#benefits of personal loan in financial planning

Explore tagged Tumblr posts

Text

How to Align Your Personal Loan with Your Financial Goals

In today’s dynamic financial landscape, a personal loan can be much more than just a quick fix during a cash crunch. When used strategically, it can help you move closer to your long-term financial goals—be it funding your child’s education, consolidating high-interest debts, renovating your home, or starting a small business.

However, the key lies in aligning your personal loan with your broader financial objectives. This requires thoughtful planning, clear goal-setting, and informed decision-making. In this article, we’ll explore how you can make your personal loan work for you—not against you—on your journey toward financial success.

Understanding the Role of a Personal Loan

A personal loan is an unsecured loan that provides you with a lump sum amount, which you can use for various purposes. It doesn’t require collateral, making it an accessible and flexible financial tool for salaried and self-employed individuals alike.

Unlike loans tied to specific assets like a car or house, a personal loan offers freedom in terms of usage. But with that freedom comes responsibility. To avoid unnecessary debt, it's important to use this financial tool wisely and align it with your life goals.

Common Financial Goals You Can Support with a Personal Loan

Aligning a personal loan with your goals starts with understanding what you truly want to achieve financially. Let’s explore some common goals and how a personal loan can support them:

1. Debt Consolidation

If you're juggling multiple credit cards or loans with high-interest rates, consolidating them into a single personal loan can simplify your finances. This reduces your EMI burden, lowers interest payments, and helps you regain financial control.

2. Higher Education

Whether it's a course for career advancement or a program for your child, education is one of the most valuable investments. A personal loan helps cover tuition, books, travel, or accommodation expenses without compromising your savings.

3. Home Renovation

Your home is a reflection of your lifestyle. A personal loan can help you modernize, repair, or upgrade your living space, increasing your property’s value and improving comfort.

4. Emergency Medical Expenses

Medical emergencies strike when least expected. A personal loan can provide immediate financial assistance to cover hospitalization, treatments, and post-operative care without draining your emergency fund.

5. Starting a Side Business

Dreaming of launching your own brand or side hustle? A personal loan can provide the seed capital for inventory, marketing, or equipment—turning your passion into profit.

Steps to Align Your Personal Loan with Your Financial Goals

To ensure your personal loan aligns with your long-term vision, follow these practical steps:

1. Define Your Financial Goals Clearly

Start by identifying what you want to achieve. Is it short-term (like paying off debt) or long-term (like starting a business)? Quantify your goals—know how much you need and by when. This helps in deciding the right personal loan amount and repayment term.

2. Evaluate Your Current Financial Situation

Before applying for a personal loan, assess your income, existing liabilities, and monthly obligations. This helps you determine how much EMI you can comfortably afford without disrupting your cash flow.

3. Choose the Right Loan Tenure

If your goal is short-term, like funding a vacation or a training course, a shorter repayment tenure may be ideal. For larger financial goals, like starting a business, a longer tenure can ease your monthly burden. Balance affordability with interest costs.

4. Compare Interest Rates and Offers

Interest rates can vary widely among lenders. Always compare personal loan options from banks, NBFCs, and digital lenders. A lower rate means more of your EMI goes toward principal repayment, helping you reach your financial goal faster.

5. Opt for Minimal Processing Fees and No Prepayment Charges

Hidden charges can eat into your loan amount. Look for a personal loan with low processing fees and flexible repayment options like prepayment or foreclosure without penalties.

6. Avoid Over-Borrowing

It might be tempting to borrow more than you need “just in case,” but this increases your repayment burden. Stick to the amount required to fulfill your specific financial goal and avoid impulsive spending.

Real-Life Example: Aligning a Personal Loan with a Career Goal

Consider Meera, a 28-year-old software developer who wanted to transition into data science. She needed ₹3 lakhs to enroll in a certification program abroad. Instead of dipping into her emergency fund, she took a personal loan for the exact amount with a 2-year repayment plan.

By doing so, she achieved two goals:

Invested in her professional growth

Managed her finances smartly without affecting her savings

Post-certification, Meera landed a higher-paying job, making it easy for her to repay the personal loan while also improving her financial future.

Mistakes to Avoid While Using a Personal Loan for Financial Goals

Even with the best intentions, missteps can derail your financial progress. Watch out for these common mistakes:

❌ Using a Personal Loan for Impulse Spending

Align your loan with a well-planned, necessary goal—not on unplanned shopping or luxury items that don’t yield long-term value.

❌ Ignoring Your Credit Score

A low credit score can lead to higher interest rates. Improve your score before applying to make the personal loan cost-effective.

❌ Choosing the Wrong Lender

Don’t accept the first offer that comes your way. Research lenders for transparency, reputation, and favorable terms.

❌ Failing to Plan for EMIs

Missing EMI payments affects your credit score and can result in penalties. Budget monthly payments from the start and set up auto-debit for timely repayments.

How Fincrif Helps You Make Smarter Loan Choices

At www.fincrif.com, we specialize in helping individuals like you make informed, confident financial decisions. Whether you're a first-time borrower or looking to refinance an existing loan, our platform enables you to:

Compare top personal loan providers

Calculate EMI with smart tools

Access curated guides and expert tips

Find offers tailored to your income, profession, and goals

Your financial success is just a well-planned personal loan away—and we're here to help you every step of the way.

Final Thoughts

When aligned with your aspirations, a personal loan transforms from a financial obligation into a stepping stone toward your dreams. Whether you're striving for career growth, financial freedom, or personal development, the right loan can offer the push you need.

But remember—borrowing is only wise when it's intentional. Define your goals, borrow responsibly, and stay committed to repayment. That way, your personal loan becomes not just a loan, but a powerful tool to achieve what matters most in your financial journey.

Ready to align your personal loan with your goals? Visit www.fincrif.com and explore tailored loan options that work for your dreams.

#nbfc personal loan#fincrif#bank#loan apps#loan services#personal loans#finance#personal loan online#personal laon#personal loan for financial goals#best personal loan#manage personal loan effectively#personal loan tips#personal loan planning#personal loan benefits#personal loan eligibility#financial goals with personal loan#how to use personal loan for debt consolidation#aligning personal loan with financial planning#personal loan for medical emergency#personal loan for self-employed#personal loan to achieve financial stability#benefits of personal loan in financial planning#personal loan interest rate comparison#financial goal setting tips#responsible borrowing personal loan

0 notes

Text

Discover the truth about $5000 personal loans in our in-depth blog post. Understand the hidden monthly costs and learn effective strategies to manage financial uncertainty. Whether you're considering a loan or already have one, gain valuable insights to make informed decisions. Click now to read more and take control of your finances!

#$5000 Personal Loans#Personal loan interest rates#Monthly payment calculation#Loan repayment strategies#Financial planning tips#Credit score impact#Loan application process#Managing loan payments#Debt consolidation#Budgeting for loans#Unsecured personal loans#Personal loan benefits#american#Hidden loan fees#Loan terms and conditions#Comparing loan offers#Fixed vs. variable interest rates

0 notes

Text

#retirement#benefits#business loan#personal loans#short term loans uk#loans#same day payday loans#mortgage#home loan#financial planning#finance

0 notes

Text

March 2025 Predictions – Rising Signs

Aries Rising

Mercury Retrograde in Aries (1st House) disrupts your communication, confidence, and decision-making. Expect delays in personal projects or confusion about your direction.

