#advisor for health savings accounts

Explore tagged Tumblr posts

Text

Steps on How to Find Your Own Health Insurance

Having health insurance is a vital part of protecting yourself and those you love. Healthcare costs continue to rise each year, and in many areas, a medical emergency can end up costing a tremendous amount of money. Without some form of health insurance in place, you may find yourself facing financial hardship as a result of a medical concern, and many Americans deal with mounting medical bills each year.

Thankfully, finding health insurance isn’t all that difficult. Below are some simple steps to take if you want to get the protection you deserve:

1. Talk to Your Employer

The first step in obtaining health insurance is to see if your employer provides access to insurance as a workplace benefit. Many employers provide health insurance coverage, and your employer will likely cover all or most of the cost of the policy.

If you’re under the age of 26, you can still take part in a parent's health insurance policy. Health insurance after age 26 is available as either an individual plan or as a group plan through an employer. When looking for health insurance after age 26, talk with your doctor first to make sure they will be covered by any policy provider you’re considering working with.

2. Select a Plan

When selecting a health insurance plan, consider your specific needs. If you’re younger, you may not have as many ongoing healthcare concerns that need to be paid for, but things can change as you get older.

Chronic healthcare conditions cannot disqualify you from obtaining health insurance, and you may also consider using the federal government’s healthcare exchange to look for a plan in your area that meets your needs. Private insurance plans may offer better coverage options, but this will depend on your budget and your state.

3. Understand Your Payments

Health insurance coverage generally requires a monthly premium to be paid to keep coverage current. If your plan is made available through your employer, they will generally take a portion of your paycheck to cover your premium. If you have a private plan, you will need to make payments independently. Lastly, understand your deductible. This is the amount you will need to spend on medical costs before your health insurance benefits apply toward your medical bills.

Read a similar article about monthly cost of health insurance here at this page.

#new years financial resolutions#best hsa accounts#health insurance after age 26#hsa benefits administration platform#hsa tax benefits#health savings account administration#advisor for health savings accounts

0 notes

Text

People Represented in each House

Including niche examples

1H

Yourself, your persona. You as an individual. Your role models (projection of your ideal self)

2H

Business partners, business collaborators, acting/modelling/any agency you are under. Podcasters you listen to, literal social media influencers, salesman, your self esteem mentors,your real estate agent, your savings coach, your bank, your stockbroker

2H includes people who influence how you earn money. 2H represents people who can influence your personal values and your self esteem E.g a Ben Shapiro to a politically curious individual, the kardashians to a teenage girl. 2nd house can also represent people involved in the maintenance, acquisition and management of your possessions and finances

3H

Your siblings, your neighbours, your relatives like extended family, peers and acquaintances like the people in your class you know of but don’t talk to enough to say they’re your friend, peers, acquaintances, colleagues/coworkers, professors, educational teachers, speaking coach, language teacher

3H is related to intellectual pursuits, learning, just all forms of intellectual development, mercury sits well here. It’s about the people who you interact with daily as they influence your way of communication The individuals here would influence your communication style, interests and knowledge

4H

Your mother (mother figure if you don’t have a mother), your parents but particularly your mother figure, the collective of your whole family, ancestors, caregivers, people that live in your house like your flatmates, your housemates, housekeepers, butlers

4H represents the physical home, the mother, familial connections, nurturers etc. so the people here would be the ones living in it and those who have influence in your domestic life

5H

Your children, your inner child, you as a parent, your nieces, your nephews, romantic partners (short term), artistic partners E.g co-writers, collaborators, people involved in your projects, your students, your mentees, your investors, your hook up partners, people who you gamble or just play games with.

5H represents children, creativity, your mentoring to others, gambling, fun, joyful light love affairs, it’s also ruled by Leo. So we have these people involved with these themes

6H

Coworkers, colleagues, employees, staff (individuals who work under you or provide a service to you), your doctor, your contractors, your nurses, your teammates, your healthcare providers, your therapist, your career coach, your internship mentor, your assistants, your service providers, your pets, your gym colleagues, your fitness instructor, your nutritionist, your organiser, your HR department, your vet

6H represents work environment, daily routines, service, health and well-being, these are the people that you find under that setting

7H

Romantic partners, your spouse, life partner, your closest friends, confidants, allies, your supporters, your business partners, anyone you form a pact with, your clients, your customers (the kind you engage with in professional settings), your lawyers, your legal team, your competitors, your opponents, your matchmaker, your wedding planner, your relationship therapist

7H ruled by Libra represents all relationships that also includes bad ones btw, business relationships, marriage, 7H represents companions, partnerships, professional relationships, legal matters, professional representation so the people that fall under this house would be those that build relationships with you

8H

Financial partners/advisors, therapists, inheritors, beneficiaries (who you inherit from), occult teachers, your intimate long term sexual partners, your accountant, your councillors, your psychologist, your insurance agents, your estate planners, your morticians

8H is associated with death, sex, psychology, transformation, joint resources etc. and so these are the kind of people that 8H would represent

9H

Your professors, your teachers, your spiritual leaders, your priest, your pastor, your favourite scholars, your favourite philosophers, your lawyers, your judges, your legal advisors, your authors, your educational materials, your foreign friends, your foreign connections.

alike to 3H in education but 9H rules higher education so it’s an octave higher than 3H in terms of the teachers associated with it. 9H also represents justice and law so it would include people that work in this field that you encounter

10H

Your father, your boss, your mentor, your manager, people of authority, your parents (father in particular), influential figures you look up to, e.g your fave celebrities, government, politicians, your PR team, your publishers, you as a role model, your admirers like the people who look up to you, influencers, your business, icons

10H association with self-image and reputation and classic Saturn authority would include those who are involved in those themes

11H

Friends, peers. Social activists, humanitarians, philanthropists, inventors, forecasters, visionaries, leaders, community organisers, trendsetters

different from 3H in the sense that with 11H friends, you actually share the same goals and interests in mind whereas with 3H it’s mostly an exchange of communication about these parts of yourself and they are less as significant in your social life compared to 11H type of friends

12H

Spiritual beings, your religion, spiritual forces, your subconscious mind, artists, creative people, writers, hospital patients, prisoners, monks, religious people, volunteers, dreamers, charities.

12H represents those that can derive what is within their inner secluded world and bring it into reality. It’s associated with empathy, mental/spiritual state, seclusion and the bed. The people here would be those that would retreat, help others and tap into realms beyond the physical)

#astro placements#astro notes#astro posts#astrology#astrology observations#1st house#2nd house#3rd house#4th house#5th house#6th house#7th house#8th house#9th house#10th house#11th house#12th house#learning astrology#astro community#astro observations#people in the houses#what each house represents#houses in astrology

1K notes

·

View notes

Note

Any tips on saving money?

