#LuxLeaks

Explore tagged Tumblr posts

Text

Tax wars, documentaire franco-norvégien réalisé par Hege Dehli et Xavier Harel

disponible sur arte.fr jusqu'au 04/07/2024

#documentaire#évasion fiscale#Icrict#paradis fiscaux#arte.fr#luxembourg#luxleaks#irlande#pays-bas#chypre#malte#suisse#panama papers#taxation unitaire#taxation minimum de 15%#joseph stiglitz#jayati gosh#thomas piketty#eva joly#gabriel zucman

0 notes

Text

Retiring the US debt would retire the US dollar

THIS WEDNESDAY (October 23) at 7PM, I'll be in DECATUR, GEORGIA, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

One of the most consequential series of investigative journalism of this decade was the Propublica series that Jesse Eisinger helmed, in which Eisinger and colleagues analyzed a trove of leaked IRS tax returns for the richest people in America:

https://www.propublica.org/series/the-secret-irs-files

The Secret IRS Files revealed the fact that many of America's oligarchs pay no tax at all. Some of them even get subsidies intended for poor families, like Jeff Bezos, whose tax affairs are so scammy that he was able to claim to be among the working poor and receive a federal Child Tax Credit, a $4,000 gift from the American public to one of the richest men who ever lived:

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

As important as the numbers revealed by the Secret IRS Files were, I found the explanations even more interesting. The 99.9999% of us who never make contact with the secretive elite wealth management and tax cheating industry know, in the abstract, that there's something scammy going on in those esoteric cults of wealth accumulation, but we're pretty vague on the details. When I pondered the "tax loopholes" that the rich were exploiting, I pictured, you know, long lists of equations salted with Greek symbols, completely beyond my ken.

But when Propublica's series laid these secret tactics out, I learned that they were incredibly stupid ruses, tricks so thin that the only way they could possibly fool the IRS is if the IRS just didn't give a shit (and they truly didn't – after decades of cuts and attacks, the IRS was far more likely to audit a family earning less than $30k/year than a billionaire).

This has become a somewhat familiar experience. If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

It was this experience that fueled my interest in forensic accounting, which led to my bestselling techno-crime-thriller series starring the two-fisted, scambusting forensic accountant Martin Hench, who made his debut in 2022's Red Team Blues:

https://us.macmillan.com/books/9781250865847/red-team-blues

The double outrage of finding out how badly the powerful are ripping off the rest of us, and how stupid and transparent their accounting tricks are, is at the center of Chokepoint Capitalism, the book about how tech and entertainment companies steal from creative workers (and how to stop them) that Rebecca Giblin and I co-authored, which also came out in 2022:

https://chokepointcapitalism.com/

Now that I've written four novels and a nonfiction book about finance scams, I think I can safely call myself a oligarch ripoff hobbyist. I find this stuff endlessly fascinating, enraging, and, most importantly, energizing. So naturally, when PJ Vogt devoted two episodes of his excellent Search Engine podcast to the subject last week, I gobbled them up:

https://www.searchengine.show/listen/search-engine-1/why-is-it-so-hard-to-tax-billionaires-part-1

I love the way Vogt unpacks complex subjects. Maybe you've had the experience of following a commentator and admiring their knowledge of subjects you're unfamiliar with, only have them cover something you're an expert in and find them making a bunch of errors (this is basically the experience of using an LLM, which can give you authoritative seeming answers when the subject is one you're unfamiliar with, but which reveals itself to be a Bullshit Machine as soon as you ask it about something whose lore you know backwards and forwards).

Well, Vogt has covered many subjects that I am an expert in, and I had the opposite experience, finding that even when he covers my own specialist topics, I still learn something. I don't always agree with him, but always find those disagreements productive in that they make me clarify my own interests. (Full disclosure: I was one of Vogt's experts on his previous podcast, Reply All, talking about the inkjet printerization of everything:)

https://gimletmedia.com/shows/reply-all/brho54

Vogt's series on taxing billionaires was no exception. His interview subjects (including Eisinger) were very good, and he got into a lot of great detail on the leaker himself, Charles Littlejohn, who plead guilty and was sentenced to five years:

https://jacobin.com/2023/10/charles-littlejohn-irs-whistleblower-pro-publica-tax-evasion-prosecution

Vogt also delved into the history of the federal income tax, how it was sold to the American public, and a rather hilarious story of Republican Congressional gamesmanship that backfired spectacularly. I'd never encountered this stuff before and boy was it interesting.

But then Vogt got into the nature of taxation, and its relationship to the federal debt, another subject I've written about extensively, and that's where one of those productive disagreements emerged. Yesterday, I set out to write him a brief note unpacking this objection and ended up writing a giant essay (sorry, PJ!), and this morning I found myself still thinking about it. So I thought, why not clean up the email a little and publish it here?

As much as I enjoyed these episodes, I took serious exception to one – fairly important! – aspect of your analysis: the relationship of taxes to the national debt.