Venus retrograde in Aries makes you question relationships and self-worth.

Venus entering Pisces (12th house) shifts focus to private love, healing, or hidden matters.

Taurus Rising

Mercury Retrograde in Aries (12th House) stirs unresolved emotions, dreams, or past issues. Time for reflection, but don’t rush decisions.

Venus retrograde in Aries brings hidden love concerns or reevaluating self-worth in private.

Venus entering Pisces (11th house) improves friendships and long-term plans.

Gemini Rising

Mercury Retrograde in Aries (11th House) disrupts social connections, miscommunication in friendships, or delays in networking efforts.

Venus retrograde in Aries brings past friendships or old alliances into focus.

Venus entering Pisces (10th house) benefits career and public recognition later.

Cancer Rising

Mercury Retrograde in Aries (10th House) creates career confusion—revisit long-term goals instead of rushing ahead.

Venus retrograde in Aries brings work-related reevaluations or past professional connections.

Venus entering Pisces (9th house) supports education, spirituality, and travel.

Leo Rising

Mercury Retrograde in Aries (9th House) brings setbacks in legal matters, education, or travel. Be flexible.

Venus retrograde in Aries makes you rethink long-term vision and beliefs.

Venus entering Pisces (8th house) benefits deep emotional healing or financial partnerships.

Virgo Rising

Mercury Retrograde in Aries (8th House) affects loans, debts, and emotional connections—avoid major financial moves.

Venus retrograde in Aries may bring back old financial or relationship entanglements.

Venus entering Pisces (7th house) improves partnerships and romantic connections.

Libra Rising

Mercury Retrograde in Aries (7th House) brings miscommunication or uncertainty in partnerships.

Venus retrograde in Aries makes you reassess love and business connections.

Venus entering Pisces (6th house) supports health, work, and daily routines.

Scorpio Rising

Mercury Retrograde in Aries (6th House) disrupts work schedules, health routines, and productivity.

Venus retrograde in Aries has you reevaluating job satisfaction or workplace relationships.

Venus entering Pisces (5th house) boosts romance, creativity, and fun.

Sagittarius Rising

Mercury Retrograde in Aries (5th House) affects creative blocks, dating life, or children’s matters. Avoid impulsive decisions.

Venus retrograde in Aries brings past romantic interests or artistic revisions.

Venus entering Pisces (4th house) benefits home life and emotional stability.

Capricorn Rising

Mercury Retrograde in Aries (4th House) disrupts home plans, family discussions, or real estate matters.

Venus retrograde in Aries brings nostalgia, family tensions, or home redecorations.

Venus entering Pisces (3rd house) improves communication and sibling relations.

Aquarius Rising

Mercury Retrograde in Aries (3rd House) causes misunderstandings, tech issues, or travel delays.

Venus retrograde in Aries makes you rethink how you express love and ideas.

Venus entering Pisces (2nd house) improves financial stability.

Pisces Rising (2nd House)

Mercury Retrograde in Aries (2nd House)affects income, budgeting, and financial decision-making.

Venus retrograde in Aries makes you reassess what truly holds value in your life.

Venus entering Pisces (1st house) boosts confidence, attractiveness, and self-care.

Key Takeaway

March is a month of reflection. Especially in Aries-related areas. Mercury retrograde urges caution in decisions, while Venus retrograde prompts emotional and financial reassessments. By late March, Pisces energy brings healing and intuitive clarity.

#astrology observations#aquarius placements#astrology#astrology rants#astrology notes#cancer placements#capricorn placements#sagittarius placements#virgo placements#aries placements#pisces placements#libra placements#leo placements#taurus placements#gemini placements#scorpio placements#astrology predictions

40 notes

·

View notes

Text

Hate to do this, but if anyone can help

TL: DR - Due to a lot of financial strain this year and moving before we planned to with little notice, my cats and my family don't have money for groceries for the next few months. We just need to make it to January and we've been trying hard, eating as cheap as possible, not going out, no extra services, etc. Heck, I only have FFXIV because a friend was nice enough to help.

But now, we're out of money and next paycheck once we cover rent and bills, we'll have less than $30. And unfortunately, we need to eat.

So if anyone can help, I'd appreciate it. Anything. Thank you. <3

Below the read-more are the longer details. If anyone doesn't mind boosting or something, I'd be grateful.

More Details:

Basically, due to having to move at least a year sooner than expected with less than 60 days' notice, we've used up every bit of savings and resources we have. Plus, due to some other financial nonsense, including the past roommates being terrible and my spouse's work using loopholes to avoid paying him overtime, we're finally having a really rough time.

We can just cover rent and the minimal bills. Several months ago, we turned off anything we didn't completely need. That includes streaming services, games, and what have you. Heck, we wouldn't have kept on the internet if my spouse didn't need it for work.

We were just trying to hold on until New Year. The New Year means a mandatory raise for my spouse and his boss has promised it's a good one (due to several years of him getting the minimum under his previous boss who was fired for several reasons). So we've been just trying to make it and just have a few months left.

Unfortunately, with just a few months to go, we've basically maxed out all we can. The next step is trying to rehome my cats to remove the cost of maintaining them, although I hate to do it. I really don't want to. Pretty much every cat I have, I either rescued and/or raised from birth. But I'm certainly not going to let them starve or suffer.

I have been trying for months to get a job, but due to personal things and limited options (only one car with limited gas, etc.), I haven't been able to find anything. I keep sending out forms and not hearing much. Due to gas prices and such, I can't even do UberEats or Doordash or something. I'm at a loss and I feel completely useless in trying to help my spouse at the moment.

I really hate asking. My little Tumblr is just cute stuff with my character, aesthetics, and trying to be positive. I'm just really desperate because I don't know what else to do.

We've looked into state help, but I live in Texas and their "poverty line" is absolutely ridiculous. My spouse makes "too much" for us to get the benefits of any kind of help, even temporarily. Due to the crappy roommates, our credit isn't great and we're already struggling to pay off things so getting a loan is pretty much impossible.

I don't really have any skills that people would pay for commissions for. I'd be happy to do writing commissions or something, but I've never had much luck with that.

So, yeah, I just...I really need some help getting through the next 60 days or so. So if you've read all this, thank you. If you reblog, thank you. If you feel like giving anything, thank you. Even if it's just kind thoughts, I appreciate it so much.

Thank you from the bottom of my heart,

Bard

61 notes

·

View notes

Note

This is a bit of a silly question, but you honestly seem to know a lot about political, business, and economics, so I thought I would ask.

So I’m seventeen, soon to be applying to universities, but I’m already so disillusioned with the world. Like, don’t get me wrong, I still have hope in collective action and volunteering and voting and all that, it just makes me sad that the entire world has kind of gone to hell. I like english literature and I like history and I like studying them, so I used to hop to study both at uni. I wanted to get a job as a teacher, because I want to make a difference in the world and have more variety than a typical desk job.

