#Lower personal loan interest rate

Explore tagged Tumblr posts

Text

How to Reduce EMI Burden on Your Personal Loan

A personal loan provides quick financial assistance for various needs, including medical emergencies, weddings, home renovations, and education expenses. However, high Equated Monthly Installments (EMIs) can become a financial burden, affecting your monthly budget and savings. Fortunately, there are several strategies to reduce your EMI burden and make loan repayment more manageable.

In this article, we will explore practical ways to lower your personal loan EMIs, factors affecting EMI amounts, and the best lenders offering flexible repayment options.

1. Understanding Personal Loan EMIs

An EMI (Equated Monthly Installment) is the fixed amount you pay every month towards your loan repayment. It consists of: ✅ Principal – The original amount borrowed. ✅ Interest – The cost of borrowing, calculated based on the loan amount, tenure, and interest rate.

The EMI amount depends on three key factors:

Loan Amount – Higher loans result in higher EMIs.

Interest Rate – A lower interest rate means a lower EMI.

Loan Tenure – A longer tenure reduces the EMI but increases the total interest paid.

Now, let's explore different ways to reduce your personal loan EMI burden.

2. Effective Ways to Reduce Your EMI Burden

2.1 Opt for a Longer Loan Tenure

Choosing a longer loan tenure spreads your repayment over more months, reducing your EMI amount. However, this also means you will pay more total interest over the loan tenure.

Example:

A ₹5,00,000 loan at 12% interest for 3 years = EMI of ₹16,607

A ₹5,00,000 loan at 12% interest for 5 years = EMI of ₹11,122

Best For: Borrowers looking for short-term relief in monthly expenses.

💡 Apply for a flexible tenure loan here: 👉 IDFC FIRST Bank Personal Loan

2.2 Make a Higher Down Payment or Part-Prepayment

If possible, make a lump sum payment towards your loan principal to reduce the EMI burden. This method helps you pay off the principal faster, lowering future EMIs.

How to do this?

Use bonuses, incentives, or tax refunds to prepay a portion of your loan.

Some lenders allow part-prepayment without extra charges.

💡 Best lenders offering part-prepayment options: 👉 Bajaj Finserv Personal Loan

2.3 Transfer Your Loan to a Lower Interest Rate Lender

If your current lender is charging high interest, consider a loan balance transfer to another bank or NBFC offering lower rates. This can significantly reduce your EMI.

Example: If your current loan interest rate is 14% p.a. and another bank offers 10.5% p.a., transferring your loan could save you a substantial amount in EMI payments.

💡 Best lenders for balance transfer: 👉 Tata Capital Personal Loan

2.4 Negotiate for a Lower Interest Rate

If you have a high credit score (750+), stable income, and good repayment history, you can negotiate with your lender for a lower interest rate, which directly reduces your EMI.

How to do this?

Request your lender for a reduced interest rate based on your financial profile.

If you’re a loyal customer, use that as leverage to negotiate better loan terms.

💡 Apply for low-interest loans here: 👉 Axis Finance Personal Loan

2.5 Opt for Step-Up EMI Plans

Some lenders offer step-up EMI plans, where your EMI starts at a lower amount and gradually increases as your income grows. This helps in managing the EMI burden in the early years.

Best for: Young professionals expecting salary hikes in the future.

💡 Lenders offering step-up EMI plans: 👉 Axis Bank Personal Loan

2.6 Choose a Fixed or Floating Interest Rate Wisely

Fixed interest rate loans have stable EMIs throughout the tenure.

Floating interest rate loans may change over time but can be lower when interest rates decrease.

If the market rates are expected to drop, consider a floating-rate loan to reduce EMI payments in the future.

💡 Best lenders for flexible interest rate options: 👉 InCred Personal Loan

2.7 Consolidate Multiple Loans into One

If you have multiple loans (personal loan, credit card debt, etc.), consider a debt consolidation loan. This helps in combining all loans into one, often with a lower interest rate and manageable EMI.

Benefits: ✅ Simplifies repayment with a single EMI. ✅ Reduces overall interest burden. ✅ Avoids multiple due dates and penalties.

💡 Apply for debt consolidation loans here: 👉 IDFC FIRST Bank Personal Loan

3. How to Avoid EMI Defaults & Late Payment Penalties

Even after reducing your EMI, ensure that you never miss a payment. Here’s how:

✔ Set Up Auto-Debit for EMIs – Link your loan EMI to auto-debit from your bank account to avoid missing payments. ✔ Keep an Emergency Fund – Save at least 3-6 months’ worth of EMI payments as a backup for emergencies. ✔ Monitor Your EMI Payments – Regularly check bank statements and loan accounts to track EMI deductions. ✔ Avoid Taking Multiple Loans – Too many loans can increase your financial stress. Borrow only what you need.

💡 For seamless EMI payments, set up auto-debit here: 👉 Personal Loan Auto-Debit Guide

Smart EMI Management for Financial Stability

Managing and reducing your EMI burden is key to maintaining financial stability while repaying your personal loan. The best strategies include:

✅ Opting for a longer tenure to reduce EMI size. ✅ Making part-prepayments to lower the outstanding principal. ✅ Transferring your loan to a lower interest rate lender. ✅ Negotiating with your lender for a better rate. ✅ Consolidating multiple loans into one for simplified repayment.

By applying these smart repayment techniques, you can ease your financial burden and repay your loan comfortably.

For the best personal loan options, check out: 👉 Apply for a Personal Loan

By planning your loan repayment wisely, you can enjoy lower EMIs, improved financial health, and stress-free loan management! 🚀

#Reduce EMI burden#Lower personal loan EMI#How to reduce EMI on loan#Personal loan EMI management#Ways to reduce loan EMI#Lower personal loan interest rate#EMI reduction strategies#Loan repayment tips#How to lower loan installment#Best ways to manage loan EMI#Personal loan balance transfer#Loan tenure and EMI impact#Debt consolidation loan#How to negotiate lower interest rates#Personal loan prepayment benefits#Fixed vs floating interest rates#Loan refinancing benefits#Personal loan repayment strategies#How to avoid EMI default#Best banks for low-interest personal loans#finance#personal loan online#personal loans#personal loan#bank#nbfc personal loan#fincrif#loan services#loan apps#personal laon

0 notes

Text

Personal loans have become an essential tool for managing various expenses, from medical emergencies and home renovations to vacations and weddings. One of the most critical aspects of taking out a personal loan is securing the lowest possible interest rate. This guide aims to provide you with comprehensive information on how to obtain a personal loan with lowest interest rate, factors that influence these rates, and strategies to improve your chances of getting the best deal.

Understanding Personal Loan Interest Rates

Personal loan interest rates can vary significantly based on several factors, including the borrower’s creditworthiness, the lender’s policies, and the overall economic environment. Typically, personal loan interest rates range from 10% to 24% per annum. The interest rate you receive will directly impact your monthly payments and the total cost of the loan over its tenure.

Factors Affecting Personal Loan Interest Rates

Credit Score: Your credit score is one of the most crucial factors in determining your interest rate. A higher credit score indicates better creditworthiness and can help you secure lower interest rates.

