#home insurance

Explore tagged Tumblr posts

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

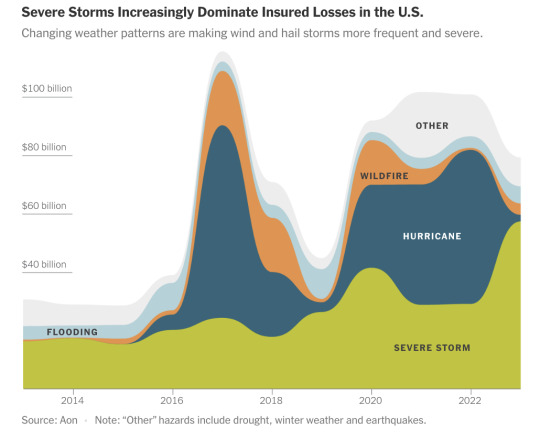

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

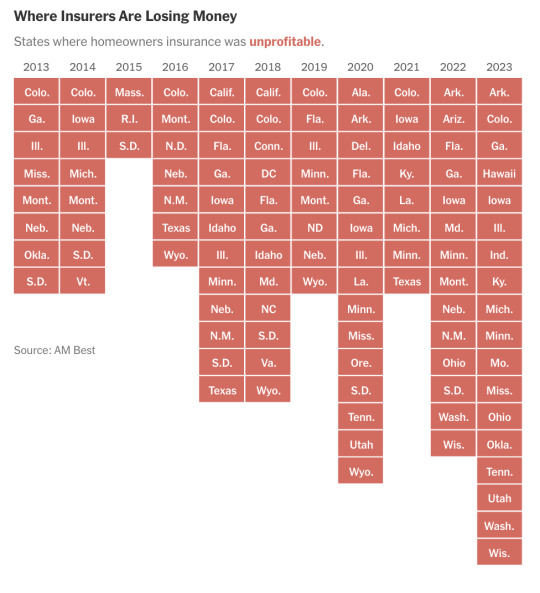

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

136 notes

·

View notes

Text

#tiktok#California#tw fire#home insurance#palisades fire#capitalism kills#capitalism is evil#capitalism is a scam#capitalism is a disease#capitalism is hell#climate change#climate crisis

18 notes

·

View notes

Text

Cindy Picos was dropped by her home insurer last month. The reason: aerial photos of her roof, which her insurer refused to let her see.

“I thought they had the wrong house,” said Picos, who lives in northern California. “Our roof is in fine shape.”

Her insurer said its images showed her roof had “lived its life expectancy.” Picos paid for an independent inspection that found the roof had another 10 years of life. Her insurer declined to reconsider its decision.

Across the U.S., insurance companies are using aerial images of homes as a tool to ditch properties seen as higher risk.

Nearly every building in the country is being photographed, often without the owner’s knowledge. Companies are deploying drones, manned airplanes and high-altitude balloons to take images of properties. No place is shielded: The industry-funded Geospatial Insurance Consortium has an airplane imagery program it says covers 99% of the U.S. population.

The array of photos is being sorted by computer models to spy out underwriting no-nos, such as damaged roof shingles, yard debris, overhanging tree branches and undeclared swimming pools or trampolines. The red-flagged images are providing insurers with ammunition for nonrenewal notices nationwide.

“We’ve seen a dramatic increase across the country in reports from consumers who’ve been dropped by their insurers on the basis of an aerial image,” said Amy Bach, executive director of consumer group United Policyholders.

The increasingly sophisticated use of flyby photos comes as home insurers nationwide scramble to “derisk” their property portfolios, dropping less-than-perfect homes in an effort to recover from big underwriting losses.

(continue reading)

56 notes

·

View notes

Text

2 notes

·

View notes

Text

Why did you buy a house? Metropolitan Life Insurance Company ad - 1958.