However. Being on Tumblr since the age of thirteen has taught me that no matter how kind or good or hardworking one person is, or even a lot of people are, one politician can still screw things up for entire groups of people. I mean… a few politicians overturned Roe Vs Wade and that sort of thing. The disability benefits bank account thing. Politicians have an enormous amount of sway over the world, and that area seems to be where someone could make the most difference.

From what I’ve seen of a political science degree, I genuinely don’t think I would enjoy it much, but I could get through it. I want to make a difference in the world very badly — it’s the only sort of legacy I care about leaving behind. And I thought being a teacher could do that for me, but the scale of being a teacher and a politician are on entirely different levels, and Tumblr has really shown me that.

So I guess I’m just asking, since you seem to be passionate making the world better too. Do you think I should study politics, so that I can try and change things on a large scale? Or study what I love and make a much smaller impact.

I honestly don't think I'm the best person to ask this question. A lot of how I ended up where I am was a matter of luck, including the luck of having parents who let me live with them rent free while I put together some savings (and even while I was unemployed).

I don't know a whole lot about polisci. I was a business major and, honestly, that major did not come in useful when hunting for a job after college... partly because all the jobs it was a foot in the door for were uhhhhhh let's go with Not The Right Fit. Most polisci majors are... I guess probably pre-law and intending to become lawyers, and lawyers do in fact often become politicians, so there's that.

My first instinct is actually 'learn a trade and join a union.' The last few years have been pretty evidential of the impact that unions can still have on both the business world and politics in general: see the impact that UAW is having, at least in the media, on the presidential election. Unions are also a pretty solid option for local networking, which is pretty key when it comes to having an impact on local or regional politics. A trade job is also something that is in high demand, stable, and pays reasonably well in most places, including paid apprenticeships, so it would give you the financial stability to focus your free time on what you want instead of on stretching to pay the bills, or having to worry about student loans. It also gives you an expertise or specialty that you can then leverage as 'evidence' of understanding the working class as a unit when engaging in something like a town hall.

Being in a union or other local organization will also give you a more hands-on understanding of how politics and things like that work, as you'll have things like contract negotiations, union votes, and policy debates going on regularly.

If you aren't the kind of person who thinks they're a fit for trade work (I'm definitely not), then college might be the right fit! But I'd definitely consider going into it with a plan for how you want to impact the world. Look up some charities or impact organizations and see what it is that they need. A lot of places are looking for grants writers or financial coordinators, or just someone who can do the accounting. It's not glamorous, and it's not like you'll be held up as a hero the way a doctor in a warzone is, but keeping track of funds or writing letters requesting funding from the government, for something like Doctors Without Borders or Planned Parenthood or Coalition for the Homeless is still an important part of the process.

Local volunteer work is also often a lot more personally satisfying and requires less overhead, so more of the money goes directly into the community you want to help, e.g. the grant writers and accountants do need a salary in a huge organization, but a local soup kitchen can probably just hire someone from the local tax office once every few months and call it good. Doing volunteer work once a month, for a soup kitchen or a homeless shelter or summer childcare program, can make way more of an impact than maybe getting a position as a staffer for a politician you may not even like that much.

That said, if you think you're good at polisci, that you'd be good at law, or that you can get a different degree with polisci as a minor that would then help you enter politics directly... maybe college for polisci is the right choice for you. Maybe you have the finances to not worry about loans, you have parents that would be supportive, and you can find an effective position after you graduate.

I can't make that decision for you. If you have a guidance counselor and they're any good--not a guarantee, but let's hope--talk to them. If you don't have a guidance counselor, maybe find a trusted teacher, or a local librarian, something like that. I don't really know you or your situation well enough to tell you what to do, but hopefully I've given you something to think about.

49 notes

·

View notes

Text

Prompt about Wealth traps in Dubai

⸻

1. Lifestyle Inflation

• Trap: Many expats earn more in Dubai than in their home country, but overspend to “match” the city’s luxury vibe—cars, dining, designer goods, penthouses.

• Result: High income, low or no savings. Lifestyle creep eats away at financial freedom.

⸻

2. No Long-Term Benefits

• Trap: Dubai doesn’t offer pension plans or long-term benefits like in the West.

• Result: You’re fully responsible for retirement savings. Many expats leave with nothing despite years of earning well.

⸻

3. Debt Culture

• Trap: Easy credit—car loans, personal loans, and credit cards are aggressively marketed.

• Consequence: Non-payment = jail or deportation. UAE has strict debt laws—it’s not like defaulting in the U.S. or Canada.

⸻

4. Illusion of Tax-Free Wealth

• Trap: You don’t pay income tax, but high costs (housing, school fees, luxury lifestyle) eat into it fast.

• Reality: Many people save less than they would in a taxed country with a more modest lifestyle.

⸻

5. Expensive Real Estate

• Trap: Overpaying for property—either buying off-plan from developers or renting overpriced apartments in trendy areas.

• Issue: Real estate can be volatile in Dubai, with sharp crashes like in 2008 and 2020. Also, you don’t own land, just leasehold.

⸻

6. Visa Dependency

• Trap: Your visa is tied to your employer. Losing your job means you may have to leave the country within 30 days unless you find another sponsor.

• Impact: Uncertainty, lack of leverage when negotiating pay or contracts, and forced decisions if laid off.

⸻

7. Hidden Fees Everywhere

• Salik (toll), DEWA (utilities), service charges, “premium” health insurance, school fees, bank charges—all add up.

• Reality: Unless you track spending aggressively, Dubai can silently drain your income.

⸻

8. False Sense of Security

• Trap: People assume a luxurious lifestyle means financial stability.

• Reality: Many living in Marina or Downtown drive luxury cars but are 1-2 paychecks from financial disaster.

⸻

Smart Moves to Avoid the Traps:

• Live below your means—rent modestly, skip status symbols.

• Build an offshore emergency fund (Dubai banks aren’t always ideal for long-term savings).

• Invest independently—no public pension, so DIY investing is essential.

• Watch debt—never borrow more than you could repay quickly if needed.

3 notes

·

View notes

Text

Exploring AI's Benefits in Fintech

The integration of artificial intelligence (AI) in the financial technology (fintech) sector is bringing about significant changes. From enhancing customer service to optimizing financial operations, AI is revolutionizing the industry. Chatbots, a prominent AI application in fintech, offer personalized and efficient customer interactions. This article explores the various benefits AI brings to fintech.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer service in fintech. These tools provide 24/7 support, handle multiple queries simultaneously, and deliver instant responses, ensuring customers receive timely assistance. AI systems continually learn from interactions, improving their efficiency and effectiveness over time.

Superior Fraud Detection

Fraud detection is crucial in the financial sector, and AI excels in this area. AI systems analyze vast amounts of transaction data in real time, identifying unusual patterns and potential fraud more accurately than traditional methods. Machine learning algorithms effectively recognize subtle signs of fraudulent activity, mitigating risks and protecting customers.

Personalized Financial Services

AI enables fintech companies to offer highly personalized services. By analyzing customer data, AI provides tailored financial advice, recommends suitable investment opportunities, and creates customized financial plans. This level of personalization helps build stronger customer relationships and enhances satisfaction.

