#Student loan debt

Explore tagged Tumblr posts

Text

Things Biden and the Democrats did, this week #13

April 5-12 2024

President Biden announced the cancellation of a student loan debt for a further 277,000 Americans. This brings the number of a Americans who had their debt canceled by the Biden administration through different means since the Supreme Court struck down Biden's first place in 2023 to 4.3 million and a total of $153 billion of debt canceled so far. Most of these borrowers were a part of the President's SAVE Plan, a debt repayment program with 8 million enrollees, over 4 million of whom don't have to make monthly repayments and are still on the path to debt forgiveness.

President Biden announced a plan that would cancel student loan debt for 4 million borrowers and bring debt relief to 30 million Americans The plan takes steps like making automatic debt forgiveness through the public service forgiveness so qualified borrowers who don't know to apply will have their debts forgiven. The plan will wipe out the interest on the debt of 23 million Americans. President Biden touted how the plan will help black and Latino borrowers the most who carry the heavily debt burdens. The plan is expected to go into effect this fall ahead of the election.

President Biden and Vice-President Harris announced the closing of the so-called gun show loophole. For years people selling guns outside of traditional stores, such as at gun shows and in the 21st century over the internet have not been required to preform a background check to see if buyers are legally allowed to own a fire arm. Now all sellers of guns, even over the internet, are required to be licensed and preform a background check. This is the largest single expansion of the background check system since its creation.

The EPA published the first ever regulations on PFAS, known as forever chemicals, in drinking water. The new rules would reduce PFAS exposure for 100 million people according to the EPA. The Biden Administration announced along side the EPA regulations it would make available $1 billion dollars for state and local water treatment to help test for and filter out PFAS in line with the new rule. This marks the first time since 1996 that the EPA has passed a drinking water rule for new contaminants.

The Department of Commerce announced a deal with microchip giant TSMC to bring billions in investment and manufacturing to Arizona. The US makes only about 10% of the world's microchips and none of the most advanced chips. Under the CHIPS and Science Act the Biden Administration hopes to expand America's high-tech manufacturing so that 20% of advanced chips are made in America. TSMC makes about 90% of the world's advanced chips. The deal which sees a $6.6 billion dollar grant from the US government in exchange for $65 billion worth of investment by TSMC in 3 high tech manufacturing facilities in Arizona, the first of which will open next year. This represents the single largest foreign investment in Arizona's history and will bring thousands of new jobs to the state and boost America's microchip manufacturing.

The EPA finalized rules strengthening clean air standards around chemical plants. The new rule will lower the risk of cancer in communities near chemical plants by 96% and eliminate 6,200 tons of toxic air pollution each year. The rules target two dangerous cancer causing chemicals, ethylene oxide and chloroprene, the rule will reduce emissions of these chemicals by 80%.

the Department of the Interior announced it had beaten the Biden Administration goals when it comes to new clean energy projects. The Department has now permitted more than 25 gigawatts of clean energy projects on public lands, surpass the Administrations goal for 2025 already. These solar, wind, and hydro projects will power 12 million American homes with totally green power. Currently 10 gigawatts of clean energy are currently being generated on public lands, powering more than 5 million homes across the West.

The Department of Transportation announced $830 million to support local communities in becoming more climate resilient. The money will go to 80 projects across 37 states, DC, and the US Virgin Islands The projects will help local Infrastructure better stand up to extreme weather causes by climate change.

The Senate confirmed Susan Bazis, Robert White, and Ann Marie McIff Allen to lifetime federal judgeships in Nebraska, Michigan, and Utah respectively. This brings the total number of judges appointed by President Biden to 193

#Thanks Biden#Joe Biden#student loans#student loan debt#debt forgiveness#gun control#forever chemicals#PFAS#climate change#green energy

3K notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

530 notes

·

View notes

Photo

When we all vote, we create the future all women deserve. Make sure you are registered to vote right now at WeAll.Vote/register — because this November, our votes will decide key issues impacting US.

