#Federal Estate Tax

Text

Do I Need to Keep My Life Insurance After I Retire? | Ask a Savant Financial Advisor [Video]

#EstateTax#EstatePlanning#FamilyWealthManagement#FederalEstateTax#InheritancePlanning#Estate Tax#Estate Planning#Family Wealth Management#Federal Estate Tax#Inheritance Planning

0 notes

Text

Things Biden and the Democrats did, this week #26

July 5-12 2024

The IRS announced it had managed to collect $1 billion in back taxes from high-wealth tax cheats. The program focused on persons with more than $1 million in yearly income who owned more than $250,000 in unpaid taxes. Thanks to money in Biden's 2022 Inflation Reduction Act the IRS is able to undertake more enforcement against rich tax cheats after years of Republicans cutting the agency's budget, which they hope to do again if they win power again.

The Biden administration announced a $244 million dollar investment in the federal government’s registered apprenticeship program. This marks the largest investment in the program's history with grants going out to 52 programs in 32 states. The President is focused on getting well paying blue collar opportunities to people and more people are taking part in the apprenticeship program than ever before. Republican pledge to cut it, even as employers struggle to find qualified workers.

The Department of Transportation announced the largest single project in the department's history, $11 billion dollars in grants for the The Hudson River Tunnel. Part of the $66 billion the Biden Administration has invested in our rail system the tunnel, the most complex Infrastructure project in the nation would link New York and New Jersey by rail under the Hudson. Once finished it's believed it'll impact 20% of the American economy by improving and speeding connection throughout the Northeast.

The Department of Energy announced $1.7 billion to save auto worker's jobs and convert factories to electronic vehicles. The Biden administration will used the money to save or reopen factories in Michigan, Ohio, Pennsylvania, Georgia, Illinois, Indiana, Maryland, and Virginia and retool them to make electric cars. The project will save 15,000 skilled union worker jobs, and created 2,900 new high-quality jobs.

The Department of Housing and Urban Development reached a settlement with The Appraisal Foundation over racial discrimination. TAF is the organization responsible for setting standards and qualifications for real estate appraisers. The Bureau of Labor Statistics last year found that TAF was 94.7% White and 0.6% Black, making it the least racially diverse of the 800 occupations surveyed. Black and Latino home owners are far more likely to have their houses under valued than whites. Under the settlement with HUD TAF will have to take serious steps to increase diversity and remove structural barriers to diversity.

The Department of Justice disrupted an effort by the Russian government to influence public opinion through AI bots. The DoJ shut down nearly 1,000 twitter accounts that were linked to a Russian Bot farm. The bots used AI technology to not only generate tweets but also AI image faces for profile pictures. The effort seemed focused on boosting support for Russia's war against Ukraine and spread negative stories/impressions about Ukraine.

The Department of Transportation announces $1.5 billion to help local authorities buy made in America buses. 80% of the funding will go toward zero or low-emission technology, a part of the President's goal of reaching zero emissions by 2050. This is part of the $5 billion the DOT has spent over the last 3 years replacing aging buses with new cleaner technology.

President Biden with Canadian Prime Minster Justin Trudeau and Finnish President Alexander Stubb signed a new agreement on the arctic. The new trilateral agreement between the 3 NATO partners, known as the ICE Pact, will boost production of ice breaking ships, the 3 plan to build as many as 90 between them in the coming years. The alliance hopes to be a counter weight to China's current dominance in the ice breaker market and help western allies respond to Russia's aggressive push into the arctic waters.

The Department of Transportation announced $1.1 billion for greater rail safety. The program seeks to, where ever possible, eliminate rail crossings, thus removing the dangers and inconvenience to communities divided by rail lines. It will also help update and improve safety measures at rail crossings.

The Department of the Interior announced $120 million to help tribal communities prepare for climate disasters. This funding is part of half a billion dollars the Biden administration has spent to help tribes build climate resilience, which itself is part of a $50 billion dollar effort to build climate resilience across the nation. This funding will help support drought measures, wildland fire mitigation, community-driven relocation, managed retreat, protect-in-place efforts, and ocean and coastal management.

The USDA announced $100 million in additional funds to help feed low income kids over the summer. Known as "SUN Bucks" or "Summer EBT" the new Biden program grants the families of kids who qualify for free meals at school $120 dollars pre-child for groceries. This comes on top of the traditional SUN Meals program which offers school meals to qualifying children over the summer, as well as the new under President Biden SUN Meals To-Go program which is now offering delivery of meals to low-income children in rural areas. This grant is meant to help local governments build up the Infrastructure to support and distribute SUN Bucks. If fully implemented SUN Bucks could help 30 million kids, but many Republican governors have refused the funding.

USAID announced its giving $100 million to the UN World Food Program to deliver urgently needed food assistance in Gaza. This will bring the total humanitarian aid given by the US to the Palestinian people since the war started in October 2023 to $774 million, the single largest donor nation. President Biden at his press conference last night said that Israel and Hamas have agreed in principle to a ceasefire deal that will end the war and release the hostages. US negotiators are working to close the final gaps between the two sides and end the war.

The Senate confirmed Nancy Maldonado to serve as a Judge on the Seventh Circuit Court of Appeals. Judge Maldonado is the 202nd federal Judge appointed by President Biden to be confirmed. She will the first Latino judge to ever serve on the 7th Circuit which covers Illinois, Indiana, and Wisconsin.

Bonus: At the NATO summit in Washington DC President Biden joined 32 allies in the Ukraine compact. Allies from Japan to Iceland confirmed their support for Ukraine and deepening their commitments to building Ukraine's forces and keeping a free and Democratic Ukraine in the face of Russian aggression. World leaders such as British Prime Minster Keir Starmer, German Chancellor Olaf Scholz, French President Emmanuel Macron, and Ukrainian President Volodymyr Zelenskyy, praised President Biden's experience and leadership during the NATO summit

#Joe Biden#Thanks Biden#politics#us politics#american politics#election 2024#tax the rich#climate change#climate action#food insecurity#poverty#NATO#Ukraine#Gaza#Russia#Russian interference

3K notes

·

View notes

Text

Federal Bulletin: Economic Arguments for Cannabis Legalization

Federal Bulletin: Economic Arguments for Cannabis Legalization

By Hilary Bricken, Pricilla at harris Bricken

On September 29, I spoke on an opening panel at the 7th annual Cannabis Law Conference for the Cannabis Law Section of the State Bar of Michigan. My co-panelist was the renowned Brookings political scientist John Hudak. One of John’s specialty areas is state and federal marijuana policy. The title of our panel was “Update on the Federal Policy…

View On WordPress

0 notes

Video

youtube

Should Billionaires Exist?

Do billionaires have a right to exist?

America has driven more than 650 species to extinction. And it should do the same to billionaires.

