#Life insurance Benefits

Explore tagged Tumblr posts

Text

Life insurance benefits

Here are the life insurance benefits. A contract for life insurance is made between you and the insurance provider. In essence, the insurance company will give your beneficiaries a lump sum, known as a death benefit, in return for your premium payments.

2 notes

·

View notes

Text

For most young adults, securing life insurance may be the least of their concerns. Most of them prioritize their life goals, careers, and relationships during the earlier stages of their lives. However, foregoing securing early life insurance can cost you more than you realize. As experts in financial management in Pennsylvania, we will break down the perks of getting life insurance early in life:

0 notes

Text

Life Insurance Benefits That You Need To Know

The Top Life Insurance Benefits You Need To Know

Everyone wants to live a long and healthy life, and life insurance can help make that happen. But what are the benefits of life insurance? This article will answer these questions and more.

Life insurance is a financial protection policy that helps pay death costs if you cannot do so yourself.

Life insurance can provide financial stability in difficult times for both your family and yourself.

Life insurance can provide a guaranteed income for your loved ones if you cannot work or can no longer earn an income.

So whether you're curious about what life insurance is and what its benefits are, or you're already a policy-holder and want to know about the latest changes to your policy, we will attempt to cover those questions.

What is life insurance?

Life insurance is a vital insurance policy that can help you and your loved ones in the event of your death. It can provide financial aid during difficult times, like when you lose your job or undergo a medical procedure. No matter what your life insurance policy offers, it's essential to review the different types of life insurance policies and find one that's right for you. For example, term life insurance policies typically have shorter term coverage than permanent life insurance policies, which offer permanent coverage. Permanent life insurance policies typically have higher premiums. Still, they also offer the peace of mind of knowing that you and your loved ones are financially secure in the event of your death. Make sure to speak with a life insurance advisor to understand all the benefits and coverages available to you.

What are the different types of life insurance policies?

When it comes to life insurance, it's essential to understand the different types of policies available. There are term life insurance policies, Whole Life and universal life insurance policies. Each has its benefits and drawbacks, so it's essential to choose the right one for you.

For term life insurance policies, which are designed to protect you for a set period, the most crucial benefit is that it's affordable. Universal life insurance policies are a good choice for couples worried about each other's safety. Whole Life police will cover you for your entire life and have fixed premiums and interest rates And finally, Universal life insurance policies are significant for people who want more control over their insurance policy. While they offer a higher premium, they offer more flexibility and peace of mind.

What are the lIving benefits of having life insurance?

Death is a reality that we all face one day. But with life insurance, you can ensure that your loved ones are taken care of financially when that happens. Life insurance will help to protect your loved ones financially in the event of your incapacity or death, and provide coverage for funeral, inheritance taxes and other expenses.This policy can also provide benefits, called Living Benefits in the event of terminal illness. If you become diagnosed as terminally ill by a medical professional, and your life expectancy is shortened, you then would be able to access the benefits of your insurance contract, while you're still alive. This can be included in the policy itself or purchased as a premium rider, depening on the policy. To ensure that you're getting the best policy for yourself and your family, consulting with a life insurance specialist is essential. They can help you understand all of the benefits of life insurance so that you can make an informed decision.

Should I get life insurance?

Life insurance can provide peace of mind in the event of a death. There are a variety of life insurance policies available, each with its own set of benefits and drawbacks. To choose the best policy for you, consult with an expert. Once you have a policy, read the fine print carefully to understand all the benefits and exclusions. Finally, renew your policy annually to ensure you're fully protected.

When is the best time to buy life insurance?

When it comes to Life Insurance, the sooner you buy, the better. When buying life insurance there are many factors to consider, so it’s essential to speak with a qualified agent. One of the best ways to find a good agent is through referrals from family and friends. Licensed Agents know the ins and out of the Life Insurance industry and will be able to help you find the policy that best fits your needs. Don’t wait, busy life insurance today and make sure you’re fully protected.

The benefits of life insurance

No one knows what life will throw at them, but life insurance can provide financial stability and peace of mind in times of trouble. It can provide a cushion for death, disability, or other financial hardship. Additionally, life insurance can help protect your loved ones financially during your death. There are various types and levels of life insurance available, so find the right policy. Remember, life insurance is not a life sentence – it can provide you and your loved ones with valuable peace of mind in tough times.