Get ready to paint the polls pink this November! 💗

#women's rights#equal pay#reproductive rights#reproductive health#cost of living#student loan debt#student debt#student debt relief#student loans#child care#register to vote#vote#voter#voting#paint the polls#election#general election#presidential election

147 notes

·

View notes

Text

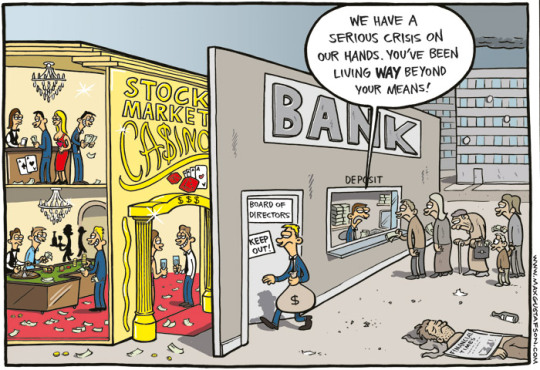

#politics#american politics#student loan debt#billionaires#tax the rich#eat the rich#millionaires#economics#american economy#socialism for the rich capitalism for the poor

76 notes

·

View notes

Text

Craig Harrington at MMFA:

The economic policy provisions outlined by Project 2025 — the extreme right-wing agenda for the next Republican administration — are overwhelmingly catered toward benefiting wealthier Americans and corporate interests at the expense of average workers and taxpayers. Project 2025 prioritizes redoubling Republican efforts to expand “trickle-down” tax cuts for the wealthy and deregulation across the economy. The authors of the effort’s policy book, Mandate for Leadership: A Conservative Promise, recommend putting key government agencies responsible for oversight of large sectors of the economy under direct right-wing political control and empowering those agencies to prioritize right-wing agendas in dealing with everything from consumer protections to organized labor activity. [...]

Project 2025 would chill labor unions' abilities to engage in political activity. Project 2025 suggests that the National Labor Relations Board change its enforcement priorities regarding what it describes as unions using “members' resources on left-wing culture-war issues.” The authors encourage allowing employees to accuse union leadership of violating their “duty of fair representation” by having “political conflicts of interest” if the union engages in political activity that the employee disagrees with. [Project 2025, Mandate for Leadership, 2023; National Labor Relations Board, accessed 7/8/24]

Project 2025 would make it easier for employers to classify workers as “independent contractors.” The authors recommended reinstating policies governing the classification of independent contractors that the NLRB implemented during the Trump administration. Those Trump-era NLRB regulations were amended in 2023, expanding workplace and labor organizing protections to previously exempt American workers. [Project 2025, Mandate for Leadership, 2023; The National Law Review, 6/19/23; National Labor Relations Board, 6/13/23]

Project 2025 would reduce base overtime pay for workers. The authors recommend changing overtime protections to remove nonwage compensatory and other workplace benefits from calculations of their “regular” pay rate, which forms the basis for overtime formulations. If that change is enacted, every worker currently given overtime protections could be subject to a slight reduction in the value of their overtime pay, which the authors claim will encourage employers to provide nonwage benefits but would effectively just amount to a pay cut. The authors also propose other changes to the way overtime is calculated and enforced, which could result in reduced compensation for workers. Overtime protections have long been a focus of right-wing media campaigns to reduce protections afforded to American workers. [Project 2025, Mandate for Leadership, 2023, Media Matters, 7/9/24]

Project 2025 proposes capping and phasing out visa programs for migrant workers. Project 2025’s authors propose capping and eventually eliminating the H-2A and H-2B temporary work visa programs, which are available for seasonal agricultural and nonagricultural workers, respectively. Even the Project 2025 authors admit that these proposals could threaten many businesses that rely on migrant workers and could result in higher prices for consumers. [Project 2025, Mandate for Leadership, 2023]

Project 2025 recommends institutionalizing the “Judeo-Christian tradition” of the Sabbath. Under the guise of creating a “communal day of rest,” Project 2025 includes a policy proposal amending the Fair Labor Standards Act to require paying workers who currently receive overtime protections “time and a half for hours worked on the Sabbath,” which it said “would default to Sunday.” Ostensibly a policy that increases wages, the proposal is specifically meant to disincentivize employers from providing services on Sundays as an explicitly religious overture. [Project 2025, Mandate for Leadership, 2023]

[...]

