng's body, and yet she did. Is Luna's interpretation that a soul attack damages the soul and reflects its state on the body? Probably not, then one wouldn't be able to detach their soul for attacks in the first place, as that would cause the body to change shape (see Mahito's Idle Transfiguration in JJK). Does Luna interpret souls as having different properties at different concentrations? Is she coating her soul around the air to create physical pressure when launching her attack? Or is it something entirely different? Whatever it turns out to be, I think it will have pretty drastic implications for how battles are fought going forward

Finally, I want to touch on an interesting line from Language. She referred to Luna and Sun as "the Pinnacle of the Spiritual and the Pinnacle the Physical" respectively, and given Luna's hazy silver appearance, it does track that she is literally made of soul, but then does that mean Luna doesn't have a physical body at all? And in fact, if Luna is only a soul, then how did she exist prior to UMA Soul's creation? Is Soul really the Rule that allows souls to exist, or the Rule that allows other souls, existences like Luna, to be?

And if Luna is a soul without a body, then...is Sun a body without a soul? Can soul-based attacks work on Sun, or does the Union need to focus solely on physical attacks? Or, does defeating Sun require that Luna be defeated simultaneously, just like Ghost, because Luna is Sun's soul?

I know I say it all the time, but Tozuka really is following Oda's footsteps incredibly well. They're both so good at sprinkling in hints that make me ask questions rather than just spoonfeeding me answers, so while I desperately want the answers, the time I get to spend chewing them over and looking for them myself makes the questions stick with me and leave that much more of an impact. I sincerely hope that other mangaka are taking notes, cus I want to see so much more of this in Jump's future!

Until next time, let's enjoy life!

23 notes

·

View notes

Text

While I'm back have, a few more headcanons!

- Belle, Sam, Piper, and Chuck were all original members of the Goldarm Gang (the gang's been alive since Belle, the oldest, was a teen).

- Piper ended up quitting after Belle left her behind during one scheme which caused her to get into lots of trouble. She doesn't want to affiliate with the gang anymore due to how much the betrayal hurt her.

- Chuck left the gang a little later to pursue his dreams as a maestro.

- Sam and Chuck are best friends :) I like to imagine that in the Season 20 animation Belle was gonna leave Chuck like she did with Piper, but Sam didn't wanna leave his best friend behind (however he was shortly stopped by a very angry Bull)

- All three members of the Ghost Station Trio (even though there are only two of them rn just imagine the other one is here) met an unfortunate end to a different train (Gus Subway, Chuck Steam Engine, etc.), and the only reason why nobody's figured out there are three dead people is because of the purple gems which brought em back. This is also the incident that caused Chuck's life-altering injuries.

- Mico absolutely HATES Kit because he's incredibly jealous of him and his fame.

- The Calamity Gang used to be the biggest Gang in the Wasteland West (Ranger Ranch environment name I made up) before the Goldarm Gang really started making waves. Eventually, they split up because of disagreements (mostly between Crow and Poco). Some time after, Crow revived the Gang with Mortis as his right-hand man and spike as his "henchman."

- Crow, Mortis, and Spike sometimes just like to hang out and watch cartoons together because I think they'd like doing that.

- (This one needs more thought put into it because I still don't know how it'd go down, but this is what I have.) The higher ups at the park tried to hide the Ghost Station in fear of the folks finding out about the "incidents" that occurred there, they tried to seal away all the ghost. They were unsuccessful with Gus, but they we successful with Chuck and the unknown third member. But don't worry, Gus busted Chuck out of there at least.

- Gus's bio parents abandoned him for an unknown reason, causing him to have to fend for himself and grow up a little faster than his peers.

8 notes

·

View notes

Text

Some responses

Oh jeez...... Guys, I did not expect my post to resonate with so many people. I was aware that the problem of people feeling excluded and mocked just for less common headcanons had to be big, but I still thought this post would stay between me and all five of my followers, hahah; I am glad that some people feel really heard here! Some are for very different reasons, too?

I ESPECIALLY want to point out this one, because it is exactly the result I've been seeing a lot:

@tsunbath I've heard similar things from (former?) Malenia fans, and also I know at least two friends for whom Maria was ruined as a character because of how toxic her fans were. You are VERY right about the fact that Malenia would've hated to be the symbol of gatekeeping and bullying in the fandoms! I feel like the same would go for Maria; there is no direct confirmation, but I doubt many people can argue that she IS compassionate soul. Like... how do those toxic fans keep making the deep, compassionate, tragic female character into THE symbol of mockery, exclusion and aggression? Beats me.

