#State Bank of India Account

Explore tagged Tumblr posts

Text

State Bank of India Balance Checking Number

Checking your bank balance is crucial for managing your finances effectively. The State Bank of India (SBI) offers multiple convenient methods for customers to check their account balance. This article will guide you through these various options, focusing on the SBI balance check number and other helpful services.

State Bank of India Balance Checking Number

https://paisainvests.com/wp-content/uploads/2024/07/sdsfdsfdsf.webp

Why Knowing Your Balance is Important

Understanding your bank balance helps you keep track of your spending, avoid overdrafts, and ensure that your financial health is in check. It’s essential for budgeting, planning expenses, and avoiding unexpected fees.

Methods to Check SBI Account Balance

1. SBI Balance Check Number

How to Use the SBI Balance Check Number

To check your SBI account balance, dial the SBI balance check number: 09223766666 from your registered mobile number. Within seconds, you’ll receive an SMS with your account balance details.

Benefits of Using the SBI Balance Check Number

This method is quick, easy, and doesn’t require internet access. It’s especially useful for those who need their balance information instantly and for customers who aren’t tech-savvy.

2. SBI Missed Call Service

How to Use the Missed Call Service

Simply give a missed call to 09223766666 from your registered mobile number. You’ll receive an SMS with your account balance shortly after.

Advantages of Missed Call Service

The missed call service is free and convenient, making it accessible to all customers, including those with basic mobile phones.

3. SMS Banking

Steps to Use SMS Banking

Send an SMS in the format BAL to 09223766666 from your registered mobile number. You will get an SMS response with your account balance details.

Pros of SMS Banking

SMS banking is useful for those who prefer texting over calling. It provides a written record of your balance, which can be handy for future reference.

4. Internet Banking

Checking Balance Online

Log in to your SBI Internet banking account using your credentials. Navigate to the ‘Account Summary’ section to view your balance and recent transactions.

Security Tips for Internet Banking

Ensure you use strong passwords, log out after each session, and avoid accessing your account from public Wi-Fi networks to maintain security.

5. SBI YONO App

Using the YONO App to Check Balance

Download the SBI YONO app from the App Store or Google Play. After registering, you can easily check your balance and perform other banking operations through the app.

Features of the SBI YONO App

The YONO app offers a comprehensive range of features, including fund transfers, bill payments, loan applications, and investment services, making it a one-stop solution for all your banking needs.

How to Register for SBI Balance Services

Registering Your Mobile Number

Visit your nearest SBI branch or ATM to link your mobile number with your account. This is essential for using SMS banking and missed call services.

Activating Internet Banking

You can activate internet banking by visiting the official SBI website (State Bank of India (onlinesbi.sbi)) and following the registration process. Alternatively, you can request assistance at your local branch.

Downloading and Setting Up the SBI YONO App

Download the app, complete the registration process by entering your account details and OTP, and set up your login credentials to start using the YONO app.

Troubleshooting Common Issues

Missed Call Service Issues

If you’re not receiving balance updates via missed calls, ensure your mobile number is registered with the bank and check for network issues.

SMS Banking Errors

Double-check the SMS format and ensure your mobile number is correctly registered. If issues persist, contact SBI customer service for assistance.

Internet Banking Login Problems

If you’re facing login issues, try resetting your password or contact SBI customer support for help. Ensure your browser is updated and clear your cache regularly.

Conclusion

SBI offers multiple convenient ways to check your account balance, making banking easy and accessible for everyone. Whether you prefer calling, texting, or using the internet, SBI has got you covered. Keeping track of your balance has never been simpler!

By Paisainvests.com

#balance inquiry SBI#bank balance check#SBI account balance#SBI account details#SBI account management#SBI balance#SBI balance check#SBI balance check number#SBI balance checking number#SBI balance enquiry#SBI balance information#SBI customer service#SBI mobile banking#SBI phone banking#SBI SMS balance check#State Bank of India

0 notes

Text

🔻NEW OFFICIAL BOYCOTT TARGET🔻

Palestinian BDS National Committee:

Coca-Cola: Quenching “Israel’s” genocidal soldiers’ thirst

1) Why?

Because Coca-Cola is implicated in “Israeli” war crimes.

According to research by WhoProfits (https://www.whoprofits.org/companies/company/4081?the-central-bottling-company-cbc-coca-cola-israel), (https://www.whoprofits.org/companies/company/4081?the-central-bottling-company-cbc-coca-cola-israel) the Central Beverage Company, known as Coca-Cola “Israel”, which is the exclusive franchisee of the Coca-Cola Company in “Israel”, “operates a regional distribution center and cooling houses in the [Israeli] Atarot Settlement Industrial Zone.” Furthermore, its subsidiary, Tabor Winery, “produces wines from grapes sourced from vineyards located on occupied land in settlements in the West Bank and Syrian Golan.”

The International Court of Justice affirmed in July 2024 that “Israel’s” entire occupation of Gaza and the West Bank, including East Jerusalem, is illegal, as are all “Israeli” settlements built on occupied land. As “Israeli” settlements – on occupied Palestinian and Syrian land – are considered war crimes under international law, Coke is complicit in a war crime.

Corporations that are implicated in the commission of international crimes connected to “Israel’s” unlawful occupation, racial segregation and apartheid regime—within or beyond the Palestinian territories occupied in 1967–are all complicit and must be held accountable. Direct complicity includes military, logistical, intelligence, financial and infrastructure support. The corporations, as well as their boards of directors and executives, may face criminal liability (https://www.somo.nl/wp-content/uploads/2024/06/Obligations-of-Third-States-and-Corporations-to-Prevent-and-Punish-Genocide-in-Gaza-3.pdf) for this complicity.

Local alternatives are popping up worldwide to substitute Coca-Cola, an unnecessary and replaceable beverage.

Local alternatives to Coca-Cola have been gaining market share across the world, including in Palestine, China, Bangladesh, Sweden, Egypt, India, South Africa, Turkey, Lebanon and elsewhere.

2) Why NOW?

The BDS movement has always considered Coca-Cola boycottable but has not prioritized it as a target based on its careful and strategic target-selection criteria (https://www.instagram.com/bdsnationalcommittee/p/C7RY0Y4C-xu/), (https://www.instagram.com/bdsnationalcommittee/p/C7RY0Y4C-xu/) so why endorse the Coke boycott now?

Human rights and health activists, among many others, have been campaigning against Coca-Cola and similarly complicit corporations for decades, including grassroots drives targeting the company for its complicity in “Israel’s” gross violations of Palestinian human rights.

