#account management solution

Explore tagged Tumblr posts

Text

Leveraging the Knowledge Base for Account Managers

In today's ever-evolving and competitive environment, being informed is not just an asset-headwise but rather a need. Knowledge drives business, and for an Account Manager, it can mean success when timely access to the right information counts. Information on updated product knowledge, industry trends, and training resources will help enhance customer interactions, sales productivity levels, and ultimately bring resilient growth to the business.

The Price of Any Ignorance

However, inadequate product knowledge can be negatively devastating for any company. Research shows that companies are likely to lose between 6.7% of their revenues globally- amounting to a jaw-dropping $3.1 trillion- because of inadequate product knowledge. These knowledge gaps can result in such harmful outcomes as misinformation among customer interactions to poor options and reduced revenue generation.

When Account Managers are ill-tuned to product features, competitive advantages, and industry turmoil, they tend to struggle delivering anything of worth to their customers. This breeds missed opportunities, dissatisfied clients, and overall company performance slump. Businesses must alleviate these odds by carrying out the utmost efforts to better prepare their Account Managers with a central and accessible Knowledge Base.

Knowledge Base for Account Managers

Knowledge Base is not merely a storehouse of knowledge but a strategic tool by which the teams can function at their level best. A proper Knowledge Base will enable Account Managers to do the following:

Stay Up to Date with Product Information

Products and services are constantly changing, and keeping one another updated about information beyond code updates, features, and enhancements is essential. Such a centralized Knowledge Base will guarantee Account Managers have the most current product specifications, merits, and points of differentiation at their disposal.

Having Better Customer Interactions

Customers expect accurate, up-to-date data when they work with Account Managers. A Knowledge Base allows them to answer customer queries with confidence, further provide relevant solutions, and nurture better client relationships.

Accelerating Decision Making

With access to industry insight, competition analysis, and best practices, Account Managers can make decisions that ensure that business objectives are aligned with customer needs.

Enhancing Efficiency and Productivity

Wasting time looking for information across several others can be both time-consuming and inefficient. A manageable Knowledge Base makes information retrieval more manageable while the Account Manager focuses more on increased sales and customer engagement.

Support Continuous Learning and Development

The business environment changes constantly, and keeping learning active is a must. A Knowledge Base containing training modules, case studies, and success stories enables Account Managers to upgrade their skills and allow them to be one step ahead.

Introduces Sciqus AMS Knowledge Base

In order to achieve this aim, Sciqus AMS introduces a very effective Knowledge Base for the dissemination of information to Account Managers. It is the center of knowledge and information available to Account Managers on the newest and most important data including:

Current Product Information-Keep themselves updated on cite developments and capabilities.

Training Modules and Learning Activities-to inspire learning and skills.

Industry News and Market Trends-head of competing companies and big changes in the particular industry.

Frequently Asked Questions and Troubleshooting Guides-allow for resolution of questions and issues more rapidly on behalf of the customer.

Sciqus AMS will position itself to potentially be a knowledge-less organization, wherein efficiencies are taken to the maximum, leading to spiritual enrichment.

Implementing a Knowledge Base: Best Practices

There can be no great Knowledge Base without a healthy dose of the following best practices for such an organization:

1. Keep It Up to Date

Update your Knowledge Base regularly with the latest product features, market trends, and training content so that it can always be relevant and accurate.

2. Ensure Immediate Accessibility

Make it user-friendly in structure and navigation, enabling Account Managers to locate and retrieve info quickly without any hindrances and obstructions.

3. Stimulate Engagement and Feedback

Encourage an environment of involvement from the Account Managers into the Knowledge Base, re-entering feedback for improvement, practicality, and value.

4. CRM and Sales Tools Integration

Linking your knowledge base to customer relationship management (CRM) and sales tools will give easy access to the information and present it within the account managers' workflows.

5. Offer Mobile Feature

If the Knowledge Base is mobile-friendly, it can provide your Account Managers with the access they need anywhere for them to assist customers in real time.

The Future of Knowledge Management in Sales

If any advancements occur, we can expect changes that will make the need for a complete Knowledge Base even more demanding. Organizations that put their resources into KM systems can expect achieved sales performance, customer satisfaction, and employee productivity.