It just deeply resonates with me how actions of the bad type of fans can create aversion to a character or a ship. I've had this phase with Mariadeline ship tbh. My advice would be - avoid searching content for the character/ship, try to find a tiny pool of people that likes them but are normal and respectful about it, allow yourself to feel identified with "normal fans of the thing" pool rather than dread of identifying with toxic gatekeepers by association... Like, the ship got recovered for me this way, same as Maria's character herself. Just remember that toxic fans and normal fans are not the same entity... It is a very rare case where division is HELPFUL! Hopefully you will be able to recover Malenia for yourself and not think of those l00sers anymore.

@mycopok I know Mal, easily the best person to have ever crossed BB fandom, and nothing will ever replace her </3 I am just happy that her positive influence still lingers even after becoming way less active, like... yeah, fans just should be allowed to explore any idea they want. Maria x Laurence is SUPER interesting concept! In fact, the initial post WAS made because of someone venting that they were afraid to post their Maria x Laurence stuff out of fear of being ostracised!

@underworldsheiress Yeahhhh again, you are not the first one I hear a story like this from. I also heard takes like 'tomboys are the grossest aesthetic, either come out as a trans or get back in line' (not exagerration). It is REALLY unfair how a woman looking masculine should be either her being a butch lesbian, or... well, no longer being a woman in the end. Infighting and forcing pointless norms on each other is a huge problem with LGBT+ community, you'd expect people to gather to support each other but... people will be people I guess :/ Anyways gigachad move of you to wear what you want.

@alma-amentet I don't quite agree with your tastes on body types maybe not gonna lie; However what you pointed out (not so much in the tags, I saw what else you said heh) is a very good example of how fandoms are open spaces and everyone should feel welcomed here. Like, the girls in the fandoms will have absolutely ridiculously specific tastes regarding male characters - not liking shorter height, not liking slim build, prettifying their canonically not-so-attractive face, judging them in sexy look contests, throwing insults towards their appearance quirks at times...

But once someone tries to pull similar things with female characters - all HELL breaks loose. Double standards in the fandoms regarding genders of the characters are absurd. I even once saw someone in BB fandom whining about how someone attempted to discuss which female character was hotter with them...... after we, as a fandom, CONSTANTLY have shit like 'sexyman contest who is sexier Mico or Brador vote now from your phones!!!!'. .... Like idk if you need to hear this as well or not, but everyone should be allowed to say 'muscular women aren't my taste' for the exact same reason why everyone is allowed to say 'muscular men aren't my taste'.

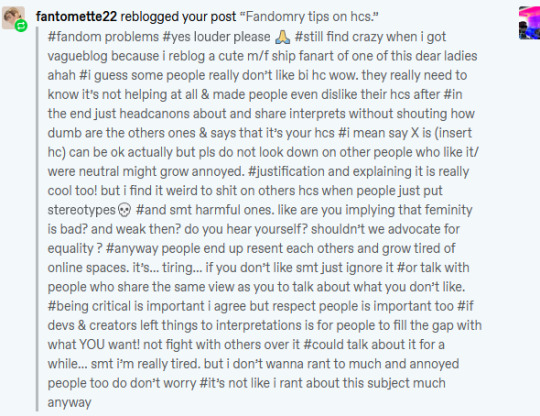

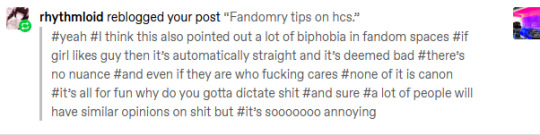

@fantomette22 @rhythmloid Devotees of the Biphobic Order are the bane of every western fandom's existence at this point for real though :/ They will see a female character that wears pants and kicks ass and start shaking over her like Gollum with The One Ring, ignoring all the context, nuance, her personal story, other possibilities, etc... Like I said - feelings of real people who just try to enjoy the fandom are more important than some toxic bunch's creepy obsession with the character they want to crown as their token masculine lesbian based on stereotypes, no less. I say if they really care about masculine lesbians, they should direct their activity towards real world and real people. Because, again - fandomry is not activism.