Enhanced Risk Management

AI-driven analytics significantly enhance risk management. By processing large datasets and identifying trends, AI can predict and assess risks more accurately than human analysts. This enables financial institutions to make informed decisions and manage risks more effectively.

Automation of Routine Tasks

AI automates many routine and repetitive tasks in fintech, such as data entry, account reconciliation, and compliance checks. This reduces the workload for employees and minimizes the risk of human errors. Automation leads to greater operational efficiency and allows staff to focus on strategic activities.

Advanced Investment Strategies

AI revolutionizes investment strategies by providing precise, data-driven insights. Algorithmic trading, powered by AI, analyzes market conditions and executes trades at optimal times. Additionally, AI tools assist investors in making better decisions by forecasting market trends and identifying lucrative opportunities.

In-Depth Customer Insights

AI provides fintech companies with deeper insights into customer behavior and preferences. By analyzing transaction history, spending patterns, and other relevant data, AI predicts customer needs and offers proactive solutions. This level of insight is invaluable for targeted marketing strategies and improving customer retention.

Streamlined Loan and Credit Processes

AI streamlines loan and credit approval processes by automating credit scoring and underwriting. AI algorithms quickly assess an applicant’s creditworthiness by analyzing various factors, such as income, credit history, and spending habits. This results in faster loan approvals and a more efficient lending process.

Conclusion

AI is transforming the fintech industry by improving efficiency, enhancing customer experiences, and providing valuable insights. As technology advances, the role of AI in fintech will grow, driving further innovation and growth. Embracing AI solutions is essential for financial institutions to stay competitive in this rapidly changing landscape.

8 notes

·

View notes

Text

Case files 13.01

CAT3RB4622-17092023-14032024

what I think happened in:

Case 13.01, the case of "The Zorrotrade App" or "Play stupid games, win stupid prizes: Cryptobro edition"

What we know about the Zorrotrade App:

It likely has no government oversight.

It does some weird background checks of new users.

It allows users to engage in highly profitable and borderline illegal financial exploits.

They have some shady experimental features that are not advertised, hidden under a tonne of submenus and must be found and opted in by the user. (Free will, babey).

They have an Adjustment Department.

What we suspect about the Zorrotrage App:

It's magic.

One of magical perks is protectingusers phone from being stolen;

One of magical cons is compulsive truth spell included in their support line answerphone.

Another magical con: the Adjustment Department.

So let's meet a Zorrotrade user. Darrien Laurel (account number 428813). He had no shame, no self-awareness and no sense of decency. Also not a shred of common sense.

He came from a poor family (though considering his definition of 'broke' I'm not sure if his parents were actually poor, or just 'won't buy me a porshe' 'poor'). He went to private public expensive high school thanks to a scholarship, which – props to him, for this thing and this thing only. Boo to anything else he did with his life.

After school he took student loan, and instead of spending in on studying, he sunk it all in financial speculations (This has to be illegal, right? Aren't there stipulation in the contract about the permissible uses of the loan?) He used every trick in the book (specifically, the "book of things that are shady as fuck and are only technically legal because rich people benefit from them"). Shorting (and possibly indirectly bankrupting) startup companies and trading in cryptocurrency among them.

He used the funds he acquired this way for the ever so important business of impressing his former classmates, getting plastic surgeries, and buying excessive and excessively expensive shit. (Your suitcase does not have to cost a 1000 dollars, you prick). (Why are you buying in dollars, anyway? Did you have that imported from USA? Use pounds or euros like a proper European, asshat).

Then, in 2020, a tragedy: while he was peacefully sailing with his good friend Oli somewhere south of France, one bad investment left him broke – that is to say, just with a few thousands worth of clothes on his back (and in his 1000$ suitcase) (and the watch on his wrist) (and just a few thousands of savings to throw away on a whim).

Truly, a more devastating blow has never been dealt to anyone in human history.

This is when he discovered that his rich 'friends' really did hate him all along. More importantly, he discovered the experimental feature on his favourite app, "Personal Projection Short Selling". There were no instructions, but by stroke of bad decisions and bad luck (blindly investing most of his remaining money + getting drank + braking his friend's TV, and getting kicked out of Oli's yacht, + getting kicked in the face by some muggers respectively) Darrien worked out that it was functionally a wager against his own good fortune.

Another entry into Things that Darrien Did Not Have: a drop of self-preservation.

Imagine stumbling into an illegal casino in an alleyway somewhere, winning your first game by chance, and immediately deciding to start playing there every night, with loaded dice, winning a lot and occasionally getting caught and getting your teeth kicked in.

Darrien did this, but he skipped a few steps. His new business plan went like this:

Put in a wager that he'll have a Bad Day.

Arrange to get seriously hurt and/or destroy one of your relationships, therefore having a Bad Day and winning the wager.

Profit

He spent several weeks knocking around the south of France, purposefully getting into fights (arguments with friends and brawls with strangers both) and accidents. He was getting harmed and isolated and felt it was all worth it because he got paid every time.

I'm going to give him a pass on never questioning how this worked, because at this point I'm fairly sure it's influence off the app itself. It's not constant supernaturalsurveillanceyou're looking for /Jedi hand-wave/ It's perfectly normal for your life's misfortunes to be monetizable. /Jedi hand-wave/ It's all good! Chill! /Jedi hand-wave/

What I can't just hand-wave is Darrien's grand finale. His famous One Last Job, then I Retire I Promise.

He 'invested' a million pounds (£ 1 000 000), burned all the bridges with his family, friends and even strangers on the internet, and then jumped off a cliff. A literal, honest to gods, not metaphorical cliff.

Sir. SIR. There's gambling with your life, and then there's this.

He lost one leg, along with structural integrity of several pretty important internal organs and bones – and he was happy upon waking, because he was (doped up on painkillers) already counting the money he was surely going to get.

Alas, reality check – this was the Find Out part of his ultimate round of Fuck Around.

He loaded his dice, he stacked his deck, he used his cheatcodes – it was only a matter of time before somebody noticed and demanded refund. (somebody knew all along – they were just waiting for the stakes to be really worth it).

This time, the app did not pay up. This time, the app called foul and demanded that he pay up – or be Adjusted.

Predictably, Darrien Laurel was not happy with this outcome and he wanted to Speak to the Manager of this Application.

He called the support line. He threatened the answerphone with legal consequences. (now they hear you). He told the answerphone his life story, up to and including his current hospitalization. (now they know you). And at the end, almost as an afterthought, he said his full name and app account number. (now they own you).

The answerphone dutifully transferred the call to adjustments department. Somebody from adjustments department crawled out of the phone and onto Darrien's bed. The call got disconnected. Darriel Laurel… got Adjusted.

Well. That sure was something. Final thoughts:

Remember when I yelled about Fae rules in case file 05-01? Do not take their money food, do not give them your name. Darriel broke those rules, and just look what happened! Well,

we don't actually know what happened. My first knee-jerk reaction was to say 'he got eated', but Personal Adjustment sounds… much more painful than just death by Mrs. Spider's mandibles. (I keep calling her that, but for some reason my mental image of that last scene is a weird metal centipede skittering out of the phone speaker that's much too small to fit it). I wonder if we'll meet Darriel, or at least some of him, again somewhere down the line. (Would he be like Needles, or more like Not-Arthur?) The incident happened about 6 month prior to Sam hearing it. Is that enough time for a new unholy abomination to incubate? Or… ripen? Whatever the 'adjustment' process entails.

