#Labour Insurance

Explore tagged Tumblr posts

Text

How to Improve Employee Safety and Reduce Labour Insurance Costs

Employee safety is a top priority for any organization, not only because it’s morally and legally necessary, but also because it has a significant impact on financial factors like labor insurance costs. High workplace safety standards lead to fewer accidents and injuries, reducing the need for labor insurance claims, which in turn can lower premiums over time. Here are several strategies that organizations can adopt to enhance employee safety and lower labor insurance expenses.

1. Develop a Robust Safety Culture

Creating a workplace culture where safety is prioritized requires commitment from top management down to every employee. Leadership should demonstrate a consistent commitment to safety through their actions and policies. Establishing a safety-first mindset encourages employees to be vigilant and proactive, reducing the likelihood of accidents. Safety culture can be promoted by:

Regular Safety Meetings: Conduct weekly or monthly meetings to discuss safety issues and review accident reports. Encourage employees to share safety concerns and suggestions.

Open Communication Channels: Employees should feel comfortable reporting hazards or near-miss incidents without fear of retribution. This open dialogue helps organizations address issues early.

A strong safety culture reduces workplace hazards, leading to fewer incidents and lowering insurance costs.

2. Implement Comprehensive Training Programs

Training employees on safe practices and protocols is fundamental to preventing accidents. A one-time training session is not enough; continuous education keeps safety at the forefront. Effective safety training programs should include:

Initial Safety Orientation: All new employees should undergo a safety orientation covering general workplace safety guidelines and specific hazards related to their roles.

On-the-Job Training: Supervisors should monitor employees' tasks and provide hands-on training to ensure they understand safe operating procedures.

Ongoing Safety Workshops: Regular workshops covering topics like ergonomics, equipment handling, and emergency procedures help reinforce safe behaviors.

By investing in training, companies can prevent injuries, ensuring lower claim rates and insurance premiums.

3. Conduct Regular Safety Audits and Risk Assessments

Performing routine safety audits and risk assessments helps identify potential hazards before they lead to incidents. Safety audits review compliance with safety regulations, while risk assessments focus on identifying potential hazards specific to each job role. Key steps include:

Routine Inspections: Conduct inspections to check machinery, workstations, and safety equipment. Ensure that fire exits are clear, ventilation is adequate, and emergency equipment is accessible.

Hazard Identification: Use a risk assessment framework to identify and rank hazards. The highest-ranked hazards should be addressed immediately to minimize risk.

Corrective Actions: Document and promptly implement corrective actions for any hazards identified during inspections.

This proactive approach prevents workplace injuries, keeping insurance claims low.

4. Invest in Safety Equipment and Technology

Proper safety equipment and technology can significantly reduce accident rates. In industries with high physical demands or machinery usage, equipment like gloves, goggles, harnesses, and helmets is essential. Additionally, technological solutions can be a powerful asset for safety:

Wearable Safety Technology: Devices that monitor workers' vital signs and alert supervisors if conditions become unsafe can prevent injuries in high-risk environments.

Automation and Robotics: Automation can be implemented for hazardous tasks, minimizing the exposure of employees to dangerous situations.

Safety Management Software: Software can streamline incident reporting, track safety training, and manage audits and compliance, providing a centralized safety database.

Investing in safety equipment and technology reduces the risk of accidents, thereby lowering the frequency and cost of claims.

5. Emphasize Ergonomics and Employee Wellness

Ergonomics is essential for preventing injuries, particularly musculoskeletal disorders caused by repetitive tasks or poor posture. Implementing ergonomic practices includes:

Ergonomic Workstations: Adjust workstations and tools to reduce strain on employees’ bodies. For example, office workers benefit from adjustable chairs and desks, while manual laborers need tools designed to reduce strain.

Regular Breaks: Encourage employees to take short breaks to stretch and relieve muscle tension.

Wellness Programs: Wellness programs that promote physical fitness, stress management, and proper nutrition contribute to overall health and reduce the likelihood of injuries.

