#accounts receivable automation software

Explore tagged Tumblr posts

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

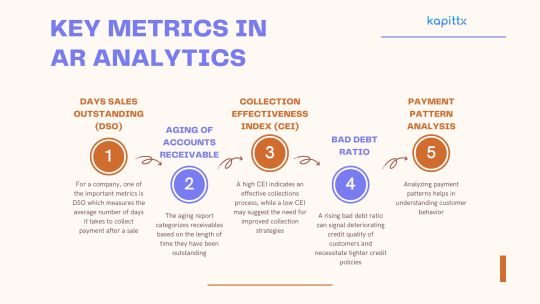

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

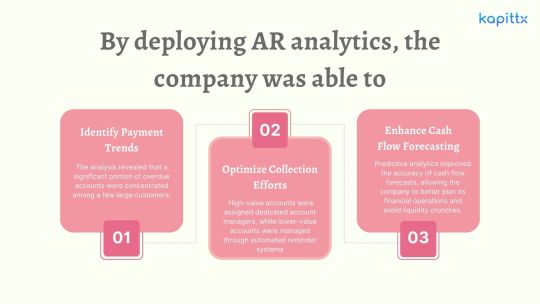

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

iNymbus DeductionsXchange resolves and disputes deductions and chargebacks automatically while increasing speed and efficiency by 30X. DeductionsXchange introduces cloud robotic automation for uploading denied claim packets to retail vendor portals and submitting disputes on the customer’s behalf. Not only are processing costs reduced dramatically via the elimination of manual labor, but companies can also take back revenue from previously invalid and undisputed chargebacks and deductions.

0 notes

Text

MYND offers efficient and reliable accounts payable management services that help businesses streamline their payment processes, reduce costs, and improve cash flow. Our team of experts uses advanced technology and proven methodologies to automate and optimize accounts payable workflows, ensuring timely payments, accurate record-keeping, and compliance with regulatory requirements. With MYND's accounts payable management services, businesses can focus on core activities and achieve greater efficiency and profitability.

#account payable management#account payable management services#accounting and bookkeeping services#accounting services for MSME#accounts payable software#accounts payable automation software#accounts payable automation solutions#accounts payable business process outsourcing#accounts payable outsourcing#accounts payable outsourcing in India#accounts payable outsourcing services#accounts payable vendor management#accounts receivable automation software#accounts receivable management software#accounts receivable outsourcing services

0 notes

Text

Accounts Receivable Automation

Revolutionize Your Financial Operations with AR Automation

Discover how Accounts Receivable Automation is changing the landscape of financial management. By automating AR processes, businesses can significantly reduce manual errors, improve cash flow, and increase efficiency. Learn more about the latest AR tools that integrate seamlessly with your existing financial systems.

For more details click : Accounts Receivable Automation

0 notes

Text

#invoice processing#invoice software#invoice process automation#automation solution#data accuracy#technology#accounts payable#accounts receivable

1 note

·

View note

Text

Should I Be the Stars of Lyra Web Event is Now Live!

As the neon fades and shadows dissipate, the stars shall sing an eternal melody

The "Should I Be the Stars of Lyra" web page reward event is now live. Participate in the event and complete the series of tasks for guaranteed Polychromes, Dennies, and other rewards!

▼Participate Here

https://hoyo.link/U4kNzDQpT

[Event Duration]

2025/01/17 12:00 – 2025/01/31 23:59 (UTC+8)

[Requirements]

Reach Inter-Knot Lv. 8

[Event Prizes]

During the event, by completing all ticket creation and sharing tasks, Proxies can receive the following rewards: Polychrome ×125, Official Investigator Log ×25, and Denny ×50,000.

>> Official Hoyolab post <<

[Event Rules]

1. During the event, Proxies can obtain "Microphones" by completing a series of tasks. Consuming "Microphones" unlocks the "Inspired Gathering" stages, allowing interaction with Agents.

2. Each time a stage is completed, Proxies can obtain multiple "Inspired Elements," which can be used in "Create Ticket."

3. Proxies can select a certain number of "Inspired Elements" to create tickets. Once completed, the tickets will be automatically saved in the "Portfolio." Note: The "Portfolio" has a storage limit, so Proxies should save creations wisely.

※ This web event is for entertainment purposes only and is not related to actual in-game content.

[Notes]

1. "Microphones," "Inspired Elements," and other items are event-related items only and have no connection to in-game content.

2. Please make sure you meet the age requirements and other stipulations required by the local laws of your country/region of residence to participate in this type of event, or ensure you participate in the event with the knowledge and consent of your guardian.

2. The event organizer reserves the right to revoke the eligibility or prize won if Proxies engage in any of the following behaviors or situations; 1) Winners who do not meet the requirements; 2) Participating in this event or intentionally disrupting its fairness through the use of any bot programs, prize-generating software, or any other automated or unfair means; 3) Other actions that violate relevant laws and regulations or the event rules.

4. Proxies should protect their personal information and avoid trusting reward notifications from other channels or disclosing personal accounts and other private information casually, to prevent infringement of personal information and property.

5. Any information collected during this event will be used to allow you to log into your HoYoverse account and participate in the event. It will not be used for any other purposes.

We will protect and manage your personal information in accordance with the relevant laws and regulations. More information can be found in our Privacy Policy on our official site. Collection and usage of your personal information will strictly abide by our Privacy Policy.

6. If you have any questions, please contact customer services: [email protected]

7. This event is subject to the Terms of Service and Privacy Policy of HoYoverse accounts and HoYoLAB. Before participating in this event, you must fully understand and agree to abide by the aforementioned terms and policies.

8. Please log in to your HoYoverse account and link a character from Zenless Zone Zero to participate in the event, to ensure proper distribution and receipt of event rewards.

9. Rewards cannot be claimed after the event ends, so please make sure to claim them on time. Rewards will be sent via in-game mail, and the mail will be valid for 30 days, so please check it promptly.

10. The web event will be unavailable during version update maintenance. It will be accessible again once the update is completed.