This is the third time we've seen a man changing their fortune through pain. And we know it's possible to game the system successfully, because the 19th century violinist did it – he died of old age, more or less satisfied with his life. Mr. Die and Darrien could never. (Smh. Kids these days. No patience, no self-discipline).

This is… how many times now that we've seen someone's body being transformed? {Not-Arthur, RedCanary (? missing eyes at least), Daria(? - partial, self inflicted), Dr. 'Jasmine bush' Samuel, Cinema Tom(? - potentially), Needles(?), Mr. Bonzo(?), Error(?), Crypto Darrien} That's 3 up to 9, I think. Something definitely likes to play play-do with human flesh.

#the magnus protocol#tmagp case files#tmagp case 13.01#tmagp 13#Zorrotrade#ep. written by Alexander J. Newall#ep. written by A.J.N+J.S.#Personal Adjustment#Darriel Laurel#Mrs. Spider#so many connections#Can somebody find my some red string? I gave away mine.#tmagp

9 notes

·

View notes

Note

Pls tell me more about ur news experience while protesting the Ford gov and their shitty choices?

I was going to UofT at the time when the ford government gutted OSAP, the ontario student aid program for those out of the know. They converted all grants into loans and no longer gave money to cover living expenses, and they struck down the 6 month grace period ontario students had after graduation to find well-paying jobs before their repayment started.

For the americans here, i should contextualize that student loans in canada do not at all work like they do in the US. We take out loans from a combination of the federal government (known as NSLSC loans) and our provinces of residence specifically. When we apply, we fill out our financial info including our income and if we are considered an "independent" student or not, the legal definition of which differs depending on your province of residence. The main difference being that independent students dont include their parents' incomes when they first apply, theyre considered their sole and only breadwinner. Depending on that income and a few other personal points, you get a combination of loans and grants that cover both tuition and partial living expenses, and when you graduate, the federal government takes all your loan and income info and doles you out a personalized regular payment plan so you have it completely paid off after 10 years if you follow it. And you have 6 months after you graduate uni to find a job and get settled where you don't pay anything. Theres also other options if you still cant pay like the repayment assistance program that freezes your payments entirely if you prove youre below a certain wealth bracket, but thats the gist of it.

Now that everyone knows the context i can tell the story. The ford government of ontario circa 2019 decided that ontario university students dont need living expense coverage, that it would universally be loans regardless of any low income status, and that the post-grad grace period wasnt necessary. And being in one of the most expensive cities in the country, that was not going to fly with my peers.

I personally took out my provincial loans from alberta student aid that has all those benefits, so the OSAP gut didnt actually affect me at all, but injustice is still injustice even if it doesnt affect me, so i joined the student protests against the ford government that people were bussing in from the other side of the province to attend. At some point along the line, other folks noticed that i was comfortable around the news cameras and my main strengths were in public speaking, so when cameras were around asking for interviews i was pushed in front of them a lot to be trusted to explain our grievances and goals without getting noticeably hotheaded, so i did a lot of live interviews for CTV and citynews toronto during those few months.

And they were kinda right to do that. Im really good at interviews and public speaking and arguing points in general, and not the best at more hands-on things when it comes to activism. And like, you do need PR people to get support for a cause, contrary to what a lot of tumblr users seem to think. Like you need people whose jobs are to present your grievances and reasons for marching in a way that presents you as respectful and worth listening to and considering the points of. So that was mainly my role in those protests. I dont know if you can still easily find those interviews buried in their broadcast archives but if you want to look for me be my guest

7 notes

·

View notes

Text

Why People Take Personal Loans Even When They Don’t Need Them

In today’s financially empowered world, the personal loan has become more than just a tool to bridge emergencies—it's often seen as a convenient financial strategy. Interestingly, many individuals opt for a personal loan not because they are in urgent need of funds, but because they recognize the strategic advantages it offers.

So why would someone take a personal loan when they don’t really need the money? Let’s explore this surprising trend, its psychological roots, and the smart financial moves behind it.

1. Building or Improving Credit Score

One of the top reasons people take a personal loan without an immediate need is to improve or diversify their credit profile. A personal loan adds an installment-type credit to your report, which balances out revolving credit like credit cards.

When paid on time, a personal loan can boost your credit score. For those planning a large loan (like a home loan) in the future, taking a personal loan and managing it well can improve their creditworthiness significantly.

2. Debt Consolidation Even Without Stress

Sometimes, people aren't in a financial crunch, but they might have multiple debts spread across credit cards and other sources. Taking a personal loan helps consolidate debt into a single EMI at a lower interest rate. Even if they can handle the payments, having just one due date and often a lower overall interest is reason enough to opt for a personal loan.

It’s a proactive, strategic move rather than a reactive one.

3. Taking Advantage of Low Interest Rates

In times of favorable interest rates, many borrowers view personal loans as an opportunity to access cheap credit. Let’s say someone doesn’t currently need ₹5 lakhs—but if they qualify for a personal loan at just 10% interest and believe they can generate better returns elsewhere, they might take it anyway.

They might invest the funds in fixed deposits, mutual funds, or even business ventures. The idea is simple—borrow low, earn high.

4. Emergency Fund Cushion

For some, a personal loan acts as an emergency fund. Rather than waiting for a rainy day and applying for a loan under pressure, they apply when their profile is strong, ensuring they get the best terms. This fund might sit in their savings account untouched—but knowing it’s there brings mental peace.

Having that financial cushion is a reason enough for many to proceed with a personal loan, even if they hope to never use it.

5. Financial Discipline Training

This may sound surprising, but some people use a personal loan as a tool to discipline themselves financially. Regular EMIs encourage structured budgeting. For those who are new to managing finances or want to prepare themselves before taking larger loans (like car or home loans), handling a small personal loan can be great practice.

It builds the habit of budgeting, timely repayments, and planning around EMIs.

6. Taking Advantage of Pre-Approved Offers

Banks and NBFCs frequently offer pre-approved personal loans to eligible customers. These offers usually come with competitive interest rates and flexible terms. Some people grab these opportunities simply because they're available at favorable terms, even if they don’t urgently need the money.

It’s often easier to get a loan when you don’t need one. Ironically, waiting until you actually need it might mean facing rejections or higher interest rates.

7. To Fund Opportunities, Not Emergencies

We often associate personal loans with solving financial crises, but what about seizing opportunities? Many take a personal loan to invest in something that won’t come around again—say, a limited-time online course, an early-bird travel deal, or a discounted business tool.

They may not "need" the money in the traditional sense, but they use it to unlock long-term value.

8. Psychological Comfort and Preparedness

Financial stress isn’t always about current problems. It’s often about the fear of future problems. Some people take personal loans as a proactive measure to calm that anxiety. Having money in hand—whether they spend it or not—makes them feel in control.

Especially in uncertain economic climates, a personal loan can provide emotional security. It might seem irrational to an outsider, but for the borrower, the peace of mind is worth it.