It can help take care of your family if something happens – but that's only one of the benefits of life insurance.

There are several benefits to life insurance that go beyond simply taking care of your loved ones in the event of your death. It can provide financial security, cover expenses during tough times and help your family cope with life changes. In addition, it can offer the peace of mind in knowing that you and yours are taken care of should something happen to you suddenly or unexpectedly.

The different kinds of life insurance

Life insurance is a necessary insurance policy for everyone, regardless of age or financial status. There are many types of life insurance to choose from, so you can find one that is right for your needs. Comparing rates and policies is essential to ensure you get the best deal possible. Be sure to speak to a life insurance advisor to find the best policy.

What are the benefits of term life insurance?

Term life insurance is a policy that provides security for a set period, usually 10, 20 or 30 years. It offers protection if you unexpectedly die. The policy can be tailored to your needs. It is usually the most affordable type of insurance and is an excellent value for someone who is just starting out with Life Insurance. It can also sometimes be converted to Whole Life Insurance without the need for another application and going through the qualification requirements. It can also be purchased as a return of premium policy, where the payments are refunded if the policies face value isn’t used.

How to get more benefits – and value – when buying life insurance.

When you're shopping for life insurance, make sure you understand all of the benefits that are available to you. Compare quotes from different insurers and find one that offers the best value for your needs. Additionally, many life insurance policies come with discounts or exclusions, so be sure to know about them before deciding. Ultimately, life insurance is an important decision that should be carefully considered. By taking the time to understand all the options and benefits, you can make an informed decision that will benefit you in the long term

Benefits of Whole Life Insurance

Widowhood, death, and disability can be life-altering events that can leave families devastated. That's where whole life insurance comes in. This policy offers long-term protection, usually up to a certain amount of money. This policy also can build cash value that you can use while you're still alive. This can come in the form of a loan against the face value of the policy or the policyholder can cash in the policy and end the coverage. This amount can cover the costs of basic living expenses, like mortgage payments, tuition payments, and other bills. Whole life insurance policies are a wise investment for those who are concerned about the financial security of their loved ones in the event of an unexpected death or disability.

Benefits of Universal Life Insurance

Universal life insurance is a type of life insurance that offers permanent benefits. This type of policy can be a good choice for people who want to protect their families from financial hardship. The benefits of universal life insurance vary depending on your chosen policy, but they typically include death, disability, and burial coverage. This policy also offer flexible payment options if needed by the policy owner, to where you could be able to make a portion of the payment, or skip a payment all together. As long as you didn't allow the cash value of the policy to beome negative, which would cause the policy to lapse. Make sure to shop around and compare rates before selecting a policy – many options are available today.

Comparing the Benefits of Term Life, Whole Life and Universal Life Insurance

When it comes to life insurance, it's essential to know the benefits of each type of policy before making a decision. Term life insurance policies provide you with a set amount of coverage for a fixed period, while whole life insurance policies offer you the opportunity to accumulate money over time. Universal life insurance policies offer more features than either term or whole life policies and include variable premiums, inheritance benefits, and benefit riders. It's important to compare all the available benefits before deciding - choosing the right type of life insurance and the right Life Insurance company can benefit you and your loved ones.

Benefits of Life Insurance Riders

Regarding life insurance, riders are a valuable addition that can provide extra benefits. There are a variety of riders available, such as a Terminal Illness Rider. It's important to know what they are so you can choose the right one for you. Some riders include income replacement, accidental death coverage, and more. Make sure to read and agree to the terms and conditions before buying your policy, as some riders may have exclusions or conditions you may need to be made aware of. Once you have selected a rider, keep it up-to-date by regularly reading and agreeing to the policy's terms and conditions. Doing so will ensure you benefit from all the rider's to effectively make use of the policy proceeds.

z`

Tax Benefits of Life Insurance

It can be scary to contemplate life insurance but knowing the tax benefits it offers is essential. Life insurance can help reduce taxes by ensuring your estate is paid for. This can be done in a couple of ways - either by paying off your debts and expenses or giving your loved one’s money to tide them over until they can fend for themselves. Life insurance can help pay off your spouse's debts and expenses if you're married. Life insurance can be a life-saving policy, so don't wait to speak to an expert about its benefits. They can help you understand and find the right policy for your needs.