International Trade

Project 2025 contains a lengthy debate between diametrically opposed perspectives on international trade and commerce.Over the course of 31 pages, disgraced former Trump adviser and current federal inmate Peter Navarro outlines various proposals to fundamentally transform American international commercial and domestic industrial policy in opposition to China, primarily by using tariffs. He dedicates well over a dozen pages to obsessing over America’s trade deficit with China, even though Trump’s trade war with China was a failure and as he focused on China, the overall U.S. trade deficit exploded. Much of the rest of Navarro’s section is economic saber-rattling against “Communist China’s economic aggression and quest for world domination.”In response, Kent Lassman of the conservative Competitive Enterprise Institute promotes a return to free trade orthodoxy that was previously pursued by the Republican Party but has fallen out of favor during the Trump era.

The Heritage Foundation’s Project 2025 agenda would be a boon for the wealthy and a disaster for the working class folk.

See Also:

MMFA: Project 2025’s dystopian approach to taxes

#Economy#Project 2025#The Heritage Foundation#Donald Trump#Income Inequality#Mandate For Leadership#Federal Reserve#IRS#Student Loan Debt#Unions#Labor#Overtime Pay#Independent Contractors#H2A Visa#H2B Visa#Sabbath#Workplace Safety#Gender Pay Gap#Trade#Consumer Financial Protection Bureau

67 notes

·

View notes

Text

50 notes

·

View notes

Text

30 notes

·

View notes

Text

#us politics#republicans#conservatives#twitter#tweet#ian millhiser#gop#us supreme court#justice clarence thomas#justice samuel alito#harlan crow#paul singer#scotus#private jets#billionaires#fuck billionaires#student loans#student loan debt#student loan forgiveness#freeze student debt#student debt forgiveness#2023

137 notes

·

View notes

Text

A couple things I crocheted in 2024!

1 - pink and green cow will be listed for sale on my Etsy soon

2 - Eggnog cow (sold)

3 - pink and purple cow (sold)

4 - autumn slouch hat is for sale on my Etsy

5 - rainbow colorblock hat is for sale

6 - mushroom snuggler is for sale

7 and 8 - yellow, black, and pink flower cushion is for sale

9 - red chill pill is for sale

10 - black and red turtle (sold)

My Etsy can be found:

#mine#north carolina#crochet#etsy handmade#etsy seller#etsy sale#profits help me pay my student loans#student loan debt#crochet beanie#crochet plushie#plushie#plushy#stuffie#cows#cute cows

4 notes

·

View notes

Text

I have no notes 📝

#democrats#genocide Joe#dnc#election 2024#tiktok#student loan debt#universal health care#minimum wage#free palestine#joe biden#bernie sanders#hillary clinton

43 notes

·

View notes

Text

I do remember that @pathfinderlittleduck ! and I remember when he did relieve $140 billion dollars worth of student loan debt (and counting) for 5 million Americans

thanks for bring that up!

812 notes

·

View notes

Text

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I paid off my student loans almost five years ahead of schedule.

For a little over a year, I dedicated every waking hour to stomping out these loans like the parasitic infestation that they were, and now that this monumental task has been accomplished it feels really, really good. I wiped out about the last $18k of loans in 14 months, and doing that required intense discipline and concentration. I channeled the mental fortitude of a Buddhist monk and the austerity of an Irish peasant circa the Potato Famine. Here’s why and how I did it.

Keep reading.

Like this article? Join our Patreon!

