#Keynesian Economics

Explore tagged Tumblr posts

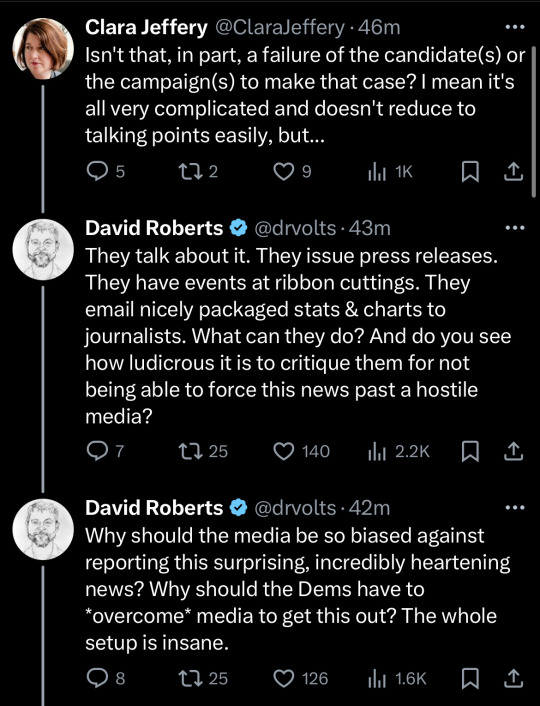

Text

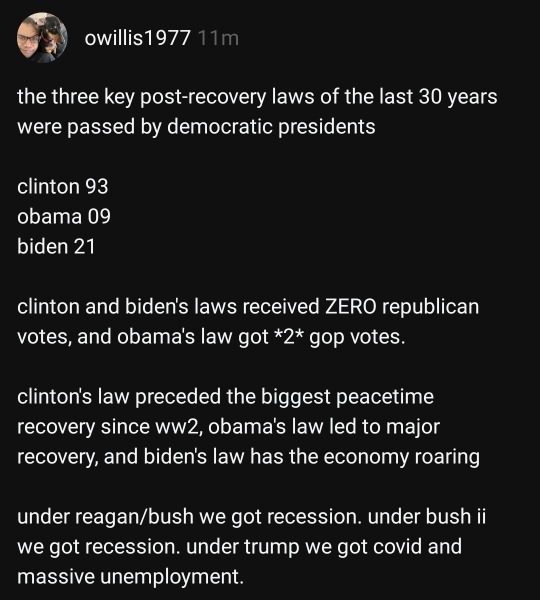

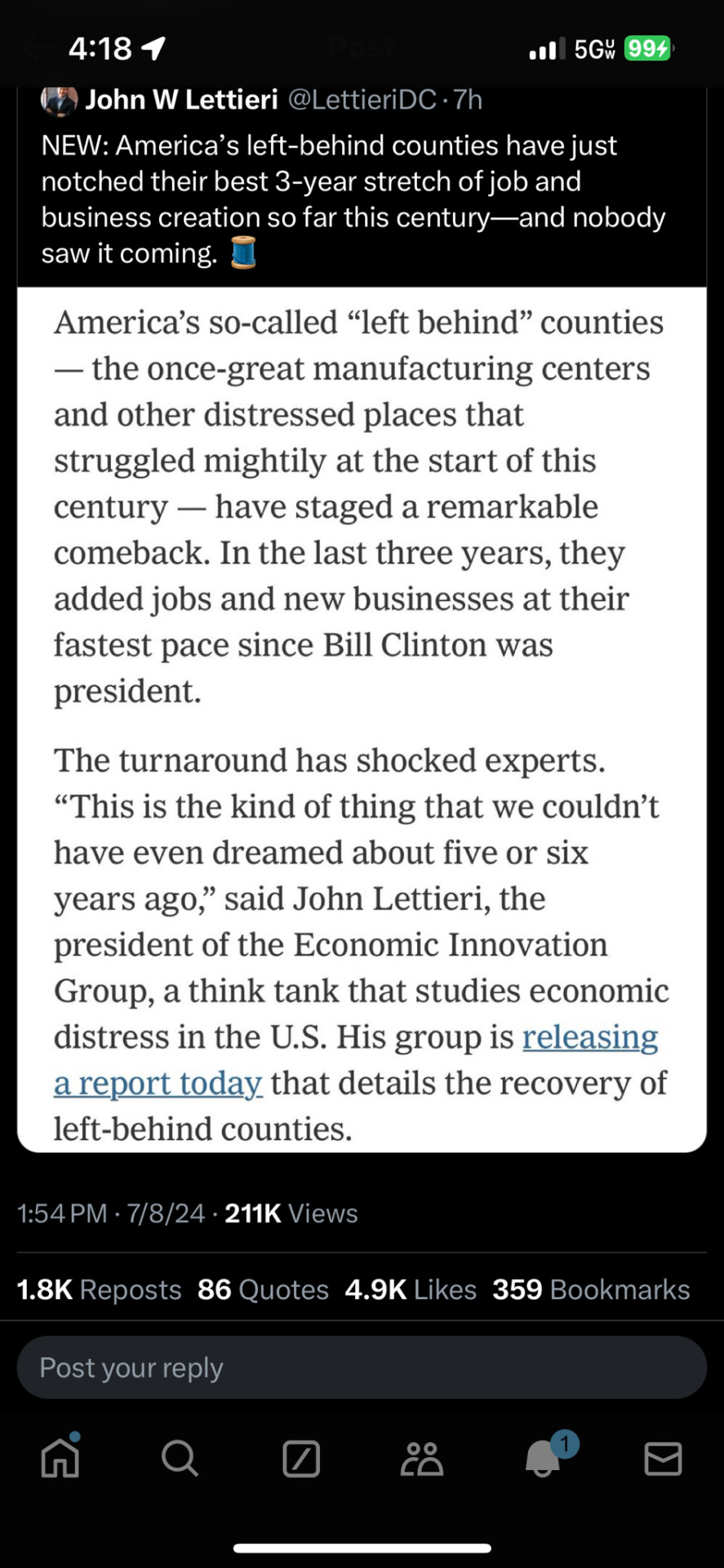

Government stimulus works.

Democratic policies work.

Republican supply side economics, their tax cuts, and their trickle down are all MASASIVE FAILURES. We have the proof.

Never forget, all the Democratic recovery plans and policies had zero Republican support and they all saved America. Not only that, Republicans predicted the recovery plans would not work.

Three strikes! Republicans caused the economic crisis, Republicans predicted the stimulus would not work, then they voted against the stimulus.

717 notes

·

View notes

Photo

#funny#funny meme#meme#humor#dark humor#office humor#Accounting#Consulting#Business#Funny memes#Excel#Economics#Keynesian Economics#Austrian Economics#Finance

1K notes

·

View notes

Text

#meme#memes#shitpost#shitposting#humor#funny#lol#satire#funny memes#funny humor#funny meme#comedy#economics#keynesian economics#statism#politics#irony#joke#parody

31 notes

·

View notes

Text

Economic statistics should be taken critically as the shaky constructions they are, but they do tell you something. Industrial policy has made its worldwide comeback within an equally worldwide exhaustion of the global economic system, the slow-motion expiration of the US-based configuration of capitalism inaugurated at the close of the Second World War. On the surface, Bidenomics seems to represent a decisive break with neoliberal dogma, and so it is in some respects; but more fundamentally, it is smoothly continuous with the deeper trend, starting in the 1940s, of fading growth prospects and rising state involvement in the private economy. If anything, it is an intensification of this trend. Its official adoption represents the belated recognition by “policymakers” that still greater state action is needed to sustain the already meager growth rates of the national economy, crushed beneath the dead weight of an expiring system.