Track your income/expenses. Knowing your monthly cash flow + essential and discretionary spending is the only sound starting point toward setting your financial goals.

Evaluate your non-essential spending habits. Consider where this money is going, and whether these expenses add value/are necessary to your life (pleasure or peace of mind is an acceptable "necessity" if you're living within your means to be clear!).

Determine the money you have left over after you cover your essential expenses and most fulfill discretionary expenses. This amount is your "saving/investment" money.

Divide your leftover amount into 3 categories: Emergency fund, goal-oriented savings (like buying a desired luxury item/furniture, a down payment on a house, a vacation, etc.), and investments.

Put your savings in a high-yield savings account. If possible, have different accounts for each purpose, especially your emergency fund and savings for future purposes. You can also get a CD for a long-term savings goal.

Put your investments (in the USA at least) in the following buckets: Roth IRA (max it out), ALWAYS take your employer's full 401k match, HSA (if you have a high-deductible health insurance plan), and S&P 500 index funds/other evergreen mutual funds + blue-chip stocks.

Purchase fewer, higher-quality items. Know the sales seasons for each product category and shop around this calendar (down to the produce items in season). If possible, rent items when it makes sense.

Only say "yes" to plans/financial obligations that add value/pleasure to your life. Don't let yourself feel shortchanged financially or emotionally. It's never worth it, honestly.

Invest in your physical, mental, and financial health first. This can mean something different for everyone but it's important!

**I'm not a professional, just another young woman on the internet, so please take this advice accordingly. Please meet with a financial advisor/CPA for formal advice and personal financial planning.

Hope this helps xx

221 notes

·

View notes

Text

Author: Collective Action Topics: austerity, australia, health care

The Abbott government is busy laying the groundwork for a massive attack on the conditions of the working class in April’s federal budget. In charge of preparing the ground is Abbott’s hand-picked Commission of Audit. In the line of fire: Medicare and your right to access a GP. The plan: Rob $750 million from Australia’s poorest whilst giving $5.9 billion dollars to private health insurers.

The Commission of Audit

The Commission of Audit is an assortment of business lobbyists and Liberal party mates. The Commission is headed by Tony Sheppard, president of the Business Council of Australia (BCA) and (until October) chairman of Transfield services. As head of the BCA he argues for lower taxes, abolition of the fair work act, and various attacks on the social wage. As chairman of Transfield Services, he profited from mining, coal, and up to $180 million in government contracts for the operation of refugee prisons in Nauru.

Commission member Peter Boxall is a former Chief of Staff to Peter Costello, who spent time working for the IMF during the “structural adjustments” of the 1980s, and played a key role in implementing John Howard’s “Work Choices”.

Amanda Vanstone joins this disreputable bunch bringing her experience as a Howard government minister responsible for attacks on the unemployed, students, and pensioners, the abolition of the Aboriginal and Torres Strait Islander Commission (ending any semblance of self-determination, as flawed as that body was) and of course, the imprisonment of many thousands of refugees.

What’s in a co-payment?

The first shot across the bow aimed in the new attack on Medicare was fired by former Abbott advisor Terry Barnes of the Australian Council of Health Research (ACHR). The ACHR is a “think tank” funded by Australian Unity, a health insurer with a lot to gain from any attack on Medicare. Barnes published a paper to coincide with the election of the Abbott government which called for the private health insurers dream – compulsory upfront fees for Australians utilising Medicare.

Barnes wants a six dollar Medicare “co-payment”. His argument is that poor Australians go to the GP too often, and that an additional six dollar upfront fee would send a “price signal” that would harmlessly discourage over use of GPs. Barnes claims that his proposal would save the Medicare budget $750 million over four years.

But a six dollar GP tax is not the only health co-payment that Australians are already slugged with. Australians already pay “out of pocket” for a raft of health care services. There is no dental care coverage under Medicare leaving most Australians unable to see a dentist unless they can pay upfront. There a significant “gaps” between the cost of services and what is covered by Medicare, and access to medical specialists routinely involves significant upfront expense for Australians on Medicare.

The effect of all of this is frightening. Co-payments fund 17% of health care in Australia. One in six dollars of health care expenditure in Australia is not covered by any insurance, public or private, and is instead forked out directly by those who can afford it least. In the United States, so often denounced for its backward and regressive healthcare system, co-payments only account for 13% of health expenditure.

And the Liberal government is gearing up to whack another six dollar charge on top of this. Far from sending a harmless “price signal”, a six dollar co-payment is a brutal measure that would reduce access to GPs by those who need them most, and already use them least.

Under Utilisation

The idea that Australia’s poorest over use GP services is both obnoxious and untrue. Terry Barnes is on the record as saying that a six dollar upfront payment would not stop anyone who is truly sick from attending a GP, as this only represents the price of “two cups of coffee”. Anyone who thinks six dollars is nothing has never attempted to live on the minimum wage, let alone the dole, family payments or a pension, in Australia.

Australian workers already make choices between rent, food and health care on a weekly basis. Cost already dissuades Australia’s poorest from accessing medical services when they need it.

Current research on working class Australian’s use of health care already shows that “poorer people are already under-utilising healthcare, and their rate of under-utilisation corresponds to their level of illness”. Mapping health care use against average income in Australia already shows that people living in Australia’s poorest neighbourhoods are “three times more likely to delay medical consultations than those living in the wealthiest suburbs”.

The highest use of GP services in Australia, and the highest concentrations of GPs, are not where people are poorest, or where people are sickest (which coincidentally is where people are poorest), but rather where people are wealthiest. The richest use GP services the most, there are more GPs in wealthier suburbs, and Australia’s wealthiest are less likely to fall ill and die young.

Being poor and working class, attempting to live on a shitty wage or poverty level pension, is a major health hazard in Australia. The wealthiest 20% of Australians live an average six years longer than those of us surviving in the ranks of the poorest 20%.

Health Cash for big business

We’re told that Medicare costs too much. A six dollar copayment, effectively a tax levied disproportionately on Australia’s poorest and sickest, might save the health budget $750 million over four years. But there is one area of health spending bloat that the Abbott government will never touch. This year alone the government will spend $5.4 billion subsidising private health insurance.

The private health insurance rebate is an enormous transfer of wealth from tax payers to private, profit oriented health insurers, such as the one funding Terry Barnes’ sick attack on what remains of universal healthcare in Australia.

