#goldman sachs

Explore tagged Tumblr posts

Text

1K notes

·

View notes

Text

JUST IN: Goldman Sachs has increased the probability of a recession within the next 12 months from 20% to 35%.

Are you tired of winning yet?

101 notes

·

View notes

Text

#luigi mangione#united healthcare#goldman sachs#eat the rich#fuck the rich#bring back the guillotine

102 notes

·

View notes

Text

#banking#goldman sachs#politics#political#us politics#donald trump#news#president trump#elon musk#american politics#jd vance#bank#major bank#america#american#law#us news#maga#president donald trump#make america great again#republicans#republican#democrats#economics#elon#trump administration

55 notes

·

View notes

Text

What stage of capitalism is this?

#What stage of capitalism is this?#goldmansachs#goldman sachs#biotech#health#cures#cure#sustainable business#class war#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#fuck ceos#ceo shooting#ceo second au#tech ceos#ceos#ceo information#uhc ceo#ceo down#ceo

23 notes

·

View notes

Text

Donald Trump’s war on DEI policies has caused a number of major corporations to bend the knee. [...] Costco is receiving some online praise, for example, after more than 98% of shareholders recently rejected a shareholder proposal for a report on any risks posed by the company’s DEI policies. JPMorgan Chase CEO Jamie Dimon and Goldman Sachs CEO David Solomon have faced similar activist proposals at their companies, but speaking at this week’s World Economic Forum in Davos, Switzerland, both said they remain committed to seeking out diverse talent despite the right-wing crusade. Asked in a CNBC interview about the anti-DEI push among investors, Dimon said: “Bring them on.” A number of other CEOs at Davos, including Pinterest CEO Bill Ready, Vista Equity Partners CEO Robert Smith and Cisco CEO Chuck Robbins, all vowed that their companies will remain committed to prioritizing diversity even as they navigate the new legal terrain under Trump. And good on them for that. Let’s hope they follow through, because doing so makes good business sense. DEI programs help foster work environments that studies have shown are more productive than ones where diversity isn’t emphasized.

Ja'Han Jones at MSNBC.com on how some business are resisting efforts to eliminate DEI programs (01.24.2025).

While quite a few companies have stupidly caved to MAGA propagandist games of ending DEI, there are some companies holding strong, such as Costco.

#Trump Administration II#DEI#Diversity Equity and Inclusion#Ja'Han Jones#MSNBC.com#Opinion#Apple#Costco#Jamie Dimon#Goldman Sachs#David Solomon#JPMorgan Chase#Robby Starbuck

17 notes

·

View notes

Text

DA GOLDMAN SACHS ALL'ENTE PER "IMMUNIZZARE TUTTI": ECCO IL CV DI CHI HA DECISO SUI VACCINI IN EUROPA

Dall’Unione Europea alla #GoldmanSachs. Dalla Goldman Sachs alla Gavi Alliance, l’ente internazionale dell'”immunizzazione per tutti”. Il percorso descritto è quello di José Manuel #Barroso: lui di un’Europa ne è stato Presidente di Commissione. E in una particolare forbice temporale, dentro la quale si nascondono direttive presenti tuttora nei tribunali. Direttive che vanno in diretto contatto…

25 notes

·

View notes

Text

When Apple announced it was launching Apple Card in 2019, it promised “a new kind of credit card” that was “designed to help customers lead a healthier financial life.” Now, government regulators say Apple and its partner Goldman Sachs caused harm to hundreds of thousands of cardholders by mishandling disputed transactions and by using deceptive marketing practices. The Consumer Financial Protection Bureau, a federal agency, has ordered the companies to pay a combined $89 million in penalties and redress to those affected. The CFPB has also banned Goldman Sachs from launching a new credit card unless it provides “a credible plan” that the product will comply with the law. “The companies violated consumer financial protection laws through their practices related to Apple Card,” said CFPB Director Rohit Chopra in prepared remarks on Wednesday. “This led to wrongful charges, mishandled disputes, and damaged credit reports.”