7 notes

·

View notes

Text

3 Ways Software Can Revolutionize Your Distribution Strategy.

In today's fiercely competitive business environment, efficient distribution can make or break a company. Customers demand fast, reliable, and cost-effective delivery, and businesses are under constant pressure to optimize their operations to meet these expectations. Distribution management software has emerged as a powerful tool to help companies streamline their distribution processes, reduce costs, and enhance customer satisfaction.

The Power of Integrated Software

While distribution management software alone can provide significant benefits, integrating it with other business systems, such as sales management software and scheme management software, can create a truly synergistic effect. This integrated approach allows for seamless information flow, improved visibility, and enhanced decision-making across the organization.

1. Inventory Management: From Reactive to Proactive

Effective inventory management is the cornerstone of a successful distribution strategy. Distribution management software provides real-time visibility into inventory levels across all locations, eliminating the need for time-consuming manual stock checks and reducing the risk of costly stockouts and overstocking.

With accurate, up-to-the-minute data on inventory levels, businesses can proactively manage their stock, ensuring they have the right products in the right place at the right time. This not only improves order fulfilment efficiency but also optimizes warehouse space utilization and reduces carrying costs.

Furthermore, advanced distribution management software often includes demand forecasting capabilities. By analyzing historical data and market trends, these systems can predict future demand with greater accuracy, enabling businesses to proactively adjust their procurement and production schedules. This helps prevent stockouts during peak seasons and avoids overstocking during periods of low demand.

2. Order Fulfillment: Speed, Accuracy, and Visibility

Customers in today's fast-paced environment want orders to be fulfilled quickly and reliably. Distribution management software empowers businesses to meet these expectations by automating and optimizing various aspects of the fulfilment process.

By automating order processing, businesses can minimize manual data entry, reduce errors, and accelerate order fulfilment times. This not only improves efficiency but also frees up valuable time for staff to focus on more strategic tasks.

Distribution management software also optimizes delivery routes, taking into account factors such as traffic, delivery windows, and vehicle capacity. This ensures that goods are delivered in the most efficient way possible, minimizing transportation costs and reducing delivery times.

Moreover, distribution management software provides real-time tracking information, allowing customers to monitor the progress of their orders and receive accurate delivery updates. This transparency boosts consumer satisfaction and confidence.

3. Sales and Scheme Management: Driving Revenue and Customer Loyalty

Integrating distribution management software with sales management software and scheme management software creates a powerful platform for driving revenue and building customer loyalty.

Scheme management software enables businesses to create and manage targeted promotions and incentive programs. This allows them to incentivize sales, move inventory, and reward loyal customers. By integrating this with distribution management software, businesses can ensure that promotional items are readily available and that orders are fulfilled efficiently.

Sales management software provides sales teams with the tools they need to manage leads, track opportunities, and close deals more effectively. By integrating this with distribution management software, sales teams can gain visibility into inventory levels and delivery schedules, allowing them to provide accurate information to customers and avoid promising delivery dates that cannot be met.

Furthermore, by combining data from distribution, sales, and scheme management software, businesses can gain valuable insights into customer behaviour, sales trends, and product performance. This data can be used to make informed decisions about pricing, promotions, and product development, ultimately driving revenue growth and improving profitability.

Conclusion

Investing in a comprehensive software solution that encompasses distribution, sales, and scheme management can be a game-changer for businesses of all sizes. By embracing the power of automation, optimization, and data-driven insights, companies can streamline their operations, boost sales, and create a loyal customer base.

2 notes

·

View notes

Text

What are Payout Solutions and How Do They Simplify Business Payments?

In today’s rapidly evolving financial landscape, businesses are constantly looking for efficient, reliable, and cost-effective ways to manage payments. Whether it’s paying employees, suppliers, or customers, seamless and error-free payment processes are critical for operational success. This is where payout solutions come into play. A payout solution is an advanced payment processing system that automates and simplifies bulk payments, ensuring businesses can send funds securely and quickly.

What are Payout Solutions?

Payout solutions refer to platforms or systems that enable businesses to distribute payments to multiple beneficiaries seamlessly and efficiently. These beneficiaries can include employees, vendors, freelancers, customers, or even stakeholders. By leveraging modern technology, payout solutions allow businesses to process bulk payments through a single interface, eliminating manual processes and reducing the chances of errors.

Payout solutions are particularly essential for businesses that deal with large volumes of transactions daily. Sectors such as e-commerce, fintech, gig economy platforms, and other industries rely heavily on streamlined payout systems to ensure their financial operations run smoothly.

For example, companies can use a payout solution to disburse salaries, refunds, commissions, incentives, or vendor payments at scale with minimal human intervention.

How Do Payout Solutions Work?

A payout solution works as a bridge between a business and its payment recipients. It integrates with the business’s financial system or software and streamlines the process of transferring funds. Here’s a step-by-step breakdown of how payout solutions operate:

Integration: The payout system integrates with the business’s existing financial software or banking platform to access required data, such as payment amounts and recipient details.

Bulk Upload: Businesses upload payment details, including beneficiary names, account information, and amounts, into the platform. This can often be done via a file upload or API integration.

Payment Processing: The payout solution processes the payments using multiple payment modes, such as bank transfers, UPI, NEFT, IMPS, wallets, or card-based systems.

Verification and Approval: Before releasing funds, the system verifies all recipient details to avoid errors or payment failures. Businesses can also set up approval workflows to ensure security and compliance.

Disbursement: Payments are disbursed instantly or as scheduled, depending on the system’s configuration and business requirements.

Notifications: Once payments are completed, recipients are notified via email, SMS, or other communication channels. Additionally, businesses receive confirmation reports to maintain records.

How Payout Solutions Simplify Business Payments

Payout solutions offer a variety of features that help businesses simplify their payment processes. Some of the key benefits include:

Automation of Payments One of the most significant advantages of payout solutions is automation. Businesses no longer need to process payments manually, which can be time-consuming and prone to errors. Automated solutions allow bulk payments to be processed quickly and accurately.

Multiple Payment Modes Modern payout systems provide businesses with flexibility by supporting various payment methods, including bank transfers, UPI, mobile wallets, and more. This ensures payments can be sent according to the preferences of recipients.