Income and Employment: Stable and high income can positively influence your loan terms. Lenders prefer borrowers with steady employment and a good income history.

Loan Amount and Tenure: The amount you wish to borrow and the repayment tenure also affect the interest rate. Shorter tenures usually attract lower interest rates, while larger loan amounts may offer better rates due to reduced risk.

Lender’s Policies: Different lenders have varying interest rate policies based on their risk appetite and operational costs.

Debt-to-Income Ratio: A lower debt-to-income ratio indicates better financial health, which can lead to more favorable interest rates.

Steps to Secure a Personal Loan with the Lowest Interest Rate

Improve Your Credit Score: Regularly check your credit score and take steps to improve it by paying bills on time, reducing outstanding debts, and maintaining a low credit utilization ratio.

Compare Lenders: Do thorough research and compare offers from multiple lenders. Use online comparison tools to evaluate interest rates, processing fees, and other charges.

Consider Your Employer: Some banks offer preferential rates to employees of certain companies. Check if your employer has tie-ups with any banks.

Choose the Right Loan Amount and Tenure: Opt for a loan amount and tenure that balances your repayment capacity and interest rates.

Maintain a Stable Income: Ensure your income is stable and sufficient to cover the loan’s EMI. A steady income source makes you a less risky borrower.

Negotiate with the Lender: Don’t hesitate to negotiate with your lender for better terms. If you have a good credit history and relationship with the bank, they may offer lower rates.

Understanding Fixed vs. Floating Interest Rates

When applying for a personal loan, you may encounter two types of interest rates: fixed and floating.

Fixed Interest Rates: The interest rate remains constant throughout the loan tenure. This offers predictability in EMIs but may be slightly higher than floating rates.

Floating Interest Rates: The interest rate can fluctuate based on market conditions. While this could lead to lower rates initially, it also comes with the risk of rate increases over time.

Choose the type that aligns with your financial stability and risk appetite.

Benefits of Securing a Personal Loan with a Low-Interest Rate

Lower EMIs: A lower interest rate translates to reduced monthly payments, making it easier to manage your finances.

Reduced Total Interest Cost: Over the loan tenure, you will pay less in interest, saving you money.

Improved Loan Eligibility: Lower EMIs can improve your eligibility for other loans in the future, as they indicate better repayment capacity.

Financial Flexibility: Savings from lower interest can be used for other financial goals or emergencies.

Tips for Successful Loan Repayment

Set Up Auto-Debit: Ensure timely EMI payments by setting up auto-debit from your bank account.

Budget Effectively: Plan your monthly budget to accommodate the EMI without straining your finances.

Avoid Additional Debt: Minimize taking on additional debt to maintain a healthy debt-to-income ratio.

Prepay if Possible: If you have extra funds, consider making prepayments to reduce the loan tenure and interest cost. Check if your lender charges prepayment penalties.

Conclusion

Securing a low interest personal loans requires a strategic approach, including improving your credit score, comparing different lenders, and choosing the right loan amount and tenure. By understanding the factors that influence interest rates and taking proactive steps, you can significantly reduce the cost of your loan and enhance your financial stability.

Remember, a personal loan is a significant financial commitment. Ensure you are fully informed about the terms and conditions, and choose a loan that best fits your financial situation. With careful planning and responsible borrowing, you can effectively manage your financial needs and achieve your goals.

#personal loan at lower interest rate#low interest personal loans#personal loan low interest rate bank#personal loan with lowest interest rate#low rate personal loans

0 notes

Text

Managing finances effectively has become more crucial than ever. One of the most sought-after financial products to help achieve this is a personal loan at lower interest rate. This comprehensive guide will delve into the benefits of securing low interest personal loans, how to find the personal loan low interest rate bank, and the steps to ensure you get the personal loan with lowest interest rate. Additionally, we will explore the factors influencing low rate personal loans and offer tips on how to maximize your chances of approval.

Understanding Personal Loans

A personal loan is a type of unsecured loan offered by financial institutions that can be used for various purposes, such as consolidating debt, funding a wedding, covering medical expenses, or financing a vacation. Since these loans do not require collateral, they often come with higher interest rates compared to secured loans. However, finding a personal loan at lower interest rate can significantly reduce your financial burden.

Benefits of Low Interest Personal Loans

Securing low interest personal loans offers several advantages:

Reduced Financial Strain: Lower interest rates mean smaller monthly payments, making it easier to manage your budget.

Cost Savings: Over the life of the loan, you will save a substantial amount on interest payments.

Easier Debt Repayment: Lower interest rates enable quicker repayment of the principal amount, helping you get out of debt faster.

Improved Credit Score: Timely repayment of a low interest personal loan can boost your credit score, enhancing your financial profile.

Finding the Personal Loan Low Interest Rate Bank

Identifying the right personal loan low interest rate bank is key to securing favorable loan terms. Here are steps to help you find the best options:

Research and Compare: Start by researching different banks and financial institutions. Compare their interest rates, loan terms, and eligibility criteria.

Check Eligibility: Ensure you meet the eligibility requirements of the banks you are considering. Factors such as credit score, income, employment history, and existing debts play a crucial role.

Use Loan Comparison Websites: Utilize online loan comparison tools to compare rates from multiple lenders at once. These platforms often provide a detailed breakdown of the loan terms.

Read Reviews: Customer reviews and testimonials can provide insights into the bank's service quality and reliability.

Consult with Bank Representatives: Directly speaking with bank representatives can help clarify any doubts and get personalized advice.

How to Get the Personal Loan with Lowest Interest Rate

To secure the personal loan with lowest interest rate, consider the following tips:

Maintain a High Credit Score: A high credit score indicates financial responsibility and reduces the lender's risk, leading to lower interest rates.

Choose a Shorter Loan Tenure: Shorter loan tenures often come with lower interest rates as the lender's risk is minimized.

Opt for a Larger Loan Amount: Sometimes, larger loan amounts attract lower interest rates. However, ensure you can manage the repayments.

Provide Complete Documentation: Submit all required documents accurately and promptly to avoid any delays or complications in the approval process.

Negotiate with Lenders: Don't hesitate to negotiate with your bank for a better interest rate, especially if you have a strong relationship with them.

Factors Influencing Low Rate Personal Loans

Several factors determine the interest rates on personal loans:

Credit Score: A higher credit score often translates to lower interest rates, as it reflects your ability to manage debt responsibly.

Income and Employment Stability: Stable and sufficient income assures lenders of your repayment capacity, resulting in lower interest rates.

Existing Debt: High levels of existing debt can increase the interest rate offered to you, as it indicates a higher risk for the lender.

Loan Amount and Tenure: Larger loan amounts and shorter tenures generally come with lower interest rates.

Lender Policies: Different lenders have varying policies and criteria for determining interest rates.

Steps to Apply for Low Interest Personal Loans

Applying for low interest personal loans involves several steps:

Assess Your Financial Needs: Determine the loan amount you require and the purpose of the loan.

