#Commercial bank

Explore tagged Tumblr posts

Text

Detecting and Preventing Business Fraud

Fraud poses a significant threat to businesses of all sizes, undermining trust, financial stability, and reputation. In today's rapidly evolving business landscape, the risk of fraud is ever-present, making it imperative for organizations to adopt robust strategies for detection and prevention. A few proactive steps for preventing fraudulent activities and safeguarding assets include:

Strengthening Internal Controls Strengthening internal controls is crucial. Ensure no single employee controls all aspects of critical transactions. Require management approval for significant transactions and regularly reconcile bank statements, accounts receivable, and payable ledgers to promptly identify discrepancies.

According to the ACFE, organizations across various industries lose an estimated $4.7 trillion annually to occupational fraud globally, amounting to approximately 5% of their revenue. The average loss per case is $1,783,000, while the median loss is $145,000.

Educating and Training EmployeesEmployees are the first line of defense against fraud. Educating them about common fraud schemes and training them to recognize and report suspicious activities is essential. Promoting a culture of honesty and integrity reduces the risk of fraud within the organization. According to a 2020 ACFE report, businesses with fraud awareness training receive 56% of their fraud tips from trained employees, compared to 39% from companies without training.

Enhancing Cybersecurity Measures Invest in real-time fraud detection systems that monitor transactions and flag unusual activities. Use data analytics to identify patterns that may indicate fraudulent behavior. Protect digital assets with robust cybersecurity measures like firewalls, encryption, and multi-factor authentication.

Conducting Regular AuditsRegular audits are essential for detecting and preventing fraud. Internal audits ensure compliance with controls and identify financial irregularities. External auditors provide unbiased reviews and offer assurance to stakeholders. Unannounced audits catch unnoticed fraudulent activities, enhancing fraud detection.

Staying Informed About Fraud TrendsStay informed about the latest fraud trends and prevention techniques. Keep up with industry news on emerging fraud schemes, join professional organizations, and provide ongoing training for employees to keep them updated on new threats.

Fraud prevention is an ongoing process that demands vigilance, education, and the right tools. Remaining proactive and committed fortifies your business against fraud, protecting assets and reputation while fostering long-term success and stability.

In today's digital landscape, a bank must prioritize stringent cybersecurity measures to safeguard customers' sensitive information. High Circle excels in this regard, conducting regular infrastructure audits, implementing robust fraud monitoring systems, employing industry-standard data encryption protocols, enforcing multi-factor authentication, and providing dedicated white-glove customer support.

High Circle’s robust security measures include: Infrastructure Audits

Regular audits ensure our systems meet the highest standards.

Fraud Monitoring

Continuous monitoring designed to detect fraud.

Industry Standard Data Encryption

Your data is encrypted to Industry Standards i.e. ISO 27001.

Multi-factor Authentication

An extra layer of security for your account.

Secure Login & Device Verification

Designed so that you can access your account securely.

White Glove / Concierge Customer Support

Get personalized customer support M-F, 8-5 CT. Leave message after hours and weekends and holidays.

Experience peace of mind with High Circle’s platform. High Circle ensures that your personal and financial information is safeguarded with the utmost care.High Circle Inc. is a financial technology company, not an FDIC-insured depository institution. All deposit products and services are provided by FirstBank, a Tennessee Corporation, Member FDIC. Funds in your deposit account are insured up to $250,000. The FDIC's deposit insurance coverage only protects against the failure of the FDIC-insured depository institution.

#commercial bank#commercial online banking#first secure bank#commercial and savings bank#high yield returns

0 notes

Text

Commercial Bank of Ethiopia recovers $11 mln lost in system Glitch.

A client uses an automated teller machine (ATM) at the Commercial Bank of Ethiopia in Addis Ababa, Ethiopia. Courtesy image. Ethiopia’s largest bank says it has recovered almost three-quarters of the $14m (£12m) it lost in a glitch that allowed customers to withdraw more money than they had in their accounts. Abe Sano, head of the Commercial Bank of Ethiopia (CBE) said on Tuesday about $10m has…

View On WordPress

0 notes

Text

ADVANCES IN FINANCE: UNLOCKING YOUR FINANCIAL POTENTIAL

Every business requires a substantial quantity of money. Which is vital for every company. It is not possible to vacillate a large amount of money, so he or she needs a source of money. So he has to find the appropriate financial institution or bank for the source of money. For the business owner, advance can be the source of finance which is mainly provided by the bank for companies.

Definition of advances in finance

The landing of money by a Lander or a loaned to be a quick one with a set quantity in interest. Formal contract between lender and a bank to offer a set amount of credit for a certain time period, also known as the advances in finance.

