#Financial Awareness

Explore tagged Tumblr posts

Text

My focus/theme for the year of 2025:

Less is More.

My desire is to focus on being grateful for what I have and trying to break my terrible habit of wanting more. No more window shopping online, no more visiting store sites for "fun", no more tossing something because it has a scratch on it. Unless it is unusable, it will be cherished and used until it can no longer serve its purpose.

This goes for most consumables and long-term purchases. I want to be more purposeful with my purchases - I want to buy things that are good quality and meant to last. I don't want to be persuaded to buy something because it is an "upgrade" to what I already own.

I also want to fix the items I have and learn to repair them instead of simply tossing them without attempting to find out why it isn't working first.

I want to learn to be grateful for the things I have. I want to be more aware of my spending habits and what I already own. I want to be less of a consumer, honestly. In a reasonable matter.

#2025#less is more#consumerism#consumer culture#consumer#grateful#mindful#mindfulness#mindful living#gratefulness#shopping#finances#financial awareness#awareness#self awareness#self improvement#self reflection#spending habits#financial habits#;; my 2025 goals#;; my 2025#my 2025#2025 goals#goals#life goals#human behaviour

7 notes

·

View notes

Text

Is Kennedy Funding a Scam? Unraveling the Claims

like you stumble upon something online that makes you raise an eyebrow, wondering if this is real? This happens to those of you who read the "Kennedy Funding ripoff report." The name Kennedy Funding has had its buzz going round on different forums, with some people wearing big smiles over the company and some. not so much.

So, who is Kennedy Funding?

Before getting into the details of the "Kennedy Funding scam report," it would be good to know what Kennedy Funding does. It is not a fly-by-night outfit. It is indeed a hard money lender. This company provides loans secured by real estate, especially for small commercial loan installments and land loans generally for projects shunned from consideration by traditional banks because they are at higher risks. With developing land, purchasing commercial property, or financing construction, Kennedy Funding can fill the gap when conventional banks won't. As with any financial institution, though, some people have walked away with complaints – and that's where the rip-off reports come in.

Unpacking the Allegations: Is There a Scam?

When you input the search terms "Kennedy Funding ripoff report," various claims appear. From feeling that one was not treated fairly by this company to individuals who argue that the company did not fulfill their claims, it is very easy to tell why many people might be wary of this company. However, let's get this straight: accusations don't equal guilt. In fact, financial organizations, in general, and hard money lenders, in particular are usually slandered. Not every loan goes well; given the huge amounts of money concerned, people lose their cool.

Here are some of the most popular criticisms against Kennedy Funding:

Loan Denials After Promises: Some borrowers claim they were led to believe that they would get their loan when, in fact, that loan gets denied at the last minute. It is frustrating if the borrower has sunk their resources thinking that the loan will go through. High Interest Rates: High interest rates are charged on hard money loans because of the amount of risk. Some customers were startled at how high that could be. Funding Took Too Long: Another, perhaps related, complaint is that a loan will take much longer than one would have expected or wanted for their funds to come through, thereby jeopardizing a project in some cases.

So, does this all add up to a ripoff? Not necessarily. Let's dig a little deeper.

High-Risk Lending = High Expectations

One thing everyone needs to know when doing business in hard money lending: it's a high-risk activity for both the lender and the borrower. Kennedy Funding often sees loans that traditional banks wouldn't touch with a ten-foot pole. That is to say, they are taking on higher risks which are reflected in interest and fees that they charge. Kennedy Funding can be a savior for the borrower who is in a tight spot and can't get financing through the old school route. However, like any high-risk transaction, always be prepared for the terms, which are not typically ideal. But it has helped thousands more customers bring in the funding that would otherwise have gone stale. Most remarkable, though, is the degree to which Kennedy Funding will customize-it's not a "just get me the money" service, for when a hundred deals go bad, so do a few of them. It's those that complain.