Check Your Credit Score: Obtain your credit report and ensure it is accurate. A good credit score will improve your chances of getting a low interest rate.

Research Lenders: Compare interest rates, terms, and eligibility criteria of various lenders.

Gather Documentation: Collect necessary documents such as proof of identity, address, income, and employment.

Submit Application: Fill out the loan application form accurately and submit it along with the required documents.

Await Approval: The lender will review your application and documents. If approved, you will receive the loan amount in your bank account.

Conclusion

Securing a personal loan at lower interest rate can provide significant financial relief and help you achieve your financial goals with ease. By understanding the benefits, researching the personal loan low interest rate bank, and following the right steps, you can increase your chances of obtaining a personal loan with lowest interest rate. Always consider the factors influencing low rate personal loans and ensure you maintain a strong credit profile to enjoy the best loan terms. With careful planning and responsible borrowing, you can make the most of low interest personal loans and pave the way for a financially stable future.

#personal loan at lower interest rate#low interest personal loans#personal loan low interest rate bank#personal loan with lowest interest rate

0 notes

Text

In today’s financial landscape, personal loans have become an essential tool for managing various expenses, from medical emergencies and home renovations to vacations and weddings. One of the most critical aspects of taking out a personal loan is securing the lowest possible interest rate. This guide aims to provide you with comprehensive information on how to obtain a personal loan with lowest interest rate, factors that influence these rates, and strategies to improve your chances of getting the best deal.

Understanding Personal Loan Interest Rates

Personal loan interest rates can vary significantly based on several factors, including the borrower’s creditworthiness, the lender’s policies, and the overall economic environment. Typically, personal loan interest rates range from 10% to 24% per annum. The interest rate you receive will directly impact your monthly payments and the total cost of the loan over its tenure.

Factors Affecting Personal Loan Interest Rates

Credit Score: Your credit score is one of the most crucial factors in determining your interest rate. A higher credit score indicates better creditworthiness and can help you secure lower interest rates.

Income and Employment: Stable and high income can positively influence your loan terms. Lenders prefer borrowers with steady employment and a good income history.

Loan Amount and Tenure: The amount you wish to borrow and the repayment tenure also affect the interest rate. Shorter tenures usually attract lower interest rates, while larger loan amounts may offer better rates due to reduced risk.

Lender’s Policies: Different lenders have varying interest rate policies based on their risk appetite and operational costs.

Debt-to-Income Ratio: A lower debt-to-income ratio indicates better financial health, which can lead to more favorable interest rates.

Steps to Secure a Personal Loan with the Lowest Interest Rate

Improve Your Credit Score: Regularly check your credit score and take steps to improve it by paying bills on time, reducing outstanding debts, and maintaining a low credit utilization ratio.

Compare Lenders: Do thorough research and compare offers from multiple lenders. Use online comparison tools to evaluate interest rates, processing fees, and other charges.

Consider Your Employer: Some banks offer preferential rates to employees of certain companies. Check if your employer has tie-ups with any banks.

Choose the Right Loan Amount and Tenure: Opt for a loan amount and tenure that balances your repayment capacity and interest rates.

Maintain a Stable Income: Ensure your income is stable and sufficient to cover the loan’s EMI. A steady income source makes you a less risky borrower.

Negotiate with the Lender: Don’t hesitate to negotiate with your lender for better terms. If you have a good credit history and relationship with the bank, they may offer lower rates.

Understanding Fixed vs. Floating Interest Rates

When applying for a personal loan, you may encounter two types of interest rates: fixed and floating.

Fixed Interest Rates: The interest rate remains constant throughout the loan tenure. This offers predictability in EMIs but may be slightly higher than floating rates.

Floating Interest Rates: The interest rate can fluctuate based on market conditions. While this could lead to lower rates initially, it also comes with the risk of rate increases over time.

Choose the type that aligns with your financial stability and risk appetite.

Benefits of Securing a Personal Loan with a Low-Interest Rate

Lower EMIs: A lower interest rate translates to reduced monthly payments, making it easier to manage your finances.

Reduced Total Interest Cost: Over the loan tenure, you will pay less in interest, saving you money.

Improved Loan Eligibility: Lower EMIs can improve your eligibility for other loans in the future, as they indicate better repayment capacity.

Financial Flexibility: Savings from lower interest can be used for other financial goals or emergencies.

Tips for Successful Loan Repayment

Set Up Auto-Debit: Ensure timely EMI payments by setting up auto-debit from your bank account.

Budget Effectively: Plan your monthly budget to accommodate the EMI without straining your finances.

Avoid Additional Debt: Minimize taking on additional debt to maintain a healthy debt-to-income ratio.

Prepay if Possible: If you have extra funds, consider making prepayments to reduce the loan tenure and interest cost. Check if your lender charges prepayment penalties.

Conclusion

Securing a personal loan at lower interest rate requires a strategic approach, including improving your credit score, comparing different lenders, and choosing the right loan amount and tenure. By understanding the factors that influence interest rates and taking proactive steps, you can significantly reduce the cost of your loan and enhance your financial stability.

Remember, a personal loan is a significant financial commitment. Ensure you are fully informed about the terms and conditions, and choose a loan that best fits your financial situation. With careful planning and responsible borrowing, you can effectively manage your financial needs and achieve your goals.

#personal loan with lowest interest rate#personal loan at lower interest rate#low interest personal loans#apply personal loan online

0 notes

Text

NEO-BANKING: Banking for the digital age 2023

The internet and the digital age have had a transformative impact on India, significantly shaping various aspects of society, the economy, and everyday life.

Over the years, internet penetration in India has witnessed remarkable growth. With a massive population and increased accessibility to smartphones and affordable data plans, a significant portion of the population now has access to the internet.

The digital revolution has brought about a surge in digital payment systems in India. Mobile payment apps like Paytm, PhonePe, and Google Pay have gained widespread adoption, enabling quick and secure transactions, peer-to-peer transfers, and cashless payments.

The digital age has also witnessed the emergence of digital financial services in India. Fintech companies offer innovative solutions such as online banking, digital wallets, investment platforms, and microfinance services, enhancing financial inclusion and access to financial services for a larger section of the population.

What is Neo Banking?

Digital-Only banking forums that operate solely online are defined as Neo-bank. In other words, banks which do not have a physical presence.

Neo-banks enhance the traditional banking experience by introducing a seamless online interface that adds a factual and digital layer to the process.

As these type of banks are digital and tech driven in nature the users have the ability to create accounts for themselves and use their offerings hassle-free.

The Reserve Bank Of India does not permit fully-digital banking establishments in India, the Neo-banks present in the nation have to partner with physical banking entities to deliver some of their key services.

To summarize Neo-banking refers to a new generation of digital banks that operate exclusively online or through mobile applications, providing modern and innovative banking services. These banks often focus on delivering a seamless user experience, personalized financial management tools, and enhanced customer-centric features.

Characteristics Of Neo-banks

Neo-banks are slowly becoming the knight in shining armor of the financial banking industry as they are offering multiple benefits to meet the evolving needs of the new age users. They focus on making banking a simple smart and personalized experience for the users.

