#cashflow management

Explore tagged Tumblr posts

Text

How Can Gen AI Revolutionize Your Accounts Receivable Process?

The advent of Generative AI (Gen AI) heralds a paradigm shift in the landscape of Finance and Accounting (F&A). Much like the introduction of spreadsheets as a product innovation decades ago, finance professionals were quick to embrace and derive immense benefits from the use of spreadsheets.

Gen AI in Finance and Accounting emerges as a potential game-changer, poised to revolutionize traditional practices within the realm of F&A and invoice payments. However, for this potential to be realized, CFOs must demonstrate openness to experimentation, allowing themselves to explore the tangible impact of Gen AI in Finance and Accounting functions.

Embarking on this journey necessitates a focused exploration of Gen AI’s applicability, particularly within accounts receivable management and invoice payments. By delving into this domain, CFOs can gain firsthand insight into the transformative power of Gen AI in Accounts Receivable. As with any strategic business investment, it is prudent to assess the anticipated returns and the timeframe within which these benefits can be realized.

In essence, embracing Gen AI in accounts receivable and invoice payments represents not only a technological advancement but also a strategic imperative for forward-thinking finance leaders. By embracing innovation and fostering a culture of experimentation, organizations can unlock unprecedented efficiency, agility, and competitive advantage in the ever-evolving landscape of finance and accounting.

How Can Gen AI Revolutionize Your Accounts Receivable Process?

Irrespective of the organization, to ensure optimal efficiency within the accounts receivable function and to explore the potential of integrating Gen AI powered Accounts receivable, it is essential to adopt a strategic approach centered around four key building blocks. These pillars serve as the foundation for effective management and innovation in accounts receivable:

Receivable Antecedents :

This encompasses the meticulous orchestration of all preliminary tasks necessary to establish a receivable. From the initial engagement with clients to the negotiation of terms, to the careful documentation of agreements, each step in this process demands precision and foresight. Building strong receivables antecedents lays the foundation for smooth transactions, timely invoice payments and ensures a robust financial framework

They include:

Customer Onboarding: Accurate customer data collection, credit checks, and setting credit limits.

Sales Order Processing: Efficiently converting orders into invoices.

Contractual Agreements: Clear terms and conditions regarding payment terms, discounts, and penalties.

Order Fulfillment: Ensuring timely delivery of goods or services.

Timely Invoicing: Generate invoices promptly after goods/services are delivered.

Clear and Accurate Invoices: Ensure clarity, itemization, and correct pricing.

Invoice Presentment and Reminders:

In the dynamic landscape of revenue management, the presentation of invoices holds paramount importance. It transcends beyond mere documentation; it embodies the essence of your transactions, encapsulating the value exchanged with your clients. Your approach to invoice presentment and invoice payments is characterized by clarity, accuracy, and timeliness. Moreover, one need to recognize the strategic significance of reminders in facilitating prompt invoice payments. Through proactive communication and gentle nudges, you endeavor to uphold transparency, nurture client relationships, and optimize cash flow dynamics.

This step involves creating and delivering invoices to customers:

Multiple Channels: Offer electronic and paper-based invoice delivery to facilitate invoice payments.

Standard Payment Reminder Schedule:

o Set a consistent schedule for sending payment reminders. This helps maintain clarity and predictability for both you and your clients. o Send reminders before the due date to gently prompt clients to pay on time. o Issue reminders close to the actual due date to emphasize the urgency.

• Personalized Reminders:

o Customize your reminders to suit each client. Address them by name and include relevant details. o Personalization shows that you value the relationship and encourages prompt payment.

• Politeness and Professionalism:

o Maintain a polite and professional tone in your reminders. o Avoid threatening language or negativity that could harm the client relationship. o Clearly state the purpose of the reminder and the essential details, such as the invoice number, amount due, and due date.

Collaboration :

Collaboration lies at the heart of your approach, both externally with your valued customers and internally among your team members and departments. Externally, effective collaboration involves understanding your clients’ needs, communicating transparently, and working together to resolve any issues or discrepancies promptly. Internally, collaboration ensures alignment across functions, streamlines processes, and maximizes efficiency, ultimately leading to superior customer service and satisfaction.

Effective communication is crucial:

Customer Communication: Regular follow-ups, addressing queries, and resolving disputes.

Internal Coordination: Collaboration between sales, finance, and customer service teams.

Dispute Resolution: Swiftly address any discrepancies.

Payments and receipt management :

Efficient management of invoice payments and receipts is essential for maintaining cash flow and optimizing financial performance. This includes implementing secure and convenient payment channels, diligently tracking incoming payments, and promptly reconciling accounts. By prioritizing invoice payments and receipt management, you can minimize delays, mitigate risks, and ensure the stability and resilience of our financial ecosystem.