Why? Because there are only five ways to become one, and they’re all bad for free-market capitalism:

1. Exploit a Monopoly.

Jamie Dimon is worth $2 billion today… but not because he succeeded in the “free market.” In 2008, the government bailed out his bank JPMorgan and other giant Wall Street banks, keeping them off the endangered species list.

This government “insurance policy” scored these struggling Mom-and-Pop megabanks an estimated $34 billion a year.

But doesn’t entrepreneur Jeff Bezos deserve his billions for building Amazon?

No, because he also built a monopoly that’s been charged by the federal government and 17 states for inflating prices, overcharging sellers, and stifling competition like a predator in the wild.

With better anti-monopoly enforcement, Bezos would be worth closer to his fair-market value.

2. Exploit Inside Information

Steven A. Cohen, worth roughly $20 billion headed a hedge fund charged by the Justice Department with insider trading “on a scale without known precedent.” Another innovator!

Taming insider trading would level the investing field between the C Suite and Main Street.

3. Buy Off Politicians

That’s a great way to become a billionaire! The Koch family and Koch Industries saved roughly $1 billion a year from the Trump tax cut they and allies spent $20 million lobbying for. What a return on investment!

If we had tougher lobbying laws, political corruption would go extinct.

4. Defraud Investors

Adam Neumann conned investors out of hundreds of millions for WeWork, an office-sharing startup. WeWork didn’t make a nickel of profit, but Neumann still funded his extravagant lifestyle, including a $60 million private jet. Not exactly “sharing.”

Elizabeth Holmes was convicted of fraud for her blood-testing company, Theranos. So was Sam Bankman-Fried of crypto-exchange FTX. Remember a supposed billionaire named Donald Trump? He was also found to have committed fraud.

Presumably, if we had tougher anti-fraud laws, more would be caught and there’d be fewer billionaires to preserve.

5. Get Money From Rich Relatives

About 60 percent of all wealth in America today is inherited.

That’s because loopholes in U.S. tax law —lobbied for by the wealthy — allow rich families to avoid taxes on assets they inherit. And the estate tax has been so defanged that fewer than 0.2 percent of estates have paid it in recent years.

Tax reform would disrupt the circle of life for the rich, stopping them from automatically becoming billionaires at their birth, or someone else’s death.

Now, don’t get me wrong. I’m not arguing against big rewards for entrepreneurs and inventors. But do today’s entrepreneurs really need billions of dollars? Couldn’t they survive on a measly hundred million?

Because they’re now using those billions to erode American institutions. They spent fortunes bringing Supreme Court justices with them into the wild.They treated news organizations and social media platforms like prey, and they turned their relationships with politicians into patronage troughs.

This has created an America where fewer than ever can become millionaires (or even thousandaires) through hard work and actual innovation.

If capitalism were working properly, billionaires would have gone the way of the dodo.

424 notes

·

View notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

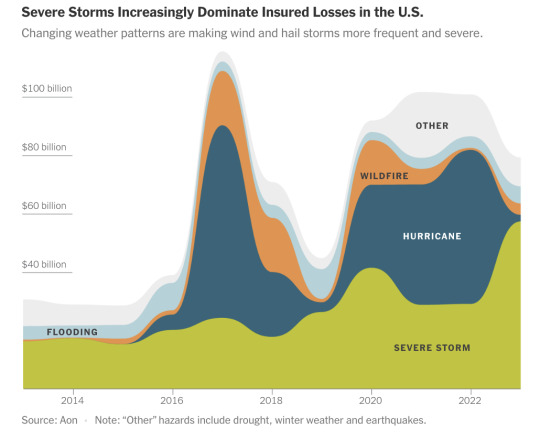

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

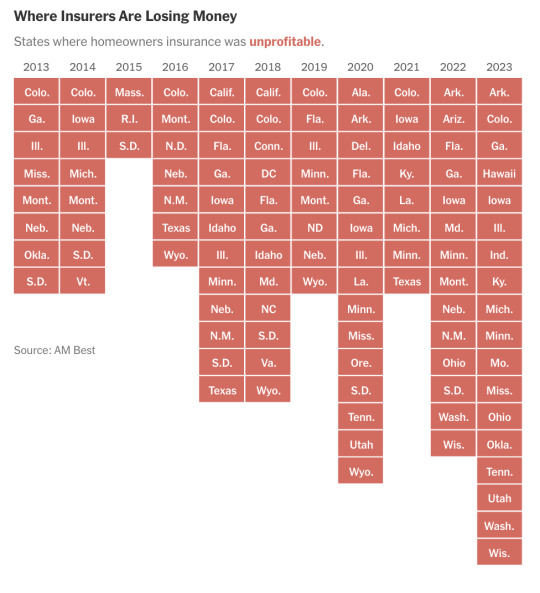

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

If Taylor Swift Had Endorsed Donald Trump

Democrats would scorn her business savvy, cap her ticket prices, and fret over her huge carbon footprint.

Wall Street Journal

By Allysia Finley

Forbes estimates Taylor Swift’s net worth at $1.3 billion. Despite her liberal leanings, the singer-songwriter has amassed her wealth the old-fashioned way: through hard work, talent and business savvy. Her endorsement of Kamala Harris last week is rich considering she owes her success to the capitalist system the vice president wants to tear down.

“The way I see it, fans view music the way they view their relationships,” Ms. Swift wrote in a 2014 piece for the Journal. “Some music is just for fun, a passing fling. . . . Some songs and albums represent seasons of our lives, like relationships that we hold dear in our memories but had their time and place in the past. However, some artists will be like finding ‘the one.’ ” She has become “the one” for hundreds of millions of fans worldwide with lyrics that chronicle relationship woes women commonly experience.

Ms. Swift took advantage of her ardent fan base in 2014 by removing her catalog from Spotify in a bid for higher royalties. “Valuable things should be paid for. It’s my opinion that music should not be free,” she explained. “My hope for the future, not just in the music industry, but in every young girl I meet, . . . is that they all realize their worth and ask for it.”

She also criticized Apple Music for not paying artists during the streaming service’s free trial, prompting the company to change its policy. As she jeers in a hit song, “Who’s afraid of little old me?” Apparently, Big Tech companies.

Last year she reportedly raked in $200 million from streaming royalties on top of the estimated $15.8 million she grossed per performance during her recent “Eras” tour. Some fans have shelled out thousands of dollars on the resale market to see Ms. Swift perform. Americans have even traveled to Europe when they couldn’t get tickets in the U.S.

Her fan base may be more loyal and enthusiastic than Donald Trump’s. JD Vance scoffed at the idea that the star’s endorsement of Ms. Harris could influence the outcome of the election. The “billionaire celebrity,” he said, is “fundamentally disconnected from the interests and the problems of most Americans.” Maybe, but she certainly taps into the problems of young women.

