#Credit card debt management

Explore tagged Tumblr posts

Text

#best credit cards in uae#best rewards credit card#best travel credit card#credit card debt management#credit score#best travel credit cards#best personal loans in uae

0 notes

Text

Eliminate Your Debt in Hartford CT

Are you struggling with managing your personal finances due to overwhelming debt? You're not alone. Many people find it challenging to stay afloat financially when faced with mounting debt. Fortunately, there are several signs you can look out for to determine if you have too much debt, including difficulty paying bills on time, an inability to save money, high credit card balances, and constantly borrowing money from friends or family members.

If you identify with one or more of these signs, it's crucial to take action to manage your debt effectively. The first step is to create a budget to help you identify your income and expenses and prioritize your debt payments. Once you have a budget in place, you can prioritize your debts by paying off those with the highest interest rates or that are past due. You can also reduce your expenses by cutting back on non-essential expenses like dining out or subscription services and consider increasing your income by taking on a side job or selling items you no longer need.

If you're still struggling to manage your debt in Hartford CT, consider seeking professional help from a financial advisor or credit counselor. They can help you create a debt repayment plan that works for your financial situation.

In conclusion, managing debt can be a challenging task, but by identifying the signs of having too much debt and taking steps to manage it effectively, you can improve your financial health and achieve your financial goals. Use the tips, tricks, and strategies outlined in this ultimate guide to effective debt management to take control of your finances and pave the way to financial success.

#credit card debt help#credit card debt settlement#how to reduce credit card debts#debt free#credit card debt consolidation loan#credit card debt management#debtfree#debtreduction#financialfreedom#personalfinance#debtmanagement#budgeting#financialplanning#debtpayoff#savemoney#creditcarddebt#emergencyfund#financialadvisor#creditcounseling#sidehustle#financialgoals

1 note

·

View note

Text

#trump#donald trump#kamala harris#trump 2024#democrats#vote kamala#kamala 2024#kamala for president#vp kamala harris#republicans#mortgage#special interest#interest rates#housing#gas prices#economy#money management#money#budgeting#budget#food and beverages#foodporn#foodie#food#salary#paycheck#paypal#debt relief#debt#credit cards

464 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

530 notes

·

View notes

Text

Please help support my financial struggles so I can get back to the good stuff in life, like upkeep my fan blog. Any bit helps. Thank you. I am grateful to all my fellow skarsgardians no matter what.

#alexander skarsgard#alexander skarsgård#fangirl#send help#help#please help#money#send money#credit cards#debt#debt management#lawsuit#gofundme#go fund me#go fund them#go fund her

20 notes

·

View notes

Note

really feel you about the iowa show i had a moment on monday where i started looking at flights to milwaukee “just to see” as if i were not an unemployed college student with class in the morning. very glad to know i am not the only one lol

stay strong brothers, we must not allow our love for fob to lead us to make too many expensive mistakes 🙏 we are holding hands in this but we must not let it overcome us

#saw someone asking on twitter how people manage to go to show after show after show#and the amount of times people said they put it on credit cards or went into debt 😬😬😬😬#some people need to take a financial literacy class i think . but thats none of my business lol#go to multiple shows for sure!! i would if i could!!! but dont do it at the expense of like. your livelihood or finances or whatever

12 notes

·

View notes

Text

pro tip;

never autopay your credit payments for the day they're due.

give yourself at least a few days of a grace period in case your payment bounces and you need to choose an alternate method. there's also the risk that your bank doesn't approve the payment in time and then it's a late fee.

#p#they only offer it as an option to test the people who are shit at money and money management.#bc they love when people have bad credit and are in debt#dont ever think your credit card company wants you to thrive. they dont.

2 notes

·

View notes

Text

Listen, I would love to get involved in petty internet drama as much as the next guy, but I have a full-time job, rent due on the first, and credit card debt, so I'm little too preoccupied at the moment

#2024 will be the year i pay off my credit card debt 🤞#i finish paying off my medical bills this month#then i gotta tackle the $1.6k on my credit carx#and i dont wanna hear anyone be like “oh how'd you let it get that bad!”#it's called not paying attention poor money management and never being taught financial literary by my parents#the important thing is that im fixing it now#not tf#my ramblings

8 notes

·

View notes

Text

What being an adult feels like to millennials.