19 notes

·

View notes

Text

Their Fertilizer Poisons Farmland. Now, They Want Protection From Lawsuits. (New York Times)

Excerpt from this story from the New York Times:

For decades, a little-known company now owned by a Goldman Sachs fund has been making millions of dollars from the unlikely dregs of American life: sewage sludge.

The company, Synagro, sells farmers treated sludge from factories and homes to use as fertilizer. But that fertilizer, also known as biosolids, can contain harmful “forever chemicals” known as PFAS linked to serious health problems including cancer and birth defects.

Farmers are starting to find the chemicals contaminating their land, water, crops and livestock. Just this year, two common types of PFAS were declared hazardous substances by the Environmental Protection Agency under the Superfund law.

Now, Synagro is part of a major effort to lobby Congress to limit the ability of farmers and others to sue to clean up fields polluted by the sludge fertilizer, according to lobbying records and interviews with people familiar with the strategy. The chairman of one of the lobbying groups is Synagro’s chief executive.

In a letter to the Senate Committee on Environment and Public Works in March, sludge-industry lobbyists argued that they shouldn’t be held liable because the chemicals were already in the sludge before they received it and made it into fertilizer.

The lobbying has found early success. A bill introduced by Senators John Boozman of Arkansas and Cynthia Lummis of Wyoming, both Republicans, would protect sludge companies like Synagro, as well as the wastewater plants that provide the sludge, from lawsuits. A House bill has also been introduced.

Ms. Lummis will “work with President Trump’s E.P.A. to ensure ‘passive receivers,’ like water utilities and others, are protected from bogus third-party lawsuits,” her office said in a statement, referring to the Environmental Protection Agency.

Synagro and Goldman Sachs declined to answer detailed questions. Synagro in its most recent sustainability report acknowledged the risks of PFAS contamination in its fertilizer, calling it “one of our industry’s challenges.”

Widespread manufacturing of PFAS began decades ago, with some of the country’s largest chemical companies making vast quantities and downplaying the risks. Water-resistant and virtually indestructible, the chemicals have been used in everything from nonstick pans and dental floss to firefighting gear and waterproof clothing.

8 notes

·

View notes

Text

By: Ronn Torossian

The day after hundreds of Pro-Hamas protestors rallied outside of a Manhattan cancer hospital, we learn that the organization which hosts these heinous rallies throughout New York City calling for an elimination to the State of Israel, and mass murder of Jews is funded by Goldman Sachs. Full stop. Period.

Goldman Sachs, one of the largest banks in the world has given $18 Million Dollars to The People’s Forum which organizes these rallies. Goldman Sachs has a fund, where donors send money to send nonprofits and rather than Goldman Sachs saying no, we will not send money to an organization which supports rape and terror, they sign the checks. And Goldman Sachs funds it. Goldman Sachs can refuse to sign the checks – they choose not to. It has been ongoing.

Manolo De Los Santos of the People’s Forum gave a speech Monday in New York City where he said “When we finally deal that final blow to destroy Israel. When the state of Israel is finally destroyed and erased from history, that will be the single most important blow we can give to destroying capitalism.”

The speech preceded a rally, “Flood Manhattan for Gaza MLK Day”, during which pro-Hamas protestors walked the streets of Manhattan blocking traffic, and eventually they protested outside Memorial Sloan Kettering Cancer Center, a hospital. As The New York Post reported protestors screamed: “Make sure they hear you. They’re in the window,” one organizer said through a bullhorn, and another in the crowd chanted, about the cancer center, “MSK, shame on you, you support genocide, too.”

These are people who support rape and baby-killing. On October 7th, the leader of The People’s Forum tweeted about “the heroic resistance of the Palestinian people”, and “the struggle for the national liberation in Palestine.” On October 7 in Manhattan. These protests are a clear call for murder with chants of “Free Palestine from The River to the Sea”, and “Intifada Now” are calls for violence and murder of Jews.