Democrats hope to use Ms. Swift’s endorsement to drive them to the polls. But it isn’t difficult to imagine what the left would be saying about her had she endorsed the Republican antihero. It might go something like this:

The billionaire has gotten rich by ripping off fans, avoiding taxes and harming competitors. Time for the government to break her up. Unlike rival artists, Ms. Swift writes, performs and owns her compositions. This vertical integration allows her to charge exorbitant royalties and ticket prices.

Tickets for her “Eras” tour on average cost about $240. That’s merely the price for admission—not including food, drink or Swiftie swag. VIP passes that include memorabilia go for $899. How dare she make young women choose between paying for groceries or rent and going to a concert.

The Federal Trade Commission must cap Ms. Swift’s ticket prices at a reasonable price—say, $20—and ban her junk fees. Concertgoers shouldn’t have to pay $65 for an “I Love You It’s Ruining My Life” sweatshirt.

Her romance with Kansas City Chiefs tight end Travis Kelce also unfairly boosts their star power, letting them charge more for endorsements. As Ms. Swift writes in one song, “two is better than one.” Mr. Kelce reportedly signed a $100 million podcast deal with Amazon’s Wonderly. By breaking up the couple, the government could reduce their royalties and ticket prices.

Ms. Swift, the self-described “mastermind,” also dodges taxes on her “full income,” which includes some $125 million in real estate and a music catalog worth an estimated $600 million. “They said I was a cheat, I guess it must be true,” Ms. Swift acknowledges in her song “Florida!!!”

Under the Biden-Harris administration’s proposed billionaire’s tax, she would have to pay a 25% levy on the $1 billion increase in her fortune since 2017. But that isn’t enough. Ms. Swift should also have to pay taxes on the appreciating value of her “name, image and likeness,” which the Internal Revenue Service considers an asset.

How much is her brand worth? Easily billions. She might say, as she does in a song, that her “reputation has never been worse.” True, Miss Americana’s image took a hit after reports that her private-jet travel in 2022 emitted 576 times as much CO2 as the average American in a year. When Ms. Swift sings, “It’s me, hi, I’m the problem, it’s me,” she’s correct. She and her fat-cat friends are what’s wrong with America.

Appeared in the September 16, 2024, print edition as 'If Taylor Swift Had Endorsed Donald Trump'.

#Taylor Swift#swifites#eras tour london#TS13#trump#president trump#trump 2024#repost#donald trump#america first

78 notes

·

View notes

Photo

Some highlights from the proposed bill for those interested:

Highest Personal Income Tax Rate Since 1986 (combined Federal Tax rate of 45%)

Highest Capital Gains Tax Since 1978. A rate over twice as high as China’s capital gains tax rate.(nearly doubles rate from 20% to 39%)

Corporate Tax Rate Higher than Communist China. (A 31% increase, from 21% to 28%)

Unconstitutional Wealth Tax on Unrealized Gains

Quadrupled Tax on Stock Buybacks. This tax will hit every American with a 401K or IRA or union pension.

$31 Billion Tax on American Energy

32% Increase to Medicare Taxes

Carried Interest Tax on Capital Gains

$23 Billion Retirement Tax

$24 Billion Cryptocurrency Tax

Real Estate Tax Hike (wants to end 1031 Like-Kind Exchanges)

Doubles the Global Minimum Tax (Global Intangible Low-Tax Income (GILTI) from on U.S. multinational corporations from 10.5 to 21 percent, which after the disallowance of foreign tax credits would provide a top rate of 26.25 percent)

#Capitalism#Socialism#Politics#Anticapitalism#Antisocialism#Wage#Wage Gap#Eat the Rich#Minimum Wage#Living Wage#Affordable Education#Affordable Healthcare#Free Education#Free Healthcare#Student Loans#Accounting#Consulting#Business#Humor#Funny#Funny meme#Funny memes#Dark Humor#Office Humor#Excel#Economics#Keynesian Economics#Austrian Economics#Finance

813 notes

·

View notes

Text

THIS MOTHERFUCKER !!!

"Supreme Court Justice Clarence Thomas has been accused of not disclosing a yacht trip to Russia and a private helicopter flight to a palace in President Vladimir Putin’s hometown, among a slew of other gifts and loans from businessman Harlan Crow.

Buried on page 14 of a letter that two Democratic senators sent to Attorney General Merrick Garland on Tuesday, in which they urged Garland to appoint a special counsel to probe Thomas, was an astonishing list of dozens of “likely undisclosed gifts and income” from Crow, Crow’s affiliated companies, and “other donors.”

In the letter, Sens. Sheldon Whitehouse (D-RI) and Ron Wyden (D-OR) said Thomas, one of the court’s staunchly conservative justices, even may have committed tax fraud and violated other federal laws by “secretly” accepting the gifts and income potentially worth millions.

“The Senate is not a prosecutorial body, and the Supreme Court has no fact-finding function of its own, making the executive role all the more important if there is ever to be any complete determination of the facts,” reads the letter requesting the appointment of a special prosecutor.

“We do not make this request lightly,” said the letter.

The list of potentially secret gifts also includes a loan of more than $267,000 provided by Thomas’ close friend Anthony Welters, the yacht trip to Russia from the Baltics, and the helicopter ride to Yusupov Palace in St. Petersburg. ProPublica first reported last year on the existence of extensive undisclosed gifts and lavish trips from Crow.

Additionally, Justice Thomas is accused of not disclosing tuitions for his grandnephew, free lodging, real estate transactions, and home renovations. The action escalates Democratic senators’ efforts to hold Thomas accountable for perceived ethics controversies.

According to the senators, Thomas’ conduct could violate the Ethics in Government Act, which requires officials like Supreme Court justices to file annual reports disclosing gifts and income accepted from outside sources.

“It is a crime,” reads the report, “To knowingly and willfully fail to file or report such information.”

Since 2023, two Senate committees have been looking into the 1991 loan from Welters that was connected to Thomas’ purchase of a luxury motor home. Welters previously responded to a New York Times request for comment on the loan only to say that it was “satisfied.”

Thomas, for his part, belatedly disclosed some—but not all—gifts from Crow this year and has defended the gifts as “personal hospitality” from some of his and his wife’s “dearest friends.”

“The evidence assembled thus far plainly suggests that Justice Thomas has committed numerous willful violations of federal ethics and false-statement laws and raises significant questions about whether he and his wealthy benefactors have,” Durban and Wyden wrote."