Digital-First Approach: Neo banks operate primarily through digital channels, providing seamless and user-friendly mobile apps or online platforms for customers to manage their finances.

Account Opening and Onboarding: Neo banks offer hassle-free and quick account opening processes that can often be completed entirely online, without the need to visit a physical branch. Onboarding typically involves a simple application, identity verification, and minimal documentation.

Enhanced User Experience: Neo banks prioritize delivering a modern and intuitive user experience. They offer clean interfaces, personalized dashboards, and interactive tools that allow customers to easily track and manage their finances, view transaction histories, and set financial goals.

Mobile Payments and Transfers: Neo banks often integrate with mobile payment systems, allowing customers to make fast and secure payments using their smartphones. They also facilitate easy and instant peer-to-peer transfers between individuals.

Budgeting and Financial Insights: Many neo banks provide robust budgeting tools and real-time spending analysis, helping customers track their expenses, set budgets, and gain insights into their financial habits. This enables users to make more informed financial decisions and improve their money management skills.

Savings and Investment Options: Neo banks frequently offer innovative savings features, such as round-up savings or automated savings plans, where spare change or designated amounts are set aside into savings accounts. Some neo banks also provide investment options, allowing customers to invest in stocks, exchange-traded funds (ETFs), or other assets.

Customer Support and Assistance: Neo banks often prioritize customer support through digital channels. They offer responsive customer service via chatbots, in-app messaging, or dedicated customer support teams to address inquiries, provide assistance, and resolve issues.

Integration with Third-Party Services: Many neo banks integrate with other financial technology services and platforms, enabling customers to connect and manage their accounts with various fintech applications, such as expense trackers, investment platforms, or lending services.

Transparent Fee Structure: Neo banks typically have transparent fee structures with minimal or no account maintenance fees, low foreign transaction fees, and competitive currency exchange rates. They aim to provide cost-effective banking solutions to customers.

Enhanced Security Measures: Neo banks prioritize security and often implement advanced encryption technologies, two-factor authentication, biometric authentication (fingerprint or facial recognition), and other measures to ensure the safety of customer data and transactions.

Types Of Neo-banks

Front end Neo-banks: Front-end Neo-banks, also known as white-label Neo-banks or banking-as-a-service (BaaS) providers, focus on offering the technology and user interface for digital banking experiences. They collaborate with traditional banks, financial institutions, or other companies to provide the front-end components of banking services

Neo-Investment Platforms: These Neo-banks focus on providing investment and wealth management services. They offer digital platforms that allow users to invest in stocks, bonds, mutual funds, and other investment products. These Neo-banks often provide intuitive interfaces, personalized recommendations, and automated portfolio management features.

Neo-Lending Platforms: Neo-banks in this category specialize in providing digital lending services. They leverage technology and data analysis to streamline the loan application and approval process, offering quick and convenient access to personal loans, student loans, small business loans, and other types of credit.

Neo-banks for Specific Communities: Some Neo-banks target specific communities or customer segments. For example, there are Neo-banks designed for immigrants or expatriates, providing services tailored to their unique needs, such as cross-border transfers, multi-currency accounts, and language support.

Neo-Transactional Platforms: These Neo-banks focus primarily on transactional services, emphasizing seamless payments, money transfers, and day-to-day financial management. They may offer features like instant payments, peer-to-peer transfers, budgeting tools, and expense tracking to simplify the user's financial life.

Neo-banks for Teens or Kids: These Neo-banks aim to educate and empower young individuals with financial literacy and responsible money management. They offer specialized accounts and tools designed for teens or kids, including parental controls, spending limits, and educational resources.

Neo-banks with Additional Services: Some Neo-banks differentiate themselves by providing additional services beyond basic banking. They may offer insurance products, crypto-currency trading, financial planning tools, or integration with third-party financial apps and services.

Difference between traditional banking and Neo-banking

Neo-banks and traditional banks differ in several key aspects, including their operational models, customer experience, technology adoption, and regulatory frameworks. Here are some of the main differences between Neo-banks and traditional banks.

Digital Focus: Neo-banks are digital-first institutions that operate primarily online or through mobile apps, while traditional banks have physical branch networks. Neo-banks leverage technology to provide convenient, seamless, and user-friendly digital banking experiences, often with intuitive interfaces and advanced features.

Cost Structure: Neo-banks typically have lower operating costs compared to traditional banks since they don't have the expenses associated with maintaining physical branches. This can allow Neo-banks to offer more competitive or even fee-free services to customers.

Speed and Convenience: Neo-banks are often known for their agility and ability to provide faster and more efficient services. Opening an account with a neo-bank can be done within minutes, and they often offer real-time transaction processing, instant payments, and quick access to financial information. Traditional banks may have longer processing times, more paperwork, and more complex procedures.

Product Range: Traditional banks typically offer a broader range of financial products and services, including various types of loans, investment products, and insurance. Neo-banks, on the other hand, may have a more focused product offering, with a primary emphasis on core banking services such as checking and savings accounts, payments, and money transfers. However, some Neo-banks are expanding their product portfolios over time.

Customer Experience: Neo-banks strive to deliver a superior customer experience by offering intuitive interfaces, personalized recommendations, and proactive customer support. They often leverage data analytics and AI technologies to understand customer preferences and provide tailored financial solutions. Traditional banks, while making efforts to improve customer experience, may face challenges due to legacy systems and complex organizational structures.

Regulatory Framework: Both Neo-banks and traditional banks are subject to regulatory oversight, but the regulatory environment for Neo-banks can vary. Neo-banks may operate under their own banking licenses or partner with traditional banks to leverage their licenses and regulatory compliance. Traditional banks, on the other hand, have long-established regulatory frameworks and compliance requirements.

Conclusion

It's important to note that Neo-banks and traditional banks are not mutually exclusive, and there is increasing collaboration between the two. Some traditional banks have launched their own neo-bank subsidiaries or invested in Neo-banks to tap into digital banking opportunities and enhance their offerings.

In conclusion, Neo-banks have emerged as disruptive players in the banking industry, reshaping the way people interact with financial services. These digital-first institutions prioritize convenience, user experience, and innovative technology to deliver banking solutions that meet the evolving needs of today's customers.

Mpower Credcure is a fast growing fintech which offers digital loans to the undeserved segments and SMSEs at cheap interest rates through their online platform at www.mpowercredcure.com.

#lowest Personal loan interest rate in bank#Personal loan all details#about Personal loan interest rate#housing loan information#Business loan now#Business loan housing finance#lower rate of interest on Personal loan

0 notes

Text

UPDATE: a judge blocked this for now: https://apnews.com/article/donald-trump-pause-federal-grants-aid-f9948b9996c0ca971f0065fac85737ce

—

This is a huge fucking problem.

These grants account for more than 10% of the GDP. 3 trillion – wiped out.

From the article:

The funding freeze by the Republican administration could affect trillions of dollars and cause widespread disruption in health care research, education programs and other initiatives. Even grants that have been awarded but not spent are supposed to be halted.