Knowledge Base offered by Sciqus AMS will be a revolution, which introduces a streamlined solution for Account Managers to be informed and efficient. With the use of this technology, companies will accelerate growth, improve customer relations, and harness long-term success in a competitive business sphere.

Conclusion In a world where knowledge is indeed power, that makes it imperative to give Account Managers the right tools to perform. So, while ensuring that a Knowledge Base is in place, a good one is very important in achieving success. Sciqus AMS offers the capability to make sure the teams are constantly updated, knowledgeable, and ready to succeed. This creates a slice from the cake to protect revenue, make more informed decisions, and enhance customer experience.

To know more visit https://sciqusams.com/

Original Source: - https://bit.ly/41Iph6P

1 note

·

View note

Text

Courier Service Management Software by @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

3 notes

·

View notes

Text

OMR Solution for MCQ Exam from @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

2 notes

·

View notes

Text

Our Services | Professional Tax & Compliance Services

At E Accountax Manager, we provide expert financial and legal services to help businesses, startups, and NGOs navigate the complexities of tax compliance, registrations, and regulatory obligations. Whether you’re starting a new venture, managing an established business, or ensuring compliance for your organization, we offer end-to-end solutions tailored to your needs.

#tax services#NGO compliance services#Part Time CFO Services#business setup services#GST services#MSME compliance services#accounting solutions#financial advisory#E Accountax Manager services#business finance solutions#TCS#TDS Services#Our Services

2 notes

·

View notes

Text

What is ERP and Why Your Small Business Needs It?

Running a small business is a challenging but rewarding endeavor. You wear many hats, juggle countless tasks, and constantly strive for growth. But as your business expands, managing everything with spreadsheets and disconnected software can become a major bottleneck. That's where Enterprise Resource Planning (ERP) systems come in.

What Exactly is an ERP?

Think of an ERP system as the central nervous system of your business. It's a type of software that integrates all your core business processes into a single, unified platform. This means your sales, inventory, accounting, human resources, and other departments can all access and share the same data in real-time.... Read More

#coquicloud#business#businesstips#entrepreneurs#odoo#technologies#techtips#software#saas#small business#business management#business consulting#efficiency#innovation#digitaltransformation#technologynews#productivitytips#cloud solutions#Coqui Cloud#Latino Businesses#Odoo Implementation#technews#Odoo Support#business automation#CRM#Accounting#Inventory Management

3 notes

·

View notes

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Tired of paper piles? 🚫 Go paperless with Magtec ERP Software! 💻 Streamline your workflow and boost efficiency. It's time to embrace the digital future.

#erp#business#software#management#automation#enterprise#resources#planning#solution#system#cloud#industry#finance#accounting#supplychain#inventory#crm#hr#manufacturing#distribution#retail#healthcare#education#hospitality#smallbusiness#mediumenterprise#largeenterprise#magtecerp#magtec#magtecsolutions

3 notes

·

View notes

Text

HRsoftBD offer Bluk SMS

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#hrsoftbd

2 notes

·

View notes

Text

what is it about being in the hands of a middle-aged parent that makes technology malfunction in ways you could never have imagined

#i swear my mom and also grandma manage to make their phones & tablets bug like it's their superpower#like. what do you mean you can't download anything from google play anymore#i tried every solution google support gives for this specific problem and Nothing fixed it#i know you don't want to lose your gardenscapes account where you reached level 3000#how did you get this all fucked up like that#like it's the kind of shit that Never happens unless you specifically find ways to make it happen on purpose and#do boomers have access to a secret ''silly mode'' button that fucks up a random setting#and since i'm the family IT guy it's up to me to fucking da vinci code my way through The Mystery Of What Caused This

3 notes

·

View notes

Text

How Can Gen AI Revolutionize Your Accounts Receivable Process?

The advent of Generative AI (Gen AI) heralds a paradigm shift in the landscape of Finance and Accounting (F&A). Much like the introduction of spreadsheets as a product innovation decades ago, finance professionals were quick to embrace and derive immense benefits from the use of spreadsheets.