Anyways thanks everyone for speaking, and sorry if the tagging annoyed you or something fdsjhfh I really appreciate that, and I do hope you all will be able to find your own group in the fandom that'll keep you mentally safe from the toxic fans ruining characters for you. Like a power barrier in the middle of the chaos! I know I did find mine, lol

#dash commentary#long post#(wow look WHO is using a tag like this hahahaha)#fandomry rambles#disco horse#controversy#fantomette girl your tags are as long as my post itself fdhhdfhsd#you had a lot to get off your chest pffffft

17 notes

·

View notes

Text

Alaia Dillmann

Name: Alaia Dillmann

Sex: Female

Pronouns: She/Her

Sexuality: Bisexual

Birthday: 09 December 2008

Age (as of 2024): 16

Height: 163 cm

MBTI: ISFP

Family: Mother, Father (unknown)

Mother: Chinese

Father: German / French / Unknown

Appearance:

Dark brown-black ish straight hair

Black eyes

Diamond shape face

- Was raised by her Grandmother because her mom worked multiple jobs

- Her grandmother died when she was 13

- Practically lives alone now

- Loves mushroom soup

- Learnt to cook from her Grandmother

- MUST!!! HAVE!!! GARLIC!!! BREAD!!!

- Loves garnishing her dishes with spring onions merely for the colour

- Favourite colour is Yellow

- Favourite season is autumn

- Loves denim

- Incredibly independent, almost too independent

- BUT!!! She has no sense of direction whatsoever

- WILL GET LOST IN HER OWN HOUSE

- Absolutely loves fruit loops

- Eats the cereal without milk

- But if she adds milk, trust she will put the milk first

- Paints a lot

- Her art is depressing but is very brightly coloured

- Like a portrait of a crying person would be bright pink or something

- Probably has ADHD

- Believes in ghosts (and has probably seen some before)

- Favourite show is "Locke & Key" on Netflix (I'm projecting ok don't judge. It's a good show)

- Hates popcorn (I'm projecting again)

- Wants a pearl-scale goldfish as a pet

- Has literally only been to the dentist 5 times in her entire life

- (She will leech off the school dentist bc it's free)

- DEFO A CONAN GRAY FAN

- Plays the acoustic guitar

- Occasionally write lyrics

- Horrible at speaking Chinese, I fear

- Acts really happy but is actually so depressed

Playlist: I should be studying

1. Belong Together by Mark Ambor

2. Little League by Conan Gray

3. Difficult by Gracie Abrams

4. Waffle House by The Jonas Brothers

5. The Very First Night (Taylor's Version) by Taylor Swift

6. Best Friend by Conan Gray

7. Line Without A Hook by Ricky Montgomery

8. Better by Mico

9. Strawberry Ice Cream by David Hugo

10. Summer Child by Conan Gray

1 note

·

View note

Text

god i am so excited to live by myself

#like. sure it will probably end up lonely.#but god the removal of the deep embarrassment that sticks around when i exist around other people is going to be wonderful#ive got the like. barest bits of a daydream n im just. excited.#its not gonna happen for a while but. soon.#theres nothing wrong right now but like#thinking about getting rid of stuff so that driving wherever i go will be good#i dont even know where im going just Away#i cant make any real decisions until it gets closer#looking at places in the areas im sorta considering just to keep me thinking about it#im excited i am gonna be saving money n like. telling oak i am no longer making big purchases unless i absolutely have to#and the only thing im gonna buy is a copy of botw since i moved away from mico n ive been using his copy#and after that all money is just for this#the only real big fear is like. transporting the boys#name change and testosterone are removed from the ''im saving money to move'' tho#but i have to get my license and then my truck n then.#speaking

3 notes

·

View notes

Text

the ship sways but the heart is steady

chapter two: how the light gets in

the untamed pairing: jiang cheng & wei ying, lan zhan/wei ying word count: 3713 summary: Wei Ying’s friends are at rock-bottom, and Wei Ying puts his life on hold to help them put theirs back together. To absolutely no one’s surprise except Wei Ying’s, his family goes with him. read on ao3

x

“We’re here,” Wen Qing says, bringing Jiang Cheng out of an involuntary doze. He realizes that the car has stopped.

