#tax debt consultation

Explore tagged Tumblr posts

Text

🌟 Navigating Tax Debt: Insights from CEO Adam Hastie 🌟

Hey Tumblr community,

I hope this message finds you well. Today, I want to address a topic that affects many of us: tax debt. As the CEO of Lexington Tax Group, I've seen firsthand the impact that IRS tax debt can have on individuals and families. That's why I'm here to share some valuable insights and resources with you.

If you're feeling overwhelmed by tax debt, it's essential to know that you're not alone. Many people find themselves in similar situations, facing uncertainty and stress. However, there are options available to help ease the burden and provide relief.

At Lexington Tax Group, we specialize in guiding individuals through the process of qualifying for hardship programs. These programs, such as Offer in Compromise (OIC), Installment Agreements, and Currently Not Collectible (CNC) status, are designed to offer financial assistance and create manageable pathways towards tax debt resolution. Our dedicated team is here to provide personalized support and expert guidance every step of the way.

Whether you're considering an Offer in Compromise, an Installment Agreement, or another hardship program, we're here to help you navigate the complexities of the IRS system and find the best solution for your unique situation.

Our services extend beyond just IRS tax debt relief. We also provide assistance with Innocent Spouse Relief, IRS Fresh Start Initiative programs, penalty abatement, tax debt negotiation, and more. Our goal is to empower you with the knowledge and resources needed to achieve financial freedom.

To learn more about how Lexington Tax Group can assist you, visit our website at www.LexingtonTaxGroup.com or give us a call at 800-328-8289. Our team is ready to provide the support and expertise you need to move forward with confidence.

Remember, there's always hope, even in the face of tax debt. Together, we can overcome this challenge and build a brighter financial future.

Wishing you peace of mind and prosperity,

Adam Hastie CEO, Lexington Tax Group

#IRS tax debt relief#tax debt assistance#tax debt help#IRS hardship programs#Offer in Compromise (OIC)#Installment Agreement#Currently Not Collectible (CNC) status#Innocent Spouse Relief#IRS Fresh Start Initiative#penalty abatement#tax debt negotiation#Taxpayer Advocate Service#tax debt settlement#IRS debt forgiveness#tax debt resolution#IRS debt reduction#tax debt consultation#tax debt forgiveness programs#IRS payment plans#tax debt relief companies#tax debt#irs lawyer#tax debt attorney#irsdebtrelief#irs audit#irs#backtaxes

0 notes

Text

Constant Rise of Online Tax Consultancy in the US

Online tax consultancy is hugely popular. In this blog, we have discussed a few important aspects of this service. Read the full write-up carefully to learn more.

Visit> https://shorturl.at/HsVsP

0 notes

Text

Financial planning for truckers

Financial planning is something a lot of folks in the industry overlook, but it’s super important if you want to stay afloat and keep your wheels rolling. First, let’s talk about budgeting. It might sound like a boring topic, but think of it as your roadmap. Without a clear budget, it’s like driving without a GPS. You know your income can be pretty unpredictable, especially with fluctuating fuel…

View On WordPress

#401(k) for truckers#budgeting for truckers#business#cash flow management#compound interest#debt management#disability insurance#financial advisor#financial planning#financial security for truckers#Freight#freight industry#Freight Revenue Consultants#health insurance#insurance for truckers#investing#IRA for truckers#life insurance#logistics#managing trucker income#owner-operator finances#rainy-day fund#retirement planning#savings#small carriers#tax tips for truckers#Transportation#Truck Maintenance Costs#trucker budget tips#trucker finances

0 notes

Text

Crucial Information Regarding Your Right to a Free Tax Consultation

The practice of tax law requires specialized knowledge and experience because the field is complex and constantly changing. A free consultation tax attorney is a lawyer whose exclusive area of practice is tax law. These lawyers can manage any complexity or simplicity in your tax situation. They are masters in managing intricate legal tax circumstances and have unmatched knowledge of the law and its implementation. You need a tax law specialist attorney if you or your business requires assistance with tax planning, representation in disputes with tax authorities, or just making sure you're following the law.

Common duties include evaluating recently established tax laws, assisting clients in tax court, and counseling clients on the tax ramifications of corporate activities and transactions. The significance of tax attorneys who provide free consultations and how they assist clients in comprehending and adhering to the intricate web of tax regulations will be discussed in the paragraphs that follow.