Efficient handling of incoming invoice payments:

Payment Channels: Accept various methods (credit cards, bank transfers, etc.).

Reconciliation: Match payments with outstanding invoices.

Cash Application: Apply payments accurately to the correct accounts.

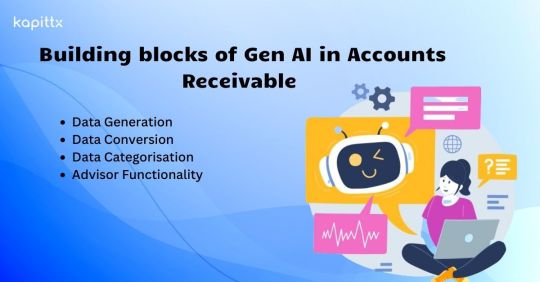

What are the building blocks of Gen AI in Accounts Receivable?

Overall, Gen AI in accounts receivable encompasses a wide range of capabilities making it a versatile tool for various applications across different domains. A few of the core building blocks are –

Data Generation: Gen AI In accounts receivable, can generate synthetic data to augment existing datasets used for training predictive models. For example, it can create simulated customer invoice payments histories, including variations in payment amounts, frequencies, and timing. This synthetic data allows organizations to train their models more comprehensively, improving the accuracy of predictions regarding future payment behavior.

Data Conversion: Gen AI in accounts receivable can facilitate the conversion of data between different formats in the accounts receivable process. For instance, it can automatically convert paper-based invoices into digital formats by extracting relevant information such as invoice numbers, amounts, and due dates using optical character recognition (OCR) technology. This conversion streamlines the invoicing process, reducing manual effort and minimizing errors.

Data Categorization: Gen AI in accounts receivable, can categorize transactions based on various criteria such as invoice payment methods, customer segments, or invoice statuses. For example, it can automatically classify incoming invoice payments as cash, checks, or electronic transfers, allowing finance teams to track payment trends and reconcile accounts more efficiently. By categorizing transactions accurately, Gen AI powered accounts receivable enhances data organization and facilitates deeper insights into receivables management.

Advisor Functionality: Gen AI in accounts receivable serves as an intelligent advisor by providing actionable insights and recommendations based on analyzed data. For example, it can identify patterns of late invoice payments or discrepancies in invoicing that may indicate potential issues with specific customers or billing processes. By alerting finance teams to these anomalies, Gen AI powered accounts receivable enables proactive intervention to mitigate risks and optimize cash flow management.

Overall, Generative AI enhances the efficiency and effectiveness of accounts receivable operations by generating data, facilitating data conversion, categorizing transactions, and providing intelligent advisory support. By leveraging Gen AI capabilities, organizations can streamline receivables management processes, improve decision-making, and ultimately enhance financial performance.

#ar automation solution#AI in Accounts Receivable#ar collection#Payment Reminder#cashflow management#AI In Finance & Accounting

2 notes

·

View notes

Text

How to Automate Business Transactions and Save Hours Every Month

Running a business requires handling numerous financial transactions, from invoicing to expense tracking. Manually managing these processes can be time-consuming and prone to errors. The good news? Automating your business transactions can save you hours every month while ensuring accuracy and efficiency. Here’s how to do it.

1. Use Automated Accounting Software

Investing in accounting software like QuickBooks, Xero, or Wave can streamline financial management. These platforms automatically categorize transactions, generate financial reports, and sync with your bank accounts, reducing manual data entry.

2. Set Up Recurring Invoices and Payments

Manually sending invoices every month can be a hassle. Use tools like FreshBooks or PayPal to set up recurring invoices for your clients. Likewise, automate bill payments for rent, utilities, and subscriptions to avoid late fees.

3. Integrate Expense Tracking Apps

Apps like Expensify and Receipt Bank allow you to scan receipts and track expenses in real time. These tools integrate with your accounting software, eliminating the need for manual entry and keeping your records up to date.

4. Automate Payroll Processing

Payroll can be complex and time-consuming. Services like Gusto, ADP, and Payworks handle employee salaries, tax withholdings, and benefits, ensuring compliance and freeing up your time.

5. Leverage Bank Rules for Transaction Categorization

Most online banking platforms allow you to set up rules to automatically categorize transactions. By defining these rules, your income and expenses are sorted without manual intervention, making bookkeeping effortless.

Final Thoughts

Automating your business transactions not only saves time but also reduces errors and improves financial organization. By leveraging technology, you can focus more on growing your business rather than getting bogged down by paperwork.