Real-Time Processing Traditional payment methods often involve delays, especially when dealing with bulk transactions. Payout solutions offer real-time or near-instant payment processing, ensuring recipients receive funds promptly.

Cost and Time Efficiency Manual payment processes require significant time and resources, leading to operational inefficiencies. By using a payout solution, businesses can reduce administrative costs and save valuable time that can be allocated to core operations.

Improved Accuracy and Security Errors in payment processing can cause delays, mistrust, and additional costs. Payout solutions use robust verification mechanisms to minimize errors and enhance security. Additionally, many systems comply with financial regulations, ensuring safe transactions.

Seamless Reconciliation Payout solutions simplify the reconciliation of payments by providing detailed transaction records and reports. Businesses can easily track completed, pending, or failed transactions, making financial management more transparent and organized.

Enhanced Customer and Vendor Experience Fast and error-free payments improve the overall experience for customers, vendors, and employees. For instance, e-commerce platforms can use payout systems to ensure quick refunds, leading to improved customer satisfaction and loyalty.

Payment Solution Providers and Their Role

Payment solution providers play a crucial role in the success of payout systems. These providers offer the technology and infrastructure needed for businesses to handle complex payment processes efficiently. By offering robust platforms, they enable organizations to send bulk payments with speed, accuracy, and security.

Companies like Xettle Technologies are leading players in the payout solutions ecosystem. They provide advanced payout platforms designed to cater to businesses of all sizes, ensuring streamlined payment operations and financial management. With such providers, businesses can focus on growth while leaving their payment challenges to trusted experts.

Key Industries Benefiting from Payout Solutions

Several industries rely heavily on payout solutions to manage their financial operations, including:

E-commerce: Automating refunds, vendor payments, and cashbacks.

Fintech: Handling instant disbursements for loans and digital wallets.

Gig Economy Platforms: Paying freelancers, contractors, and service providers seamlessly.

Insurance: Disbursing claim settlements quickly to enhance customer trust.

Corporate Sector: Managing salaries, incentives, and reimbursements.

Conclusion

Payout solutions have revolutionized the way businesses manage their financial transactions. By automating and simplifying payment processes, businesses can save time, reduce costs, and improve accuracy while ensuring recipients receive funds promptly. Whether it’s paying employees, vendors, or customers, payout solutions offer a scalable and secure way to handle bulk payments effortlessly.

As payment solution providers like Xettle Technologies continue to innovate, businesses can look forward to more efficient and seamless financial operations. For organizations aiming to streamline their payouts, adopting a reliable payout solution is a step toward achieving operational excellence and enhanced financial management.

2 notes

·

View notes

Text

Everything You Need to Know About Cosmolex Accounting Software

In today’s fast-paced business world, having the right accounting software is essential for smooth financial management. CosmoLex has emerged as a leading choice for businesses, particularly in the legal and professional services industries, offering comprehensive accounting solutions tailored to specific needs.

This guide will explore why CosmoLex stands out as the best accounting software, detailing its features, benefits, and unique selling points. We will also address common questions to help you understand if CosmoLex is the right tool for your business.

What is CosmoLex?

CosmoLex is a cloud-based accounting software solution designed with professionals in mind, especially those in the legal industry, such as law firms and solo practitioners. With an all-in-one platform, CosmoLex combines essential accounting functions with specialized features that cater to the unique needs of legal professionals. Unlike traditional accounting software, CosmoLex streamlines financial management while also addressing compliance and trust accounting requirements.

With features that extend beyond basic bookkeeping, CosmoLex helps firms manage time tracking, billing, client management, and compliance, all in one integrated system. The software's easy-to-use interface and powerful functionality have made it a go-to solution for professionals looking for efficiency and accuracy in their financial operations.

Key Features of CosmoLex

1. Trust Accounting Compliance

One of CosmoLex’s standout features is its trust accounting capabilities, specifically designed to meet the strict regulations of the legal industry. Trust accounts require meticulous record-keeping to ensure that client funds are handled appropriately. CosmoLex automates the process of tracking client trust balances, generating trust account reconciliations, and ensuring compliance with local bar association rules.

2. Integrated Time Tracking and Billing

CosmoLex combines time tracking and billing into one seamless process, making it easy for law firms to log billable hours and create invoices directly from the platform. This feature helps streamline the billing process, improves accuracy, and ensures that no billable time goes unaccounted for. Whether you need to track time spent on client meetings or specific case tasks, CosmoLex offers a user-friendly interface that simplifies time tracking and invoicing.

3. Comprehensive Financial Management

Beyond its specialized tools, CosmoLex provides full-service accounting capabilities, including accounts payable/receivable management, general ledger, and financial reporting. It allows businesses to manage their financial data accurately, create financial statements, and generate customizable reports that provide insights into their financial health.

4. Automated Bank Reconciliation

CosmoLex automates the process of bank reconciliation, which is crucial for maintaining accurate financial records. By connecting your bank accounting software, transactions are automatically imported, matched, and reconciled. This reduces the manual effort needed for reconciliation and minimizes the risk of human error.

5. Client and Matter Management

CosmoLex offers integrated client and matter management tools that allow you to organize client files, manage documents, and maintain case notes within the same system. This helps legal professionals keep track of all case-related information in one place, ensuring that critical documents are easily accessible when needed.

6. Billing Customization and Payment Processing

The software supports customizable invoice templates and allows you to set payment terms and accept online payments through integrated payment gateways. This feature not only streamlines the billing process but also provides clients with convenient payment options, thereby improving cash flow for the business.

7. Compliance and Security

CosmoLex prioritizes data security with encryption, secure cloud storage, and multi-factor authentication. Compliance is also a key focus, especially for law firms that must adhere to various legal and financial regulations. The platform ensures that all data is protected and compliant with the necessary guidelines for trust accounting.

Benefits of Using CosmoLex

1. All-in-One Solution

One of the major advantages of CosmoLex is that it combines various essential tools into a single platform. This eliminates the need for separate software solutions for accounting, time tracking, billing, and client management, streamlining workflow and reducing administrative overhead.