There's two ways of approaching this question, which I think of as akin to classical vs quantum physics. In the orthodox, classical telling, the government taxes us to pay for programs. This is crudely true at 10,000 feet and as a rule of thumb, it's fine in many cases. But on the ground – at the quantum level, in this analogy – the opposite is actually going on.

There is only one source of US dollars: the US Treasury (you can try and make your own dollars, but they'll put you in prison for a long-ass time if they catch you.).

If dollars can only originate with the US government, then it follows that:

a) The US government doesn't need our taxes to get US dollars (for the same reason Apple doesn't need us to redeem our iTunes cards to get more iTunes gift codes);

b) All the dollars in circulation start with spending by the US government (taxes can't be paid until dollars are first spent by their issuer, the US government); and

c) That spending must happen before anyone has been taxed, because the way dollars enter circulation is through spending.

You've probably heard people say, "Government spending isn't like household spending." That is obviously true: households are currency users while governments are currency issuers.

But the implications of this are very interesting.

First, the total dollars in circulation are:

a) All the dollars the government has ever spent into existence funding programs, transferring to the states, and paying its own employees, minus

b) All the dollars that the government has taxed away from us, and subsequently annihilated.

(Because governments spend money into existence and tax money out of existence.)

The net of dollars the government spends in a given year minus the dollars the government taxes out of existence that year is called "the national deficit." The total of all those national deficits is called "the national debt." All the dollars in circulation today are the result of this national debt. If the US government didn't have a debt, there would be no dollars in circulation.

The only way to eliminate the national debt is to tax every dollar in circulation out of existence. Because the national debt is "all the dollars the government has ever spent," minus "all the dollars the government has ever taxed." In accounting terms, "The US deficit is the public's credit."

When billionaires like Warren Buffet tell Jesse Eisinger that he doesn't pay tax because "he thinks his money is better spent on charitable works rather than contributing to an insignificant reduction of the deficit," he is, at best, technically wrong about why we tax, and at worst, he's telling a self-serving lie. The US government doesn't need to eliminate its debt. Doing so would be catastrophic. "Retiring the US debt" is the same thing as "retiring the US dollar."

So if the USG isn't taxing to retire its debts, why does it tax? Because when the USG – or any other currency issuer – creates a token, that token is, on its face, useless. If I offered to sell you some "Corycoins," you would quite rightly say that Corycoins have no value and thus you don't need any of them.

For a token to be liquid – for it to be redeemable for valuable things, like labor, goods and services – there needs to be something that someone desires that can be purchased with that token. Remember when Disney issued "Disney dollars" that you could only spend at Disney theme parks? They traded more or less at face value, even outside of Disney parks, because everyone knew someone who was planning a Disney vacation and could make use of those Disney tokens.

But if you go down to a local carny and play skeeball and win a fistful of tickets, you'll find it hard to trade those with anyone outside of the skeeball counter, especially once you leave the carny. There's two reasons for this:

1) The things you can get at the skeeball counter are pretty crappy so most people don't desire them; and ' 2) Most people aren't planning on visiting the carny, so there's no way for them to redeem the skeeball tickets even if they want the stuff behind the counter (this is also why it's hard to sell your Iranian rials if you bring them back to the US – there's not much you can buy in Iran, and even someone you wanted to buy something there, it's really hard for US citizens to get to Iran).

But when a sovereign currency issuer – one with the power of the law behind it – demands a tax denominated in its own currency, they create demand for that token. Everyone desires USD because almost everyone in the USA has to pay taxes in USD to the government every year, or they will go to prison. That fact is why there is such a liquid market for USD. Far more people want USD to pay their taxes than will ever want Disney dollars to spend on Dole Whips, and even if you are hoping to buy a Dole Whip in Fantasyland, that desire is far less important to you than your desire not to go to prison for dodging your taxes.

Even if you're not paying taxes, you know someone who is. The underlying liquidity of the USD is inextricably tied to taxation, and that's the first reason we tax. By issuing a token – the USD – and then laying on a tax that can only be paid in that token (you cannot pay federal income tax in anything except USD – not crypto, not euros, not rials – only USD), the US government creates demand for that token.

And because the US government is the only source of dollars, the US government can purchase anything that is within its sovereign territory. Anything denominated in US dollars is available to the US government: the labor of every US-residing person, the land and resources in US territory, and the goods produced within the US borders. The US doesn't need to tax us to buy these things (remember, it makes new money by typing numbers into a spreadsheet at the Federal Reserve). But it does tax us, and if the taxes it levies don't equal the spending it's making, it also sells us T-bills to make up the shortfall.

So the US government kinda acts like classical physics is true, that is, like it is a household and thus a currency user, and not a currency issuer. If it spends more than it taxes, it "borrows" (issues T-bills) to make up the difference. Why does it do this? To fight inflation.

The US government has no monetary constraints, it can make as many dollars as it cares to (by typing numbers into a spreadsheet). But the US government is fiscally constrained, because it can only buy things that are denominated in US dollars (this is why it's such a big deal that global oil is priced in USD – it means the US government can buy oil from anywhere, not only the USA, just by typing numbers into a spreadsheet).