#small business#entrepreneur#financial tips#automation#business tips#money tips#business finance#bookkeeping#save time#self employed#productivity hacks#accounting#cashflow management#money management#work smarter not harder

0 notes

Text

Cashflow Management | 1 Finance

A key component of both individual and corporate financial management is cash flow planning. In order to maintain financial stability, fulfill immediate obligations, and accomplish long-term objectives, it entails the analysis, forecasting, and management of incoming and outgoing cash.

#finance#personal finance#financegoals#financemanagement#financial advisor#tax planning#cashflow management#investment planning

1 note

·

View note

Text

Avoiding Cash Flow Crunches: Leveraging Invoice Factoring to Stay Afloat

In the unpredictable waters of business, cash flow crunches can hit like a sudden storm, threatening the stability and growth of even the most well-managed companies. For small and medium-sized enterprises (SMEs) especially, maintaining a healthy cash flow is crucial for day-to-day operations, expansion plans, and overall sustainability. This is where invoice factoring emerges as a lifeline, offering a reliable solution to bridge the gap between invoicing and actual payment.

Understanding the Cash Flow Conundrum

In the unpredictable waters of business, cash flow crunches can hit like a sudden storm in Malaysia, threatening the stability and growth of even the most well-managed companies. For small and medium-sized enterprises (SMEs) especially, maintaining a healthy cash flow is crucial for day-to-day operations, expansion plans, and overall sustainability. This is where invoice factoring emerges as a lifeline, offering a reliable solution to bridge the gap between invoicing and actual payment. Cashflow management in Malaysia presents unique challenges for SMEs. However, with effective cashflow management strategies, businesses can navigate these challenges successfully, ensuring financial stability and fostering growth in a competitive market landscape.

The Power of Invoice Factoring

Invoice factoring, also known as accounts receivable financing, presents a proactive approach to managing cash flow challenges. Instead of waiting for clients to settle their invoices, businesses can sell their outstanding invoices to a third-party factoring company at a discount. In return, they receive immediate cash, typically covering 70% to 90% of the invoice value, with the remainder held as a reserve.

How Invoice Factoring Works

Submission of Invoices: The business submits its unpaid invoices to the factoring company, along with relevant documentation.

Verification and Approval: The factoring company assesses the creditworthiness of the invoiced customers and verifies the legitimacy of the invoices.

Advancing Funds: Upon approval, the factoring company advances a significant portion of the invoice value to the business, usually within 24 to 48 hours.

Collection Process: The factoring company takes responsibility for collecting payment from the customers on behalf of the business.

Final Settlement: Once the customers settle their invoices, the factoring company deducts its fees and releases the remaining balance to the business, minus any reserve amounts.

Benefits of Invoice Factoring

- Immediate Cash Injection: Invoice factoring provides businesses with instant access to cash, enabling them to meet pressing financial obligations and seize growth opportunities without delay.

- Improved Cash Flow Management: By converting accounts receivable into cash, businesses can better predict and manage their cash flow, reducing the risk of cash shortages and late payments.

- Outsourced Collections: Factoring companies handle the arduous task of chasing payments, freeing up valuable time and resources for businesses to focus on core activities.

- Flexible Financing Option: Unlike traditional loans, invoice factoring is not a debt-based financing solution. Instead, it leverages existing assets (invoices), making it an attractive option for businesses with limited collateral or poor credit history.

Conclusion

In the dynamic world of business, maintaining a healthy cash flow is paramount for survival and success. Invoice factoring offers a strategic financial tool for businesses to navigate cash flow crunches and sustain steady growth. By converting unpaid invoices into immediate cash, Small and medium businesses can overcome liquidity challenges, seize growth opportunities, and stay afloat in turbulent times. As a flexible and accessible financing option, invoice factoring in Malaysia empowers businesses to thrive in an ever-evolving marketplace.

0 notes

Text

The ROI of Moolamore: How It Can Save You Time and Money

Exhausted from spending countless hours crunching numbers and attempting to comprehend or understand your cash flow? Do you have sleepless nights and constant worries about managing your small or medium-sized business? Do you wish there was a way to untangle all the complexities?

In today's fast-paced business world, time is money, so effective financial management and strategic planning are critical. Behold! This brings us to a revolutionary solution that will save your company time and money. Let's delve into the details and discover Moolamore's incredible ROI! Make sure to read this blog to the end!