9. Leveraging for Business Cash Flow

Entrepreneurs and freelancers often face cash flow gaps. They might not be in a cash crunch today, but they anticipate lean months ahead. Rather than waiting for stress to build up, they take a personal loan in advance to maintain operations smoothly.

Even if they don’t use the entire amount immediately, they know it will help navigate slower income periods without disrupting their business.

10. Loyalty Benefits and Better Credit Access Later

Some borrowers know that loyalty matters. By taking and repaying personal loans on time, they strengthen their relationship with lenders. This can result in better offers and faster approvals in the future.

They’re playing the long game—taking a personal loan today to unlock better credit options tomorrow.

Is It a Good Idea to Take a Personal Loan Without Needing It?

This depends on your financial goals, repayment capacity, and discipline. If you’re using a personal loan strategically—like building credit, consolidating debt, or investing—it can be a powerful tool. However, it's essential to avoid impulsive borrowing just because funds are available.

Remember, every loan comes with repayment responsibilities. Make sure you’re not borrowing just to spend.

Tips Before Taking a Personal Loan Without Immediate Need

Assess Your Repayment Capacity – Ensure you can comfortably manage EMIs alongside existing obligations.

Check the True Cost – Factor in interest, processing fees, and GST. Don't let “low EMI” mislead you.

Avoid Unnecessary Temptation – Don’t take a personal loan just to splurge. Use it for strategic reasons.

Keep the Loan Secure – If you’re not using the funds right away, park them in a separate account.

Maintain a Healthy Credit Mix – Use this as an opportunity to strengthen your credit profile, not weaken it.

Final Thoughts

The personal loan is no longer just a lifeline for emergencies—it's becoming a flexible, strategic financial product. From improving credit scores to leveraging low interest rates, there are multiple valid reasons why people choose to take personal loans even when they don’t urgently need them.

If done wisely, a personal loan can be an asset instead of a liability. But the key lies in responsible borrowing. Know your reasons, plan your repayments, and always borrow with intention—not impulse.

At FinCrif.com, we’re here to help you understand how personal loans work and when they’re truly beneficial. Stay informed, borrow smart, and build a secure financial future—whether you need the money today or just want to be ready for tomorrow.

#loan apps#finance#fincrif#nbfc personal loan#personal loans#loan services#personal loan online#bank#personal loan#personal laon#loans#personal finance#reasons to take a personal loan#benefits of personal loan#pre-approved personal loan#personal loan for credit score improvement#personal loan for debt consolidation#low interest personal loan#using personal loan for investment#emergency fund personal loan#personal loan for business#psychological reasons for taking a personal loan#strategic borrowing#financial planning with personal loan#personal loan advantages#credit building with personal loan

0 notes

Text

Cash Advance in Quebec: Fast Financial Relief for Short-Term Needs

For Quebec residents needing quick cash to cover unexpected expenses, a cash advance can offer fast access to funds. This short-term financial solution is designed to help manage urgent costs like medical bills, car repairs, or utility bills, providing you with immediate cash when you need it most.

Here’s what you need to know about cash advances in Quebec, including how they work, requirements, benefits, and some important considerations before you apply.

What Is a Cash Advance?

A cash advance is a short-term loan that provides immediate funds, usually repaid on your next payday or within a few weeks. In Quebec, cash advances are often offered by payday lenders and online loan providers, making them accessible and convenient for those facing temporary cash flow issues.

How Does a Cash Advance Work?

Application: You can apply online or at a cash advance location in Quebec. The application typically requires basic information like your ID, proof of income, and bank details.

Approval Process: Cash advances don’t usually require a credit check, so approvals are quick, often within minutes.

Funding: Once approved, the funds are sent to your bank account, sometimes within hours through e-Transfer or direct deposit.

Repayment: The loan amount plus any fees is usually due on your next payday. Some lenders may offer flexible repayment options for a slightly longer term.

Benefits of Cash Advances in Quebec

Quick Access to Funds: Cash advances are ideal for emergencies, as they provide immediate funds without lengthy approval times.

No Credit Check Needed: Most cash advance providers don’t perform a credit check, making them accessible to people with low credit scores.

Flexible Usage: You can use a cash advance for a wide range of expenses, from car repairs to last-minute travel.

Easy Online Applications: Many Quebec lenders offer online applications, allowing you to apply from the comfort of your home.

Requirements for Getting a Cash Advance in Quebec

To qualify for a cash advance, lenders generally require:

Proof of Income: Regular income, such as employment income, government benefits, or pension funds.

Canadian Bank Account: A bank account for direct deposit and repayments.

Government-Issued ID: Proof of identity and Quebec residency.

Contact Information: A valid phone number and email address.

Things to Consider Before Taking a Cash Advance

While cash advances provide immediate financial relief, there are a few important considerations:

High Fees and Interest: Cash advances often come with high fees. In Quebec, payday lenders can charge up to $15 per $100 borrowed, which can add up quickly.

Short Repayment Period: Repayment is typically due on your next payday, which can be challenging if you don’t have enough cash flow to cover the loan.

Risk of a Debt Cycle: Repeatedly relying on cash advances may lead to a cycle of debt. Borrow only what you need and plan to repay on time.

Tips for Using a Cash Advance Responsibly

Borrow Only When Necessary: Use a cash advance only for urgent expenses that can’t be postponed.

Budget for Repayment: Make sure you’ll have sufficient funds to repay the loan on time to avoid additional fees.

Explore Other Options First: If possible, consider alternatives like personal loans, borrowing from family or friends, or using a credit card cash advance if it’s more affordable.

Understand the Terms: Be clear on the fees, interest rate, and repayment schedule before agreeing to the loan.

Alternatives to Cash Advances in Quebec

Credit Union Loans: Many credit unions in Quebec offer short-term loans at lower interest rates than payday lenders.

Installment Loans: These loans allow for longer repayment periods and may offer better terms than cash advances for those who qualify.

Credit Card Cash Advance: While credit card cash advances have high interest, they might still be cheaper than payday loans if paid off quickly.

Community Assistance Programs: For essential expenses, check if any local resources or assistance programs in Quebec can help.

Frequently Asked Questions (FAQs)

1. Can I get a cash advance with no credit check in Quebec?Yes, most cash advance lenders don’t require a credit check, focusing instead on your income and ability to repay.

2. How much can I borrow with a cash advance?Cash advance amounts typically range from $100 to $1,500, depending on your income and the lender’s policies.

3. How quickly can I receive the funds?Many lenders offer same-day or next-day funding, particularly if you apply online.

4. Are cash advances expensive?Yes, cash advances come with high fees due to their short-term nature. In Quebec, the maximum fee allowed is $15 per $100 borrowed.

5. What happens if I can’t repay my cash advance on time?If you’re unable to repay on time, contact your lender. Many lenders offer extensions, but they usually come with additional fees. Avoid defaulting, as it could negatively impact your financial situation.

Cash advances in Quebec provide a quick financial solution for short-term needs, but they come at a cost. While they can help in emergencies, it’s essential to borrow responsibly, considering both the repayment terms and potential alternatives. By planning carefully, a cash advance can provide the immediate relief you need without compromising your financial stability.