The supply of dollars is infinite, but the supply of labor and goods denominated in US dollars is finite, and, what's more, the people inside the USA expect to use that labor and goods for their own needs. If the US government issues so many dollars that it can outbid every private construction company for the labor of electricians, bricklayers, crane drivers, etc, and puts them all to work building federal buildings, there will be no private construction.

Indeed, every time the US government bids against the private sector for anything – labor, resources, land, finished goods – the price of that thing goes up. That's one way to get inflation (and it's why inflation hawks are so horny for slashing government spending – to get government bidders out of the auction for goods, services and labor).

But while the supply of goods for sale in US dollars is finite, it's not fixed. If the US government takes away some of the private sector's productive capacity in order to build interstates, train skilled professionals, treat sick people so they can go to work (or at least not burden their working-age relations), etc, then the supply of goods and services denominated in USD goes up, and that makes more fiscal space, meaning the government and the private sector can both consume more of those goods and services and still not bid against one another, thus creating no inflationary pressure.

Thus, taxes create liquidity for US dollars, but they do something else that's really important: they reduce the spending power of the private sector. If the US only ever spent money into existence and never taxed it out of existence, that would create incredible inflation, because the supply of dollars would go up and up and up, while the supply of goods and services you could buy with dollars would grow much more slowly, because the US government wouldn't have the looming threat of taxes with which to coerce us into doing the work to build highways, care for the sick, or teach people how to be doctors, engineers, etc.

Taxes coercively reduce the purchasing power of the private sector (they're a stick). T-bills do the same thing, but voluntarily (they the carrot).

A T-bill is a bargain offered by the US government: "Voluntarily park your money instead of spending it. That will create fiscal space for us to buy things without bidding against you, because it removes your money from circulation temporarily. That means we, the US government, can buy more stuff and use it to increase the amount of goods and services you can buy with your money when the bond matures, while keeping the supply of dollars and the supply of dollar-denominated stuff in rough equilibrium."

So a bond isn't a debt – it's more like a savings account. When you move money from your checking to your savings, you reduce its liquidity, meaning the bank can treat it as a reserve without worrying quite so much about you spending it. In exchange, the bank gives you some interest, as a carrot.

I know, I know, this is a big-ass wall of text. Congrats if you made it this far! But here's the upshot. We should tax billionaires, because it will reduce their economic power and thus their political power.

But we absolutely don't need to tax billionaires to have nice things. For example: the US government could hire every single unemployed person without creating inflationary pressure on wages, because inflation only happens when the US government tries to buy something that the private sector is also trying to buy, bidding up the price. To be "unemployed" is to have labor that the private sector isn't trying to buy. They're synonyms. By definition, the feds could put every unemployed person to work (say, training one another to be teachers, construction workers, etc – and then going out and taking care of the sick, addressing the housing crisis, etc etc) without buying any labor that the private sector is also trying to buy.

What's even more true than this is that our taxes are not going to reduce the national debt. That guest you had who said, "Even if we tax billionaires, we will never pay off the national debt,"" was 100% right, because the national debt equals all the money in circulation.

Which is why that guest was also very, very wrong when she said, "We will have to tax normal people too in order to pay off the debt." We don't have to pay off the debt. We shouldn't pay off the debt. We can't pay off the debt. Paying off the debt is another way of saying "eliminating the dollar."

Taxation isn't a way for the government to pay for things. Taxation is a way to create demand for US dollars, to convince people to sell goods and services to the US government, and to constrain private sector spending, which creates fiscal space for the US government to buy goods and services without bidding up their prices.

And in a "classical physics" sense, all of the preceding is kinda a way of saying, "Taxes pay for government spending." As a rough approximation, you can think of taxes like this and generally not get into trouble.

But when you start to make policy – when you contemplate when, whether, and how much to tax billionaires – you leave behind the crude, high-level approximation and descend into the nitty-gritty world of things as they are, and you need to jettison the convenience of the easy-to-grasp approximation.

If you're interested in learning more about this, you can tune into this TED Talk by Stephanie Kelton, formerly formerly advisor to the Senate Budget Committee chair, now back teaching and researching econ at University of Missouri at Kansas City:

https://www.ted.com/talks/stephanie_kelton_the_big_myth_of_government_deficits?subtitle=en

Stephanie has written a great book about this, The Deficit Myth:

https://pluralistic.net/2020/05/14/everybody-poops/#deficit-myth

There's a really good feature length doc about it too, called "Finding the Money":

https://findingmoneyfilm.com/

If you'd like to read more of my own work on this, here's a column I wrote about the nature of currency in light of Web3, crypto, etc:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