The tasks of a tax attorney could include

An attorney who practices just tax law is known as a "tax lawyer". They provide financial planning guidance to maximize tax conditions, adhere to tax laws, and settle disputes with the Internal Revenue Service or other tax authorities. Very little attention is paid to business taxes, estate taxes, foreign taxes, and tax debt. Many tax lawyers are employed by accountancy or legal firms. It's possible that a few of them work for themselves and manage their own businesses.

Tax attorneys that offer free consultations usually counsel clients on several strategies to receive favorable tax treatment. Lawyers not only create and negotiate contracts and other legal documents, but they can also represent clients in court, including tax court. Tax attorneys typically assist customers of accounting and consulting firms in adhering to tax laws.

Reason of hiring a tax attorney

Developmentof an estate:

Tax professionals can assist you with estate planning duties such establishing trusts, distributing assets to close relatives, and finishing required documentation during a free consultation.

Fixing up a business:

You can reduce your taxable income when you plan for the start-up, acquisition, sale, or growth of your company by scheduling a free consultation with a free consultation tax attorney.

Not being subject to taxes:

Tax attorneys provide free consultations if you need assistance disputing or resolving an overdue amount with the IRS or another tax agency. For example, they can assist you in selecting a joyful, innocent spouse or an offer that can be modified.

Qualities of a tax attorney to take into account

Acquiring legal authority to practice law

If a tax lawyer is licensed to practice law and offers free initial consultations, then they can. To find out if a tax lawyer is authorized to practice law in your state, go to the website of the bar organization in your state.

Recommending a greater level of investigation or attention

Most states require you to complete law school before granting you a license to practice law. Only the most experienced tax attorneys are able to obtain a Master of Laws (LL.M.) in taxation.

The TIN of the person making the arrangements

If you file tax returns for money, you must obtain a tax identification number from an IRS accountant. Without the tax preparer's signature and PTIN, your tax return cannot be filed.

Final Words

Get the most individualized tax advice and assistance possible by scheduling a free appointment with a free consultation tax attorney. In this way, it is free to talk with a tax attorney. You can receive individualized assistance with your tax situation without needing to pay anything up front. If you need assistance understanding the rules, you can get a free consultation with a tax attorney.

#tax relief services#tax debt relief#irs tax relief#tax settlement services#irs fresh start programs#irs penalty abatement#free consultation tax attorney

0 notes

Text

Opportune Financial Services | Financial Planner | Financial Consultant in Boston MA

Opportune Financial Services offers tailored solutions as your Financial Planner in Quincy MA. Our team of experts is dedicated to helping you secure your financial future with comprehensive strategies that are designed to meet your unique needs and goals. Whether you're preparing for retirement or looking for the right insurance coverage, we're here to provide the guidance you need. As a trusted Financial Consultant in Boston MA, Opportune Financial Services also provides expertise in tax filing and debt management. We understand the challenges of managing finances in today's economic environment. Our experts help you achieve financial stability and growth through personalized consulting and reliable advice. Call us for a consultation!

#Financial Planner in Quincy MA#Financial Consultant in Boston MA#Tax Preparation Service near me#Tax Filing Service near me#Debt Management Service near me

1 note

·

View note

Text

As you approach retirement age, the thought of returning to work might be on your mind. Whether you're considering part-time roles or fully immersing yourself back into the workforce, this article is designed to provide insights into the financial aspects of such a decision.

#tax resolution near queens ny#taxservices#tax consultant#tax relief near queens ny#business tax consultant rosedale ny#irs tax settlement#tax settlement queens ny#queens ny tax debt relief#queens ny tax services#cpa tax services

0 notes

Text

#Business Turnaround Consulting Services#HMRC VAT Debt management#Time to Pay arrangement advice#HMRC & Tax Advice#HMRC Negotiations#DS01 and Strike Off Advice#Company Voluntary Arrangement Specialist Advice

0 notes

Text

10 years ago, Biloxi, Mississippi built a new ballpark and promised economic home-runs

Last month, WLOX did a fantastic story on whether the city of Biloxi was getting what was financially promised from a new ballpark that was built 10 years ago. The short answer is not even slightly. The ballpark was to be built for the Biloxi Shuckers, the Class AA affiliate of the Milwaukee Brewers. In 2015, the city spent $36 million to build a new ballpark. Mississippi Gov. Phil Bryant claimed…