#adulting#idk how i manage to function hald the time#millennials#have an apartment a job and can pay my bills so i think im doing something right#but also have lots of credit card debt#rugrats#shitpost#be watching cartoons and coloring in my free time

4 notes

·

View notes

Text

Gonna have to bust out the comm sheet soon bc work is not scheduling me and. frankly. I simply do not want to be there as of late

#management change has been BRUTAL but we're working on it#anyways. need to get the business email set up bc i lowkey don't really wanna keep putting my full legal name out there lmao#i just. hope i can feel good enough to carry this out. all the time off and i feel so eh bc of work stuff#i wish it didn't bother me so much!! i don't WANT it to bother me this much!! i want to make art and make art for ppl bc i love to make art#maybe i'll go for a walk and feel like the light is coming back into my life.#also the extra money would really help me pay down my credit card debt so i'll be including that in the sheet lmao#it'll be a pretty simple sheet. flat rate. feeling lazy about it but i wanna be a little more serious about it this time#bc i uh. would really like to not be in debt if i can help it lmao. i'm making it work but it could also work better#anyways. keep your eyes open for that!#shai speaks

4 notes

·

View notes

Text

#best credit cards in uae#credit card debt management#best travel credit card#credit score#best travel credit cards

0 notes

Text

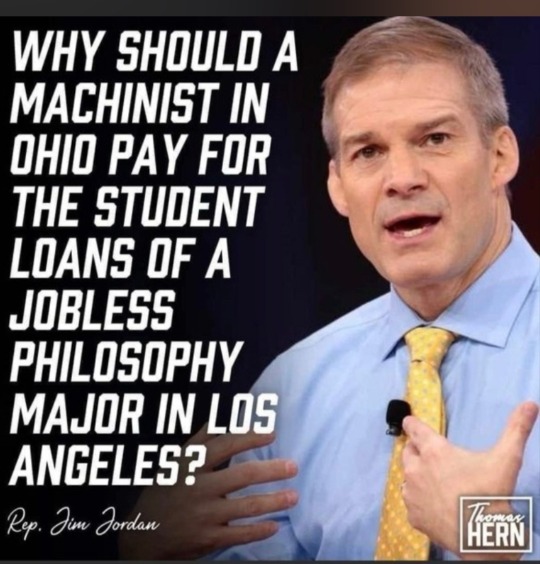

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

39 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Credit and Credit Cards

Understanding credit

Dafuq Is Credit and How Do You Bend It to Your Will?

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Ask the Bitches: What’s the Difference Between Credit Checks and Credit Monitoring?

When (And How) To Try Refinancing or Consolidating Student Loans

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Using credit

How to Instantly Increase Your Credit Score…For Free

How to Build Good Credit Without Going Into Debt

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Season 1, Episode 3: “My Parents Have Bad Credit. Should I Help by Co-signing Their Mortgage?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Season 2, Episode 2: “I’m Not Ready to Buy a House—But How Do I *Get Ready* to Get Ready?”

Credit cards

A Hand-holding Guide To Getting Your First Credit Card

63% of Millennials Are Making a Big Mistake With Credit Cards

Let’s End This Damaging Misconception About Credit Cards

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Here’s What to Do With Those Credit Card Pre-approval Offers You Get in the Mail

We’ll periodically update this masterpost as we continue to write tutorials and answer questions on credit. So if there’s anything you’re confused about, keep the questions coming!

And if we’ve helped you increase your credit score or pay off your credit card debt, consider tossing a coin to your Bitches through our PayPal. It ensures we can pay our lovely assistant and keep bringing you free articles and episodes like those above.

Toss a coin to your Bitches on PayPal

#credit#credit score#credit history#credit report#credit card#credit card debt#good credit#personal finance#money tips#debt management#debt consolidation#debt

352 notes

·

View notes

Video

youtube

Debthelper got my credit score from 540 to 680 #debtrelief #debtmanageme...

#youtube#debthelper got my credit score increased#debthelper lowered my credit card interest#happy client#actual client testimonial#i recommend a debt management program

0 notes

Text

How to Use a Personal Loan for Debt Consolidation

Managing multiple debts can be overwhelming, especially when dealing with high-interest credit cards, loans, and other financial obligations. Debt consolidation is an effective strategy to streamline your repayments and reduce financial stress. One of the best ways to consolidate debt is by taking a personal loan. In this guide, we’ll explore how you can use a personal loan for debt consolidation, its benefits, and key factors to consider before making a decision.

Understanding Debt Consolidation

Debt consolidation involves combining multiple outstanding loans or credit balances into a single loan with a fixed interest rate and repayment term. This approach simplifies repayment and can potentially lower your interest burden, making it easier to manage finances.

Why Choose a Personal Loan for Debt Consolidation?

A personal loan is an unsecured loan that provides a lump sum amount to borrowers, which they can use to repay their existing debts. Here’s why it can be an ideal choice for debt consolidation:

Lower Interest Rates – Personal loans generally offer lower interest rates compared to credit cards and other high-interest debts.