Authorities allow these terrorist Anti-Semitic supporters to block traffic, disrupt the city and threaten Jews. The People’s Forum has hosted Anti-Semitic rallies in NYC since October 8th they are well-funded and well organized and there are also events on Karl Marx, Vladimir Lenin and “the path to revolution.” In the New York Post, a 74-year-old Jewish woman was quoted as saying, “I thought I was in Germany in 1939.” She is right, and in 2024 the free world is either with us or against us. Goldman Sachs is funding calls for the mass murder of Jews. Goldman Sachs is signing checks which pays for Anti-Semitic events in New York City. It must end now. It’s not unlike Outten Golden, a leading law firm in New York City, where their lawyer Kathleen Peratis has visited the Hamas deadly terror tunnels multiple times, praised Hamas leaders, openly opposes a Jewish state and supports BDS.

Elie Wiesel rightfully said: “I swore never to be silent whenever and wherever human beings endure suffering and humiliation. We must always take sides.” Goldman Sachs stop funding this.

25 notes

·

View notes

Text

The list:

Pepsi

Goldman Sachs

Google

Target

Meta

Amazon

McDonalds

Walmart

Ford

Lowe's

Harley Davidson

Brown Forman

John Deere

Tractor Supply

#DEI#diversity#equity#Inclusion#Pepsi#Goldman Sachs#Brown Forman#Tractor Supply#Target#Walmart#Ford#McDonalds#Meta#Amazon#Lowes#Google#harley davidson

4 notes

·

View notes

Text

All six of the largest US banks, JPMorgan, Citigroup, Bank of America, Morgan Stanley, Wells Fargo and Goldman Sachs, have quit a similar group for banks, the Net-Zero Banking Alliance, in recent weeks.”

4 notes

·

View notes

Text

The True Nature of Globalization (Essay)

FDR//The attack on Pearl Harbor was his trap.

In the early 2000s, Japan was violated by the USA. This was done softly, by privatizing the postal service. By privatizing the post office's savings and insurance, which at the time had a value of 340 trillion yen (2.3 trillion dollars), the funds were transferred to the control of Goldman Sachs. Japan was given an "order" called the "Annual Request," and Prime Minister Junichiro Koizumi followed it. This company represents the interests of the USA. This is the company it is-

Goldman Sachs was condemned for its investment trust pyramid, but a man guaranteed its social status after the war. This was Sidney Weinberg, who became a co-owner in 1927. President Franklin Roosevelt, a friend of his, had Weinberg establish the Business Advisory and Planning Council of the US Department of Commerce in 1933. This organization was responsible for negotiating between the government and the private sector regarding the New Deal policy. (Wikipedia)

Franklin Roosevelt is remembered as the US President (Democrat) who framed Japan.

Whether it is the EU, the policies of the US Democratic Party, or China's Belt and Road Initiative, it is globalization. Although this policy claims equality and freedom among ethnic groups on the surface, it means a relationship of "ruler-ruled." There is no equality between ethnic groups; it is a relationship in which one side dominates the other. Such is the relationship between the USA and Japan.

Globalization talks about ethnic equality and is tolerant of immigrants, but in most cases, immigration becomes a major problem in every country. As a result, politicians who are called far-right are on the rise in each country. However, I applaud the immigrant expulsion policy of Italian Prime Minister Meloni, who is considered far-right. Globalism inevitably gives birth to the far-right. In Japan, the Kurdish issue has arisen later than in other countries, but no political party that can be considered far-right has yet emerged. If I had to say, would the Sanseito Party be an example of this?

Rei Morishita

2024.11.09

グローバリズムの正体(エッセイ)

フランクリン・ルーズベルト/「真珠湾攻撃」は、彼の罠だった。

2000年代初頭、日本はUSAに凌辱された。それは郵政民営化というソフトな形で行われた。当時340兆円あった郵便局の貯金、保険を民営化することで資金がゴールドマン・サックスの支配下に流れた。日本には「年次要望書」という「命令書」が渡されていて、小泉純一郎首相が従ったのだ。この会社はUSAの利益を代表する。こんな会社である――

投信ピラミッドを断罪されたゴールドマン・サックスであったが、その社会的地位を戦後にわたり保証する男がいた。1927年から共同経営者となったシドニー・ワインバーグ(Sidney Weinberg)である。親交のあったフランクリン・ルーズベルト大統領は1933年、ワインバーグにアメリカ商務省経済顧問計画会議(Business Advisory and Planning Council)を設立させた。この機関はニューディール政策をめぐり政府と民間の交渉を担当した。(wikipedia)

