#Subprime mortgage crisis

Explore tagged Tumblr posts

Text

The Big Short (2015, Adam McKay)

01/09/2024

#the big short#2015#adam mckay#michael lewis#christian bale#steve carell#ryan gosling#brad pitt#Subprime mortgage crisis#academy awards#Academy Award for Best Picture#Academy Award for Best Adapted Screenplay#Hedge fund#Subprime lending#Credit default swap#Mercato immobiliare#Investment fund#deutsche bank#Collateralized debt obligation#Credit rating agency#Las Vegas#morgan stanley#United States dollar#Swap#American Film Institute#budget#rotten tomatoes#metacritic#88th Academy Awards

4 notes

·

View notes

Photo

Listen. listen. I was working in affordable housing right before the crash in 2008 and we saw it coming. but we were city employees, working on the scale of a single city, so we saw something big coming but we didn't know what it was.

The kind of housing I worked in was called "inclusionary development". Developers would be given permission to build luxury condo developments on the condition that some number of units (usually between 10 and 20%) had what's called a deed rider on them. The deed rider contained a bunch of legal requirements that amounted to ensuring that only people who could barely afford one of these units were qualified to buy them. This was supposed to be a "hand up, not a handout" (I hate that phrase so much), but it created a basically permanent class of house-poor people who were nearly broke all the time, but they had achieved the dream of owning a home. In the libertarian utopia of the mid-aughts, these people had been "removed from the cycle of poverty" or some such shit but in fact, they'd just been placed permanently in the jaws of the crocodile, and one thing destabilizing their financial situation would result in foreclosure and homelessness.

When people talk about "subprime mortgages" or "subprime lending", that's code (in part) for situations like this. People who couldn't qualify for "normal" loans went through an intrusive process where they were verified to have very little in the way of cash or investments and to make juuuuuust enough money to be able to pay a really awful mortgage as long as nothing went wrong. As a prize for putting up with third parties being all up in your money business, you were offered the chance to sign up for a pile of loans at 0% down with absolutely punishing interest rates such that you could realistically never expect to get ahead on your payments. The idea was the the property would itself somehow magically make you solvent while bleeding you dry for the enrichment of the banks and the white men who profit from them. Of course, the game was rigged so that the property couldn't help you, the owner, unless you cheated- got help paying off your loans, rented it out to earn more income the way rich people are expected to, hid money on the audit, or lied. If you did those things and got caught, you could lose your home and the white men at the top still profited. Libertarianism at its purest.

Even so, we saw about two foreclosures a year for roughly 2002-2006. and then, in the first half of 2007, we saw two per month. My manager and I were alarmed, and she asked me to call all the people who'd been foreclosed on in the last year and ask if they'd be willing to share what happened. I emphasized when I called that there was absolutely no legal requirement for them to share, but that my manager and I were hoping there would be some kind of common thread that we could try to do something about about.

Some of these people I had talked to personally in my compliance role, even multiple times. All of them knew who my agency was and that we were tasked with making sure they were acting in accordance with the legal requirements they'd signed at more or less financial gunpoint. What I am saying is that all of these people had a complicated relationship with me and the agency I worked for.

They all shared, and for every single one of them, the reason was medical bills. Most of them had had something awful happen personally (car crash, cancer), a couple had sick or injured family members. But for all of them it was the other half the grift, the for-profit medical system, which was making them unable to fulfill their legal agreement to be milked dry by the mortgage portion of the grift.

This last episode of Leverage fucks me up because this is so, so, so important.

“This is a big ass speech. This is a big ass stop the show, this is the moral framework of the entire five years you’ve seen. Nate Ford justifies 77 episodes of Leverage in this speech, cause you know what? It is the last goddamn episode, you’re gonna know why we made the show. We didn’t make the show cause we thought it was clever or cute or fun. I always say this, no show succeeds unless somebody loves it and you know what, everybody loves this show and to me, what Nate’s saying here is important enough to say out loud. No one should be allowed to cheat and get away with it.” - John Rogers, The Long Goodbye Job DVD Commentary

