#SBI balance checking number

Explore tagged Tumblr posts

Text

State Bank of India Balance Checking Number

Checking your bank balance is crucial for managing your finances effectively. The State Bank of India (SBI) offers multiple convenient methods for customers to check their account balance. This article will guide you through these various options, focusing on the SBI balance check number and other helpful services.

State Bank of India Balance Checking Number

https://paisainvests.com/wp-content/uploads/2024/07/sdsfdsfdsf.webp

Why Knowing Your Balance is Important

Understanding your bank balance helps you keep track of your spending, avoid overdrafts, and ensure that your financial health is in check. It’s essential for budgeting, planning expenses, and avoiding unexpected fees.

Methods to Check SBI Account Balance

1. SBI Balance Check Number

How to Use the SBI Balance Check Number

To check your SBI account balance, dial the SBI balance check number: 09223766666 from your registered mobile number. Within seconds, you’ll receive an SMS with your account balance details.

Benefits of Using the SBI Balance Check Number

This method is quick, easy, and doesn’t require internet access. It’s especially useful for those who need their balance information instantly and for customers who aren’t tech-savvy.

2. SBI Missed Call Service

How to Use the Missed Call Service

Simply give a missed call to 09223766666 from your registered mobile number. You’ll receive an SMS with your account balance shortly after.

Advantages of Missed Call Service

The missed call service is free and convenient, making it accessible to all customers, including those with basic mobile phones.

3. SMS Banking

Steps to Use SMS Banking

Send an SMS in the format BAL to 09223766666 from your registered mobile number. You will get an SMS response with your account balance details.

Pros of SMS Banking

SMS banking is useful for those who prefer texting over calling. It provides a written record of your balance, which can be handy for future reference.

4. Internet Banking

Checking Balance Online

Log in to your SBI Internet banking account using your credentials. Navigate to the ‘Account Summary’ section to view your balance and recent transactions.

Security Tips for Internet Banking

Ensure you use strong passwords, log out after each session, and avoid accessing your account from public Wi-Fi networks to maintain security.

5. SBI YONO App

Using the YONO App to Check Balance

Download the SBI YONO app from the App Store or Google Play. After registering, you can easily check your balance and perform other banking operations through the app.

Features of the SBI YONO App

The YONO app offers a comprehensive range of features, including fund transfers, bill payments, loan applications, and investment services, making it a one-stop solution for all your banking needs.

How to Register for SBI Balance Services

Registering Your Mobile Number

Visit your nearest SBI branch or ATM to link your mobile number with your account. This is essential for using SMS banking and missed call services.

Activating Internet Banking

You can activate internet banking by visiting the official SBI website (State Bank of India (onlinesbi.sbi)) and following the registration process. Alternatively, you can request assistance at your local branch.

Downloading and Setting Up the SBI YONO App

Download the app, complete the registration process by entering your account details and OTP, and set up your login credentials to start using the YONO app.

Troubleshooting Common Issues

Missed Call Service Issues

If you’re not receiving balance updates via missed calls, ensure your mobile number is registered with the bank and check for network issues.

SMS Banking Errors

Double-check the SMS format and ensure your mobile number is correctly registered. If issues persist, contact SBI customer service for assistance.

Internet Banking Login Problems

If you’re facing login issues, try resetting your password or contact SBI customer support for help. Ensure your browser is updated and clear your cache regularly.

Conclusion

SBI offers multiple convenient ways to check your account balance, making banking easy and accessible for everyone. Whether you prefer calling, texting, or using the internet, SBI has got you covered. Keeping track of your balance has never been simpler!

By Paisainvests.com

#balance inquiry SBI#bank balance check#SBI account balance#SBI account details#SBI account management#SBI balance#SBI balance check#SBI balance check number#SBI balance checking number#SBI balance enquiry#SBI balance information#SBI customer service#SBI mobile banking#SBI phone banking#SBI SMS balance check#State Bank of India

0 notes

Text

SBI Balance Check Number – Simplified Enquiry with SBI Quick

In the fast-paced world of banking, staying updated with your account balance is crucial. State Bank of India (SBI), one of the largest and most trusted banks in India, offers a convenient solution for this through its SBI Quick Enquiry service.

What is SBI Quick Enquiry?

SBI Quick Enquiry is an innovative service provided by the State Bank of India, designed to offer customers quick and easy access to their account balance and mini statements. It allows you to check your account balance instantly, without the need for internet connectivity or visiting a physical branch.

How Does it Work?

Using SBI Quick Enquiry is remarkably simple. All you need to do is give a missed call or send an SMS from your registered mobile number to the designated SBI Quick number. Within moments, you will receive an SMS containing your account balance details.

The SBI Quick Balance Check Number:

To avail of this service, you can dial 09223766666 from your registered mobile number. Give a missed call, and in a matter of seconds, you will receive an SMS with your current account balance.

Additional Features:

Apart from checking your balance, SBI Quick Enquiry also allows you to request a mini statement. Simply send an SMS in the prescribed format, and you will receive your recent transaction details promptly.

Advantages of Using SBI Quick Enquiry:

Instant Access: Get your account balance on-the-go, anytime, anywhere.

No Internet Required: You don’t need an internet connection or a smartphone to use this service.

Secure and Convenient: The service is secure, as it can only be accessed from your registered mobile number.

Time-Saving: Avoid long queues or navigating through complex menus; SBI Quick is swift and straightforward.

SBI Quick Enquiry is a game-changer for those seeking hassle-free and rapid access to their account information. It reflects SBI’s commitment to leveraging technology for the convenience of its customers. By simply dialing the SBI balance check number, you unlock a world of banking ease right at your fingertips. Stay updated, stay informed with SBI Quick Enquiry.

1 note

·

View note

Text

Sarkari Jobs & Results 2025: Latest Government Job Notifications & Exam Results

Introduction

In India, government jobs—commonly referred to as "Sarkari Naukri"—hold immense importance due to their job security, attractive benefits, and respect in society. Every year, millions of aspirants compete for a limited number of vacancies in various government sectors, making it a highly competitive field. With 2025 around the corner, staying updated with the latest government job notifications and exam results is crucial for job seekers.

For Bihar government job updates, visit Bihar Job Help.

Why Government Jobs Are Highly Sought After in India

Government jobs in India are not just about employment; they symbolize stability and long-term security. Here are some key reasons why aspirants prefer Sarkari jobs over private-sector jobs:

Job Security: Unlike private jobs, government positions are rarely affected by layoffs or economic downturns.

Attractive Salary & Perks: Competitive salaries, allowances, medical benefits, pensions, and housing facilities make these jobs financially appealing.