2. Enhanced Efficiency

CosmoLex’s user-friendly design and automated features help businesses save time on routine tasks. The time tracking, billing, and reconciliation automation allow professionals to focus on their core activities rather than spend valuable time on manual bookkeeping.

3. Accurate and Transparent Reporting

With real-time financial reporting capabilities, CosmoLex helps businesses keep a clear picture of their financial status. Customized financial reports can be generated for better insights, aiding in more informed decision-making and strategic planning.

4. Improved Cash Flow

By enabling easy online payment processing and accurate invoicing, CosmoLex helps businesses improve their cash flow. Clients can pay invoices directly through integrated payment gateways, which helps speed up the collection process.

5. Legal-Specific Features

CosmoLex is specifically designed for legal professionals, so it includes features that cater to the needs of law firms that other generic accounting software might not offer. This includes trust accounting compliance, case management, and billing features tailored for legal services.

How Does CosmoLex Compare to Other Accounting Software?

1. CosmoLex vs. QuickBooks

QuickBooks is one of the most widely used accounting platforms for small to medium-sized businesses. While it offers strong accounting capabilities, it does not provide specialized features tailored for legal professionals, such as trust accounting compliance and integrated client matter management. CosmoLex excels in this area by combining industry-specific tools with general accounting features.

2. CosmoLex vs. Clio

Clio is a popular practice management software for law firms that includes billing, case management, and document storage. However, while Clio does provide some financial features, it lacks full-service accounting capabilities such as automated bank reconciliation and comprehensive financial reporting that CosmoLex offers. CosmoLex integrates these features into one platform, making it an all-in-one solution.

3. CosmoLex vs. Xero

Xero is a well-known accounting software designed for a broad range of businesses. While it offers great financial management tools, it lacks the legal-specific features that CosmoLex has, such as trust accounting compliance and client matter management. For law firms needing specialized accounting and practice management, CosmoLex is the more comprehensive option.

Pros and Cons of Using CosmoLex

Pros:

All-in-One Platform: Combines accounting, time tracking, and client management.

Trust Accounting Compliance: Ideal for law firms that need to manage client trust accounts.

User-Friendly Interface: Easy to navigate, even for those without an accounting background.

Seamless Integration: Works well with payment gateways and other third-party tools.

Automated Features: Time-saving automation for bank reconciliation, billing, and reporting.

Cons:

Cost: CosmoLex can be more expensive compared to simpler, non-specialized accounting software.

Learning Curve: While the interface is user-friendly, new users may still need time to familiarize themselves with all the features.

Not Ideal for Non-Legal Firms: The software is best suited for law firms and may not provide enough value for businesses in other industries.

Final Thoughts

CosmoLex has established itself as one of the best accounting software solutions for legal professionals due to its comprehensive, all-in-one approach. From trust accounting compliance to integrated time tracking and billing, CosmoLex provides the tools needed to manage the financial and operational aspects of a law firm effectively. While it may come at a higher cost compared to simpler accounting software, its specialized features and time-saving automation make it a worthwhile investment for law firms and professional service providers. By choosing CosmoLex, businesses can enhance efficiency, ensure compliance, and focus on delivering excellent services to their clients.

FAQs

What Industries Benefit the most from CosmoLex?

CosmoLex is designed primarily for legal professionals and firms. It is best suited for law firms, solo practitioners, and accounting firms that handle legal trust accounting and billing.

How does CosmoLex Handle Data Security?

CosmoLex employs strong data security measures such as encryption, cloud storage, and multi-factor authentication to protect user data and ensure compliance with industry regulations.

Can I try CosmoLex before Purchasing?

Yes, CosmoLex offers a free trial for potential customers to test out the platform and determine if it fits their business needs.

Does CosmoLex Integrate with other Software?

CosmoLex integrates with popular tools and platforms like Xero, QuickBooks, and payment gateways, ensuring a seamless workflow for users who may need to use additional software for their operations.

Is CosmoLex Suitable for Solo Practitioners?

Yes, #CosmoLex is an excellent choice for solo practitioners who need a comprehensive accounting and practice management solution. Its user-friendly design and specialized features make it ideal for professionals who manage their own practices.

2 notes

·

View notes

Text

Why You Need to Outsource Medical Billing Services to a Third-Party Medical Billing Company

In today's complex healthcare landscape, managing medical billing can be a daunting task for healthcare providers. From coding and claims submission to payment posting and denial management, the intricacies of medical billing can significantly impact a practice's revenue cycle. Outsource medical billing services to a third-party medical billing company can streamline operations, improve efficiency, and ultimately boost your bottom line.

Benefits of Outsourcing Medical Billing Services

Enhanced Efficiency: A dedicated medical billing company has the expertise and resources to streamline your billing processes. They can automate tasks, reduce errors, and accelerate claim processing, leading to faster payments.

Increased Revenue: By outsourcing, you can ensure accurate and timely claims submission, minimizing denials and maximizing reimbursement. A specialized billing company can identify and recover lost revenue, optimizing your revenue cycle.

Reduced Administrative Burden: Offloading medical billing tasks to a third-party company allows your staff to focus on patient care and other core competencies. This frees up valuable time and resources, improving overall productivity.

Compliance Adherence: Staying up-to-date with ever-changing healthcare regulations can be challenging. A reputable medical billing company has the knowledge and experience to ensure compliance with HIPAA, ICD-10, and other relevant regulations, mitigating legal and financial risks.

Improved Cash Flow: Timely claim processing and efficient payment collection can significantly improve your cash flow. A dedicated billing company can optimize your revenue cycle, ensuring you receive payments promptly.

Challenges of In-House Medical Billing

High Staffing Costs: Hiring and retaining qualified billing staff can be expensive, especially in competitive markets.

Complex Regulations: Keeping up with the ever-evolving healthcare regulations requires specialized knowledge and ongoing training, which can be a significant burden.

Time-Consuming Tasks: Manual data entry, claim submission, and follow-up can be time-consuming and prone to errors.

Limited Expertise: In-house staff may lack the specialized expertise to handle complex billing scenarios and appeals processes effectively.