During “Israel’s” ongoing, livestreamed genocide, “Israeli” soldiers have often been pictured with Coke cans, donated (https://www.timesofisrael.com/over-100000-soldiers-to-receive-bamba-and-coke-thursday/) to them by various genocide-enabling groups. This has provoked even more anger against the company, particularly given that “Israel” is starving 2.3 million Palestinians in the occupied and besieged Gaza Strip, severely limiting their access to clean water and, as a result, inducing the mass spread of contagious diseases.

Given this context, Palestinian activists in Gaza (https://x.com/QudsNen/status/1827696428795482136) and many BDS activists in the Arab world, in many Muslim-majority countries, and in some European countries as well, have called on the BDS movement to add Coke to its priority targets.

The BDS movement had previously targeted General Mills for its manufacturing of Pillsbury products in the illegal Atarot Settlement Industrial Zone - the same Zone where the Coke facility operates. Thanks to effective BDS campaigning, we won the demand (https://bdsmovement.net/news/victory-general-mills-divest-from-apartheid-israel) for General Mills to end its business in Atarot. We know a campaign against Coke is winnable too.

Based on all the above, and given Coke’s large contribution (through business-as-usual and taxes) to “Israel’s” war chest during the genocide, the Palestinian BDS National Committee (BNC), the largest Palestinian coalition leading the global BDS movement, has endorsed the grassroots, organic #BoycottCoke campaigns to pressure the company to end its complicity in “Israel’s” illegal occupation, apartheid and genocide.

BoycottCoke

#palestine#free palestine#gaza#free gaza#current events#jerusalem#israel#yemen#tel aviv#palestine news#BDS#boycott israel#keep boycotting#boycott divest sanction#boycott disney#israeli apartheid#boycottcoke

255 notes

·

View notes

Text

Today, we know from the research of Jason Hickel and his colleagues that in 2021 the Global North was able to extract from the Global South 826 billion hours in net appropriated labor. This represents $18.4 trillion measured in Northern wages. Behind this lies the fact that workers in the Global South receive 87–95 percent lower wages for equivalent work at the same skill levels. The same study concluded that the wage gap between the Global North and the Global South was increasing, with wages in the North rising eleven times more than wages in the South between 1995 and 2021. This research into the contemporary global labor arbitrage is coupled with recent historical work by Utsa Patnaik and Prabhat Patnaik that has now documented the astronomical drain of wealth during the period of British colonialism in India. The estimated value of this drain over the period of 1765–1900, cumulated up to 1947 (in 1947 prices) at 5 percent interest, was $1.925 trillion; cumulated up to 2020, it amounts to $64.82 trillion. It should be emphasized that the Global North’s contemporary drain of economic surplus from the Global South, via the unequal exchange of labor embodied in exports from the latter, is in addition to the normal net flow of capital from developing to developed countries recorded in national accounts. This includes the balance on merchandise trade (import and exports), net payments to foreign investors and banks, payments for freight and insurance, and a wide array of other payments made to foreign capital such as for royalties and patents. According to the United Nations Conference on Trade and Development (UNCTAD), the net financial resource transfers from developing countries to developed countries in 2017 alone amounted to $496 billion. In neoclassical economics, this is known as the paradox of the reverse flow of capital, or of capital flowing uphill, which it ineffectively tries to explain away by various contingent factors, rather than acknowledging the reality of economic imperialism. With respect to the geopolitical dimension of imperialism, the focus this century has been on the continuing decline of U.S. hegemony. Analysis has concentrated on the attempts of Washington, since 1991, backed by London, Berlin, Paris, and Tokyo, to reverse this. The goal is to establish the triad of the United States, Europe, and Japan—with Washington preeminent—as the unipolar global power through a more “naked imperialism.” This counterrevolutionary dynamic eventually led to the present New Cold War. Yet, despite all of the developments in imperialism theory over the last century, it is not the theory of imperialism so much as the actual intensification of the Global North’s exploitation of the Global South, coupled with the resistance of the latter, that has stood out. As Sweezy argued in Modern Capitalism and Other Essays in 1972, the sharp point of proletarian resistance decisively shifted in the twentieth century from the Global North to the Global South. Nearly all revolutions since 1917 have taken place in the periphery of the world capitalist system and have been revolutions against imperialism. The vast majority of these revolutions have occurred under the auspices of Marxism. All have been subjected to counterrevolutionary actions by the great imperial powers. The United States alone has intervened militarily abroad hundreds of times since the Second World War, primarily in the Global South, resulting in the deaths of millions. In the late twentieth and early twenty-first centuries, the primary contradictions of capitalism have been those of imperialism and class.

3 November 2024

101 notes

·

View notes

Text

Submitted via Google Form:

What would happen to the richest countries in the world these days because they export oil when my story takes place in 2400 and and the oil is all gone and these countries are where my story actually takes place. Where all the money is now is pretty much the countries that produce cutting edge technology.

Licorice: 2400 CE is 376 years in the future.

Which countries were the richest 376 years ago? That would take us back to 1648. The richest country in the world was China, with India not far behind. The Ottoman Empire was another superpower, and most of today’s Middle Eastern oil states were its posessions. The USA didn’t even exist. The British had barely begun building their empire; the Netherlands and France were both far richer and more powerful than GB, but the European powerhouse was Spain with its Latin American colonial empire pumping out seemingly inexhaustible supplies of silver and gold bullion, inspiring a golden age of piracy in the Caribbean.

China, India, France: their wealth was based mostly on strong diverse domestic economies.

Britain, Portugal and the Netherlands: they were too small and poor to build a China-type self-sufficient diverse economy. They grew rich on trade.

Ottoman Empire: a multicultural melting pot covering roughly the same geographic area as the Eastern Roman Empire, the Ottomans had it all. But they fell behind in the 19th century, and the empire was torn apart by the waves of nationalism that swept across the globe after the French Revolution. The Ottoman Empire no longer exists.

Spain grew rich in the same way the oil economies grew rich, by mining a single commodity and using it to pay for everything

A country like the USA is going to be as fine as anywhere can be after the oil is gone. Like China, India and the EU they will diversify into renewable resources and keep right on truckin’ because their economies are sufficiently wealthy and diverse, their population sufficiently educated, and their governments sufficiently forward thinking to do this.

Back in the 18th century, the measly little island of Britain took the wealth it earned from trade to invest in R&D, invented the industrial revolution, and used its tech advantage to conquer an empire the likes of which had never hitherto been seen.

Spain, on the other hand, didn’t invest in itself. The gold and silver from the Spanish Main trickled through its fingers the way easy money always does with lottery winners. Much of the bullion ended up in China via British, Dutch, and Portuguese ships. Spain’s empire disintegrated in the 19th century.