Work-Life Balance: Most government jobs offer fixed working hours, paid leaves, and holidays, ensuring a healthy work-life balance.

Retirement Benefits: Pension plans and other post-retirement benefits provide financial security even after service.

Social Status & Respect: Holding a government job is considered prestigious, often increasing social status.

For the latest Bihar government jobs, check Bihar Job Help regularly.

Major Government Sectors Offering Jobs in 2025

The Indian government offers employment opportunities across various sectors. Some of the most prominent ones include:

Banking: Clerk, PO, SO, Manager (IBPS, SBI, RBI, NABARD)

Railways: Loco Pilot, Station Master, TT (RRB - Railway Recruitment Board)

Defense: Army, Navy, Air Force (UPSC, NDA, CDS, AFCAT)

Public Service: IAS, IPS, IFS (UPSC, State PSCs)

Education: Teacher, Lecturer, Professor (UGC NET, CTET, State TETs)

Healthcare: Doctors, Nurses, Pharmacists (AIIMS, ESIC, State Health Depts.)

Engineering & Technical: JE, AE, Scientist (DRDO, ISRO, SSC JE, PSU Jobs)

For Bihar government job opportunities, visit Bihar Job Help.

Upcoming Sarkari Job Notifications 2025

If you are looking for the latest job opportunities in 2025, here are some major government exams and recruitment notifications to watch out for:

UPSC Civil Services Exam 2025 - Notification expected in February, Prelims in June.

IBPS PO & Clerk 2025 - Banking exams are conducted in multiple phases throughout the year.

SSC CGL & CHSL 2025 - Expected notifications in March-April.

Railway RRB NTPC & Group D 2025 - Expected to be announced in early 2025.

State Public Service Exams - Vary by state but usually announced in the first quarter.

Defence Exams (NDA, CDS, AFCAT) - Conducted multiple times a year.

Teacher Eligibility Tests (TET, CTET, UGC NET) - Crucial for aspiring teachers and professors.

To stay updated with these notifications, candidates can regularly check official websites like:

www.upsc.gov.in (UPSC exams)

www.ibps.in (Banking jobs)

www.ssc.nic.in (SSC recruitments)

www.indianrailways.gov.in (Railway jobs)

State PSC Websites (For state government jobs)

Bihar Job Help for Bihar job notifications.

Understanding the Recruitment Process

Most government job recruitments follow a structured process:

Notification Release: The respective government body releases an official notification detailing vacancies, eligibility, application process, and exam dates.

Application Process: Candidates must apply online within the given time frame.

Admit Card Release: Admit cards are issued before exams.

Examinations (Prelims & Mains): Most jobs require one or more rounds of written exams.

Interview or Skill Test: Some posts require additional interviews or skill-based tests.

Final Merit List & Selection: Based on exam performance and category-wise cutoffs, a final list of selected candidates is released.

How to Check Sarkari Results 2025

Once the exams are conducted, results are usually published within a few months. Here’s how candidates can check their Sarkari results:

Visit the Official Website - Each recruiting body publishes results on its official portal.

Find the Result Section - Look for "Latest Results" or "Exam Results."

Enter Required Details - Roll number, registration ID, or other credentials may be required.

Download the Result - Print or save the result for future reference.

Popular Websites for Sarkari Results:

www.sarkariresult.com

www.ncs.gov.in (National Career Service)

Official government portals (UPSC, SSC, IBPS, etc.)

Bihar Job Help for Bihar job results.

1 note

·

View note

Text

Step-by-Step Guide to Create Digital Bank Shop for Financial Success

In today’s fast-paced digital world, traditional banking is evolving, and businesses are seeking innovative ways to offer financial services. One such opportunity is to create a digital bank shop, where customers can access a wide range of banking services, from money transfers to bill payments, all through digital channels. By setting up a digital banking hub, you can tap into a growing market of tech-savvy customers, providing them with essential services that are quick, convenient, and secure. If you’re looking to take advantage of this growing trend, here's your step-by-step guide to create a digital bank shop for financial success.

Step 1: Understand the Concept of a Digital Bank Shop

A digital bank shop is a physical or online space where customers can access various banking services, including money transfers, bill payments, prepaid card services, and more. These shops are equipped with digital kiosks, ATMs, and other banking technology that make it easy for customers to perform transactions. The key to creating a digital bank shop is providing access to essential financial services in a tech-friendly and user-friendly environment.

Step 2: Decide the Services You Want to Offer

When creating a digital bank shop, the first step is to determine which banking services you want to offer. Popular services provided at digital bank shops include:

SBI Kiosk Banking Services: These services offer basic banking facilities such as cash deposits, withdrawals, account balance checking, and mini-statements. By offering kiosk banking, you can provide services to customers without the need for a traditional bank branch.

Aadhaar Micro ATM: This service allows users to perform financial transactions using their Aadhaar numbers, such as withdrawing money or checking account balances, all through a micro ATM. It is especially useful in rural and remote areas.

Money Transfer Center: Money transfers are in high demand, and by offering a money transfer center at your digital bank shop, you can enable customers to send money easily across the country or internationally.

Prepaid Card Banking Services: Many customers prefer prepaid cards for easy and secure payments. Offering prepaid card banking services allows your customers to load money onto the cards and use them for online or in-store purchases.

Education Bill Payment Centre: Many students and their families need to pay for educational expenses. By offering an education bill payment centre, you can cater to this segment by providing a hassle-free way to make payments.

Bill Collection Center: With the growing number of utility bills, setting up a bill collection center is an essential service that can benefit your customers. They can pay electricity, gas, water, and other utility bills at your digital bank shop.

Online Digi Kiosk Service: By incorporating online digi kiosk services, you can offer a self-service option where customers can access various banking services independently.

Step 3: Get Paypoint Franchisee

If you're new to the financial service sector, a great way to start is by partnering with established players in the industry. Getting a Paypoint franchisee is an excellent way to kickstart your digital bank shop. Paypoint is a trusted name in digital payments, and as a franchisee, you gain access to their network, services, and support. This allows you to offer a range of services like bill payments, money transfers, mobile recharges, and more. By joining the Paypoint network, you’ll also have access to their training programs, marketing materials, and customer service support, all of which will help you grow your digital banking business.

Step 4: Choose the Right Technology

To create a digital bank shop, you will need to invest in the right technology. The key components of a digital bank shop include:

Kiosks and ATMs: Ensure you have self-service kiosks and ATMs that allow customers to perform essential banking transactions like cash withdrawals, deposits, and balance checks.

Mobile Devices and Tablets: Use mobile devices and tablets to access digital banking apps for transactions, especially if you're offering services like money transfers or bill payments.