Compare Life Insurance Companies

Your life is precious and protecting yourself and your loved ones is essential. That's why life insurance is a vital policy. It can provide benefits like financial assistance in the event of your death and protection for your loved ones in the event of your incapacity. To find the best life insurance policy for you, it's essential to compare policies and find the right one for your needs. Life insurance companies offer various discounts and term options that you should be aware of before deciding. Additionally, be sure to ask questions when speaking with a representative about life insurance - they'll be able to help you understand everything involved!

Frequently Asked Questions

How much does a standard policy cost?

A few important things to consider when purchasing life insurance include your age, health condition, and occupation.

The standard policy will cost anywhere from $5,000 to $100,000, depending on your coverage and the company. For example, a standard policy may include life insurance, medical insurance, death benefit coverage, critical illness coverage, and more.

Higher coverage may be necessary if you're over 55 or have a chronic illness such as cancer. However, it's essential to factor in your budget before making any life insurance decisions. Contacting several companies to compare policies and select the best suits your needs is also essential.

What happens if I die while my policy is still in effect?

If you die while your life insurance policy is still in effect, the beneficiaries will be your spouse and children. The beneficiaries are entitled to the insured benefits. Depending on your policy type, some exclusions may apply, meaning that not all members of your family may be covered by it.

Can I add someone as an additional beneficiary to my policy?

Yes, you can add someone as an additional beneficiary to your life insurance policy. This will allow them to receive the money if something happens to you while you're still alive. Additionally, this person may be able to claim the money as their estate if they are the next of kin.

Conclusion

Life insurance is a crucial insurance policy that can help protect your loved ones in the event of your death. Not only does life insurance provide financial security for your family, but it also provides tax benefits and life insurance riders that can benefit your family in different ways. To find the best life insurance policy for you, compare companies and choose the policy that best suits your needs. Don't wait - get life insurance now to protect your loved ones!

0 notes

Text

i am so fucking frustrated with myself right now

#what do you mean i can't just fucking go online and fill out a form!!!!!!!!!!! just fucking do it idiot!!!!!!#i have to apply for insurance benefits by the end of the day and i can't fucking do it#our post comrade.#i have a general idea of what to do. i have a general idea of what buttons to click#but i cannot fucking do it. i don't know why.#i need to do it but i don't have anyone telling me exactly what to do so im just frozen here.#fuck my life. i'm too stupid to live and im too stupid to die

7 notes

·

View notes

Photo

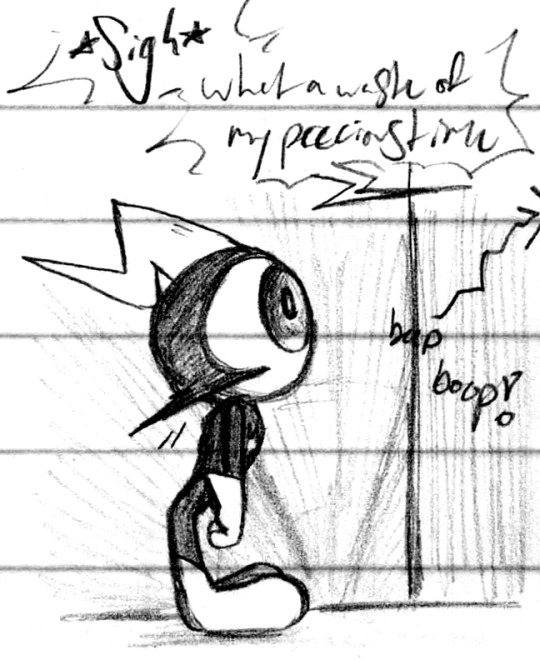

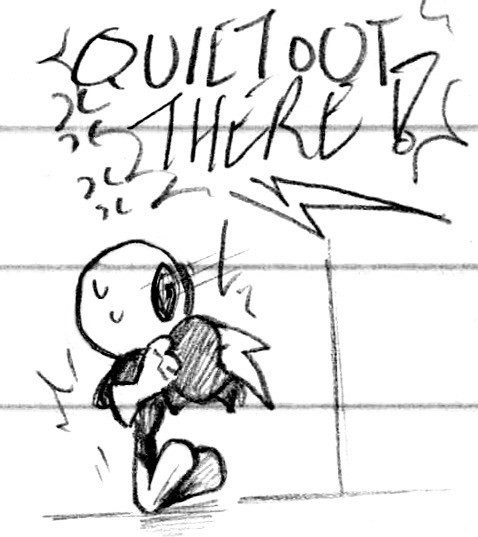

Stop celebrating so loud, you’ll wake everyone up! (P1 | P2 | P3) (Patreon)

[Panel 1] Hater: *sigh* What a waste of my precious time. [SFX: beep boop!]