“The use of Federal resources to advance Marxist equity, transgenderism, and green new deal social engineering policies is a waste of taxpayer dollars that does not improve the day-to-day lives of those we serve,” said a memo from Matthew Vaeth, the acting director of the Office of Management and Budget.

(Use of that language, that entire segment, "Marxist equity ... policies" is disgusting. If you think you're wary of propaganda and you do not see the enormous red flags in that statement, I do not know how to help you. If you're not beyond it, maybe pick up a history book — the 1930s are particularly pertinent.)

The average person may not understand just how far-reaching this is, how many programs and services are covered by grants, that regular people rely on all across the US and globally.

Not to mention how many people just had their livelihood demolished.

Researchers, for example, spend months and years writing grant proposals, their work and income relies on these cycles. So even if this is "temporary", a lot of people are going to struggle.

This is not just a few people in lab coats somewhere, working on something you don't care about. Government-funded research is released to the public, since we paid for it, and is very typically about things the public will want to know:

Is this product safe or deadly?

Is this medication actually a "wonder drug" or does it harm you in the long term?

Is this pollution going to affect us long-term?

Etc.

Seriously, if you wanted any of those things to get better — you wanted lower rates of cancer and other deadly and disabling disease? You worry about trusting public health guidelines because you're concerned about bias and vested interests in research? You want "small government" that doesn't interfere with people's bodies based on a small group's religious dogma, with zero basis in factual, verifiable reality?

Then you should have voted to keep this administration out of government.

Because their idea — which is outlined in Project 2025, and they are following it closely — is that research will be required to rely 50% on private funding.

Guess what private funding introduces a ton more of: private interests, private bias. The interests of stakeholders who do not give a shit if you are being killed by their product, as long as line goes up in the short run.

But even beyond scientific researchers — and those who rely on that work, e.g. journalists, science communicators, public health advocates, scientific artists —

grants fund others like: teachers, police, farmers, women's and homeless shelters, native orgs, medical workers, and on the list goes.

All pending "review" by a thoroughly unqualified gang of convicted criminals and cronies.

656 notes

·

View notes

Text

Michael Sheen’s extraordinary gesture as he pays off debts of hundreds of people

He plays an angel on screen and he has proven he is an angel in real life by undertaking an extraordinary gesture. In an unprecedented move the actor has used his own money to write off personal debts of hundreds of people in South Wales

It’s been confirmed that Michael, who famously plays angel Aziraphale in Good Omens, has brought light and relief to many families struggling with debt with this wonderful act of benevolence.

The move was not publicly announced by the Port Talbot star, but was uncovered by fans who spotted posts on Facebook in local community groups from a television production company called Full Fat TV.

The posts read: ‘Actor Michael Sheen has been campaigning for a fairer credit system for years and in an extraordinary gesture, he has used his own money to write off personal debts for hundreds of people in South Wales. If you have received a letter from a company called Ten Acquisitions the good news is that Michael has paid off some of your debt and he’d love to hear from you. The details of how to get in touch with him are in the letter.’

Intrigued by the posts which appealed to those who had received letters from a company called Ten Acquisitions confirming that Michael had paid off debts, one fan took to X to ask him directly if the posts were true.

Fans wondered if it was somebody using his name as a scam, but the actor in replies on his X account confirmed the posts were neither clickbait nor a scam.

He wrote: ‘It’s not clickbait. I want to clarify, because we want people to get in touch.’

The campaigning Welshman, a long time advocate for a fairer credit system, has teamed up with the production company to film a documentary about the plight of those struggling due to unfair financing.

On Monday, Michael appeared in Parliament where he joined calls for a fair banking act to tackle the credit crisis affecting people and businesses.

In 2022-2023, more than 9 million were declined for credit, with millions relying on pay-day-lenders and buy-now-pay-later schemes with high interest rates. At its worst, lack of access to affordable credit means hundreds of thousands of people find themselves turning to loan sharks, while viable businesses remain stuck, unable to develop and create jobs. Campaigners are calling for a Fair Banking Act to help ensure that everyone can access essential financial services and support.

Speaking at the event in Parliament on Monday, Michael said: “Anyone can find themselves in a place where they need credit to make ends meet or to get through a difficult time. The lack of affordable credit for people on lower incomes is harming individuals and families, but also businesses and communities. Whole regions are seeing their growth held back. We can’t keep waiting and hoping that things will get better. We need something to change now. The Fair Banking Act could be the thing which really makes the difference”.

"We can’t keep waiting and hoping that things will get better. We need something to change now."@michaelsheen has joined calls for a #FairBankingAct to tackle credit crisis affecting people and businesses.

101 notes

·

View notes

Note

Hi aunties. I have a high balance on my credit card and Credit Karma was suggesting getting a personal loan to pay it off? How is that better than just paying on the card?

Hi bb!

What Credit Karma is suggesting is often called "credit consolidation" or "refinancing." Basically, A Bank will buy your credit card debt and pay it off immediately. In exchange, they'll give you a NEW loan at a lower interest rate. They make money on the interest you pay them, and you save money as you pay them back by not paying as much interest.

Make sense? Here's how we explain it through the lens of student loan debt (though it works basically the same for credit cards):

When (And How) To Try Refinancing or Consolidating Student Loans

{ MASTERPOST } Everything You Need to Know about Credit and Credit Cards

Did we just help you out? Join our Patreon!

74 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Text

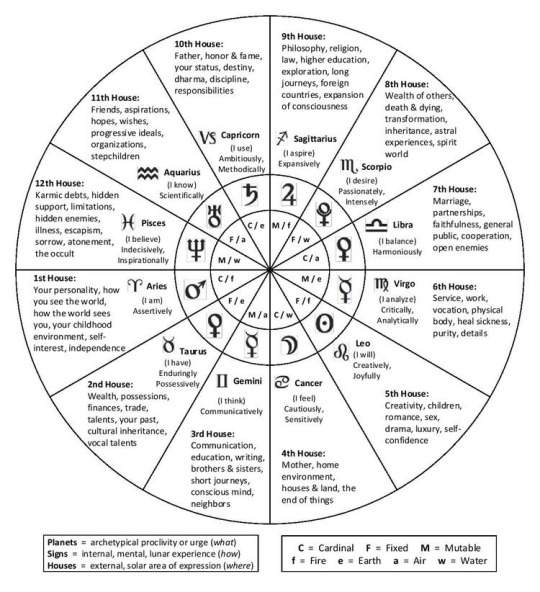

ASTRO 101 - THE HOUSES (PART II)

SEVENTH HOUSE - I BALANCE

(The Seventh House is ruled by Libra and Venus.)

House of marriage, personality and character of our partner, partner’s job

Civil partnership, bilateral relations, long and committed relationship, close friends, closely associated with, opposite side, associations, union, consultancy

Terms of relationship and behavior

Joint ventures, hostilities, adversary, rivals, competition

Traits we feel lacking in ourselves, the parts of us that are in us but have not been revealed and that we have difficulty in accepting

Lower back, skin, external sexual organs, bladder, ovaries, blood

International relations, military or civil wars, treatises, arbitrators, illegal criminals, marriage and divorce rates, foreign trade, public relations

EIGHTH HOUSE - I DESIRE

(The Eighth House is ruled by Scorpio, Mars and Pluto.)