フランクリン・ルーズベルトは、日本を陥れたUSA大統領(民主党)として記憶される。

EUにせよ、USAの民主党の政策にせよ、中国の一帯一路政策にせよ、グローバリズムである。この政策は、表面的には民族の平等、自由を標榜していても、「支配―被支配」関係を意味する。民族間に平等はありえず、一方が他方を支配するという関係なのである。USAと日本の関係がそうだ。

グローバリズムでは民族の平等が語られ移民に寛容だが移民がどの国でも大問題になるケースがほとんどだ。そのため、各国には極右と称される政治家が台頭している。しかし極右とされるイタリアのメローニ首相の移民追放政策に、私は拍手を送る。グローバリズムは、必然的に極右を生む。日本では、他国に遅れて、クルド人問題が起きているが、まだ極右といえる政党は出てきていない。あえて言えば参政党がそれに当たるか?

#globalization#essay#rei morishita#FDR#Japan#USA#Goldman Sachs#Democrat#relationship of "ruler-ruled#far-right

6 notes

·

View notes

Text

#goldman sachs#recession#banking#banks#bank#money#finance#economic#economics#economy#politics#political#us politics#news#donald trump#president trump#american politics#elon musk#jd vance#law#poverty#america#us news#trump administration#maga#elon#republicans#republican#american#democrats

27 notes

·

View notes

Text

How Goldman Sachs's "tax-loss harvesting" lets the ultra-rich rake in billions tax-free

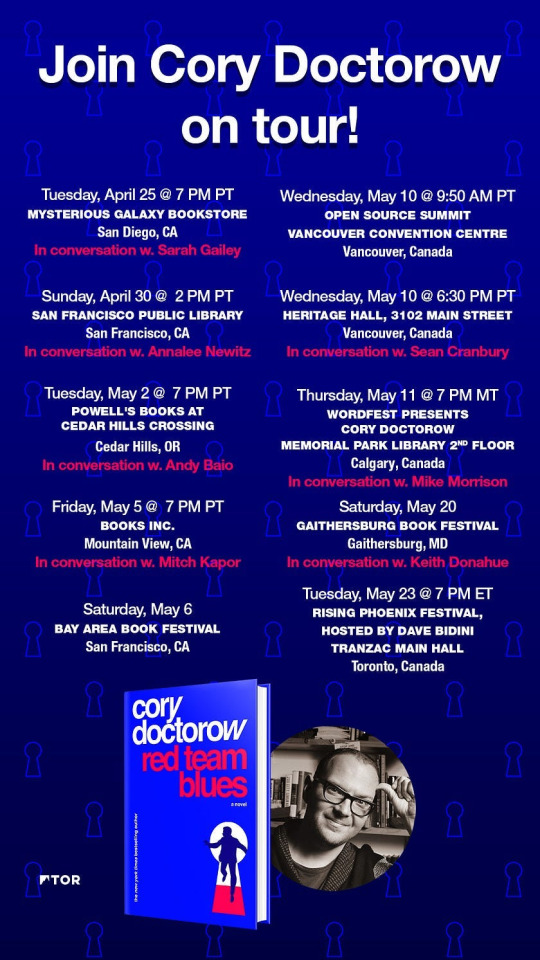

Tomorrow (Apr 25) I’ll be in San Diego for the launch of my new novel, Red Team Blues, at 7PM at Mysterious Galaxy Books, hosted by Sarah Gailey. Please come and say hi!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

With the IRS Files, Propublica ripped away the veil of performative complexity disguising the scams that the ultra-rich use to amass billions and billions (and billions and billions) of dollars, paying next to no tax, or even no tax at all. Each scam is its own little shell game, a set of semantic and accounting tricks used to gussy up otherwise banal rip-offs.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

The finance sector has a cute name for this kind of complexity: MEGO, which stands for "my eyes glaze over." If you're trying to rip off a mark, you just pad out the prospectus, make it so thick they decide there must be something good in there, the same way that any pile of shit that's sufficiently large must have a pony under it...somewhere.