The private health insurance rebate was meant to make private health insurance more affordable by keeping premiums low. Introduced in 1999, this massive payment to health insurers has occurred at the same time that average health insurance premiums have risen 130%. Average prices (inflation) in the same period have only risen 50%.

The justification for this massive rort was that subsidising private health insurance would save money in the long run by reducing costs to Medicare. The most recent analysis shows that this $5.4 billion subsidy does little to shift costs from Medicare, and its abolition would save the government at least $3 billion a year.

Conclusions

The class self-interest of the government’s health policy is blatant: Tax the poor, throw money at the rich. The so-called Commission of Audit is stacked with the same big business cronies and Liberal mates who have always attacked the conditions of working class Australians, and now they are coming for what remains of Australia’s public health system. If the health budget is unsustainable, and the poorest really do have to be slugged with an additional six dollar GP tax, it is only because the government continues to throw bucket loads of money at private health insurers. The truth is that private health insurers want Medicare dismantled, so that more Australians are forced into their health insurance rackets, paying ever greater premiums for a diminishing health service.

#healthcare#medicare#health care#medicine#science#australian politics#anarchism#anarchy#anarchist society#practical anarchy#practical anarchism#resistance#autonomy#revolution#communism#anti capitalist#anti capitalism#late stage capitalism#daily posts#libraries#leftism#social issues#anarchy works#anarchist library#survival#freedom#austerity

7 notes

·

View notes

Text

The Importance of Accounting and Finance Education in Today's World

In a fast-paced and ever-evolving global economy, the fields of accounting and finance play a crucial role in sustaining both business and personal financial health. From small startups to multinational corporations, the need for skilled financial professionals is evident. At the Ancrifintech Institute of Taxation (AIT), we’re committed to equipping students with practical knowledge and expertise to thrive in this dynamic field.

Why Accounting and Finance Skills Matter

Whether you’re running a business, managing personal investments, or planning for future growth, a solid understanding of accounting and finance fundamentals can be life-changing. Here's why:

Informed Financial Decisions: Knowledge of financial principles empowers individuals and businesses to make better financial decisions, reducing risks and maximizing returns.

Job Market Demand: As the economy grows more complex, so does the demand for accounting and finance professionals. Many roles, from tax advisors to financial analysts, require specialized training.

Personal Financial Management: Beyond professional applications, financial literacy is vital for personal wealth management. It helps individuals understand budgeting, saving, and investment principles, leading to greater financial security.

How AIT Prepares You for Success

AIT offers a variety of courses designed to meet the needs of both beginners and seasoned professionals. Here’s what makes our programs stand out:

Comprehensive Curriculum: Our programs cover essentials like tax laws, accounting principles, financial analysis, and short-term courses tailored for today’s industry needs.

Experienced Faculty: AIT’s faculty members are experts in their fields, bringing real-world experience to the classroom and ensuring students learn the latest industry practices.

Practical Approach: We emphasize hands-on training, case studies, and practical exercises, enabling students to apply concepts immediately in their work environments.

Flexible Learning Options: Our short-term and finance-focused courses make it easy for working professionals to gain new skills without a long-term commitment.

Building a Strong Future with AIT

Choosing AIT means joining a community dedicated to the success of each student. As industries grow and change, we continuously update our courses to align with the latest standards and trends. By providing quality education, AIT empowers individuals to meet the challenges of a rapidly evolving financial landscape.

Whether you’re looking to enhance your career or start fresh in the field, AIT is here to help you achieve your goals. Discover the Ancrifintech Institute of Taxation difference, and take the first step toward a brighter financial future today!

3 notes

·

View notes

Text

Millennials Money Tips for Personal Finance

It is very difficult for millennials to manage their own finances today as the world of competition requiring one to workout harder has changed in a matter of months. From student loan debt to increasing living costs, this generation has faced financial struggles that are all its own. Nevertheless, there are strategies out there that can work for the millennial in search of sustainable financial security or even just a better bottom line. Below are a few of the basic personal finance tips for millennials.

1. Set Clear Financial Goals

The first step in any financial plan is establishing specific and attainable goals. Whether it's to buy a home, pay off your student loans, or save for retirement — knowing what you're working towards will keep you more engaged and inspired. Divide your goals into short-term (one to two years), medium-term (three to five years) and long-(five or more). This approach helps you to prioritize and use your resources accordingly.

2. Create and Stick to a Budget

The Facet of Financial Management: Budgeting Track your income and expenses: The very first step is to track how much you are earning, after that what things consume your bills? Budgeting tools; you may use an app to categorize what you spend on and where they can be reduced. If possible, adhere to the 50/30/20 rule — apportion half of your funds towards needs and twenty percent for saving or repaying debt.

3. Build an Emergency Fund

It is only a rainy day fund to act as an emergency safety net in case life decides not to follow your plan. The hopefully three to six months of absolute must-have sequestered in a separate, liquid account. It can help you with the cost of surprising expenses–whether they be medical bills or it lets you maintain your financial schedule, rather than having a huge hole in it due to car repairs.

4. Manage Debt Wisely

For many millennials, student loan debt can be a large financial weight. Start your payoff journey with high-interest debt — credit card balances are a solid place to begin. Refinance or consolidate student loans at a lower interest rate. Establish and Maintain a HISTORY of consistent on-time payments to improve your credit score, reducing overall debt.

5. Invest for the Future

If you want to create wealth then investment is the most important thing for it. If your employer offers a matching 401(k) plan, that is what you should start with. Demand more investment options like IRAs, Stocks and Mutual Funds. Simply Diversify A toasted way to diversification! The point is that, your money should earning with compounding.

6. Enhance Financial Literacy

One can be really good at making informed decision which is backed by financial literacy. Use online sources, books and courses to learn more about personal finance. Understanding concepts such as interest rates, inflation and investment options can help you make more informed financial decisions.

7. Plan for Retirement

Architecting retirement: It is never too early to plan for retirement. Save a minimum of 15% of your income toward retirement. Make use of Roth IRAs and traditional IRA tax-advantaged accounts. You may want to talk with a financial advisor who can help you put together your own retirement plan based on what you hope for in retirement and how much risk you are willing to take.

8. Protect Your Assets

But while it may not be the sexiest asset class around, insurance is integral to any complete financial plan. Make sure of health, auto and and home insurance coverage. Good idea: If you have dependents, consider life insurance. Disability insurance provides you income in the event of an illness or injury.