16 notes

·

View notes

Text

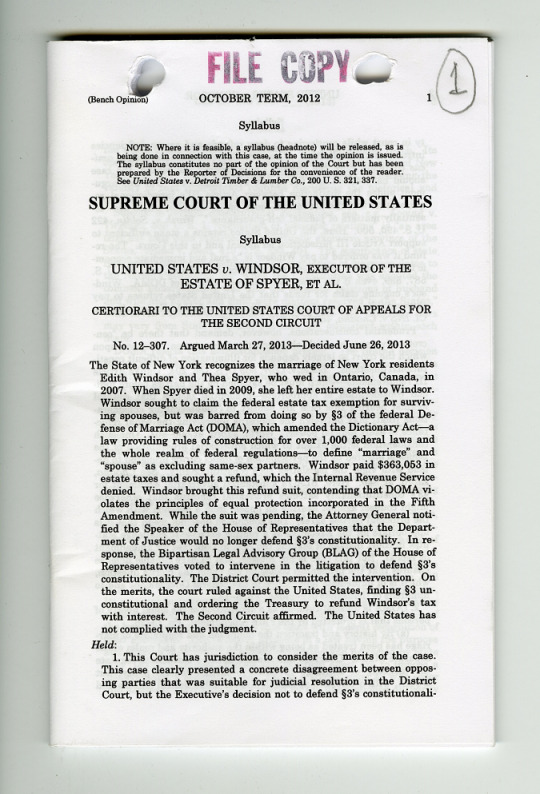

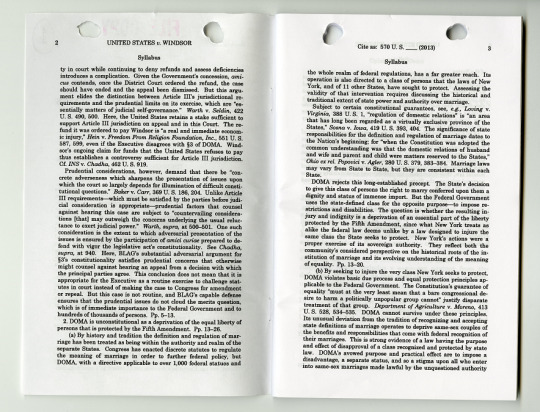

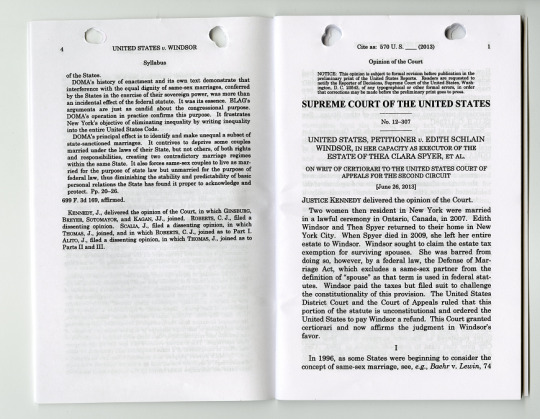

The Supreme Court ruled that the Defense of Marriage Act was unconstitutional on June 26, 2013.

In U.S. v Windsor, SCOTUS held that the federal government could not discriminate against same-sex couples.

Record Group 267: Records of the Supreme Court of the United States

Series: Appellate Jurisdiction Case Files

Transcription:

[Stamped: " FILE COPY "]

(Bench Opinion) OCTOBER TERM, 2012 1 [Handwritten and circled " 1" in upper right-hand corner]

Syllabus

NOTE: Where it is feasible, a syllabus (headnote) will be released, as is

being done in connection with this case, at the time the opinion is issued.

The syllabus constitutes no part of the opinion of the Court but has been

prepared by the Reporter of Decisions for the convenience of the reader.

See United States v. Detroit Timber & Lumber Co., 200 U.S. 321, 337.

SUPREME COURT OF THE UNITED STATES

Syllabus

UNITED STATES v. WINDSOR, EXECUTOR OF THE

ESTATE OF SPYER, ET AL.

CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR

THE SECOND CIRCUIT

No. 12-307. Argued March 27, 2013---Decided June 26, 2013

The State of New York recognizes the marriage of New York residents

Edith Windsor and Thea Spyer, who wed in Ontario, Canada, in

2007. When Spyer died in 2009, she left her entire estate to Windsor.

Windsor sought to claim the federal estate tax exemption for surviv-

ing spouses, but was barred from doing so by §3 of the federal Defense

of Marriage Act (DOMA), which amended the Dictionary Act---a

law providing rules of construction for over 1,000 federal laws and

the whole realm of federal regulations-to define "marriage" and

"spouse" as excluding same-sex partners. Windsor paid $363,053 in

estate taxes and sought a refund, which the Internal Revenue Service

denied. Windsor brought this refund suit, contending that DOMA vi-

olates the principles of equal protection incorporated in the Fifth

Amendment. While the suit was pending, the Attorney General notified

the Speaker of the House of Representatives that the Department

of Justice would no longer defend §3's constitutionality. In re-

sponse, the Bipartisan Legal Advisory Group (BLAG) of the House of

Representatives voted to intervene in the litigation to defend §3's

constitutionality. The District Court permitted the intervention. On

the merits, the court ruled against the United States, finding §3 un-

constitutional and ordering the Treasury to refund Windsor's tax

with interest. The Second Circuit affirmed. The United States has

not complied with the judgment.

Held:

1. This Court has jurisdiction to consider the merits of the case.

This case clearly presented a concrete disagreement between oppos-

ing parties that was suitable for judicial resolution in the District

Court, but the Executive's decision not to defend §3's constitutionali-

[page 2]

2 UNITED STATES v. WINDSOR

Syllabus

ty in court while continuing to deny refunds and assess deficiencies

introduces a complication. Given the Government's concession, ami-

cus contends, once the District Court ordered the refund, the case

should have ended and the appeal been dismissed. But this argu-

ment elides the distinction between Article Ill's jurisdictional re-

quirements and the prudential limits on its exercise, which are "es-

sentially matters of judicial self-governance." Warth v. Seldin, 422

U. S. 490, 500. Here, the United States retains a stake sufficient to

support Article III jurisdiction on appeal and in this Court. The re-

fund it was ordered to pay Windsor is "a real and immediate econom-

ic injury," Hein v. Freedom From Religion Foundation, Inc., 551 U. S.

587, 599, even if the Executive disagrees with §3 of DOMA. Wind-

sor's ongoing claim for funds that the United States refuses to pay

thus establishes a controversy sufficient for Article III jurisdiction.

Cf. INS v. Chadha, 462 U. S. 919.

Prudential considerations, however, demand that there be "con-

crete adverseness which sharpens the presentation of issues upon

which the court so largely depends for illumination of difficult consti-

tutional questions." Baker v. Carr, 369 U. S. 186, 204. Unlike Article

III requirements---which must be satisfied by the parties before judi-

cial consideration is appropriate---prudential factors that counsel

against hearing this case are subject to "countervailing considera-

tions [that] may outweigh the concerns underlying the usual reluc-

tance to exert judicial power." Warth, supra, at 500-501. One such

consideration is the extent to which adversarial presentation of the

issues is ensured by the participation of amici curiae prepared to de-

fend with vigor the legislative act's constitutionality. See Chadha,

supra, at 940. Here, BLAG's substantial adversarial argument for

§3's constitutionality satisfies prudential concerns that otherwise

might counsel against hearing an appeal from a decision with which

the principal parties agree. This conclusion does not mean that it is

appropriate for the Executive as a routine exercise to challenge stat-

utes in court instead of making the case to Congress for amendment

or repeal. But this case is not routine, and BLAG's capable defense

ensures that the prudential issues do not cloud the merits question,

which is of immediate importance to the Federal Government and to

hundreds of thousands of persons. Pp. 5-13.