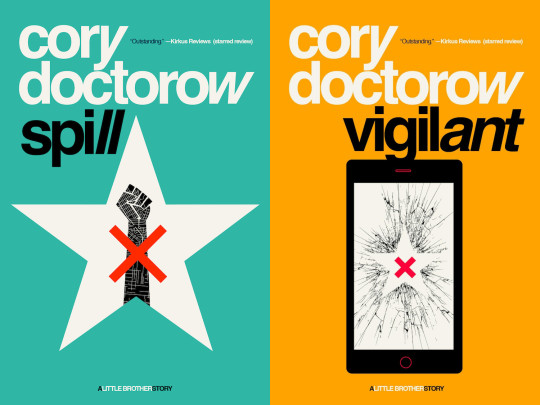

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/21/we-can-have-nice-things/#public-funds-not-taxpayer-dollars

#pluralistic#mmt#modern monetary theory#warren buffett#podcasts#pj vogt#billionaires#economics#we can have nice things#taxes#taxing billionaires#the irs files#irs files#jesse eisenger#propublica

1K notes

·

View notes

Text

Scandalo LuxLeaks, Corte europea dalla parte degli informatori

Per la Corte europea dei diritti dell'uomo è stata violata la libertà di espressione di una delle due gole profonde

0 notes

Quote

If you read the Panama Papers, the Paradise Papers, Luxleaks, Swissleaks, or any of the other spectacular leaks from the oligarch-industrial complex, you'll have seen the same thing: the rich employ the most tissue-thin ruses, and the tax authorities gobble them up. It's like the tax collectors don't want to fight with these ultrawealthy monsters whose net worth is larger than most nations, and merely require some excuse to allow them to cheat, anything they can scribble in the box explaining why they are worth billions and paying little, or nothing, or even entitled to free public money from programs intended to lift hungry children out of poverty.

Cory Doctorow

45 notes

·

View notes

Text

Deputy attorney general John Petry has been chosen to succeed Martine Solovieff as the country’s attorney general, the National Council of Justice said on Friday.

Solovieff is due to retire on 1 February, after almost a decade in the top legal post.

Petry, 59, brings with him nearly 30 years of experience in the public prosecutor’s office. His extensive legal background began with studies at the University of Strasbourg, followed by a two-year stint as a practising lawyer.

He is perhaps most well-known to the public for his involvement in the high-profile LuxLeaks trial, where he advocated for a six-month suspended sentence for whistleblower Antoine Deltour.

Solovieff, now 66, has served as attorney general since August 2015, when she succeeded Roby Biever.

2 notes

·

View notes

Text

0 notes

Text

DANS LA MAISON D'AMOUR

Biden garantit

La sécurité d'Israël

Apparemment

Pour l'impérialisme

En réalité

Pour sécuriser

Et conforter

Le dieu Juif

Rendu plus fort

Than the World Stick

Le dieu moustique

WikiLeaks LuxLeaks

Et SwissLeaks

Permettant une Europe plus unie

Francophones Germanophones

De travailler ensemble

Europe esprit sain du commerce

Ciné qui se Jenner

Maffias en tous genres

Contre l'illibéral qui nous gêne

Ca fou un de ses bordels

OTAN va se renforçant

Samedi 12 octobre 2024

0 notes

Text

Low tax bills paid by the tech giant were an unlawful subsidy, EU judges ruled, in a move which EU Competition Commissioner Margrethe Vestager hailed as a 'big win' for tax justice.

Apple has lost a €13 billion case in the EU's highest court regarding the low tax bills it paid for years in Ireland, a surprise victory for Brussels in a campaign against sweetheart deals struck with multinationals.

The judgment, released today (10 September) by the EU Court of Justice, backs the European Commission, which said the corporate tax rates as low as 0.005% paid by the tech giant represented an unlawful subsidy, striking down a previous ruling from the lower-tier General Court.

"Ireland granted Apple unlawful aid which Ireland is required to recover", the Court of Justice said in a statement, giving a "final judgment" in the matter.

It's one of a pair of victories today in Brussels' battle against big tech, as Google lost a separate appeal against a €2.4bn EU fine for favouring its own services — bookending the career of Margrethe Vestager, whose double term as EU antitrust chief ends in a couple of months.

The Commission's victory means Apple must pay as much as €13bn — or potentially more, with interest and costs — to the Irish Treasury.

The Commission's initial finding, now confirmed, came after the LuxLeaks revelations of tax rulings which implicated Jean-Claude Juncker, the former Luxembourg leader who was at the time president of the EU executive.

Vestager's action against big — and largely American — multinationals such as Starbucks, Fiat Chrysler and Amazon saw her badged by then-President Donald Trump as the EU's "tax lady" who "really hates the USA".

The case represented an unusual, and controversial, foray by Brussels into tax policy — which is normally set by national capitals, with the EU only intervening if tax breaks distort the bloc's internal market.

The legal case hinged on how the iPhone maker treated intellectual property income in its books — and whether the Commission was right to say those corporate profits should have been allocated to its European base in Ireland.

The EU's General Court found against the Commission in 2020, but, in an opinion prepared for the Court of Justice last November, Advocate General Giovanni Pitruzzella questioned the legal reasoning of the lower-tier tribunal.

In financial terms, it represents the largest case of the EU's tax campaign, which otherwise hasn't found a huge success in the courts.