3 notes

·

View notes

Text

Buying back CHIPS

The only way to stop public money from being siphoned off to shareholders and top executives

ROBERT REICH

SEP 24

Friends,

One of my goals in writing this letter is to expose where government needs to take a stronger hand to safeguard the public interest from corporate avarice.

I applaud the economic policies of the Biden-Harris administration, which have abandoned the neoliberal claptrap of former Democratic administrations and come down on the side of working people.

But I also want those policies to work. The administration’s commendable goal of reviving America’s semiconductor industry by subsidizing new chip factories in the United States is today endangered by the increasing likelihood that those subsidies will enrich big shareholders and CEOs rather than strengthen our semiconductor industrial base.

So far, nearly $30 billion in federal CHIPS grants have been awarded, with the grants going to 11 semiconductor producers.

But the major goal of these producers is not to revive America’s semiconductor industry. It’s to raise their share prices. Most of these producers have spent billions buying back their shares of stock in order to do just that.

As I’ve emphasized in previous letters to you, stock buybacks increasingly are being used by corporations to satisfy Wall Street’s insatiable demand for higher share prices.

But every dollar the semiconductor producers spend on buybacks is a dollar not spent on innovation for long-term competitiveness.

This contradiction between the public interest in a strong American semiconductor industry and corporate interests in high stock prices creates a significant risk that public subsidies in the CHIPS Act will be siphoned off to shareholders and top executives through stock buybacks.

Taxpayer money should not be used to boost share prices and CEO pay. Recipients of this money should not be allowed to engage in stock buybacks.

The first CHIPS grant of $35 million went to BAE Systems in June 2023. At the time, BAE was in the midst of a $2 billion stock buyback; another nearly $2 billion in stock buybacks has been authorized by BAE’s board.

Intel, America’s largest homegrown producer of semiconductors and already the recipient of $8.5 billion in CHIPS money has been authorized by its its board to buy back a further $7.24 billion of its own shares of stock. (Meanwhile, the administration has promised Intel nearly $20 billion in grants and loans.)

Intel spent $30.2 billion on buybacks between 2019 to 2023. It also assured investors last year that the company remained committed to delivering “very healthy” dividends.

All told, semiconductor producers now in line for $30 billion in public subsidies spent more than $41 billion on stock buybacks between 2019 and 2023.

Their CEOs — whose compensation packages are larded with stocks and stock options — have every incentive to continue pumping up their own corporations’ stock prices with buybacks.

According to a recent report from the Institute for Policy Studies and the Americans for Financial Reform Education Fund, CEOs whose corporations have entered into preliminary CHIPS agreements with the government hold more than $2.7 billion worth of stock in their companies ($306 million on average). They therefore stand to personally benefit from buybacks.

CHIPs money is being distributed to these corporations by the Commerce Department. Secretary of Commerce Gina Raimondo has given personal assurances that “CHIPS money is not a subsidy for big companies … for stock buybacks or to pad their bottom line.” The Department has stated that when awarding grants, it will give preference to companies who commit to not engage in stock buybacks.

But none of the companies receiving CHIPS subsidies has publicly committed to suspending their existing stock buyback plans.

The Commerce Department has only asked applicant corporations to detail their plans for stock buybacks over five years. (These applications and the subsequent agreements are not public.)

Moreover, it’s relatively easy for big corporations to shift money among units or subsidiaries to obscure buybacks, especially if other corporations buy parts of them or if outside private equity investors control parts of their operations.

Intel is a case in point. The chipmaker Qualcomm is now considering buying parts of Intel’s design business and possibly its foundry unit. And the giant private equity firm Apollo Management is likely to make a big investment in Intel (Apollo has already bought a stake in Intel’s chip-manufacturing operation in Ireland).

Given the increasing pressure from Wall Street and CEOs to use stock buybacks to boost share prices, the administration must ensure that public subsidies improve the semiconductor manufacturing base and do not merely enrich shareholders and CEOs.

How do do this? My humble advice to the Secretary Raimondo and the Biden-Harris administration: Bar all semiconductor producers who receive government subsidies from making stock buybacks. Make the prohibition explicit in all final CHIPS subsidy contracts.

2 notes

·

View notes

Text

Former U.S. Rep. George Santos is expected to plead guilty to multiple counts in his federal fraud case, according to a person familiar with the matter.

Santos, a Republican from New York, is expected to enter the plea at a court hearing planned for Monday on Long Island, the person said.

The person could not publicly discuss details of the plea and spoke to The Associated Press on condition of anonymity.

Messages were left seeking comment from Santos and three lawyers representing the former congressman.

The court hearing was scheduled for Monday afternoon after prosecutors and Santos’ lawyers jointly requested one on Friday. They also sought and received a delay in certain pre-trial deadlines.

The news comes just weeks before jury selection was set to begin on Sept. 9. Santos has previously pleaded not guilty to a range of financial crimes, including lying to Congress about his wealth, collecting unemployment benefits while actually working and using campaign contributions to pay for personal expenses such as designer clothing.

Among the charges Santos faces are wire fraud, theft of public funds, money laundering and aggravated identify theft.

Prosecutors recently told the judge that the trial could last three weeks because they expected to call at least three dozen witnesses, including some victims of Santos’ alleged crimes.

Santos has previously maintained his innocence and called the investigation a “witch hunt,” claims that prosecutors called “baseless” in a recent court filing. But in December, when prosecutors said plea negotiations were ongoing, Santos said in an interview at that time that a deal was “not off the table.”

Asked if he was afraid of going to prison, he said: “I think everybody should be afraid of going to jail, it’s not a pretty place and uh, I definitely want to work very hard to avoid that as best as possible.”

Earlier this week, Judge Joanna Seybert rejected Santos’ request that potential jurors fill out a written questionnaire gauging their opinions of him. His lawyers argued in court filings it was necessary because “for all intents and purposes, Santos has already been found guilty in the court of public opinion.”

Lawyers for the government had also been seeking to admit as evidence some of the lies Santos made during his campaign. Before he was elected in 2022 to represent parts of Queens and Long Island, he falsely claimed to have graduated from both New York University and Baruch College and that he had worked at top Wall Street firms.

Two campaign aides to Santos have already pleaded guilty to crimes related to the former congressman’s campaign. Last October, his ex-treasurer, Nancy Marks, pleaded guilty to a fraud conspiracy charge and implicated Santos in a scheme to embellish his campaign finance reports with a fake loan and fake donors. A lawyer for Marks said at the time his client would be willing to testify against Santos if asked, saying she had been “mentally seduced” by Santos.

A month later, Sam Miele, a former fundraiser for Santos, pleaded guilty to a federal wire fraud charge, admitting he impersonated a high-ranking congressional aide while raising campaign cash for Santos.

The New York Republican was expelled from Congress in December after an ethics investigation found “overwhelming evidence” he had broken the law and exploited his public position for his own profit.

2 notes

·

View notes

Text

The Rich Rule Over the Poor!