#cashflow ROI#return on investment cashflow#importance of cashflow ROI#cashflow management#cashflow optimization#cashflow analysis

0 notes

Text

When the Corporate Veil is Broken: Asset Protection Gone Wrong

Most directors of small and medium-sized companies across Perth know about asset protection from a company. Operating a business through a company for its asset protection advantages is one of the main reasons that business accountants across Perth recommend companies. Know more: Asset Protection Advice: Westcourt

1 note

·

View note

Text

Reverse logistics is the process in which consumer goods are returned to their original point of origin. First, consumers must return unwanted items to be reclaimed. Returns are then sent off to a collection center before being prepared for redistribution to secondary outlets. Depending upon the type of item, products are typically either recycled or resold. Monitoring the flow of reverse logistics within your organization is critical to maintaining an efficient supply chain.

Learn More :- https://www.inymbus.com/

0 notes

Text

Financial Planning Worth $1-2 Million US Dollars. I would request you all to go through this guide and share it with everyone you know, so that they can secure their financial future.

#finance planning#finance management#financial freedom#finance#financial security#financial management#retirement planning#how to earn money#financial goals#cashflow#debt management#risk management#investment planner#passive income#passive investing#estate planning#retire early#financial advice#money management#money manifestation#money#cash management

6 notes

·

View notes

Text

Get more information @ https://contetra.com/strategic-business-financial-management-solutions/

#Strategic cfo services in Mumbai#Financial consulting services#Strategic financial management#Cashflow optimization#virtual cfo services in Mumbai

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

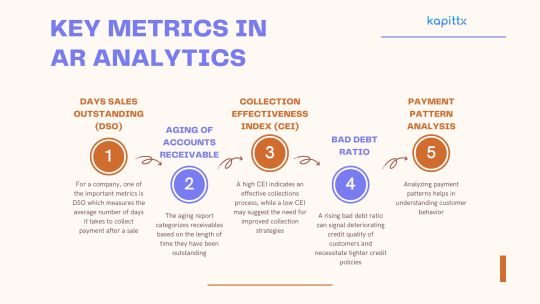

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

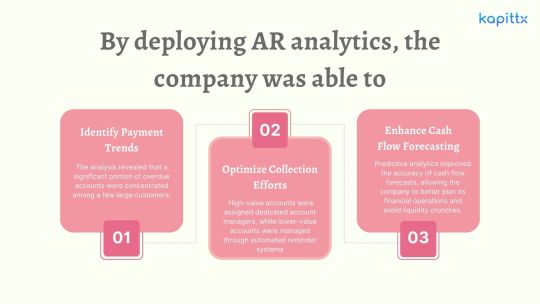

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Why Reconciling Your Bank Statements Monthly Saves You Money

As a business owner, staying on top of your finances is crucial for success. One simple yet often overlooked habit that can save you money is reconciling your bank statements every month. Here’s why this practice is essential and how it can benefit your business.

1. Catch Errors Early

Mistakes happen, whether they’re banking errors, duplicate transactions, or unauthorized charges. By reconciling your bank statements monthly, you can spot these discrepancies early and take action before they impact your finances.

2. Avoid Overdraft Fees and Penalties

If your records don’t match your bank’s records, you could accidentally overdraft your account, leading to costly fees. Monthly reconciliation ensures you know exactly how much money is available, helping you avoid unnecessary charges.

3. Improve Cash Flow Management

Keeping your bank statements in check allows you to maintain a clear picture of your income and expenses. This insight helps you budget more effectively and make informed financial decisions to keep your business running smoothly.

4. Detect Fraud or Unauthorized Transactions

Reconciling your statements regularly helps you spot any unauthorized withdrawals or fraudulent activities. The sooner you identify and report these issues, the quicker you can resolve them and prevent further financial loss.

5. Simplify Tax Preparation

Accurate financial records make tax time much easier. Regularly reconciling your bank statements ensures all transactions are accounted for, reducing stress when it’s time to file taxes and helping you take advantage of potential deductions.

Final Thoughts

Reconciling your bank statements each month is a small but powerful habit that can protect your business from financial loss and help you stay in control of your money. Make it a routine, and you’ll enjoy better financial clarity, fewer surprises, and more savings in the long run.

#small business#entrepreneur#financial tips#bookkeeping#money tips#business finance#money management#bank reconciliation#save money#business tips#self employed#accounting#productivity hacks#cashflow management#tax season

0 notes

Text

Barbershop Accounting 101: Comprehensive Guide for Beginners

Running a successful barbershop is not just about delivering fresh haircuts and fades. It requires effective financial management to preserve profitability. Financial management also ensures business growth. Barbershop accounting can be complex, but when

Running a successful barbershop is not just about delivering fresh haircuts and fades. It requires effective financial management to preserve profitability. Financial management also ensures business growth. Barbershop accounting can be complex, but when broken down into clear steps, it becomes manageable and rewarding. This guide is designed for barbershop owners. It builds a solid foundation in…

#Accounting#Bookkeeping#business#Business Finance#cash-flow-management#cashflow#financial-management#Guide#Small Business

1 note

·

View note

Text

Enhancing Financial Health For Businesses With Cashflow Management Services.