The Commission lost legal challenges involving McDonald's, Starbucks and Engie, though in a recent interview with Euronews' Radio Schumann podcast, Vestager argued her crusade had nonetheless led to a series of national and international tax reforms.

Despite the billions it stood to gain, the Irish government opposed the Commission's case; the country has become the European hub for a number of US tech companies.

Michael McGrath previously defended the company as Ireland's finance minister — and is now himself due to move to Brussels to be European Commissioner, with his portfolio set to be announced by President Ursula von der Leyen shortly.

In remarks to reporters, Vestager said the ruling was a "big win" for EU citizens, the bloc's single market, and tax justice — and that her campaign also had an indirect impact.

"Our investigations have decisively contributed to a mind shift, a change of attitudes among Member States" in which practices like Apple's could no longer occur, she said, citing regulatory and legislative reforms at national, European and global level.

"We now have now learned from the court" about the limits of EU tax action, following the mixed bag of legal cases, Vestager said — with caselaw clarifying that Brussels can check national capitals follow their own rules.

For MEP Pasquale Tridico (Italy, Left), who chairs the European Parliament's tax Committee, the judgment is "historic".

"We now expect the future European Commission to propose legislation that bans all forms of tax avoidance and competitive advantages for tech giants and large corporations within the European Union," Tridico said in a statement, adding: "Our fight for tax justice will go on, stronger than ever”.

In a statement, the Irish finance ministry said it "will of course respect the findings of the Court regarding the tax due in this case ... Ireland does not give preferential tax treatment to any companies or taxpayers."

The disputed tax rulings are no longer in force, and Ireland has in any case since reformed how it allocates profits for non-resident companies, the statement said.

Billions in unpaid taxes that Apple had placed in trust, pending resolution of the case, will now begin to be transferred to the Irish state, the statement added.

In a separate statement, Apple said it was "disappointed" with the judges' decision.

"We always pay all the taxes we owe wherever we operate and there has never been a special deal," a company spokesperson, adding that it is one of the largest taxpayers in the world.

"The European Commission is trying to retroactively change the rules and ignore that, as required by international tax law, our income was already subject to taxes in the US," added the company, which argues it has already paid $20 bn (€18bn) in US taxes on the same profits.

But the ruling has already been hailed by tax activists who have long called for the closing of what they see as corporate tax loopholes.

“This ruling exposes EU tax havens’ love affair with multinationals," said Chiara Putaturo, EU tax expert for the charity Oxfam, said in a statement. "It delivers long-overdue justice after over a decade of Ireland standing by and allowing Apple to dodge taxes."

0 notes

Link

Mecaniques du journalisme #FranceCulture #podcastFranceCulture

0 notes

Text

Pourquoi la gestion des #lancements d’#alerte est si difficile en #entreprise

Depuis quelques semaines, l’actualité met les lanceurs d’alerte sur le devant de la scène. En février 2023, la Grande Chambre de la Cour européenne des droits de l’homme (CEDH) a annulé la condamnation pénale de Raphaël Halet, l’un des lanceurs d’alerte de Luxleaks qui avait révélé les pratiques d’évasion fiscale de PriceWaterhouseCoopers. En France se déroule actuellement le procès en appel du Mediator, dans lequel le groupe pharmaceutique a été reconnu coupable en première instance de « tromperie aggravée » et d’« homicides et blessures involontaires ». Une sentence qui n’aurait pas pu être prononcée sans les révélations de la pneumologue Irène Frachon sur la dangerosité de coupe-faim commercialisé pour traiter le diabète.

0 notes

Text

Big Business can't stop its illegal, fantastically lucrative gossiping

Seven years ago, I called Leonard Cohen’s Everybody Knows “the perfect anthem for our times.”

Everybody knows the war is over Everybody knows the good guys lost Everybody knows the fight was fixed The poor stay poor, the rich get rich That’s how it goes Everybody knows

https://memex.craphound.com/2016/11/11/leonard-cohen-wrote-the-perfect-anthem-for-our-times/

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/16/compulsive-cheaters/#rigged

That was just after Cohen died, and while the world seems to want to settle on Hallelujah as his totemic song, Everybody Knows keeps inserting itself into the discourse, in the most toxic, hope-draining way possible. Whenever some awful scandal involving the great and the good breaches, we’re told that “everybody knew” already, so let’s move on.