Gen AI in Finance and Accounting emerges as a potential game-changer, poised to revolutionize traditional practices within the realm of F&A and invoice payments. However, for this potential to be realized, CFOs must demonstrate openness to experimentation, allowing themselves to explore the tangible impact of Gen AI in Finance and Accounting functions.

Embarking on this journey necessitates a focused exploration of Gen AI’s applicability, particularly within accounts receivable management and invoice payments. By delving into this domain, CFOs can gain firsthand insight into the transformative power of Gen AI in Accounts Receivable. As with any strategic business investment, it is prudent to assess the anticipated returns and the timeframe within which these benefits can be realized.

In essence, embracing Gen AI in accounts receivable and invoice payments represents not only a technological advancement but also a strategic imperative for forward-thinking finance leaders. By embracing innovation and fostering a culture of experimentation, organizations can unlock unprecedented efficiency, agility, and competitive advantage in the ever-evolving landscape of finance and accounting.

How Can Gen AI Revolutionize Your Accounts Receivable Process?

Irrespective of the organization, to ensure optimal efficiency within the accounts receivable function and to explore the potential of integrating Gen AI powered Accounts receivable, it is essential to adopt a strategic approach centered around four key building blocks. These pillars serve as the foundation for effective management and innovation in accounts receivable:

Receivable Antecedents :

This encompasses the meticulous orchestration of all preliminary tasks necessary to establish a receivable. From the initial engagement with clients to the negotiation of terms, to the careful documentation of agreements, each step in this process demands precision and foresight. Building strong receivables antecedents lays the foundation for smooth transactions, timely invoice payments and ensures a robust financial framework

They include:

Customer Onboarding: Accurate customer data collection, credit checks, and setting credit limits.

Sales Order Processing: Efficiently converting orders into invoices.

Contractual Agreements: Clear terms and conditions regarding payment terms, discounts, and penalties.

Order Fulfillment: Ensuring timely delivery of goods or services.

Timely Invoicing: Generate invoices promptly after goods/services are delivered.

Clear and Accurate Invoices: Ensure clarity, itemization, and correct pricing.

Invoice Presentment and Reminders:

In the dynamic landscape of revenue management, the presentation of invoices holds paramount importance. It transcends beyond mere documentation; it embodies the essence of your transactions, encapsulating the value exchanged with your clients. Your approach to invoice presentment and invoice payments is characterized by clarity, accuracy, and timeliness. Moreover, one need to recognize the strategic significance of reminders in facilitating prompt invoice payments. Through proactive communication and gentle nudges, you endeavor to uphold transparency, nurture client relationships, and optimize cash flow dynamics.

This step involves creating and delivering invoices to customers:

Multiple Channels: Offer electronic and paper-based invoice delivery to facilitate invoice payments.

Standard Payment Reminder Schedule:

o Set a consistent schedule for sending payment reminders. This helps maintain clarity and predictability for both you and your clients. o Send reminders before the due date to gently prompt clients to pay on time. o Issue reminders close to the actual due date to emphasize the urgency.

• Personalized Reminders:

o Customize your reminders to suit each client. Address them by name and include relevant details. o Personalization shows that you value the relationship and encourages prompt payment.

• Politeness and Professionalism:

o Maintain a polite and professional tone in your reminders. o Avoid threatening language or negativity that could harm the client relationship. o Clearly state the purpose of the reminder and the essential details, such as the invoice number, amount due, and due date.

Collaboration :

Collaboration lies at the heart of your approach, both externally with your valued customers and internally among your team members and departments. Externally, effective collaboration involves understanding your clients’ needs, communicating transparently, and working together to resolve any issues or discrepancies promptly. Internally, collaboration ensures alignment across functions, streamlines processes, and maximizes efficiency, ultimately leading to superior customer service and satisfaction.

Effective communication is crucial:

Customer Communication: Regular follow-ups, addressing queries, and resolving disputes.

Internal Coordination: Collaboration between sales, finance, and customer service teams.

Dispute Resolution: Swiftly address any discrepancies.

Payments and receipt management :

Efficient management of invoice payments and receipts is essential for maintaining cash flow and optimizing financial performance. This includes implementing secure and convenient payment channels, diligently tracking incoming payments, and promptly reconciling accounts. By prioritizing invoice payments and receipt management, you can minimize delays, mitigate risks, and ensure the stability and resilience of our financial ecosystem.