In short, if you’re a country with a booming economy dependent on a single non-renewable commodity, and you are smart, you will use that wealth to build your competitive advantage in diverse areas of human economic activity. You will educate your population to be creative and entrepreneurial. This is more likely to happen if your government is some flavour of democracy.

If you’re not smart or if your government is controlled by a small clique of aristocrats or a dictator and his court with no accountability to the future, your elite will simply take most of the wealth for themselves, stick it into Swiss bank accounts, and leave the country impoverished and under-developed when they flee the inevitable coup.

Since the history of the years 2024-2400 hasn’t yet been written, it’s up to you to decide what the countries in your story are going to do. All of them are well aware that the oil bonanza will not last forever. You might find this useful: “How the Gulf Region is Planning for Life After Oil”.

So, which of your countries will be smart and which will be foolish? Which ones will have the foresight to build a viable post-oil future for themselves, and which ones will slide backwards into poverty, ignorance, and oppression? You decide.

21 notes

·

View notes

Text

On August 27, Sabir Malik, a migrant worker in the Indian state of Haryana, was lured from his home and beaten to death by a mob of at least 10 Hindu men. They suspected that Malik, a Muslim, had eaten beef. Lab tests run by local police would later find that he hadn’t. But it didn’t matter: The attack was led by “cow vigilantes,” the name for Hindu nationalist militias and mobs that take it upon themselves to violently enforce Hindu supremacy on India’s minority communities, particularly Muslims.

A new report from the Center for the Study of Organized Hate (CSOH) shared exclusively with WIRED found that Instagram, which is owned by Meta, is becoming a key avenue for cow vigilantes to share their violent exploits with a wider audience, and even raise money.

“It's clear that Meta is complicit in the proliferation or the flourishing of cow vigilantism in India,” says Raqib Hameed Naik, founder and executive director of CSOH. These practices, Naik says, are likely in violation of Meta’s own policies around hateful and violent content.

Between February and August 2024, CSOH identified and analyzed 1,023 Instagram accounts run by users involved in cow vigilantism. Researchers found that 30 percent of the accounts shared content showing physical violence against Muslims involved in the cattle business. Some videos flagged by CSOH show high-speed car chases down India’s highways, where cow vigilantes tail and try to pull over trucks carrying cows. Others are more graphic, showing vigilantes beating men who they claim are engaging in cow slaughter or the cattle trade. One video, which garnered 5,200 likes, showed three frightened Muslim men in the trunk of a car. Another video shows a cow vigilante beating an older Muslim man with a wooden bat. That video received more than 1,200 likes.

The 121 Instagram Reels analyzed by CSOH showing physical violence against people transporting cattle garnered over 8.3 million views, and most were not labeled with the Meta filter that warns users of graphic content. CSOH found 53 accounts that had posted violent content were eligible for Instagram’s “Send Gift” function, which allows approved creators to earn money directly from donations from their followers. Other accounts would post bank details in their Reels or comments sections. “That means anyone on Instagram who likes their work can send them money to continue doing that violent extremist activity,” says Naik.

To test Meta’s systems, CSOH reported 167 posts that depicted violence using Instagram’s on-platform reporting systems. None of the posts had been removed as of October.

According to Meta’s policies, it does not allow “content that glorifies, supports, or represents events that Meta designates as violating violent events,” including “hate events” and “hate crimes.” Meta spokesperson Erin Logan told WIRED that Meta has “strict policies against violent or graphic content on our platforms, and we enforce these rules impartially. We will review this report once we are provided it and will remove any violating content and disable accounts of repeated offenders.” Logan declined to answer questions about whether Meta considers cow vigilantes as part of “violent or hateful groups.” Last year, the company removed profiles associated with Monu Manesar, a cow vigilante who was arrested and accused of instigating violence in Haryana.

Cow protection is not new in India, where Hinduism holds cows sacred. But the country also has a substantial minority population that includes Christians, Muslims, Buddhists, Sikhs, and Adivasis, or indigenous people, that have no religious prohibition against eating beef. Dalits, the group at the bottom of the Hindu caste system, also sometimes consume beef. Due to their marginalized status, Muslims and Dalits in particular have long relied economically on the cattle industry.

Since India prime minister Narendra Modi and his Hindu-nationalist Bharatiya Janata Party swept into power in 2014, several states have passed stricter laws when it comes to cow protection. A Congressional Research Service report released last week noted that cow vigilantism was one of several types of “religiously motivated repression and violence” used by Hindus and supported by the country’s Hindu nationalist government against minority communities. According to an April report from Armed Conflict Location and Event Data, cow vigilantism was the motivator for 22 percent of all communal violence by Hindus targeting Muslims between 2019 and 2024.

“Vigilantes organize their targeting to disburse punishment to minorities through extrajudicial means,” says Angana Chatterji, chair of the Political Conflict, Gender and People’s Rights Initiative at UC Berkeley. “Hindu nationalist leaders in government have aligned with these militias, and their speeches often function as dog whistles to rally people, reportedly stirring them to commit these extrajudicial acts that have included home invasion, theft, and lynching.”

Chatterji says that making the violence public on a place like Instagram allows cow vigilantes to recruit new members and rally other Hindu nationalists in different parts of the country. “For Muslims and minorities and their allies, Instagram messaging is calculated to spread terror with impunity,” she says. “To indicate, ‘Stop protesting. We are going to come for you and there will be nothing to stop us,’ especially as law enforcement is often either absent or in collusion.”

Naik worries that the problem is much deeper than just the accounts he and his team were able to identify. Earlier this year, Meta shuttered CrowdTangle, its tool that allowed researchers to track content across its platforms. “I would say it's the tip of the iceberg,” says Naik, because there is no public access to Meta’s data for journalists and civil society organizations.

India is an important market for Meta—it accounts for more than 362 million users on Instagram alone—and in the past, the company has been hesitant to take action on content that could put it in the crosshairs of the Indian government. In 2022, The The Washington Post reported that Facebook allowed hate speech and propaganda to stay on the platform under pressure from India’s government. (Meta’s shareholders later voted against an inquiry into the issue.) In 2020, The Wall Street Journal reported that employees in India worried that Meta’s then-head of public policy for India was unevenly applying the company’s hate speech policies to allow violent rhetoric from Bharatiya Janata Party politicians to stay up on the platform.

“It is interesting to note what is stopped by social media platforms—because some messaging is stopped immediately—and what is allowed to grow,” says Chatterji. “Just the extent of violence in the images requires that they should be taken down.”