#vintage illustration#vintage advertising#insurance#home insurance#insurance companies#met life#metlife#metlife insurance#metropolitan life insurance company#metropolitan life insurance#metropolitan life

3 notes

·

View notes

Text

Find the Cheapest Travel Insurance for Schengen Visa:

Introduction to Schengen Travel Insurance

Once in Europe traveling is full of excitement. But, it’s significant to be well-protected. Schengen travel insurance is not something that is suggested as an option, it is rather a mandatory requirement which is made compulsory for all Schengen visa applicants. Besides healthcare, it also protects passengers from such types of expenses as trip cancellations and other unforeseen contingencies. Let’s explore the Cheapest Travel Insurance for Schengen Visa in this article.

Understanding Cheapest Travel Insurance for Schengen Visa Requirements

In particular, the insurance policy that is compulsory when applying for the Schengen visa is vital when arranging your European trip. The policy should insure at least €30,000 for the medical expenses and the repatriation returning the insurance sum to the insurance company. It must provide you with pass-free access to all Schengen countries for the entire period of your stay.

The Importance of Travel Insurance for Schengen Visa Applicants

Securing travel insurance is not merely a tick off of the “to have” list, but a support that is there for the times when you need it the most. In this way, the provider is prevented from the situations of not going anywhere like emergency happenings, robbery, or the hurdles of the trip.

Selecting the Right and Cheapest Travel Insurance for Schengen Visa Plan

Deciding the best insurance plan may be a challenge but it’s important to forget about possible uncertainties during a trip. The following is an explanation of how to choose an insurance package that covers the essentials with a budget in mind and how to find Cheapest Travel Insurance for Schengen Visa.

2 notes

·

View notes

Text

Phone: (858) 569-1009

Address: 10769 Woodside Ave Ste 103, Santee, CA 92071, United States

Email: [email protected]

LOCAL INSURANCE AGENCY OFFERING ALL LINES OF INSURANCE. AUTO INSURANCE, HOME INSURANCE, RENTERS INSURANCE, MOBILE HOME INSURANCE, MANUFACTURED HOME INSURANCE, LIFE INSURANCE, BUSINESS INSURANCE, WORKERS COMP

2 notes

·

View notes

Text

How to Choose the Right Home Insurance in the UAE?

Home insurance is a type of property insurance that covers losses and damage that occur to an individual’s house or insured belongings. The coverage can cover costs due to natural calamities such as floods and earthquakes. Plus, it covers fire-related damages to the property.

Although the UAE is one of the safest places, the absence of home insurance can put a huge financial burden on people for rebuilding. In this blog, find out how to choose the right home insurance in the UAE.

Understand Insurance Needs

The first step is to understand personal insurance needs. The location of the residence is one of the major factors one should consider while opting for a home insurance policy. In addition, decide if you want insurance coverage only for the property or the belongings in the house or both. Other factors such as age, income, health, employment, settlement plan, family and more can be considered too.

Do Research

Do your own research about the different insurance companies. Find out the following about the insurance providers:

Company Reputation

Financial Stability

Customer Service

Claim Settlement Time

Search online for reviews, customer feedback and ratings. Seek help from friends and families. Else, get expert advice from insurance experts in the UAE. Also, it is important that the insurance provider has a licence as per the laws in the UAE.

Compare Different Home Insurance Policies

Once you narrow down the list of insurance companies, start comparing different home insurance policies offered. Read carefully each and every detail to have a complete understanding of the insurance coverage promised. Plus, read the terms and conditions thoroughly. Compare the procedures to claim insurance and the time required to achieve a settlement.

Consider the Features

Find out if there are additional benefits or add-ons offered by the insurance company in addition to the standard coverage. It is necessary to cover specific needs besides basic coverage. However, one of the main factors to consider is the cost. Take time and assess if the add-ons are worth the additional money.

Budget

The cost of a home insurance policy is one of the key factors that distinguish one insurer from another. Compare the following things to find the best insurance policy that provides the best value:

Premium

Deductible Amounts

Exclusions

Discuss if there are discounts or promotions that can significantly lower the cost and boost savings on insurance.

Review

Periodical review of the home insurance is essential to meet the changing needs and the coverage required. The best thing is to review annually if the insurance coverage is enough for the future.

Claim Rejection

Make sure to submit all the necessary documents and provide all the necessary details to avoid claim rejection when one needs it the most. As world events become more unpredictable, choosing a home insurance policy can keep everyone protected. Crossroads Insurance Brokers is a leading insurance broker in the UAE offering cutting-edge insurance solutions. Contact us for more details.

