#work at goldman sachs

Explore tagged Tumblr posts

Text

youtube

g

#goldman sachs#how to get a job at goldman sachs#goldman sachs interview#goldman sachs internship#goldman sachs intern#goldman sachs day in the life#goldman#goldman sachs investment banking#goldman sachs ceo#goldman sachs job#goldman sachs jobs#goldman sachs marcus#goldman sachs resume#work at goldman sachs#goldman sachs salary#goldman sachs analyst#goldman sachs partner#goldman sachs bitcoin#goldman sachs hirevue#goldman sacks#goldman sachs biography#Youtube

0 notes

Text

Actually yeah fundamentally I am just very interested in the dissonance of being gay and being right wing (as in really advocating for those positions) and the kind of mental gymnastics u have to do to justify it. To justify to yourself and to others.

#my search history atm looks like someone being radicalised#maybe i am being radicalised given my two weeks of delusion that i would work for goldman sachs

8 notes

·

View notes

Text

Got a text from my hometown area code asking if this was still (real name) Idk who this person is

2 notes

·

View notes

Text

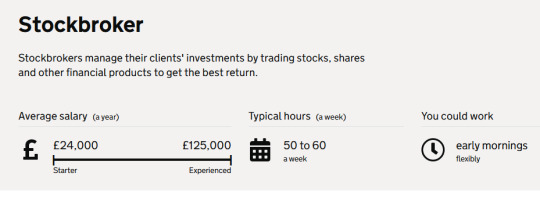

i love the government careers website with their neat and tidy little infographics containing sick and twisty information. you could use this image as a jumpscare screen in a horror game. 60 hours a week well that sounds like just the job for me and is a perfectly normal expectation. anyway i also love paying my university £9250 a year so that i can lose braincells doing a group presentation on careers advice like im in secondary school pshce lessons

#me when i have to calmly present my slides about banking as if i didnt read abt the goldman sachs employee suicide case and get the urge to#drop out of my degree immediately: o_o#i wont drop out bc its a useful degree to have in general + u can ofc work as a normal accountant in a non morally repugnant capacity#but the cognative dissonance of it all etc........esp when we get onto the economics + corporate accounting modules as opposed to the simpl#small business accounting that weve started off with

4 notes

·

View notes

Text

ed zitron, a tech beat reporter, wrote an article about a recent paper that came out from goldman-sachs calling AI, in nicer terms, a grift. it is a really interesting article; hearing criticism from people who are not ignorant of the tech and have no reason to mince words is refreshing. it also brings up points and asks the right questions:

if AI is going to be a trillion dollar investment, what trillion dollar problem is it solving?

what does it mean when people say that AI will "get better"? what does that look like and how would it even be achieved? the article makes a point to debunk talking points about how all tech is misunderstood at first by pointing out that the tech it gets compared to the most, the internet and smartphones, were both created over the course of decades with roadmaps and clear goals. AI does not have this.

the american power grid straight up cannot handle the load required to run AI because it has not been meaningfully developed in decades. how are they going to overcome this hurdle (they aren't)?

people who are losing their jobs to this tech aren't being "replaced". they're just getting a taste of how little their managers care about their craft and how little they think of their consumer base. ai is not capable of replacing humans and there's no indication they ever will because...

all of these models use the same training data so now they're all giving the same wrong answers in the same voice. without massive and i mean EXPONENTIALLY MASSIVE troves of data to work with, they are pretty much as a standstill for any innovation they're imagining in their heads

52K notes

·

View notes

Text

0 notes

Text

Goldman Sachs: il “piano di valutazione strategica delle risorse” prevede di licenziare gli smart worker

Nonostante Goldman Sachs abbia riportato un utile nel secondo trimestre 2024 che è più che raddoppiato, la politica di licenziamento dei lavoratori con scarse prestazioni continuerà anche quest’anno e si prevede il taglio tra il 3 e il 4 per cento della sua forza lavoro, ovvero tra i 1.300 e i 1.800 dipendenti. Lascia perplessi che i profili da licenziare vengano identificati non solo basandosi…

1 note

·

View note

Text

British billionaire Lord Sugar rips remote work while Zooming in—but he may have a point about mentorship | Fortune

British billionaire Lord Sugar rips remote work—while Zooming in from off-site. But he may have a point that it’s ‘bad for morale, bad for learning’

In a remote interview, the host of the UK version of "The Apprenctice" said no one learns “sitting at home in your pajamas.”

BY JANE THIER

February 05, 2024 2:17 PM EST

“You don’t learn sitting at home in your pajamas,” the entrepreneur and host of the U.K.’s “The Apprentice” said. Don Arnold—WireImage/Getty Images

Lord Alan Sugar hates remote work so much he calls in remotely to the BBC to complain about it.

The British billionaire went viral on TikTok for espousing his anti-remote-work views from the comfort of a remote office—but work experts have agreed with much of what he’s saying.

“You don’t learn sitting at home in your pajamas,” the entrepreneur and host of the U.K.’s The Apprentice said. The interview, conducted last week, was part of Sugar’s press tour following the 18th season premiere of The Apprentice. “I’m totally against it, quite frankly. I think it’s bad for morale, bad for learning. I know I learn from being with other people in an office.”

While Sugar has taken a more incendiary stance than most, his opinions are hardly unpopular—especially among older, more established businesspeople.

Citadel CEO Ken Griffin said that failing to work in person is a “grave mistake” and could make it easier for your boss to fire you, since they’re unlikely to know you personally. Goldman Sachs CEO David Solomon called remote work an “aberration,” and JPMorgan Chase’s Jamie Dimon said remote workers at his bank should probably work elsewhere, while Tesla’s Elon Musk took it a step further, saying remote employees are simply pretending to work...."

Can we yeet these selfish mofos, into the Sun? The wealth class in Britain is ALL TRASH. 'LORD Sugar'. JP Morgan regularly involves itself in such things as Trafficking (Epstein) Psyops against America (one of the people involved in QANON, worked at JP Morgan). Goldman Sachs is barely legitimate, itself. And we all know how destructive Apartheid Clyde has been. California shouldn't forget how he cost the state its planned Train system, over an Electric Vehicle stunt.

They want their portfolios to stay up, their physical footprint to block land, and most importantly, to use employees for various manipulations. Work Harassment and Psychological Games come to mind. The negative shit people deal with in an office atmosphere. I really think it's all about Control.

As an FYI, if people really think these men are not inherently evil, just remember the type of films we've been getting lately; most, financed by Wall Street. So much Psychological Horror, Underage Sexual themes, and Hyperviolence. Fight for your right to Remote Work!

#The Apprentice#Lord Sugar#UK#JP Morgan#Jamie Dimon#Jeffrey Epstein#QANON#Goldman Sachs#David Solomon#Citadel#Ken Griffin#Tesla#Neuralink#Disney Company#Twitter#Elon Musk#Remote Work#WE HAVE A SERIOUS BILLIONAIRE BLIGHT INTERFERING WITH THE ABILITY TO HAVE A LIFE!#Fortune Magazine#Fucking Hypocrites

0 notes

Text

AI hasn't improved in 18 months. It's likely that this is it. There is currently no evidence the capabilities of ChatGPT will ever improve. It's time for AI companies to put up or shut up.

I'm just re-iterating this excellent post from Ed Zitron, but it's not left my head since I read it and I want to share it. I'm also taking some talking points from Ed's other posts. So basically:

We keep hearing AI is going to get better and better, but these promises seem to be coming from a mix of companies engaging in wild speculation and lying.

Chatgpt, the industry leading large language model, has not materially improved in 18 months. For something that claims to be getting exponentially better, it sure is the same shit.

Hallucinations appear to be an inherent aspect of the technology. Since it's based on statistics and ai doesn't know anything, it can never know what is true. How could I possibly trust it to get any real work done if I can't rely on it's output? If I have to fact check everything it says I might as well do the work myself.

For "real" ai that does know what is true to exist, it would require us to discover new concepts in psychology, math, and computing, which open ai is not working on, and seemingly no other ai companies are either.

Open ai has already seemingly slurped up all the data from the open web already. Chatgpt 5 would take 5x more training data than chatgpt 4 to train. Where is this data coming from, exactly?

Since improvement appears to have ground to a halt, what if this is it? What if Chatgpt 4 is as good as LLMs can ever be? What use is it?