29 notes

·

View notes

Text

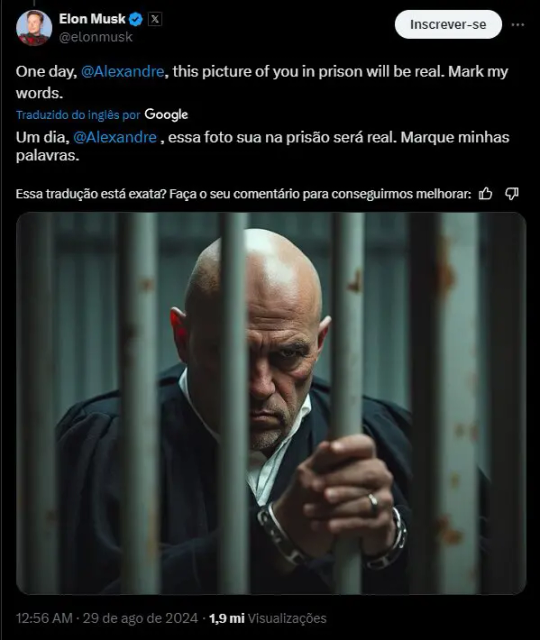

To anybody wondering what exactly happened to twitter on Brazil here's the full version of the story coming from a brazilian:

-Elon closes the branch offices in Brazil as some sort of protest.

-Supreme court sends an email to the legal representative to ask for the removal of about 14 far right/nazi accounts.

-Twitter doesn't respond, a daily fine of 20.000 reais and an arrest warrent for the national administrator (15 days to 6 months + fine).

-Elon takes away the coutry's legal representative. Foreign companies need an office and/or a legal rep to be allowed to operate in Brazil.

-The official twitter account posts about being censored in Brazil, mentioning by name the judge who had sent the intimation and arguing that it wasn't made public. The judge in question then commented under the post, leaving the whole document for anyone to read as they like. Twitter has 24 hours to appoint a new rep and pay their more then 150 million reais in accumulated fines or it'll be blocked in Brazil.

-Elon says he will not comply with the Supreme court's decisions and instead resorts t posting corny AI generated images on his account.

-24 hours pass with no other negotiations from Twitter and as such the process of blocking the site as well as shutting down related Starlink accounts and freezing both of their bank assets starts. (https://noticias-stf-wp-prd.s3.sa-east-1.amazonaws.com/wp-content/uploads/wpallimport/uploads/2024/08/30171714/PET-12404-Assinada.pdf)

-At this point the brazilian army sends a message to the supreme court stating that they were using Starlink for their own communications.

Elon had no problems with blocking accounts in other countries like in India but he had long been attacking the brazilian government since the 2022 election where former far-right president Jair Bolsonaro lost. Elon had been eyeing up brazilian lithium, Starlink was primarily sold to illegal miners in the Amazon and the military had been using it to coordinate about mineral deposits. Anyone can clearly see Elon's true intentions were to spread misinformation and destabilize the country for his own gain, we already know what his position with South America is when Bolivia nationalized it's lithium. Please spread the truth and don't believe this coward's lies, Brazil is a free, democratic sovereign country and he will stop at nothing until it's back at where it was in the 60's if it meas he'll have to spend slightly less money to make his stupid cars.

#brazil#elon musk#twitter#tesla#starlink#spacex#alexandre de moraes#to the americans reading please for the love of god don't let Trump win#It'll only make things worse for everyone who lives in the global south#look up about the brazilian military dictatorship

22 notes

·

View notes

Note

I totally agree that a lot of immigrants are just as conservative if not more so than many normie white Republicans.

If you’ve immigrated to the U.S. from a non-English speaking country and now you make money in dollars as opposed to, like, INR, then you’ve worked your ass off to be where you are and you want to enjoy the fruits of your labor. Manifest destiny. What you don’t want is other people coming over and doing the same thing because it could, irrationally, mean that you will make less, and rationally, if more people are achieving what you achieved, your accomplishment is less impressive. These are examples of emotional logic that I’ve personally witnessed.

But the most compelling thing I’ve seen is this: When you come to the U.S. and start making money in dollars, there’s this expectation and frankly a demand that you will support your family members back home. Some people find it to be more unreasonable and annoying than others. But sure, they might bring gifts when they visit, they might wire some money over occasionally, whatever. But the last thing they want is their demanding family members coming over so they can demand money IN PERSON. I think this applies to a lot of immigrants. Source: My own family lol.

Plus there’s the other conservative viewpoints of not wanting to give up money as taxes, of having a strong police presence and owning a gun to keep the property value of suburbs high, of being generally anti-drug so there will be fewer slackers (I’m not saying that people who are addicts are lazy, just that that’s the perception), of being pro-life because abortion is wrong for cultural/religious reasons. Just being a POC is not enough to vote liberally, contrary to white Twitter leftist expectations.

Yeah that's in line with my experiences too although without much of the supporting family stuff lol. To be fair, we never really had much interaction with my extended family since my parents had a love marriage and my mom's brother didn't talk to her for 17 years, and we lived in America far away, but my dad did help his family out a fair amount.

I think what a lot of white liberals/leftists struggle to understand is that marginalization isn't virtue. The way I think about is that people with the most socially regressive views, whether in Iran or India or Alabama, deserve food and clean water, but they do NOT deserve to have their views endorsed, regardless of the color of their skin or amount of money in their bank account.

Moreover, just because people are "non-white" in America doesn't mean that they're not the majority in their home countries and they internalize that privilege even in the United States. Chimamanda Ngozi Adhichie pointed this out too, that in America, she was a "person of color" but in Nigeria, she was part of the majority group. My family is a bit different in that we had very little engagement with India after we moved here, but that's also why we, or rather my parents, are so much more liberal than the average immigrant family.

My parents are staunchly pro-choice, pro-LGBT, and pretty supportive of immigration (even if they think that the border has to be orderly), and center-left on economics. They sent me to public school (although I went to Cornell for college) because my dad was like, we're paying taxes for school anyways we might as well take full advantage of it.

But yeah, does that all make sense?

12 notes

·

View notes

Text

Lately, the government and the top banks of Australia have been pushing for the eradication of payments by cash, leaving phone apps alone, and possibly a medical implant as well.

I have fought against it as best I can, buy there's not much I can do.

It's illegal to have large amounts of cash, and self defense is a crime, so storing at home is not really an option. Besides, I am a disabled pensioner, and the government decided long ago that going through the bank is mandatory.

Covid was the best opportunity they ever had to eliminate personal freedom - I mean, to force everyone to use insecure apps on insecure phones that had insecure operating systems on insecure hardware.