9. Check Your Credit Score

Great credit can unlock lower-interest rates and financial possibilities. Review your credit report on a regular basis for inaccuracies and work towards building up the score. By paying your bills on time, keeping credit card balances low and only opening new accounts when you need them (and therefore improved scores so long as other key factors don't weigh in ).

10. Seek Professional Advice

If you are unsure of where to begin or need help, then speak with a financial advisor. They can give you advice and even consult with you to build a financial plan as well. Also look for a good pedigree — Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

With these personal finance tips, a millennial can move forward in the financial journey feeling more secure for their future. Earning money is only part of the process… its mastering discipline, consistency and continuous learning that leads to long-term financial success.

#millionaire#millionarelifestyle#investing#investment#personal finance#startup#business#entrepreneur#economy#mindset#luxury#luxurious

3 notes

·

View notes

Text

How Financial Advisors Can Be Your Key to Financial Security

In today's complex world of investments, financial planning, and wealth management, achieving financial security can be a daunting task. As you navigate the path to financial stability and prosperity, a financial advisor can be your key to success. These professionals offer expertise, guidance, and personalized strategies to help you meet your financial goals and secure your future. Here's how a financial advisor can play a crucial role in your journey toward financial security:

Tailored Financial Planning: Financial advisors begin their work by understanding your unique financial situation, goals, and risk tolerance. They craft a personalized financial plan that aligns with your objectives, whether it’s saving for retirement, buying a home, funding your children’s education, or building an emergency fund.

Investment Management: A significant aspect of financial security is growing your wealth through smart investments. Financial advisors can help you build a diversified investment portfolio that balances risk and reward while aiming to maximize returns. They also monitor and adjust your investments as market conditions change, keeping you on track toward your long-term goals.

Retirement Planning: Planning for retirement can be complex, but a financial advisor can simplify the process. They can help you understand different retirement account options, estimate your retirement expenses, and develop a strategy to ensure you have enough savings to maintain your desired lifestyle in retirement.

Tax Efficiency: Effective tax planning can save you money and boost your financial security. Financial advisors work to minimize your tax liability by leveraging tax-advantaged accounts, investment strategies, and other tax-efficient planning techniques.

Debt Management: If you’re struggling with debt, a financial advisor can provide strategies to pay down your balances while maintaining a healthy financial outlook. They can help you prioritize debt payments and create a plan to eliminate high-interest debt efficiently.

Risk Management: Financial advisors help you assess and manage risks that can impact your financial security, such as unexpected health issues, loss of income, or property damage. They recommend insurance products like life, health, and property insurance to protect you and your loved ones from unforeseen events.

Estate Planning: Proper estate planning ensures that your assets are distributed according to your wishes and minimizes potential taxes and legal issues for your heirs. Financial advisors can help you create or update your will, trust, and other estate planning documents.

Accountability and Support: Working with a financial advisor provides you with accountability and support as you work toward your financial goals. They can help you stay disciplined, make informed decisions, and adjust your plans as needed.

Navigating Life Transitions: Life is full of changes, from starting a family to changing careers or facing unexpected challenges. Financial advisors can guide you through these transitions, helping you adjust your financial plan and investments to accommodate new circumstances.

Peace of Mind: Ultimately, having a financial advisor gives you peace of mind. Knowing that you have a professional watching over your financial well-being allows you to focus on enjoying life and pursuing your dreams without the stress of financial uncertainty.

In conclusion, a financial advisor can be an invaluable partner on your journey to financial security. By providing personalized guidance and strategic planning, they help you achieve your financial goals and navigate life’s financial challenges with confidence. Consider working with a financial advisor to secure a brighter financial future for you and your loved ones.

3 notes

·

View notes

Text

This overview of the history illustrates the pervasiveness of “belief perseverance,” the psychological tendency to maintain a belief despite clear and strong new evidence that should challenge it, especially in the context of institutional incentives that favor inertia and resistance to change. In an era of amazing scientific advances, with very rapid vaccine development following virus sequencing obtained in a few days, the very slow acceptance of critical new knowledge reminds us that the human aspects of science remain as pervasive as they were in past eras.

The persistence of the droplet paradigm may have been aided by several other reasons. First, even if the mechanism is incorrect, it still works reasonably well to reduce infection from airborne diseases, especially less contagious ones that mostly transmit in close proximity. Distance from an infectious person will always increase the dilution of exhaled air and reduce such transmission. Unfortunately, major systematic problems arise when a true empirical fact (distance reduces transmission) is used to reach the incorrect conclusion (the mechanism is spray-borne droplets), and then, the incorrect mechanism is used to deduce what other measures may be protective. For example, during the COVID-19 pandemic billions of dollars were spent putting up lateral plexiglass barriers in schools to block droplet projectiles (even though such barriers have actually been shown to increase SARS-CoV-2 transmission29) rather than opening the windows or wearing masks. Second, spray-borne droplets are relatively easy to protect against, just keep your distance and wash hands and you should be quite safe. It thus provides simple rules to communicate to healthcare workers and the general population. Third, it removes the intense fear that airborne transmission can cause, and that has been associated with it throughout history. The historical fear often appears to be rooted in the more phantasmagorical conception of airborne transmission: The infected air can reach a person anywhere, and there is little that one could do to protect oneself from it. Critically, the logic leading to the fear did not account for the importance of dilution, and the feasibility of using it to reduce transmission. The irrational fear caused by this lack of understanding is paralyzing and creates real-world problems for controlling disease transmission, as summarized, for example, in the above quotes from Cornet and Chapin: Either people just gave up, or extreme measures were needed such as treating tuberculosis patients like lepers. Fourth, given that strict airborne transmission prevention measures can be costly or unavailable at large scale in healthcare facilities (e.g., negative pressure rooms in hospitals), there was a reluctance of public health organizations to declare a widespread virus such as SARS-CoV-2 during the pandemic as airborne, out of fear of the budgetary, legal, and labor consequences. Governments also seemed content to promote measures that only require personal responsibility, such as handwashing, and were much more reluctant to explain airborne transmission clearly as it would require costly actions on their part, for example, to improve ventilation and filtration in public buildings. Finally, a desire to save face by some authorities may have also played a role. They had emphatically declared airborne transmission of SARS-CoV-2 to be “misinformation,” and it could be embarrassing to subsequently acknowledge the importance of airborne transmission, which may perhaps qualify as one of the largest errors in the history of public health. In the private words of a public health advisor to a national government, “an approach is needed that will allow [us] to save face.”

interesting paper about how/why authorities incorrectly identified COVID as a non-airborne disease, exacerbating the pandemic and spreading misinfo about protective measures

7 notes

·

View notes

Text

Mastering Your Finances: A Roadmap to Long-Term Financial Health

Introduction

Achieving financial stability is a crucial step toward a secure and stress-free life. Effective financial management enables you to avoid debt, save for the future, and make informed investment decisions. In this comprehensive guide, we will explore practical tips and strategies to help you master your finances and achieve long-term financial health.