[Panel 2] Peepers: ...

[Panel 5] Peepers: YEAAAA

[Panel 6] Hater: QUIET OUT THERE!

[Panel 7] Peepers: Sorry sir! Hater: Hmph!

#Doodles#Wander Over Yonder#Commander Peepers#Hater's offscreen but he does still talk so lol#Lord Hater#Final part :D Just the victory lap! Almost counts as a bonus - especially since I was running out of space lol#They're all a bit smaller but I still like them fine :)#Such a nothing conversation to Hater while it's everything to Peepers hehe ♪#''I should've joined the Hater Empire forever ago!!" Kicking himself for being fearful when he has such a cool boss haha#Personally I do think that the Hater Empire has killer health and life insurance#The employee benefits aren't Amazing outside of Hater's own whims like the food court but there's gotta be something other than propaganda#Plus y'know - they're an invading force he does kinda need to make sure that they're all fighting-fit lol#Peepers certainly got some of his best years before Wander came around that part of the galaxy tho lol so who knows maybe it's changed a lot#I know I've said it every other time but hhhhh his poses are so fun to draw <3 He just feels so versatile!#A stretchy poseable figure in my mind's eye haha#He can be so placid and so excitable and so frightened and he's just an eyeball with legs! I'm love him <3#Still gotta get into drawing Watchdog irises weird squishy shapes at some point - yet another cool feature of theirs :D

61 notes

·

View notes

Text

do you ever start your lil weekend tasks and then half way through just wanna give up and go back to bed

#im trying to transfer phone carriers and its just#so unbelievably hard idk why my friends all said u could do it online#like am i stupid doodoo brains orr#also i submitted like insurance claims and that whole process just drained my life force#i didnt even do that much but they were like please check ur benefits first and i spent 1548592 hrs trying to find the page#do they deliberately hide it!!!

41 notes

·

View notes

Text

I think I cried harder today over my dad's jackets than I did at his deathbed. That was a miserable time of course, a memory that will likely be seared into my brain until I die, but I cried... I think a normal amount, all things considered. More than I ever usually do of course, but I typically don't cry At All. All this free crying is certainly surreal.

The jackets, though. I was put in charge of doing his laundry, because we don't want to pack up dirty clothes. I was expecting it to be unpleasant bc my dad's dirty clothes - gross. But really, it was much more unpleasant in that... those were his. It felt wrong to touch them. Felt wrong to treat his jackets as gross. Because they were just his jackets. They weren't even in the hamper. And then I was remembering him wearing them, and then I was crying. Again. And again. Weeping over these damn jackets.

Then I found a shirt on his bed that still smelled like him. It smelled like a Hug From Dad. And that set me off crying even harder.

In total, I think I cried like 6 times within 40 minutes. It took me that long to finish sorting the damn clothes bc I just. Was a wreck. Like, what are you supposed to do when you're living life like normal, vaguely hopeful bc you're taking steps to secure your own happiness, and then 4 days later you're sorting your dad's laundry because he fucking died. Suddenly. Without a goodbye.

And you have to worry about his lack of a will (even under an ideal situation, only 2 heirs and no conflicts between us, probate's a fucking Bitch), and arranging the funeral, and prepping his obituary, and picking out pictures, and writing a speech bc you want to talk at his funeral, of Course you want to talk at his funeral, but even just thinking about anecdotes you could share has you crying yet again.

I've cried more times in the past 3 days than likely the entirety of last YEAR. And that's WITH my cat, and uncle, and family friend dying. Those all hurt, my uncle most of all, & I was real fucked up over it. But this? This was my Dad. Likely the person I'd have named 2nd closest to me in my life, second only to my sister. He wasn't perfect, but he did so much for me throughout my entire life. All he wanted was to raise us to be happy and independent. And he accomplished it, we're getting by without him, but we still wanted several more decades with him. He was only 57. We should've gotten several more decades with him.