Effective cashflow management is the lifeblood of any successful business. Whether you're a small startup or a large corporation, maintaining a steady flow of cash is essential for daily operations, growth, and long-term sustainability. Cashflow Management Services Abu Dhabi play a crucial role in helping businesses achieve financial stability, manage risks, and capitalize on opportunities. Here’s how these services can benefit your business.

Understanding Cashflow Management

Cashflow management involves tracking, analyzing, and optimizing the flow of cash in and out of your business. It’s not just about ensuring you have enough money to pay your bills; it’s about strategically managing your finances to maximize profitability and minimize risk. Cashflow Management Services provide businesses with the tools, insights, and strategies needed to maintain a healthy cashflow, forecast future cash needs, and make informed financial decisions.

Key Benefits of Cashflow Management Services

1- Improved Financial Planning and Forecasting

Cashflow management services offer advanced tools for financial forecasting, helping businesses predict their future cash needs. By understanding the inflows and outflows of cash, businesses can plan for potential shortfalls and avoid surprises. This level of foresight allows for better decision-making, whether it’s investing in new opportunities, expanding operations, or managing debt.

2- Enhanced Liquidity Management

Liquidity is the ability of a business to meet its short-term obligations. Effective cashflow management ensures that a company has enough liquid assets to cover its day-to-day expenses. Cashflow management services help businesses optimize their liquidity by streamlining accounts receivable and payable, managing inventory levels, and identifying opportunities to improve cash conversion cycles.

3- Risk Mitigation

Financial risks are an inherent part of running a business, but poor cashflow management can exacerbate these risks. Cashflow management services help businesses identify potential cashflow gaps and implement strategies to mitigate risks, such as securing lines of credit, optimizing payment terms with suppliers, and managing customer payment behaviors. This proactive approach can prevent financial crises and ensure business continuity.

4- Better Cost Control

By closely monitoring cashflow, businesses can identify areas where they may be overspending or not utilizing resources efficiently. Cashflow management services help businesses analyze their expenses, negotiate better terms with vendors, and implement cost-saving measures. This not only improves profitability but also frees up cash for reinvestment in growth initiatives.

5- Access to Real-time Financial Data

Cashflow management services often provide businesses with real-time access to their financial data. This allows business owners and managers to make informed decisions quickly and respond to changes in the market or within the company. Having up-to-date financial information is crucial for staying competitive and seizing opportunities as they arise.

6- Support for Growth and Expansion

Growth requires investment, and investment requires capital. Cashflow management services can help businesses plan for expansion by ensuring they have the necessary funds available when needed. Whether it’s opening a new location, launching a new product, or investing in new technology, having a solid cashflow plan in place makes growth initiatives more achievable and less risky.

Why Partner with Cashflow Management Experts?

While many business owners and financial managers understand the importance of cashflow, managing it effectively can be challenging. Cashflow management services offer specialized expertise and technology that can make a significant difference. By partnering with experts, businesses can leverage best practices, advanced analytics, and tailored strategies to optimize their cashflow and drive long-term success.

Moreover, cashflow management services can save businesses time and resources by automating routine tasks, providing actionable insights, and offering ongoing support. This allows business owners to focus on what they do best – running their business – while ensuring their finances are in capable hands.

Conclusion

In today’s fast-paced and ever-changing business environment, effective cashflow management is more important than ever. By utilizing Cashflow Management Services Abu Dhabi, businesses can gain greater control over their finances, reduce risks, and position themselves for sustainable growth. Whether you're looking to improve liquidity, plan for the future, or navigate financial challenges, cashflow management services are an essential tool for achieving your business goals.

0 notes

Text

In a memo to White in 1977 Thompson had highlighted some deficiencies in the bank:

We are no longer producing enough well-rounded trained executives for all key jobs becoming available. Indeed, we have difficulty producing managers who can lend prudently and tellers who can balance their cash . . . various studies . . . show that our reputation for service is not as high as it ought to be . . . we are encountering staff history . . . we have become bureaucratic.

#book quotes#westpac#edna carew#nonfiction#memo#bob white#geoff thompson#70s#1970s#20th century#highlight#deficiency#bank of new south wales#bank#training#executives#difficulty#manager#lending#banking#prudence#bank teller#balancing#cashflow#reputation#customer service#staff#hostility#bureaucratic#bureaucracy

0 notes