He can’t see much of the estate through the glare on the windshield, so he glances into the backseat. Wei Ying is still very much dead to the world, and still sprawled against Lan Zhan, who is playing what sounds like Candy Crush on Wei Ying’s phone. Wen Ning is fast asleep on Lan Zhan’s opposite shoulder with the rabbit crate nestled safely in the loose loop of his arms.

It can’t possibly be comfortable for any of them, except maybe the rabbits.

“I’ll extract you in a sec,” Wen Qing says.

“Take your time,” Lan Zhan replies peacefully.

Rolling his eyes, Jiang Cheng drags himself out of the car. The dry heat smacks into him like a solid wall. Stretching stiff muscles, he gazes across the overgrown yard. It’s—alright, it’s a lot.

The whole property is clearly old farmland gone to seed. There’s some rusted equipment all choked through with weeds sitting off to one side of a dirt road, which wings around to a distant structure that must have once been a barn. Goldenrod is growing all over the place, and with the late afternoon sun baking overheard, it really adds to the illusion that everything has been bathed yellow.

The villa itself is both better and worse than Jiang Cheng was expecting. It has exterior walls, at least. And most of a roof. Maybe once, it might have been someone’s pride and joy.

Wen Qing leaves the engine running, circling around the front of the car to stand next to Jiang Cheng. Her eyes look ancient with fear.

“I don’t know if we can do this,” she says. She’ll only say it now, where her brother and her best friend can’t hear. She’ll be strong all the rest of the time.

Jiang Cheng can’t begrudge her this important, much-needed moment of weakness. He bumps their shoulders together. He lets her lean on him for a bit. Jiang Cheng isn’t either of his siblings—he doesn’t know how to be a voice of comfort. The best he can do is just be here.

“What’s that stupid thing you and your siblings always say before you do something that almost gets you killed?” Wen Qing asks suddenly.

Immediately defensive, because he’s the one who started it back when he was like seven and Yanli and Wei Ying thought it was adorable and wouldn’t let it die, Jiang Cheng snaps, “It’s not stupid. It’s fucking—motivational.”

“It can be both. You’re living proof.”

“Oh, fuck you.”

She sighs, that familiar laughing sound that defangs Jiang Cheng in one fell swoop.

“‘Attempt the impossible,’” he recites grudgingly.

The sun is steadily sinking lower through the sky. All the daytime color is deep and rich now with the promise of evening, everything on the brink of shadow. A breeze rolls through the yard, catching Jiang Cheng’s hair and tossing it into his eyes. It carries smells he can’t recognize, smokey and woodsy, a little floral, clean.

There’s no smog, no oppressive diesel or baked garbage smell, no heavy industry works bleeding its fumes all over the place. It smells the way summer smelled in the books A-Li used to read to him.

He’ll get used to the heat, Jiang Cheng thinks. Summer has always been his favorite season. He doesn’t know if he’ll get used to the smell.

“Did you ever manage it?” Wen Qing asks quietly. “The impossible?”

Jiang Cheng can’t help but smile, half a dozen memories crowding forward in the space of a heartbeat. Him, and his brother, and his sister, always together. Never apart. Keeping each other safe, and even more importantly, keeping each other happy.

“All the time,” he says.

It must be the right thing to say. Wen Qing stands a little taller. Her expression goes so firm with resolve that Jiang Cheng would never have believed that she’d wavered if he hadn’t seen it for himself.

This was right, he realizes. It finally quiets the uncertain voice still loitering around in the back of his mind. Coming here for her was right.

#

Wei Ying is much more enthusiastic about the decrepit property than Jiang Cheng and Wen Qing combined, and for the life of him, Jiang Cheng can’t decide how much of it is an act to make the Wens feel better about their circumstances. It seems largely genuine.

“Can you believe how huge this house is?” Wei Ying says gleefully, somewhere in the middle of his third lap around the property. “Babe, the dining room is as big as our entire apartment!”

Lan Zhan smiles at him, likely just because he called him ‘babe’. Jiang Cheng is going to throw up on both of them at least once.

The inside is not actually quite as depressing as they feared. There’s old furniture stacked up in most of the rooms, each individual piece moldy and cobwebbed and not likely to support anyone’s weight without breaking in half, and collections of miscellaneous things, like ten-thousand stacks of newspapers in the study, and just as many empty wine bottles out on the back porch.