Secure Payment Gateways: To provide services like prepaid cards, online bill payments, and money transfers, you’ll need secure payment gateways to process transactions smoothly and safely.

Customer Support Tools: Invest in customer support tools such as chatbots, live agents, or even a help desk to assist customers with their transactions or service-related issues.

Step 5: Become a Digital Banking Service Provider

To take your digital bank shop to the next level, consider becoming a digital banking service provider. This allows you to offer a wider range of services such as loans, savings accounts, and other financial products in addition to the basic services mentioned earlier. By partnering with a bank or a financial institution, you can gain access to their offerings and provide these services to your customers.

Step 6: Legal Requirements and Licensing

Before you start offering any financial services, it is crucial to understand the legal requirements and licensing needed to operate a digital bank shop. In most cases, you will need to get approval from regulatory bodies like the Reserve Bank of India (RBI) or other relevant financial institutions. Additionally, ensure that you have the necessary licenses for providing services like money transfers, prepaid cards, and bill payments.

Step 7: Location and Infrastructure

Choosing the right location is critical when creating a digital bank shop. Ideally, your shop should be located in a high-traffic area such as near schools, marketplaces, residential areas, or business districts. You’ll also need to set up a safe and secure environment with the necessary infrastructure to support your digital banking services.

Step 8: Marketing and Promotion

Once you’ve set up your digital bank shop, it’s time to market your services. You can use both online and offline strategies to promote your digital bank shop. Leverage social media, local advertising, and word-of-mouth to reach potential customers. Consider offering discounts or incentives to new customers to attract them to your shop. Building strong relationships with your community and providing excellent customer service will also help your business grow.

Step 9: Monitor and Improve Services

After you launch your digital bank shop, continuously monitor the performance of your services. Collect feedback from customers and analyze transaction data to identify areas for improvement. By adapting to customer needs and making necessary adjustments, you can ensure the long-term success of your digital banking venture.

Conclusion

Creating a digital bank shop is an excellent way to capitalize on the growing demand for digital banking services. By offering a variety of services such as SBI kiosk banking services, money transfer centers, prepaid card banking services, and Aadhaar micro ATMs, you can provide customers with the financial services they need in a convenient, tech-friendly environment. Partnering with trusted networks like Paypoint, becoming a digital banking service provider, and staying compliant with legal requirements will ensure your digital bank shop thrives. By following these steps, you can build a successful business that meets the demands of the modern financial world.

#Create Digital Bank Shop#Digital Banking Service Provider#SBI kiosk banking services#prepaid card banking services#Digital Banking

0 notes

Text

0 notes

Text

Understanding SBI Demat Account Charges: Complete Guide by NiftyFriend

Opening a Demat account is one of the first steps for anyone interested in investing in the stock market. For Indian investors, one of the most trusted names in the banking and financial services sector is the State Bank of India (SBI). As with any financial service, understanding the associated costs and charges is crucial for making informed decisions. In this comprehensive guide by NiftyFriend, we will explore SBI Demat Account Charges and also discuss SBI Demat Account Opening Charges, helping you make an educated choice for your investment needs.

What is a Demat Account?

A Demat account (short for Dematerialized account) is a digital account that holds your securities, such as stocks, bonds, and other financial assets, in an electronic form. This system eliminates the need for physical certificates, making trading and transferring securities more convenient. The Demat account acts as a repository for your financial holdings, and managing it properly ensures smooth trading on stock exchanges.

Why Choose SBI for Your Demat Account?

State Bank of India (SBI) is a prominent name in the Indian financial sector, offering a wide range of banking and investment services. SBI’s Demat account services are trusted by millions of customers because of the bank’s extensive experience, reliability, and customer-centric approach. SBI offers Demat accounts with user-friendly features, and customers can access their accounts online, making it easy to track their investments and trade seamlessly.

Additionally, SBI has a robust support system, helping investors navigate the stock market with ease. The primary reason for choosing SBI for your Demat account is the bank’s reputation for providing security, trustworthiness, and convenience, especially for first-time investors.

SBI Demat Account Opening Charges: What to Expect

When opening a Demat account with SBI, it is important to understand the various charges involved. These charges cover the processing, maintenance, and transaction-related activities associated with your account.

Here’s a breakdown of the SBI Demat Account Opening Charges:

Account Opening Charges: SBI charges a one-time account opening fee when you first open a Demat account. The fee may vary depending on the type of account you choose. However, this is generally a low cost that is charged upfront at the time of account creation.

Annual Maintenance Charges (AMC): The most significant charge for maintaining a Demat account is the Annual Maintenance Charge (AMC). This fee is charged every year for managing the account, providing access to online trading platforms, and supporting transaction-related services. For SBI Demat accounts, the AMC typically ranges from INR 400 to INR 500. It’s important to note that this charge is subject to change, so it’s always a good idea to check for updates before committing.

Transaction Charges: Transaction charges are levied on every buy or sell transaction involving securities in your Demat account. SBI charges a fee for the transfer of shares from one account to another, and these charges depend on the number of securities being transferred. The charges are generally a percentage of the transaction value, and you will be informed of the exact charges before proceeding.

Pledge Charges: If you want to pledge your securities for obtaining loans, SBI charges a fee for this process. This is called the Pledge Fee, and it’s applicable when using securities in your Demat account as collateral.

Additional Charges: In addition to the above-mentioned fees, SBI may also charge fees for services like physical delivery of statements, non-maintenance of minimum balance, and duplicate statements. It’s important to understand these charges, as they can affect the overall cost of managing your Demat account.

SBI Demat Account Charges: Transaction Fees and Other Costs

When it comes to SBI Demat Account Charges, the transaction fees are one of the most significant costs to be aware of. SBI charges a certain percentage of the transaction value for each trade. Here are the common types of transaction charges you can expect:

Debit Transaction Charges: These charges apply when you transfer securities from your Demat account to another account or when you sell your securities in the market. The charges typically vary based on the number of shares or the value of the transaction.

Corporate Action Charges: When corporate actions like dividends, mergers, or stock splits occur, there may be additional charges for processing these actions in your Demat account. SBI charges a small fee for these corporate actions, which is usually disclosed at the time of the action.

Securities Transaction Tax (STT): Securities Transaction Tax (STT) is a tax imposed by the government on the transaction value of securities. While the STT is not an SBI-specific charge, it is an important cost factor for every investor to consider when executing a trade.

GST on Charges: Apart from the above-mentioned charges, the Goods and Services Tax (GST) is applicable on all Demat account services. The GST rate for Demat services is generally 18%. This is an additional cost that you must factor into your calculations.

How to Open an SBI Demat Account?