There were scandal when apps were exposed data harvesting, accessing information they didn't have the rights to, and even hacking the microphone and camera of the phone.

https://www.consumerreports.org/electronics-computers/privacy/how-to-protect-yourself-from-camera-and-microphone-hacking-a1010757171/

But the push to do the thing was relentless. You can't stop progress! Nobody else is complaining, the bank told me.

Except people do complain, helpless and hopeless. I worked in tech support, and would hear all day long the agony of those whose assets were cleaned out, and that was in the days of internet banking, when the scammer call centers of India were just a sparkle in Satan's Eye.

You see, the reason banks existed was that they took money in exchange for the service of PROTECTION.

Now, they take your money, and if you get robbed, that's a YOU problem.

And the government is backing them up. Remember the GFC, when most governments expressed their hatred of capitalism by backing banks no matter how badly they embezzled customers?

The Bank and the State had merged.

Mussolini's vision had succeeded.

Fascism took a century, but it in the end, it won. But I am not sure even the 1930s fascists could see this coming.

youtube

21 notes

·

View notes

Photo

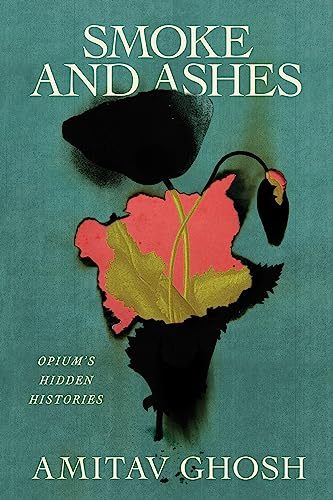

Smoke and Ashes: Opium's Hidden Histories

"Smoke and Ashes: Opium’s Hidden Histories" is a sweeping and jarring work of how opium became an insidious capitalistic tool to generate wealth for the British Empire and other Western powers at the expense of an epidemic of addiction in China and the impoverishment of millions of farmers in India. The legacy of this “criminal enterprise,” as the author puts it, left lasting influences that reverberate across cultures and societies even today.

Written in engaging language, Smoke and Ashes is a scholarly follow-up to the author’s famous Ibis trilogy, a collection of fiction that uses the opium trade as its backdrop. In Smoke and Ashes, the author draws on his years-long research into opium supplemented by his family history, personal travels, cross-cultural experience, and expertise in works of historical verisimilitude. Composed over 18 chapters, the author delves into a diverse set of primary and secondary data, including Chinese sources. He also brings a multidimensional angle to the study by highlighting the opium trade's legacy in diverse areas such as art, architecture, horticulture, printmaking, and calligraphy. 23 pictorial illustrations serve as powerful eyewitness accounts to the discourse.

This book should interest students and scholars seeking historical analysis based on facts on the ground instead of colonial narratives. Readers will also find answers to how opium continues to play an outsize role in modern-day conflicts, addictions, corporate behavior, and globalism.

Amitav Ghosh’s research convincingly points out that while opium had always been used for recreational purposes across cultures, it was the Western powers such as the British, Portuguese, the Spaniards, and the Dutch that discovered its significant potential as a trading vehicle. Ghosh adds that colonial rulers, especially the British, often rationalized their actions by arguing that the Asian population was naturally predisposed to narcotics. However, it was British India that bested others in virtually monopolizing the market for the highly addictive Indian opium in China. Used as a currency to redress the East India Company (EIC)’s trade deficit with China, the opium trade by the 1890s generated about five million sterling a year for Britain. Meanwhile, as many as 40 million Chinese became addicted to opium.

Eastern India became the epicenter of British opium production. Workers in opium factories in Patna and Benares toiled under severe conditions, often earning less than the cost of production while their British managers lived in luxury. Ghosh asserts that opium farming permanently impoverished a region that was an economic powerhouse before the British arrived. Ghosh’s work echoes developmental economists such as Jonathan Lehne, who has documented opium-growing communities' lower literacy and economic progress compared to their neighbors.

Ghosh states that after Britain, “the country that benefited most from the opium trade” with China, was the United States. American traders skirted the British opium monopoly by sourcing from Turkey and Malwa in Western India. By 1818, American traders were smuggling about one-third of all the opium consumed in China. Many powerful families like the Astors, Coolidges, Forbes, Irvings, and Roosevelts built their fortunes from the opium trade. Much of this opium money, Ghosh shows, also financed banking, railroads, and Ivy League institutions. While Ghosh mentions that many of these families developed a huge collection of Chinese art, he could have also discussed that some of their holdings were most probably part of millions of Chinese cultural icons plundered by colonialists.

Ghosh ends the book by discussing how the EIC's predatory behaviors have been replicated by modern corporations, like Purdue Pharma, that are responsible for the opium-derived OxyContin addiction. He adds that fossil fuel companies such as BP have also reaped enormous profits at the expense of consumer health or environmental damage.

Perhaps one omission in this book is that the author does not hold Indian opium traders from Malwa, such as the Marwaris, Parsis, and Jews, under the same ethical scrutiny as he does to the British and the Americans. While various other works have covered the British Empire's involvement in the opium trade, most readers would find Ghosh's narrative of American involvement to be eye-opening. Likewise, his linkage of present-day eastern India's economic backwardness to opium is both revealing and insightful.

Winner of India's highest literary award Jnanpith and nominated author for the Man Booker Prize, Amitav Ghosh's works concern colonialism, identity, migration, environmentalism, and climate change. In this book, he provides an invaluable lesson for political and business leaders that abdication of ethics and social responsibility have lasting consequences impacting us all.

Continue reading...

18 notes

·

View notes

Text

Why Is Europe Making Itself Irrelevant”

Paul Craig Roberts

Readers want to know why the UK PM and European leaders–really, non-readers, misleaders, bad leaders–want war with Russia over Ukraine. My answer is that they don’t.

What would they go to war with? According to the European “leaders,” they already have given all their weapons to Ukraine and have nothing with which o fight a war. The only way Europe can send any money to Ukraine is to get the EU central bank to print euros to send to Ukraine. Moreover, the NATO force structure depends on the United States. Without the US, Europe lacks a force structure that can support a war. Trump has ruled out war with Russia and read Zelensky the riot act. Unless Putin makes a fantastic mistake, I expect the conflict to end.

Perhaps what is going on with Europe’s is that EU governments, after sending so much money and weapons to Ukraine backed by claims that Ukraine was winning and would win, want to be able to say that Trump sold out Ukraine in order to avoid accountability to the deceived populations of Europe. They can blame Trump for denying Ukraine and NATO a victory.