Usually the advance can be short term borrow. In this format they have less legal formalities. When the bank gives advances to clients via overdraft or loan account, this is known as credit by bankers.

What is advance rate

An advance rate is a percentage of the value Which is determined by the bank for the borrower. In different banks, the advance rate is different Which is dependent on borrowed value. The advance rate’s malfunction is the same as the loan value ratio. If a borrower has an advantage rate of 25% and the Present value is $100000 then the maximum advance the borrower can receive $ 25000.

Various types of bank advances

Commercial banks invest their funds in various profitable projects. Commercial bank usually granted which amount of advances is That Given below:

Loan: An advance granted by a bank by opening a loan account for a fixed term by pledging immovable property or debentures as collateral is called a loan. Borrowers can withdraw through such advance checks at one time or at various times as per requirement. The interest rate on such loans is high and interest starts accruing after transfer as loan. Present day long term and medium term loans are known as loans.

For loans of this kind, there is a charge for interest for the loan. Loans are repaid by current accounts. Interest rates for these loans are very high. Bank cost in providing such loans is relatively low. The interest rate on such days is lower as compared to other loans. People can easily collect such loans.

2. Cash : Commercial banks pledge the goods of traders and grant them advances called credit accounts. Borrowers can withdraw such amounts repeatedly up to a specified period. Banks usually don’t provide such loans to customers.

Generally only cash loans are given to clients who have integrity and trustworthiness Borrower can withdraw the sanctioned loan amount in lump sum or in part. By providing such loans, the income of the bank increases. Such loans are repaid in instalments or lump sum. By providing such loans, the good relationship of the bank is developed with the honest and trustworthy businessmen. Customer good behavior Play Bank can give loan to the customer up to a long time through the same.

3. Bank overdraft : As a bank depositor, if the bank gives an opportunity to withdraw the extra specified amount of money, then this principle is called a deposit loan against security. Interest has to be paid on it but only the money has to be paid in print. Businessmen prefer overdraft loans. This type of loan is provided against such security. In case of this type of loan, the bank gives the opportunity to withdraw the excess amount deposited in the current account, but the limit of the excess amount is fixed.

Businessmen have to raise short-term financing needs. Loans can be repaid conveniently. loans can be raised in lump sum or in part.

Conclusion

So ,advances in finance are very important for businessmen to spread their Business. On the other hand , advances in finance are also significant for banks. Because It is a golden opportunity for them to earn profit.

#finance#accounting#stock market#study motivation#studying#studyspo#sales#startup#school#success#advances in finance#loans#personal loans#business loan#financial planning#banking#Bank overdraft#Cash#Commercial bank#advances#financial institution

0 notes

Link

Commercial Bank Wins ‘Best Trade Finance Provider’ 2023 in Qatar

As per the latest news, Commercial Bank, the most innovative digital bank in Qatar has been honored with the “Best Trade Finance Provider in Qatar” by Global Finance for the fourth consecutive year. Global Finance is the world’s major publication that acknowledges distinct contributions to the financial industry. This award recognizes Commercial Bank’s outstanding performance in the trade finance sector and its constant dedication to delivering top-notch financial products and services to its clients. The Bank has been successfully maintaining its position as the “Best Bank In Qatar 2021” by Global Finance.

Trade finance plays an essential role in Commercial Bank’s business tactics, and the Bank has a well-established proven track record of enabling its clients to navigate the intricacies of international trade and minimize risks. The reason behind the Commercial Bank’s success in trade finance is none other than its commitment to innovation and its emphasis on delivering the best possible financial products and services to its clients. The Bank is dedicated to searching for opportunities to improve its trade finance offerings and fulfilling the advanced requirements of its clients.

Read more: https://www.emeriobanque.com/news/commercial-bank-in-qatar-wins-best-trade-finance-provider-2023

#Commercial Bank#Best Trade Finance Provider in Qata#financial products#international trade#trade finance

0 notes

Text

based off this video. i think teto is a union man

#art#traditional art#watercolour#fanart#vocal synth#kasane teto#synthv#utau#utauloid#koharu rikka#synthesizer v#voicepeak#my vocal synth tagging systems are getting messier and messier by the second#anyway i dont know why i picture her caring a lot about labour rights and regulations. its probably because 1)#shes just been around so long and has been actively updated this whole time#(not just the sv bank release but also her utau banks as well) so she probably has lots of experience#and 2) twindrill somehow managed to snag a commercial voicebank contract that lets them keep up the utau banks too#which i do appreciate. i like hearing voices on all kinds of software but it sucks that a lot of utau that move commercial take down their#old voicebanks. probably licensing stuff in like vocaloid and such's agreements#although the two utau who have sv banks (teto and renri) were both able to keep up their old stuff so maybe sv has looser contracts?#sv is made by the moresampler guy after all. maybe theyre a little more open about it#anyway i think thats why i picture her being really savvy with this stuff LOL i think shes great at chilchucking it you know#advocating for her fellow synths and negotiating contracts the whole nine yards#i think she will unionize your vocal synths. i think she will unionize them.