Opening an SBI Demat account is a straightforward process. Here’s a step-by-step guide on how to open an SBI Demat account:

Visit the SBI Website: You can open an SBI Demat account online by visiting the official website of SBI. Alternatively, you can also visit your nearest SBI branch for in-person assistance.

Fill Out the Application Form: To open a Demat account with SBI, you need to fill out the application form. The form requires basic personal details such as your name, address, date of birth, and PAN number.

Submit Documents: You’ll need to submit certain documents to complete your Demat account opening process. These may include your PAN card, address proof (Aadhaar, passport, utility bills), and a passport-sized photograph.

Sign the Agreement: SBI will require you to sign an agreement, outlining the terms and conditions associated with your Demat account. The agreement is a legally binding document that defines your rights and responsibilities.

Complete the KYC Process: SBI follows the Know Your Customer (KYC) norms, which are mandatory for opening a Demat account. You will need to complete the KYC process by submitting necessary documents for identity verification.

Receive Account Details: Once your application is processed and approved, you will receive your Demat account details, including a unique account number. You will also be provided with access to online trading platforms.

How NiftyFriend Can Help You with SBI Demat Account?

NiftyFriend offers expert guidance and assistance in managing your Demat account with SBI. Whether you’re looking to open a new account or need help with understanding charges, NiftyFriend can make the process smoother for you. With our personalized services, you can be assured of making the right financial decisions without any confusion regarding SBI Demat Account Charges.

We provide up-to-date information about the latest charges, rules, and regulations to help you stay ahead in your investment journey. Our team of experts is always ready to assist you with any questions or concerns about your Demat account and its associated charges.

Conclusion

When considering an SBI Demat account, it is essential to understand the different charges involved, including SBI Demat Account Opening Charges and ongoing maintenance costs. Having a clear understanding of these charges will help you plan your investment strategy accordingly.

SBI offers a reliable and secure platform for managing your Demat account, and with the help of NiftyFriend, you can navigate these services with ease. Whether you’re a first-time investor or a seasoned trader, NiftyFriend ensures you have all the information you need to make informed decisions about your Demat account.

0 notes

Text

Homeloan takeover to SBI

Switch Your Home Loan to SBI for the Lowest Interest Rates and Zero Processing Charges

If you are looking to reduce your monthly financial burden or simply seeking more favorable terms on your home loan, transferring your existing loan to SBI could be the perfect solution. With options like the lowest home loan interest rate, zero processing charges, and convenient home loan takeover services for locations like Greater Noida West, SBI is making homeownership more affordable and accessible. Let’s dive into the benefits and process of a home loan takeover to SBI.

Why Choose SBI for Your Home Loan Takeover?

Home loan takeovers, also known as balance transfers, allow you to shift your existing loan from one bank to another with more favorable terms. The Homeloan takeover to SBI offers significant perks, such as competitive interest rates, minimal fees, and flexible repayment options. Here's why this is advantageous:

Lowest Home Loan Interest Rate: One of the primary reasons to consider SBI for your loan transfer is the availability of the lowest home loan interest rate in the market. A lower interest rate directly reduces your monthly EMIs, making homeownership more affordable in the long term. When you switch to SBI, you gain access to competitive rates that could save you a substantial amount of money over the tenure of your loan.

Home Loan with Zero Processing Charges: Many banks charge processing fees during the transfer process, which can add up. SBI, however, offers home loans with zero processing charges, making the transfer easier on your budget. This means that your total transfer expenses are minimized, helping you make a smoother and more affordable transition.

Special Offer for Greater Noida West Residents: SBI's home loan take over in Greater Noida West caters to a fast-growing residential area, providing competitive interest rates and exclusive benefits to residents. With this tailored offer, SBI is supporting Greater Noida West homeowners by making homeownership more affordable and sustainable in this vibrant locality.

Key Benefits of SBI's Home Loan Takeover

When you choose to transfer your home loan to SBI, you gain access to a number of financial advantages. Let’s discuss some key benefits:

Competitive Rates and Savings: As mentioned, the lowest home loan interest rate is one of the standout features of SBI’s loan offerings. A slight reduction in the rate can have a significant impact on the total cost of the loan, making SBI’s home loan takeover option a smart financial choice for cost-conscious homeowners.

Home Loan with Zero Processing Charges: By choosing an SBI home loan with zero processing charges, you avoid the additional financial burden often associated with loan transfers. This is particularly beneficial if you’re seeking to save as much as possible during the transfer process.

Simple and Transparent Application Process: SBI offers a straightforward application process that minimizes hassle and reduces paperwork. You can easily apply for the home loan takeover to SBI with just a few key documents. With digital processing and quick approvals, transferring your loan has never been easier.

How to Transfer Your Home Loan to SBI

Switching your home loan to SBI is simple and hassle-free. Here are the main steps involved:

Check Eligibility: Before you initiate the transfer, ensure that your current home loan and financial profile meet SBI’s eligibility criteria for a home loan takeover.

Submit Required Documents: Key documents include your existing loan statement, identity proof, and income proof. These documents help SBI assess your eligibility for the lowest home loan interest rate and other benefits.

Approval and Disbursement: Once approved, SBI will take over your existing loan, often providing a home loan with zero processing charges to ease the transition. The remaining loan amount is disbursed directly to your previous lender, completing the takeover process smoothly.

SBI: A Smart Choice for Home Loan Takeover in Greater Noida West

For residents in Greater Noida West, SBI offers a specially curated home loan take over Greater Noida West plan that ensures a smooth transition with favorable terms. By switching your loan to SBI, you benefit from the lowest home loan interest rate and enjoy the flexibility of a home loan with zero processing charges. With its extensive range of loan options and customer-focused services, SBI is a trusted partner for homeowners seeking financial ease and security. Visit here - https://myloankart.com/

0 notes

Text

How to get a FASTag for a second-hand car?

Obtaining a FASTag for a second-hand car is a straightforward process – though it involves a few extra steps compared to getting one for a brand-new vehicle. This guide will take you through the necessary steps. By the end, you’ll understand all the requirements and information for getting a FASTag for a second-hand car.

Understanding FASTag and Its Importance

Before obtaining a FASTag for a second-hand car, it’s important to understand what a FASTag is and why it’s essential. FASTag is an electronic toll collection system operated by the National Payments Corporation of India (NPCI) under the guidelines of the National Highways Authority of India (NHAI). It uses Radio Frequency Identification (RFID) technology to automatically deduct toll charges as you pass through toll plazas on national highways.

Why Do You Need a FASTag?

Convenience: No need to stop and pay cash at toll booths.

Time-Saver: Faster transit through toll plazas.