Propublica's writers haven't merely confirmed just how little America's oligarchs pay in tax - they've also de-MEGO-ized each of these scams, like the way that Peter Thiel used the Roth IRA - a tax-shelter for middle-class earners to help save a few thousand dollars for retirement - to make $5 billion without paying one cent in tax:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

One of my favorite IRS Files reports described how Steve Ballmer - the billionaire ex-CEO of Microsoft - laundered vast fortunes into a state of tax-free grace by creating hundreds of millions in "losses" from his basketball team, the LA Clippers. Ballmer paid 12% tax on the $656 million he took out of the Clippers - while the players whose labor generated that fortune paid 30-40% on their earnings:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

That was Propublica's first Ballmer story, back in the summer of 2021. But they ran a followup last February that I missed (it came out while I was on a book tour in Australia), and it's wild: a tale of "loss harvesting," a form of fuckery involving Goldman Sachs that's depraved even by their own standards:

https://www.propublica.org/article/irs-files-taxes-wash-sales-goldman-sachs

Loss farming is a scam that was invented in the 1920s, whereupon it was promptly banned by Congress. But Goldman and other plutocrat Renfields have come up with tiny modern variations on this century-old con that the IRS is either unable or unwilling to address.

Here's how it works. Say you've got a stock portfolio where some of the stocks have gone up and others have gone down. You want to sell the high stocks and hang onto the low ones until they bounce back. But if you sell those stocks that have gone up, you have to "realize" the profit from them and pay 20% capital gains tax on them (capital gains tax is the tax you pay on money you get from owning things; it's much lower than income tax - the tax you pay for doing things).

But you pay tax on your net capital gains - the profits you've made minus the losses you've suffered. What if you sold those loser stocks at the same time? If you made a million on the good stocks and lost a million on the bad ones, your net income is zero - and so is your tax bill.

The problem is that selling stocks when they've gone down is a surefire way to go broke. Every investing book starts with this advice: you will be tempted to hold onto your stocks that are going up, because they might continue to go up. You'll be tempted to sell your stocks that are going down, because they may continue to go down. But if you do that, you'll only sell the stocks that have lost money, and never sell the stocks that have made money, and so you will lose everything.

Back when the pandemic started, your shares in movie theater chains were in the toilet, while your stock in tech companies shot through the roof. If you sold the tech stocks then and held onto your movie stocks and sold them now, you'd have cleaned up - today, tech stocks are down and movie theater stocks are up. But if you sold the cinema shares when they bottomed out, and held onto your tech stocks when they were peaking, you'd be busted today.

So selling your loser stocks to offset the gains from your winners is a bad idea. That's where loss-farming comes in: what if you sold your tech stocks at their peak, and sold your bottomed-out cinema stocks at the same time, but then bought the cinema stocks again, right away? That way you'd have the "loss" from selling the cinema stocks, but you'd still have the stocks.

That's called "wash trading," and Congress promptly banned it. If you've heard of wash-trading, it's probably something you picked up during the NFT bubble, which was a cesspit of illegal wash-trading. Remember all those eye-popping NFT sales? It was just grifters with multiple wallets, buying NFTs from themselves, making it seem like there was this huge, white-hot market for monkey JPEGs. Wash-trading.

Turns out that crypto really did democratize finance...fraud.

Wash-trading has been illegal for a century, but brokerages have invented modern variations on the theme that are legal-ish, and the most lucrative versions of these scams are only available to billionaires, through companies like Goldman Sachs.

There are a bunch of these variations, but they all boil down to this: there are lots of ways to sell an asset and buy it again, while making it look like you bought a different asset. Like, say you're invested in Chinese tech companies through an exchange-traded fund (ETF) that bundles together "all the Top Chinese tech stocks."

Maybe you bought this fund through Vanguard, the giant brokerage. Now, say Chinese stocks are way down, because the Chinese government is doing these waves of lockdowns on the factory cities. If you could sell those Chinese stocks now, you'd get a massive loss, enough to wipe out all the profits from all your good stocks.