View On WordPress

#Biloxi#Biloxi Shuckers#COVID#Debt#Debt Payments#Economic Development#Field Of Schemes#Governor#Johnson Consulting#Milwaukee Brewers#Minor League Baseball#Mississippi#MLB#Phil Bryant#Repair Fund#Sales Tax#Sun Herald#WLOX

0 notes

Text

So I've seen a few of my mutuals clutching their pearls over the UHC shooter being praised, others cheering him on, and some cheering him on reluctantly. While nobody asked for it, I'm going to give my input as a forensic specialist and consultant.

We have a multi tiered judicial system that splits things into "price points". If you're in certain tax brackets you get tried a certain way. If you're a corporation, CEO of a big corporation, or a board member / officer then you also get special treatment as well.

(In fact, one of the best recent representations of this is the trial scene from the new season of Helluva Boss where Solas is not executed when taking responsibility for the crime Blitz is accused of when Blitz was going to be executed for it.)

We then split all of this into what we call "blue collar" and "white collar" crime. White collar crime does more damage to people than what we classify as blue collar crime.

The latter is what we make television shows and podcasts out of, the former is maybe touched upon in a legal or financial drama.

The latter involves people who fall in the realm of Ed Gein who maybe kill into the double digits, the former involves people who make decisions that harm and/or kill into the hundreds if not thousands.

The latter involves robberies and assaults, the latter involves people going into debt because of a corporate decision and maybe committing suicide because they can't pay it off.

The latter involves vandalism of a building, the former involves a company being slapped with a fine because they polluted an entire area and now the residents have to deal with life altering and damaging health issues.

In my time as a forensic consultant I have worked cases that would fit into Hannibal very easily. So have my colleagues. It's not uncommon for us to encounter something at a crime scene that we would call ontologically evil because it is absolutely horrific to witness. I've been on a few cases where I would definitely classify the perpetrator of the crime as such.

But considering all of that... I would still say the worst crimes are committed by corporations and their leadership because they do so much more damage. They harm so many more people and our legal system is not set up for that.

It's set up to handle the murder, the robbery, and so on. It's set up so that people can receive justice for very immediate and visceral crimes. It's punitive and handles the individual.

It was barely set up to handle something like Love Canal.

It's definitely not set up to measure and act upon the scale of harm that corporations and their leadership impart upon the average citizen through exploiting loopholes in regulations, committing actual criminal behavior, and other unethical acts that simply result in a fine. It doesn't know how to prosecute a company and its leadership for causing lifelong harm to people.

We are still using criminological theory from the 18th century as the basis for a lot of our criminal justice system. So you can understand why it's not set up to handle white collar crime that would impact whole populations.

I personally can't recall any conversation with a colleague where we discussed a CEO or board members actually being charged with something that encapsulated the harm they did to people. It's always some form of fraud or embezzlement, because money matters more.

That's the issue. Those charges usually result in a fine which can easily be paid off and then they're back to it. Maybe they get fired, maybe the company is dissolved, but rarely do we get a Bernie Madoff like ending. Even then, the charge against Madoff was for the ponzi scheme he was running. A financial crime.

And that's the crux of it all. We are all witness to the privileges given to certain tax brackets here in the USA. The blatant corruption, bending of ethics and morals, and exploitation of legal and regulatory loopholes with no real recourse. I'm not surprised something like this happened. I'm shocked that it didn't happen sooner to be honest. Yes, we can change the system in some instances. But in others? You're naive. Completely and utterly. Remember my post about the ghost gun and how the NRA controls firearm research in this country and threatens careers? That's been since the 90s. That's 30ish years. You sound just like the grad student who comes in with big ideas who thinks they can change the system and we all look at you and go "good luck kid, but here's all our attempts, our continuing attempts, and the threats we've gotten." It's a been there, done that situation that only changes when the powers that be actually feel that they're no longer untouchable and under threat. It's the way it has always been (I even have some examples in entomology like this I can throw out there as well).

Now, I'm not saying we should go full Robespierre and drag every CEO out to the guillotine. I'm not an accelerationist or maximalist by any account. But I'm not crying over this at all, nor am I shaming anyone who is cheerfully celebrating. Hell, many of us recently celebrated the death of leaders whose crimes would fall into the blue collar category (and you should be able to understand the impact of both and how bad both things are).