2. DOMA is unconstitutional as a deprivation of the equal liberty of

persons that is protected by the Fifth Amendment. Pp. 13--26.

(a) By history and tradition the definition and regulation of mar-

riage has been treated as being within the authority and realm of the

separate States. Congress has enacted discrete statutes to regulate

the meaning of marriage in order to further federal policy, but

DOMA, with a directive applicable to over 1,000 federal statues and

[NEW PAGE]

Cite as: 570 U.S._ (2013) 3

Syllabus

the whole realm of federal regulations, has a far greater reach. Its

operation is also directed to a class of persons that the laws of New

York, and of 11 other States, have sought to protect. Assessing the

validity of that intervention requires discussing the historical and

traditional extent of state power and authority over marriage.

Subject to certain constitutional guarantees, see, e.g., Loving v.

Virginia, 388 U.S. 1, "regulation of domestic relations" is "an area

that has long been regarded as a virtually exclusive province of the

States," Sosna v. Iowa, 419 U. S. 393, 404. The significance of state

responsibilities for the definition and regulation of marriage dates to

the Nation's beginning; for "when the Constitution was adopted the

common understanding was that the domestic relations of husband

and wife and parent and child were matters reserved to the States,"

Ohio ex rel. Popovici v. Agler, 280 U. S. 379, 383-384. Marriage laws

may vary from State to State, but they are consistent within each

State.

DOMA rejects this long-established precept. The State's decision

to give this class of persons the right to marry conferred upon them a

dignity and status of immense import. But the Federal Government

uses the state-defined class for the opposite purpose---to impose re-

strictions and disabilities. The question is whether the resulting injury

and indignity is a deprivation of an essential part of the liberty

protected by the Fifth Amendment, since what New York treats as

alike the federal law deems unlike by a law designed to injure the

same class the State seeks to protect. New York's actions were a

proper exercise of its sovereign authority. They reflect both the

community's considered perspective on the historical roots of the in-

stitution of marriage and its evolving understanding of the meaning

of equality. Pp. 13--20.

(b) By seeking to injure the very class New York seeks to protect,

DOMA violates basic due process and equal protection principles ap-

plicable to the Federal Government. The Constitution's guarantee of

equality "must at the very least mean that a bare congressional de-

sire to harm a politically unpopular group cannot" justify disparate

treatment of that group. Department of Agriculture v. Moreno, 413

U. S. 528, 534-535. DOMA cannot survive under these principles.

Its unusual deviation from the tradition of recognizing and accepting

state definitions of marriage operates to deprive same-sex couples of

the benefits and responsibilities that come with federal recognition of

their marriages. This is strong evidence of a law having the purpose

and effect of disapproval of a class recognized and protected by state

law. DOMA's avowed purpose and practical effect are to impose a

disadvantage, a separate status, and so a stigma upon all who enter

into same-sex marriages made lawful by the unquestioned authority

[page 3]

4 UNITED STATES v. WINDSOR

Syllabus

of the States.

DOMA's history of enactment and its own text demonstrate that

interference with the equal dignity of same-sex marriages, conferred

by the States in the exercise of their sovereign power, was more than

an incidental effect of the federal statute. It was its essence. BLAG's

arguments are just as candid about the congressional purpose.

DOMA's operation in practice confirms this purpose. It frustrates

New York's objective of eliminating inequality by writing inequality

into the entire United States Code.

DOMA's principal effect is to identify and make unequal a subset of

state-sanctioned marriages. It contrives to deprive some couples

married under the laws of their State, but not others, of both rights

and responsibilities, creating two contradictory marriage regimes

within the same State. It also forces same-sex couples to live as mar-

ried for the purpose of state law but unmarried for the purpose of

federal law, thus diminishing the stability and predictability of basic

personal relations the State has found it proper to acknowledge and

protect. Pp. 20-26.

699 F. 3d 169, affirmed.

KENNEDY, J., delivered the opinion of the Court, in which GINSBURG,

BREYER, SOTOMAYOR, and KAGAN, JJ., joined. ROBERTS, C. J., filed a

dissenting opinion. SCALIA, J., filed a dissenting opinion, in which

THOMAS, J., joined, and in which ROBERTS, C. J., joined as to Part I.

ALITO, J., filed a dissenting opinion, in which THOMAS, J., joined as to

Parts II and III.

[NEW PAGE]

Cite as: 570 U. S. _ (2013) 1

Opinion of the Court

NOTICE: This opinion is subject to formal revision before publication in the

preliminary print of the United States Reports. Readers are requested to

notify the Reporter of Decisions, Supreme Court of the United States, Washington,

D. C. 20543, of any typographical or other formal errors, in order

that corrections may be made before the preliminary print goes to press.

SUPREME COURT OF THE UNITED STATES

No. 12-307

UNITED STATES, PETITIONER v. EDITH SCHLAIN

WINDSOR, IN HER CAPACITY AS EXECUTOR OF THE

ESTATE OF THEA CLARA SPYER, ET AL.

ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF

APPEALS FOR THE SECOND CIRCUIT

[June 26, 2013]

JUSTICE KENNEDY delivered the opinion of the Court.

Two women then resident in New York were married

in a lawful ceremony in Ontario, Canada, in 2007. Edith

Windsor and Thea Spyer returned to their home in New

York City. When Spyer died in 2009, she left her entire

estate to Windsor. Windsor sought to claim the estate tax

exemption for surviving spouses. She was barred from

doing so, however, by a federal law, the Defense of Mar-

riage Act, which excludes a same-sex partner from the

definition of "spouse" as that term is used in federal stat-

utes. Windsor paid the taxes but filed suit to challenge

the constitutionality of this provision. The United States

District Court and the Court of Appeals ruled that this

portion of the statute is unconstitutional and ordered the

United States to pay Windsor a refund. This Court granted

certiorari and now affirms the judgment in Windsor's

favor.

I

In 1996, as some States were beginning to consider the

concept of same-sex marriage, see, e.g., Baehr v. Lewin, 74

#archivesgov#June 26#2013#2010s#Pride#LGBTQ+#LGBTQ+ history#U.S. v Windsor#Defense of Marriage Act#same-sex marriage#Supreme Court#SCOTUS

143 notes

·

View notes

Text

Except for the fact that this guy says it all started in 1913 but the Boomers started being born AFTER WWII, and he blames Boomers, this is interesting...