But of course, China's going to figure out the lockdown situation eventually, so you don't want to actually get rid of those stocks right now, especially since they're worth so much less than you paid for them. So right after you sell your Vanguard Chinese tech ETF shares, you buy the same amount of Schwab's Chinese tech-stock ETF.

An ETF of "leading Chinese tech companies" is going to have basically the same companies' stock in it, no matter whether it's sold by Vanguard, State Street or Schwab. But as far as the IRS is concerned, this isn't a wash-trade, because you sold a thing called "Vanguard ETF" and bought a thing called "Schwab ETF" and these are different things (even if the main difference is the name on the wrapper, and not what's inside).

There's other ways to do this. For example, lots of companies have different "classes" of stock. Under Armour sells both Class A (voting) and Class C (nonvoting) stocks. Though voting stock is worth a little more than nonvoting stock, they both rise and fall together - if the Class A shares are up 10%, so are the Class C shares. So you can dump your Under Armour Class A's, buy Under Armour Class C's and own essentially the same amount of Under Armour stock - but as far as the IRS is concerned, you just sold your interest in one company and bought an interest in a different company, and you can take a big loss and write down your profits from other stock trades.

The IRS does prohibit wash-trading, but only in the narrowest sense. Brokerages are obliged to report trades in which a customer buys and sells exactly the same security, with the same unique ID (the CUSIP number), within 60 days. Beyond that, IRS guidance is extraordinarily wishy-washy, calling on filers to "consider all the facts and circumstances" of their transactions. Sure, that'll work.

Propublica found zero instances of the IRS targeting any of these trades, ever, for enforcement. That's especially true of the most egregious version of loss-harvesting, a special version that only the ultra-rich can take advantage of, called "direct indexing." You might know about "index funds," where a brokerage sells a single fund that tracks a broad index of stocks - for example, you can buy an S&P 500 index that goes up and down with the total value of the top 500 stocks in America.

Direct indexing is something that giant banks like Goldman Sachs offer to their very richest clients. The brokerage buys a mix of stocks that are likely to track the whole index, and puts those shares directly into the client's account. Rather than owning shares in a fund that owns the stocks, you own the stocks directly. That means that when you want to harvest some losses, you can sell just a few of the stocks in the index, rather than your shares in the whole fund.

Here's how that works. In 2017, the US index was up 20%; global indexes were up even more. Steve Ballmer made a bundle. But Goldman Sachs, acting on Ballmer's behalf, sold s few of the stocks in the portfolio and harvested a $100,000,000 loss, that Ballmer could use to trick the IRS into treating his massive profits as though he'd made very little taxable income.

Goldman uses a whole range of tricks to keep billionaires like Ballmer in a lower tax-bracket than the janitors who clean the floors after his team's games. They not only buy and sell different classes of stock in companies like Discovery and Fox; they also buy and sell the same company's stock in different countries. For example, they sold Ballmer's shares in Shell in one country, and then immediately bought the same amount of shares in another country. The IRS doesn't treat this as a wash-trade, despite the fact that the shares have the same value, and, indeed, companies like Shell routinely merge their overseas and domestic shares with no change in valuation.

Thanks to Goldman's ruses - and the IRS's willingness to accept them - Ballmer's wealth has swollen to grotesque proportions. He generated $579 million in losses from 2014-18, and as a result, got to keep at least $138m that he'd have otherwise had to pay to the IRS.

Goldman's not the only one in on this game: Iconiq Captial - a firm that also offers marriage partner scouting for its richest clients - has $13.2 billion under management on behalf of just 337 people. Among those high-rollers: Mark Zuckerberg, whose $88m in gains from Iconiq investments were offset by $34m in imaginary losses that the company manufactured with wash-trades.

In theory, the simplest form of wash-trading - selling your Vanguard China fund and buying a Schwab China fund - is available to any investor. Leaving aside the fact that the top 1% of Americans own most of the stock, this is still a deceptive proposition. This kind of wash-trading only benefits investors who hold their shares outside of a sheltered retirement account, which is a vanishing minority indeed.