In today’s culture, debt is often viewed as a normal part of life. Whether it’s taking out student loans, financing a car, or relying on credit cards to cover expenses, many people are accustomed to borrowing money. But financial expert Dave Ramsey warns against this mindset, drawing from a biblical principle found in Proverbs 22:7: “The rich rule over the poor, and the borrower is servant to the lender.” For Ramsey, this verse serves as a profound warning about the dangers of debt and a call to pursue financial freedom.

Debt as Modern-Day Slavery

When discussing debt, Ramsey doesn’t mince words. He often refers to debt as a form of modern-day slavery. Just as a servant is bound to their master, someone in debt is bound to their lender. Each month, a portion of their hard-earned income is already spoken for—sent off to pay for past purchases, often with interest. This, according to Ramsey, is a form of bondage.

People in debt often lose their ability to make decisions based on what’s best for their future because their past borrowing controls their present and future income. As Ramsey puts it, being in debt means you’ve sold your freedom to the lender. The greater the debt, the less freedom you have to make choices that align with your goals and dreams. Instead, you’re working to satisfy the demands of the creditor.

The Stress and Anxiety of Borrowed Money

Debt isn’t just a financial burden; it’s also an emotional one. Ramsey frequently highlights the stress that debt can cause. The fear of missing a payment, the anxiety of mounting interest, and the constant juggling of bills can take a heavy toll on a person’s mental and emotional well-being. This stress doesn’t just stay confined to finances; it often spills over into relationships, health, and overall life satisfaction.

In fact, studies show that financial stress is one of the leading causes of marital conflict. When debt becomes overwhelming, it can lead to arguments, resentment, and even divorce. Ramsey is quick to point out that eliminating debt can significantly reduce stress and create a more peaceful home life.

Achieving Financial Independence

One of Ramsey’s core messages is that avoiding debt is key to achieving financial independence. When you live debt-free, your income is yours to control, rather than being obligated to a creditor. This financial freedom allows you to save, invest, and plan for the future in ways that aren’t possible when you’re tied down by debt.

Ramsey advocates for a lifestyle of living within your means, which is the opposite of the “buy now, pay later” mentality that’s so prevalent today. He encourages people to delay gratification, save for major purchases, and build an emergency fund to avoid going into debt when life’s unexpected expenses arise. By doing so, individuals can protect themselves from falling into the debt trap and remain in control of their financial future.

Biblical Wisdom for Modern Money Management

Dave Ramsey’s teachings are deeply rooted in biblical principles, and Proverbs 22:7 is one of the cornerstones of his philosophy. Ramsey believes that the Bible offers timeless wisdom on money management, and that following these teachings can lead to a more peaceful and prosperous life.

In addition to avoiding debt, Ramsey emphasizes other biblical principles like generosity, wise stewardship, and contentment. He believes that by applying these principles, individuals can achieve both financial peace and spiritual fulfillment. For Ramsey, financial success isn’t just about accumulating wealth—it’s about using money in a way that honors God and benefits others.

From Borrowing to Building Wealth

One of the most powerful shifts that can occur when you move from borrowing to building wealth is the change in mindset. Ramsey teaches that wealth-building begins once you stop borrowing money. When you’re not sending payments to creditors every month, you have the freedom to invest in your future.

This is where Ramsey’s famous Baby Steps come into play. He encourages people to start by building a small emergency fund, then aggressively paying off all their debt (except for their mortgage), and finally moving on to saving for the future and giving generously. These steps are designed to help people break free from debt and begin building lasting wealth.

Conclusion: Choosing Freedom Over Bondage

Proverbs 22:7 serves as a powerful reminder of the dangers of debt. Dave Ramsey’s teachings on this verse challenge the cultural norm that debt is inevitable or even desirable. Instead, Ramsey encourages us to choose financial freedom over financial bondage.

By avoiding debt, living within our means, and applying biblical principles to our finances, we can break free from the slavery of debt and achieve true financial independence. It’s not an easy journey, but as Ramsey often says, “If you live like no one else, later you can live like no one else.”

#Debt-Free Living#Financial Freedom#Dave Ramsey#Proverbs 22:7#Money Management#Biblical Finance#Financial Independence#Personal Finance#Avoid Debt#Wealth Building#Debt Slavery#Living Debt-Free#Financial Peace#Budgeting Tips#Debt Relief#Emergency Fund#Financial Stress#Christian Finance#Money and Faith#Baby Steps#new blog#today on tumblr

1 note

·

View note

Text

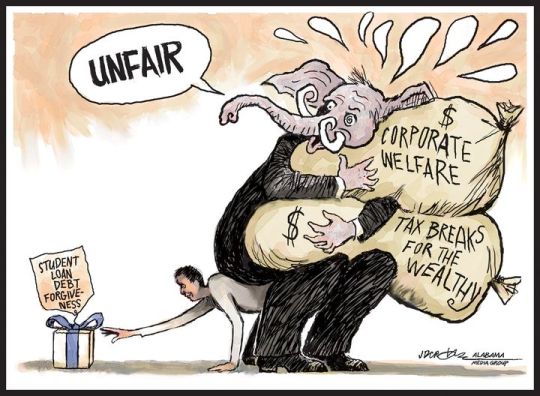

J.D.Crowe

* * * *

The Opus Dei court's unmistakable message to college students: you don't share our politics, so screw you. The Supreme Court on Friday struck down President Joe Biden’s signature initiative to cancel student loan debt for more than 40 million Americans. The Higher Education Relief Opportunities for Student Act of 2003 (HEROES) program would have forgiven eligible borrowers of up to $20,000 each, costing some $400 billion overall, but it was blocked by an appeals court in October. The justices were split on the decision 6-3, with the conservative majority saying the president—and his secretary of education—do not have the authority to unilaterally act without congressional approval. “The Secretary asserts that the HEROES Act grants him the authority to cancel $430 billion of student loan principal,” Chief Justice John Roberts wrote in his majority opinion. “It does not. We hold today that the Act allows the Secretary to ‘waive or modify’ existing statutory or regulatory provisions applicable to financial assistance programs under the Education Act, not to rewrite that statute from the ground up.”

In making his case, Roberts cited former House speaker Nancy Pelosi, noting that the California Democrat said in July 2021 that people “think that the President of the United States has the power for debt forgiveness. He does not. He can postpone. He can delay. But he does not have that power. That has to be an act of Congress.” The case hinged on one’s particular reading of the HEROES Act, with Republicans largely interpreting the version of the act passed by Congress as not allowing for Biden’s debt relief plan. The majority of Democrats, however, argued that the act clearly gave Biden all the leeway he needed to cancel student debt. “Congress authorized the forgiveness plan (among many other actions); the Secretary put it in place; and the President would have been accountable for its success or failure,” Justice Elena Kagan wrote in her dissent for the court’s liberal wing. “But this Court today decides that some 40 million Americans will not receive the benefits the plan provides, because (so says the Court) that assistance is too ‘significant.’” Indeed, Kagan argued, “The Court’s first overreach in this case is deciding it at all.” She also noted that there was “nothing personal in the dispute here.”

[The Daily Beast]

#debt forgiveness#Daily Beast#corrupt SCOTUS#Student loans#J.D.Crowe#political cartoon#debt relief plan

12 notes

·

View notes