But here we are now. Playing investigators to his life, digging into all his shit, trying to find documents and take inventory of all his things, and learning Many things about him in the process. In his lockbox of sensitive documents, like his SSN and birth certificate and all that stuff, we found an old letter. About a decade old now, written in my hand. Right at the very top, we found that he'd kept the letter I wrote to him telling him frankly about my struggles and the things I wanted him to do better. He kept it. He tried to take it to heart. He looked at it again, sometime more recently than all the rest of the documents. That was on top.

His love for us is evident everywhere. The pictures he has hanging up all over the place, majority of them with us in them. The old fathers day cards placed on display in his bedroom bookshelf. The gifts we gave him, even stupid little knick knacks, placed around his apartment with pride. I wish we'd taken more videos of him. I don't want to forget the sound of his voice. I don't want to forget his smell either, the smell of a Hug From Dad, but I still tossed that shirt into the wash even though it felt like saying yet another goodbye.

It's the suddenness that hurts the most, I think. We were planning on having him help me finally get my license this year. My final words to him, the last thing he would've seen from me, were messages asking up on whether he'd called his car insurance company to make sure there wouldn't be problems. I should've called him more. I don't know if I'm going to learn from this.

I cut my 2 weeks off early to have time to grieve and to work on things for the funeral and settling the estate. The last thing I'd wanna do right now is selling fucking bubble tea in a job I already decided to leave. So here I am without a job, though with potentially two life insurance policy payouts to come. Inheriting half his 401k. Inheriting couches, knickknacks, keepsakes, paintings, art pieces, maybe even his guitar and other furniture if we can figure out what to do about space (I don't have room for this furniture, I don't know if I even have room for the couches, but God do I want to keep so much of this furniture). It has me even considering keeping one of his guns, just one. A tiny little revolver, it sits so comfortably in my hand. I don't even want to use it for anything. I just want to have it, keep it stored in a drawer with its ammo kept separate. I don't like guns, but this is a part of him. He loved collecting guns. He was about as responsible with them as someone can be, keeping them locked in a lockbox and impressing upon his children the importance of gun safety (I've known the basic gun safety rules ever since I was a little kid. Of course, of course, of course.) It reminds me of him. It's horrifically easy to have a gun in Indiana. I apparently don't even need a permit to carry anymore. (I have no intention to ever carry this in public.)

It's all a cycle. Business, grief, thoughts about my future. Round and round, like the most nauseating carousel in existence. I don't know how I'm still so functional. My skills with compartmentalization have been my lifesaver.

And im just thinking about the story my dad's best friend shared today. About a friend of theirs who lost her father. She reached out after hearing about my dad to share his words with her: "it's okay to grieve, but don't make his death your life".

He explicitly referenced himself in this, saying if he were to die suddenly that he wouldn't want us to define ourselves by it. Grief is expected, but he wants us to be able to move on. He's always wanted us to establish ourselves and make ourselves happy. He wouldn't want to be a weight holding us back from that.

So every time I start to feel guilty for thinking about having nicer furniture or using his life insurance payout to fund the rest of my college, I remind myself of that. Thinking about the material isn't a bad thing. I'm only human. And in the end, he'd Want me to be thinking about it. He never intended to die, certainly not without warning like this, so he would've only encouraged me being pragmatic about it all.

He only ever wanted us to be happy. So I need to do what I can to live up to that.

I love him. I miss him already.