21 notes

·

View notes

Text

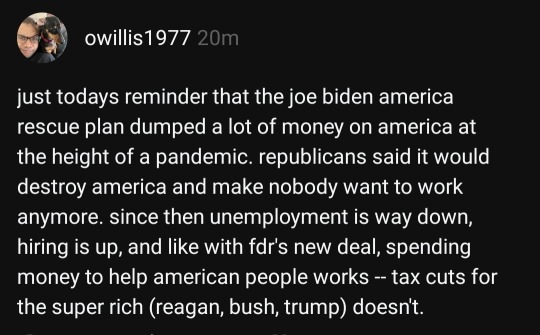

For Dell’s Billionaire CEO, Taxing the Ultra-Rich is a Joke

6 notes

·

View notes

Text

@dysfucktional-queer Also notable how Republicans just abandoned Keynesian economics, not because of some financial disaster that occurred because of using Keynesian economics. Republicans just decided it didn't work, mostly to excuse refusing to pass more stimulus and therefore deny Obama a win. But now its Republican orthodoxy that Keynesian economics doesn't work with no evidence to back up that assertion.

68K notes

·

View notes

Text

youtube

Gold and Silver have always been safe-haven assets, but with The Great Financial Reset, Are You Prepared? In this video, we break down the Deagle Report, the decline of purchasing power, and the battle between Austrian and Keynesian economics. Learn how to protect your wealth, escape the failing system, and navigate economic uncertainty.

#american politics#america news#news#usa politics#Financial Reset#Keynesian economics#silver coins#us news#youtube#united states#gold#currency#austrian economics#austrian politics#investing#Youtube

1 note

·

View note

Text

“When the facts change, I change my mind."

John Maynard Keynes (1883-1946) is one of the most influential economists of modern times. Educated at Cambridge University, he returned to teach at, and become a fellow of, Kings College, Cambridge. In 1915 Keynes joined the UK Treasury and acted as an advisor to government for many years.

The General Theory of Employment, Interest, and Money: John Maynard Keynes is best known for his seminal work, "The General Theory of Employment, Interest, and Money" (1936), which laid the foundation for modern macroeconomics and introduced concepts such as aggregate demand and the importance of government intervention in the economy.

Role in the Bretton Woods Conference: Keynes played a significant role in the Bretton Woods Conference in 1944, which led to the establishment of the International Monetary Fund (IMF) and the World Bank, aiming to stabilize the global economy post-World War II.

Keynesian Economics: Keynesian economics advocates for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of depression. This theory became particularly influential during and after the Great Depression.

Advisor to the UK Government: Throughout his career, Keynes served as an economic advisor to the British government, especially during World War I and the Great Depression, helping to shape economic policy and wartime financing.

Cambridge Apostle: During his time at Cambridge University, Keynes was a member of the Cambridge Apostles, an intellectual secret society. This group included many prominent thinkers and had a significant influence on Keynes's intellectual development.

#John Maynard Keynes#Keynesian economics#Cambridge University#Kings College Cambridge#Influential economist#Macroeconomics#UK Treasury#Government advisor#The General Theory of Employment#Interest and Money#Economic policy#Fiscal policy#Keynesian Revolution#Aggregate demand#Employment theory#Depression economics#20th-century economics#Economic intervention#Keynesianism#British economist#Public spending#quoteoftheday#today on tumblr

0 notes

Photo

#Accounting#Consulting#Business#Humor#Funny#Funny meme#Funny memes#Dark Humor#Office Humor#Excel#Economics#Keynesian Economics#Austrian Economics#Finance#meme

1K notes

·

View notes

Text

Biden implemented a stimulus package and the economy grew. LIKE IT HAS EVERY TIME THIS HAS HAPPENED. The only reason people "forget" that this is how the economy works is because of Mitch "Make Obama a 1 Term President" McConnel has been shrieking that "stimulus packages don't work!" for the last 16 years because a stimulus package under Obama would have fixed the economy faster and insured his reelection. Therefore it became Republican orthodoxy to post-facto justify their position to hurt Obama by hurting the economy. And when it becomes Republican orthodoxy, it just becomes media orthodoxy by default. Ironically, Biden is so old that he could remember stimulus bills working.