House of death - natural or unnatural, accident, suicide, fire, drowning, diseases, corruption, crises, surgery

Sex, sexuality, erotism, desire, fantasies, fetishes, sexual life

Alteration and transformations, sharing

Heritage, money that comes to us beyond of our control, money that comes to us from others, inheritance from husband

Tax, alimony, debt, heritage, loan, lottery, gambling

Robbery, fighting, theft, slaughter, butchers, coroners, harassment, rape

The fears, privacy, feel rage towards, abomination

Psychology, occultism, parapsychology, subconscious, spiritual psychology

Genitals, groin area, colon, sex organs, gall bladder, rectum, urogenital system

International debts, international financial agreements, charges, stock certificates, interest rates, foreign exchanges, credits, fuses, mortgages, pension funds, legacies, mortality, life-critical, suicide

Surgery, morgue, surgeons, laboratories, nuclear forces, sewage, organized crimes, terrorists, detective, demimonde, arms, underground sources, cabalistic subjects

NINTH HOUSE - I ASPIRE

(The Ninth House is ruled by Sagittarius and Jupiter.)

House of wisdom, mastership, higher education, academic trainings

Cults and thoughts, abstract reasoning, moral evidence, philosophizing, religious cult, reflection, abstract thoughts

The house where we deepen the information we get from the 3rd house

Distant relatives

Society's mindset, social law rules, social and moral rules, harmony with society

Expedition, long trips, distant travels, foreign countries, foreigners, exterior, crew, communication instruments, media, broadcast

Hips, thighs, sciatic nerves, lower spine, liver, autonomic nervous system

Foreign relations and trade, courts, laws, judges, minorities, companies, advertising portfolios, religion and clergy, the country's philosophical and religious tendencies, migrations, long-distance communications, fast-moving news, broadcasting, popular culture, foreigners

Universities, airlines and transport, maritime transport, ministry of foreign affairs, flight attendants

TENTH HOUSE - I USE

(The Tenth House is ruled by Capricorn and Saturn.)

House of profession, honor, social status, public esteem, dignity, business, character, reputation and career

Glory, name, fame, recognition, way of life, purpose and power

Social roles, status in society, the part of society that sees us, social identity, prestige and title

Marital status, our partner's family, parents, father, authoritarian leaders

Skin, hair, knees, teeth, bones, joints, skeletal system, reputation

Government, the state's reputation by foreign countries, heads of state, powers, executives, leaders, celebrities, notable personages, public figures, uplands

ELEVENTH HOUSE - I KNOW

(The Eleventh House is ruled by Aquarius, Saturn and Uranus.)

House of friends, groups, associations, endowments, a circle of friends, people around us, hives, social environments and organizations

Goals, future plans, hopes, goals of life, wishes, happy news, wealth, fortune, expectations from life and dreams

Income from career, colleagues, international friendships, audiences we offer ideas, incoming wealth, gains, profits, writings

Social media, mass media and virtual communities

Endowments associations, politics, parties, establishment, the masses

Lower leg, calves, ankles, electrical impulsive of the nerves, circulatory system, elimination

Allied countries, social institutions and administrations, legislative changes, national mobilizations, revolts, revolutions, organizations, erosions

TWELFTH HOUSE - I BELIEVE

(The Twelfth House is ruled by Pisces, Jupiter and Neptune.)

House of tribulations, secret matters, troubles, subconscious, covert and covered topics, privacy, loneliness, ermitage, place of isolation

Thoughts, anxieties, and fears underlying repressed consciousness, spiritual life

The things we hide from others and are afraid to tell, our shadow sides, psychological problems

Karmic transmissions, burdens and problems we brought from the past

Secret enemy, backfriend

What kind of pregnancy our mother had, our condition in the mother’s womb and the emotions transferred to us in the mother’s womb

Fantasies and fetishes

Feet, all bodily fluids, the lymphatic system

Secret enemies, secret organizations, private affairs, spies, psychics, fortune-tellers, wizards, deep and secret affairs, criminals, thefts, assassinations, drugs, addicts, dark business people, unemployment and strikes

Hospitals, prisons, rehabilitation centers, mental hospitals, faith houses, orphanages, clinics, charities, overseas

#aesthetic#astrology#birth chart#astro notes#astroblr#astroloji#girlblogger#seventh house#eighth house#ninth house#tenth house#eleventh house#twelfth house#venus#pluto#mars#jupiter#saturn#uranus#neptune#astro houses#astro101#zodiac signs#astro natal#horoscope#libra#scorpio#saggitarius#capricorn#aquarius

201 notes

·

View notes

Text

Personal loans have become an essential tool for managing various expenses, from medical emergencies and home renovations to vacations and weddings. One of the most critical aspects of taking out a personal loan is securing the lowest possible interest rate. This guide aims to provide you with comprehensive information on how to obtain a personal loan with lowest interest rate, factors that influence these rates, and strategies to improve your chances of getting the best deal.

Understanding Personal Loan Interest Rates

Personal loan interest rates can vary significantly based on several factors, including the borrower’s creditworthiness, the lender’s policies, and the overall economic environment. Typically, personal loan interest rates range from 10% to 24% per annum. The interest rate you receive will directly impact your monthly payments and the total cost of the loan over its tenure.

Factors Affecting Personal Loan Interest Rates

Credit Score: Your credit score is one of the most crucial factors in determining your interest rate. A higher credit score indicates better creditworthiness and can help you secure lower interest rates.

Income and Employment: Stable and high income can positively influence your loan terms. Lenders prefer borrowers with steady employment and a good income history.

Loan Amount and Tenure: The amount you wish to borrow and the repayment tenure also affect the interest rate. Shorter tenures usually attract lower interest rates, while larger loan amounts may offer better rates due to reduced risk.

Lender’s Policies: Different lenders have varying interest rate policies based on their risk appetite and operational costs.

Debt-to-Income Ratio: A lower debt-to-income ratio indicates better financial health, which can lead to more favorable interest rates.

Steps to Secure a Personal Loan with the Lowest Interest Rate

Improve Your Credit Score: Regularly check your credit score and take steps to improve it by paying bills on time, reducing outstanding debts, and maintaining a low credit utilization ratio.

Compare Lenders: Do thorough research and compare offers from multiple lenders. Use online comparison tools to evaluate interest rates, processing fees, and other charges.

Consider Your Employer: Some banks offer preferential rates to employees of certain companies. Check if your employer has tie-ups with any banks.

Choose the Right Loan Amount and Tenure: Opt for a loan amount and tenure that balances your repayment capacity and interest rates.

Maintain a Stable Income: Ensure your income is stable and sufficient to cover the loan’s EMI. A steady income source makes you a less risky borrower.

Negotiate with the Lender: Don’t hesitate to negotiate with your lender for better terms. If you have a good credit history and relationship with the bank, they may offer lower rates.