#property insurance#insurance broker in the UAE#home insurance#property insurance in UAE#personal insurance

2 notes

·

View notes

Text

Farmers Insurance St. Louis - Ed Fogelbach: Your Trusted Insurance Partner

Introduction

When it comes to safeguarding your assets and securing your financial future, having a reliable insurance provider is crucial. Farmers Insurance St. Louis - Ed Fogelbach is your go-to agency for comprehensive coverage tailored to meet your unique needs. Whether you are looking for Car Insurance, Home Insurance, or Business Insurance, our team is committed to providing top-tier protection and peace of mind.

With a strong reputation as the Best Insurance Company Near Me, we prioritize customer satisfaction, ensuring that each client receives personalized service and robust policies. Our goal is to protect what matters most to you while making the insurance process seamless and stress-free.

Why Choose Farmers Insurance St. Louis - Ed Fogelbach?

Choosing an insurance provider is an important decision that affects your financial stability and long-term security. Here’s why Farmers Insurance St. Louis - Ed Fogelbach stands out:

Tailored Insurance Solutions – We understand that every client has unique needs, which is why we offer customized policies that align with your specific requirements.

Experienced Professionals – Our team consists of highly trained experts dedicated to helping you find the best coverage options.

Competitive Pricing – We offer affordable plans without compromising on coverage quality.

Local Expertise – Being a local agency, we have in-depth knowledge of St. Louis and surrounding areas, ensuring our policies are relevant and effective.

Unparalleled Customer Service – Our priority is you. We work diligently to provide prompt assistance and claims support whenever needed.

Comprehensive Car Insurance Coverage

Accidents happen, but with the right Car Insurance, you can drive with confidence knowing you are protected against unexpected expenses. Our auto insurance policies cover:

Liability Coverage – Protects you in case you are at fault in an accident, covering bodily injury and property damage.

Comprehensive Coverage – Covers damages caused by non-collision incidents such as theft, vandalism, and natural disasters.

Collision Coverage – Pays for vehicle repairs or replacement if involved in an accident.

Uninsured/Underinsured Motorist Coverage – Ensures financial protection if you're involved in an accident with a driver lacking sufficient insurance.

Personal Injury Protection (PIP) – Covers medical expenses, lost wages, and other related costs after an accident.

Reliable Home Insurance for Your Peace of Mind

Your home is one of your most valuable assets, and having the right Home Insurance policy is essential to protect it from unforeseen risks. Our policies include:

Dwelling Coverage – Covers damages to your home’s structure from perils like fire, storms, and vandalism.

Personal Property Protection – Protects belongings such as furniture, electronics, and valuables from theft or damage.

Liability Coverage – Offers financial protection in case someone is injured on your property.

Additional Living Expenses (ALE) Coverage – Pays for temporary housing if your home becomes uninhabitable due to a covered event.

Flood & Earthquake Insurance – Optional add-ons to safeguard against natural disasters.

Business Insurance to Safeguard Your Enterprise

Running a business comes with inherent risks, making Business Insurance a necessity to protect your company from financial setbacks. Our business policies include:

General Liability Insurance – Covers third-party bodily injury, property damage, and legal costs.

Commercial Property Insurance – Protects your business premises and assets from risks like fire, theft, and natural disasters.

Workers' Compensation – Ensures employee protection by covering medical expenses and lost wages due to workplace injuries.

Professional Liability Insurance – Shields businesses from claims of negligence, errors, or omissions.

Business Interruption Insurance – Covers lost income in case of temporary business closure due to a covered event.

How Farmers Insurance St. Louis - Ed Fogelbach Makes a Difference

At Farmers Insurance St. Louis - Ed Fogelbach, we go beyond offering standard insurance policies. We believe in forming long-term relationships with our clients, providing ongoing support and guidance to ensure your insurance needs are met at all times. Our commitment to excellence is what makes us recognized as the Best Insurance Company Near Me by many satisfied clients in St. Louis.

Personalized Consultation

We understand that choosing the right insurance can be overwhelming. That’s why we offer personalized consultations to assess your specific needs and recommend policies that best fit your lifestyle and budget.