#leverage#subprime mortgage crisis#leverage dvd commentary#yes this#exactly a thousand percent this#listen#capitalism and property ownership are fucked#the white men who profit from these systems of oppression are doing on purpose with malice aforethought#renting is also oppressive but don't let that hide the oppression of home ownership from you

14K notes

·

View notes

Text

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges. ll. Background of the 2008 Market Crash A. Economic conditions leading up to the crash Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

#2008#bankruptcy#credit default swaps#crisis#derivatives#financial collapse#fraud#government bailout#investigation#lending practices#mortgage-backed securities#regulation#regulatory failure#risky loans#Silicon Valley Bank#subprime mortgages#systemic risk#United States

11 notes

·

View notes

Text

i haven't dnf'd a book in a very long time but i might have to do it with the big short..... not ashamed to say i do not and may never understand the finance world, and also i really don't enjoy the feeling of undiluted rage that comes over me every time the author lauds some guy whose first instinct upon seeing a precarious financial situation is to figure out how best to profit. also x2 i picked it as a research book but it's so far divorced from any of the perspectives i was looking for as to be completely unhelpful for my purposes

#anyway if anyone has book recs on the subprime mortgage crisis or housing injustice in general i would be in your debt#you can probably guess why lmfao#this is a paper jam

0 notes

Text

The 2008 Financial Crisis: A Global Wake-Up Call

Written by Delvin The 2008 financial crisis stands as a stark reminder of the fragility of the global financial system. Triggered by the collapse of the subprime mortgage market in the United States, this crisis had far-reaching consequences that reverberated across the globe. In this blog post, we will delve into the key factors that led to the crisis, its impact on the global economy, and the…

View On WordPress

#2008 Financial Crisis#dailyprompt#Financial#Financial Literacy#knowledge#money#Money Fun Facts#Real Estate#Subprime Mortgage Market Collapse#The 2008 Financial Crisis: A Global Wake-Up Call

1 note

·

View note

Text

Halloween costume idea: Margot Robbie in a bubble bath explaining the subprime mortgage crisis/2008 financial crisis

#holding a sign that says ‘ask me about the subprime mortgage crisis’#the bubble bath is the hard part bc I’d need a lot of cotton balls…#txt

1 note

·

View note

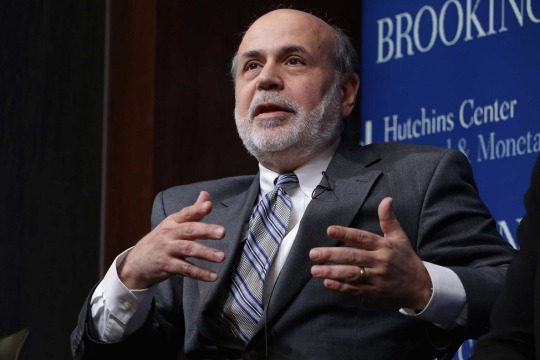

Photo

#Luminaries - Ben Bernanke

Ben Bernanke, in full Benjamin Shalom Bernanke, (born December 13, 1953, Augusta, Georgia, U.S.), American economist who served as chairman of the Board of Governors of the Federal Reserve System (“the Fed”), the central bank of the United States, from 2006 to 2014.

#gentlemans code#luminaries#ben bernanke#brookings#economics#economist#academia#academic#federal reserve system#Nobel Prize#Fed chairman#financial crisis#subprime mortgage#crisis#professor#Harvard university#massachusetts institute of technology#stanford university

1 note

·

View note

Text

just witnessed the very slight misteach thats going to create a huge error in some students first big corporate/govt job

#university#programming#python#they said to set a bool as true at the start of a project if establishing a variable in an if statement returns an error instead of a catch#which fixes that error but if theres another error that ignores the if itll say the qualification is met#basically 'whoopsie i coded the next subprime mortgage crisis' waiting to happen