Services Offered by a Medical Billing Company

Claims Submission: Accurate and timely submission of claims to payers.

Coding and Billing: Correct coding of medical services and procedures.

Payment Posting: Efficient posting of payments and adjustments.

Denial Management: Effective handling of denied claims, including appeals and resubmissions.

Follow-up on Claims: Timely follow-up on outstanding claims to expedite payment.

Financial Reporting: Detailed financial reports to track revenue and expenses.

Staffing Cost Savings

By outsourcing medical billing, you can significantly reduce staffing costs. You won't need to hire and train in-house billing staff, saving you money on salaries, benefits, and overhead expenses.

Overhead Cost Savings

Outsourcing can also help you save on overhead costs. You won't need to invest in billing software, hardware, and other infrastructure. Additionally, you can reduce office space requirements, further lowering your overhead expenses.

How Right Medical Billing LLC Can Save Your Money and Time

Right Medical Billing LLC is a leading medical billing company that can help you streamline your revenue cycle and improve your bottom line. Our experienced team of billing experts offers a comprehensive range of services, including:

Expert Billing Services: Our team stays up-to-date with the latest industry regulations and coding guidelines to ensure accurate and timely claims submission.

Advanced Technology: We leverage cutting-edge technology to automate tasks, reduce errors, and accelerate the billing process.

Dedicated Account Managers: You'll have a dedicated account manager to oversee your billing operations, ensuring smooth communication and timely resolution of issues.

Improved Cash Flow: Our efficient follow-up and denial management processes help you collect payments faster, improving your cash flow.

Reduced Administrative Burden: By outsourcing your medical billing, you can free up your staff to focus on patient care, leading to increased productivity and patient satisfaction.

Why Choose Right Medical Billing LLC?

By choosing Right Medical Billing LLC, you can:

Increase Revenue: Our expertise in coding, billing, and claims submission can help you maximize reimbursement.

Improve Efficiency: Our streamlined processes and advanced technology can significantly reduce turnaround time for claims.

Enhance Compliance: Our team ensures adherence to all relevant regulations, mitigating legal and financial risks.

Reduce Costs: Our cost-effective solutions can help you save money on staffing, technology, and overhead expenses.

Improve Patient Satisfaction: By freeing up your staff to focus on patient care, you can enhance patient satisfaction and loyalty.

In conclusion, outsourcing medical billing services to a reputable company like Right Medical Billing LLC can provide numerous benefits, including increased efficiency, improved revenue, reduced administrative burden, and enhanced compliance. By partnering with us, you can streamline your operations, improve your cash flow, and focus on what matters most: providing quality patient care.

2 notes

·

View notes

Text

What is Cash Application and How AI is Revolutionizing Cash Application Management?

What is Cash Application and How AI is Revolutionizing Cash Application Management?

Managing cash flow efficiently is the lifeblood of any business, especially for companies dealing with high volumes of transactions. Cash application has emerged as one of the most critical functions for businesses, as it directly impacts both cash flow and customer relationships. But what is cash application process, and how is AI transforming this fundamental process to enhance speed, accuracy, and efficiency?

Why Cash Application is Crucial for Companies

Cash application, while often overshadowed by other financial processes, is an essential part of accounts receivable (AR) management. It entails matching incoming customer payments to open invoices, and keeping accounts current and precise. When cash application management is done efficiently, it ensures that businesses maintain healthy cash flow, avoid disruptions, and provide superior customer service. Conversely, poor cash application management can lead to customer dissatisfaction, increased operational costs, and strained cash flow.

In mature as well as fast-growing markets, medium to large-scale businesses operate with complex payment systems, and the stakes are even higher. Delayed or inaccurate cash application management can result in collection inefficiencies, with businesses wasting time chasing already settled invoices. Moreover, mismanagement of the cash application process can tarnish a company’s reputation, as frustrated customers deal with errors like duplicated collection efforts or unapplied payments.

What is Cash Application Process?

Cash application is the process of matching incoming customer payments with the respective invoices. In a typical B2B setup, customers pay their bills or invoices via various payment methods, including checks, ACH (Automated Clearing House) transfers, and online payments. Each payment must be reconciled with the correct invoice to ensure the customer’s account is updated accurately.

Data Collection: Data is pulled from multiple sources like ERPs (Enterprise Resource Planning), billing systems, bank statements, and customer payment advices. Payments may also arrive through various channels such as check payments, wire transfers, and online transactions.

Matching Payments to Invoices: Payments are matched to open invoices based on the remittance advice from customers. This requires close attention to discrepancies like deductions, credit notes, and partial payments.

Reconciliation: Once matched, payments are reconciled against the company’s bank statements to ensure accuracy.

4. Handling Discrepancies: Issues such as short payments, overpayments, deductions, and disputed amounts must be resolved to maintain accurate records.

Common Challenges in Manual Cash Application

“Manual cash application processes are time-consuming and prone to human error. This process can be broken down into two main categories: Payment Reconciliation and Cash Posting.“

Payment Reconciliation

The most time-consuming part of the cash application process is payment reconciliation. This involves matching invoice amounts with remittance information and bank statements. For cash application specialists, visibility into accounts receivable and expected payments is crucial. This information is typically available in the accounts ERP. Keeping track of these payments ensures they are received in a timely manner and properly allocated to the appropriate accounts.

Depending on the payment mode and channel, these formats will vary. For instance, lockbox formats differ from ACH payment reports, and online payment information differs from wire transfers. Additionally, if the payments involve multiple currencies, FX conversion rates can further complicate the process. While bank formats are generally standard, the data still needs to be retrieved for payment reconciliation from either PDFs or Excel sheets.

During the payment reconciliation process, it’s key to segregate mismatched transactions from matched transactions by taking inputs from ERP data, customer remittance information, and bank statements.

Common types of mismatches are due to following:

1. Deductions: Deductions occur when customers reduce the payment amount due to various reasons like returns, discounts, or allowances. Reconciling these requires matching the deduction details with the corresponding invoice and ensuring the justification for the deduction is valid.

2. Short Payments: Short payments happen when customers pay less than the invoiced amount. These discrepancies need to be investigated to understand the cause—whether it’s an error, a dispute, or an approved discount.