29K notes

·

View notes

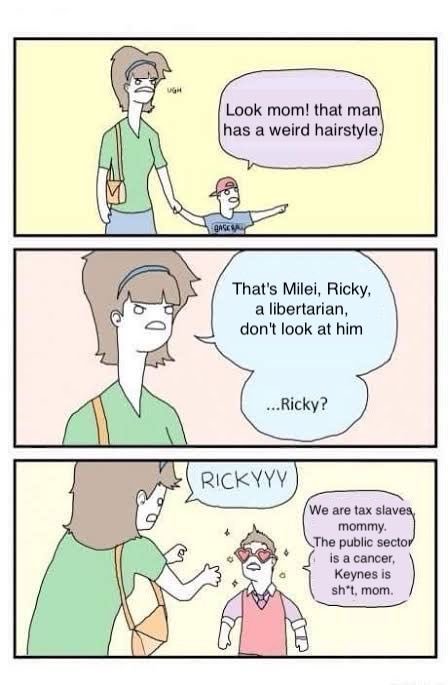

Text

#meme#memes#shitpost#shitposting#humor#funny#lol#funny memes#satire#funny humor#funny meme#facts#fact#javier milei#libertarian#la libertad avanza#viva la libertad carajo!#keynesian economics#politics#irony#joke#parody

8 notes

·

View notes

Text

Theories of the Philosophy of Macroeconomics

The philosophy of macroeconomics deals with the study of large-scale economic phenomena, such as aggregate output, employment, inflation, and economic growth. It seeks to understand the principles, assumptions, and implications of overall economic activity and the interactions between different sectors of the economy. Some key theories in the philosophy of macroeconomics include:

Classical Economics: Classical economics emphasizes the long-run equilibrium of the economy, where prices and wages adjust to ensure full employment and resource utilization. It stresses the importance of free markets, minimal government intervention, and the self-regulating nature of the economy.

Keynesian Economics: Keynesian economics, developed by John Maynard Keynes, focuses on short-run fluctuations in economic activity and the role of aggregate demand in determining output and employment. It advocates for government intervention through fiscal policy (such as government spending and taxation) and monetary policy (such as interest rate adjustments) to stabilize the economy and address unemployment during recessions.

Monetarism: Monetarism, associated with economists like Milton Friedman, emphasizes the role of monetary policy in influencing aggregate demand and economic outcomes. It argues that changes in the money supply directly impact inflation and economic growth, advocating for stable and predictable growth in the money supply to maintain price stability and promote long-term economic growth.

New Classical Economics: New classical economics incorporates microeconomic foundations into macroeconomic models and emphasizes the rational expectations hypothesis. It posits that individuals form expectations about future economic variables based on all available information, leading to self-correcting market outcomes and limited effectiveness of government policies.

New Keynesian Economics: New Keynesian economics builds on Keynesian principles but incorporates microeconomic foundations and imperfect competition into macroeconomic models. It emphasizes the role of nominal rigidities, such as sticky prices and wages, in explaining short-run fluctuations in economic activity and advocates for countercyclical policies to stabilize the economy.

Real Business Cycle Theory: Real business cycle theory attributes fluctuations in economic activity to exogenous shocks to productivity and technology. It argues that changes in real factors, such as productivity shocks, drive business cycles, while monetary and fiscal policy have limited effects on real economic outcomes.

Post-Keynesian Economics: Post-Keynesian economics extends Keynesian principles by emphasizing the role of uncertainty, financial instability, and institutional factors in shaping economic behavior. It critiques mainstream macroeconomic models for their simplifying assumptions and advocates for a more heterodox approach to macroeconomic analysis.

Modern Monetary Theory (MMT): Modern Monetary Theory challenges traditional views on fiscal policy and government finance, arguing that countries with sovereign currencies can issue fiat money to finance government spending without facing solvency constraints. It emphasizes the role of fiscal policy in achieving full employment and price stability, advocating for policies that prioritize job creation and public investment.

These theories and approaches in the philosophy of macroeconomics provide frameworks for understanding the determinants of aggregate economic activity, the role of government policy, and the dynamics of economic fluctuations and growth.

#philosophy#epistemology#knowledge#learning#chatgpt#education#ethics#psychology#economics#economic theory#theory#Classical economics#Keynesian economics#Monetarism#New classical economics#New Keynesian economics#Real business cycle theory#Post-Keynesian economics#Modern monetary theory (MMT)#macroeconomics

1 note

·

View note

Text

Biden unexpectedly becomes the best president in the last 3 decades (very low bar to be sure). Pro labor, pro infrastructure, pro middle class.