0 notes

Text

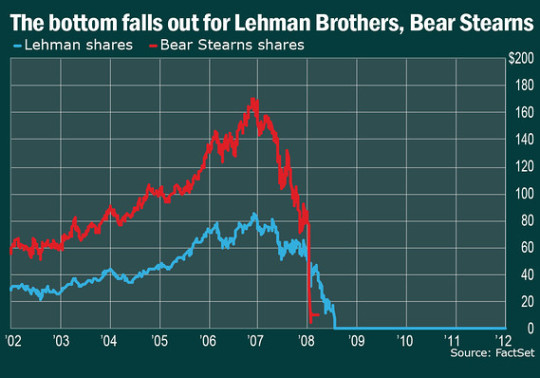

The fact that Trevor died when he did is so fucking funny to me because he just baaarely scrapes by with plausible deniability for involvement in the ‘08 mortgage crisis. If he had lived for literally three or four more years he would’ve been authorizing horrible subprime lending loans thru the soon-to-be-defunct Lehman Brothers. I don’t think the recession has ever been explicitly mentioned in the show but like. Does he know?? 😭

#the only thing I can imagine he’d be worried about in late 2000 would be the dot com bubble#bitch he doesn’t even know about the twin towers!!!#ghosts cbs#cbs ghosts#trevor lefkowitz

84 notes

·

View notes

Text

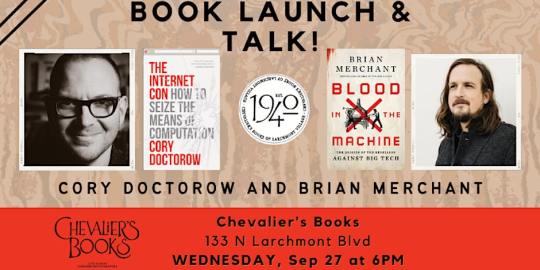

Intuit: “Our fraud fights racism”

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

In one sense there is nothing remarkable in observing that capitalists would prefer individuals who agree to work and consume in ways that most advantage capital. We need only to consider the ravages of the subprime mortgage industry that helped trigger the great financial crisis of 2008 or the daily insults to human autonomy at the hands of countless industries from airlines to insurance for plentiful examples of this plain fact. However, it would be dangerous to nurse the notion that today’s surveillance capitalists simply represent more of the same. This structural requirement of economies of action turns the means of behavioural modification into an engine of growth. At no other time in history have private corporations of unprecedented wealth and power enjoyed the free exercise of economies of action supported by a pervasive global architecture of ubiquitous computational knowledge and control constructed and maintained by all the advanced scientific know-how that money can buy. Most pointedly, Facebook’s declaration of experimental authority claims surveillance capitalists’ prerogatives over the future course of others’ behaviour. In declaring the right to modify human action secretly and for profit, surveillance capitalism effectively exiles us from our own behaviour, shifting the locus of control over the future tense from “I will” to “You will.” Each one of us may follow a distinct path, but economies of action ensure that the path is already shaped by surveillance capitalism’s economic imperatives. The struggle for power and control in society is no longer associated with the hidden facts of class and its relationship to production but rather by the hidden facts of automated engineered behaviour modification.

Shoshana Zuboff, The Age of Surveillance Capitalism

51 notes

·

View notes

Text

This week's deep dive rec is TAL: The Giant Pool of Money, a collaboration between This American Life and NPR News, that was the first long-form reporting that really made me understand how the hell subprime mortgage defaults led to a global financial crisis:

This American Life producer Alex Blumberg teams up with NPR's Adam Davidson for the entire hour to tell the story—the surprisingly entertaining story—of how the U.S. got itself into a housing crisis. They talk to people who were actually working in the housing, banking, finance and mortgage industries, about what they thought during the boom times, and why the bust happened. And they explain that a lot of it has to do with the giant global pool of money.

And since one hour isn't as much of a deep dive as usual (an hour and a half if you listen to the new reporting in the second half of their follow-up episode from a year after the financial collapse), I'll double-rec Michael Lewis's The Big Short: Inside the Doomsday Machine which goes even more in-depth on the financial and regulatory mechanisms at work.