The economy is actually WORSE right now than during the Great Depression:

An idea kicked around by conservatives a few years ago -- conservatives, not necessarily Republicans -- is to ban corporations (including trust funds) from owning housing. And that would work.

I could be out of date here but, federal guidelines said that any owner occupied housing up to five units is a private home. So you just go with that, say that corporations (including trust funds) can't own any house with less than five units. If a structure has six units or more, fine, but anything less and they can't own it.

This would IMMEDIATELY increase tax revenues and significantly increase the number of houses available to families.

Tax revenues: Your typical family is allowed to deduct the interest paid on their mortgage, and that's it. Any corporation, including a trust fund, is going to deduct EVERYTHING from their taxes! Paint? Repairs? New appliances? Anything. If it's an "Expense" then it's tax deductible for the corporation. And in return for lavishing these tax goodies on the rich, they horde real estate, shrink the housing pool, drive up housing prices which in turn drives up rents. IT'S A LOSE/LOSE SITUATION FOR WORKING FAMILIES!

Neither party cares.

Neither has done a goddamn thing about the snowballing housing crisis.

Our 1% are ending America at it's roots, the family, and they are doing it out of greed.

#donald trump#FJB#Banana Republic#taxes#kyle rittenhouse#MAGA#suck my freedom#god is a republican#make america great again#trump#too big to rig#too big to steal#congress

14 notes

·

View notes

Text

ASX set to slide as markets drift [Video]

#EstateTax#EstatePlanning#FamilyWealthManagement#FederalEstateTax#InheritancePlanning#Estate Tax#Estate Planning#Family Wealth Management#Federal Estate Tax#Inheritance Planning

0 notes

Text

Tax his land,

Tax his bed,

Tax the table

At which he's fed.

Tax his work,

Tax his pay,

He works for peanuts

Anyway!

Tax his cow,

Tax his goat,

Tax his pants,

Tax his coat.

Tax his tobacco,

Tax his drink,

Tax him if he

Tries to think.

Tax his car,

Tax his gas,

Find other ways

To tax his ass.

Tax all he has

Then let him know

That you won't be done

Till he has no dough.

When he screams and hollers

Then tax him some more,

Tax him till

He's good and sore.

Then tax his coffin,

Tax his grave,

Tax the sod in

Which he's laid.

When he's gone,

Do not relax,

It’s time to apply

The inheritance tax.

A sampling of our taxes:

Accounts Receivable Tax

Airline Surcharge Tax

Airline Fuel Tax

Airport Maintenance Tax

Building Permit Tax

Cigarette Tax

Corporate Income Tax

Death (Estate) Tax

Dog License Tax

Driving Permit Tax

Environmental Tax

Excise Taxes

Federal Income Tax

Federal Unemployment

Fishing License Tax

Food License Tax

Gasoline Tax

Gross Receipts Tax

Health Tax

Hunting License Tax

Hydropower Tax

Inheritance Tax

Interest Tax

Liquor Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Mortgage Tax

Personal Income Tax

Property Tax

Poverty Tax

Prescription Drug Tax

Real Estate Tax

Recreational Vehicle Tax

Retail Sales Tax

Service Charge Tax

School Tax

Telephone Federal, State, and Local Surcharge Taxes

Vehicle License Registration Tax

Vehicle Sales Tax

Water Tax

Watercraft Registration Tax

Well Permit Tax

Workers Compensation Tax

In 1913, the 16th Amendment was ratified allowing Congress to tax all types of income. Where did the overwhelming abundance of taxes come from? Politicians.

We are way past being used for their folly. Time to make some big changes!

TRUMP#2024

❤️🇺🇸🤍🇺🇸💙

21 notes

·

View notes

Note

I love the idea of Wu being a kind, just and wise Earth King while being a selfish, bratty twink privately making Mako's job as caring, doting and level-headed consort crucial for the well-being of the transitioning Earth Kingdom into a Federation of Earth Countries/Estates. Give me yar best shot of Pre-Democracy Earth King Wu, please?

Listen Wu just kinda has a bratty streak he can't help it!!! And yes once he gets his act together and gets serious about ruling and reforming the earth kingdom he's got to have SOME outlet for his inner brat and Mako is subject to it (don't let Mako's grumpy face fool you he likes it wink wink).

I have always headcanoned that it takes a while to transition to a democracy but I go back and forth on how long and whether or not they actually get married and Mako becomes a consort or if he just lives in Ba Sing Se with Wu.

As for Wu, I think he's a good listener and I think he pays attention to what the people envision for the transition. He vowed to let each state come up with their own timetable for elections, and I think his focus would perhaps be on reforming the central government ESPECIALLY taxes. Like Hou-Ting was taxing states into poverty (as shown in season 3 when korrasami collected the tax money for her) Wu's gonna fix that for sure. I also like to imagine he's inspired to create a better, more consistent safety net for the people, avatar health and human services you know. Child welfare, unemployment, public health, etc. specifically after Mako opens his eyes to the reality of poverty that exists in the world.

And I think Mako's right by his side though I go back and forth on how he supports Wu. Maybe they're married and he's actually King Consort and has some Real Power. Or maybe he lives in Ba Sing Se and works there. Or maybe he divides his time between Ba Sing Se and Republic City, doing a little work in both.

16 notes

·

View notes

Text

The IRS says it has collected an additional $360 million in overdue taxes from delinquent millionaires as the agency’s leadership tries to promote the latest work it has done to modernize the agency with Inflation Reduction Act funding that Republicans are threatening to chip away.

Leadership from the federal tax collector held a call with reporters Thursday to give updates on how the agency has used a portion of the tens of billions of dollars allocated to the agency through Democrats’ Inflation Reduction Act, signed into law in August 2022.

Along with the $122 million collected from delinquent millionaires last October, now nearly half a billion dollars in back taxes from rich tax cheats has been recouped, IRS leaders say.

The announcement comes as the IRS braces for a more severe round of funding cuts.

The agency cuts previously agreed upon by the White House and congressional Republicans in the debt ceiling and budget cuts package passed by Congress last year — which included $20 billion rescinded from the IRS over two years — would be frontloaded as part of the overall spending package for the current fiscal year that could help avoid a partial government shutdown later this month.

IRS Commissioner Daniel Werfel said that “the impact of the rescission that’s being discussed as part of the current budget will not impact our efforts until the later years.”

He said the agency would still spend its now-$60 billion allocation over the next 10 years and spread the need for more funding into later years.

“Our intent is to spend the money to have maximum impact in helping taxpayers,” he said, “to have maximum impact now and in the immediate future.”

“My hope is that as we demonstrate the positive impact that IRA funding is having for all taxpayers, that there will be a need and a desire amongst policymakers at that time to restore IRS funding so that we can continue the momentum that’s having a very positive impact,” Werfel said.