Quick and Hassle-Free Claims Process

Filing a claim should be straightforward and stress-free. Our dedicated claims team works efficiently to process claims promptly, ensuring you receive the compensation you deserve without unnecessary delays.

Transparent Policies with No Hidden Costs

We believe in transparency and honesty. Our policies are designed with clear terms and conditions, ensuring you know exactly what’s covered without any hidden surprises.

Commitment to Community

Being a local agency, we take pride in serving the St. Louis community. We actively participate in local events and initiatives, reinforcing our commitment to the people we serve.

Get a Free Quote Today

If you’re looking for reliable Car Insurance, Home Insurance, or Business Insurance, Farmers Insurance St. Louis - Ed Fogelbach is here to help. Our team is dedicated to providing the best coverage solutions tailored to your needs.

0 notes

Text

💰 Affordable Home Insurance That Fits Your Needs!

Protecting your home shouldn’t be complicated or expensive. At Begin Insurance, we provide simple, hassle-free insurance solutions that give you complete coverage without breaking the bank.

As a trusted Home Insurance Company, we offer: 🔸 Easy application process & instant quotes 🔸 Flexible plans to match your budget 🔸 Reliable customer support when you need it most

🔑 Start protecting your home today with Begin Insurance!

These variations focus on different angles—security, family, and affordability—to attract diverse potential clients. Let me know if you need more! 🚀

0 notes

Text

What are the Benefits of Having Home Insurance?

Home insurance provides financial security in case of damage to your house due to natural disasters, fire, vandalism, or other unexpected events. Repairs and rebuilding costs can be overwhelming, but a good policy ensures that you won’t have to bear the full financial burden alone.

Coverage for Personal Belongings

A home insurance policy often includes coverage for personal belongings, such as furniture, electronics, and valuable items. If these are stolen or damaged, your policy can help replace them, reducing your financial strain.

Liability Protection

Accidents happen, and if someone gets injured on your property, you may be held legally responsible. Home insurance provides liability coverage, which can help cover medical expenses and legal fees if necessary.

Additional Living Expenses Coverage

If your home becomes uninhabitable due to damage, home insurance can cover temporary living costs, such as hotel stays and meals, until repairs are completed.

Peace of Mind for Homeowners

Owning a home comes with responsibilities and risks. Having home insurance ensures that you are financially protected from unexpected situations, giving you peace of mind.

Personal Insurance Benefits

Many home insurance policies fall under personal insurance plans, offering various options to customize coverage based on your specific needs. This ensures that your home and personal assets are safeguarded according to your preferences.

Mortgage Requirement Compliance

Most lenders require home insurance before approving a mortgage. This protects both the homeowner and the lender by ensuring the property remains financially covered in case of damage or loss.

Affordable Coverage Options

Home insurance policies are available at various price points, allowing homeowners to choose coverage that fits their budget. Comparing policies and providers can help you find an affordable yet comprehensive plan.

Protection Against Natural Disasters

Many home insurance plans offer coverage for damages caused by floods, earthquakes, hurricanes, and other natural calamities. This added protection ensures that homeowners do not suffer financial hardships in the aftermath of such events.

Theft and Burglary Protection

Homeowners can claim compensation for stolen items, reducing the financial loss caused by burglary. Some policies also cover damages resulting from break-ins, further securing your property.

Conclusion

Home insurance is an essential investment that provides financial security, peace of mind, and protection against various risks. From covering property damage to offering liability protection, it ensures that homeowners remain financially stable in unforeseen circumstances.

0 notes

Text

0 notes

Text

Understanding USA Insurance: A Complete Guide for Beginners

Understanding USA Insurance: A Complete Guide for Beginners Learn the basics of insurance in the USA, including types, benefits, costs, and how to choose the right coverage. Introduction Insurance plays a vital role in financial planning in the United States. It provides protection against unforeseen events, helping individuals and businesses manage risks effectively. However, navigating the…

#Auto Insurance#Beginner’s Guide#Health Insurance#Home Insurance#Insurance#Life Insurance#USA Insurance

0 notes

Text

0 notes