Reading the Fine Print

Now, let's get to something important: the fine print. Most of the complaints from Kennedy Funding seem to stem from miscommunication about what the loan entails. People expect a loan to come through faster or thought that the interest rate would be lower than average for a hard money loan. So, if you're thinking of engaging the services of Kennedy Funding, or any lender for that matter, make sure that you know what you are getting yourself into from the very beginning. Read the fine print, and never be afraid to ask questions. Make sure that you get all your answers straight from the horse's mouth. This will help you avoid a number of shocks in later stages.

What the Ripoff Reports Actually Say?

Much of what falls under the heading "Kennedy Funding ripoff report" appears to be by borrowers who had no clear understanding of what is involved in hard money lending. Such loans usually are made to people who cannot qualify for traditional loans, so the risks and costs are much more significant.

Ripoff reports tend to focus on

Shock Over Interest Rate: Borrowers who have no idea how high the hard money lending rates can be often become surprised when they see the final numbers. Miscommunication About Approval: Some people feel they were misguided to believe that their loan was a sure thing when, after all ready time is done, it has been denied. This one can feel as if you are being pulled out from under the rug. Long-Dragged-Out Timelines: Another peeve of many borrowers is that your loans take a lot longer to process than usual. Of course, in most cases, Kennedy Funding can't be blamed. Such a delay, however, can create a lot of tension-especially if you are on a tight timeline to finish a project. But this is the thing: most of these issues are only normal when it comes to hard money lending. They don't happen with Kennedy Funding alone.

Is Kennedy Funding Right for You?

Now that we have walked through the ripoff reports and what they really mean, the question at hand is: should you do business with Kennedy Funding? If you need a loan and the traditional banks won't give you one, then Kennedy Funding may be an excellent choice to consider. But come at it with your eyes wide open. Know the risks. Understand how high the interest rates are. Understand that things may not always work out as planned.

Some Tips When Working with Kennedy Funding (or Any Hard Money Lender)

Read Every Word: Yes, loan agreements are dense, but read them line for line. All the fine print can make all the difference in setting your expectations.

Be Prepared for Higher Rates: This is not a cheap source of capital, and you shouldn't have a head in the clouds either to think you are going to get a cheap rate with a hard money lender.

Communicate Properly: Ask questions! If you don't understand something, or it doesn't feel right, be sure to communicate about it and get clarification before signing anything.

Backup Plans: Loans fall through and experience delay - this is the reality of hard money lending. Always have contingency plans in place.

Conclusion

When you search "Kennedy Funding ripoff report," you're sure to come across all experiences. On one hand, there have been problematic clients. However, one ought to appreciate that hard money lending is a niche and can be terminated quite wrongly. Indeed, Kennedy Funding has much higher rates and possibly nothing for everyone. However, for those occasions when hard money does not advance, then they are valuable financiers. It basically comes down to doing your homework, asking the right questions, and knowing what you are investing in. So if you walk into Kennedy Funding, coming in with realistic expectations, you might just find out they're the key that gets your project kicked off!

0 notes

Text

Navigating Digital Finance's Cyber Risks

In today's fast-paced world, managing our finances has become a breeze, thanks to digital finance. With just a few taps on our smartphones, we can check account balances, transfer money, and even invest in stocks. It's convenient, it's efficient, but it's not without its risks. Welcome to the era of digital finance in India, where cybersecurity challenges loom large.

Digital Finance: A Boon or a Bane?

Picture this: You're sitting at home, sipping on a cup of chai, and you decide to make an online payment. It's quick, hassle-free, and you're done in minutes. However, what you might not realize is that with every transaction you make online, you're exposing yourself to potential cyber threats.

Digital finance has undoubtedly made our lives easier, but it has also opened up a Pandora's box of cybersecurity challenges. From phishing attacks to data breaches, cybercriminals are constantly lurking in the digital shadows, ready to pounce on unsuspecting victims.