But there’s something to it, Jiang Cheng can’t deny that. Some sort of presence to it. A history, maybe, that haunts all these empty spaces that used to be full and busy and lived-in. It makes him linger over an old console table at the end of the second floor hallway, with a dusty jewelry box sitting on top. There are someone’s ruined treasures inside. This was someone’s home.

Maybe it could be that again.

“We’ll have to drive into town for dinner,” Wen Qing says, surveying their progress in the living room. They’ve set up camp there, since they’re losing too much light to do much else. “And flashlights. The electric company promised they’d have an inspector out here in the morning.”

Wei Ying collapses onto a dusty sofa, which is probably actively infested with something, or at the very least was at some point, and pats at the cushion next to him until Lan Zhan unfolds himself from his seat on a wine crate and joins him there.

“This place really isn’t that bad, A-Qing,” Wei Ying says. “You made it sound like they’d gutted it down to the studs.”

“That’s how it was described to me,” she says. She seems a lot firmer on her feet, now that she’s walked the length of the place and knows firsthand that it probably isn’t going to collapse on top of their heads at a moment’s notice. “What was it our cousin called it, A-Ning?”

“A rathole,” Wen Ning says helpfully, feeding the rabbits bits of dried rosemary out of his hands. “He said he was glad it was our problem and not his.”

“He’s probably just angry it wasn’t left to him in nainai’s will,” Wen Qing says.

“Is this your cousin who got kicked out of school for driving his professor’s car off a bridge or the one who was arrested for breaking and entering?” Wei Ying asks.

“Same cousin,” Wen Ning says. “He’s not very nice.”

Jiang Cheng doesn’t have a leg to stand on when it comes to asshole relatives, so he stands up and says, “Let’s get a move on. We’re already gonna be coming back in the dark. A-Ning, put the rabbits away. Lan Zhan, stop mooning over my brother.”

“If it’s gonna be dark by the time we get back anyway, there’s time for mooning,” Wei Ying grumbles.

He squeaks and scrambles over the back of the sofa when Jiang Cheng advances on him, and Wen Qing berates them for trying to break what little furniture they have three minutes after they fucking got here, and for a few minutes the old house is packed to the rafters with shouting and laughter as they jostle each other out the door.

It already feels a little fuller than it did when they arrived, in a way that has nothing to do with the suitcases stacked in the hall.

#

Jiang Cheng gets up the morning feeling unfairly jet-lagged. Everyone else is awake already, sitting on the floor of the kitchen, eating dry cereal because the fridge isn’t running yet and things like milk are still only a distant dream. They greet him with a round of sleepy but sincere hellos and Wei Ying passes him a box of Lucky Charms.

Lan Zhan, who bought a camping generator and a power strip when they went to town the night before, holds his hand out for Jiang Cheng’s phone. Jiang Cheng surrenders it so it can be charged and refuses to admit out loud that he’s glad that Lan Zhan is marrying into his family.

By the time the inspector arrives, they’re picking their way through the junk in the kitchen. “Start with one room,” Wei Ying says, likely repeating the helpful Youtuber whose DIY videos he paid an obscene amount of his fiance’s money on the in-flight WiFi to watch. “Make it ours.”

So they’re clearing out cabinets and removing ancient rodent carcasses and sorting dusty glassware into possibly-salvageable and definitely-garbage piles when a loud knock draws their attention down the hall to the foyer where a friendly-looking, if bemused, man in a hard hat is standing on the threshold of the open front door.

Wen Qing shoves a blender into Jiang Cheng’s hands that probably hasn’t blended a damn thing in thirty years and pats as much dust off of her person as she can.

“You’ve got this,” Wei Ying says with enough belief to power a small aircraft. “And if you need me to flirt with him for any reason, just say the word. Lan Zhan will understand.”

Lan Zhan won’t understand, if Jiang Cheng is as good at reading his mico-expressions as he thinks he is. The inspector, who could clearly hear Wei Ying’s voice from like ten feet away, is already grinning when Wen Qing introduces herself.

Ultimately, after a walk around the house, the inspector has good news and bad news. He starts with the bad news.

“It could be a lot worse,” he says frankly. “But this building is practically an antique, and it hasn’t been upgraded in two decades, at least. We might be able to get away with a partial wiring, but anything less than a full one would leave you at a real risk of an electrical fire.”

Wen Qing’s whole body goes stiff. Wen Ning steps up beside her, taking her hand in one of his bandaged ones.