As Jim Covello, a leading semiconductor analyst at Goldman Sachs said (on page 10, and that's big finance so you know they only care about money): if tech companies are spending a trillion dollars to build up the infrastructure to support ai, what trillion dollar problem is it meant to solve? AI companies have a unique talent for burning venture capital and it's unclear if Open AI will be able to survive more than a few years unless everyone suddenly adopts it all at once. (Hey, didn't crypto and the metaverse also require spontaneous mass adoption to make sense?)

There is no problem that current ai is a solution to. Consumer tech is basically solved, normal people don't need more tech than a laptop and a smartphone. Big tech have run out of innovations, and they are desperately looking for the next thing to sell. It happened with the metaverse and it's happening again.

In summary:

Ai hasn't materially improved since the launch of Chatgpt4, which wasn't that big of an upgrade to 3.

There is currently no technological roadmap for ai to become better than it is. (As Jim Covello said on the Goldman Sachs report, the evolution of smartphones was openly planned years ahead of time.) The current problems are inherent to the current technology and nobody has indicated there is any way to solve them in the pipeline. We have likely reached the limits of what LLMs can do, and they still can't do much.

Don't believe AI companies when they say things are going to improve from where they are now before they provide evidence. It's time for the AI shills to put up, or shut up.

5K notes

·

View notes

Text

BOYCOTTING FOR PALESTINE

The Official BDS Boycott Targets

Campaigns

Block the boat: End maritime arms transfer to Israel

Ban Apartheid Israel from Sports (FIFA, Olympics)

CAF get off Israel's train: Boycott CAF

Greenwashing Apartheid

Israeli Spyware

Military Embargo

Farming Injustice

Consumer Boycotts - a complete boycott of these brands

Cisco

Axa

Puma

Carrefour

HP

Siemens

Chevron

Intel

Caltex

Israeli produce

Re/max

Ahava

Texaco

Sodastream

Intel

Organic Boycott Targets - boycotts not initiated by BDS but still complete boycott of these brands

Disney

Macdonald's

Dominos

Papa Johns

Burger King

Pizza Hut

Wix

Divestments and exclusion - pressure governments, institutions, investment funds, city councils, etc. to exclude from procurement contracts and investments and to divest from these

Elbit Systems

CAF

Volvo

CAT

Barclays

JCB

HD Hyundai

TKH Security

HikVision

Pressure - boycotts when reasonable alternatives exist, as well as lobbying, peaceful disruptions, and social media pressure.

Google

Amazon

AirBnb

Booking.Com

Expedia

Teva

Here are some companies that strongly support Israel (but are not Boycott targets). There is no ethical consumption under capitalism and boycotting is a political strategy - not a moral one. If you did try to boycott every supporter of Israel you would struggle to survive because every major company supports Israel (as a result of attempting to keep the US economy afloat), that being said, the ones that are being boycotted by masses and not already on the organic boycott list are coloured red.

5 Star Chocolate

7Days

7Up

Apple

Arsenal FC

ALDO

Arket

Axe

Accenture

Ariel

Adidas

ActionIQ

Aquafina

Amika

AccuWeather

Activia

Adobe

Aesop

Azrieli Group

American Eagle

Amway Corp

Axel Springer

American Airlines

American Express

Atlassian

AdeS

Aquarius

Ayataka

Audi

Barqs

Bain & Company

Bayer

Bank Leumi

Bank Hapoalim

BCG (Boston Consulting Group)

Biotherm

Bershka

Bloomberg

BMW

Boeing

Booz Allen Hamilton

Burberry

Bath & Body Works

Bosch

Bristol Myers Squibb

Capri Holdings

Costa

Carita Paris

CareTrust REIT

Caterpillar

Coach

Cappy

Caudalie

CeraVe

Check Point Software Technologies

Cerelac

Chanel

Chapman and Cutler

Channel

Cheerios

Cheetos

Chevron

Chips Ahoy!

Christina Aguilera

Citi Bank

Codral

Cosco

Canada Dry

Citi

Clal Insurance Enterprises

Clean & Clear

Clearblue

Clinique

Champion

Club Social

Coca Cola

Coffee Mate

Colgate

Comcast

Compass

Caesars

Conde Nast

Cooley LLP

Costco

Côte d’Or

Crest

CV Starr

CyberArk Software

Cytokinetics

Crayola

Cra Z Art

Daimler

Dr Pepper

Del Valle

Daim

Doctor Pepper

Dasani

Doritos

Daz

Dior

Dell

Deloitte

Delta Air Lines

Deutsche Bank

Deutsche Telekom

DHL Group

David Off

Disney

DLA Piper

Domestos

Domino’s

Douglas Elliman

Downy

Duane Morris LLP

Dreft Baby Detergent & Laundry Products

Dreyer’s Grand Ice Cream

eBay

Edelman

Eli Lilly

Evian

Empyrean

Ericsson

Endeavor

EPAM Systems

Estee Lauder

Elbit Systems

EY

Forbes

Facebook

Fairlife

Fanta

First International Bank of Israel

Fiverr

Funyuns

Fuze

Fox News

Fritos

Fox Corp

Gatorade

Gamida Cell

GE

Glamglow

General Catalyst

General Motors

Georgia

Gold Peak

Genesys

Goldman Sachs

Grandma’s Cookies

Garnier

Guess

Greenberg Traurig

Guerlain

Givenchy

H&M

Hadiklaim

Huggies

Hanes

HSBC

Head & Shoulders

Hersheys

Herbert Smith Freehills

Hewlett Packard

Hasbro

Hyundai

Henkel

Harel Insurance Investment & Financial Services

Hewlett Packard Enterprise

HubSpot

Huntsman Corp

IBM

Innocent

Insight Partners

Inditex Group

IT Cosmetics

Instacart

Intermedia

Interpublic Group

Instagram

ICL Group

Intuit

Jazwares

Jefferies

John Lewis

JP Morgan Chase

Jaguar

Johnson & Johnson

JPMorgan

Kenon Holdings

Kate Spade

Kirks’

Kinley Water

KKR

KFC

KKW Cosmetics

Kurkure

Keebler

Kolynos

Kaufland

Kevita

Knorr

KPMG

Lemonade

Lidl

Loblaws

Levi Strauss

Louis Vuitton

Life Water

Levi’s

Levi’s Strauss

LinkedIn

Land Rover

L’Oréal

Lego

Levissima

Live Nation Entertainment

Lufthansa

La Roche-Posay

Lipton

Major League Baseball

Manpower Group

Marriott

Marsh McLennan

Maison Francis Kurkdjian

Mastercard

Mattel

Minute Maid

Monster

Monki

Mainz FC

Mellow Yellow

Mountain Dew

Migdal Insurance

Marks & Spencer

Mirinda

McDermott Will & Emery

Motorola

McKinsey

Merck

Michael Kors

Mizrahi Tefahot Bank

Merck KGaA

Micheal Kors

Milkybar

Maybelline

Mount Franklin

Meta

MeUndies

Mattle

Microsoft

Munchies

Miranda

Morgan Lewis

Moroccanoil

Morgan Stanley

MRC

Nasdaq

Naughty Dog

Nivea

Next

NOS

Nabisco

Nutter Butter

No Frills

National Basketball Association

National Geographic

Nintendo

New Balance

Nutella

Newtons

NVIDIA

Netflix

Nescafe

Nestle

Nesquick

Nike

Nussbeisser

Oreo

Oral B

Old spice

Oysho

Omeprazole

Oceanspray

Opodo

P&G (Procter and Gamble)