The Growing Threat of Phishing Attacks

Phishing attacks have become increasingly sophisticated. Cybercriminals create fake emails or websites that mimic trusted financial institutions or government agencies. These emails often contain urgent messages, enticing you to click on malicious links or share sensitive information. In India, where online banking and financial transactions are on the rise, phishing attacks have become a prevalent threat.

To protect yourself, always double-check the sender's email address and never share personal or financial information via email. Your bank will never ask for your sensitive details through email or text messages.

Also Read: E-commerce and Payment Gateways: Transforming Online Transactions

Data Breaches: Your Information at Risk

Data breaches have made headlines globally, and India is no exception. Investment banks in India and corporate advisory firms are attractive targets for cybercriminals due to the wealth of sensitive financial information they possess. When such institutions fall victim to data breaches, your personal and financial data can end up in the wrong hands.

To safeguard your data, regularly update your passwords, enable two-factor authentication, and monitor your financial statements for any suspicious activity. According to Palo Alto Networks, 67% of the Indian government sites and other essential services saw an upsurge of over 50% cyber attacks.

Securing Equity Capital Markets

Equity capital markets play a vital role in the Indian financial landscape. As more investors participate in stock trading, the security of online trading platforms becomes paramount. A breach in these platforms can result in significant financial losses.

Choose reputable brokerage firms with robust cybersecurity measures to stay safe while trading. Additionally, educate yourself about the latest cybersecurity threats and best practices in online trading.

Also Read: Why Is Financial Literacy Important?

Stay Vigilant

As you navigate the world of digital finance in India, keep these simple guidelines in mind:

Be cautious of phishing attempts.

Protect your data through strong passwords and two-factor authentication.

Choose reputable financial institutions and investment platforms.

Stay informed about cybersecurity threats and best practices.

In a digital age where "easy" often comes hand in hand with "risky," your financial security rests in your hands. Stay vigilant, stay safe, and enjoy the benefits of digital finance without fear. In a nutshell, embrace digital finance, but do so with your eyes wide open to the cybersecurity challenges that come with it. Your financial future in India depends on it.

Conclusion

In this era of digital finance, convenience should not come at the cost of security. It's crucial to be aware of the cybersecurity challenges and take proactive steps to protect your financial assets and personal information. Remember, while digital finance offers immense opportunities, it also presents risks that we can't afford to ignore.

0 notes

Text

How to Save for Retirement

Good news: There's a lot about retirement savings that you DO NOT have to thoroughly understand to make savvy investments. You don't have to be a math person or have a traditional job or have a "5 year plan".

1) Start saving as early as you can. The one financial advantage we have over the older generations is TIME, so USE IT. Starting early means making "free money," your interest earns interest that will be paid back to you. The amount you save in the early years is expected to double every decade, so the more years with an account, the more free money.

2) Start today if you haven't yet. I mean it. Even if it's only 50-100 / month. You will have an account earning free money in your name, and it's easy to add more funds later when the basics are already set up. If you don't have access to a 401(k) or similar, open an IRA (the Roth IRA kind is for those with a low income and a low tax payment in the springs). NOW is more important than which type of account.

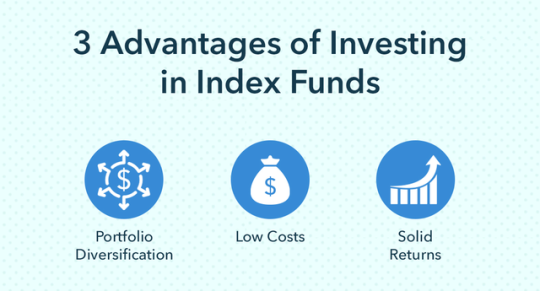

3) Choose an "index fund" with a "target date" around the age you expect to retire. Index funds are basically a tiny sliver of the whole economy around you - stocks for companies large and small, bonds for the US government, real estate, international components. Index funds provide better returns for a lower fee than "actively managed" funds, where the professional's guess wrong more often than not. If you are investing in an index, or piece of the market, than the market can never leave you behind. Target dates mean more higher risk, higher reward stocks in the earliest years, and gradually adjusting to more stable and steady bonds as you near retirement and have less time to recoop a loss. If any of this sounds scary or complicated, this is the common and proven best way to invest over a lifetime.