“A full rewiring then,” he says, firm in the way he only is when someone else needs him to be. “We’ll figure it out.”

Apparently sympathetic, the man nods. He imparts the good news. “We’ll get started on the repairs right away. I can probably get some guys out as early as this afternoon, and it shouldn’t take longer than a week.” After a beat, he adds, “We can arrange a payment plan when all’s said and done. I’m not going to hound you about a lump sum up front. We’re a pretty close-knit community out here, pretty neighborly. Don’t be surprised if you’ve got people poking their heads in at you soon.”

Wen Qing, who grew up in LA, seems to need a minute to digest that. Wen Ning seems automatically delighted.

“Hey, thanks for everything,” Wei Ying says when the inspector starts to head back to his truck.

The inspector grins and taps his hard hat in reply, looking amused. Jiang Cheng doesn’t have to search farther than two inches past Wei Ying’s shoulder to find out why.

“Jesus Christ, Lan Zhan, they’re not going to elope,” Jiang Cheng says, shoving him back towards the kitchen. “Wei Ying has literally never looked at another human being since the first time he looked at you.”

“Aww,” Wen Ning says.

“Shut up, that wasn’t—it’s annoying! Not cute!”

“It can be both things,” Wen Qing says dryly. She’s smiling.

#

Through some grace of god, the plumbing is sound. Unlike the wiring, the pipes were replaced recently enough that they’re not made of lead or polybutylene or anything else that will make them violently sick from bathing or drinking out of the tap.

This leads Jiang Cheng and Wei Ying on an expedition to the basement in search of the hot water heater. Jiang Cheng could fucking cry when they find out it’s one of those huge gas-powered tanks. Wei Ying looks up how to turn the gas on without exploding the place into tiny pieces, because of course he has data out here even though no one else does, and it’s as simple as turning a valve they find in the middle of some big fuck-off spiderwebs.

“Hot showers tonight!” Wei Ying sings when they make it back upstairs, significantly more dusty than they were when they descended. Wen Ning gazes at them with such open admiration that Jiang Cheng doesn’t want to admit there was literally no skill involved in the process at all.

The electricity inspector is proven right about curious visitors exactly four hours after he said it, as a warbling little voice calls, “Hello?” from the front porch.

The kitchen is in the middle of a thorough scrubbing, and Wen Ning isn’t allowed to put his hands anywhere near chemicals or heat or anything, really, aside from the lazy rabbits, so he pops up to his feet and scurries to the front of the house in a desperate bid to do something productive.

“A-jie,” he calls a moment later, in a tone that gets Wen Qing’s attention faster than a fucking lightning bolt from the sky probably would have. Her urgency is distracting. The rest of them don’t want to keep cleaning cabinets while Something Is Happening, so Jiang Cheng, Wei Ying and Lan Zhan get up and follow after a minute of pretending to work.

There’s a little old woman, probably well into her seventies, holding one of each of the Wen siblings’ hands and talking warmly. A little boy is clinging to her leg, peering up at them with wide eyes.

Granny, as she insists they call her, has lived in this town her whole life, and was a close friend of Wen Qing and Wen Ning’s grandparents.

“I heard about the fire,” she says, clutching their hands, “and I want you to know that I’ll help you however I can. There’s not much heavy lifting I can do, really, but—cooking and cleaning, I am more than capable of!”

Jiang Cheng, who had respect for his elders literally beaten into him growing up, would sooner walk into traffic than he would let this kind old woman clean for him. The sentiment is clearly echoed on all of his friends’ faces, and his brother steps forward to look at her with big, liquid eyes.

“Granny, you’ll stay and keep us company even if we don’t have any interesting stuff for you to do, won’t you? Even if all you do is sit here in the shade and chat with us for a bit? It’ll break my heart if you don’t, it really will.”

This earns Wei Ying a fond pat on the cheek, as he’s adopted by Granny on the spot. She does stay for a few hours, and they make a meal out of some day-old donuts and chips and sunflower seeds. Jiang Cheng watches Granny visibly come to the conclusion that they’re all incapable of feeding themselves, and something needs to be done about it, even if she politely declines to say it out loud.

Her grandson, A-Yuan, has picked his way cautiously to the little makeshift enclosure they’ve constructed for the rabbits, and crouches next to it to look in at them with wide, wanting eyes.