Fuel Efficiency: Reduced fuel consumption as you avoid stops at toll booths.

Cashback Offers: Some banks offer cashback on toll payments made through FASTag.

Mandatory: As of February 2021, FASTag has become compulsory for all vehicles on Indian highways.

Checking for Existing FASTag

When purchasing a second-hand car, the first thing you need to check is whether the car already has a FASTag. If the previous owner had installed a FASTag, you might be able to transfer it to your name. Here’s how you can do it:

Steps to Check Existing FASTag

Ask the Seller: Check with the seller if the vehicle has an active FASTag.

Contact the Issuing Bank: If the FASTag was issued by a particular bank, you can contact the bank’s customer care to confirm the status of the FASTag.

Online FASTag Portals: Some banks provide online services where you can check the status of a FASTag by entering the vehicle’s registration number.

Transferring the FASTag to Your Name: You will need to transfer the FASTag to your name if the car you are buying already has one. The process generally involves submitting a few documents to the issuing bank, including the car’s new Registration Certificate (RC) and proof of identity. The bank will update its records to reflect the change of ownership.

Applying for a New FASTag

If the second-hand car does not have a FASTag or if the existing FASTag cannot be transferred, you will need to apply for a new one. Here’s how you can go about doing that:

Documents Required:

Vehicle Registration Certificate (RC): Double-check that the RC is updated with your name as the new owner.

KYC Documents: These include your proof of identity (Aadhaar card, PAN card, Passport) and proof of address.

Passport-Sized Photograph: A recent photograph for identification purposes.

Where to Apply:

Banks: Many banks, such as SBI, ICICI, HDFC, and others, issue FASTags. You can visit their branches or apply online through their websites.

Point-of-Sale (POS) Locations: FASTags are also available at POS locations at toll plazas and through authorized agents.

Online Marketplaces: Some e-commerce platforms and payment apps also offer the option to purchase FASTags online.

How to Apply:

Visit the Bank or POS Location: Submit the necessary documents and fill out the application form.

Online Application: If applying online, fill out the form on the bank’s website, upload the necessary documents, and make the payment.

Activation: Once your application is approved, the FASTag will be activated, and you can start using it immediately.

Recharging Your FASTag

Once you have your FASTag, you’ll need to fill it up so that there is sufficient balance for toll payments. The following are some different methods of recharging your FASTag:

Online Banking – Use your bank’s online banking portal to recharge your FASTag.

UPI – Using UPI apps to add funds to your FASTag account.

Mobile Banking Apps – Most banks have mobile apps that allow you to manage your FASTag, including recharges.

It’s essential to keep track of your FASTag balance to avoid any issues at toll plazas. Most banks offer SMS alerts. You can also check your balance through the bank’s app or customer portal.

Common Issues and Troubleshooting

While FASTag is generally easy to use, you might encounter some issues (especially with a second-hand car). Here are some common problems and solutions of resolving them:

Incorrect FASTag Installation

Problem: The RFID tag is not working correctly due to improper placement.

Solution: Make sure the FASTag is placed correctly on the windshield as per the instructions.

Low Balance Issues

Problem: Your FASTag balance is insufficient, leading to transaction failures at toll plazas.

Solution: Recharge your FASTag in advance and set up low-balance alerts.

Inactive FASTag

Problem: The FASTag is not active, possibly due to a lapse in ownership transfer or delayed activation.

Solution: Contact the issuing bank to resolve activation issues and ensure the FASTag is linked to your vehicle.

Getting a FASTag for a second-hand car is a relatively simple process, provided you have all the necessary documents and follow the correct procedures. The important thing to remember above all is that the FASTag gets properly registered in your name and linked to your vehicle.

By following the steps revealed in this guide, you can enjoy seamless and hassle-free toll payments on your road trips, making your driving experience more convenient and efficient.

0 notes

Text

Complete Guide: How to Analyze a Stock? 12-Step Beginner’s Guide

Investing in the stock market can be rewarding, but without proper analysis, it’s just speculation. Whether you’re a beginner or an experienced investor, analyzing a stock before buying is crucial. In this guide, we break down how to analyze a stock in 12 simple steps using real-world examples from the Indian stock market.

1. Understand the Business: What Does the Company Do?

Before investing, ask:

What does the company do?

How does it make money?

Who are its competitors?

Example: HDFC Bank (NSE: HDFCBANK)

HDFC Bank is India’s largest private sector bank, generating revenue from loans, deposits, and financial services. It competes with ICICI Bank (NSE: ICICIBANK) and SBI (NSE: SBIN).

Where to Find Information?

Company Website – Annual reports, business model.

Moneycontrol, Economic Times, NSE/BSE Filings – Industry insights.

2. Check Financial Statements: Is the Company Profitable?

Look at three key financial statements:

Income Statement – Shows revenue, expenses, and profit.

Balance Sheet – Lists assets, liabilities, and shareholder equity.

Cash Flow Statement – Tracks cash movements.

Example: Reliance Industries (NSE: RELIANCE)

Revenue (FY 2023): ₹9.76 lakh crore

Net Profit: ₹74,088 crore

Cash Flow: ₹88,531 crore from operations

Where to Check?

NSE/BSE Websites

Strike.Money – A powerful charting and analysis tool

3. Analyze Revenue & Profit Growth: Is It Consistently Growing?

Look for steady revenue and profit growth over 5-10 years.

Example: TCS (NSE: TCS)

Revenue Growth: From ₹1.67 lakh crore (FY 2020) to ₹2.26 lakh crore (FY 2023)

Net Profit Margin: ~18% (Consistently high)

A growing company with stable profits is a good investment.

4. Evaluate Key Financial Ratios: Are the Numbers Strong?

Liquidity Ratios (Measure financial health)

Current Ratio (Ideal > 1): Infosys – 2.5 (Strong liquidity)

Profitability Ratios

Return on Equity (ROE) > 15% is good

Example: HDFC Bank ROE – 16.5% (FY 2023)

Debt Ratios

Debt-to-Equity (D/E) Ratio

Tata Steel: 2.2 (High Debt – Risky)

Asian Paints: 0.03 (Very Low Debt – Safe)

Valuation Ratios (Decide if the stock is overpriced)

P/E Ratio (Price-to-Earnings)

Nifty 50 Avg: 25

TCS P/E: 29 (Fairly Valued)

Zomato P/E: Negative (Still unprofitable)

5. Does the Company Have a Competitive Advantage?

A strong business moat protects a company from competition.