Section 1: Building a Strong Financial Foundation

A solid financial foundation is akin to the bedrock of a grand architectural marvel. Without it, the structure above cannot stand tall and resilient against the test of time.

Spend Less Than You Earn The cornerstone of financial stability lies in the principle of spending less than you earn. Much like the conservation of energy, where output should not exceed input, your financial health thrives when your expenditures are less than your income. Begin by meticulously tracking your expenses. Utilize tools like budgeting apps or a simple spreadsheet to categorize and monitor every dollar spent. Create a budget that aligns with your financial goals, allowing you to live within your means and avoid unnecessary debt.

Emergency Fund An emergency fund serves as your financial safety net, a buffer against life's unpredictable events. Aim to save 3-6 months' worth of living expenses in an easily accessible account. This fund acts as a safeguard, ensuring you can navigate unexpected expenses, such as medical bills or car repairs, without derailing your financial progress. The importance of this fund cannot be overstated, as it provides peace of mind and stability in turbulent times.

Section 2: Investing Wisely

Investing is the art and science of making your money work for you. However, like any scientific endeavor, it requires careful research, understanding, and strategic planning.

Understand Before You Invest Before diving into the world of investments, take the time to understand the various options available. Whether it's stocks, bonds, real estate, or other assets, each investment vehicle comes with its own set of risks and rewards. Conduct thorough research and consider seeking advice from a financial advisor. Their expertise can provide valuable insights and help you make informed decisions.

Don't Invest More Than You Can Afford to Lose A cardinal rule in investing is to never put at risk more money than you can afford to lose. Diversification is your ally in mitigating risk. Spread your investments across different asset classes and sectors to minimize the impact of any single investment's poor performance. This approach, known as diversification, enhances the stability and potential growth of your portfolio.

Section 3: Managing Debt Effectively

Debt, if managed wisely, can be a tool for growth. However, if left unchecked, it can become a burden that stifles financial progress.

Good Debt vs. Bad Debt Not all debt is created equal. Good debt, such as student loans or mortgages, can be considered investments in your future. They often come with lower interest rates and have the potential to increase your earning power or net worth. Conversely, bad debt, like high-interest credit card debt, can quickly spiral out of control. Focus on paying off high-interest debt first to free yourself from its financial stranglehold.

Debt Reduction Strategies There are several effective strategies for reducing debt. The snowball method involves paying off your smallest debts first, providing a psychological boost as you eliminate balances one by one. The avalanche method focuses on paying off debts with the highest interest rates first, saving you money on interest over time. Consider consolidating your debt into lower-interest loans or credit cards to make your payments more manageable.

Section 4: Boosting Your Income

Increasing your income is a proactive approach to achieving financial goals faster. It provides additional resources to save, invest, and pay off debt.

Side Hustles and Freelancing In today's gig economy, opportunities for side hustles and freelance work abound. Whether it's driving for a rideshare service, offering consulting services, or starting an online business, additional income streams can significantly enhance your financial situation. This extra income can be directed towards debt reduction, savings, or investments, accelerating your journey towards financial stability.

Investing in Yourself Your most valuable asset is yourself. Investing in your education and skills can have long-term benefits for your career and earning potential. Consider taking courses, attending workshops, or gaining certifications in your field. Continuous personal and professional development not only enhances your employability but also opens doors to higher income opportunities.

Section 5: Reducing Expenses and Saving Money

Reducing expenses is akin to tightening the bolts on a well-oiled machine. Every bit of savings contributes to smoother financial operations and long-term stability.

Cutting Unnecessary Costs Take a critical look at your spending habits and identify unnecessary expenses. Cancel subscriptions you no longer use, cook at home instead of dining out, and find ways to save on utilities and other monthly bills. Small changes in your spending habits can accumulate into significant savings over time.

Smart Shopping Adopt smart shopping strategies to maximize your savings. Compare prices, use coupons, and take advantage of sales to save money on everyday items. By being a savvy shopper, you can stretch your dollars further and make your budget work more efficiently.

Conclusion

Achieving financial stability requires a combination of smart spending, wise investing, and proactive debt management. By following these tips and staying committed to your financial goals, you can build a secure future and achieve long-term financial health. Remember to stay informed, adapt to changing circumstances, and celebrate your progress along the way.

Additional Resources

Consider consulting a financial advisor for personalized advice and guidance.

Utilize budgeting and investment apps to track your progress and stay on top of your finances.

Continuously educate yourself on personal finance and investing to make informed decisions.

In the grand tapestry of life, your financial health is a thread of paramount importance. With knowledge, discipline, and strategic planning, you can weave a future of stability, security, and prosperity.

Call to Action

Are you ready to take control of your financial future? Join our community at [Your Blog Name] for more in-depth articles and resources on financial management, investing, and achieving financial freedom. Don't forget to subscribe to our YouTube channel, [Unplugged Financial], where we dive into the history of money, explore the current financial landscape, and discuss how Bitcoin can revolutionize the financial world. Together, we can navigate the path to financial independence and create a brighter future.

Stay Connected:

Visit our blog: Bitcoin Revolution

Subscribe to our YouTube channel: Unplugged Financial

Let's learn, grow, and achieve financial freedom together!

#FinancialFreedom#MoneyManagement#InvestingTips#DebtFreeJourney#PersonalFinance#Budgeting#FinancialAdvice#SmartInvesting#EmergencyFund#SideHustles#FinancialStability#WealthBuilding#CryptoRevolution#Bitcoin#FinancialLiteracy#MoneyMatters#SaveMoney#IncreaseIncome#FrugalLiving#FinancialGoals#financial education#financial empowerment#financial experts#cryptocurrency#digitalcurrency#blockchain#finance#unplugged financial#globaleconomy

5 notes

·

View notes

Text

How to Help Your Family Wealth Last for Generations

Suppose you have accumulated significant wealth and want to pass it on to your heirs. In that case, you may wonder how to ensure they use it wisely and responsibly. After all, you want to make sure your hard-earned money is well-spent by the next generation.