“Do you want to pet them?” Wei Ying says. The answer is obviously yes, no matter that A-Yuan shyly ducks his head and doesn’t answer, so Wei Ying lifts the white rabbit out and places it carefully in the child’s lap. “This is Bao. She’s my favorite. Don’t tell Pidan.”

A-Yuan giggles, carefully petting Bao’s velvety ears with the tips of his fingers. Bao is content to just sit there and soak up the affection until the end of days, the most laid-back creature on the planet.

“Pidan?” A-Yuan asks, glancing inquisitively at the black rabbit, who is chewing noisily on a piece of cardboard.

“Her sister,” Wei Ying says, lifting the black rabbit out and putting it next to Bao. A-Yuan is laughing fully, now, gifted with too much rabbit for his tiny arms to contain. “She’s silly and annoying and a trouble-maker. For some reason, she’s Lan Zhan’s favorite. Don’t tell Bao.”

“For some reason,” Lan Zhan intones solemnly. He’s looking at Wei Ying the way he’s always looking at him.

“I can’t stand this,” Jiang Cheng says to Wen Qing. “There has to be something else for me to clean, far away from them.”

“Have you seen where you are? There’s a million things for you to clean.”

But she gets up when he does, and they wander through the mostly-clean kitchen and into the pantry, where the shelves are nearly fully-stocked with foods at least ten years past their expiration. Sighing, Wen Qing ties back her hair. The curve of her neck is disarmingly delicate.

Jiang Cheng glances away quickly and refuses to think about why.

#

There’s a spigot in the conservatory that refuses to work. There’s a wall dividing the dining room and the living room that just doesn’t make sense. There’s broken windows and holes in the roof. Wen Ning walks across the second floor balcony to release an angry squirrel that they found in a wardrobe and nearly falls over the edge when the wrought iron railing bends beneath his weight. The yard and the grounds are an outright disaster.

The plot on the west side of the house was once home to a small vineyard, which explains some of the tubing and big gallon buckets they found in the conservatory. The original owners must have made their own fruit wine. The land by the barn is fenced off in a way that suggests a vegetable garden, and the rest of the considerable acreage is eaten up by the edge of a big lake, the remains of a dock leaning out over the water.

It’s all neglected, overgrown, untamed.

But, Jiang Cheng thinks, almost a month after they arrived, it’s getting there.

The last time it rained, he and Wei Ying and Wen Ning ran through the house looking for leaks, and couldn’t find a single one. For some reason it was so fucking exciting to have a roof without holes that they called people about it.

Yanli was ecstatic. Lan Huan, who, Jiang Cheng thinks, still doesn’t fully understand why his brother and future brother-in-law disappeared to California to begin with, was bemused but very happy for them. Granny brought over a strawberry sponge cake in celebration.

She’s been spending more time at the villa, anyway. One of the guest rooms has become hers, for those nights that dinner runs late and Wei Ying employs his wide gray eyes and convinces her not to drive home in the dark. All of them are more than okay with it, because otherwise she would go home to an empty house with no one for company but a four-year-old, and that makes Jiang Cheng’s stomach feel sour.

Granny says that A-Yuan has gotten attached, but she doesn’t specify what he’s attached to. It could be the bunnies, it could be all the wide open space to run around in, and it could just as well could be Jiang Cheng’s idiot brother, who carries A-Yuan around on his shoulders or under his arm tirelessly and threatens to plant him with the radishes every time he misbehaves.

They returned the rental car because someone in town had an old truck they didn’t mind parting with. There’s no A/C, but it’s not exactly a hardship to crank the windows down and drive really fast instead. Jiang Cheng usually volunteers Wei Ying for trips into town with him, because, even though he would die before he’d admit it out loud, it’s nice to have his brother to himself for a change.

If Yanli were here, he thinks, trudging through the little grocery store and deflecting most of Wei Ying’s attempts to sneak stupid shit into their shopping cart, it would actually be perfect.

#

They’re piled on the new second-hand sofa and a couple salvaged leather armchairs in the living room, watching a Dreamworks movie with A-Yuan on the satellite TV that Lan Zhan’s fuck-off bank account secured for them, when Wei Ying’s phone rings.

Wei Ying is sharing one of the recliners with Lan Zhan, tucked into his fiance’s lap with his legs draped over the arm of the chair and his head tucked into Lan Zhan’s shoulder, and it looks as though it would take an act of god to move him.