Efficient handling of incoming invoice payments:

Payment Channels: Accept various methods (credit cards, bank transfers, etc.).

Reconciliation: Match payments with outstanding invoices.

Cash Application: Apply payments accurately to the correct accounts.

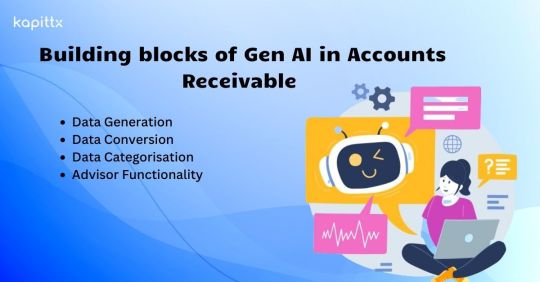

What are the building blocks of Gen AI in Accounts Receivable?

Overall, Gen AI in accounts receivable encompasses a wide range of capabilities making it a versatile tool for various applications across different domains. A few of the core building blocks are –

Data Generation: Gen AI In accounts receivable, can generate synthetic data to augment existing datasets used for training predictive models. For example, it can create simulated customer invoice payments histories, including variations in payment amounts, frequencies, and timing. This synthetic data allows organizations to train their models more comprehensively, improving the accuracy of predictions regarding future payment behavior.

Data Conversion: Gen AI in accounts receivable can facilitate the conversion of data between different formats in the accounts receivable process. For instance, it can automatically convert paper-based invoices into digital formats by extracting relevant information such as invoice numbers, amounts, and due dates using optical character recognition (OCR) technology. This conversion streamlines the invoicing process, reducing manual effort and minimizing errors.

Data Categorization: Gen AI in accounts receivable, can categorize transactions based on various criteria such as invoice payment methods, customer segments, or invoice statuses. For example, it can automatically classify incoming invoice payments as cash, checks, or electronic transfers, allowing finance teams to track payment trends and reconcile accounts more efficiently. By categorizing transactions accurately, Gen AI powered accounts receivable enhances data organization and facilitates deeper insights into receivables management.

Advisor Functionality: Gen AI in accounts receivable serves as an intelligent advisor by providing actionable insights and recommendations based on analyzed data. For example, it can identify patterns of late invoice payments or discrepancies in invoicing that may indicate potential issues with specific customers or billing processes. By alerting finance teams to these anomalies, Gen AI powered accounts receivable enables proactive intervention to mitigate risks and optimize cash flow management.

Overall, Generative AI enhances the efficiency and effectiveness of accounts receivable operations by generating data, facilitating data conversion, categorizing transactions, and providing intelligent advisory support. By leveraging Gen AI capabilities, organizations can streamline receivables management processes, improve decision-making, and ultimately enhance financial performance.

#ar automation solution#AI in Accounts Receivable#ar collection#Payment Reminder#cashflow management#AI In Finance & Accounting

2 notes

·

View notes

Text

I went from doing a highly specific job at an agency to having a much broader set of tasks at a small company and still every day experts will call me to offer their services for some of those tasks and I have to be like

#I don't want to speak to growth advisors and account managers anymore#I literally asked someone for advice and she had nothing#so then I offered my own solution and she went yeah you should do that#cool thanks

7 notes

·

View notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

Mobile App Development by @hrsoftbd Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

3 notes

·

View notes

Text

E-Commerce Solution from HRsoft Bangladesh

#mobile app design bd#mobile app development bd#accounting software bd#accounting software development bd#advocate dairy management bd#website desing bd#website development bd#omr solution bd#omr development bd#Courier service management software bd#doamin and hosting bd#bulk sms bd#prescription software bd#e-commerce solution bd#online education system bd#spa management software bd#parlor management software bd#ballot counting software bd#dairy farm software bd#shop management software bd#invoice software development bd#salon management software bd#ERP solution bd#vehicle manageent bd#Coaching Management Software bd#hrsoftbd

2 notes

·

View notes

Text

Importance of ERP for Engineering Companies

Enterprise Resource Planning (ERP) is a software system that integrates all the business processes and data of an organization into a single platform. ERP software Companies in India provide solutions that cater to different industries and businesses, including engineering companies. The engineering industry is highly dynamic and requires an efficient system to manage its operations effectively. In this blog, we will discuss the importance of ERP for engineering companies and highlight the benefits of implementing an ERP software in India.