Types of Moats

Brand Power: Tata Motors, Titan

Cost Advantage: Reliance Jio

Technology Edge: Infosys, TCS

Network Effect: Zomato, Paytm

Example: Asian Paints (NSE: ASIANPAINT)

Market Leader (60% share in India)

Strong brand recall, high pricing power

6. Study Industry & Market Trends: Is the Sector Growing?

Look at Industry Growth Rate:

IT Sector (Infosys, Wipro, TCS) – Growing at 12% YoY

EV Industry (Tata Motors, Ola Electric) – High Growth

Government Policies Impact:

PLI Schemes boosting manufacturing stocks

Where to Get Industry Reports?

RBI, SEBI Reports

Industry Research Reports from CRISIL, ICRA

7. Evaluate Management & Leadership: Who Runs the Company?

Strong leadership drives growth.

What to Check?

CEO’s Track Record – N. Chandrasekaran (Tata Sons)

Corporate Governance – High promoter holding is good.

Example: HDFC Bank Leadership

Sashidhar Jagdishan (CEO) – Led HDFC’s digital transformation

Promoter Holding: ~21% (Stable leadership)

8. Is the Stock Valued Fairly?

A good stock doesn’t always mean a good buy.

How to Find a Fair Price?

Discounted Cash Flow (DCF) Model – Used by Warren Buffett

Compare P/E Ratio with Industry Avg

Example: Infosys (NSE: INFY) P/E vs. Industry

Infosys P/E: 21

Industry Average P/E: 24

Conclusion: Slightly undervalued – potential buy

9. Does It Pay Dividends or Buy Back Shares?

Dividend-paying stocks provide stable returns.

Example: Dividend Yield of Top Stocks

ITC: 3.5%

HUL: 1.8%

Reliance: 0.4% (Lower but growing)

Stock buybacks also increase share value.

Example: TCS Buyback in 2023

₹18,000 Cr buyback boosted stock price by 5%

10. How Risky Is the Stock? Check Volatility & Beta

Key Risk Indicators

Beta (>1 is volatile, <1 is stable)

Debt Level – High debt = High risk

Example: Stock Volatility in 2023

Tata Motors Beta: 1.6 (Highly Volatile)

HUL Beta: 0.7 (Stable Defensive Stock)

A diversified portfolio reduces risk.

11. Technical Analysis: When to Buy & Sell?

Use Strike.Money for charting stock trends.

Key Indicators

Moving Averages: 50-day vs. 200-day

RSI (Relative Strength Index): Overbought (>70), Oversold (<30)

MACD Crossover: Buy signal when MACD crosses above signal line

Example: Nifty 50 Technical Trend (Feb 2024)

RSI at 55 – Neutral zone

50-day MA above 200-day MA – Bullish signal

12. Stay Updated with Market News & Sentiment

Stock prices react to news, quarterly earnings, and global events.

Best Sources for Stock Market News

Economic Times, Moneycontrol, CNBC India

Strike.Money – Live charts and market insights

Example: Adani Stocks Crash in 2023

Reason: Hindenburg Report exposed financial irregularities

Impact: Adani Enterprises fell 50% in a week

Common Mistakes Beginners Make in Stock Analysis

🚫 Investing Based on Tips – Do your own research. 🚫 Ignoring Debt Levels – High debt can be risky. 🚫 Not Checking Valuation – Even good stocks can be overpriced. 🚫 Emotional Investing – Buy based on analysis, not fear or hype.

Final Thoughts: Build a Winning Investment Strategy

Mix fundamental & technical analysis for best results.

Long-term investing beats short-term trading.

Learn from experts like Warren Buffett, Peter Lynch.

👉 Use Strike.Money for stock research & charts.

Got a stock in mind? Start analyzing today! 🚀

0 notes

Text

Unveiling the Importance and Functions of CIF Number in SBI

Introduction:

In the realm of banking, customer convenience and security are of utmost importance. The State Bank of India (SBI), being one of the largest and oldest banks in the country, ensures a seamless and secure banking experience for its customers. One crucial aspect of SBI's customer management is the CIF (Customer Information File) number. In this article, we'll delve into the significance and functions of the CIF number in SBI.

Understanding CIF Number:

The CIF number is a unique identification number assigned to each account holder by the bank. It serves as a comprehensive record that encapsulates all pertinent details of a customer's banking relationship with SBI. This alphanumeric code is crucial for streamlining operations, ensuring data accuracy, and enhancing security.

Significance of CIF Number:

Account Management: The CIF number is the backbone of account management in SBI. It allows the bank to maintain a centralized database containing all essential customer information. This includes personal details, account transactions, loan details, and other relevant information.

Easy Retrieval of Information: CIF numbers make it convenient for both customers and the bank to retrieve and access specific account details. Whether it's for checking account balances, transaction history, or availing various banking services, the CIF number acts as a quick reference point.

Security Measures: In an era where digital transactions are prevalent, ensuring the security of customer information is paramount. The CIF number plays a crucial role in this regard by providing a unique identifier for each customer, reducing the risk of unauthorized access and fraud.

Loan Application and Processing: When applying for loans or credit facilities, the CIF number streamlines the process. It enables the bank to assess the customer's creditworthiness based on their historical financial data, making loan approval and processing more efficient.

Unified Banking Experience: For customers with multiple accounts or availing various banking services, the CIF number offers a unified experience. It links all associated accounts and services under one unique identifier, simplifying the management of diverse financial activities.

How to Locate CIF Number:

Passbook: The CIF number is often printed on the first page of the bank passbook. Customers can easily find it by checking the details on this page.

Cheque Book: The CIF number is also present on the front page of the SBI cheque book. It is usually printed near the account number.

Online Banking: Customers can log in to their SBI online banking portal to find their CIF number. The information is typically available in the account details section.

Conclusion:

The CIF number in SBI is more than just a combination of letters and numbers; it is a key to a customer's banking journey. Understanding its significance and keeping track of this unique identifier is essential for a smooth and secure banking experience with the State Bank of India.

0 notes

Text

How Do I Convert My Zero-Balance Account To A Savings Account In SBI?

State Bank of India (SBI) is one of the most popular banks in India that offers a range of banking products and services. If you have a zero-balance account in SBI, you may be wondering how to convert it into a savings account. The good news is that converting your zero-balance account into a savings account is a straightforward process and can be done through various channels. In this blog post, we'll discuss the steps you need to take to convert your SBI zero-balance account into a savings account.

Step 1: Fill Out the Account Opening Form

To convert your zero-balance account into a savings account, you need to fill out the account opening form. You can download the form from the SBI website or collect it from your nearest SBI branch. Fill out the form with accurate information, including your personal and contact details. Make sure to provide the correct account number and name, as this will be used to identify your account during the conversion process.