#speculation nation#negative/#this got really long on accident. but i think typing this out was really helpful for me.#getting the thoughts out. processing. the works.#nearly cried several times just from writing this.#...and honestly i might reference this again when i start seriously writing my eulogy.#things suck a Lot right now. and i really wish they were different.#feels like i picked a bad choice in a video game and am now seeing the Bad Ending or whatever#all i need to do is reload a previous save. it's all still there. perfectly preserved in my memories.#but... that's all gone. as suddenly and unfair as it is ive been thrust into a new chapter of my life so thoroughly.#it's not all bad though. he wasnt prepared for dying so it's been hell to prepare for him#we dont know if we'll even be able to get into his fucking iphone. stupid piece of shit.#but he had life insurance. he had a union job. and That comes with benefits#(something about a year's salary going to the family. aka half a year's salary to Me. and isnt That mind boggling.)#as much as it hurts im going to be realistic about it. im going to do what i need to finish my education.#and im going to use it as a springboard for finally becoming a 'proper adult'.#the kind who could own a nice kitchen fridge. one with an ice machine on the front of the door#and freezers in the drawers.#maybe then i could think about getting motorcyle lessons. not from my dad as i originally wanted#but i wanna keep the family biker spirit alive. i wanted it even before he died. and now i want it even more.#ive had so so many thoughts. it's only been 3 days. ive had to emotionally numb myself several times just to Get Through It.#everything is exacerbated. my mom wants to go to the funeral. we will have to fight her on this. my dad Hated her.#and i certainly dont fucking want her around either. not then. not when im talking about my dad.#(my dad. my Dad. i saw him die. i felt him cold. i do not regret it. it still hurts me.)#it's overwhelming. i loved him so fucking much. even with his flaws he was truly an amazing father.#i'll... shut up now. if you read this far. well. hug your loved ones a little tighter. you never know when youll lose them.

10 notes

·

View notes

Text

Worldwide Insurance Companies along with detailed information

Gathering a complete list of all insurance companies worldwide, along with detailed information about each, is a vast and complex task. The number of insurance companies globally is in the thousands, varying across regions and industries (life, health, property, casualty, etc.). Additionally, companies frequently merge, change names, or cease operations, which makes maintaining an up-to-date list…

#Allianz#Auto Insurance#AXA#Berkshire Hathaway#Business Insurance#Check for Discounts and Benefits#China Life Insurance#clarity of policy information#Credit Score#Critical Illness Insurance#customer experience#customer service#financial stability#Group Health Insurance#High ratings#Homeowners Insurance#Individual Health Insurance#insurance companies#Insurance company#insurance company&039;s#investment#Investment Performance#Life insurance#lower risk#MetLife#Monitor and Review#Munich Re#New York Life insurance#Northwestern Mutual#Pet Insurance

5 notes

·

View notes

Text

falls down

#mine#today was day 2 of job and it seems like a really good deal...the benefits are CRAZY#depending on the healthcare plan i pick i could literally pay $0 a month as my premium#great day to be single with no kids <3#and the PTO is great and they have short term disability insurance which seems like a great option for when i get hysto#other benefits are all awesome and i know theres upward mobility which is really big for me#theres a part of me thats like...well...what if i did this job for a while...got my hysto next year...#saved up...got promoted...#then at some point move out...i was eyeing REDACTED CITY IN MY STATE#as a place to live especially post promotion (assuming i would get one) when i have more $$...#just a good way to sort of start my real adult life and all#but then i have an interview next week with a umm. i think it was a community college#over in another part of the state and then i got an email from a DIFFERENT cc#idk if we can interview because of schedule stuff we'll see. but that job pays GREAT money especially for my age#so im like ummm!!! hello...but i'm also not sure about the location...#i would definitely interview at least once just to get a feel for it#but im like arrrghhhh so much uncertainty...#raaaaggghhh#i've spent all summer saying i just want to skip ahead to the part where i have the job im sticking with#and everything is settled and nice#and it seems we're getting closer to that point but as we get closer i get more and more nervous#URRGH

2 notes

·

View notes

Note

Happy early birthday! I hope you’ll have a great few days and get to celebrate with something fun 💕

Thank you! My local movie theater is doing a Studio Ghibli weekend, so I’m going to go see at least Howl’s Moving Castle. Other than that, I’m mostly going to be cleaning my apartment because my whole family is descending in two weeks for my retirement ceremony.

#everything in my life is all about this retirement#I apologize to all the people around me because it’s the first thing out of my mouth in nearly every conversation#14 days left in the Navy#and then I get a decent pension for the rest of my life#it’s very weird to think about#I’m in the phase where it just seems fake#listen kids#there are good reasons to join the military#(and bad ones)#and it’s definitely not for everyone#but pensions are getting rarer and rarer#and the military is pretty much the only one that pays out young#someone who joined at 18 can start a pension at 38#I joined at 20 and will be getting a pension starting at 41#hopefully for the next 50+ years#also free healthcare while in the service#huge benefit#I’m probably most nervous about dealing with that once I get out#because I’ve never really had to do anything with insurance#ok this got very rambly and off topic#thank you!