Pampers

Pull & Bear

Pepsi

Pfizer

Popeyes

Parker Pens

Philadelphia Cream Cheese

Pizza Hut

Powerade

Purina

Phoenix Holdings

Propel

Ponds

Pure Leaf Green Tea

Power Action Wipes

PwC

Prada

Perry Ellis

Prada Eyewear

Pringles

Payoneer

Procter & Gamble

Purelife

Pureology

Quaker Oats

Reddit

Royal Bank of Canada

Ruffles

Revlon

Ralph Lauren

Ritz

Rolls Royce

Royal

S.Pellegrino

Sabra Hummus

Sabre

Sony

SAP

Simply

Smart Water

Sprite

Schwabe

Shell

Soda Stream

Siemens

StreamElements

Schweppes

Sunsilk

Signal

Skittles

Smart Food

Sobe

Smarties

Sephora

Sam’s Club

Superbus

Samsung

Sodastream

Sunkist

Scotiabank

Sour Patch Kids

Starbucks

Sadaf

Stride

Subway

Tang

Tate’s Bake Shop

The Body Shop

Tesco

Twitch

The Ordinary

Tim Hortons

Tostitos

Timberland

Topo Chico

Tapestry

Tropicana

Tommy Hilfiger

Tommy Hilfiger Toiletries

Turbos

Tom Ford

Taco Bell

Triscuit

TUC

Twix

Tottenham Hotspurs

Twisties

Tripadvisor

Uber

Uber Eats

Urban Decay

Upfield

Unilever

Vicks

Victoria’s Secret

V8

Vaseline

Vitaminwater

Volkswagen

Volvo

Walmart

Wegmans

WhatsApp

Waitrose

Woolworths

Wheat Thins

Walkers

Warner Brothers

Warner Chilcot

Warner Music

Wells Fargo

Winston & Strawn

WingStreet

Wissotzky Tea

WWE

Wheel Washing Powder

Wrigley Company

YouTube

Yvel

Yum Brands

Ziyad

Zara

Zim Shipping

Ziff Davis

#free palestine#palestine#free gaza#israel#gaza#long post#from river to sea palestine will be free#palestinian lives matter#palestinian genocide#free free palestine#current events#fuck israel#anti zionisim#isntreal#defund israel#ceasefire#boycott israel#boycott divest sanction#boycott starbucks#boycott disney#boycott mcdonalds#boycotting#boycott divestment sanctions#my post#boycotts work

778 notes

·

View notes

Text

How the Biden-Harris Economy Left Most Americans Behind

A government spending boom fueled inflation that has crushed real average incomes.

By The Editorial Board -- Wall Street Journal

Kamala Harris plans to roll out her economic priorities in a speech on Friday, though leaks to the press say not to expect much different than the last four years. That’s bad news because the Biden-Harris economic record has left most Americans worse off than they were four years ago. The evidence is indisputable.

President Biden claims that he inherited the worst economy since the Great Depression, but this isn’t close to true. The economy in January 2021 was fast recovering from the pandemic as vaccines rolled out and state lockdowns eased. GDP grew 34.8% in the third quarter of 2020, 4.2% in the fourth, and 5.2% in the first quarter of 2021. By the end of that first quarter, real GDP had returned to its pre-pandemic high. All Mr. Biden had to do was let the recovery unfold.

Instead, Democrats in March 2021 used Covid relief as a pretext to pass $1.9 trillion in new spending. This was more than double Barack Obama’s 2009 spending bonanza. State and local governments were the biggest beneficiaries, receiving $350 billion in direct aid, $122 billion for K-12 schools and $30 billion for mass transit. Insolvent union pension funds received a $86 billion rescue.

The rest was mostly transfer payments to individuals, including a five-month extension of enhanced unemployment benefits, a $3,600 fully refundable child tax credit, $1,400 stimulus payments per person, sweetened Affordable Care Act subsidies, an increased earned income tax credit including for folks who didn’t work, housing subsidies and so much more.

The handouts discouraged the unemployed from returning to work and fueled consumer spending, which was already primed to surge owing to pent-up savings from the Covid lockdowns and spending under Donald Trump. By mid-2021, Americans had $2.3 trillion in “excess savings” relative to pre-pandemic levels—equivalent to roughly 12.5% of disposable income.

So much money chasing too few goods fueled inflation, which was supercharged by the Federal Reserve’s accommodative policy. Historically low mortgage rates drove up housing prices. The White House blamed “corporate greed” for inflation that peaked at 9.1% in June 2022, even as the spending party in Washington continued.

In November 2021, Congress passed a $1 trillion bill full of green pork and more money for states. Then came the $280 billion Chips Act and Mr. Biden’s Green New Deal—aka the Inflation Reduction Act—which Goldman Sachs estimates will cost $1.2 trillion over a decade. Such heaps of government spending have distorted private investment.

While investment in new factories has grown, spending on research and development and new equipment has slowed. Overall private fixed investment has grown at roughly half the rate under Mr. Biden as it did under Mr. Trump. Manufacturing output remains lower than before the pandemic.

Magnifying market misallocations, the Administration conditioned subsidies on businesses advancing its priorities such as paying union-level wages and providing child care to workers. It also boosted food stamps, expanded eligibility for ObamaCare subsidies and waved away hundreds of billions of dollars in student debt. The result: $5.8 trillion in deficits during Mr. Biden’s first three years—about twice as much as during Donald Trump’s—and the highest inflation in four decades.

Prices have increased by nearly 20% since January 2021, compared to 7.8% during the Trump Presidency. Inflation-adjusted average weekly earnings are down 3.9% since Mr. Biden entered office, compared to an increase of 2.6% during Mr. Trump’s first three years. (Real wages increased much more in 2020, but partly owing to statistical artifacts.)

Higher interest rates are finally bringing inflation under control, which is allowing real wages to rise again. But the Federal Reserve had to raise rates higher than it otherwise would have to offset the monetary and fiscal gusher. The higher rates have pushed up mortgage costs for new home buyers.

Three years of inflation and higher interest rates are stretching American pocketbooks, especially for lower income workers. Seriously delinquent auto loans and credit cards are higher than any time since the immediate aftermath of the 2008-09 recession.

Ms. Harris boasts that the economy has added nearly 16 million jobs during the Biden Presidency—compared to about 6.4 million during Mr. Trump’s first three years. But most of these “new” jobs are backfilling losses from the pandemic lockdowns. The U.S. has fewer jobs than it was on track to add before the pandemic.

What’s more, all the Biden-Harris spending has yielded little economic bang for the taxpayer buck. Washington has borrowed more than $400,000 for every additional job added under Mr. Biden compared to Mr. Trump’s first three years. Most new jobs are concentrated in government, healthcare and social assistance—60% of new jobs in the last year.

Administrative agencies are also creating uncertainty by blitzing businesses with costly regulations—for instance, expanding overtime pay, restricting independent contractors, setting stricter emissions limits on power plants and factories, micro-managing broadband buildout and requiring CO2 emissions calculations in environmental reviews.

The economy is still expanding, but business investment has slowed. And although the affluent are doing relatively well because of buoyant asset prices, surveys show that most Americans feel financially insecure. Thus another political paradox of the Biden-Harris years: Socioeconomic disparities have increased.

Ms. Harris is promising the same economic policies with a shinier countenance. Don’t expect better results.

#Wall Street Journal#kamala harris#Tim Walz#Biden#Obama#destroyed the economy#america first#americans first#america#donald trump#trump#trump 2024#president trump#ivanka#repost#democrats#Ivanka Trump#art#landscape#nature#instagram#truth

166 notes

·

View notes

Text

This is it. Generative AI, as a commercial tech phenomenon, has reached its apex. The hype is evaporating. The tech is too unreliable, too often. The vibes are terrible. The air is escaping from the bubble. To me, the question is more about whether the air will rush out all at once, sending the tech sector careening downward like a balloon that someone blew up, failed to tie off properly, and let go—or more slowly, shrinking down to size in gradual sputters, while emitting embarrassing fart sounds, like a balloon being deliberately pinched around the opening by a smirking teenager. But come on. The jig is up. The technology that was at this time last year being somberly touted as so powerful that it posed an existential threat to humanity is now worrying investors because it is apparently incapable of generating passable marketing emails reliably enough. We’ve had at least a year of companies shelling out for business-grade generative AI, and the results—painted as shinily as possible from a banking and investment sector that would love nothing more than a new technology that can automate office work and creative labor—are one big “meh.” As a Bloomberg story put it last week, “Big Tech Fails to Convince Wall Street That AI Is Paying Off.” From the piece: Amazon.com Inc., Microsoft Corp. and Alphabet Inc. had one job heading into this earnings season: show that the billions of dollars they’ve each sunk into the infrastructure propelling the artificial intelligence boom is translating into real sales. In the eyes of Wall Street, they disappointed. Shares in Google owner Alphabet have fallen 7.4% since it reported last week. Microsoft’s stock price has declined in the three days since the company’s own results. Shares of Amazon — the latest to drop its earnings on Thursday — plunged by the most since October 2022 on Friday. Silicon Valley hailed 2024 as the year that companies would begin to deploy generative AI, the type of technology that can create text, images and videos from simple prompts. This mass adoption is meant to finally bring about meaningful profits from the likes of Google’s Gemini and Microsoft’s Copilot. The fact that those returns have yet to meaningfully materialize is stoking broader concerns about how worthwhile AI will really prove to be. Meanwhile, Nvidia, the AI chipmaker that soared to an absurd $3 trillion valuation, is losing that value with every passing day—26% over the last month or so, and some analysts believe that’s just the beginning. These declines are the result of less-than-stellar early results from corporations who’ve embraced enterprise-tier generative AI, the distinct lack of killer commercial products 18 months into the AI boom, and scathing financial analyses from Goldman Sachs, Sequoia Capital, and Elliot Management, each of whom concluded that there was “too much spend, too little benefit” from generative AI, in the words of Goldman, and that it was “overhyped” and a “bubble” per Elliot. As CNN put it in its report on growing fears of an AI bubble, Some investors had even anticipated that this would be the quarter that tech giants would start to signal that they were backing off their AI infrastructure investments since “AI is not delivering the returns that they were expecting,” D.A. Davidson analyst Gil Luria told CNN. The opposite happened — Google, Microsoft and Meta all signaled that they plan to spend even more as they lay the groundwork for what they hope is an AI future. This can, perhaps, explain some of the investor revolt. The tech giants have responded to mounting concerns by doubling, even tripling down, and planning on spending tens of billions of dollars on researching, developing, and deploying generative AI for the foreseeable future. All this as high profile clients are canceling their contracts. As surveys show that overwhelming majorities of workers say generative AI makes them less productive. As MIT economist and automation scholar Daron Acemoglu warns, “Don’t believe the AI hype.”