4) If your employer offers a retirement match contribution (often 2% - 5% of your takehome pay), invest at least that much of your own pay, because again we love FREE MONEY.

5) Increase your retirement payments to yourself anytime life gets easier. Significant raise at work? Moved to a cheaper town? Paid off your car / house / student loans / day care years? Send some of that new monthly money straight into the retirement fund.

6) Your eventual goal is to save 15% of your annual income toward retirement. If this seems insane, start where you can, and aim to add an additional 1-2% with every new year.

7) "Set it and forget it." DO NOT TOUCH your retirement money. Don't even look at it. Maybe once / year if you are curious. The road of compound interest will include some downturns with the stock market is down. This is normal for everyone, but keeping that steady investment through highs & lows is the best strategy for longterm growth of your money.

7b) It is not a kindness to your children to pull money out of your retirement savings on their behalf. You'll lose that much money plus the years of "free money" accumulation plus some early withdrawal fees &/ weird tasks. This makes you more likely to become financially dependent on your kids during your retirement. Not a favor in the long run.

8 ) "If investing feels fun and exciting, then you are not investing, you are gambling." If you are intrigued by the idea of investing in particular companies or trying to time the market - cool. Take some money that wouldn't be disastrous to lose and try your luck - the odds are not in your favor. But your retirement plan must be slow and steady. Source

#personal finance#financial awareness#financial literacy#retirement#investment#401k#roth ira#compound interest#retirement savings#retirement security#retirement strategies#retirement planning#npr#npr life kit#gambling#investing#benefits#stocks#bonds#stock market#index funds#time is on my side#do not touch#slow and steady

0 notes

Text

Midweek Musings, Save Yourself from The Racket

I’ve said many times, self-care is important! Well, this week I was reminded, “So is financial self-protection.” Who wants to throw away money? I sure don’t. I learned years ago to shop around for auto insurance. If you had no claim history, shopping around is in your favor. I plan to do it for every Auto insurance renewal. Facebook donations- I was looking at all PayPal purchases for the last…

View On WordPress

#anti-virus#don&039;t be fooled#financial awareness#lessons learned#Midweek Musings#money#online scams

0 notes

Text

Teaching kids about good money habits.

Developing good money habits from childhood is crucial for a lifetime of financial success. However, the question remains: whose responsibility is it to teach this essential skill? Should it be left solely to parents, or should schools also play a role in financial education? It is widely accepted that parents are the primary educators of their children. Therefore, it is their responsibility to…

View On WordPress

#children and saving#financial awareness#lifetime habits#savings habits#school or home responsibility#teaching good money skills#working together

0 notes

Text

I'm sorry but the irony of Nico calling Max unprofessional is sending me so bad like sir there's an entire garage full of people, who were literally in the trenches trying to survive the Brocedes fallout while just doing their jobs, who might have a few things to say about your (& Lewis') level of professionalism at that time 😭✋️

#f1#formula 1#formula one#max verstappen#nico rosberg#lewis hamilton#brocedes#like niki lauda had to try multiple times to literally parent trap them to try and get them on speaking terms it never worked#because one would arrive they'd see the other and the other would leave#& if i remember correctly the garage crew would swap around from race to race as a like see we aren't favouring anybody gesture 😭#and thats no shade to nico because it was both of them contributing to that environment#his comment re max is just making me laugh#like if i was a part of the pr/media team - which is a part of the degree I'm working on irl - at merc that year i would've lost the plot#like its insane reflecting on it nearly a decade later but the poor souls just trying to do their job in the eye of that storm#truly gods strongest soldiers#ngl the professional comment irks me a bit because its not like max is engaging in inappropriate work place behaviour#he's engaging in another aspect of racing that his involvement raises awareness of & that makes racing more accessible#& we all know how inaccessible not only getting into racing is but also to continue to pursue the further along you go#theres so many stories of 1 sibling giving up racing so the other can keep going because the family can't afford for them both to race#its a huge financial strain & we only see a handful of drivers talk about that & try to do something to change it#and nicos fellow sky sports commentators are routinely unprofessional on so many levels#additionally max had a lot of valid reasons to be annoyed at his team today#but alas he's not english so he's ungrateful#i hate that drivers can't criticise their teams or car without immediately being branded as bratty & ungrateful#ESPECIALLY WHEN THEIR JOB IS TO GIVE FEEDBACK#you can see the double standards from sky when say Lando or George have complaints with their team/car v the likes of Max and Yuki#especially Yuki my god the things i would do to get the British media to leave him alone#this was a jokey post at one point and then became a rant whoops lmao#I'll leave it that before i write an actual essay here 😭✋️