195 notes

·

View notes

Text

Star Trek: Lower Decks "Room for Growth" & "Parth Ferengi's Heart Place"

#Star Trek Lower Decks#Lower Decks#Room for Growth#Parth Ferengi's Heart Place#Beckett Mariner#Brad Boimler#spoilers#lower decks spoilers#commercial#bank#bonk#commer-seal#danny and renae watch lower decks

828 notes

·

View notes

Text

MERRY SPIRALMAS!! it’s still Christmas in my country, i hope everyone had nice days! it’s not Christmas till ive seen that stupid Christmas commercial sooo. IT CRACKS ME UP SO BAD IDK WHY

Realistically, Zeke would also have a funny quip but im terrible at writing his dialogue. Williams never seen the commercial and the line was purely coincidental albeit pretty cheesy, when Zeke does show it to him, he’s most offended by them saying folgers is real coffee (Z: THATS WHAT U ARE GETTING OUT OF IT??)

#william schenk#spiral from the book of saw#spiralshipping#zeke banks#ezekiel banks#spiral 2021#saw#spiralposting#sawposting#saw franchise#spiral fanart#folgers commercial

25 notes

·

View notes

Text

25 notes

·

View notes

Text

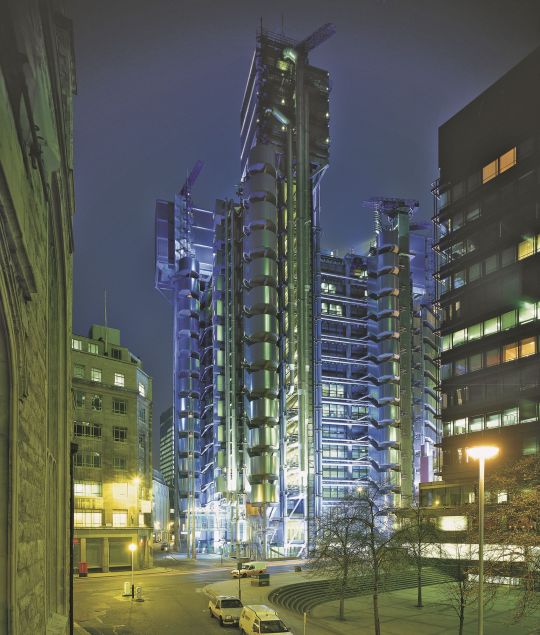

Lloyd's Building, London - Richard Rogers

#Richard Rogers#architecture#design#building#modern architecture#interiors#concrete#steel#structure#high tech#modern#iconic#services#city of london#banks#commercial#tower#skyscraper#cool architecture#english architecture

130 notes

·

View notes

Text

chucky in the box… so what are you in for

#this is a joke for like two people#i love his amerant bank card commercial it’s so funny#he’s such a bad actor but he loves to do it#get that man on a stage#florida panthers#matthew tkachuk#panthers lb

12 notes

·

View notes

Text

Detecting and Preventing Business Fraud

Fraud poses a significant threat to businesses of all sizes, undermining trust, financial stability, and reputation. In today's rapidly evolving business landscape, the risk of fraud is ever-present, making it imperative for organizations to adopt robust strategies for detection and prevention. A few proactive steps for preventing fraudulent activities and safeguarding assets include:

Strengthening Internal Controls Strengthening internal controls is crucial. Ensure no single employee controls all aspects of critical transactions. Require management approval for significant transactions and regularly reconcile bank statements, accounts receivable, and payable ledgers to promptly identify discrepancies.

According to the ACFE, organizations across various industries lose an estimated $4.7 trillion annually to occupational fraud globally, amounting to approximately 5% of their revenue. The average loss per case is $1,783,000, while the median loss is $145,000.

Educating and Training EmployeesEmployees are the first line of defense against fraud. Educating them about common fraud schemes and training them to recognize and report suspicious activities is essential. Promoting a culture of honesty and integrity reduces the risk of fraud within the organization. According to a 2020 ACFE report, businesses with fraud awareness training receive 56% of their fraud tips from trained employees, compared to 39% from companies without training.

Enhancing Cybersecurity Measures Invest in real-time fraud detection systems that monitor transactions and flag unusual activities. Use data analytics to identify patterns that may indicate fraudulent behavior. Protect digital assets with robust cybersecurity measures like firewalls, encryption, and multi-factor authentication.