6 August 2024

#ai#artificial intelligence#generative ai#silicon valley#Enterprise AI#OpenAI#ChatGPT#like to charge reblog to cast

184 notes

·

View notes

Text

Next year will be Big Tech’s finale. Critique of Big Tech is now common sense, voiced by a motley spectrum that unites opposing political parties, mainstream pundits, and even tech titans such as the VC powerhouse Y Combinator, which is singing in harmony with giants like a16z in proclaiming fealty to “little tech” against the centralized power of incumbents.

Why the fall from grace? One reason is that the collateral consequences of the current Big Tech business model are too obvious to ignore. The list is old hat by now: centralization, surveillance, information control. It goes on, and it’s not hypothetical. Concentrating such vast power in a few hands does not lead to good things. No, it leads to things like the CrowdStrike outage of mid-2024, when corner-cutting by Microsoft led to critical infrastructure—from hospitals to banks to traffic systems—failing globally for an extended period.

Another reason Big Tech is set to falter in 2025 is that the frothy AI market, on which Big Tech bet big, is beginning to lose its fizz. Major money, like Goldman Sachs and Sequoia Capital, is worried. They went public recently with their concerns about the disconnect between the billions required to create and use large-scale AI, and the weak market fit and tepid returns where the rubber meets the AI business-model road.

It doesn’t help that the public and regulators are waking up to AI’s reliance on, and generation of, sensitive data at a time when the appetite for privacy has never been higher—as evidenced, for one, by Signal’s persistent user growth. AI, on the other hand, generally erodes privacy. We saw this in June when Microsoft announced Recall, a product that would, I kid you not, screenshot everything you do on your device so an AI system could give you “perfect memory” of what you were doing on your computer (Doomscrolling? Porn-watching?). The system required the capture of those sensitive images—which would not exist otherwise—in order to work.

Happily, these factors aren’t just liquefying the ground below Big Tech’s dominance. They’re also powering bold visions for alternatives that stop tinkering at the edges of the monopoly tech paradigm, and work to design and build actually democratic, independent, open, and transparent tech. Imagine!

For example, initiatives in Europe are exploring independent core tech infrastructure, with convenings of open source developers, scholars of governance, and experts on the political economy of the tech industry.

And just as the money people are joining in critique, they’re also exploring investments in new paradigms. A crop of tech investors are developing models of funding for mission alignment, focusing on tech that rejects surveillance, social control, and all the bullshit. One exciting model I’ve been discussing with some of these investors would combine traditional VC incentives (fund that one unicorn > scale > acquisition > get rich) with a commitment to resource tech’s open, nonprofit critical infrastructure with a percent of their fund. Not as investment, but as a contribution to maintaining the bedrock on which a healthy tech ecosystem can exist (and maybe get them and their limited partners a tax break).

Such support could—and I believe should—be supplemented by state capital. The amount of money needed is simply too vast if we’re going to do this properly. To give an example closer to home, developing and maintaining Signal costs around $50 million a year, which is very lean for tech. Projects such as the Sovereign Tech Fund in Germany point a path forward—they are a vehicle to distribute state funds to core open source infrastructures, but they are governed wholly independently, and create a buffer between the efforts they fund and the state.

Just as composting makes nutrients from necrosis, in 2025, Big Tech’s end will be the beginning of a new and vibrant ecosystem. The smart, actually cool, genuinely interested people will once again have their moment, getting the resources and clearance to design and (re)build a tech ecosystem that is actually innovative and built for benefit, not just profit and control. MAY IT BE EVER THUS!

72 notes

·

View notes

Text

Born on 16 March 1965, Mark Carney is a Canadian economist and banker who was the governor of the Bank of Canada from 2008 to 2013 and the governor of the Bank of England from 2013 to 2020. He is chairman, and head of impact investing at Brookfield Asset Management since 2020, and was named chairman of Bloomberg Inc., parent company of Bloomberg L.P., in 2023. He was the chair of the Financial Stability Board from 2011 to 2018. Prior to his governorships, Carney worked at Goldman Sachs as well as the Department of Finance Canada. He also serves as the UN Special Envoy for Climate Action and Finance.

95 notes

·

View notes

Text

2010

beneath the boardwalk, part 8 (series masterlist)

glass in the park

warnings: the usual...angst, fluff, smut, etc.

word count: 13k

In late January, I bought a fur coat. I don't know if it's real or faux because I still haven't determined the difference in feeling between the authentic and the fake but I thrifted it so there's no guilt if it is made out of a poor chinchilla or something. It carried a dramatic feeling with it. I would wear it all the time. Sometimes, I would go out on walks just to wear it. I'd walk from my apartment to Grand Central and take the subway back just to make sure people saw it.

Alex returned to touring around the same time. While I was in a dirty slush-filled New York, Alex was travelling through the coastal cities of France. I knew it was cold there too but I'm sure it was much more conventionally beautiful and I envied him at times when I came home and my socks were soaked through.

We tried to talk on the phone daily, but time zones were difficult. We promised one another to always call on Saturday mornings for me so if we missed previous days in the week, I would always be able to tell him about my work week on Saturday.

Alex seemed to have everything and nothing going on. He'd play shows, get drunk or high, play ping-pong, take pictures of the Belem Tower, and watch Mighty Mouse.

I was busy. I liked it. My work would sometimes be straightforward office work, sometimes I'd visit places to review, sometimes they sent me home early to test products out, and sometimes they had me stay late to review products. I had a group of friends that I went out drinking with on Fridays and it was social drinking, not drinking to get drunk. One night, I ordered a Shirley Temple and laughed about it on the subway ride home at the thought of my younger self seeing me: a sober girl taking the subway home alone from the bar. It was nice to finally like myself. Or at least who I was becoming.

In my empty time, I wrote autobiographical things. I sometimes sent things to Alex but I found my writing became more introspective and it wasn't details I wanted to share with him. I was fearful of why I felt the need to hide it, but I didn't even feel much like reading it.

My friend, Fennel (he hates his name too), said it came from an overprotective biological need that all women must hide things from men, even if they are loving and trusting. I didn't think so. I told him I trusted Alex more than I trusted myself. He told me that was the issue.

Fennel cultivated weed on the balcony of his apartment in Murray Hill. He had a boyfriend named Kaka, who was a former Chippendales stripper and currently worked for Goldman Sachs. Sometimes, when he got drunk enough he'd reenact a routine. They were both in their early 40s, shared a dog named Rooster, and, still to this day, had the most luxurious apartment I have ever seen.

The building had a disheveled front but inside they had an open floor plan, a kitchen that was larger than my apartment, and the glorious aforementioned balcony. Fennel was a creative director at Condé Nast and had taken a liking to me because of my crooked teeth and what he called my "gemütlich" British accent.

I went over to their place nearly every week. They often had parties and I'd arrive in the early afternoon claiming to help them set up but I'd eat their fancy Bonilla a la Vista potato chips and play with Rooster. Their dinner parties were grandiloquent and their house parties were glamourously gauche.

One Sunday, I went over early through Fennel's insistence on dressing me. It was Pygmalion in a way or maybe I was the Edie Sedgwick to his Andy Warhol (I said this to him once and he took great offence because Warhol slept with Edie and he had no intention of taking advantage of me) but I quite liked it. I felt like a living doll and through his higher-up position and wealth, he was able to obtain fabulous pieces that he let me keep.