546 notes

·

View notes

Text

The dollar collapse is happening NOW!"

The Storm is coming sooner than expected. All financial systems controlled by the corrupt government will collapse.

This crash will be felt on a global level, and many currencies, especially the USD, will be worthless.

Fiat accounts, savings and retirement accounts, mortgage, e.t.c will crash down and wipe off from the system once this event happens, Quantum Financial System is the savior.!!!

Convert every money in your possession to digital gold & silver backed coins and move them into the QFS ledger for safety . There will be a Global Reset. All banks and fiat exchanges will be closed, and there will be a lot of uncertainty & confusion. Cash will be worthless and outdated, and all bank accounts will be closed and crash to zero .

All cabal public banks will be confiscated, and foreclosures will be frozen, as will all public and private dept(mortgage,loans, credit, and debit cards).

#bad government#bad omens#donald trump#reeducate yourself#wells fargo#new york#bank of america#bank crash#breaking news#qfs#bank clash#world news#xlm#xrpcommunity#xrp news#xrp#marine life#veterans#patriotic#politics#quantum financial system#decentralised finance#decentralisation#decentralized#be aware#stay woke#washington dc#trump 2024#community#usa news

780 notes

·

View notes

Text

thinking about modern au Kabru

ivy league college student, probably studying law and political science on a full scholarship. first time living away from Milsiril so he has to promise her, yes mom i’ll call you at least four times a week, no mom i don’t need your amex black card, yes mom the normal credit card is fine i need to learn how to budget like a Normal Person (it has a limit of $20k — that’s not normal Kabru).

Milsiril insists for a long time that she’ll just get him a house off campus so he can have his own space (aka a place she can drop by anytime and possibly live a few months out of the year just to be close to him) but Kabru puts his foot down and tells her the best way he’s gonna make friends is by living with other students (bye mom).

his floor in the coed dorms is the party floor and he always makes sure to invite everybody (his nightmare is accidentally leaving anyone out and having them think that he doesn’t like them). somehow it’s always a good time, everyone leaves with more friends than they came with, it never gets totally out of control, and plenty of girls who are interested in him (and a lot of guys too tbh) bring tons of baked treats so there’s always free food. Kabru is the RA’s favourite person to have in the building (even though Kabru himself is messy but most of the people he’s friends with are nice and clean up after themselves).

he has a porsche (Milsiril gift for his 16th bday) but he’s adamant about not driving it unless he absolutely has to (because he doesn’t wanna look like a douche). BUT he never says no when his friends ask for rides (so he ends up driving all the time anyway). he actually contemplates selling the porsche and going for a more practical car but Mickbell is like ‘dude you are not taking this away from me.’ Kabru sighs and decides to keep it because his friends (Mickbell) like being chauffeured around in a fancy convertible (Rin, Holm, and Dia don’t care, they’re just glad they don’t have to walk to the grocery store).

he’s probably on a casual texting basis with most of his professors and you know he’s going to all their office hours, grabbing beer with them just to keep chatting about life outside of school. and that’s how he winds up in some super secret faculty group chat where he’s now privy to all the college administration gossip.