This current has been running through our society for decades now. Remember when the Snowden leaks hit and a yawning chorus of nihilists told us that they knew already and so should anyone else with the smallest iota of sophistication? Back then Jay Rosen coined a rejoinder to this counsel of despair: “Don’t savvy me”:

https://twitter.com/jayrosen_nyu/status/344825874362810369

Everybody knows. It’s what we heard after the Panama Papers. Swissleaks. Luxleaks. The Paradise Papers. Everybody knows! It’s what the nothing-to-see-here crowd said about Propublica’s explosive IRSLeaks, back in 2021:

https://pluralistic.net/2021/06/15/guillotines-and-taxes/#carried-interest

The leaks revealed the tax-dodges of the richest and most powerful people in America, which were jaw-dropping in their audacity and shamelessness. Sure, maybe you suspected that the 400 richest people in America paid less tax than you — but did you really guess that the means by which they did this was through taking massive deductions on their elite hobbies?

https://pluralistic.net/2022/04/13/taxes-are-for-the-little-people/#leona-helmsley-2022

Maybe “everybody knows” that the game is rigged, but did you know how? Like, did you know that REITs — a tax shelter for mom-and-pop investors who buy an income property for their retirement — have become a primary vehicle for gutting unions at hotels, slashing wages and imposing brutal, dangerous working conditions?

https://pluralistic.net/2022/03/01/reit-modernization-act/#reit-makes-might

The leaks are cumulative. By combining data from one leak with another, we can build out a far more detailed picture of the conspiracy — and it is a conspiracy — among the utlrawealthy and their Renfields in the law, real-estate and accounting trades to duck their responsibilities and mound ever-more treasure on their hoards.

Take the Jersey Offshore leaks (2020), comprising the internal memos of La Hougue, a fantastically crooked firm of fixers on the Isle of Jersey, one of the lawless tax-crime jurisdictions that the UK pretends it has no control over. La Hougue has a playbook, 11 tactics for lying about your taxes. The remarkable thing about these 11 tactics is how flimsy they are, how easy it is to penetrate their lies. When Parliament says it can’t possibly do anything about the criminal havens in the Channel, remember the Jersey Offshore leaks and remind yourself that not even Parliament is that credulous. They know. Everybody knows:

https://pluralistic.net/2021/06/20/la-hougue/#complexity

Why do working people think the Democrats are just another party for the ultra-rich? Maybe it’s Pelosi’s relentless opposition to meaningful curbs on insider trading. Or maybe it’s the kinds of politicians that the Democratic Machine likes to rally behind — like Tali Farhadian Weinstein, who raised millions in 2021, in large-money donations from Democratic finance-sector donors in her bid to become the DA of Manhattan. Farhadian Weinstein and her husband have more than $100m in annual income, and yet, paid no federal tax in 2013, 2015 and 2017. In 2014, they paid $6,584:

https://pluralistic.net/2021/06/17/quis-custodiet-irs/#trumps-taxes

Propublica isn’t done with the IRS Files. Today, they published a long investigation into ultra-rich corporate executives who buy and sell their competitors’ stock for massive profits with suspiciously precise timing. The data comes from 1099-B filings, which brokerages file with the IRS with each trade, but which the IRS doesn’t share with the SEC:

https://www.propublica.org/article/secret-irs-files-trading-competitors-stock

Here are some examples:

Ohio billionaire August Troendle, CEO of Medpace, repeatedly bought and sold shares of $Syneos — his company’s archrival, timing the transactions with a management shakeup that dropped the stock by 16% in one day, and an SEC investigation that crushed Syneos’s stock by 25%. His precision timing made him at least $2.3m in profit.

Isaac Larian, CEO of Bratz-maker MGA, made $28m trading shares in Mattel, MGA’s nemesis and frequent litigant — during a period when Mattel stock crashed by 57% (!). Larian boasts that “I made a LOT more money shorting Mattel stock than they did running a $4.5 billion toy company.”

Larian’s trades also involved some very precise timing. Sometimes, he took positions just before his own company announced its upcoming products, and others positions immediately preceded major disclosures from Mattel. Larian’s subordinates told Propublica that he is “is a boss with an endless appetite for information about his company and its competitors, constantly grilling subordinates on minutiae about the industry.”

Larian couldn’t explain the timing of these trades. His lawyer told Propublica that it was “false and defamatory” to suggest that he “possessed material, nonpublic information that Larian knew was obtained in breach of a duty.”

Next up is Gerald Boelte, founder and chair of the massive oil company LLOG. LLOG partners with other companies for its oil drilling. Companies like Stone Energy. Boelte bought a huge position in Stone the day before the company’s 2015 earnings report, in which they revealed an increase their reserves’ value, pulling in a 65% one day profit. He’d never bought shares in Stone before.

Boetle told Propublica, “I do not and have never traded on any material, non-public information of competitors, business partners or others… Any implication that I was investing based upon advance knowledge is therefore clearly false.”

Jim Sankey is CEO of Invue. He bought $3.2m worth of shares in his rival Checkpoint, while checkpoint was in secret negotiations to be acquired by CCL Industries. Sankey was already thoroughly connected to Checkpoint, having sold a $150m product line to them in 2007. There’s no record that he’d ever traded Checkpoint before. He made $2.3m. Sankey says “he did not know Checkpoint was going to be acquired.” He says that his company was not approached by Checkpoint as a potential acquirer.

Barry Wish was a board member of Ocwen, a company he co-founded. After the Great Financial Crisis, Ocwen bid unsuccessfully to buy $215b worth of Bank of America mortgages. The winning bidder was Nationstar. Three weeks before Nationstar’s winning bid was announced, Wish bought $600k worth of Nationstar shares. After the bid was announced, he sold them for for a $157k profit.