Fixed Repayment Tenure – Unlike revolving credit, personal loans have a fixed repayment schedule, helping you stay on track.

Single Monthly Payment – Instead of managing multiple EMIs, you only need to focus on one.

Improved Credit Score – Timely repayment of a personal loan can boost your credit score over time.

No Collateral Required – Most personal loans are unsecured, meaning you don’t have to pledge assets.

Steps to Use a Personal Loan for Debt Consolidation

1. Assess Your Debt Situation

Before applying for a personal loan, list all your outstanding debts, including credit card balances, existing loans, and other liabilities. Calculate the total amount you owe and compare the interest rates.

2. Check Your Credit Score

Lenders evaluate your credit score before approving a personal loan. A good credit score increases your chances of securing a loan at a lower interest rate. If your score is low, consider improving it before applying.

3. Compare Personal Loan Offers

Different banks and NBFCs offer personal loans with varying interest rates, loan amounts, and tenures. Compare multiple options to find the best deal. You can check personal loan options from:

IDFC First Bank Personal Loan

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

Axis Finance Personal Loan

Axis Bank Personal Loan

4. Apply for a Personal Loan

Once you’ve selected the right lender, apply for a personal loan with the required documents such as income proof, identity verification, and bank statements. The loan approval process is usually quick, especially with digital applications.

5. Use the Loan to Pay Off Debts

After receiving the loan amount, use it to clear your outstanding balances. Ensure that you close all your previous loans and credit card dues to avoid any further interest accumulation.

6. Stick to a Repayment Plan

Make sure to pay your new personal loan EMIs on time. Set up auto-debit or reminders to avoid missing payments, as delays can impact your credit score.

Factors to Consider Before Taking a Personal Loan for Debt Consolidation

Interest Rate & Processing Fees

While a personal loan can help reduce financial stress, it’s essential to compare interest rates and additional charges like processing fees before applying.

Loan Tenure

Choose a tenure that aligns with your repayment capacity. A shorter tenure means higher EMIs but less interest paid overall, while a longer tenure reduces EMI burden but increases total interest cost.

Prepayment Charges

If you plan to repay your loan early, check for any prepayment penalties. Some lenders charge a fee for early closure of the loan.

Avoid New Debts

Debt consolidation helps streamline finances, but it’s important to avoid accumulating new debts. Stick to a budget and spend wisely to maintain financial stability.

Alternatives to Personal Loan for Debt Consolidation

If a personal loan is not the right choice for you, consider these alternatives:

Balance Transfer on Credit Cards – Transfer high-interest credit card debt to a lower-interest card.

Loan Against Fixed Deposit – If you have a fixed deposit, you can take a loan against it at a lower interest rate.

Home Equity Loan – If you own property, you may use its equity for a loan.

Borrow from Employer or Family – Some employers offer low-interest loans, and borrowing from family may also be an option.

Conclusion

Using a personal loan for debt consolidation is a smart way to manage finances, reduce interest burden, and simplify repayments. However, it’s crucial to compare loan options, assess your repayment capacity, and avoid new debt to make the most of this financial strategy. If you’re looking for the best personal loan options, explore lenders such as IDFC First Bank, Bajaj Finserv, Tata Capital, and Axis Bank for competitive interest rates and flexible repayment terms.

#finance#personal loan online#nbfc personal loan#personal loans#bank#loan services#fincrif#loan apps#personal loan#personal laon#Personal loan#Debt consolidation loan#Consolidate debt with personal loan#Best personal loan for debt consolidation#Personal loan for paying off debt#Debt consolidation vs personal loan#Low-interest personal loan#Personal loan for credit card debt#Debt management with personal loan#Unsecured personal loan#Fixed-rate personal loan#Loan for financial planning#Benefits of debt consolidation#How to consolidate debt#Best lenders for personal loans#Fast approval personal loan#Personal loan interest rates#Personal loan eligibility#Reduce debt burden#Improve credit score with personal loan

0 notes

Text

Unlock Your Potential: Setting S.M.A.R.T. Financial Goals for Success

Introduction Setting financial goals is crucial for achieving success and realizing your full potential. By following the S.M.A.R.T. criteria – specific, measurable, achievable, relevant, and time-bound – you can create a roadmap to financial success. In this article, we will explore the importance of setting S.M.A.R.T. financial goals and how it can help you unlock your potential. Why Setting…

#best investment strategies#budgeting for beginners#financial goals setting.#financial management for small businesses#guide to building wealth#how to choose a financial advisor#how to save money effectively#investment opportunities in 2024#managing debt#Personal finance tips#smart ways to use credit cards#tax-saving strategies#tips for retirement planning#top financial planning tools#understanding credit scores

0 notes