I walked around barefoot in their apartment wearing a Yohji Yamamoto (Fennel insulted me for not knowing who that was) white dress that flowed with every step I took while discussing Alex, who they had yet to meet.

"I can't believe you've been with him since you were 18." Kaka marvelled at this fact every time we talked about Alex.

"We had some brief pauses in there but yeah. You guys have been together for over a decade."

Fennel chuckled. "We were both in our 30s. It's quite the difference."

I sat on their black leather couch and leaned my head on the back of it. They were both setting the table. I was relaxing. "Yeah but isn't it hard at any age?"

"Sure but if I was still with the same person I was with at 18...well, that was a woman so it wouldn't count," Fennel laughed.

"Are you going to marry him?" Kaka asked. He was a complete romantic who would often say how much he loved love.

"I don't know. Maybe. I don't know if I ever want to get married."

"Independence?" Fennel questioned as he pulled out a wine bottle.

"Parents."

"Ah," he sighed.

"But I have a feeling they always hated each other. I've always loved Alex. Does that make me lovesick and annoying?" I turned my head to ask them.

"Yes, but it's admirable. You seemed to have picked the right one. Good looking, loyal, you talk about him so sweetly," Kaka praised.

"I sometimes wonder if he picked the right one." It wasn't a newfound concern. I always felt secure in my relationship with Alex, not so much in myself. Occasionally, the worry of whether he could do better than me peeked itself out, usually when he was away and I didn't have the physical reassurance.

"Hush!" Kaka told me. "Any woman is better than a man. Take it from me." He kissed me on my cheek and it was nice to feel so fabulous. Fennel let me keep the Yamamoto. I try it on whenever I feel insecure.

*

I got sick on Valentine's Day. I had been unscathed for too long and on the morning of Alex's return from Europe—Valencia, Spain to be specific—I woke up with the urge to vomit. So, I vomited. And when Alex arrived home, I was vomiting.

I heard his bag drop while I was keeling over the toilet. The clacking of his boots on our wood floors stopped at the tile of our bathroom as he said, "Jesus, are you okay?" He hesitated, surely disgusted, before kneeling on the floor beside me, rubbing my back.

I had emptied most of my stomach and was dry heaving mostly. I slumped against the wall, catching my breath. "Welcome home." I managed a faint smile and my sarcasm didn't cause any laughter from Alex.

His hand stroked my forearm. He still had his jacket on and I was in my pajamas. "What's wrong?"

"I don't know. I just woke up nauseated."

"Food poisoning?" He suggested as he stroked his thumb over my knee.

I shook my head. "No, no. I feel fine now."

I attempted to stand up but Alex held me down. "Are you sure?"

"Yeah, yeah. I just need to lay down for a little." I slowly stood, reorienting myself.

Alex, still kneeling proposal-style, offered, "Alright. Do you want me to carry you?"

I laughed. "I can manage to walk five feet to the bedroom, Alex." I headed toward our unmade bed.

"I can manage to carry you five feet to the bedroom." He wanted to make sure I knew that.

I smiled and to placate his need to help I had him get me a glass of water. He returned, jacket- and shoeless, with my glass of water. I took a sip and placed it on the bedside table we found at the Grand Bazaar last December. Alex sat in front of me, taking my feet into his lap. "You think it's the flu?"

I shook my head and slumped back onto the pillows up against the headboard. "No, no. I feel fine and I don't have a fever."

"Hungover?" He smirked, poking fun.

"No," I mocked. "An upset stomach. I'm fine now. How have you been? How was the flight?"

"Fine," he quickly answered. "Did you eat anything this morning?"

I shook my head. "I'm fine," I insisted. "How are you?"

"Fine. Do you want me to get you something? Tea? Crackers?" He continued to pester.

"No. Can we talk about something else or else I might vomit on you?" I crossed my arms, frustrated with myself for ruining the morning, frustrated with him for continuing to ruin this reunion.

"I'm just concerned something might be wrong. Should we go to the doctor?"

I rolled my eyes. "I'm fine. I know my own body. It was just a little morning bug."

His eyes shot up and wide looking straight at me as if he had just gotten an electric shock. "Do you think you could be...?"

I took my feet off his lap, criss-crossing them. "Oh, god, I'm not pregnant. Calm down."

"You sure? When was your last...you know?" He moved his hand up and down in front of his stomach.

I raised my eyebrows and laughed. "Period? What are you? A 12-year-old boy, you can't say the word?"

He sat awkwardly, a nervous look on his face. "No, it's just, you know..."

"I don't know and I don't know where this sudden weird behavior of yours is coming from." I sipped on the water and rolled my eyes behind my closed lids.

He reached out to rub my knee again. It was becoming rather annoying like a fly pestering you. "I'm concerned. That's all. So? When was it?"

I shrugged. "Like a month ago. I don't know."

He was bug-eyed and staring into my soul. "Well, are you late?"

"I don't keep track of that stuff." It was probably laziness or maybe because I was on birth control. Granted, I wasn’t very regular with that anymore. I never liked taking it and Alex hadn’t been there for a month.

"You don't keep track!" He stood up, pacing like it was the 1950s and he was stuck in the hallway while I was giving birth.

"You don't even have a period." I crossed my arms and leaned further back into bed. I was tired. He must have been jet lagged too. Why weren’t we sleeping?

"Yeah, but I am having sex with you."

"We last had sex a month ago. I'm not pregnant."

"And have you had a period since?"

I sighed. "No."

He exhaled and his head fell to his chest. He looked like my father. His head slumped after my mother disappointed him. It terrified me. Like I had done something wrong by not shedding my uterine lining. I didn't feel pregnant. Alex's concern made me concerned but I was more scared by the way his head sank.

"Should I go buy a test?" I asked. I didn't feel like fighting that I wasn't. I got an eerie feeling like I was overhearing my parents fight but I had suddenly body swapped with my mother. It felt like some trust had snapped in between Alex and me. For him, he'll say it wasn't and that it was based solely on concern. I thought otherwise. Like his paranoia had overtaken him.

"I'll go," he offered.

I shook my head and went to my dresser for a change of clothes. "No, it's fine." It's wicked that in my mind I held more worry over someone catching Alex Turner with a pregnancy test than actually being pregnant.

I threw the fur coat on and made my way to the nearby CVS. I had never bought one before. I don't know if I thought I ever would but I suppose I imagined it over different circumstances—a happy one, maybe with someone beside me with equal excitement. I bought a tube of toothpaste and a bag of Cheetos. I still had vomit on my breath.

Alex was sitting on the couch when I returned. His fingers were tapping the armrest and he had the TV on The View but he held a locked stare with the front door, meeting my eyes as I walked in.

I tossed the plastic bag on the coffee table and collapsed on the couch beside him. "I don't have to pee."

"Okay."

I grabbed the remote sitting between us and began to flip channels. Not much of anything good was on that early. I felt Alex staring at me but he didn't speak so I didn't speak. I landed on Notting Hill. "I hate this movie," I said just to have something to say.

He didn't say anything. Not even a Hugh Grant joke.

A half-hour passed in silence beside the movie before I stood up, dug the box out, and went to the bathroom. Not a word from Alex. I slammed the bathroom door shut.

I fumbled with the test for a while, struggling to open the box's lid. I wondered if Alex didn't join me in the bathroom because he thought I needed privacy or because he was upset. I think he was mostly just a scared little boy.

He felt so little to me in that moment and not in the way I loved. He was small and made my blood boil, even if I couldn't fully blame him for his concern. But his silence bugged me. His impassive form on the couch, a refusal to move or communicate. He had a habit of getting in his own head and barring entry. He'd say it was his personality. I'd say it was immaturity.

I took the test and waited for the results to appear alone in the bathroom. Negative, as expected. Still, I was left with uncertainty about what to do. I was mad at him but I didn't want to yell. I was relieved but I didn't want to celebrate. I was left where he was: silence.

Alex was still where I had left him. I put the test on the coffee table and sat down beside him, the last 10 minutes of Notting Hill playing. But he didn't move to look at it. His head turned to me instead. He was reading my face rather than the test. I stayed neutral and stared onward, refusing his enticing gaze.

"I'm sorry if I made you..." He hadn't fully grasped what I was thinking. I tend to think men and women are mostly the same but I find our biological difference is showcased in those times of stress. "It's negative. Right?"

I nodded, staring at Julia Roberts, arms crossed. "Mhmm."