#wednesday deep dives#I read The Big Short after consuming a bunch of other related reporting so I can't speak to it as a beginner's guide#but it was written with a general audience in mind and I think the TAL episode would be enough of a primer to make it understandable

25 notes

·

View notes

Text

"The Indian Removal Act of 1830 The annexation of 55 percent of Mexico in 1848 The forced taking of the Philippines The forced taking of Puerto Rico The forced taking of Hawaii Japanese internment camps The destruction of a thriving Black community in Tulsa, Oklahoma The destruction of a thriving Black community in Rosewood, Florida Past and present-day redlining The abandonment of Black New Orleanians during and after Hurricane Katrina Predatory lending leading to the subprime mortgage crisis that wiped out billions in Black wealth

This is just a short list but, I hope, you get where I am going with this. Our American history is simply too rife with documented instances in which land occupied by people of color has forcibly been taken, preyed upon, intentionally devalued, or flat out destroyed for any well-meaning white people to roll their eyes when an old Black woman says that she believes that white people had an organized plan to take land occupied by Black people in D.C."

-Dax-Devlon Ross, Letters to My White Male Friends (2021)

32 notes

·

View notes

Text

#2008 recession#bailout#central banks#consumer confidence#economic downturn#financial institutions#foreclosure#global financial crisis#government debt#government regulation#housing market crash#quantitative easing#risky lending practices#stimulus package#stock market#subprime mortgages#TARP#unemployment

0 notes

Text

In Memoriam: Pluto in Capricorn

Y'all Mind if I Go Listicle on This One

setting the scene- pluto first entered capricorn on january 25th, 2008. retrograde sent it back to sagittarius for a few months over the summer (6/14/08 - 11/25/08) and 11/26/08 and beyond, it's been pluto in capricorn. pluto is currently in its final degree of capricorn. we had brief previews of pluto in aquarius (3/23/23 - 6/11/23 and 1/20/24 - 9/1/24), and from the afternoon of 11/19/24 forward, we will be in pluto in aquarius until 2043.

a sampler of news headlines from january/early february 2008:

"Stock markets around the world plunge amid growing fears of a U.S. recession, fueled by the 2007 subprime mortgage financial crisis."

"U.S. President George W. Bush says Israel must return to its pre-1967 borders to enable the establishment of a Palestinian state."

"Israel blocks fuel to the Gaza City power plant, causing a citywide blackout."

"George W. Bush delivers his final State of the Union Address as President of the United States"

"President Vladimir Putin says Russia would target its missiles at Ukraine if it threatened Russia's national security."

"The U.S. Department of Agriculture stands down two employees as part of its investigation of the biggest meat recall in United States history."

"WHO declares global tobacco control efforts and an approach to avoid tens of millions of premature deaths by the middle of this century."

"Bird flu cases in poultry spread in India, as the H5N1 virus infects seven districts in the state of West Bengal."

"Writers Guild of America strike (2007–present): Hollywood writers reach tentative agreement with the major movie studios."

in summary- end of Bush presidency, 2008 election, bird flu, attempts at nicotine control, war against Palestinians, imminent economic collapse, Russia/Ukraine, hollywood on strike, recalled meat, also several countries trying to get YouTube outlawed. imagine!

Wow crazy! What's Pluto's deal?

what does it mean for pluto to be in capricorn? pluto is the planet of transformation, destruction, rebirth, hidden truths, generational/societal shifts, and it's currently in capricorn, the sign of practicality, hard work/professional ambition, and leadership. capricorn, the zodiac's father figure. the merger of the two means slow-moving and long-lasting change in life/career path, family/societal structures (i.e patriarchy), financial systems, so on. pretty telling that we started this transit with a global financial crisis and now we're......here! posts circulate periodically about empires lasting ~250 years, which is about as long as it takes for a pluto return. if we're taking the US to have been "born" on 7/4/1776, the US' natal pluto placement is capricorn! never in the history of the US has pluto been back into its birth sign of capricorn until 2008. this placement means the US's foundation is one of these qualities listed above- built on patriarchy, conservatism, so on. this pluto return was technically in 2022 (around 27 degrees capricorn) and the effects could be felt +/- a few years on each side, since pluto moves so slowly. i think most would say the US (as we've known it) has been forced to confront the ugly sides of its foundations since 2020!

anyway, on with the pop culture highlight reel for pluto in capricorn. remembering the themes i described above (conservative/family values, patriarchy, financial systems, etc), let us look back.....