Wish told Propublica that he never traded competitors’ stock: “No, not at all.” Propublica read him the details of the trade from his leaked 1099-B. He said “You might see it, but I don’t have any recollection” and hung up.

Steven Grossman is a cardboard heir — a nepobaby who inherited Southern Container Corp from his grandpa. After he sold the company to Rock-Tenn for $1b in 2013, he stayed on as a senior exec. Over the next 5 years, he traded large blocks of shares in Rock-Tenn’s competitors, companies like Temple-Inland, a company that he made a 37% profit on after its acquisition was announced in 2011, one week after Grossman started buying its shares.

Grossman falsely told Propublica, “I haven’t traded stock since then.” IRS records show that Grossman continued to trade. Grossman also told Propublica that he had no role with Rock-Tenn, despite being on their payroll for five years. When asked about his extremely lucky timing buying and selling Temple-Inland, he said “That was 10 years ago” and hung up.

As Propublica’s Robert Faturechi and Ellis Simani write, Securities regulations have their origins in the crash of 1929, and the subsequent collapse in confidence in markets and capitalism, the sense that the system was rigged for the wealthy and political insiders. That is a pretty good summation of sentiment today:

https://pluralistic.net/2023/03/15/mon-dieu-les-guillotines/#ceci-nes-pas-une-bailout

It’s not just that corporate executives are corrupt, it’s that they’re lavishly, shamelessly, endlessly, incorrigibly corrupt. Take Canadian Pacific and Kansas City Southern, the sixth- and seventh-largest Class I railroads in the USA, whose merger was just approved by the Surface Transportation Board.

There are plenty of good reasons for the STB to have blocked this merger. The rail industry is already excessively concentrated, and its top execs are so convinced that they’re both too big to fail and too big to jail that they’re rendering entire towns permanently uninhabitable in order to eke out a few more points in profit:

https://pluralistic.net/2023/02/11/dinah-wont-you-blow/#ecp

But there are specific reasons to have blocked this merger, starting with the whistleblower report about CP and KCS executives illegally coming together for a three-day “retreat” at The Breakers hotel in Palm Beach, a notorious site for Republican operatives to collude with the business lobby:

https://prospect.org/infrastructure/transportation/2023-03-16-canadian-pacific-kansas-city-southern-rail-merger/

As Luke Goldstein writes for The American Prospect, both companies spent millions in 2020 and 2022 on campaign contributions to “grease the skids” for the merger — in particular, ensuring that the combined company could transport Alberta tar sands oil (the filthiest, most energy intensive oil in the world) to US ports.

Though the STB was informed of the illegal meeting — in which the two companies behaved as though the merger had already been finalized — STB chair Martin Oberman told Goldstein that the Board did not write to the companies for an explanation before waving through their merger.

Instead, Oberman dismissed the complaint on the grounds that “Railroads have to be able to talk to one another to function.” Typically this takes place over a free phone call, though — not on a three-day executive junket at a hotel where the rooms run $1,500/night.

Oberman knows what happened at that meeting.

Everybody knows.

It comes as no surprise to learn that before FTX imploded and destroyed the savings of its depositors, it paid out $3b to its top executives, including the criminal Sam Bankman-Fried:

https://gizmodo.com/sbf-ftx-crypto-sam-bankman-fried-1850232043

It comes as no surprise that Silicon Valley Bank paid out bonuses to its execs and employees hours before it collapsed:

https://www.cnbc.com/2023/03/11/silicon-valley-bank-employees-received-bonuses-hours-before-takeover.html

Everybody knows.

It’s comforting to think that the tax code loopholes that the ultrawealthy exploit are an epiphenomenon of complexity, an unavoidable consequence of the technical requirements of a big regulation that spans 300m+ people. But the truth is, the loopholes in the US tax code were inserted by politicians who got massive campaign contributions from donors who directly benefited from those loopholes. Senator Ron Johnson got $20m from the owners of Uline (Dick and Liz Uihlein) and roofing magnate Diane Hendricks, then he blocked the Trump tax bill until his fellow lawmakers inserted a loophole that produced $215m for the Uihleins and Hendricks, in just the first year:

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory It’s not even surprising that a sitting US Senator amended a bill to give hundreds of millions of dollars to billionaires who gave him tens of millions of dollars.

Everybody knows. It’s weirdly comforting to think that everyday people vote for demagogue wreckers because Facebook hired a legion of evil sorcerers to fashion a mind-control ray out of Big Data and AI, but Facebook lies about everything, and everyone who ever claimed to have a mind-control ray was a liar.