Fortunately, some strategies can help you preserve and protect your family's wealth for generations. Here are some tips to consider:

Communicate your values and expectations.

One of the most important things you can do is to have open and honest conversations with your family members about your values, goals, and expectations regarding money. Share your story of how you built your wealth, what challenges you faced, and what lessons you learned. Explain how you want your wealth to benefit your family and society. Encourage your heirs to ask questions, express their opinions, and share their aspirations.

Communicating your values and expectations can help your family develop a shared understanding and appreciation of your wealth. You can also foster a culture of trust, respect, and responsibility among your family members.

Educate and mentor your heirs.

Another critical strategy is to educate and mentor your heirs on financial literacy and stewardship. Teach them the basics of budgeting, saving, investing, and philanthropy. Help them develop the skills and knowledge to manage their finances and make intelligent decisions. Provide them with opportunities to practice and apply what they learn, such as giving them an allowance, involving them in family business decisions, or supporting their entrepreneurial ventures.

Educating and mentoring your heirs can help them become confident and competent in handling money. You can also instill in them a sense of purpose and gratitude for the wealth they inherit.

Establish a governance structure.

A third strategy is establishing a governance structure for your family's wealth. This involves creating a formal framework for how your wealth will be distributed, managed, and monitored over time. For example, you can set up a family office, a trust, a foundation, or a combination of these entities. Also, appoint a board of directors, a trustee, an advisor, or a committee to oversee the operations and performance of these entities.

By establishing a governance structure, you can ensure that your wealth aligns with your values and objectives. You can also provide clarity, accountability, and transparency for your family members.

Seek professional guidance.

A final strategy is to seek professional guidance from experts specializing in estate planning, tax planning, investment management, philanthropy, and family dynamics. These professionals can help you develop a comprehensive program that addresses your unique needs and goals. They can also help you navigate the complex legal, financial, and emotional issues that may arise when transferring wealth across generations.

By seeking professional guidance, you can benefit from the expertise and experience of others who have helped families like yours achieve their legacy goals. You can also avoid costly mistakes and pitfalls that could jeopardize your wealth or cause conflicts among your family members.

Prepare for an excellent wealth transfer.

According to some estimates, over $68 trillion will be transferred from baby boomers to their heirs over the next 25 years. This is the most sizable intergenerational transfer of wealth in history. If you are part of this excellent wealth transfer, you must prepare yourself and your family for this momentous event.

One way to prepare is to assess your estate plan regularly and update it as needed. Ensure that your wills, trusts, beneficiary designations, powers of attorney, health care directives, and records are current and reflect your wishes. Consider using strategies such as gifting, charitable giving, life insurance, annuities, or trusts to reduce taxes or protect assets from creditors or lawsuits.

Another way to prepare is to involve your heirs in the planning process. Share your intentions and expectations for how they will inherit and use the wealth with them. Discuss with them the potential challenges and opportunities that come with inheriting wealth. Help them understand their roles and responsibilities as stewards of the family legacy.

By preparing for the excellent wealth transfer, you can ensure that your wealth will be transferred smoothly and efficiently to the next generation. You can also help your family avoid common pitfalls such as overspending, mismanagement, or disputes.

This blog post helps you implement ways to help your family's wealth last for generations. If you need more assistance with this topic, please contact me at (816) 551 - 7961 or visit my website at www.legacywealthjoy.com. I would love to hear from you and help you achieve your legacy goals.

References

"Important Steps for Proper Retirement Planning." Personal & Business Banking - Banks in Delaware, www.wsfsbank.com/help-guidance/knowledge-center/important-steps-for-proper-retirement-planning. It was accessed on 20 July 2023.

3 notes

·

View notes

Text

Retirement Planning: Securing Your Golden Years

Introduction

Retirement planning is a critical aspect of financial stability and ensuring a comfortable life during your golden years. While it may seem distant, the earlier you start planning, the better prepared you'll be. In this guide, we'll delve into the intricate details of retirement planning, covering everything from setting financial goals to investment strategies. Get ready to embark on a journey towards a secure retirement.

Retirement Planning Essentials

Setting Clear Financial Goals Retirement planning begins with setting clear financial goals. Ask yourself how much you'll need to maintain your desired lifestyle post-retirement. This includes housing, healthcare, and leisure activities. Create a detailed budget to estimate your future expenses accurately.

Creating a Retirement Timeline Establishing a retirement timeline is crucial. Determine when you'd like to retire and consider factors such as your current age, life expectancy, and any unexpected early retirements. A well-defined timeline helps shape your savings and investment strategies.

Assessing Your Current Financial Situation Take stock of your current financial situation. Calculate your assets, liabilities, and net worth. This assessment forms the foundation for developing a personalized retirement plan.

Investment Strategies for Retirement Diversifying Your Portfolio Diversification is key to managing risk in your retirement investments. Spread your investments across different asset classes, including stocks, bonds, and real estate. This minimizes the impact of market fluctuations.

Tax-Efficient Investments Explore tax-efficient investment options, such as IRAs and 401(k)s. These accounts offer tax advantages, allowing your retirement savings to grow more effectively.

Seeking Professional Advice Consider consulting a financial advisor who specializes in retirement planning. Their expertise can help you make informed decisions and optimize your investment strategy.

FAQs on Retirement Planning What is the ideal age to start retirement planning? Begin retirement planning as early as possible. Ideally, start in your 20s or 30s to take advantage of compounding interest.

Can I rely solely on Social Security for retirement income? While Social Security provides some income, it's advisable to have additional savings and investments to ensure financial security during retirement.

How do I calculate my retirement savings goal? Calculate your retirement savings goal by estimating your future expenses and factoring in inflation. Online retirement calculators can assist in this process.

Should I pay off all debts before retiring? It's generally wise to minimize high-interest debts before retiring. However, low-interest debts may be manageable during retirement.

What if I haven't started saving for retirement yet? Start now, regardless of your age. Even small contributions can accumulate over time and make a significant difference.

How can I adjust my retirement plan if unforeseen circumstances arise? Regularly review and adjust your retirement plan as needed. Life changes, such as health issues or job changes, may require modifications.

Conclusion Retirement planning is a journey that requires careful consideration, diligent saving, and informed decision-making. By setting clear goals, assessing your financial situation, and adopting the right investment strategies, you can pave the way for a secure and enjoyable retirement. Remember, it's never too early or too late to start planning for your golden years.