Instead, the primary beneficiaries of this activity are the usual suspects: convicted monopolists like Ballmer, or useless scions of wealthy families, like the kids of Walmart founder Sam Walton, who emerged into this world through very lucky orifices and are thus effectively exempt from the need to work or pay tax for life.

Jim Walton is Sam Walton's youngest orifice-lottery-winner. Young Jim saw a $10 billion increase in his wealth from 2014-18, making him the tenth richest person in America. Thanks to wash-trading, he declared only $111 million of that $10 billion on his taxes, and paid $0.00 in tax on that $10 billion gains.

One way that the rich are especially well-situated to exploit loss-harvesting is in converting short-term gains - which are taxed at 40% - into long-term gains, which are taxed at 20%. For people who make a lot of money buying and selling shares as pure speculation, flipping them in less than a year, wash-trading can create the appearance of long-term holdings. Analyzing their trove of leaked IRS files, Propublica showed that Americans who report over $10 million in income almost never report short-term gains. Instead, two-thirds of the richest Americans report short-term losses.

One fascinating wrinkle is that rich people may not even know this is going on. Whatsapp co-founder Brian Acton, managed to "lose" $2.9 million when he sold $17 million in shares - the same day he bought $17 million in shares in nearly the same companies from another brokerage. Then, a few months later, he reversed those transactions, selling his new fund and buying the old one and harvesting another $600,000 in losses.

When Propublica asked Acton about this, he told them he was "not really aware of any events like that...Broadly my wealth is managed by a wealth management firm and they manage all the day to day transactions."

This is completely believable and consistent with the extraordinarily frank account of how elite money-management works that Abigail Disney described in 2021, where the ultra-rich are insulated from the scams, tricks and wheezes that lawyers and accountants dream up to keep their fortunes steadily mounting with no action needed on their part:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Could the IRS block this kind of wash-trading? Yes, but they'd need action from Congress. The most effective way to do this would be to force shareholders to "mark to market" the value of their holdings, taxing them each year on the fluctuations in their portfolio.

Propublica notes that this is incredibly unlikely to happen, though. As an alternative, Congress could change the rule that blocks investors from claiming losses when they buy and sell "substantially identical" shares with a rule that applies to "substantially similar" stocks. This proposal comes from Columbia Law's David Schizer, who says the law "ought to be updated to reflect how people invest today instead of how they invested 100 years ago."

But for any of that to have an effect, the IRS would have to change its auditing and enforcement practices, which currently see low-income earners (who can't afford fancy tax-lawyers who'll tie up the IRS for months or years) being disproportionately targeted, while America's super-rich, ultra-rich, and stupid-rich are allowed to submit the most hilariously, obviously fictional returns and get away with it.

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Catch me on tour with Red Team Blues in San Diego, Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

[Image ID: A dilapidated shack. A sign reading 'Internal Revenue Service Building' stands next to it. From its eaves depends another sign, reading 'Internal Revenue Service' and bearing the IRS logo. From the window of the shack beams the grinning face of billionaire Steve Ballmer. Behind the shack is a DC avenue terminating in the Capitol Dome.]

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Image: Matthew Bisanz (modified) https://commons.wikimedia.org/wiki/File:NYC_IRS_office_by_Matthew_Bisanz.JPG

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Ted Eytan (modified) https://commons.wikimedia.org/wiki/File:2021.02.07_DC_Street,_Washington,_DC_USA_038_13205-Edit_%2850920473547%29.jpg

CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0/deed.en

--

Bart Everson (modified) https://www.flickr.com/photos/editor/1287341637

Eric Garcetti (modified) https://commons.wikimedia.org/wiki/File:Steve_Ballmer_2014.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#paper losses#direct indexing#tax-loss harvesting#steve ballmer#propublica#irs files#the rich are different from you and me#mego#wash trading#tax evasion#goldman sachs#vampire squid#mark zuckerberg

88 notes

·

View notes

Text

I'd be such a good data analyst I would open Excel spreadsheets with all the data and stuff and be like "Wow! This one takes the cake!"

4 notes

·

View notes