Kabru is elected for student council during his freshman year and he’s probably the favourite to be sc president one day.

he doesn’t really date (gets too in his head about how he doesn’t wanna ruin any friendships) but he does hang out one on one with a lot of girls and treats them all really well. he probably goes so far out of his way to be platonic that he flies a little too close to the ‘Just Like One of the Girlies’ sun, he kinda forgets that most people interpret it as flirting coming from him. which leads to a few awkward conversations. people feeling led on, a few angry jealous boyfriends, scathing dms about him being a girl stealing homewrecker.

it’s such a nightmare for him and he needs it to end right now. so he begs Rin to ‘date’ him for a week or two and then publicly dump him just so the entire student body gets the message that he is Just A Friend.

Rin stares at him for a few seconds. then she laughs. she laughs and laughs. she laughs for a crazy long time. and then eventually she goes, ‘wow you’re an asshole, Kabru. no i won’t be your fake girlfriend. you’re gonna suffer and i’m going to enjoy it.’

and that’s when Kabru has a moment of enlightenment. ok yeah. asking for that is probably really selfish and mean. maybe he needs to think about girls’ feelings more and that’s maybe more important than his deep seated need to be liked, and when has Rin ever been wrong about anything.

he apologizes. and so begins one of the more serious talks he’s ever had with Rin about being okay with not being liked.

he thinks he can really turn over a new leaf. the whole ‘not worrying about what other people think’ thing goes pretty well — up until Kabru meets the aloof professor for his Monsters and Myths class who keeps forgetting and mispronouncing his name.

Kabru has never needed someone to like him So Bad, he needs Prof. Touden to like him as a matter of life and death, and he’s willing to look stupid for it (fails a midterm on purpose to justify begging for one on one tutoring)

#wow if you made it to the end of this post here’s some surprise labru#kabru says fuck my gpa i need this white boy to like me#i am plagued by demons (labru professor/student situationship)#dungeon meshi modern au#ok but the Kabru Milsiril dynamic is my new favourite chew toy#especially them in a modern setting#all of the lavish gifts and expensive lifestyle that Milsiril would want Kabru to have#perhaps even as a way of depending on her forever (love to an unhealthy degree)#but Kabru is more interested in people than material things#so perhaps he’s a little out of touch financially (thinks a jug of milk costs $12)#but he’s still very much socially aware#enough to know that he can’t just be another annoying trust fund kid with a dumb car and designer clothes and zero fucks about academics#so his social and academic excellence is probably in large part overcompensation for his privileged upbringing#and even the thought of someone not liking him gives him stomach cramps LOL#kabru my love you will always be famous#kabru of utaya#kabru#wasabi rambles#labru#dungeon meshi#delicious in dungeon

281 notes

·

View notes

Note

I love your posts, and i love the stuff you make, but it does suck still seeing Homestuck stuff in this day and age from someone who otherwise seemed cool.

I don't know you, and I don't pretend to, but I'd still recommend you look more into it. It's not really media worth condoning, for your sake and for anyone else following you.

#let it be known im perfectly aware of all the shit thats gone down with homestuck#that said; its a huge part of internet culture and something i also grew up with#and its not like i've ever supported it financially anyway#my posts#asks#anon#my art#bweenop#shitposts

633 notes

·

View notes

Text

free Palestine.

here’s a great recently updated post with fundraisers to help the people from Palestine.

i might lose followers for this but i don’t care. if you’re against Palestine, you’re welcome to leave.