Understanding Fixed vs. Floating Interest Rates

When applying for a personal loan, you may encounter two types of interest rates: fixed and floating.

Fixed Interest Rates: The interest rate remains constant throughout the loan tenure. This offers predictability in EMIs but may be slightly higher than floating rates.

Floating Interest Rates: The interest rate can fluctuate based on market conditions. While this could lead to lower rates initially, it also comes with the risk of rate increases over time.

Choose the type that aligns with your financial stability and risk appetite.

Benefits of Securing a Personal Loan with a Low-Interest Rate

Lower EMIs: A lower interest rate translates to reduced monthly payments, making it easier to manage your finances.

Reduced Total Interest Cost: Over the loan tenure, you will pay less in interest, saving you money.

Improved Loan Eligibility: Lower EMIs can improve your eligibility for other loans in the future, as they indicate better repayment capacity.

Financial Flexibility: Savings from lower interest can be used for other financial goals or emergencies.

Tips for Successful Loan Repayment

Set Up Auto-Debit: Ensure timely EMI payments by setting up auto-debit from your bank account.

Budget Effectively: Plan your monthly budget to accommodate the EMI without straining your finances.

Avoid Additional Debt: Minimize taking on additional debt to maintain a healthy debt-to-income ratio.

Prepay if Possible: If you have extra funds, consider making prepayments to reduce the loan tenure and interest cost. Check if your lender charges prepayment penalties.

Conclusion

Securing a low interest personal loans requires a strategic approach, including improving your credit score, comparing different lenders, and choosing the right loan amount and tenure. By understanding the factors that influence interest rates and taking proactive steps, you can significantly reduce the cost of your loan and enhance your financial stability.

Remember, a personal loan is a significant financial commitment. Ensure you are fully informed about the terms and conditions, and choose a loan that best fits your financial situation. With careful planning and responsible borrowing, you can effectively manage your financial needs and achieve your goals.

#personal loan at lower interest rate#low interest personal loans#personal loan low interest rate bank#personal loan with lowest interest rate#low rate personal loans

1 note

·

View note

Note

If the King/Queen of Westeros decided to implement a national bank of Westeros, how would they navigate relationships with the Iron Bank and any perceived competition? Thinking of the same way that the Rogare Bank might have fallen to Faceless Man assassinations?

I would personally recommend a more cooperative policy, because there are definite ways that a Westerosi central bank could be of benefit to the Iron Bank - especially since central banks don't tend to compete with merchant or commercial banks for the same kind of business.

To begin with, the existence of a central bank acting as lender of last resort to Westerosi moneylenders and merchants is going to be good for the Iron Bank's business in Westeros, because that's going to massively reduce the risk of default, which would mean the Iron Bank's loans would see a higher rate of return even at lower interest rates, and likely would lead to an increased volume of business, as more people would be able to afford to take out loans from the Iron Bank.

If the Westerosi central bank is anything like the central banks of Early Modern Europe, it might be quite possible that the Iron Bank would become a minority shareholder in the Westerosi central bank, and quite likely would be one of the central bank's major customers when it comes to the sale of royal bonds - if only because the existence of a central bank would make Westerosi public debt a much sounder investment than under the medieval model.

#asoiaf#asoiaf meta#westerosi economic policy#medieval finance#medieval economics#iron bank#medieval banking#early modern state-building#early modern finance#central banking

47 notes

·

View notes

Text

The problem is thinking that "fascism will start" with a certain person being elected to control our capitalist system, when in reality, this is what's been happening:

Regulations are removed. Companies keep buying out smaller companies until they're the only ones that exist & it's near impossible to start your own business. This means more people are forced to work for & rely on large corporations for their needs. Violence, slavery, and terrorism is used to produce the products we use. The bigger the company is, the more they can lobby and influence the government.

The upper class buy out all of the homes, so you're forced to rent or take out huge loans with high interest rates. Being homeless in public is illegal, so you have no choice! Your landlord, usually a complete stranger, can control what you do, who you have over, & how often you're allowed to have them over. They're allowed to take your home from you at any time.

Companies and landlords can raise prices as much as they want when there's no competition. Wages don't keep up with price increases. Everything you have is on a subscription & you don't truly own anything. Not having money for things means you go to jail or prison. Existing in a place without money is "loitering" and can get you arrested.

You can pay your way out of legal repercussions, meaning the lower class are the only ones who are truly policed. People are sitting in jail for "crimes" that hurt nobody, meanwhile rich people pay to avoid jail time for much worse offenses. It's profitable to put poor people in prison so that they can work as slaves. Cops also get paid vacations for murdering the "right people" (usually Black, Native, and Mexican folks). The economy, government, and cops are incentivized to put as many marginalized people as they can in there. The lower class has to do what the upper class says under threat of violence.

And, of course, protesting any of this means you can get thrown in jail or murdered, too. Freedom?

Now, every aspect of our lives that the government doesn't control will be controlled by corporations & the land-owning class. It doesn't matter who is in power as long as capitalism is still around, because again, the bigger these companies get, the more influence they have on the government. All it takes is a threat to ruin the economy.

We need to be fighting the real enemy here – oligarchy.

32 notes

·

View notes

Text

Joe Biden polls at or below 40 percent approval. Historically, such unpopularity has made it almost impossible for a president to be reelected.

His age advances by the hour. His voice falters, his memory fades, and his gait is reduced to short steps, with his arms, winglike and in tandem, offering balance.

Biden is not so much an octogenarian as an unhealthy and prematurely aging 80-year-old. It is America’s irony that he is fit for almost no other job in the country other than President, which apparently allows for a 3-day-a-week ceremonial role while others in the shadows run the country.

So how does Biden become renominated and reelected, as polls show he is behind in almost every critical swing state on nearly every issue? Answer: not by campaigning, not by championing his record, and especially not by doubling down on his neo-socialist and now unpopular agendas.

Instead, his campaign is focused on four other strategies to beat Donald Trump.

First, left-wing local, state, and federal prosecutors are tying Trump up in court on crimes that have never been seen before and will never be again after the election. All the cases are politically motivated, with many coordinated with the White House.

Even if Trump is not convicted by blue-state prosecutors, in blue-state courtrooms, in front of blue-state juries, he will lose critical campaigning time.

Trump may end up paying out $1 billion in legal fees and fines. At 76, the monotonous days in court are designed to destroy him financially, physically, and mentally.

Biden and his operatives know that, in the long term, they may have fatally damaged the American legal system with such judicial sabotage. But short-term, they hope to destroy Trump before the ballots are cast.

Second, in his fourth year, Biden is suddenly selling government favors to special-interest voting blocs, or hoping to bring short-term relief to voters at the expense of long-term damage to the nation.

For elite college students and graduates, there are now billions of dollars in student-loan cancellations, despite a Supreme Court ruling declaring such targeted contractual amnesties illegal.

For consumers, before the election, Biden will likely drain the last drops from the critical Strategic Petroleum Reserve to lower gas prices—now sky-high due to his previous disastrous green policies.