Step 2: Submit the Necessary Documents

Once you've filled out the account opening form, you need to submit a few necessary documents. SBI may ask for your passport-sized photographs, proof of identity, and address proof. You can submit any government-issued documents such as your PAN card, Aadhaar card, voter ID, or passport as proof of identity and address. Make sure to carry the original documents with you when you visit the SBI branch.

Step 3: Deposit the Minimum Balance

After submitting the necessary documents and the account opening form, you need to deposit the minimum balance required for opening a savings account. The minimum balance varies for urban, metropolitan, and rural areas, and you can find the exact amount on the SBI website or by visiting the nearest SBI branch. Once you deposit the minimum balance, your zero-balance account will be converted into a savings account.

Step 4: Wait for Your Account to be Activated

After you've completed the above three steps, your account will be activated within a few days. You'll receive an SMS or email after your savings account is activated, and you'll be able to access all the savings account features, including internet banking, mobile banking, and ATM services.

Must Read This: Does ICICI Bank Check CIBIL Credit Score Before Opening Saving Account?

Step 5: Update Your KYC Details

Once your account is activated, make sure to update your KYC details. Guaranteed Interest Account Your KYC details are essential for maintaining your savings account, and it is mandatory to update them periodically. You can visit the SBI branch or update your KYC details online through internet banking or mobile banking.

Conclusion:

Converting your zero-balance account into a savings account in SBI is a simple process that can be done within a few days. All you need to do is fill out the account opening form, submit the necessary documents, deposit the minimum balance, and wait for your account to be activated. SBI offers various channels for opening a savings account, including the SBI YONO app, internet banking, and visiting the nearest SBI branch. So, go ahead and convert your zero-balance account into a savings account and enjoy the benefits of having a savings account in SBI.

0 notes

Text

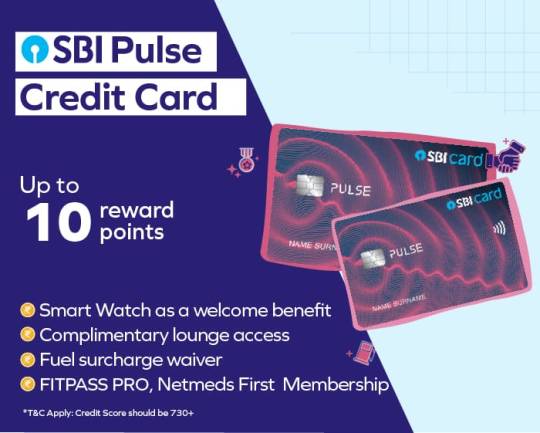

SBI Pulse Credit Card

In today's digital age, credit cards have become an essential tool for managing financial transactions conveniently and securely. Among the prominent players in the credit card industry, SBI Credit Cards stand out as a reliable and customer-centric option. With a wide range of cards tailored to suit various lifestyles and financial needs, SBI Credit Cards offer numerous benefits and rewards to their users. Let's explore the features and advantages that make SBI Credit Cards an excellent choice for individuals seeking a reliable financial companion. Benefits of SBI Pulse Credit Card Welcome Benefits - Get a Noise ColorFit Pulse 2 Max Smart Watch worth Rs. 5,999 on payment of joining fee Health & Benefits - Enjoy 1 year complimentary FITPASS PRO Membership, to be received every year, on card renewal - Enjoy 1 year complimentary Netmeds First Membership, to be received every year, on card renewal Rewards - Earn 10 Reward Points per Rs. 100 spent on Chemist, Pharmacy, Dining and Movies spends - Earn 2 Reward Points per Rs.100 spent on all your other spends Milestone - Waiver of Renewal Fee on annual spends of Rs. 2 Lakhs - Get Rs. 1500 E-Voucher on achieving annual retails spends of Rs. 4 Lakhs Travel - Complimentary 8 Domestic Lounge visits (Restricted to 2 per quarter) - Complimentary Priority Pass Membership for first two years of cardholder membership Others - 1% Fuel Surcharge waiver for each transaction between ₹500 & ₹4,000. Maximum Surcharge waiver of ₹250 per statement cycle, per credit card account - Get complimentary Air Accident Liability Cover of ₹50 Lakhs - Get complimentary credit card Fraud Liability Cover of ₹1 lakh - Loss of check in baggage up to ₹72,000 (1000 USD) - Delay of check in baggage ₹7,500 - Loss of travel documents up to ₹12,500 - Baggage Damage- Cover up to ₹5000 Eligibility Criteria Salaried - Age Group: 21 - 65 years - Income Range: ₹20,000+ - Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Salary certificate, Recent salary slip, Employment letter, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Eligibility Criteria Self-employed ❏ Age Group: 21-70 years ❏ Income Range: ₹30,000+ ❏ Documents Required: - Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, , or any other government-approved ID - Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID - Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc. - You should be new to SBI Bank You must be an Indian resident - Credit Score should be 730+ Application Process Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process - Your PAN card - Aadhaar card and - Bank account details 01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue' 02 Enter your professional details such as employment type, office address and click on 'Continue to Digilocker' 03 Enter your Aadhaar number, Security code(captcha) and click ‘Next’ 04 Enter the OTP sent to your mobile number and click on 'Continue' 05 Your application has been 06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC - On completion of the due process, the bank will take a final decision on card approval - Once approved, you will get the credit card within 7 to 15 days of the final decision Help & Support FAQs - Is SBI Pulse credit card beneficial for fitness freaks? Yes, you can say that the SBI Pulse credit card is made for fitness freaks, where the user gets a complimentary Noise ColorFit Pulse Smartwatch after paying the joining fee. You can track your fitness activities through this smartwatch. - How can I access my FITPASS PRO membership using the SBI Card Pulse? You will have to make a prior reservation using the FITPASS mobile application. - Can I use SBI Card Pulse internationally? Yes, SBI Card Pulse can be used in over 24 million outlets across the world. - Is SBI Card Elite credit card internationally acceptable? SBI ELITE credit card is accepted at over 24 million Visa outlets worldwide, including 3,25,000 outlets in India. - Does SBI Card Elite credit card provide Fraud liability cover? Yes, you get a cover of Rs. 1 Lakh against fraudulent transactions. - Does SBI Card Elite credit card offer fuel surcharge waiver & if yes, where can I avail it? Yes, SBI Elite Credit Card offers fuel surcharge waiver. It can be availed at any petrol pump in India. - How can I connect with SBI Bank customer care? Please call SBI's 24X7 helpline number i.e. 1800 1234 (toll-free), 1800 11 2211 (toll-free), 1800 425 3800 (toll-free),1800 2100(toll-free), or 080-26599990. Congratulations! Enjoy the benefits of SBI Credit Card. Read the full article

0 notes

Text

Guarding Your Health: The Power of Comprehensive Health Insurance

There has been a significant surge in the demand for health insurances among people due to the surge in the cases of various diseases such cancer, dengue, and diabetes. Besides, rise in the geriatric population in various countries, increase in awareness about health insurance among people living in the rural area, growth in the standard of living, and disposable income among people are expected to drive the growth of the global health insurance market. According to the report published by Allied Market Research, the global health insurance market is expected to reach $4.15 trillion by 2028, growing at a CAGR of 9.7% from 2021 to 2028.