“Here,” Wen Qing says, amused, and leans over to pass the phone to Jiang Cheng.

“What are you good for if you won’t even answer your own phone?” Jiang Cheng grumbles without heat.

“Eye-candy,” Wei Ying says shamelessly.

“Hello?” he says loudly into the phone so he won’t have to spend a second thinking about what his own brother just fucking said to him.

“A-Cheng,” Yanli says.

“Oh, A-Li,” Jiang Cheng says, smiling automatically. “You didn’t call this morning. I meant to call you after dinner, but my phone died, because someone hogged the charger to play Candy Crush all day.”

Lan Zhan gazes at him serenely.

“A-Cheng,” Yanli says again, very gently. “Are you with A-Ying?”

“Yeah, of course,” Jiang Cheng says. His smile is fading. After a life spent reading verbal cues from his siblings, something about Yanli’s tone has his stomach doing somersaults. “He’s right here. What’s wrong? Are you okay?”

Out of the corner of his eye, he sees Wei Ying sitting up. A-Yuan’s bright little voice is asking what’s wrong, and Wen Ning is shushing him. Wen Qing’s hand covers Jiang Cheng’s free one, as light and insubstantial as a bird landing on a telephone wire, until the second he needs a firmer hold.

“Of course I am, I’m okay.”

“A-Li,” he says, feeling light-headed. “What’s wrong?”

With a deep, shuddering breath, she tells him.

#the untamed#mo dao zu shi#mdzs#yunmeng shuangjie#wangxian#jiang cheng#wei ying#lan zhan#wen qing#wen ning#wen yuan#jiang yanli#my writing#mdzs fic#the ship sways#surprise i have this weekend off so i wrote the next chapter just for the hell of it :^)

27 notes

·

View notes

Note

Here's a dust of quote:

"Said I couldn't love someone, 'cause I might break."

Kit in every incarnation of the character embodies this quote. That fear of showing themselves, that fear of being hurt, that fear that being soft will only end with them broken... It's why I love Kit so much but also why MingKit has a slight edge for me over MarkKit. Because it's that action,that moment of being fully soft, that does it for me. And 2moons2 kit does that softness just a wee bit better for me.

In some ways, this feels like King. I could see King expressing something similar to this about his feelings for Ram. It's fear and it's insecurity and it's just... not knowing what will happen.

This is Lukmo, absolutely his entire character. And we're going to get to see what happens with this for sure. Since his entire character arc is learning to love and to be loved and to care about people, to be himself more openly. I cannot wait.

I mean, Phupha kind of lived this when he decided to stay away from Tian, let's be honest. He broke from love and from loneliness and then he learned how much more love can be.

I feel like Tong feels this way about Pok and then, well, everything went to hell and isn't getting better and, well, he might be right about that honestly if the story doesn't get better.

Chu ShuZi definitely feels this way as he starts to fall for ChangCheng. He hasn't loved since his twin and he wasn't planning on loving again... but you can't just not fall for ChangCheng, let's be honest.

I am strongly reminded of Mico and Xavier from Hello Stranger but for very different reasons. Mico because he doesn't feel like he can trust Xavier and Xavier as he overcomes his own fears about how to balance the two loves he has. I seriously wish they'd taken more time to discuss this more seriously in the movie. The end was so rushed but there was so much potential if they'd taken the time to focus on the communication rather than rushing to the conclusion instead.

Pai ends up feeling this way after Itt breaks his heart with the whole competition thing. And it's so badly done. Honestly, it's better in what I managed of the novel... which is so sad because the show actually developed deeper characters than the novel did! So, boooo on MGAYG. Boooo I say.

JM embodies this quote in the show. He's living proof of how much love can hurt and how it takes resilience to get past pain and the many different forms that resilience can take but also how coping mechanisms can hurt you even when they feel like they help.

That's a pretty good list and a couple rambles!

#quote anon#ilu quote anon#top secret together#guardian#hello stranger#mgayg#stuck on you#2moons2#gen y#atoats#thaibl#thai bl#i love them all so much#this was a really fun quote to do

9 notes

·

View notes

Text

$2.3 TRILLION BAILOUT!! BUY BITCOIN!!! Hyperinflation – Programmer explains

VIDEO TRANSCRIPT