#student loans#student loan debt#student debt#student loan debt forgiveness#personal finance#debt#debt free

15 notes

·

View notes

Photo

Max Gustafson

* * * *

LETTERS FROM AN AMERICAN

March 12, 2023

Heather Cox Richardson

At 6:15 this evening, Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and Federal Deposit Insurance Corporation (FDIC) Chairman Martin J. Gruenberg announced that Secretary Yellen has signed off on measures to enable the FDIC to fully protect everyone who had money in Silicon Valley Bank, Santa Clara, California, and Signature Bank, New York. They will have access to all of their money starting Monday, March 13. None of the losses associated with this resolution, the statement said, “will be borne by the taxpayer.”

But, it continued, “Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

The statement ended by assuring Americans that “the U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.”

It’s been quite a weekend.

On Friday, Silicon Valley Bank (SVB) failed in the largest bank failure since 2008. At the end of December 2022, SVB appears to have had about $209 billion in total assets and about $175 billion in deposits. This made SVB the sixteenth largest bank in the U.S., big in its sector but small compared with the more than $3 trillion JPMorgan Chase. This is the first bank failure of the Biden presidency (while Donald Trump Jr. tweeted that he had not heard of any bank failures during his father’s presidency, there were sixteen, eight of which happened before the pandemic). In fact, generally, a few banks fail every year; it is an oddity that none failed in 2021 or 2022.

The failure of SVB created shock waves for three reasons. First, SVB was the major bank for technology start-ups, so it involved much of a single sector of the economy. Second, only about $8 billion of the $173 billion worth of deposits in SVB were less than the $250,000 that the FDIC insures, meaning that the companies who had made those deposits might not get their money back quickly and thus might not be able to make payrolls, sparking a larger crisis. Third, there was concern that the problems that plagued SVB might cause other banks to fail, as well.

What seems to have happened, though, appears to be specific to SVB. Bloomberg’s Matt Levine explained it most clearly:

As the bank for start-ups, which have a lot of cash from investors and the initial public offering of stock, SVB had lots of deposits. But start-up companies don’t need much in the way of loans because they’ve just gotten so much cash and they don’t yet have fixed assets. So, rather than balancing deposits with loans that fluctuate with interest rates and thus keep a bank on an even keel, SVB’s directors took a gamble that the Federal Reserve would not raise interest rates. They invested in long-term Treasury bonds that paid better interest rates than short-term securities. But when, in fact, interest rates went up, the value of those long-term bonds sank.

For most banks, higher interest rates are good news because they can charge more for loans. But for SVB, they hurt.

Then, because SVB concentrated on start-ups, they had another problem. Start-ups are also hurt by rising interest rates because they tend to promise to deliver returns in the long term, which is fine so long as interest rates stay steadily low, as they have been now for years. But as interest rates go up, investors tend to like faster returns than most start-ups can deliver. They take their money to places that are going to see returns sooner. For SVB, that meant their depositors began to need some of that money they had dumped into the bank and started to withdraw their deposits.

So SVB sold securities at a loss to cover those deposits. Other investors panicked as they saw SVB selling at a loss and losing deposits, and they, too, started yanking their money out of the bank, collapsing it. Banks that have a more diverse client base are less likely to lose everyone all at once.

The FDIC took control of the bank on Friday. On Sunday, regulators also shut down Signature Bank, based in New York, which was a major bank for the cryptocurrency industry. Another crypto-friendly bank, Silvergate, failed last week.

Congress created the FDIC under the Banking Act of 1933 to restore trust in the American banking system after more than a third of U.S. banks failed after the Great Crash of 1929, sparking runs on banks as depositors rushed to take out their money whenever rumors suggested a bank was in trouble, thus causing more failures. The FDIC is an independent agency that insures deposits, examines and supervises banks to make sure they’re healthy, and manages the fallout when they’re not. The FDIC is backed by the full faith and credit of the government, but it is not funded by the government. Member banks pay insurance dues to cover bank failures, and when that isn’t enough money, the FDIC can borrow from the federal government or issue debt.

Over the weekend, the crisis at SVB became a larger argument over the role of government in the protection of the economy. Tech leaders took to social media to insist that the government must cover all the deposits in the failed bank, not just the ones covered under FDIC. They warned that the companies whose deposits were uninsured would fail, taking down the rest of the economy with them.