Prioritizing ergonomics and wellness leads to healthier employees and reduces the frequency of injury claims, contributing to lower insurance premiums.

6. Develop an Emergency Response Plan

Having a clear emergency response plan is essential to prevent small incidents from becoming major accidents. The plan should cover how to respond to fires, chemical spills, or medical emergencies, and should include:

Clear Evacuation Procedures: Ensure all employees know evacuation routes and assembly points.

First Aid Training: Train employees on basic first aid and CPR so they can respond quickly to emergencies.

Regular Drills: Conduct fire drills and other emergency simulations to help employees react calmly under pressure.

A well-implemented emergency plan minimizes the impact of emergencies, helping avoid costly claims and keeping labor insurance costs low.

7. Monitor and Review Safety Performance

Finally, organizations should continuously monitor and review safety performance. Key performance indicators (KPIs) for safety, such as the number of incidents, near-miss reports, and time lost due to injury, can help assess the effectiveness of safety measures. Regular reviews enable adjustments to safety protocols and training programs.

By monitoring safety performance, organizations can refine their approach to safety management, achieving long-term reductions in accidents and insurance expenses.

Conclusion

Investing in employee safety is both a moral obligation and a strategic financial decision. By fostering a strong safety culture, conducting regular training and audits, investing in equipment and technology, and implementing ergonomic practices, companies can protect their employees while keeping Labour Insurance costs manageable. In the long term, a safe workplace translates to higher employee morale, productivity, and profitability, making it a win-win for everyone involved.

0 notes

Text

The New Democratic Party and a group of labour unions are calling on the federal government to change Canada’s employment insurance rules so that new parents, especially new mothers, are not denied regular EI benefits if they get laid off. In a letter sent Thursday to Randy Boissonault, Canada’s employment minister, and NDP MP Daniel Blaikie, along with the Canadian Labour Congress, Unifor and the Canadian Union of Public Employees, are demanding an end to “gender discrimination” in the program. A copy of the letter shared with Global News stated: “Under the current EI Act, special and regular benefits can be combined up to a 50-week maximum. Using qualifying hours for regular benefits reduces what you can claim in maternity and parental benefits, and vice-versa. “This means that women who have a baby and access maternity benefits lose their protection in the event of a lay-off,” the letter to Boissonnault reads.

Continue Reading

Tagging @politicsofcanada

#cdnpoli#canada#canadian politics#canadian news#labour unions#NDP#employment insurance#gender discrimination#parental leave#layoffs

82 notes

·

View notes

Text

#wes streeting#uk politics#ukpol#uk labour party#private medical#private healthcare#private health insurance#bribes#good law project

4 notes

·

View notes

Video

tumblr

LBC | US Senator BernieSanders warns the UK against America’s private healthcare model.

#politics#the left#bernie sanders#Healthcare#health insurance#capitalism#economic inequality#UK#labour#NHS#medicare for all#single payer#video

55 notes

·

View notes

Text

Currently doing some proper looking for highschool completion that would actually work for me, and so far we haven't found anything at all. We've gone through 5 websites they're either not offering the courses I need, don't run during hours when I'm awake, or aren't in my city. Starting to look for highschool equivalency courses to see if I'll have better luck, but I really don't know :(

#like what am i supposed to do if i cant finish school???#i cant do manual labour. i cant be on my feet for more than like 10mins at a time. what jobs could i possibly do.#this is all very confusing and its looking like im not making the deadline for insurance coverage anyway which is. not good.#batty blogging#text