He scooted closer to me. "Jane." His hand landed on my sweatpants-covered thigh and my eyes decided to finally snap over to him, small, tiny, scared little boy Alex. "I would've..."

"What?"

He looked at me as if he didn't expect a reaction from me. His expression was stunned and his hand stilled. "I don't know." You brought his hand up to his forehead, pushing his long strands back over his head. He took a deep breath. "This whole morning has felt like whiplash."

I scoffed, "Yeah." My head turned away from him. I was battered with the feeling of numbness. In the past, I think I would've cried. Or yelled. Now, I felt indifferent. I didn't know how to feel about that either.

"Have I ruined Valentine's Day?" He asked in an attempt to make me laugh.

I shut off the TV and stood up. "Yeah." I walked away to the bedroom. Alex stayed out in the living room.

When I went out to the kitchen, Alex was asleep on the couch. I made as much noise in the kitchen as possible to wake him up. I knew he was jet lagged and tired but I was a scorned woman.

I started the tea kettle and turned around to see a yawning Alex. "Do you want tea?" I offered.

He shook his head and placed his hands on the back of a chair. "I'm sorry for being an asshole." I turned away, not particularly interested in looking at him, instead I searched for a mug. "I suppose I have a habit of that. But I figured we could go out tonight. Go to a pub. Get some drinks."

Alex smiled, proud of himself for upholding a minimal tradition in my eyes. "I have plans tonight."

I didn't expect him to roll over and die. "Oh. Okay." He sat down on one of the stools and said nothing else.

There was no fight in him, meaning I had to be the one to fight. "Fennel and Kaka are having a party. I told them we'd go."

"That'll be fun.” He sent me a complacent smile. “I'll finally get to meet them."

I smiled back just as limitingly. "They've heard a lot."

He looked down at his hands. "Bad, I'm sure."

I exhaled. "I don't hate you, Alex."

"Feels like it." He was moody and refused eye contact, almost like he was me. We had been around each other for so long that we had become each other. People would say this to me but I rarely saw it.

"Call it PMSing. It just wasn't the best greeting."

He nodded, the understanding slowly seeping into him. "I know. I'm sorry for that."

"I woke up early to be awake when you got back and there I go getting sick."

He looked guilty. Solemn and culpable. "I should be making you tea."

I turned back with a smile. "Yeah. You should."

He walked closer and hugged my side. He placed a kiss on my temple and squeezed me close to him. "Go sit down. I'll bring this over to you."

I kissed his cheek. "Alright."

*

Fennel and Kaka's apartment was stuffed with everything. People, liquor, drugs, music, hearts. Alex wore a white shirt with a suit jacket over top. I wore a pink floral Roberto Cavalli cocktail dress, Fennel provided. Maybe it was because of our fight earlier or maybe I had just changed since I had seen Alex last, but I held a superiority complex over him. The silk of my dress wrapped me in elegance and the rough quality of his suit jacket. Oh, shit, I was becoming posh.

Looking back, I wasn't dignified or aware enough that my mother held these opinions of my father as well. However, I was also in a bitter state, and even Alex said I looked better than him so I wasn't really kidding myself.

People held cocktails and canapés were being moved throughout the room. Alex and I stood in the corner silently, I sipped the edge of my gimlet to keep it from spilling. Alex drank a whiskey. I kept thinking about it, in an ashamed way, but then I found humour in it and thought it best to break the ice and tell Alex what I was thinking. "We really are my mother and father."

He turned, originally with a neutral look on his face before spotting the crack of my smile. He breathed laughter out and lifted his glass, taking a slow sip from it. I imagine he was looking for something to say. We hadn't spoken for so long that his vocal chords must’ve needed a refresher course. He dropped the glass to his side. "I hope all the good parts."

I chuckled. "You say that like there are some."

He tossed his head side-to-side. "They've always had elegance to them. They intimidate me. The way the act is, you know..." He moved his hand like he was fishing for the word, trying to find it in the ocean of his mind.

"Posh?" I suggested.

His jaw dropped. "Now, Janie, I would never say that."

"Oy! Jane Cavendish!" It was Fennel, approaching us with Kaka following behind him. They were both dressed in matching maroon suits, each with a cocktail. "Beautiful. Always beautiful. And this must be Alex. Oh, how we've waited for this moment."

"Don't say that. You'll make him nervous," I told them. Alex didn't like it when I told people this. He found it to be invasive for other people—those not close to him—to know his emotions. I found Fennel and Kaka to be trustworthy of this information.

Alex peered over at me like I was his mother embarrassing him in front of his friends. "It's nice to finally meet you both." He shook their hands and they were both very impressed by this. I could tell.

"You both look lovely," I told them.

"Ralph Lauren," Fennel replied. He moved his hand down the fabric of his suit. "Red velvet. Feel." He reached out for my hand and rubbed it up against the velvet, the smoothness running under my fingers. "Now, you, Alex." He grabbed Alex's hand doing the same. It was awkward and made me giggle but Fennel always had a way of putting people at ease. At the sound of my enjoyment, Alex chuckled, nodding his head in approval of the fabric choice.

Kaka told Alex, "Has Jane told you how jealous we are of you two?"

Alex looked over at me at the knowledge of this news. "No, no. Why?" He shoved his hands in his pockets.

"The romance," Kaka swooned. "I wish I could have met Fennel sooner but we were a mess at your age. To find your love so early and keep it going and in the way you two are. If I was doing that at 23, I'd be a mess. Young love is just so lovely. Sorry, I'm a little inebriated."

Alex chuckled. "That's fine."

"You're a very beautiful couple," Fennel said. "I know a lot of ugly ones. Inside and out."

"Well, we had a fight before this so, if that brings us down from paradise for a bit." Alex seemed shocked I had said this. I thought I sounded like my 17-year-old self again. It was honest to me but it was also childish.

Fennel waved his hands. "Fights are great. You should have makeup sex in the bathroom."

I asked, "But where will everyone do coke?" We all laughed. Alex too, if not out of humour than of peer pressure.

Hours passed. We talked with some of my co-workers and Fennel's and Kaka's cultured friends. While Alex was in the bathroom, I talked with David Remnick and nearly fainted out of nervousness because I couldn't remember how to say Ibuprofen.

Alex and I went to the balcony to smoke. The city rushed by below and we each lit a cigarette up alone. I sighed and leaned on the railing, my head in my hand. It was so hot in the apartment but I felt so chilly outside as the wind rushed by. I felt Alex place his hand on my back. He was like a hot water bottle. He knocked against my spine like he was checking to make sure all my vertebrae were still in place. "You look like Juliet."

I turned my head to look at him but his head was off to the left, the smoke escaping out of the side of his mouth. He looked like he was stargazing, even though he couldn't have seen any in that light-polluted sky. His touch on me was this firm thing. I had never felt him so strongly like he wanted me to know he was still standing there beside me.

"The moon is so bright," he said. I looked into his eyes, searching for it in there. I followed his line of sight before my own landed on the glowing sphere hanging up in the sky. It stood bold against the black void surrounding it.

I looked at Alex, bold as ever. I couldn't manage anything with my tongue. I just stared at him while he stared at the moon. I don't know if he felt my eyes on him or if he was so enraptured with the moon that he couldn't handle looking anywhere else.

I sighed, standing up straight. I don't know what I was thinking by standing up so quickly. I don't know why I didn't just stay there and watch him for hours. "I've never understood the whole man-in-the-moon thing."

Alex shrugged, still staring above. "You can see anything if you look long enough."

I scuffed my cigarette out on the railing but kept the dog end in my hand. "Do you think if I stare at it long enough I'll see you?"

He hummed his response. I wasn't sure if we were speaking in some kind of code or just dancing around one another's words. Everything felt off, even if we looked so on track. I was uneasy in finding a response. He acted like he wanted to be alone but his hand persisted its touch on my back. His lips wrapped around his smoke and his eyes stared off into the lights of the city.

My arms crossed and I stood at what felt like such a distance. I stepped sideways, figuring Alex to be done with me and on to his stargazing. I'd have greater engagement talking to the walls inside and at least then I'd have a cocktail too. I turned away and his hand grazed across my back as I moved.

"I feel like I've done something wrong," Alex finally spoke. I had my back to him and it felt like I may never look at him again. Either he or my feet wouldn't allow me to turn around to see him. "I overstepped earlier."

My hand went to my forehead and it was like my brain was going to swell up and push itself out of my skull. I spun around on my heels. He was leaning back against the rail nonchalantly but held such caution in his bones. His eyes had a hard time staying on mine as he committed to the nervous habit of playing with his nails and tapping the end of his cigarette. "It's fine. I don't want to fight about it. I'm tired."