3. FX Differences: When dealing with international transactions, FX (foreign exchange) differences arise due to fluctuations in currency exchange rates. Accurate reconciliation involves converting payments to the base currency and accounting for any exchange rate discrepancies.

4. Tax Holds: Tax holds can occur if there’s an issue with the tax calculations on an invoice. These need to be reviewed to ensure compliance with tax regulations and to adjust the accounts accordingly.

5. Refunds & Chargebacks: Refunds and chargebacks require meticulous tracking. Refunds are payments returned to the customer, while chargebacks are transactions disputed by the customer and reversed by the bank. Proper documentation and validation are essential for reconciling these entries.

6. Payment Processing Charges: When using payment gateways or ACH processing services, fees are often deducted from the payment amount before it reaches the company’s account. Reconciling these charges involves matching the net payment with the gross amount and the associated fees.

Once these mismatches are identified and addressed, the transaction-level payment reconciliation provides a clear picture, enabling accurate cash posting entries into the ERP system. This clarity ensures that all payments are correctly allocated, improving cash flow management and financial reporting accuracy.

What is Cash Posting :

Cash posting is a critical step in the cash application process where payments are recorded in the ERP system to reflect accurate account balances.

What are Cash Posting Challenges

Some of the main challenges businesses face include:

Unapplied Payments: Payments that remain unapplied for days or weeks after receipt cause significant delays. These unapplied payments can create redundancy in collection efforts, as the finance team might continue to contact customers for payments that have already been made but not yet matched and applied.

Misapplied Payments: Incorrectly posting payments to the wrong account or invoice can lead to extensive rework. This mistake requires manual corrections, consumes valuable time, and frustrates customers, potentially leading to disputes and delayed future payments.

Payment Without Remittance Advice: When customers do not provide clear instructions on how their payments should be applied, businesses may struggle to identify the correct account or invoice. This often results in unapplied or misapplied payments, further complicating the reconciliation process.

Multiple Payment Channels: Companies dealing with various payment gateways (e.g., Stripe, PayPal, and Dwolla) or handling both online and traditional check payments face the challenge of reconciling payments in different formats. The diverse formats increase the risk of mismatched data and complicate the reconciliation process.

These challenges create inefficiencies, directly affecting cash flow and customer satisfaction. Research shows that companies with poor cash application processes can experience a 20-30% delay in receiving payments due to manual errors and system inefficiencies. Streamlining and automating the cash posting process can significantly improve the accuracy and speed of payment reconciliation, leading to better financial management and enhanced customer relationships.

The Role of AI in Cash Application Process

Enter AI: artificial intelligence is now revolutionizing cash application process by automating much of the manual work and improving accuracy. Let’s understand how AI powered cash application process will create an impact on your cash flow management:

Automated Matching: AI powered cash application process can process vast amounts of payment data from multiple sources and automatically match payments to open invoices, eliminating the need for human intervention. This drastically reduces the time it takes to apply cash and ensures accuracy.

Error Reduction: AI powered cash application automation software reduces the risk of human error, particularly with misapplied or unapplied payments. By leveraging machine learning, AI systems can learn from past applications and improve their matching algorithms over time.

Handling Payment Discrepancies: AI powered cash application process can flag discrepancies such as short payments, overpayments, or missing remittance advices, and automatically suggest resolutions. For instance, if a payment doesn’t match the invoice amount, the system can identify potential deductions or adjustments based on past transactions.

4. Faster Reconciliation: AI powered cash application automation software accelerates the reconciliation process by matching payments with bank statements in real-time, minimizing delays and ensuring accurate financial records.

5. Handling Complex Payment Structures: AI powered cash application process systems can manage various payment types (check payments, ACH, online payments) and integrate with multiple payment gateways (like PayPal, Stripe, and Aydan), providing a seamless cash application process regardless of the payment method used.

Benefits of AI-Powered Cash Application Process

The introduction of AI into cash application automation software offers numerous benefits:

Speed: What once took days or even weeks can now be accomplished in minutes. AI significantly reduces processing times by automating the matching and reconciliation process.

Accuracy: AI systems are highly accurate, meaning fewer errors, less rework, and improved cash flow.

Scalability: AI can easily scale to accommodate growing transaction volumes, making it ideal for large businesses with high payment frequencies.

Cost Reduction: By automating processes, AI reduces the need for large accounts receivable teams, saving on labor costs.

Should Cash Application Be Outsourced?

While outsourcing cash application to third-party providers is an option, businesses must weigh the pros and cons. Outsourcing can reduce the need for in-house expertise and can be a more affordable option in the short term. However, it may introduce delays and limit control over sensitive financial processes.

On the other hand, AI-driven cash application solutions can offer a middle ground by automating processes while keeping them in-house. This provides greater control and ensures that the company maintains direct oversight of payment processing, while still reaping the benefits of automation.

Conclusion

The adoption of AI powered cash application automation software is transforming how businesses handle one of their most critical functions. By eliminating manual errors, speeding up payment processing, and ensuring accurate application of payments, AI offers a robust solution that allows businesses to streamline their operations and improve cash flow. As AI continues to evolve, it is poised to become an indispensable tool for finance departments looking to stay competitive in the fast-paced world of business.

Investing in AI powered cash application automation software can lead to improved customer relationships, faster cash cycles, and enhanced operational efficiency, positioning companies for long-term success in an increasingly digital economy.

#ai based accounts receivable#cashflow management#payment reminder#Cash application process#accounts receivable automation software#ai in accounts receivable#payment reconciliation#ar management

0 notes

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

BROWSERS, ADBLOCKERS AND OTHER ADDONS

tl;dr: Use LibreWolf and install CleanURLs, or if not, use uBlock Origin and CleanURLs on whatever browser you use.Librewolf : https://librewolf.net/uBlock Origin : https://ublockorigin.com/CleanURLs : https://github.com/ClearURLs/Addon

BROWSERS:

I will not start an argument about the necessity of privacy respecting browsers, I assume if you're reading this rambling of mine about the subject you're at least partially interested in not leaking all your data to the internet. Most browsers you'll encounter are leaky, and they will give your data to 3rd parties, either by poor design or implementation or knowingly and happily for money, but some browsers are just more leaky than others, so your choice of browser matters.