Numerous players of the market are launching innovative health insurance services to effectively cater to needs of people in times of crisis. For instance, SBI General Insurance, the largest state-owned banking and financial services company in India owning 70 percent of the total capital, announced the launch of its new health insurance vertical. The company envisions to become one of the top general insurers in health insurance over the period of next three years.

Understanding Health Insurance: Health insurance is a contract between you and an insurance provider that helps you cover the costs of medical expenses. It acts as a shield against unexpected healthcare costs, ensuring that you don't have to compromise on your health due to financial constraints. Health insurance plans vary widely, offering coverage for services such as doctor visits, hospital stays, prescription medications, preventive care, and more.

Click Here to Health Insurance Market

Types of Health Insurance:

Health Maintenance Organization (HMO): HMO plans offer a network of doctors and hospitals that you must use for non-emergency care. They often require a primary care physician referral to see a specialist.

Preferred Provider Organization (PPO): PPO plans provide more flexibility in choosing healthcare providers. You can see both in-network and out-of-network doctors, though the latter may cost more.

Exclusive Provider Organization (EPO): EPO plans combine elements of HMO and PPO plans. You're typically covered only for in-network care, except in emergencies.

Point of Service (POS): POS plans require a primary care physician and referrals for specialists. They offer more coverage for out-of-network care than HMOs.

High Deductible Health Plan (HDHP): HDHPs have higher deductibles and lower premiums. They're often paired with Health Savings Accounts (HSAs) for tax-advantaged savings.

Catastrophic Health Insurance: This plan is designed for young and healthy individuals. It covers essential health benefits after you meet a high deductible.

Benefits of Health Insurance:

Financial Security: Health insurance provides a safety net against unexpected medical expenses, preventing you from facing crippling debt due to healthcare costs.

Access to Quality Care: With insurance, you can seek medical attention promptly, ensuring early diagnosis and effective treatment.

Preventive Services: Many insurance plans cover preventive services like vaccinations, screenings, and annual check-ups, promoting proactive health management.

Prescription Medication Coverage: Health insurance often includes coverage for prescription drugs, making essential medications more affordable.

Mental Health Support: An increasing number of plans offer coverage for mental health services, acknowledging the importance of holistic well-being.

Key Considerations:

Coverage and Network: Understand the healthcare services covered by the plan and whether your preferred doctors and hospitals are in-network.

Premiums and Deductibles: Balance monthly premiums and annual deductibles based on your health needs and budget.

Out-of-Pocket Costs: Consider co-pays, co-insurance, and maximum out-of-pocket limits to gauge potential expenses.

Provider Choice: Choose a plan that aligns with your preferred healthcare providers and their availability.

Prescription Coverage: Ensure that the plan adequately covers prescription medications you currently use or may need in the future.

Life Changes: Be prepared to adjust your coverage as life circumstances change, such as marriage, having children, or retirement.

Conclusion: Health insurance serves as a lifeline that safeguards your health and financial stability. By understanding the types, benefits, and considerations associated with health insurance, you empower yourself to make informed decisions that contribute to your overall well-being. Remember, investing in your health today is an investment in a healthier and more secure future.

0 notes

Text

All you need to know about SBI home loan in India

Everyone dreams of owning a beautiful home. The desire to provide a secure place for your family often calls for a significant financial investment. However, the skyrocketing property prices have made this dream a bit daunting for many. That's where home loans come into the picture, and when we talk about home loans in India, we cannot ignore the SBI home loan.

The State Bank of India, or SBI, is one of India's largest and most trusted banking and financial services organizations. With a broad array of loan products, it is known for its customer-centric approach and user-friendly procedures.

Before you take the plunge and apply for a home loan, it's essential to understand the features, benefits, and the application process of the SBI home loan. This article aims to provide you with an informative overview to make your home-buying journey smooth and hassle-free.

SBI home loan Features

SBI offers competitive interest rates, and these rates are even more attractive for women borrowers. The bank provides home loans for various purposes, including buying a new home, construction, renovation, and extension of existing homes. The repayment tenure is quite flexible, ranging from 5 to 30 years.

Another crucial aspect of SBI home loans is the transparency in the processing fees. The bank charges a nominal fee for processing your home loan application, and there are no hidden costs involved. Furthermore, SBI offers the option to shift your existing home loan from other financial institutions to SBI with its Balance Transfer scheme, providing you with the benefit of lower interest rates.

Eligibility Criteria and Documentation for SBI home loan

The eligibility criteria for an SBI home loan is based on various factors like the applicant's age, income, employment type and stability, credit history, and the property's value. The bank also takes into account the applicant's repayment capacity before sanctioning the loan.

The documents required for the loan process include proof of identity, proof of residence, income proof, employment details, property documents, and a duly filled application form. It's advisable to check the detailed list of required documents on the official SBI.

Applying for an SBI loan

The application process for an SBI loan can be initiated online or offline. You can apply online through the SBI official website or visit the nearest SBI branch. The bank's representatives provide you with all the necessary assistance during the application process.

To make the whole process even more comfortable, organizations like Easy Bank Loan come into play. They guide you through every step of your home loan process, from application submission to the disbursal of the loan amount, ensuring a smooth experience.

SBI home loan Customer Service

SBI provides excellent customer service to its home loan customers. You can contact them for any loan-related queries or issues via their toll-free customer care number. Additionally, the bank also offers online complaint registration and tracking services to ensure quick resolution of issues.

In conclusion, when looking for a home loan in India, SBI is a reliable choice due to its attractive interest rates, transparent processes, and extensive customer support. Remember, every step you take towards buying your dream home is a step towards securing your future. So, choose wisely and make your home-owning dream a reality with a home loan.

Resource : https://eazybankloan.blogspot.com/2023/07/all-you-need-to-know-about-sbi-home-loan-in-india.html

0 notes

Link

sbi bank balance check kaise kare:ghar baithe bank account ke balance check kare,mini statement bank balance check number

#sbi mini statement#sbi balance#sbi balance checking number#how to register mobile number in sbi#sbi mobile number registration for balance enquiry

0 notes