"Okay." He deflected his silence onto me, acting as if I was the one causing tension between us. Earlier that was the case but I dropped it in the kitchen and moved on with life. The whole day Alex held a wall around him. It wasn't a new thing for him to have his guard up, but I usually wasn’t the one blocked from entering.

I swore to myself long ago, after our break-up in '07 that I wouldn't be accusatory to Alex. Trust had always been strong but we always had a weak link. His stare now penetrated me and I felt like the nervous one. My arms stayed crossed but my hands began to squeeze the sides of me and I looked away, inside at the party, which had grown louder as the pretense of class had dropped with the amount of alcohol and drugs. "Did something happen on tour?"

My eyes moved back at his quietness. I had a sick feeling in my stomach but I didn't feel like I had a right to. I'm the one who fucked up before so I'd forgive him if he did now. Instead of guilt, he stared at me like he didn't know what language I was speaking. "No. Why?"

I don't know if he wanted me to feel sorry for him because I was accusing him of something that he didn't do or if he was as lost as I was when it came to this stalemate. "You just seem off. That's all."

He shrugged. "It's been a weird day." I was hit with a wave and I'm still figuring out whether it was from nostalgia or because I actually did see it but I swore he looked 17 again at that moment. I'll always see glimpses of that. The locked-in memory of his first impression. Through his long hair and whatever frustration he seemed to have, I smiled because we were standing in a garden. One that was on a balcony and was mainly weed other than one pot of zinnias.

I dropped my arms and plucked at the fabric of my dress. I didn't tell him what I thought. I thought myself to be a little childish in my reminiscing but it was Valentine's Day and I don't know why we went to this party because I always just wanted Alex to myself. I was a desperate woman with a sole propensity to be alone with Alex, especially when it was the day of his homecoming. I blamed it on my period, which I got the following day (not pregnant).

"You didn't want to come here tonight?" I said it as a question but it was a statement. I was already sure of Alex's stance. His inability to relax around strangers and his reluctance to engage in small talk. I knew he also had an inclination to be alone with me.

He played nice though. Always gave in to me easily on these kinds of dilemmas because it's what I wanted. He couldn't give me much in other areas (I had just finally won the whole location problem) so he found it expected to do what I wanted to do when he was around. But, sometimes (I use sometimes very loosely because I do in fact like getting my way), I liked doing what he wanted to do. Most of all, my favourite thing was talking to him. So, why would I spend a whole night chit-chatting with other people? (Besides, David Remnick because that really was a dream come true).

"I'm having fun." He wasn't very convincing. A tone of neutrality and a shrug of his shoulders that just looked like disinterest.

I chuckled to myself. "I'd like to give myself some credit. I know you better than anyone else so I know that you're full of shit."

He laughed and finally dropped his cigarette and his rough shoulders. "I'm just tired."

"Sure," I dragged out, unconvinced. "I'm kind of wishing we just went to a pub or something."

Alex looked down and rubbed his forehead. "Yeah. I'm wishing a lot of things right now."

My brows furrowed and I wanted to look closer at him but his hand and hair shielded his expression. "Like what?"

He put his hands in his pockets and looked out at the city. "I don't know. I think I'm just a little messed up right now."

I stepped forward, wanting to stand next to him, wanting to touch him. I moved close enough that he was forced to look at me. "What's going on?"

The browns of his eyes looked darker and shinier as if they had been glazed over. I wanted to touch his face and have him lean into my hand, but I wanted to hear what he had to say first. He fidgeted with the cuffs of his jacket but I had him cornered. "Just in my head. The usual."

"About what? Me?" It might have been selfish to think so but he looked like he might cry while looking at me and I don't think I had felt that insecure in front of Alex in years.

He shook his head. "I don't even want to say it. It's so stupid."

"I don't want you to leave it in there."

His eyes darted in a million directions before landing on mine. "Just things are changing."

It took me a second to understand. It took me a gust of wind passing before I pointed to myself. "Me?"

He rattled his brain with the shake of his head. "I'm just in my head, Janie."

I grabbed his upper arm, forcing him to take notice of me. "Well, let me in. You know, I like when we talk." I smiled up at him and he released the hint of a smile, a sparkle behind his eyes. "I like knowing what's going on and what you have to say, what you're thinking. I don't get much of that while you're away and I think we both stew in our thoughts for so long that we're practically bored of it by the time we see the other and then we think we don't have to bother saying anything. But I've never heard about this and I want to know about this. I want to know about you if you let me."

A grin covered his face, so wide his teeth peeked through to wave to me. "What?" I asked. His smile just seemed to grow bigger and his eyes cast down on me. I thought he might kiss me but I'm glad he didn't, I didn't want to get distracted. "What?" I insisted, punching his leaning figure.

"Nothing," he said so cheerfully. I thought he might have taken something to cause this sudden change. He put his hand on my shoulder like he wanted to touch me but wanted to make sure we kept our distance. "I just love the way you talk. I don't know. Like the way you know how my brain works and you feel everything I'm feeling. I just...I love talking to you too. It's what I've always loved about you. I feel like I can't do this with anyone else. Just lay myself out and never have to worry. I think I forgot the feeling."

I wrapped my arm around his neck, closing the distance, and having us stand chest-to-chest. "We'll blame the jetlag."

"Sorry for being moody. I think it's an after-effect of prolonged homesickness."

"It's fine. I suffer from it too." It made me smile that we both considered each other home. It was cheesy and cliche but that didn’t make it untrue.

"Do you think there's a cure?" He moved closer and it took me that long to realize we hadn't kissed all day between the vomit and the fighting and the party. I should be put in jail for this.

I didn't kiss him right away. I hugged him first just to feel him, make sure he was there, all of him. "I might start with getting out of here."

Alex insisted, "Don't make me force you to leave."

"I wouldn't if I didn't want to. I'm craving shitty fries and chairs that squeak." And him. I really craved him.

"You love it when we play poor together."

"I love when we're together." We finally kissed at that point, waiting any longer felt like too much. He was right with me and I never wanted him to leave. If we kissed any longer we might have fallen off the side of the balcony. Together.

I dragged him through the apartment with me, trailing like my puppy but he was my loyal dog. His hand was clasped in mine and I kissed both Kaka's and Fennel's cheeks and promised to have dinner sometime soon for a more proper introduction to Alex. "Enjoy your Valentine's, love," Kaka said in his drunken impersonation of a British accent.

"You too," Alex said for both of us.

He put my fur coat on me and we left onto the sidewalk of the loved-up city. We decided to walk back in the direction of our apartment and land at a shitty bar along the way. We walked side-by-side like we were two anxious teenagers again. I suppose we had regressed in the absence of one another and the readjustment was more structurally unsound than usual.

"So, uh," I started, "you think I've changed too much?"

He threw his head back. "Don't listen to me."

I grabbed his arm, tugging on it. "No, I want you to be honest with me. None of this evasiveness."

Alex put his arm around my shoulder, pushing me into him. "I'm just catching up a little. You've been busy while I've been gone and I like that."

"But too much too quick?" Fennel and Kaka and the load of other people they had in their apartment could be too much. It overwhelmed me at times and I knew most of the people in the room.

We stopped at a corner, waiting for a light. He turned his head to look directly at me. "Just give me a bit of a grace period." He smiled so carefully. Not in a calculated way but to reaffirm his statement.

I smiled back. "I'd give you anything you want." It was probably too much to give a person, something I wasn't even willing to give to myself, but we were sharing a desperate kind of love. It wasn't the healthiest but he was the only person I knew would love me no matter what.

He seemed struck by this statement, unable to tear his eyes away to spot the green light in front of us. I pointed ahead at it but he didn't move his feet. He bent down and kissed my cheek firmly. I think he would have stayed there forever if I hadn't pushed him and insisted we cross the street before the light turned red again. He leaned down and whispered, "Ditto."

We stopped at The Scratcher in the East Village. It was Irish but akin to English by nature. It had exposed brick and when I asked the bartender for a Guinness (me) and lager shandy (Alex) he talked with me about England long after he had given me our drinks. The lighting was low and it was late but the bar was still full with mostly lonely hearts, save us and a few other couples.

Alex found us a table in the back corner by a group of rowdy men and for a bit it did feel like we were back home. "That's what I love about New York," I mused to him. "I find pieces of home here. I never found that in Los Angeles. Too deserty."