The European talk of sending “peacekeepers” to Ukraine is nonsense. Putin intends a settlement, an over-and-done-with event, not a ceasefire with European “peacekeepers.” Trump can’t get a settlement if he sides with the EU against Putin. If Trump and Putin don’t accept “peacekeepers,” it can’t happen.

Here is a thought. Trump sees economic growth as fed by opportunity. He sees more opportunity in business deals with Russia, India, China, the rest of Asia, and Africa than he sees in Europe. Trump understands that it was sanctions and the weaponization of the dollar that produced BRICS and the search for an alternative for central bank reserves and international payments. To save the dollar’s role as reserve currency, Washington needs to stop bullying. Trump, like Putin, wants deals that work for everyone, not wars. In a w

2 notes

·

View notes

Text

The purchasing power parity (PPP) exchange rates that undergird the WBPL [World Bank’s poverty line] are calculated on the basis of prices across the entire economy – including commercial airfares, sports cars, and meals at high-end restaurants – rather than the prices of goods that people need in order to meet basic needs, such as food and shelter. When it comes to measuring poverty, what matters is not income as such but rather what that income can buy in terms of access to essential goods; in other words, what matters is the welfare purchasing power of income. Allen (2017) analyses commodity prices around the world in 2011 and finds that the cost of meeting basic needs, measured in PPP terms, changes depending upon the price of food and shelter relative to prices across the rest of the economy. In Zimbabwe a person’s subsistence needs can be met with $1.74, PPP. But purchasing a similar basket would cost $3.19 in Egypt, and $4.02 in France. Because the WBPL does not account for the variable cost of meeting basic needs in different countries, it cannot be used to establish meaningful estimates of poverty.

The problems with the WBPL become particularly acute when comparing socialist states like pre-reform China to capitalist states such as India or Brazil. Socialist states tend to invest in public provisioning systems to provide people with access to essential goods . In such cases, the cost of meeting basic needs is generally quite low. In capitalist states, with high levels of commodification or privatisation, the same goods may be significantly more expensive. Therefore, a dollar of income (in broad-gauge PPPs) is likely to have a stronger welfare purchasing power in socialist states than in capitalist states.

Capitalist reforms and extreme poverty in China: unprecedented progress or income deflation?

29 notes

·

View notes

Text

2 notes

·

View notes

Text

As AI tools become increasingly sophisticated and accessible, so too has one of its worst applications: non-consensual deepfake pornography. While much of this content is hosted on dedicated sites, more and more it’s finding its way onto social platforms. Today, the Meta Oversight Board announced that it was taking on cases that could force the company to reckon with how it deals with deepfake porn.

The board, which is an independent body that can issue both binding decisions and recommendations to Meta, will focus on two deepfake porn cases, both regarding celebrities who had their images altered to create explicit content. In one case about an unnamed American celebrity, deepfake porn depicting the celebrity was removed from Facebook after it had already been flagged elsewhere on the platform. The post was also added to Meta’s Media Matching Service Bank, an automated system that finds and removes images that have already been flagged as violating Meta’s policies, to keep it off the platform.

In the other case, a deepfake image of an unnamed Indian celebrity remained up on Instagram, even after users reported it for violating Meta’s policies on pornography. The deepfake of the Indian celebrity was removed once the board took up the case, according to the announcement.

In both cases, the images were removed for violating Meta’s policies on bullying and harassment, and did not fall under Meta’s policies on porn. Meta, however, prohibits “content that depicts, threatens or promotes sexual violence, sexual assault or sexual exploitation” and does not allow porn or sexually explicit ads on its platforms. In a blog post released in tandem with the announcement of the cases, Meta said it removed the posts for violating the “derogatory sexualized photoshops or drawings” portion of its bullying and harassment policy, and that it also “determined that it violated [Meta's] adult nudity and sexual activity policy.”

The board hopes to use these cases to examine Meta’s policies and systems to detect and remove nonconsensual deepfake pornography, according to Julie Owono, an Oversight Board member. “I can tentatively already say that the main problem is probably detection,” she says. “Detection is not as perfect or at least is not as efficient as we would wish.”

Meta has also long faced criticism for its approach to moderating content outside the US and Western Europe. For this case, the board already voiced concerns that the American celebrity and Indian celebrity received different treatment in response to their deepfakes appearing on the platform.

“We know that Meta is quicker and more effective at moderating content in some markets and languages than others. By taking one case from the United States and one from India, we want to see if Meta is protecting all women globally in a fair way,” says Oversight Board cochair Helle Thorning-Schmidt. “It’s critical that this matter is addressed, and the board looks forward to exploring whether Meta’s policies and enforcement practices are effective at addressing this problem.”

The board declined to name the Indian and American celebrities whose images spurred the complaints, but pornographic deepfakes of celebrities have become rampant. A recent Channel 4 investigation found deepfakes of more than 4,000 celebrities. In January, a nonconsensual deepfake of Taylor Swift went viral on Facebook, Instagram, and especially X, where one post garnered more than 45 million views. X resorted to restricting the singer’s name from its search function, but posts continued to circulate. And while platforms struggled to remove that content, it was Swift’s fans who reportedly took to reporting and blocking the accounts that shared the image. In March, NBC News reported that ads for a deepfake app that ran on Facebook and Instagram featured the images of an undressed, underaged Jenna Ortega. In India, deepfakes have targeted major Bollywood actresses including Priyanka Chopra Jonas, Alia Bhatt, and Rashmika Mandann.

Ever since deepfakes emerged half a decade ago, research has found that nonconsensual deepfake pornography overwhelmingly targets women—and it has continued to explode. Last year, reporting from WIRED found that 244,625 videos had been uploaded to the top 35 deepfake porn hosting sites—more than any previous year. And it doesn’t take much to make a deepfake. In 2019, VICE found that just 15 seconds of an Instagram story is enough to create a reliable deepfake, and the technology has only gotten more accessible. Last month, a school in Beverly Hills expelled five students who had made nonconsensual deepfakes of 16 of their classmates.

“Deepfake pornography is a growing cause of gender-based harassment online and is increasingly used to target, silence, and intimidate women on- and offline,” says Thorning-Schmidt. “Multiple studies show that deepfake pornography overwhelmingly targets women. This content can be extremely harmful for victims, and the tools used for creating it are becoming more sophisticated and accessible.”

In January, legislators introduced the Disrupt Explicit Forged Images and Non-Consensual Edits, or DEFIANCE Act, that would allow people whose images were used in deepfake porn to sue if they could show that it was made without their consent. Congresswoman Alexandria Ocasio-Cortez, who sponsored the bill, was herself the target of deepfake pornography earlier this year.