As of December, the IRS says it opened 76 examinations into the largest partnerships in the U.S. that include hedge funds, real estate investment partnerships and large law firms.

“It’s clear the Inflation Reduction Act funding is making a difference for taxpayers,” Werfel said. “For progress to continue we must maintain a reliable, consistent annual appropriations for our agency.”

15 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

December 26, 2023

HEATHER COX RICHARDSON

DEC 27, 2023

On December 26, 1991, the New York Times ran a banner headline: “Gorbachev, Last Soviet Leader, Resigns; U.S. Recognizes Republics’ Independence.” On December 25, Soviet president Mikhail Gorbachev had resigned, marking the end of the Union of Soviet Socialist Republics, often referred to as the Soviet Union or USSR.

Former Soviet republics had begun declaring their independence in March 1990, the Warsaw Pact linking the USSR’s Eastern European satellites into a defense treaty dissolved by July 1991, and by December 1991 the movement had gathered enough power that Belarus, Russia, and Ukraine joined together in a “union treaty” as their leaders announced they were creating a new Commonwealth of Independent States. When almost all the other Soviet republics announced on December 21 that they were joining the new alliance, Gorbachev could either try to hold the USSR together by force or step down. He chose to step down, handing power to the president of the Russian Federation, Boris Yeltsin.

The dissolution of the USSR meant the end of the Cold War, and those Americans who had come to define the world as a fight between the dark forces of communism and the good forces of capitalism believed their ideology had triumphed. Two years ago, Gorbachev said that with the collapse of the Soviet Union, "They grew arrogant and self-confident. They declared victory in the Cold War."

The collapse of the USSR gave the branch of the Republican Party that wanted to destroy the New Deal confidence that their ideology was right. Believing that their ideology of radical individualism had destroyed the USSR, these so-called Movement Conservatives very deliberately set out to destroy what they saw as Soviet-like socialist ideology at home. As anti-tax crusader Grover Norquist wrote in the Wall Street Journal: “For 40 years conservatives fought a two-front battle against statism, against the Soviet empire abroad and the American left at home. Now the Soviet Union is gone and conservatives can redeploy. And this time, the other team doesn't have nuclear weapons.”

In the 1990s the Movement Conservatives turned their firepower on those they considered insufficiently committed to free enterprise, including traditional Republicans who agreed with Democrats that the government should regulate the economy, provide a basic social safety net, and promote infrastructure. Movement Conservatives called these traditional Republicans “Republicans in Name Only” or RINOs and said that, along with Democrats, such RINOs were bringing “socialism” to America.

With the “evil empire,” as President Ronald Reagan had dubbed the Soviet Union, no longer a viable enemy, Movement Conservatives, aided by new talk radio hosts, increasingly demonized their domestic political opponents. As they strengthened their hold on the Republican Party, Movement Conservatives cut taxes, slashed the social safety net, and deregulated the economy.

At the same time, the oligarchs who rose to power in the former Soviet republics looked to park their illicit money in western democracies, where the rule of law would protect their investments. Once invested in the United States, they favored the Republicans who focused on the protection of wealth rather than social services. For their part, Republican politicians focused on spreading capitalism rather than democracy, arguing that the two went hand in hand.

The financial deregulation that made the U.S. a good bet for oligarchs to launder money got a boost when, shortly after the September 11, 2001, attacks, Congress passed the PATRIOT Act to address the threat of terrorism. The law took on money laundering and the illicit funding of terrorism, requiring financial institutions to inspect large sums of money passing through them. But the Financial Crimes Enforcement Network (FinCEN) exempted many real estate deals from the new regulations.

The United States became one of the money-laundering capitals of the world, with hundreds of billions of dollars laundered in the U.S. every year.

In 2011 the international movement of illicit money led then–FBI director Robert Mueller to tell the Citizens Crime Commission of New York City that globalization and technology had changed the nature of organized crime. International enterprises, he said, “are running multi-national, multi-billion dollar schemes from start to finish…. They may be former members of nation-state governments, security services, or the military…. These criminal enterprises are making billions of dollars from human trafficking, health care fraud, computer intrusions, and copyright infringement. They are cornering the market on natural gas, oil, and precious metals, and selling to the highest bidder…. These groups may infiltrate our businesses. They may provide logistical support to hostile foreign powers. They may try to manipulate those at the highest levels of government. Indeed, these so-called ‘iron triangles’ of organized criminals, corrupt government officials, and business leaders pose a significant national security threat.”

In 2021, Congress addressed this threat by including the Corporate Transparency Act in the National Defense Authorization Act. It undercut shell companies and money laundering by requiring the owners of any company that is not otherwise overseen by the federal government (by filing taxes, for example, or through close regulation) to file with FinCEN a report identifying (by name, birth date, address, and an identifying number) each person associated with the company who either owns 25% or more of it or exercised substantial control over it. The measure also increased penalties for money laundering and streamlined cooperation between banks and foreign law enforcement authorities.

But that act wouldn’t take effect for another three years.

Meanwhile, once in office, the Biden administration made fighting corruption a centerpiece of its attempt to shore up democracy both at home and abroad. In June 2021, Biden declared the fight against corruption a core U.S. national security interest. “Corruption threatens United States national security, economic equity, global anti-poverty and development efforts, and democracy itself,” he wrote. “But by effectively preventing and countering corruption and demonstrating the advantages of transparent and accountable governance, we can secure a critical advantage for the United States and other democracies.”

In March 2023 the Treasury told Congress that “[m]oney laundering perpetrated by the Government of the Russian Federation (GOR), Russian [state-owned enterprises], Russian organized crime, and Russian elites poses a significant threat to the national security of the United States and the integrity of the international financial system,” and it outlined the ways in which it had been trying to combat that corruption. “In light of Russia’s further invasion of Ukraine,” it said, “we must redouble our efforts to prevent Russia from abusing the U.S. financial system to sustain its war and counter Russian sanctioned individuals and firms seeking to exploit vulnerabilities in the U.S. financial system.”

The collapse of the USSR helped to undermine the Cold War democracy that opposed it. In the past 32 years we have torn ourselves apart as politicians adhering to an extreme ideology demonized their opponents. That demonization also helped to justify the deregulation of our economy and then the illicit money from the rising oligarchs it attracted, money that has corrupted our democratic system.

But there are at least signs that the financial free-for-all might be changing. The three years are up, and the Corporate Transparency Act will take effect on January 1, 2024.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters from an American#money laundering#the former Soviet Union#financial deregulation#movement conservatives#Corporate Transparency Act#corruption#history#the hard right

11 notes

·

View notes

Text

What Did the Biden Family’s Foreign Clients Get for their Money?

Hunter Biden pleads guilty to federal tax charges.