Conducting Regular AuditsRegular audits are essential for detecting and preventing fraud. Internal audits ensure compliance with controls and identify financial irregularities. External auditors provide unbiased reviews and offer assurance to stakeholders. Unannounced audits catch unnoticed fraudulent activities, enhancing fraud detection.

Staying Informed About Fraud TrendsStay informed about the latest fraud trends and prevention techniques. Keep up with industry news on emerging fraud schemes, join professional organizations, and provide ongoing training for employees to keep them updated on new threats.

Fraud prevention is an ongoing process that demands vigilance, education, and the right tools. Remaining proactive and committed fortifies your business against fraud, protecting assets and reputation while fostering long-term success and stability.

In today's digital landscape, a bank must prioritize stringent cybersecurity measures to safeguard customers' sensitive information. High Circle excels in this regard, conducting regular infrastructure audits, implementing robust fraud monitoring systems, employing industry-standard data encryption protocols, enforcing multi-factor authentication, and providing dedicated white-glove customer support.

High Circle’s robust security measures include: Infrastructure Audits

Regular audits ensure our systems meet the highest standards.

Fraud Monitoring

Continuous monitoring designed to detect fraud.

Industry Standard Data Encryption

Your data is encrypted to Industry Standards i.e. ISO 27001.

Multi-factor Authentication

An extra layer of security for your account.

Secure Login & Device Verification

Designed so that you can access your account securely.

White Glove / Concierge Customer Support

Get personalized customer support M-F, 8-5 CT. Leave message after hours and weekends and holidays.

Experience peace of mind with High Circle’s platform. High Circle ensures that your personal and financial information is safeguarded with the utmost care.High Circle Inc. is a financial technology company, not an FDIC-insured depository institution. All deposit products and services are provided by FirstBank, a Tennessee Corporation, Member FDIC. Funds in your deposit account are insured up to $250,000. The FDIC's deposit insurance coverage only protects against the failure of the FDIC-insured depository institution.

0 notes

Text

Genesis on their tour bus in Germany, 1982, by Martyn Goddard. Credit the photographer if reposting.

102 notes

·

View notes

Text

youtube

Y’all Danny recently did this commercial! He just posted it on Instagram a few hours ago. I am so happy for him! 🥹 Bestie deserves the best! Hope he gets more acting roles soon!

Also, I am so ignorant when it comes to sports. Is the other guy a baseball player? 🤔

#daniel dimaggio#Oliver Otto#commercial#baseball#truist bank#he looks so cute with short hair and that baseball uniform!#american housewife#so happy for him#daniel is the best#go danny!#Youtube

21 notes

·

View notes

Note

I once read the reason why merchants were so ill seen in pre-modern times was because there was a lack of understanding on how they buying a product from a place of production and selling at a place of consumption added value to the product and thus entitled the merchant to selling at a profit something he did not produce. My question is (and I undertand it is quite out of your area of expertise): do you think the Bronze Age civilizations would have shared such a view, or would they have interpreted merchants and their trade closer to how we do, given those civilizations dependance on the commerce of copper and tin?

I don't think it's a question of not understanding - I think it's a question of disagreeing that buying low and selling high as opposed to actually contributing physical labor creates a moral right of ownership.

I would highly recommend Jacob Soll's book on this point, because one of the things he points out is that this attitude or belief was incredibly common across pre-modern societies from Western Europe all the way to Japan and China, in part because these societies were overwhelmingly agricultural economies where the farmer was respected because they were vital to survival, such that even the aristocratic elite tended to espouse a kind of pastoral "gentleman farmer" ideal and despise the values of merchants.

In these contexts, Soll notes, the idea that merchants and other middlemen had economic (and thus moral and cultural) value was something that had to be actively asserted and argued for, and he uncovers a literature on the subject that goes as far back as Cicero and all the way through the Middle Ages and beyond. At the same time, it was an incredibly divisive and contested topic that the merchants didn't win a lot of the time - hence the Church getting behind Aquinas' concept of the "just price," hence why Renaissance bankers had to reverse-engineer lending at interest to get around prohibitions on usury, etc.

#history#historical analysis#merchants#feudalism#ancient history#medieval history#early modern history#nobility#peasants#medieval banking#commercial revolution#medieval economy#political economy#medieval economics

51 notes

·

View notes

Text

gong yoo behind the scenes of the kb 9 to 6 bank commercial films (2023)

(source)

#gong yoo#gongyoo#gong ji cheol#gong jicheol#gongjicheol#공지철#공유#k actor#kactor#kookmin bank#kookminbank#kb kookmin bank#kbkookminbank#kb star banking#kb 9 to 6 bank#주식회사 국민은행#commercial#commercial film#cf#behind the scenes#I LOVE HIM SO MUCH#mjracles

32 notes

·

View notes