ERP software providers in India offer solutions that are specifically designed for the manufacturing industry, including engineering companies. These solutions help streamline the complex processes involved in manufacturing and engineering operations, including supply chain management, inventory management, production planning, and quality control. The benefits of implementing an ERP for manufacturing company in India are numerous, and some of the most significant advantages are highlighted below.

Improved Efficiency and Productivity: ERP software in India provides real-time access to data and helps automate various tasks, including procurement, inventory management, and production planning. This automation reduces manual intervention, saves time and resources, and increases the efficiency and productivity of the organization.

Enhanced Decision Making: An ERP system provides a unified view of all the business processes and data, including sales, inventory, finance, and production. This real-time data helps the management make informed decisions and quickly respond to market changes, customer demands, and supply chain disruptions.

Cost Savings: An ERP for engineering companies can help reduce costs by optimizing inventory levels, reducing production lead times, and minimizing waste. It also helps eliminate redundancies and improves communication between different departments, reducing the need for multiple software systems and saving licensing and maintenance costs.

Improved Customer Satisfaction: ERP software providers in India offer solutions that help streamline the entire order-to-delivery process, from quoting and order processing to production and delivery. This streamlining ensures on-time delivery of quality products, improves customer satisfaction, and enhances customer loyalty.

Compliance with Regulations: ERP software in India offers features that help organizations comply with various regulations and standards, including ISO, FDA, and other industry-specific regulations. This compliance helps avoid legal and financial penalties and protects the organization's reputation.

In conclusion, implementing an ERP system for an engineering company in India can significantly improve its operations, increase efficiency, reduce costs, and enhance customer satisfaction. ERP software Companies in India offer solutions that are specifically designed for the manufacturing industry, including engineering companies, and cater to the unique needs and challenges of the industry. Therefore, it is essential for engineering companies to consider implementing an ERP system to remain competitive and achieve long-term success.

#ERP software Companies in India#ERP software providers in India#ERP for manufacturing company in India#ERP software in India#Manufacturing ERP software in India#ERP software company in India#ERP solution providers in India#erp software for engineering#software development#industry#manufacturer#automation#accounting#business process#management software#business and management#business analytics#business analyst

7 notes

·

View notes

Text

What is POS Software?

Ehishab POS Software is a point of sale (POS) software developed by Fara IT Limited. It is designed to facilitate sales transactions and manage various aspects of a business's operations. The software provides a user-friendly interface and a range of features to help businesses efficiently handle their sales processes.

Why Ehishab is the best POS software in Bangladesh

Determining the best POS software in Bangladesh depends on various factors and can be subjective based on individual business needs and preferences. However, some reasons why Ehishab POS Software is considered one of the best in Bangladesh are:

Localized Features: Ehishab POS Software is specifically developed to meet the needs of businesses in Bangladesh. It takes into account the unique requirements and regulations of the local market, ensuring that businesses can operate efficiently and comply with local standards.

User-Friendly Interface: The software offers a user-friendly interface that is easy to navigate and understand. This makes it accessible to businesses of different sizes and industries, even those without extensive technical expertise.

Comprehensive Functionality: Ehishab POS Software provides a wide range of features to manage sales, inventory, and customer relationships. It offers functionalities such as barcode scanning, payment processing, inventory tracking, customer management, and reporting, providing businesses with a comprehensive solution for their operations.

Local Support and Customization: Fara IT Limited, the company behind the software, provides local support and assistance to businesses. They offer training, customer support, and customization options to tailor the software to specific business requirements, ensuring a smooth implementation and ongoing usage.

Reputation and User Feedback: Ehishab POS Software has gained a positive reputation among businesses in Bangladesh. User feedback and reviews highlight its effectiveness in streamlining operations, improving efficiency, and enhancing customer experiences.

3 notes

·

View notes