Maybe people vote for demagogue wreckers because they believe the system is rotten, and maybe they believe the system is rotten because the system is rotten. Maybe the self-described evil sorcerers of Big Tech aren’t “hacking our dopamine loops” — maybe they’re just helping opportunists target people who are justifiably angry:

https://onezero.medium.com/how-to-destroy-surveillance-capitalism-8135e6744d59

The problem with this explanation is that it requires “progressive” parties to actually do stuff to demonstrate that they are on the side of people, not the side of paperclip-maximizing immortal colony organisms and the corporate executives who pretend to run them:

https://twitter.com/thehill/status/1184004730722217984

I try to have hope — that is, I try to believe that if we can only make changes to our material circumstances, however small they may seem, that we might attain a new vantagepoint that reveals more possible changes within our grasp:

https://gen.medium.com/hope-not-optimism-943e88291b

Some days, it’s hard to have hope. Some days, it’s so obvious that everybody knows, all that I can muster is fury. Fury is not a full substitute for hope, but it’ll do. It’s a far superior alternative to the fatalism that “everybody knows” and thus nothing can be done.

Some fights you win, and other fights, you just fight, because surrender isn’t an option. Everybody knows, right? If everybody knows, then everybody might just decide to do something about it.

Next Monday (Mar 20), I’m doing a remote talk for the Ostrom Workshop’s Beyond the Web Speaker Series.

[Image ID: A smoke-filled room lit by candles. Around a large formal table sit various 19th century gentlemen-type people. One of them stands and reads from a memo. The shadow he casts is in the shape of a dollar-sign.]

#pluralistic#railroads#conspiracies#insider trading#surface transportation board#kcs#kansas city southern#cpr#canadian pacific railway#irsfiles#propublica#August Troendle#Syneos#Medpace#sec#irs#MGA Entertainment#bratz#barbie#mattel#Isaac Larian#Gerald Boelte#LLOG Exploration#Stone Energy#checkpoint Systems#ccl industries#Nationstar#Ocwen#Barry Wish#Steven Grossman

51 notes

·

View notes

Text

Το θαύμα των Χριστουγέννων: Κανένας Έλληνας πολιτικός στα Pandora Papers

Το θαύμα των Χριστουγέννων: Κανένας Έλληνας πολιτικός στα Pandora Papers

Ουδείς Έλλην πολιτικός στα «Pandora Papers»… Θαύμα; Γραφει η Ζεζα Ζήκου Η έκπληξη έγινε όταν ανακοινώθηκε πρόσφατα από την Διεθνή Κοινοπραξία Ερευνητών Δημοσιογράφων (ICIJ) η οκτασέλιδη λίστα των «Pandora Papers» με τους 283 Έλληνες γνωστούς επιχειρηματίες και άλλους… αλλά για πρώτη φορά δεν υπήρξε μεταξύ τους Έλληνας πολιτικός! Όντως είναι ασυνήθιστο. Προφανώς, εξηγείται από το γεγονός ότι…

View On WordPress

0 notes

Text

Pandora Papers : accentuons la pression populaire, prélevons les évadés fiscaux !

LuxLeaks, SwissLeaks, Panama Papers, Malta Files, Paradise Papers, CumEx, OpenLux… et maintenant les Pandora Papers. Au lendemain de notre action de “Prélèvement à la source” des multinationales pratiquant l’évasion fiscale, l’ICIJ (Le Consortium international des journalistes d’investigation) sortait de nouvelles révélations concernant la fraude fiscale mondialisée. Pratiquée par de nombreuses…

View On WordPress

0 notes

Text

ON VEUT TUER MA SOEUR ANNE

Le dieu Juif

Krypton-Amérique

Lien espace

Biden a avec lui

Les minorités

Trump The WASP

Remontés contre

Une gauche française

Qui insulte le Sud Profond

Du Texas aux petits Blancs

Les traitant de nazis

Alors qu'ils sont Républicains

Leur anticommunisme

C'est une Providence

Contre le totalitarisme

En individus ils résistent

L'empire rouge ne les a pas eus

Espaces Américains

Ils correspondent

A Schengen Européen

LuxLeaks la lumière blanche

Libérale elle s'enclenche

Des dames conservatrices

Tiennent leur revanche

Dimanche 14 juillet 2024

0 notes

Link

Mecaniques du journalisme #podcastFranceCulture #FranceCulture

0 notes

Text

Advance Pricing Agreements

Geheime Steuerabsprachen ("Advance Pricing Agreements") zwischen EU-Regierungen und multinationalen Konzernen haben ein neues Rekordhoch erreicht. via @Attacd

Geheime Steuerabsprachen zwischen EU-Regierungen und multinationalen Konzernen – wie sie etwa im LuxLeaks-Skandal öffentlich wurden – haben ein neues Rekordhoch erreicht. Dies belegen neue Daten aus der Europäischen Union. Besonders bemerkenswert: Die Anzahl dieser Absprachen, die mit dem englischen Begriff Advance Pricing Agreements, kurz APAs geschönt werden, nimmt trotz der von der…

View On WordPress

#Advance Pricing Agreements#APAs#Attac#Attac Deutschland#Detlev von Larcher#Eurodad#Europäische Union#Gesamtkonzernsteuer#LuxLeaks#Steuerdeals

1 note

·

View note