3 notes

·

View notes

Photo

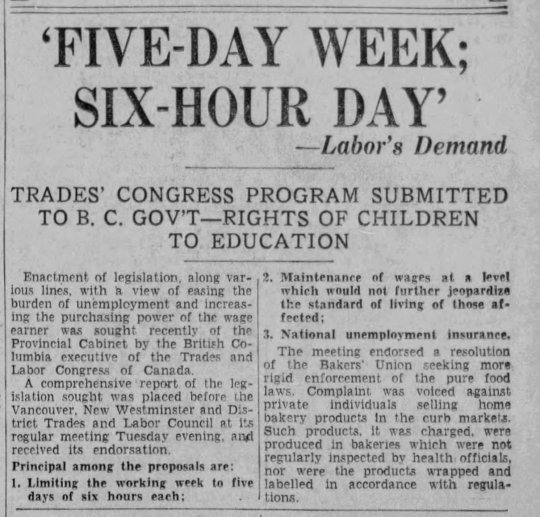

“FIVE-DAY WEEK; SIX-HOUR DAY’ - Labor’s Demand,” Vancouver Sun. February 22, 1933. Page 18. ---- TRADES' CONGRESS PROGRAM SUBMITTED TO B. C. GOV'T - RIGHTS OF CHILDREN TO EDUCATION ---- Enactment of legislation, along various lines, with a view of easing the burden of unemployment and increasing the purchasing power of the wage earner was sought recently by the Provincial Cabinet by the British Columbia executive of the Trades and Labor Congress of Canada.

A comprehensive report of the legislation sought was placed before the Vancouver, New Westminster and District Trades and Labor Council at its regular meeting Tuesday evening, and received its endorsation.

Principal among the proposals are:

Limiting the working week to five days of six hours each;

Maintenance of wages at a level which would not further jeopardize the standard of living of those affected;

National unemployment insurance.

The meeting endorsed a resolution of the Bakers' Union seeking more rigid enforcement of the pure food laws. Complaint, was voiced against private individuals selling home bakery products in the curb markets. Such products, it was charged, were produced in bakeries which were not regularly inspected by health officials, nor were the products wrapped and labelled in accordance with regulations.

#victoria#vancouver#trades and labor congress of canada#trade unions#labour demands#union demands#new westminster#vancouver trades and labor council#working week#working class politics#health inspections#bakers' union#unemployment insurance#great depression in canada#british columbia politics

2 notes

·

View notes

Text

Honestly, it’s almost worse from the sidelines - we can’t alter it in any way and we have our own total arseholes to experience viscerally day to day but it’s not like we can ignore the possibility of the tangerine having the nuclear codes again.

#please I beg you all#vote blue#Labour are about to pretend they don’t know how to tax billionaires again#the SNP is falling apart (somewhat deservedly)#We’re having to cut programs left right and centre#they’re going to put up national insurance which will fuck everyone working for a small business#can you just not elect this monstrosity to the most powerful political office in the world so I can stop freaking out over TWO political#nightmares instead of just one?

105K notes

·

View notes

Text

Pub giant warns price of pint will go up 10p - and it's all Rachel Reeves' fault | UK | News News Buzz

One of the loudest cheers of the Autumn Budget from Rachel Reeves came from the announcement that the price of a pint was set to fall thanks to the freezing of alcohol duty, but that might not be the case. A major pub chain has warned that Labour’s national insurance hike could see the cost of a pint increase. Pub group Fullers has warned that the incoming national insurance contribution hikes…

#Fullers#Hospitality Sector#Labour#national insurance contributions.#National Insurance hikes#price rise#Rachel Reeves#The Chancellor#The-budget

0 notes

Text

Essential HR & Payroll Solutions: GOSI Compliance, Employee Benefits, and Contract Rules in UAE

For companies operating within Saudi Arabia and the UAE, efficient administration of payroll and HR is essential to ensure compliance with the local rules and regulations as well as effectively manage employee benefits. This guide provides the basis for the GOSI Compliance, HR payroll solutions as well as the regulations for contracts to help companies navigate the complexities of regulations and help their employees.

Understanding HR Payroll Management in Saudi Arabia & UAE

Effective payroll management system does more than processing salary payments; it also helps ensure the compliance of local laws, improves benefits administration, and enhances overall efficiency. Businesses operating in Saudi Arabia and the UAE are faced with unique challenges when it comes to payroll. These range from figuring out the GOSI system in Saudi Arabia to managing benefits for employees in the absence of limitless contracts for the UAE.