Apart from the ethical issues that uncontrollable data selling raises, online ads, tracking cookies and these tracking methods lead to a slower internet, higher processor and memory requirements, a messy design of webpages, and a plethora of other security issues and opportunities for bad actors ("hackers"). The sheer number of so-called attack vectors that web browsing presents is astounding.

Just to give a brief image of it, visit the site https://privacytests.org/, it will show you a comparison of web browsers on their performance of not leaking stuff to other people. The different tests are performed daily, and the website is rather informative about these tracking methods, attack vectors. Some part may be less important to you (Tor capabilities for example), so not all privacy respecting features are created equal, but this is the closest you'll ever get to an open and easily digestable learning material on browser privacy.

At the time of writing the best option for daily use is LibreWolf, basically a fine-tuned Firefox. It also has a lot of features for advanced users, but is generally easy to use, with built in uBlock Origin, and javascript disabled (which you may want to enable for certain web pages).You may want to know that certain browsers are tracking your movement and build a profile on you without ever visiting any webpage, and this category includes Firefox, and Chromium as well.

ADBLOCKERS:

Most adblockers have long sold their souls to the devil, and they are the ones collecting data on you, and some of them are purposefully not blocking certain ads, go figure. A lot of them are not open source, or not even open on their business pactices. You wouldn't hire a security company to protect your business who has a sketchy and non-transparent working, and who you cannot verify that they are not accepting money from the Chinese Communist Party, would you? The easy answer is to use uBlock Origin, an open source, transparent, free as in freedom software, with a completely transparent working, and verifiable everything. Please note that uBlock and uBlock Origin are not the same adblocker, and the regular uBlock has been bought by - guess what - an advertising company.

CleanURLs: Sometimes when you receive a youtube link, and you click on in, instead of youtube.com/watch?=xxxxxxx you'll get a ten times longer link with fbclid and really long alphanumerical stuff, isn't it weird? Does this link need to be this long to function? Well, the answer is no. It's just one of the tricks how websites track you with even more unnecessary cookies, that try to follow you from site A to site B (for example to figure out which youtube account belongs to which facebook user to make even more targeted ads). You can manually delete all those cross-site tracking stuff from every link you use but it's a tedious, but easily automated task. That's where CleanURLs come in, to do this instead of you. You'll be surprised how many tracking attempts are blocked in a day by this stuff.May these tools bring you a faster and cleaner internet experience.

18 notes

·

View notes

Text

Elevate Your Business with Online Accounting and Bookkeeping Services by MASLLP

Introduction:

In today’s fast-paced digital world, businesses of all sizes are looking for efficient ways to manage their finances. Online accounting and bookkeeping services have become a game-changer, providing businesses with real-time financial insights and streamlined operations. MASLLP offers top-notch online accounting and bookkeeping services designed to meet the unique needs of your business. In this blog, we will explore the benefits of these services and why MASLLP is the ideal partner for your financial management needs.

The Advantages of Online Accounting and Bookkeeping Services

Accessibility and Convenience One of the primary benefits of online accounting and bookkeeping services is accessibility. With MASLLP’s services, you can access your financial data anytime, anywhere. This flexibility allows you to make informed decisions on the go, without being tied to a physical office.

Real-Time Financial Insights Online accounting services provide real-time updates on your financial status. MASLLP ensures that your books are always up-to-date, giving you accurate insights into your business’s financial health. This real-time information is crucial for strategic planning and timely decision-making.

Cost-Effective Solution Outsourcing your accounting and bookkeeping to MASLLP can be more cost-effective than maintaining an in-house team. You save on salaries, benefits, and overhead costs while gaining access to professional expertise and advanced accounting software.

Enhanced Security Security is a top priority when it comes to financial data. MASLLP utilizes robust security measures to protect your sensitive information. Our online accounting platform ensures that your data is encrypted and secure, safeguarding it from unauthorized access.

Scalability As your business grows, your accounting needs will evolve. MASLLP’s online accounting and bookkeeping services are scalable, meaning they can easily adapt to your changing requirements. Whether you’re a startup or an established enterprise, our services can grow with you. Why Choose MASLLP for Online Accounting and Bookkeeping Services? Expertise and Experience MASLLP has a team of highly qualified professionals with extensive experience in accounting and bookkeeping. Our experts are well-versed in the latest industry practices and regulations, ensuring that your financial management is in capable hands. Tailored Solutions We understand that every business is unique. MASLLP offers customized accounting and bookkeeping solutions tailored to your specific needs. Our personalized approach ensures that you receive the support and services that are best suited to your business. Advanced Technology MASLLP leverages cutting-edge technology to provide efficient and accurate accounting services. Our advanced accounting software automates routine tasks, reduces errors, and enhances productivity, allowing you to focus on growing your business. Comprehensive Services Our online accounting and bookkeeping services cover a wide range of financial management needs, including: Bookkeeping: Accurate and timely recording of financial transactions. Financial Reporting: Preparation of financial statements and reports. Tax Preparation: Expert tax planning and compliance services. Payroll Services: Efficient payroll management and processing. Accounts Receivable and Payable: Management of incoming and outgoing payments. Exceptional Customer Support At MASLLP, we pride ourselves on providing exceptional customer support. Our team is always available to answer your questions, address your concerns, and provide guidance. We are committed to building long-term relationships with our clients based on trust and transparency. Conclusion Online accounting and bookkeeping services are essential for modern businesses seeking efficiency, accuracy, and scalability. MASLLP offers comprehensive, secure, and customized solutions that cater to your unique financial management needs. By choosing MASLLP, you gain a trusted partner dedicated to helping your business thrive. Don’t let financial management be a burden. Contact MASLLP today to learn more about our online accounting and bookkeeping services and how we can support your business’s growth and success.