Wall Street Journal

By James Freeman

Hunter Biden has been convicted of federal crimes for not paying all the taxes he owed on his foreign income. But the most important question for Americans remains unanswered: What exactly did his overseas clients get in return for their money? His Thursday guilty plea on tax charges prevented testimony that may have gone some way toward providing an answer. This potential testimony may also explain why Hunter Biden waited until now to acknowledge his guilt.

The Journal’s Sara Randazzo, Ryan Barber and Annie Linskey report from Los Angeles:

Federal prosecutors signaled an aggressive strategy as the trial drew near, previewing an approach that would show how foreign interests paid the younger Biden to influence the U.S. government while his father was vice president during the Obama administration. Prosecutors said they planned to cast a light on a lucrative arrangement with a Romanian real-estate magnate who was facing a corruption investigation in his home country, along with his ties to the oil company CEFC China Energy and his tenure on the board of Burisma, a Ukrainian gas company.

In court Thursday, [prosecutor Leo Wise] insisted on reading the entirety of the 56-page indictment into the record—over the objection of Biden’s lawyer—to establish the facts underlying the guilty plea.

Alanna Durkin Richer reported last month for the Associated Press:

Hunter Biden’s lawyers say prosecutors are inappropriately trying to insert “politically-charged” allegations about his foreign business dealings into the upcoming federal tax trial against the president’s son.

Special counsel David Weiss’ team told the judge last week that they plan to call to the witness stand a business associate of Hunter Biden’s to testify about an arrangement with a Romanian businessman who was trying to “influence U.S. government policy” during Joe Biden’s term as vice president…

The Romanian businessman, Gabriel Popoviciu, wanted U.S. government agencies to probe a bribery investigation he was facing in his home country in the hopes that would end his legal trouble, according to prosecutors.

Prosecutors say Hunter Biden agreed with his business associate to help Popoviciu fight the criminal charges against him. But prosecutors say they were concerned that “lobbying work might cause political ramifications” for Joe Biden, so the arrangement was structured in a way that “concealed the true nature of the work” for Popoviciu, prosecutors alleged…

In fact, Popoviciu and Hunter’s business associate agreed that they would be paid for their work to “attempt to influence U.S. government agencies to investigate the Romanian investigation,” prosecutors said. Hunter Biden’s business associate was paid more than $3 million, which was split with Hunter and another business partner, prosecutors say.

Ms. Richer also noted that Hunter Biden’s defense lawyers “slammed prosecutors for showcasing ‘these matters on the eve of Mr. Biden’s trial—when there is no mention of political influence in the 56-page Indictment.’ ” The A.P. story continued:

“The Special Counsel’s unnecessary change of tactic merely echoes the baseless and false allegations of foreign wrongdoing which have been touted by House Republicans to use Mr. Biden’s proper business activities in Romania and elsewhere to attack him and his father,” the defense wrote.

But the defense has now opted not to defend.

Of course Romania is not the only foreign jurisdiction that proved fruitful for the Biden family business. The majority staff of several House committees recently reported:

From 2014 to the present… Biden family members and their associates received over $27 million from foreign individuals or entities…

Witnesses acknowledged that Hunter Biden involved Vice President Biden in many of his business dealings with Russian, Romanian, Chinese, Kazakhstani, and Ukrainian individuals and companies.Then-Vice President Biden met or spoke with nearly every one of the Biden family’s foreign business associates, including those from Ukraine, China, Russia, and Kazakhstan.

And of course let’s not forget Hunter Biden’s own deposition on Capitol Hill. This column noted in March that mere minutes after making yet another broad claim of not involving his father in the business, Hunter Biden confirmed the story of travelling with then-Vice President Joe Biden on Air Force Two to China and introducing his father to Jonathan Li in the lobby of the Bidens’ hotel. The following excerpt from the deposition suggests that the timing could not have been better:

[Committee member or staff]: At the time that you did introduce your father to Jonathan Li, did you or any of your business associates have any potential business with Jonathan Li?

[Hunter Biden]: I was working with Jonathan on a potential that he had an idea for creating a private equity fund based in China to do cross-border investments.

Nice. But good luck explaining what value Hunter Biden might be able to add to such an enterprise. Years later, his Chinese associates still hadn’t come up with a story. In 2019 Cissy Zhou and Jun Mai reported in the South China Morning Post:

BHR (Shanghai) Equity Investment Fund Management Company has grabbed global media attention for its links with Hunter Biden, the son of former United States vice-president Joe Biden, after US President Donald Trump fired a barrage of corruption allegations at him and requested China investigate the Bidens’ financial activities in the country.

The company has repeatedly declined to elaborate on the younger Biden’s role at the firm when contacted by the South China Morning Post via phone, mail and visits to the office. But Jonathan Li Xiangsheng, the firm’s chief executive and Hunter Biden’s partner, has said the company was working on an explanation about the American’s role.

Li refused to comment on the younger Biden when reached by the Post on Monday.

A recent visit to the firm’s registered address in Beijing found a small, plainly decorated office, where a receptionist said she had never seen Hunter Biden.

Is there anything Joe Biden said about the family business in 2020 that has turned out to be true?

Meanwhile as Vice President Kamala Harris seeks a promotion, perhaps she ought to disclose if she ever questioned anyone or learned anything about the Biden family business and its implications for American foreign policy. One would guess she was at least curious. Did she ever talk to anyone about the ethical standards for Hunter Biden’s art sales, which turned out to be a sham while she was serving alongside Joe Biden?

Vice President Harris is not just a lawyer but a former prosecutor and a former state attorney general, for goodness sake. Wasn’t she the least bit concerned?

***

Spokespeople for both the president and the vice president say that they won’t be pardoning Hunter Biden. But then why is Hunter Biden’s lawyer still making what seems like a political argument rather than a legal one?

Jack Morphet and Priscilla DeGregory report for the New York Post on comments from defense lawyer Abbe Lowell:

“Hunter decided to enter his plea to protect those he loves from unnecessary hurt and cruel humiliation,” Lowell said.

“This plea prevents that kind of show trial that would not have provided all the facts or served any real point in justice. He will now move on to the sentencing phase, while keeping open the options to raise the many clear issues with this case on appeal.”

He’s going to appeal a case in which he just pleaded guilty to all the charges? Sounds like an argument built for the White House briefing room, not a courtroom.

***

James Freeman is the co-author of “The Cost: Trump, China and American Revival” and also the co-author of “Borrowed Time: Two Centuries of Booms, Busts and Bailouts at Citi.”

#Biden#Biden Administration#Jill Biden Hunter Biden#Joe Biden#Corrupt#Biden is corrupt#indict. prosecute. incarcerate.#Obama#Obama knew what Biden was doing#Obama Biden conspiracy#Democrats#trump#trump 2024#president trump#ivanka#repost#americans first#america first#donald trump#america#democratic party#democrats are corrupt#democrats will destroy america

44 notes

·

View notes