Key Components of Payroll Management Software

Employing payroll software for managing payroll has numerous benefits especially for companies with a variety of employees and complicated needs for payroll. Here are a few key aspects to be looking for:

Automatic Payroll Processing Automating payroll will help to reduce errors, speed up the process and increase accuracy.

Monitoring Compliance is a way to verify compliance with local laws governing labor, like GOSI, which is a requirement in Saudi as well as UAE contract regulations.

Self-Service Portals for Employees allows employees to check their pay details, benefits, as well as leave balances quickly.

Integration with other HR Systems seamless integration with HR systems to automate processes like leave and attendance tracking.

GOSI Compliance in Saudi Arabia

The General Organization for Social Insurance (GOSI) is the social insurance system that is mandatory for Saudi Arabia, covering various benefits for employees including disability and retirement. The compliance with GOSI is vital for all companies operating within the Kingdom.

What is GOSI?

GOSI offers social insurance benefits to Saudi citizens as well as expats who work for private companies. Employers and employees also contribute to GOSI which helps with the retirement benefits, workplace hazards as well as disability and retirement benefits.

Employer's Contribution Employers must contribute 12 percent of the salary of the employee to GOSI in Saudi.

employee contribution Employees can also contribute 10 percent of their wages to GOSI.

The reporting requirement Companies must be able to accurately pay their employees to GOSI each month to ensure that they are in compliance.

Importance of GOSI Compliance

For businesses in Saudi Arabia, maintaining GOSI compliance is not only an obligation of law but crucial to create an environment that is positive for employees.

Avoiding penalties Infractions to GOSI rules can result in sanctions and legal consequences.

Benefits for Employees: GOSI compliance ensures employees are provided with insurance and retirement benefits which improve job satisfaction.

Reputation Management Compliance with GOSI shows that your company is committed to ensuring the security of your employees as well as establishing a positive company image.

HR Payroll Management in the UAE: Limited and Unlimited Contracts

In the UAE the employment contracts are classified by their terms as only and unlimited and have distinct rules for each kind. Understanding these distinctions is essential for companies, particularly when it comes to the calculation of benefits at the end of the service and coordinating the payroll.

Limited Contracts

The limit contract with the UAE is generally a fixed-term contract, with a term of one to three years. It is terminated automatically at the expiration date unless it is renewed.

The End-of-Service Benefits Employees who have contracts with a limited duration can receive a gratuity contingent on the duration of their service.

End of Contract Rules A termination that occurs prior to the expiration date of the contract could result in penalties unless the parties have mutually agreed on.

Renewal Limits and Renewal Renewal Contracts with limited terms can be renewed, however they have stricter rules for renewal and termination.

Unlimited Contracts

A Unlimited contract with the UAE doesn't have an end date fixed and can be ended by either party upon giving notice.

Flexible termination Employers and employees are able to terminate an unlimited contract at any time with notice, which makes this contract flexible.

Gratuity Rights The employees have the right to receive a gratuity in accordance with the number of years they have worked since their termination.

is a common choice for roles that last a long time Unlimited contracts are typically utilized for long-term and indefinite tasks, making them an increasingly popular option for permanent jobs.

Using Payroll Management Software for Compliance and Efficiency

Installing payroll management software will simplify the complicated demands for payroll for Saudi Arabia and the UAE. Here's how:

Automated Compliance Management

Payroll software helps with compliance by staying up-to-date on rules and regulations like GOSI, which is a part of Saudi Arabia and UAE regulations on employment.

Automated Calculation of Contributions It ensures the accuracy of GOSI and employee contributions to employers as well as employees working in Saudi Arabia.

Calculation of the Contract-Specific Gratification Calculates gratuities according to the conditions of limited contracts in the UAE.

Reduces the risk of errors made by manual Automating reduces the possibility of mistakes while ensuring that payroll processing is accurate.

Efficient Employee Benefits Management

The management of the benefits of employees through payroll software enables the administration of benefits to be simplified and improves employee satisfaction and efficiency of HR.