#accounting & bookkeeping services in india#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#audit#ap management services

6 notes

·

View notes

Text

Melio is a financial technology platform designed to streamline accounts payable and receivable processes for small and medium-sized businesses. It aims to simplify bill payments, improve cash flow management, and enhance overall financial operations. Here is a detailed review of its features and functionalities:

Key Features

Bill Payments:

Multiple Payment Methods: Melio allows businesses to pay vendors using ACH bank transfers, credit cards, or checks. This flexibility helps businesses manage cash flow and earn credit card rewards, even if the vendor only accepts checks. Schedule Payments: Users can schedule payments in advance, ensuring timely bill payments and avoiding late fees. Batch Payments: The platform supports batch payments, allowing users to pay multiple bills at once, saving time and reducing administrative burden.

Accounts Receivable:

Payment Requests: Businesses can send payment requests to customers via email, including a link for customers to pay directly through the platform.

Customer Management: Track customer payments, manage outstanding invoices, and automate reminders to improve collection rates.

Integration and Syncing:

Accounting Software Integration: Melio integrates with popular accounting software like QuickBooks, Xero, and FreshBooks, ensuring seamless data synchronization and reducing manual data entry.

Bank Integration: Direct integration with banks facilitates easy payment processing and reconciliation. User-Friendly Interface:

Dashboard: A clean and intuitive dashboard provides an overview of pending and completed payments, cash flow status, and upcoming bills.

Mobile Access: The platform is accessible via mobile devices, allowing users to manage payments and view financial data on the go.

Security and Compliance:

Secure Transactions: Melio employs robust security measures, including encryption and secure data storage, to protect user information and financial transactions.

Compliance: The platform adheres to financial regulations and industry standards, ensuring compliance with relevant laws.

Cash Flow Management:

Flexible Payment Options: By allowing credit card payments for bills, Melio helps businesses manage cash flow more effectively, providing the flexibility to defer payments while still meeting obligations.

Payment Scheduling: Advanced scheduling options enable better planning and control over outgoing cash flow.

Collaboration Tools:

Team Access: Multiple users can be granted access to the platform, allowing for collaborative financial management. Permission settings ensure that sensitive information is accessible only to authorized personnel.

Audit Trail: Detailed records of all transactions and activities help maintain transparency and accountability.

Pros Flexibility in Payments: The ability to pay bills via credit card, even when vendors don’t accept them, provides a unique advantage in managing cash flow and earning rewards. Ease of Use: The platform’s user-friendly interface and straightforward setup make it accessible for businesses of all sizes.

Integration with Accounting Software: Seamless integration with major accounting tools ensures accurate financial tracking and reduces manual workload.

Security: Strong security measures and compliance with industry standards provide peace of mind for users.

Batch Payments: Support for batch payments simplifies the process of paying multiple bills, saving time and reducing errors.

Cons Cost: While Melio offers a free version, certain advanced features and payment methods (like credit card payments) incur fees, which might be a consideration for cost-sensitive businesses. Limited Global Reach: Melio primarily serves businesses in the United States, which may limit its usefulness for companies with significant international operations or those based outside the U.S. Learning Curve for Advanced Features: Some users might find the advanced features complex initially, requiring time to fully utilize all functionalities.

Melio is a powerful and flexible tool for small and medium-sized businesses looking to streamline their accounts payable and receivable processes. Its ability to manage payments through various methods, integration with popular accounting software, and user-friendly design make it an attractive option for businesses aiming to enhance their financial operations. While there are costs associated with some features and a learning curve for advanced functionalities, the overall benefits, including improved cash flow management and operational efficiency, make Melio a valuable tool for modern businesses.

4 notes

·

View notes

Text

In today’s fast-paced business environment, enhancing productivity is more crucial than ever to successfully accomplish this, one can rely on the power of automation. By automating routine tasks, businesses can save time, reduce errors, and focus on more strategic activities. In this blog post, we will explore essential automation strategies that can help boost productivity in your organization.

Boost productivity with these essential automation strategies. Automation is transforming the way businesses operate, making processes more efficient and streamlined. Implementing the right automation strategies can lead to significant improvements in productivity and overall business performance. In this article, we will discuss several key automation strategies that can help you achieve these goals.

1. Automate Repetitive Tasks

One of the most effective ways to boost productivity is by automating repetitive tasks. These tasks often consume a significant amount of time and can be easily automated using the right tools. For example, you can automate data entry, email responses, and appointment scheduling. By doing so, you free up valuable time for more critical activities.

2. Utilize Workflow Automation

Workflow automation involves creating a series of automated actions that complete a process. This strategy is particularly useful for complex processes that involve multiple steps and departments. Tools like Zapier and Microsoft Power Automate can help you set up automated workflows, ensuring that tasks are completed efficiently and accurately.

3. Implement Marketing Automation

Marketing automation can significantly enhance your marketing efforts by automating tasks such as email marketing, social media posting, and lead nurturing. Platforms like HubSpot and Mail chimp offer comprehensive automation features that can help you reach your target audience more effectively and improve your marketing ROI.

4. Enhance Customer Service with Chatbots

Integrating chatbots into your customer service strategy can greatly improve efficiency and customer satisfaction. Chabot’s can handle a wide range of customer queries, provide instant responses, and escalate issues to human agents when necessary. This not only saves time but also ensures that customers receive timely and accurate support.

5. Streamline Financial Processes

Automation can also be applied to financial processes such as invoicing, expense tracking, and payroll management. Tools like QuickBooks and Xero offer robust automation features that can help you manage your finances more efficiently and reduce the risk of errors.

Boost Productivity with These Essential Automation Strategies. Automation is a powerful tool that can help businesses enhance productivity and efficiency. By implementing the strategies discussed in this article, you can streamline your processes, reduce manual workload, and focus on more strategic activities. Have you tried any of these automation strategies?

#Automation#Productivity#BusinessEfficiency#TechTrends#WorkflowAutomation#DigitalTransformation#AutomationTools#SmartBusiness#Innovation#Accomation#BusinessAutomation#InvoiceManagement#EfficiencyTools#AutomationSolutions#SmallBusinessTools#StreamlineOperations#BusinessGrowth#FinancialAutomation

2 notes

·

View notes