#right now i can’t offer help financially#but i hope spreading awareness helps#my art#drawing#art#palestine#pro palestine#free palestine#palestine art#palestine support#anti zionisim#palestinian resistance#justice for palestine#palestine will be free#artists on tumblr

195 notes

·

View notes

Text

I don't know if anyone is actually gonna see this, but I've recently become homeless (I'm queer and disabled) and I'm going through a lot right now and I could really use some help. I know everyone is struggling right now, but if anyone is able to share this I would really appreciate it. There's more info about my whole situation in the link.

https://gofund.me/0a92dfb6

dog pic for visibility, this is my boy Koda and we could really use some help ❤️

#mutual aid#mutual funds#donations#mutual assistance#fundraiser#funding#charity#funds#emergency#emergency funds#community aid#financial aid#financial assistance#cowdfunding#please share#reblog#queer aid#queer mutual aid#trans mutual aid#crowdfund#people helping people#trans awareness week#transgender awareness week#trans awareness

60 notes

·

View notes

Text

that's the tea ✨️

#just a heads up#im aware of the vivziepop controversies#and no i do NOT support her actions nor i fund her shows financially#call me a pirate atp lmao#but alastor is so bbygurl i love his egocentric ass#doodles#feli art#art#drawings#artists on tumblr#digital art#fanart#hazbin hotel#hazbin art#hazbin hotel fanart#hazbin alastor#alastor#alastor altruist#alastor the radio demon#the radio demon#alastor hazbin hotel

171 notes

·

View notes

Text

Decoding How Generation Z is Transforming Finance

In a world fueled by innovation, a new player has emerged on the financial stage, ready to revolutionize the way we think about money. Generation Z, armed with digital prowess and a passion for change, is setting the tone for a financial transformation like no other. As the finance landscape undergoes a Gen Z-driven makeover, let's explore how these trailblazers are reshaping the future of fiscal affairs.

The Digital Natives

Unlike their predecessors, Generation Z was practically born with a smartphone in hand. Their fluency in technology has led to a fundamental shift in the way financial transactions are conducted.

Mobile banking apps, digital wallets, and online investment platforms have become their preferred tools for managing money. This preference for digital solutions has driven traditional banks to enhance their online offerings, fostering a wave of innovation in the fintech sector.

Also Read: Improving Net Interest Margin: Strategies for Financial Institutions

Financial Awareness and Education

Generation Z displays a remarkable level of financial awareness compared to previous generations. Access to information through the internet has empowered them to educate themselves about personal finance, investments, and the global economy.

They are more likely to research and compare financial products before making decisions. This heightened financial literacy is challenging financial institutions to provide more transparent and easily understandable services.

The Rise of ESG Investing

Environmental, Social, and Governance (ESG) investing has gained significant traction among Generation Z. This generation shows a deep concern for social and environmental issues, and they want their investments to align with their values.

ESG-focused investment options, which consider companies' impact on these factors, have seen a surge in popularity among young investors. This trend is encouraging businesses to adopt more sustainable practices and be socially responsible.

Gig Economy and Flexibility

Generation Z is redefining the concept of a traditional career. With a strong inclination towards the gig economy, they prioritize flexibility and multiple income streams over a conventional 9-to-5 job.

This shift is prompting financial institutions to design products that cater to irregular income patterns and offer solutions for short-term financial goals.

Cryptocurrency and Beyond

The allure of cryptocurrency has not escaped Generation Z. They are more open to exploring digital currencies as a part of their investment portfolio.

The decentralized nature of cryptocurrencies appeals to their mistrust of traditional financial institutions. This interest is pushing the boundaries of how we perceive and interact with money and investments.

Challenges for Financial Institutions

The changing dynamics brought forth by Generation Z are not without challenges for the financial sector. Traditional banks must adapt to the digital-first mindset of this generation to remain relevant. Moreover, maintaining security and privacy in an increasingly digital world is of paramount importance.

Also Read: The Ultimate Guide To Cash Flow Management

Conclusion

Generation Z isn't just reshaping finances; they're scripting a new financial saga. Their tech prowess, ethical investments, and unconventional work styles are sculpting a nimble, socially aware financial realm. As they assert influence, the industry must pivot and unite for a thriving, responsible economic voyage ahead.

1 note

·

View note

Text

Credit Scores

Disclaimer: Some of this advice may not be immediately applicable to people who are struggling financially.

On the other hand, if you are responsible with money & lucky, your credit score will pretty much take care of itself.