Self-Service Portals for Employees Employees have the ability to see their benefits, balances on leave and pay slips, increasing the transparency of their benefits.

Benefits packages that can be customized Payroll software allows you to handle a variety of benefits for employees including retirement and health insurance.

The Leave Management: Monitors annual absences, sick days, and other absences in order to calculate entitlements with precision.

Ideal for Small Businesses

For payroll firms that cater to small businesses employing tools for managing payroll is crucial to manage benefits and payroll with a limited amount of resources.

Cost-effective Many payroll software choices are designed to be accessible to small-sized companies.

Scalability as the business grows, payroll software is able to be adapted to handle a larger number of employees and the more complicated payroll requirements.

Time-Saving Automates tedious tasks. This frees HR resources to concentrate upon strategic projects.

Employee Benefits in Saudi Arabia & UAE

The provision of extensive employees with a wide range of benefits is essential for employers to keep and attract top talent from Saudi Arabia and the UAE. Here's a list of the most common benefits that are offered:

Health Insurance

Insurance for health is a compulsory obligation to be covered in Saudi Arabia and the UAE, with employers required to offer coverage to their employees.

Saudi The requirement Employers must provide healthcare insurance coverage to employees as well as their families.

UAE Requirements Health insurance is compulsory in all UAE residents. Employers generally cover dependent and employee insurance.

End-of-Service Gratuity

The end-of-service bonus is an important incentive for employees who work in UAE in the UAE and Saudi Arabia, calculated based on the length of their employment.

UAE Gratuity In the case of gratuity entitlements, they differ depending on the type of contract, whether unlimited or limited..

Saudi Gratuity Like similar to UAE, Saudi Arabia mandates gratuity payments to employees upon the completion of at two years of employment.

Leave Entitlements

Each country has its own specific regulations for annual leave,maternity leave and sick leave law. They must be effectively managed by payroll systems.

annual leave Employees have the right to at least 21 days of annual paid time off in the UAE.

sick leave The two countries Saudi Arabia and the UAE provide sick leave paid with specific limitations dependent on the length of employment.

Maternity Leave Employers are obliged to offer Maternity leaves in each country, generally between 45 and 90 days.

Insuring compliance with Payroll and Benefits regulations

For businesses operating in Saudi Arabia and the UAE and the UAE, compliance with requirements for benefits and payroll is vital to avoid penalties and create a positive work environment.

Best Practices for Compliance

Stay Up-to-date Review and update policies in order to be in sync with changes to GOSI laws in Saudi Arabia and UAE labor laws.

Install Payroll Software Make sure you invest in dependable HR payroll software to handle payroll and benefits as well as compliance easily.

Inform employees Keep employees updated about their rights and benefits as well as ensuring transparency and confidence.

Conclusion

Controlling the payroll process, GOSI compliance and employee benefits, managing employee benefits, GOSI compliance, and payroll Saudi Arabia and the UAE requires a deep knowledge of local regulations as well as effective HR strategies. With the help of complete payroll management tools and staying current in terms of contract rules, businesses can simplify their operations and increase satisfaction of employees. Utilizing technology, like the HR payroll management software provided by OPS helps to be compliant and help the workforce efficiently, which is essential to the long-term success of these ever-changing markets.

OPS offers customized solutions to help companies operating in Saudi Arabia and the UAE adhere to the highest standards of compliance while offering the most efficient tools to manage the benefits of employees and payroll.

#best payroll company for small business#payroll outsourcing for midsize business#payroll management system software#payroll services for midsize business#payroll training#payroll outsourcing for small business#payroll companies for small business#payroll management software#dubai minimum wage#dubai labor law#payroll services#outsourcing company in uae#uae it outsourcing support#payroll providers uae#managed payroll services#hrms payroll software#best payroll company for large business#payroll service provider for large business#minimum wage in dubai#labor in dubai#uae labour law leave salary#labour law sick leave uae#dubai labour insurance last date#uae labour law working hours#unlimited contract uae#limited contract in uae#uae limited contract#gosi in saudi arabia#wage protection system#hr and payroll