#RetirementPlanning#FinancialSecurity#RetirementGoals#InvestmentStrategies#FinancialFreedom#RetirementSavings#EstatePlanning#WealthManagement#TaxEfficiency#FinancialAdvisors#RetirementIncome#EarlyRetirement#SecureFuture#FinancialWellness#RetirementJourney#Toronto#Canada

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

Reasons Why It's Important to Keep Accurate Business Records💯📝

In today's fast-paced business world, keeping accurate and organised records is the key to success and growth! 🏢💼 That's why bookkeeping services are a game-changer! Continue on reading to find out what advances proper record keeping has and get helpful recommendations on reliable bookkeeping services Sunshine Coast. Let's dive into the amazing benefits they bring: 1️⃣ Managing Cash Flow: 💰 Maintaining a healthy cash flow is crucial for your business's sustainability. With professional bookkeeping services, you can track cash inflow and outflow, identify potential shortages, and proactively manage your finances. No more surprises, just financial stability even in unforeseen circumstances! 🌈🚀 2️⃣ Providing Valuable Financial Insights: 📈 Accurate records through bookkeeping services give you priceless insights into your company's financial situation. You can analyse spending patterns, pinpoint areas for cost reduction, and gain a comprehensive understanding of your business's financial health. Armed with this knowledge, you'll make informed decisions and boost your company's performance! 💡💪 3️⃣ Making Informed Financial Decisions: 💸 Understanding your business's finances is the key to making smart choices. Bookkeeping services ensure you have up-to-date information about revenues, expenses, and overall financial position. With this knowledge, you can evaluate investment opportunities, assess project profitability, and strategically plan for your company's future growth! 📊💼 4️⃣ Avoiding Tax Penalties: ⚖️ Nobody wants to deal with hefty penalties and financial burdens! Accurate record-keeping through bookkeeping services saves you from that headache. You'll have the necessary documentation to support your tax declarations, income statements, and deductions. By working with professional accounting consultants like Wardle Partners Accountants and Advisors on the Sunshine Coast, you stay compliant with tax laws, submit accurate reports, and minimise risks. A win-win situation! 💯📝 5️⃣ Reducing Stress During Tax Time: 😅📅 Tax season can be stressful, but with proper record keeping, you can breeze through it! Bookkeeping services help you stay organised throughout the year. All of your financial records, including receipts and invoices, will be easily accessible, facilitating a quick and easy filing procedure. With cloud software, you can save time by electronically collecting records and attaching them to your accounting software. Say goodbye to last-minute scrambling for missing information! 🌤️⏰ Remember, accurate business records are the backbone of your success! Take charge of your financial records and seek professional help if needed. If you're in need of accounting, tax preparation, or bookkeeping services on the Sunshine Coast, Wardle Partners Accountants and Advisors have got you covered! 🤝🌟 Our experienced professionals offer personalised and efficient services tailored to your unique needs.🚀💼 #BookkeepingServices #SunshineCoast #FinancialSuccess #AccurateRecords #BusinessGrowth #StressFreeTaxSeason

2 notes

·

View notes

Text

Introduction: Managing your personal finances can be challenging, but it's also essential if you want to achieve financial security and independence. Fortunately, there are many simple and effective ways to save money and build wealth, even if you're on a tight budget. In this blog post, we'll discuss five practical tips that you can start implementing today to improve your financial situation.

Create a Budget: One of the most important things you can do to manage your money is to create a budget. A budget is a plan that helps you track your income and expenses, and it can help you identify areas where you can cut back and save money. Start by listing all of your income sources, such as your salary, freelance income, or side hustle earnings. Then, list all of your expenses, including rent/mortgage payments, utilities, food, transportation, and entertainment. Subtract your expenses from your income, and see how much money you have left over each month. Use this surplus to pay off debt or save for your financial goals.

Cut Back on Expenses: Once you have a budget, it's time to look for ways to cut back on expenses. Start by looking at your discretionary spending, such as eating out, shopping, and subscriptions. Consider reducing or eliminating these expenses, and look for cheaper alternatives. For example, you can cook more meals at home, shop for second-hand clothes, or cancel subscriptions that you don't use. Every dollar you save can go towards building wealth.

Automate Your Savings: Saving money can be challenging, but it's essential if you want to build wealth. One way to make saving easier is to automate it. Set up automatic transfers from your checking account to your savings account each month. You can also enroll in your employer's retirement plan or open an individual retirement account (IRA) to save for your retirement. Automating your savings ensures that you're putting money aside consistently, even when you're busy or forgetful.

Use Credit Wisely: Credit cards can be useful for building credit and earning rewards, but they can also be a source of debt if you're not careful. To use credit wisely, it's important to pay off your balance in full each month to avoid interest charges. You can also look for credit cards with low interest rates or no annual fees. Be cautious of using credit for impulse purchases or to fund a lifestyle that you can't afford. If you do carry a balance, aim to pay off as much as possible each month to reduce your debt and interest charges.

Invest for the Future: Investing is an essential part of building wealth over the long term. Even if you're starting with a small amount, you can still invest in stocks, bonds, or mutual funds through an online broker or robo-advisor. Investing allows you to earn higher returns than traditional savings accounts, but it also involves some risk. Be sure to do your research and consult with a financial advisor if you're unsure about investing.

Conclusion: Building wealth and achieving financial security is a journey, but it starts with simple actions that you can take toda. By creating a budget, cutting back on expenses, automating your savings, using credit wisely, and investing for the future, you can start building a solid financial foundation. Remember that every small step you take towards financial health and wealth is a step in the right direction.

#investment#financial markets and investing#marketing#finance#money#free#dollar#rupees#limited life#lifetime#tip#life insurance#viralpost#viral on internet#budget#ThrowbackThursday or TBTMotivationMondayWisdomWednesdayTransformationTuesdayFlashbackFridaySelfieSundayOOTD Outfit of the Day#nature#health#beauty#healthyliving#instagood#Fitnessmotivation#throwbackthursday#FlashbackFriday#Travelgram#Relationshipgoals#Love#loveislove#Friends#Fitspo or FitfamOOTN (Outfit of the Night)Goals or LifeGoalsInspirationalQuotesArt or ArtistsofInstagramThrowbackThursday or

4 notes

·

View notes

Text

The Benefits of Using Xero for Your Business and How Experts Can Help You Get the Most Out of It

As a business owner, you know how important it is to stay on top of your finances. You need to keep track of your income and expenses, manage payroll, and stay compliant with tax laws. But with so much to do, it can be overwhelming to manage everything manually. That's where Xero comes in. Xero is a cloud-based accounting software that can help streamline your financial management processes and save you time and money. In this blog, we'll discuss the benefits of using Xero for your business and how Xero experts in Australia can help you get the most out of it.