423 notes

·

View notes

Text

Escuela de Keynes

0 notes

Text

Preference for liquidity is important

J.M. Keynes wrote many interesting things in his book "The general theory" which were ignored or distorted by many other economists, and perhaps the most interesting is the concept of liquidity preference, which properly understood has quite important aspects.

The reason to me seems that the role of many economist is to praise those owning much capital, and one way is to claim that those owners are virtuous: by not spending their income or wealth, by abstaining from consumption, they provide savings to finance investment, and interest and profit are their reward, so the more reward they get the more they will provide savings to finance more investments.

But J.M. Keynes pointed out that unless it is physically hoarded somehow the money that people claim to "save" is always actually spent to buy some sort of investment: even just leaving them in the bank means investing those funds in a loan to the bank.

Therefore investors always spend their non-consumed money to purchase some kind of investment, and what matters a lot to them is its effect on the liquidity of their portfolio: they will prefer more liquid investments if their portfolio is already more illiquid than they wish, that is if they reckon that future investment purchases will yield more than present or past (already invested) opportunities.

So owners of much money don't virtuously sacrifice their consumption to save to finance enterprise, but rather switch from less liquid (and usually longer term) investment purchases for more liquid (and usually shorter term) ones.

Then there are two types of investment activities:

To buy assets low to sell them high, that is to speculate.

To buy inputs to production to produce and sell the outputs, that is to finance enterprise.

In general to finance production is less liquid than flipping assets, as production takes time and also often requires scale.

Therefore when the preference for liquidity increases far from financing enterprise "savers" switch massively to financing speculation. Such as the enormous government-supported speculation on housing rents and prices in the UK and the USA (and several other countries) where the vast majority (90-95%) of financing goes to mortgages (and trading stocks on margin).

#political economy#neoliberalism#property#john maynard keynes#keynesian economics#liquidity preference#liquidity#investment#speculation

0 notes

Text

KEYNESIAN ECONOMICS

The central tenet of this school of thought is that government intervention can stabilize the economy.

Circa 1930. John Maynard Keynes (British Economist) spearheaded this movement.

THE REVOLUTIONARY IDEA

Inadequate demand leads to prolonged periods of high unemployment. An economies output of goods and services is the sum of consumption, investment, government purchases and net exports. There are three tenets: 1. Aggregate demand is influenced by public and private economic decisions. Keynesian economics supports a mixed economy guided mainly by the private sector but partly operated by the government. 2. Prices, and especially wages, respond slowly to changes in supply and demand 3. Changes in aggregate demand, whether anticipated or unanticipated, have their greatest short-run effect on real output and employment, not on prices. Keynesians believe that, because prices are somewhat rigid, fluctuations in any component of spending—consumption, investment, or government expenditures—cause output to change. If government spending increases, for example, and all other spending components remain constant, then output will increase.

These are the findings of Keynes' books The general Theory of Employment, Interest and Money (1936), and Treatise on Money.

A key quote from his works was surrounding the argument that governments should solve problems in the short run rather than wait for market forces to fix things over the long run, because "In the long run we are all dead."

Post 1970's, many advanced economies suffered stagflation, a term many of my peers will be familiar with (in the years 2022-23, we have experienced one of the worst examples of this phenomenon thanks to the Russian-Ukraine war, cost of living crisis, mild market collapse following the event of NFT's and digital currency like bitcoin.) Keynesian economics had no response for stagflation, which gave an opportunity for Monetarism to gain popularity, as they doubted that governments had the fiscal responsibility, policy or ability to be able to regulate the business cycle.

"If you were going to turn to only one economist to understand the problems facing the economy, there is little doubt that the economist would be John Maynard Keynes. Although Keynes died more than a half-century ago, his diagnosis of recessions and depressions remains the foundation of modern macroeconomics. Keynes wrote, ‘Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slave of some defunct economist.’ In 2008, no defunct economist is more prominent than Keynes himself." Gregory Mankiw, (Harvard) New York Times, 2008

0 notes