Pluto in Capricorn - Pop Culture Notables

(a non-exhaustive list, prioritizing my Most Memorable. Forgetting stuff is inevitable but this is a hell of a list)

- a moodboard for visual accompaniment - please support me getting into Pinterest

MOVIES:

Avatar, the Twilight series, Scott Pilgrim vs. the World, Moonlight, Inception, Get Out, La La Land, Zero Dark Thirty, The Social Network, The Blind Side, Ex Machina, The Wolf of Wall Street, the Fifty Shades series, Black Swan, all of the Jennifer Lawrence x Bradley Cooper movies, The Help, High School Musical 3, the Minions franchise, John Krasinski war hero arc, Interstellar, every single Marvel movie (minus the first 3 Spiderman movies, those were pluto in Sag), Frozen, The Dark Knight, Zootopia, the last 3 Harry Potter movies, Hunger Games series, Lady Bird, Call Me By Your Name, Parasite, Hereditary, the Hangover movies, 21 Jump Street series, Step Brothers, Project X, Bridesmaids, A Star is Born, Crazy Rich Asians, the Magic Mike series, Hidden Figures, the To All The Boys movies, Easy A, the Kick-Ass series (important to the Aaron Taylor Johnson fans)

TV:

indulge me as i go in depth on this....

Reality TV continues to expand after the early 2000s boom (a direct product of the writers strike)- Jersey Shore, RuPaul's Drag Race, every Real Housewives city after the original (Orange County), Are You The One, Love Island, Love is Blind/dating shows on streaming services, the rise of Nick Lachey -hosted competition/reality shows, the Love & Hip Hop franchise, Vanderpump Rules, Shark Tank, Basketball Wives, MasterChef, grandfathering in Keeping up with the Kardashians (first aired months before pluto into cap), Below Deck, Dance Moms, Impractical Jokers, Chopped MTV - Teen Wolf, Awkward, Girl Code/Guy Code, 16 and Pregnant, Teen Mom, Rob Dyrdek's Fantasy Factory, Silent Library, Skins, Ridiculousness, Catfish Huge Cartoon Network moment- Adventure Time, Regular Show, The Amazing World of Gumball, Chowder, Steven Universe, the Total Drama series (grandfathered in from pluto in sag) Disney & Nickelodeon - Shake It Up, Sonny with a Chance, Phineas and Ferb, Wizards of Waverly Place, Good Luck Charlie, The Suite Life on Deck, Victorious, Big Time Rush, True Jackson VP, iCarly (grandfathered in from pluto in sag) Revivals - Cribs, Punk'd, Fear Factor, Twin Peaks, The X-Files, Fuller House, Rush Hour tv series, Girl Meets World, iCarly, Queer Eye, Sex and the City: And Just Like That, That 90's Show, Arrested Development, Fraiser, Futurama, The Proud Family: Louder and Prouder, Rugrats More shows I want to mention but didn't want to categorize- Modern Family, Parenthood, The Vampire Diaries, Parks and Recreation, Brooklyn Nine-Nine, Community, Game of Thrones, American Ninja Warrior, Cake Boss, Lena Dunham's GIRLS, Broad City, The Walking Dead, Downton Abbey, Pretty Little Liars, The Great British Bake Off, Storage Wars, Glee, Sherlock, Tosh.0, South Park, Supernatural (grandfathered in from pluto in sag)

MUSIC:

i have spoken for so long about television that i will just direct the audience to this Spotify playlist of vetted pluto in capricorn hits (thank you to this playlist creator) - https://open.spotify.com/playlist/5XALIurWS8TuF6kk8bj438?si=4cd575cfa9564201

MISC/EVENTS:

the transition from myspace to facebook, majorrrrr social media takeover- instagram, tiktok, twitter, tumblr, vine, snapchat, yikyak, reddit, BeReal, skype/oovoo, so on - all either founded or gained traction, social media becomes a career, Amazon buys Whole Foods, Occupy Wall Street, gay marriage legalized, the entire Obama presidency, rise of Donald Trump's political career and presidency, #MeToo movement, "incels", formation of BLM, Colin Kaepernick takes a knee during NFL national anthem and causes nationwide outrage, Nationwide 2020 BLM protests and marches, increased visibility on police brutality (w/ the rise of social media, body cam requirements, etc), more anti-racist organizations and coalitions created across racial groups following the creation of BLM and 2020 racial unrest, strengthening of the alt-right pipeline and supporting right-wing sycophants/"influencers", Joe Rogan podcast, Pokemon GO to the polls, both Prince William and Prince Harry's royal weddings, Tiger Woods cheating scandal, rise of bizarre celebrity sexting scandals (notably: many celebs with capricorn placements), Jonas Brothers purity rings, Gisele Bündchen & Tom Brady's first baby (NOTE: PLUTO IS CHANGING SIGNS AND GISELE IS CURRENTLY PREGNANT AGAIN W/ HER NEW MAN'S BABY), formation of Odd Future, Lady Gaga's meat dress, Beyoncé's children, Kim Kardashian's 72-day marriage, Bieber Fever, Bangerz era Miley Cyrus, Summer 2016, Hot Girl Summer, One Direction/boyband takeover, Charlie Sheen's hashtag winning moment, Caitlyn Jenner tell-all, Bobby Shmurda’s arrest, Free Britney, Ben Affleck x JLo notably first happened right before pluto in cap and they got back together right at the tail end of pluto in cap, the infamous white and gold or blue and black dress, the term Girlboss, the Ice Bucket Challenge, Hamilton, the rise of fanfiction, the rise of Buzzfeed and listicle journalism, Fyre Festival scam, Fenty Beauty launched, growing concerns about the electric grid, the rise of streaming services, the iPhone absolutely dominates the cell phone market and we all have supercomputers on us 24/7, e-cigs and vapes more commercially available in response to anti-cigarette campaigns, the iPad, Angry Birds/Candy Crush and the affiliates, COVID, rise of remote work, "Adele Dazeem", David Cook winning American Idol over David Archuleta (see: title photo for this post), self driving cars, new wave of the opioid overdose epidemic, AI takeover

See also: Fall Out Boy's version of Billy Joel's We Didn't Start the Fire - has a handful of pre-pluto in cap events but close enough

NOTABLE CELEBRITY DEATHS:

Michael Jackson, Brittany Murphy, Heath Ledger, Prince, Christina Grimmie, Cameron Boyce, Amy Winehouse, Aretha Franklin, Steve Jobs, George Michael, Whitney Houston, Chadwick Boseman, David Bowie, Toni Morrison, Carrie Fisher, Donna Summer, Nelson Mandela, Cory Monteith, Naya Rivera, Robin Williams, bell hooks, Anthony Bourdain, Pop Smoke, Mac Miller, Nipsey Hussle, James Gandolfini, Paul Walker, Alexander McQueen, Chester Bennington, Virgil Abloh, Lil Peep, Avicii, Joan Rivers, XXXTentacion, George HW and Barbara Bush, John McCain, Nancy Reagan, Hugh Hefner, Dick Clark, Margaret Thatcher, Queen Elizabeth II, Henry Kissinger

we exit this crazy transit having had:

a deep exploration of werewolf/vampire stories (often, allegories for capitalism)

the rise of reality tv through unfair conditions for tv workers

more copaganda in direct response to increased organizing around police brutality

a film industry dominated by military-funded superhero movies

popularization of Girlbossing alongside the destruction of labor rights

the rise of social media and its monetization

cigarettes reinventing themselves and then the OGs making a comeback

a considerable embrace of ""traditional"" values

a slow decay of the concept of celebrity

numerous financial crises and major changes to the workforce

everyone now has to have a smartphone and thus, the ability to work 24/7 from anywhere

the highest measured period of unemployment in several decades (spring 2020)

a very bootstrappy approach to global pandemic response

AI becoming increasingly popular- especially since the first dip of pluto into aquarius

and now, a fresh resurgence of 2024 Cougar movies (The Idea of You, A Family Affair, Lonely Planet and very soon, Babygirl).

What a ride. Onto the next era….

#astrology#astro#astrology transits#capricorn#pluto#pluto in capricorn#capricorn pluto#2010s#pop culture#pop#culture#tv#movies#politics#society#history#y2k#2000s#archive#pop culture archive#transit astrology

2 notes

·

View notes