3 notes

·

View notes

Text

i'm so fucking tired

#job hunting juggling various interviews & dreading committing to anything bc i'm not passionate about any of these positions#and yet i really really really need money so if a part time gig hires me i will Have to quit if i hear from a full time afterwards#& i WILL feel guilty abt it even though i have no respect for any of the part time jobs i applied to bc theyre all seasonal retail#AND. to make matters worse & me more stressed.#due to Life Things i got shunted onto a new insurance so i have to change everything over to the new system & figure all that out#& i can't keep seeing my amazing doc & i'm sad bc i wanted to get a referral from her for a top surgeon after i got the job thing sorted ou#so now i have to set up a new doc & transfer my records & hope the new one will fill my scrips bc she cant see me irl till february#& i was supposed to start meds for my newly diagnosed adhd last week but that's stuck somewhere in insurance limbo & idk when i'll get it#and if i get a job with benefits i have to do all this insurance shit AGAIN and i'm so stressed about the possibility of that#idk. manifest a good easy job with good benefits that i can tolerate if not enjoy for me or whatever.#hurgle hurgle

3 notes

·

View notes

Text

Not just related to Michigan, as every state must do reviews.

“In just two months, a bureaucratic review will begin that experts say could cost hundreds of thousands of low-income Michiganders their health insurance — and threaten nonprofit clinics that treat more than 400,000 Medicaid patients across the state.

Beginning April 1, more than 3 million Michigan Medicaid clients will have to prove they are eligible for benefits extended since 2020 under a federal health emergency that barred states from removing anyone from Medicaid during the COVID-19 pandemic. Michigan’s Medicaid ranks grew by more than 700,000 since the pandemic hit.

Federal estimates calculate up to 15 million U.S. Medicaid enrollees could lose coverage during the benefits review, including 6.8 million people who could be booted from the rolls despite being eligible.”

#my post#medicaid#government insurance#spoonies#michigan news#articles#disability benefits#life of a spoonie#disability rights#disability issues#social issues

13 notes

·

View notes

Text

so fucking heartbroken that my next therapy appt isnt till the 30th

#i hate the holidays i hate them i hate them i hate them#i need to talk to her!!!!#shes literally the only person in all this who gets it + is in my corner#i need her advice or support or just. to talk to her and have her understand#id try to book a last minute phone appt or smth if i could afford it#as it is im already abt to max out my insurance coverage w the appt on the 30th#actually i dont even think my remaining balance will cover it#which is. fun. considering the whole reason im wishing i could book another appt#is to talk abt how my insurance is refusing to extend my std benefits 🙃🙃🙃 meaning im not getting oaid 🙃🙃🙃#merry fucking christmas to me i guess#peace and love on planet earth unless youre suicidally depressed and severely traumatized to the point of being unable to work#then you can get fucked#but whatever yknow#whatever#ill continue to beg n jump thru hoops#ill continue to try to get ppl to believe me#same way i have been my entire life#remember kids: the system doesnt actually want to help you#the system wants you working or it wants you dead#lol soz said i was better. guess im not!#still filled w rage#i should take more melatonin#at least i can sleep

5 notes

·

View notes

Text

Welcome to Canada Life Benefit, where protecting lives and securing futures is at the heart of everything we do. As a premier provider of Life Insurance Brokerage, we are dedicated to helping individuals and families navigate the uncertainties of life with confidence and peace of mind.

2 notes

·

View notes

Text

Just enrolled for insurance for the new year and ughhhh

#chit chat#work stuff#my raise means nothing in the face of insurance costs#tbf it was a 25 cent raise so like. it meant nothing anyway. but still#i do have life insurance this year tho so if i get hit by one of the assholes that fly through the parking lot while i lift forks#well. i won't benefit but i know someone who will.#lmao#death mention in tags

3 notes

·

View notes

Text

Today's List of Nice Things:

My client and I listened to a LOT of Skald today. So good.

Speaking of, he's been swimming at the gym every day since we went on Monday, and HE GOT A FULL NIGHT OF SLEEP AND WAS READY TO WORK TODAY. HOLY SHIT.

Got to finally release two original projects today. I'm exhausted, but happy.

Hacks making me feel all the feels today.

#listen#if you have health insurance of any kind#call them up and find out if gym membership is a covered benefit#it just might change your life having free access to a swimming pool#this has been a PSA#who is forlornmelody?#brain hygiene

3 notes

·

View notes