Others noted that the very men who were arguing the government should protect all the depositors’ money, not just that protected under the FDIC, have been vocal in opposing both government regulation of their industry and government relief for student loan debt, suggesting that they hate government action…except for themselves. They also pointed out that in 2018, under Trump, Congress weakened government regulations for banks like SVB and that SVB’s president had been a leading advocate for weakening those regulations. Had those regulations been in place, they argue, SVB would have remained solvent.

It appears that Yellen, Powell, and Gruenberg, in consultation with the president (as required), concluded that the collapse of SVB and Signature Bank was a systemic threat to the nation’s whole financial system, or perhaps they concluded that the panic over that collapse—which is a different thing than the collapse itself—was a threat to the nation’s financial system. They apparently decided to backstop the banks to prevent more damage. But they are eager to remind people that they are not using taxpayer money to shore up a poorly managed bank.

Right now, this appears to leave us with two takeaways. The Biden administration had been considering tightening the banking regulations that were loosened under Trump, and it seems likely that the need for the federal government to step in to protect the depositors at SVB and Signature Bank will make it much harder for those opposed to regulation to keep that from happening. There will likely be increased pressure on the Biden administration to guard against helping out the wealthy and corporations rather than ordinary Americans.

And, perhaps even more important, the weekend of panic and fear over the collapse of just one major bank should make it clear that the Republicans’ threat to default on the U.S. debt, thus pulling the rug out from under the entire U.S. economy unless they get their way, is simply unthinkable.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Finance#the economy#Heather Cox Richardson#Letters From An American#Banking regulation#bank collapse#bank failure#Max Gustafson#debt#student loan debt#venture capitalists

81 notes

·

View notes

Text

Chris Geidner at Law Dork:

On Friday afternoon, a federal appeals court blocked the Biden administration from doing almost anything to provide student loan relief to those people nationwide whose loans are currently in income-contingent repayment plans. It was the third appeals court ruling relating to the Saving on a Valuable Education, or SAVE, program — and followed a June 30 order from a different appeals court that would have allowed the program to go into effect. Friday’s order from the U.S. Court of Appeals for the Eighth Circuit is the first of those appellate orders addressing the SAVE program that contained any substantive discussion of the effort. With the ruling, seven Republican-led states succeeded in getting a three-judge panel of all Republican appointees on a federal appeals court that only has one Democratic appointee to issue a nationwide injunction blocking the SAVE program. More than that, the injunction goes even further — blocking any similar relief, regardless of whether it is issued under the rule creating the SAVE program or otherwise.

The per curiam order issuing an injunction pending appeal, unsigned and with its grand total of eight pages of substance, was issued for Judge Raymond Gruender, a George W. Bush appointee, and Judges Ralph Erickson and Steven Grasz, Trump appointees. The ruling caused significant confusion coming a day or two after many borrowers across the country received word that their loans had been placed into forbearance following an earlier order from the same court in mid-July. Although the covered loans are not accruing interest during this time, according to the Education Department, the months the loans are in forbearance will not court toward borrowers’ Public Service Loan Forgiveness or income-driven repayment loan forgiveness time. Neither the Justice Department nor Education Department provided comment on Friday’s ruling or next steps in its immediate aftermath. The bottom line, though, is that the SAVE plan is blocked currently — and that this is not the final word.

Right-wing judicial activists on the 8th Circuit Court blocked the SAVE program from going forward.

#Saving On A Valuable Education#Student Loans#Biden Administration#8th Circuit Court#Missouri v. Biden#SAVE#Student Loan Debt#Higher Education#Alaska v. Cardona

16 notes

·

View notes

Text

Anyone in the US have any advice on student loans?

After being in college for like 10 years I racked up like 43k .

And today it's all hit my credit report and tanked my credit score from 730 to 513.

I don't know what to do.

I'm freaking the fuck out.

4 notes

·

View notes

Text

14 notes

·

View notes