If that is not enough, Biden has ordered Ukraine not to hit Russian oil facilities to avoid panic in the global petroleum markets before early and mail-in balloting begin.

Biden will quietly jawbone the Federal Reserve Bank to lower interest rates and reinflate the economy, despite his own creation of hyperinflation that caused interest rates to rise in the first place.

He will pander to Arab-American voters in swing-state Michigan by cutting arms deliveries to Israel, even as it seeks to destroy the killers of October 7.

And if that mollification is not sufficient to win Michigan, he will suddenly slap higher tariffs on imported Chinese electrical vehicles to win back apostate union auto workers.

Three, the left learned after 2016 that the only way to beat Trump is to change the way Americans vote.

So under the cover of the COVID-19 lockdown, the left sued in critical states to reduce Election Day to a mere construct, while 70 percent of voters mailed in their ballots or voted by early, rolling balloting over many weeks.

The key was the inability to fully authenticate votes, given the old practice of showing up on Election Day and presenting an ID was declared “racist.”

Four, Biden, as he did in 2020, will outsource his campaign to the media, 95 percent of which is left-wing. Talking televised heads will claim Biden is “sharp as a knife” while focusing on Trump’s tweets, Stormy Daniels, Michael Cohen, and lurid but irrelevant testimonies that permeate Trump’s court appearances.

Trump will continue to hold weekend-long, massive 100,000-person rallies, even in blue states. Meanwhile, Biden’s fixers in the media, administrative state, and legal community will counter that even with no crowds and no campaigning, Biden can win through 24/7 nonstop “October Surprises”—all summer long.

So expect more false “Russian collusion,” “laptop disinformation,” and “January 6 insurrection” hoaxes and their new replacements designed to smother the airwaves with salacious scandals nonstop.

Biden’s fading tenure is similar to the last sad months of Woodrow Wilson’s second term, when in 1919-20, the country was assured that a bedridden president was somehow hard at work, even as his wife, doctors, and handlers kept everyone else away.

Biden’s keepers do not seem to care about the president’s own failing health or his dismal polls. They discount his rare, anemic, and disastrous public appearances. They laugh off the huge Trump rallies. And they certainly could care less about the bad optics of pandering to special interests at the expense of the country or the damage done to the American legal and balloting systems.

Instead, Bidenites believe they can reelect an unhealthy, unpopular, and unsuccessful president by any means necessary.

And they may be right.

17 notes

·

View notes

Text

I’m pissed. I am so pissed right now. (Super long, very personal rant below)

I’m an attorney. A lawyer. My job is to advise my clients to the best of my ability of what legal options they have and which acts may be in their best interest. That’s why one of the other names for my job is counselor.

It is not to get more clients. It is not to file more bankruptcies. My job, my ethical obligation, is to provide my professional expertise to clients in relation to pursuing a bankruptcy.

Which means sometimes my ethical duty is to advise clients that filing a bankruptcy is the worse option for their situation and other steps would serve them better to reach their goals.

So when a client who makes less than the median income (which is fairly low, especially with inflation) comes in owning their house in full (meaning lots of value in the house to pay off debts), it is my job, my ethical obligation, to warn her that filing bankruptcy will mean she has to pay every single cent of her debts back. That she will be handing over almost half of her pay every month to the bankruptcy court to pay back her creditors. Or else the bankruptcy trustee has the right to sell her house.

And after discussing her situation with the senior attorney, turns out that it’s actually a better option for her to take out a small home equity loan and negotiate for lower debt payoffs for her credit cards and personal loans. It’s a lower interest rate, she gets a lot more leeway before her house is at risk, it’s quicker, and it will preserve her credit score. In every conceivable way it’s a better option for her.

So I call her to discuss that there are other options for her before I sink hours into preparing her case.

This woman freaks the fuck out. She’s convinced the loan will lead to her losing her house. She demands to know why I would even suggest it. She implies I have no clue what I’m doing and am just trying to take advantage (which is… no? I’m telling you that you’d be better off not using our services). I try to calm her down and ask for a few days to put together the numbers to show her what her options will look like. She agrees to a phone call in two days.

Two days later, she sends me a basic email saying she no longer wants to go forward with the bankruptcy. Silly me thinks that means she’s given thought and realized that a 3.5-5% small loan and negotiating payoffs is better than 5 years at 8-18% interest plus attorney fees.

Wrong! She also emails one of the partners and writes a nasty message about me and how “incompetent” I am! Because I suggested a home equity loan! Because I did my ethical duty! And I found this out because I went to add a note to her file about giving her a refund and found a note from the partner about her complaints about me.

And I do not trust the partners to take my side. I did the right thing. I took the right actions. I know I did. And the Senior attorney will back me up! We literally just had a discussion that legal ethics requires that at times we have to advise clients not to file bankruptcy, even if that means we lose their business.

But I cannot believe that the partners will stand behind my actions. I can’t. Not after the last year. Too many times have they assured me that they have my back only to throw me under the bus the moment they actually have to prove it.

A client is rude and combative to me and my paralegal? Makes me deeply uncomfortable and keeps on insisting on coming into the office so he can attempt to railroad me by physical intimidation into doing what he wants instead of the actual correct legal actions? Partners says he understands and that he’s okay if we turn this client away. Then he calls the client, tells them I’m also on the line, and immediately rolls over because the asshole isn’t rude to him. And I have another month of near constant harassment and arguments and passive aggressive insults.

A client gives off creepy vibes? Again insists on coming into the office for every little thing? Has a criminal record for domestic issues and an active criminal case open against him for pedophilia? Oh well. He paid a lot up front so guess I have no choice but to keep representing him. For the next 5 years.

Client starts being threatening and aggressive to our paralegal before we even meet with him? Demands to be seen and threatens to come into our office even though we are booked all afternoon? Gives the former criminal prosecutor senior attorney bad vibes before she’s even seen him? Meet with him anyway! Oh he just lost his job because he threatened his HR? Has been arrested for domestic violence? Just attempted to physically intimidate his now former boss and had the cops called him? That’s fine! We have security concerns? Oh well, they’ll think about it during the partners meeting next month.

I’d like to take the time to learn how to do post filing work or how to file bankruptcies in the neighboring district that I actually live in? Tough. More front end work for a court that’s literally on the other side of the state! And if that doesn’t keep me occupied, they’ll send me front end stuff from the other side of the country!

So I really don’t trust that when I tell them I was doing my ethical obligation and making my client aware that there are better options that they will take my word over hers. I can’t. They’ve shown me that’s not how they think. It’s being a business first, with being a law practice a distant second, and mentoring new attorneys a far away third. Caring for our staff is barely a blip on the horizon for them.

But I know I did the right thing. And if that client wants to go to another firm and pay most of her paycheck to the trustee every month, fine by me. And if they try to lecture me about how I “handled it poorly” and should have just filed it without saying anything, I can’t guarantee I won’t just walk out.

I’ve got contract work. I’ve been approached by headhunters. One literally emailed me this morning. I like this work, but for once I’m not scared to walk away.