But our legal system needs a complete and utter overhaul to handle white collar crime that happens in the modern era and address the very real harm that these companies and leadership do. I would love to see actual legal repercussions for these companies and have them held accountable for the harm they've done. But I realistically don't think that will happen in my life time, and neither do a lot of others. Hence why something like this did happen, and will likely happen again.

#uhc ceo#uhc assassin#Forensic consultant#forensic specialist#forensic specialist speaks#Our CJ system is outdated#There are a bunch of new and modern criminology theories out there that are not implemented because it would undermine so much#But implementing them would improve so many things and systems

106 notes

·

View notes

Text

Why, after every electoral loss, is the left always the scapegoat? It’s easier to blame activists for pushing a progressive agenda than confront the real issue: the Democratic Party has long been shaped by far more powerful forces—corporate interests, lobbyists, and consultants—whose influence has neglected the real crises facing everyday Americans. We see this cycle again and again. Contrary to establishment narratives, the Democratic leadership has often resisted advocacy organizations pushing for bold reforms on immigration, Big Tech, climate, debt, healthcare, rent, mass incarceration, Palestinian rights, and for policies like the Build Back Better agenda. This tension isn’t just about differing priorities—it reveals the actual balance of forces in the party. Corporate donors on Wall Street and Silicon Valley pour billions into campaigns, shaping agendas to suit their interests. A consultant class reaps millions from flawed strategies and failed candidates yet continues to fail upward, perpetuating a pattern of mediocrity. They, not progressives, are the roadblock preventing Democrats from becoming a populist force that could disrupt the status quo and win back voters of all stripes. It was these elements within the party that kneecapped the Democrats’ most ambitious efforts to help ordinary Americans. The Biden administration entered with huge plans, notably Build Back Better, which would have delivered immediate relief: expanded child tax credits, free community college, universal child care and pre-K, paid leave, and more. Progressives pushed mightily for Build Back Better to pass. It was centrist obstruction—namely Senators Manchin and Sinema—that blocked those policies. The result was a patchwork of long-term measures like the Inflation Reduction Act and the Bipartisan Infrastructure Deal, whose benefits won’t be felt until 2025 at the earliest, if at all. By failing to pass Build Back Better, Democrats lost the chance to deliver easy-to-understand, tangible economic benefits and solidify their image as the party of working people. And it was corporate Democrats—particularly lobbyists like Harris’s brother-in-law, former Uber executive Tony West, and David Plouffe—who held the most sway over Harris’s campaign. They advised her to cozy up to ultra-wealthy celebrities, Liz and Dick Cheney, and Mark Cuban, and avoid populist rhetoric that could have distanced her from the corporate elites who dominate the party. In 2024, the biggest spenders in Democratic Party politics weren’t progressives—it was AIPAC, cryptocurrency PACs, and corporate giants like Uber, all of whom poured millions into Democratic campaigns without regard for public opinion or the will of the people.

18 November 2024

92 notes

·

View notes

Text

Also preserved in our archive (Daily updates!)

By Laura Weiss

The Biden administration cut pandemic-era health benefits, and the Harris campaign failed to present any comprehensive health care reform policies. This was not an inspiring message for voters

In a week of hand-wringing and finger-pointing over what Democrats might have done differently in this year’s presidential election, one big topic has been absent from the conversation: Health care reform and public health. It’s a surprising omission given how 2020 was largely a referendum on pandemic response—a referendum Trump failed. The issue remains highly salient: At least eight in 10 voters said it was “very important” for the 2024 presidential candidates to talk about the affordability of health care.

But beyond Harris’s promise to maintain the Affordable Care Act and introduce some moderate reforms to drug pricing and medical debt, the issue felt like an afterthought. As of October, two-thirds of U.S. adults said they didn’t think the presidential campaigns were paying enough attention to health care.

The issues of health care and the Covid-19 pandemic are still front of mind to large swaths of voters and, in some ways, inextricable. President Biden owed his 2020 win in part due to his promise that he would do better than his predecessor in handling the pandemic; that unlike Trump, he would “follow the science.” And at first, he did. But once it became clear that new variants would arise and vaccines would not prevent all Covid cases—though they did limit hospitalizations and deaths—the Biden administration went way off course. Rather than following the science and ramping up rapid-test production, covering testing and new vaccines, and upholding commonsense safety measures like masking in health care, his Covid czar, a corporate executive, chose to pretend Covid was a thing of the past.