“Victims of nonconsensual pornographic deepfakes have waited too long for federal legislation to hold perpetrators accountable,” Ocasio-Cortez said in a statement at the time. “As deepfakes become easier to access and create—96 percent of deepfake videos circulating online are nonconsensual pornography—Congress needs to act to show victims that they won’t be left behind.”

10 notes

·

View notes

Text

GST Registration Services in Delhi by SC Bhagat & Co.

Navigating the complex world of taxation in India can be challenging, especially for businesses in a dynamic city like Delhi. One critical aspect of compliance is GST registration, a mandate for businesses exceeding specific turnover thresholds. SC Bhagat & Co., a trusted name in accounting and taxation, offers seamless and reliable GST registration services in Delhi to help businesses stay compliant and thrive.

Why GST Registration is Crucial The Goods and Services Tax (GST) is a unified tax structure introduced to simplify India’s taxation system. GST registration is mandatory for businesses that:

Have an annual turnover exceeding ₹40 lakhs (₹20 lakhs for service providers). Are engaged in inter-state supply of goods or services. Operate under specific sectors requiring GST compliance (e.g., e-commerce, exporters). Failing to register for GST can lead to penalties, restricted operations, and reputational damage. This is where SC Bhagat & Co. steps in with expert assistance.

GST Registration Services by SC Bhagat & Co. SC Bhagat & Co. provides end-to-end GST registration solutions tailored to the unique needs of your business. Their services include:

Eligibility Assessment The experts at SC Bhagat & Co. assess whether your business falls under the mandatory GST registration criteria and advise accordingly.

Document Preparation and Submission Their team ensures that all necessary documents, including PAN, Aadhaar, business registration certificates, and bank statements, are prepared and submitted correctly.

GST Identification Number (GSTIN) Generation Once registered, SC Bhagat & Co. helps you obtain your unique GSTIN, ensuring compliance with Indian tax laws.

Post-Registration Compliance Support GST registration is just the beginning. The team provides ongoing support, including:

Filing GST returns Addressing notices from GST authorities Maintaining compliance records Benefits of Choosing SC Bhagat & Co. Here’s why SC Bhagat & Co. is the go-to partner for GST registration services in Delhi:

Expertise in Tax Laws With years of experience, the firm offers in-depth knowledge of GST regulations, ensuring accurate and hassle-free registration.

Personalized Solutions They understand that every business is unique. SC Bhagat & Co. provides tailored solutions to meet specific requirements.

Timely and Efficient Service Their streamlined processes ensure quick GST registration, enabling businesses to operate without delays.

Cost-Effective Services SC Bhagat & Co. offers affordable services without compromising on quality, making them a trusted partner for businesses of all sizes.

Why Delhi Businesses Trust SC Bhagat & Co. Delhi’s diverse business landscape demands a taxation partner that understands its challenges. SC Bhagat & Co. has established itself as a reliable ally for startups, SMEs, and large enterprises, helping them navigate GST complexities with ease. Conclusion GST compliance is a non-negotiable aspect of running a business in India. With SC Bhagat & Co.’s GST registration services in Delhi, you can ensure seamless compliance while focusing on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

6 notes

·

View notes

Text

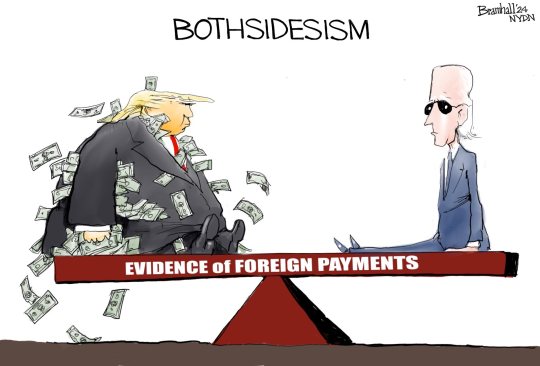

LETTERS FROM AN AMERICAN

January 4, 2024

HEATHER COX RICHARDSON

JAN 5, 2024

The Democrats on the House Oversight Committee today released a 156-page report showing that when he was in the presidency, Trump received at least $7.8 million from 20 different governments, including those of China, Saudi Arabia, United Arab Emirates, Qatar, Kuwait, and Malaysia, through businesses he owned.

The Democrats brought receipts.

According to the report—and the documents from Trump’s former accounting firm Mazars that are attached to it—the People’s Republic of China and companies substantially controlled by the PRC government paid at least $5,572,548 to Trump-owned properties while Trump was in office; Saudi Arabia paid at least $615,422; Qatar paid at least $465,744; Kuwait paid at least $300,000; India paid at least $282,764; Malaysia paid at least $248,962; Afghanistan paid at least $154,750; the Philippines paid at least $74,810; the United Arab Emirates paid at least $65,225. The list went on and on.

The committee Democrats explained that these payments were likely only a fraction of the actual money exchanged, since they cover only four of more than 500 entities Trump owned at the time. When the Republicans took control of the House of Representatives in January 2023, Oversight Committee chair James Comer (R-KY) stopped the investigation before Mazars had produced the documents the committee had asked for when Democrats were in charge of it. Those records included documents relating to Russia, South Korea, South Africa, and Brazil.

Trump fought hard against the production of these documents, dragging out the court fight until September 2022. The committee worked on them for just four months before voters put Republicans in charge of the House and the investigation stopped.

These are the first hard numbers that show how foreign governments funneled money to the president while policies involving their countries were in front of him. The report notes, for example, that Trump refused to impose sanctions on Chinese banks that were helping the North Korean government; one of those banks was paying him close to $2 million in rent annually for commercial office space in Trump Tower.

The first article of the U.S. Constitution reads: “[N]o Person holding any Office of Profit or Trust under [the United States], shall, without the Consent of the Congress, accept of any present, Emolument [that is, salary, fee, or profit], Office, or Title, of any kind whatever, from any King, Prince, or foreign State.”

The report also contrasted powerfully with the attempt of Republicans on the Oversight Committee, led by Comer, to argue that Democratic Joe Biden has corruptly profited from the presidency.

In the Washington Post on December 26, 2023, Philip Bump noted that just after voters elected a Republican majority, Comer told the Washington Post that as soon as he was in charge of the Oversight Committee, he would use his power to “determine if this president and this White House are compromised because of the millions of dollars that his family has received from our adversaries in China, Russia and Ukraine.”

For the past year, while he and the committee have made a number of highly misleading statements to make it sound as if there are Biden family businesses involving the president (there are not) and the president was involved in them (he was not), their claims were never backed by any evidence. Bump noted in a piece on December 14, 2023, for example, that Comer told Fox News Channel personality Maria Bartiromo that “the Bidens” have “taken in” more than $24 million. In fact, Bump explained, Biden’s son Hunter and his business partners did receive such payments, but most of the money went to the business partners. About $7.5 million of it went to Hunter Biden. There is no evidence that any of it went to Joe Biden.