I just don't want anyone to be accidentally lowering their credit score because they don't know the "rules of the game."

.......................................................................................................................

Dos:

--Pay off all your debt owed every single month - car loan, mortgage and yes credit card. (It's a common falsehood that carrying a credit card balance helps your score, it only does harm plus wastes your money on interest.)

--Keep your credit card spending below 30% of your official spending limit for that card; lower% is even better.

--For an credit card bill above the 30%, pay your balance before the "statement date" and don't wait until the due date.

--If you get a significant raise or other financial boon, contact your credit card company to request a raise to your spending limit.

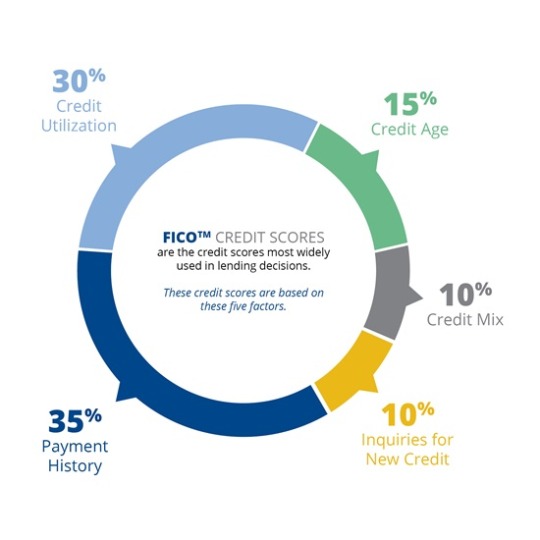

--Focus on your FICO credit score, and don't worry about any other credit score calculators.

--Avoid "hard inquiries" into your credit unless you expect to be approved for an imminent large purchase (vehicles, rental/mortgage, etc.)

--Only take out credit if you know you won't abuse it. A "thin file" is better than a file full of financial red flags.

Don'ts:

--Cancel your oldest credit card. Keep it going, set it up to autopay a small monthly bill (netflix, water, or the like)

--Apply for new credit cards unless you really need them. The hard credit check, the newness of the credit line, any overdue payments, and any spending near that card's credit limit can ALL harm your credit score.

--Expect a credit score change to change immediately or directly due to increased income or increased savings. Those factors are not a part of your credit score (though of course if you budget that money well, your credit score will eventually reflect your better financial stability).

--Fuss if your credit score is 740 instead of 850; 740 is the low end of the "perfect" range, you'll be approved for basically anything.

--Worry if your starting credit score is below 740. Nothing is wrong and you are not being penalized. Credit scores include 5 components: payment history, amounts owed, length of credit history, credit mix - these will all improve over time if you don't miss payments. The 5th component, new credit, may be lowering your score when you open your first credit line, but this too will fade with time (as long as you don't quickly open additional credit lines).

How to find your credit score for free from trusted sources: 1) Check with your bank or credit union.

2) Request your score through these three companies only: Experian, TransUnion, and Equifax. 3) use Consumer Financial Protection Bureau links:

(Note that you may have slightly different FICO credit scores across different financial websites, this is normal.)

Sources

#credit score#fico#npr#npr life kit#cfpb#equifax#transunion#experian#personal finance#financial awareness#financial literacy#what they should have taught in high school#credit cards#credit history#credit utilization

0 notes

Text

this is why prenups are important because you have to leave her. she's not an adult. she's a child in an adult body who wants this guy to just be a walking, talking atm machine with a dick. she's clearly contributing nothing but wants him to work himself to death so that she can have a social media worthy life. this is why men need to continue asking "what does she bring to the table?" or they will find themselves in this situation.

#dating#marriage#prenups#relationship advice#adulting#financial planning#partnership#equality#marriage advice#gender roles#modern relationships#prenup agreements#financial responsibility#relationship expectations#equality in marriage#prenup awareness#financial independence#relationship goals#gender dynamics#prenup discussion#marriage equality#relationship boundaries

319 notes

·

View notes