As new variants surged, Biden followed directives from consultants, corporations, and vibes. The Democrats’ current Covid-19 prevention playbook barely differs from that of Republicans, even though the World Health Organization has said this year that we are still in a pandemic.

But the Biden administration did not just stumble in following the science, it also lost its way in terms of capitalizing on its own successful policies, which taught broad lessons in the value of breaking from a broken health care status quo. Since Biden declared the end of the state of emergency in May 2023, tens of millions have lost benefits that they had gained in 2020—including Medicaid expansion, paid sick leave, increased unemployment benefits, and coverage for Covid testing and vaccines. Losing these benefits while inflation soared, income stagnated, and poverty increased certainly played a role at the ballot box.

“Pandemic social programs enjoyed broad support,” said Dr. Lucky Tran, a public health and science communicator based in New York. “However, when countries like the U.S. declared the end of the public health emergency, these programs were allowed to expire, despite Covid continuing to surge throughout the year and the long-term impacts on people’s health and economic well-being.”

Both campaigns seemed to view discussing Covid-19 itself as a “toxic” political issue, as Tran put it, but the Biden administration’s public health failings certainly didn’t help the cause of the Democrats, who had come into office promising a different approach. Disabled and immunocompromised people—who constitute a quarter of the population—feel betrayed by an administration unwilling to protect them.

The expansion of the social safety net that came with the pandemic—which included Medicaid expansion, unemployment benefits, child tax credits, rent freezes, and paid sick leave—was undoubtedly popular. As it happened, voters cut across partisan assumptions in three red states (Alaska, Missouri, and Nebraska) to vote to increase sick leave benefits. Trump has promised not to cut Medicaid, though it never pays to trust him. During his last administration, he cut funding to programs that helped users navigate the complicated ACA system as well as ad spending.

During the state of emergency, some 23 million Americans gained health care coverage through Medicaid, thanks to a provision that halted Medicaid disenrollments. Typically, Medicaid enrollees have to prove their eligibility every year or their coverage will be removed; that means going through an onerous process involving forms, income verification, and bureaucracy in order to prove their income is low enough to grant them Medicaid. Medicaid eligibility was also expanded in several states during that time and its coverage was broadened to include things that made health care more accessible, like telehealth. The end of the state of emergency meant the end of the Medicaid disenrollment provision, and since then those tens of millions who gained coverage have lost it.

As Bryce Covert put it in The New York Times last March, “The message received is that the government could have done these things all along but had chosen not to—and has chosen once again to withdraw that kind of security.”

Jeff Reese, a bartender in Colorado, was one of the millions of people who lost Medicaid under Biden: “The Covid measures to help get us through, such as expanded Medicaid, food stamps, and unemployment benefits, were critical in getting me through the early part of Covid,” he told me. “Having access to health care was really good since I’m now in my fifties. I did have some preexisting conditions diagnosed, and I started treating and monitoring them, adopted a plant-based diet, and generally was able to improve my health.”

When the Covid emergency was declared over, he lost his coverage. This February, Reese suffered a serious e-bike accident that put him in the hospital for weeks, and he had to turn to GoFundMe to pay for intensive physical therapy. He says now that he owes $100,000 in medical bills, which he negotiated down from almost half a million with the hospital. He hasn’t been able to find an ACA plan that works for him yet, so he remains uninsured.

Though he begrudgingly voted for Harris in the election, many of his peers did not. “I haven’t been too keen on [the Democrats’] ability to see to my interests for a while,” he said. Reese said that he would have felt more enthusiastic in his vote had the Democrats presented a more comprehensive plan on health care. He said it was Barack Obama mentioning single-payer health care during his campaign that led him to vote Democrat for the first time after voting third party since 1992. According to a Gallup poll, a majority of Americans think the government should ensure that everyone has health care coverage.

To the extent that Harris addressed health care, it was largely to voice support for abortion rights or highlight Trump’s threats to unravel the ACA. In October, Harris ran some ads on health care and talked up her efforts to lower prescription drug costs. In a town hall on Univision, Harris faced criticism when answering a question from a Latina voter, Martha, about her problems qualifying for disability despite her debilitating long-Covid symptoms. Harris responded by talking about her support for medical debt relief, sidestepping the crux of the question.