All of the committee’s claims have similar reality checks. Jonathan Yerushalmy of The Guardian wrote that after nearly 40,000 pages of bank records and dozens of hours of testimony, “no evidence has emerged that Biden acted corruptly or accepted bribes in his current or previous role.”

Still, the constant hyping of their claims on right-wing media led then–House speaker Kevin McCarthy (R-CA) to authorize an impeachment inquiry in mid-September, and in mid-December, Republicans in the House formalized the inquiry.

There is more behind the attack on Biden than simply trying to even the score between him and Trump—who remains angry at his impeachments and has demanded Republicans retaliate—or to smear Biden through an “investigation,” which has been a standard technique of the Republicans since the mid-1990s.

Claiming that Biden is as corrupt as Trump undermines faith in our democracy. After all, if everyone is a crook, why does it matter which one is in office? And what makes American democracy any different from the authoritarian systems of Russia or Hungary or Venezuela, where leaders grab what they can for themselves and their followers?

Democracies are different from authoritarian governments because they have laws to prevent the corruption in which it appears Trump engaged. The fact that Republicans refuse to hold their own party members accountable to those laws while smearing their opponents says far more about them than it does about the nature of democracy.

It does, though, highlight that our democracy is in danger.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

17 notes

·

View notes

Text

Special Purpose Acquisition Companies (SPACs) and Their Relevance to Indian Firms

Special Purpose Acquisition Companies, or SPACs, have become a buzzword in global financial markets. As an innovative way to take companies public, SPACs offer a faster and more flexible alternative to traditional Initial Public Offerings (IPOs). While the model has gained significant traction in the United States, it presents a unique opportunity for Indian firms looking to expand and raise capital abroad. However, challenges related to regulatory frameworks and market risks still persist. This blog explores what SPACs are, their advantages, and how they might fit into the Indian corporate landscape.

What is a SPAC?

A SPAC is essentially a “blank-check” company with no commercial operations. Its sole purpose is to raise funds through an IPO to merge with a private company, allowing the target company to become publicly listed without going through the traditional IPO process. Investors buy into a SPAC based on the expertise of its sponsors, trusting them to identify and acquire a promising target. If no acquisition takes place within a set timeframe (usually 24 months), the SPAC must return the money to investors.

Key Characteristics of SPACs:

Speed and efficiency: Companies can become publicly listed faster than via a standard IPO.

• Lower regulatory scrutiny: SPAC mergers avoid much of the red tape associated with IPOs.

• Pre-negotiated valuations: Target companies can negotiate valuations with the SPAC sponsors rather than relying on fluctuating market conditions.

The Global Rise of SPACs

SPACs became especially popular in 2020 and 2021, accounting for nearly half of all IPOs in the United States during that period. Successful companies like Virgin Galactic and DraftKings used SPACs to go public, paving the way for others to explore this model. Investment banks, venture capitalists, and private equity firms have embraced SPACs as a quick, lucrative way to introduce companies to public markets.

Why SPACs gained momentum:

1. Volatile markets: During periods of market uncertainty, SPACs offer companies more predictability in terms of valuation and timeline.

2. Demand for faster capital access: Startups and high-growth firms, particularly in sectors like technology and healthcare, found SPACs an attractive way to secure investments.

The Relevance of SPACs for Indian Firms

Indian firms, especially those in technology, fintech, renewable energy, and pharmaceuticals, are increasingly eyeing global markets. SPACs offer a convenient way for these firms to list abroad, particularly on exchanges such as the NASDAQ or the New York Stock Exchange (NYSE).

Advantages of SPACs for Indian Firms:

1. Global Market Access: Companies looking to expand internationally can benefit from SPACs by gaining a listing on prestigious foreign exchanges.

2. Flexible Valuation Models: Indian startups and unicorns often find it challenging to secure favorable valuations through traditional IPOs. SPACs offer them the opportunity to negotiate more favorable terms.

3. Capital for Growth: Indian firms in growth-intensive sectors can leverage SPAC mergers to secure quick funding for global expansion.

Challenges Indian Firms May Face

While SPACs hold immense potential, Indian companies encounter several regulatory and market barriers in leveraging this route effectively:

1. Regulatory Uncertainty: The Securities and Exchange Board of India (SEBI) has yet to create clear guidelines on SPAC transactions, adding a layer of uncertainty for companies and investors.

2. Foreign Exchange and FEMA Regulations: Indian firms must navigate the complexities of Foreign Exchange Management Act (FEMA) regulations to raise capital abroad.

3. Speculative Nature of SPACs: Not all SPACs find suitable acquisition targets, leading to market skepticism and reputational risks.

Examples of Indian Companies Exploring SPACs

Some Indian firms have already started testing the SPAC model. For instance, ReNew Power, a leading renewable energy company, merged with a U.S.-based SPAC to get listed on the NASDAQ. This case shows that Indian firms, especially in industries aligned with global trends like sustainability, can find success through SPAC mergers.

In addition, startups in the tech and digital economy sectors are increasingly considering SPACs to bypass the lengthy regulatory processes involved in listing on Indian exchanges. However, SEBI’s reluctance to recognize SPACs domestically means these companies currently need to explore foreign exchanges for listings

What Lies Ahead: Will SPACs Become a Mainstay in India?

As Indian companies continue to expand globally, SPACs offer an alternative path to raise capital and build international credibility. If SEBI introduces SPAC-friendly regulations, India could see a surge in SPAC-based listings—both domestically and internationally. Additionally, financial hubs such as Singapore and Hong Kong are emerging as attractive venues for SPAC deals, offering Indian firms new avenues for public listings.

Conclusion

SPACs present a promising yet challenging opportunity for Indian firms looking to expand and raise capital in global markets. With advantages such as flexible valuations, quicker listings, and access to foreign capital, this model can benefit high-growth Indian companies in technology, healthcare, and renewable energy. However, regulatory uncertainties and market risks need to be addressed for Indian firms to fully capitalize on this trend.

As the world watches the evolution of SPACs, Indian firms and regulators must adapt to these changing dynamics. With the right policies in place, SPACs could become a pivotal part of India’s global corporate strategy.

By understanding and engaging with this evolving financial mechanism, Indian firms can position themselves for success in global markets. As you build your corporate law portfolio, tracking these trends will showcase your knowledge of innovative legal and financial strategies—an essential skill for future corporate lawyers.

2 notes

·

View notes