Alex leaned his cheek on his fist. His eyes looked tired but his smile stayed exercising. "You seem really happy here."

I shrugged. It was hard to admit these things. Like if I spoke it out loud it would cease to be true. "I guess, in a way, it feels like it’s something I did on my own. I know I'm not alone but...you know what I mean."

His eyes flashed down at the table and he sat up straight, leaning back against his chair. "Yeah. I know what you mean." He sipped his drink and I could tell he was going to say something once he washed his words down. "I really like it here too." The infliction in his voice was distracted as if he was thinking about 10 other things. I didn't know which one to ask about.

"Tour's almost over." I was ashamed that it flew by for me. Maybe because I was more occupied. I thought it should have felt like it dragged on forever. The way I used to feel about it. Granted it was shorter than the previous tours but I had never been this involved with Alex. We shared a home now, yet, his things—his clothes next to mine and the record collection collecting dust—didn't make me long for him, yearn for him. Perhaps, it was growing up. Perhaps, it was growing apart.

I circled my finger around my glass's edge. "I don't know if I'll be able to get off for the London shows."

"That's fine." He has always been so accepting. Like most things, it was a blessing and curse. Sometimes, I hated that he didn't put up a fight. He never told me what he desired, even with things like LA. It was a work obligation, not something he wished for. Maybe it's because I always wanted too much and Alex balanced it out by wanting too little.

"I got off work tomorrow. If you want to do anything."

He smirked. "I have one idea." Alex did desire some things.

*

I cut Alex's hair a week later. He complained of it being too long and I suggested he go to the barber and then he said I should do it. It was late but we were very happy.

We shared a glass of wine. I had Alex sit in the bathtub and I kneeled on the tile floor. We washed it first and then emptied the bathtub before I began to cut it. "What if you end up not liking it?" I questioned. I wasn't nervous. If anything I was power-hungry holding the kitchen scissors.

"I'll like it. It'll grow back either way. How bad could you fuck it up?” He chuckled before saying, “Last time you did this we broke up. Can't fuck up more than that."

His laughter induced me to join him. I sipped the wine before passing it to him. It felt very adult and I told him that. He said, "I could do this forever."

*

Alex experienced his first nor'easter blizzard at the end of February. I had experienced my first at the beginning of the month. He was quite excited for it. It was childish excitement like he was going to receive a snow day. I suppose his snow day was the fact that I didn’t have to go to work. I ended up getting Thursday and Friday off, which, well, did feel like a snow day.

However, it was cold. Like really cold. We ventured outside at the start of the storm to collect groceries and experience the snowfall. We got into a snowball outside our building’s front door before the snow turned to slush. Alex accidentally ended up hitting Russ Tillerson, who lived on the floor below us. He had a good spirit and laughed before shoving snow down Alex’s back, smushed in between his skin and his coat.

It took me a good few minutes to recover from laughter over Alex’s shivers. “It’s not fun,” he insisted, still patting snow out.

I hit his thick jacket with my gloved hand. “You’re not a good sport.”

He pouted and whined, “I don’t want to be a good sport. I want to be warm.”

I stroked his cheek, rubbing the icicle crystals stuck on my glove onto his skin making him wince. “Awwww. Poor baby. I’ll run you a bath when we get back.” He quite enjoyed that bath.

The days were fun but long. We watched TV and had sex for most of it. We ate sloppy like we were at a slumber party. We got high Friday night while watching Goodfellas. I ate a bag of salt & vinegar chips and half a pack of Chips Ahoy! Alex ate a whole pack of Oreos and drank enough Coke to shut down your organs.

“I’m sorry I’m so high,” I apologized.

He waved me off and sunk deeper into the couch pillows. “It’s fine. I wish we had more Coke.”

“We could do coke coke.”

“You have coke coke?”

“No. But we could get some?” It was candy in my new circle. Easy to obtain, sweet to do, horrible for you.

“Nah,” he rejected. “You’ve done it?”

“Yeah. I used to do it with…what’s his name…Robert.”

“Oh.”

“I’m sorry I’m so quiet,” I apologized again.

“You’re good.”

“Ray Liotta is so hot.”

“You’re so hot.”

“Mhmm.” My eyes moved away from blue eyes to Alex’s brown. He had sat up from his slump and was leaning on the armrest, observationally. “Don’t do that.”

“What?” He smirked, all-knowing.

“You know…how horny I get…” His smirk grew. “Don’t look at me like that!”

He curled his fingers, beckoning me to him. “Come here. Let me do you.”

I laughed and closed my eyes, prepared to succumb to sleep. His foot knocked mine. “What?”

“C’mon.”

He came to me. And, well, in me.

*

Alex left halfway through March, narrowly missing another nor’easter, but this time less severe. Opal came a few days later for work. She stayed at the Bowery Hotel, a few blocks east of me. I had walked by it a million times and always longed to go in. It was my second most desired hotel after the Plaza.

She was there for work but apparently now had a boyfriend there too but that was all supposed to be obvious. Opal talked about things like you already knew everything about it. She told outlandish stories where she'd say, "You know how Charlie is" when I had never heard of Charlie before. Nonetheless, she was exciting and good company.

Alex was in Baltimore by the time I called him while drunk. Opal and I had gone to House of Yes and said yes to every drink along the way. Opal left with some guy who wasn't her boyfriend but it's okay because they had an open relationship, I think. Therefore, I was left outside House of Yes going home alone. I don't blame Opal for ditching me; the guy was hot and I insisted she go by saying I wasn't drunk, just tipsy.

I called Alex and lit up a cigarette at the same time. He picked up after 2 rings while I was still muffled by the cigarette in between my teeth. "Hiya, honey," I mumbled.

I heard laughing, either from him or the drunkards around him. He had been drinking too but not heavily. "Hey, sweetie." He moved away from the sound. I imagined him tucking himself away in the back end of the tour bus.

"I'm needy and I miss you," I whined.

His soft chuckling rang through the phone. "What's that mean?"

"It means I'm walking to the subway in Brooklyn." I scraped my heels against the cement.

"Ah. You and Opal have fun?"

"Yeah, but I'm drunk and alone. She's probably having sex right now. Everyone is having sex right now." House of Yes was a very sexual place in 2010.

"I'm not."

"Yeah,” I giggled. “I figured that one out. Could you imagine? You're on the phone with me having sex."

"What? Like phone sex?" He teased me.

I scolded him, "I'm not having phone sex in public. I meant like you were fucking someone else and on the phone with me."

"Why would I fuck someone else?" His tone was puzzled and I think he was drunker than I thought he was at the time.

"I don't know. I'm drunk. There's no logic to my thinking."

"I don't think I'll ever have sex with someone else. It'd be weird."

"I'd have sex with other people."

"Really?" He didn’t sound worried. Just curious.

"Yeah. Like George Clooney or something."

"I'll let you have Clooney. I’d fuck Clooney."

"Nah. He wouldn't settle down with me anyway."

There was a pause of silence before he expressed, "Miss you."

"Yeah. Me too."

He buzzed as if the words were sinking in. "End of the month and then I'm all yours."

"I like that idea. I've been hanging out with Opal so much I think she's starting to hate me."

"No. She just needs hot ass like the rest of us." It had been a very lonely month in the sex department.

"I'm not hot ass?"

"You're the hottest ass."

"Subway's here."

"Okay. Let me know when you're home."

"Yeah. Love you."

He hummed in agreement.

*

Alex returned at the end of April. We relaxed back into domestic obliviousness. That weekend, we went over for dinner at Fennel and Kaka's. We drank wine, ate fancy chicken, and played with Rooster.

We sat at one end of their dining room table. Alex's nervousness had faded but he remained stiff, the obvious odd man out. We were laughing about work and Sally Condalteen's explosible haircut, all out of Alex's frame of reference.

Fennel, observing this, gasped and said, "I just realized I haven't even heard the story of how you two met."

I turned to Alex, who was looking at me. I was like a mother training a child to speak for themselves. "You tell it. I've never heard your side of things."

"Okay. Uh, well, Jane had a class with Matt, who is the drummer of, you know, the band, and he invited her to our first gig. We sort of knew each other—small college and that kind of thing—but never talked. So, at the venue, I went up to her and called her the wrong name. The whole night I figured I screwed things up and made a fool of myself. Then, I'm outside smoking and she comes out and I thought maybe I wouldn't say anything but then I realized I'd probably never get another chance, so..."

"You went for it?" Kaka, a big woosy romantic, grinned.

"Obviously," I answered.