0 notes

Text

I AM NOT AMUUUUuuuuuuuusssseeeed!!!! *Irene the union imp goes hurtling over the horizon*

me: if I become the evil overlord I will never harm my minions

[5 years later]

highly throwable imp: hoohoohee

me: hmm

195K notes

·

View notes

Text

PM did not rule out an NI increase for employers

#employers’ NI#Keir Starmer#Labour budget 2024#National Insurance#October 30 budget#Rachel Reeves#tax increase#UK economy

0 notes

Text

youtube

The Workman Compensation Policy, also known as the Employer’s Liability Insurance, is designed to provide financial protection to employers against liabilities arising from workplace injuries, occupational diseases, or death of their employees. Coverage for medical expenses, disability benefits, and legal costs is offered, ensuring that employees receive timely compensation and support in case of work-related accidents or illnesses. The policy is considered essential for businesses to comply with legal requirements and to demonstrate their commitment to the well-being of their workforce.

#pa#gpa#papolicy#personalaccidentalpolicy#personalaccidental#accidentpolicy#death#life#protectioncover#protection#familyprotection#gpapolicy#accident#individualaccidentalpolicy#labourinsruance#labourinsruancepolicy#staffpolicy#labour#staff#accidentalbenefit#benefits#beemawala#ibeemaglobal#shanuAhluwalia#awareness#spreadinginsuranceAwareness#insurance#insuranceagent#insurancepolicy#insurancebroker

1 note

·

View note

Text

Arbitration lawyers in UAE:-

Mayed Advocates & Legal Consultants offers a wide range of legal services in the United Arab Emirates, including corporate law, real estate law, family law, and more. With a team of experienced lawyers, the firm provides expert legal advice and representation to individuals and businesses. https://mayedadv.ae/en/arbitration/

#Commercial law firms Dubai#New commercial law UAE#Dubai employment law#Insurance law in UAE#Insurance lawyer Dubai#Arbitration lawyers in UAE#Family lawyers UAE#Civil lawyer Dubai#Labour lawyer Dubai#Maritime law UAE

0 notes

Text

A real ad I was shown today online

#A real ad I was shown today online#advertisements#advertising#rp advert#roleplay advert#marketing#rent is theft#rent is too damn high#landlords are parasites#landlords are leeches#landlords are scum#landlords are bastards#landlords are the worst#landlord insurance#fuck landlords#landlords#landlord#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#fuck labour

1 note

·

View note

Text

The law is the first in Europe — and the world — to provide sex workers with social security provisions such as pensions and maternity leave, as well as an official employment contract. When Emily first heard about Belgium's decision to create Europe's first labour law for sex workers in Europe, she was excited that her working conditions would finally improve. "In this way, we will get a wider choice of safe places where we can offer our services in a self-determined way because, at the moment, that's not really the case," Emily, who lives in a major city in Belgium, told Euronews. An independent sex worker for three years, Emily (name changed to protect her identity) has personally experienced the lack of support for sex workers during the COVID-19 pandemic, where many lost their income yet were ineligible for government support as their sector did not officially exist. She and others are hoping this will change with the introduction of Europe's — and the world's — first labour law for sex workers in Belgium. What does the new law mean in practice? The legislation, which was approved unanimously with 93 votes in favour and 0 votes against earlier this month, allows procurers to provide Belgian sex workers with an employment contract for the first time. The change gives sex workers access to social security provisions such as pensions, health insurance and annual vacation. It also gives sex workers protection from work-related risks, including implementing standards on who can become an employer.

continue reading

Good! I hope it works well and is rolled out across Europe.

0 notes

Text

Workmen's Compensation Insurance

Some of the benefits of the Workmen’s Compensation Insurance include:

Financial Protection.

Employer insurance coverage

Partial salary repayment and coverage of medical costs.

Recipients Waive the Right to Sue

#svn financial hub#insurancepolicy#Workmen's Compensation Insurance#https://svnfinancialhub.in/labour-insurance/

0 notes