Cloud-Based Convenience:

One of the primary benefits of using Xero is that it's cloud-based, meaning you can access your financial information from anywhere with an internet connection. This is especially beneficial for businesses with remote employees or those that require frequent travel. You can also collaborate with your accountant or bookkeeper in real-time, which means you can make financial decisions faster and with more accuracy.

Automated Processes:

Xero's automation features can help you save time on manual tasks like data entry, bank reconciliation, and invoicing. Xero can integrate with your bank accounts and credit cards to automatically import transactions, making it easy to reconcile accounts. You can also set up rules to categorize transactions automatically and even create recurring invoices for regular customers.

Comprehensive Reporting:

Xero offers a variety of reports that can help you gain insight into your business's financial health. You can create reports on cash flow, profit and loss, balance sheets, and more. These reports can help you identify areas where you can save money, plan for future growth, and make informed financial decisions.

Scalability:

Xero is designed to grow with your business. Whether you're a sole trader or a large corporation, Xero can adapt to your needs. You can add users, integrate with other software, and customize your dashboard to suit your business's specific requirements.

How Xero Experts in Australia Can Help:

While Xero is designed to be user-friendly, it can still be overwhelming for some business owners. That's where Xero experts in Australia come in. Xero experts, also known as Xero Champions, are certified advisors who can help you get the most out of the software. They can help you set up your account, integrate Xero with other software, and provide ongoing support and training. With their expertise, you can maximize the benefits of Xero and make informed financial decisions for your business.

In conclusion, Xero is an excellent accounting software for businesses of all sizes. Its cloud-based convenience, automation features, comprehensive reporting, and scalability make it a valuable tool for managing your finances. By working with Xero Champions in Australia, you can ensure that you're using the software to its fullest potential and make the most out of your investment.

2 notes

·

View notes

Photo

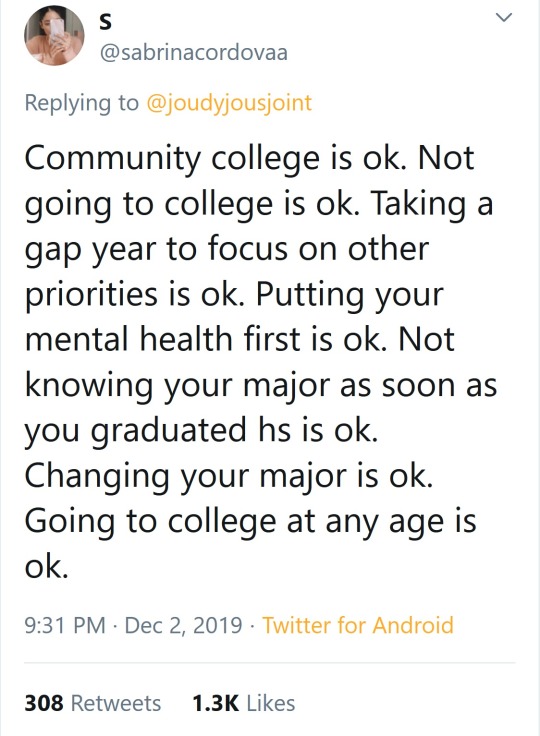

Don't buy into the hype that you *have* to go to college right after high school. Yes, its easier if you do because if you wait, you have things like bills that you now need to pay, but sometimes waiting is better.

Case 1; me - A hundred years ago, when I graduated HS, I had a really shitty guidance counselor. The dude did my entire graduation class, and he legit sucked ass. I, like most of my classmates, was on the "college track" in high school, which meant that we didn't take any practical classes, like accounting or shop, we took languages, and extra science/math/English classes. Senior year when we're talking to the guidance counselor about applying to college, 90% of us were told 'college might not be for you, you should try community college and see if you can do it,' which is a nice sentiment, but if you can't you don't have any marketable skills now. Needless to say, I went to CC, ran out of money, and got a job. Jobs mean college is now part time, and since it was a 9 to 5 job, I just stopped going when it got to hard. I didn't go back until I was 30, and since I now had a career, spouse, kids and a mortgage, it took me a long time to finish. I graduated at 43, with a BS that started in the CC and then transferred to a 4 year school. Transferring saved me a ton of money. A few years passed, and I went back to school for my masters, which I got at 53.

tl;dr, its never to late to go to college

Case 2; oldest kid - Oldest kid was smart, and genuinely loved learning and school. In his junior year, he had some significant mental health fuckery going on, but managed to get through it and graduate with pretty good grades. We decided that it would be good for his mental fuckery to go away to college, and he got accepted to a good one, about 4 hours away. He did not do well because he wasn't ready for college. He dropped out in his freshman year, and none of the classes he took were considered completed, so there was nothing to transfer. He decided that college was bullshit, and went to work in food service. He loved working, but started with some health issues that took forever to figure out and consequently lost that job. Figured out the health problem (apparently he can no longer tolerate caffeine), got a better job still in food service, worked there for a while before quitting because food service sucks. While all this was going on, his friends were graduating college, and starting their careers, and he'd grown up a great deal and decided that college might be less bullshit than he thought. So he moved in with his grandparents and started going to CC and is now pulling straight A's and loving it. He's planning on transferring to a 4 year school, and becoming a teacher. ALSO, he just found out today that the CC has an "honors" track, and that a relatively local Ivy League will accept students from the CC with a high GPA in that honor program. They have an acceptance rate of 6% for students out of high school, but according to the honors advisor, love taking people from the honors CC program. They're now his "reach" school, and the local, highly ranked, teaching college is his "sure thing" when he applies to transfer next spring, after he graduates.

tl;dr its ok to delay college a few years until you're ready, and in some cases can be beneficial since you have a better idea of what you want to do, and how to get there. But still start at the community college because its cheaper.

Case 3; youngest kid - We learned from the oldest kid, and did not send the youngest to college right away. We were dealing with the fallout from being in HS during Covid, as well as relocating to a new house in a different state. Once we'd settled in, I did make her get a job, and it had to be a 9 to 5, or at least something with regular hours. She ended up working at a dairy packaging/making milk and butter. She fucking hated it, but did it for almost a year before she couldn't take it anymore. Faced with going to college, or getting another shit job, she opted for college. She is now a sophomore at a four year college, and doing much better than she expected based on how she felt in HS.

tl;dr sometimes taking a gap year or two will mean the difference between succeeding and failing, so don't be afraid to do it.

every year we have to say it

144K notes

·

View notes