Meanwhile, disability claims jumped by over a million between 2020 and 2023, largely attributable to long Covid, according to the Center for American Progress. Martha, who was left homeless and uninsured due to her struggles with long Covid, and who referenced “Make America great again” in her question, did not seem satisfied by Harris’s response.

At the last minute, Harris added expanding Medicare to cover some home care and addressing the high costs of ambulance rides, into her platform. But it was too little, too late. (Notably, Harris backed Medicare for All during her 2020 campaign.)

“I think the result of elections around the world have shown that ‘back to normal’ messaging was ineffective, with many incumbent governments losing office in large part due to a failure in acknowledging people’s pain and providing real plans to help people in the long term,” said Tran.

Trump’s brand of economic populism appealed to voters who are hoping for something different. But if things were already bad when it comes to health care, public health agencies, and health research, they are bound to get worse over the next four years.

“A second Trump presidency will erode essential public health and health care infrastructure, increase distrust in science and public health, and will put many people at greater risk of death and serious illness,” Tran warned.

Though Trump is no longer saying he necessarily wants to repeal the ACA—and is in fact now taking credit for “saving” it (um, OK), he can still do a ton of damage to this important health insurance program. For example, Democrats are worried about a looming expiration to ACA deductible subsidies, which make coverage possible for many, and fewer protections for people with preexisting conditions (that is to say: most people) who could not get health care before Obamacare outside of employer-sponsored plans.

Beyond that, Trump says he’ll let Robert F. Kennedy Jr. “go wild on health” and plans to give him a high-level Cabinet role, perhaps leading the Department of Health and Human Services. Kennedy, who has zero health experience (and who once suffered from a literal brain worm) is a notorious anti-vaxxer—so much so that his views got him kicked off Facebook. An HHS under his watch would surely limit access to vaccines, leading to outbreaks of diseases we thought we left behind in the twentieth century. Even if he is unable to outright ban vaccines, his efforts would surely stigmatize and discourage them. In a time when we still need a durable, variant-proof Covid vaccine and bird flu threatens to become a new pandemic, the outcome will be devastating.

“All of the policies which make the U.S. more vulnerable to Covid will also make the U.S. less prepared for future pandemic threats like bird flu because to prevent them we need health agencies that are competent, objective, and transparent; wide access to prevention and treatment tools; and strong trust in science and public health information, all of which will be under attack by the new administration,” said Tran.

Kennedy has also pledged to cut funding to the Food and Drug Administration, the Centers for Disease Control, and National Institutes of Health, which means more public health disruptions such as listeria outbreaks, as well as inaccurate or absent public messaging about current and future diseases, and less funding for biomedical research to help us understand and treat diseases affecting millions of Americans.

Some of the NIH’s biomedical research is going into things like long Covid, which affects some 20 million Americans and counting, as people are repeatedly reinfected. After a wobbly start, this research was finally showing promising signs under new NIH leadership and a $515 million grant, as I wrote a few weeks ago. We can probably wave goodbye to any further funding at the federal level.

Meighan Stone, who leads the Long Covid Campaign, says it’s critical to allocate NIH funding for Covid research as quickly as possible, before Trump takes office. “[Long Covid] is impacting force-readiness for the military, it is impacting the number of Americans who are having to apply for disability, it is affecting the economic strength of the United States,” she told me last month. “This is a significant public health issue, and it’s growing. We’re getting to the level of disease burden of other concerns like strokes, heart attacks, cancer,” she continued. “This is not a red state or blue state problem, this is a problem that’s impacting all Americans.”

It is clear that health care reform is urgently needed in this country, as numerous attempts in previous campaigns have attested. Democrats and Republicans alike take the blame for empowering insurance companies to call the shots and set the prices for this basic human right. As millions lost the pandemic-era health care benefits that provided much-needed immediate assistance, as well as pointing to the potential of a better future, the two parties—having staked out meaningful differences with one another—ended up reconverging on their approach to public health. We may never know how many decided to stay home this election because they felt disaffected at the sight of their presidential candidates abandoning following science and sensible policy. Now we will all witness what it looks like to go from bad to far, far worse.

#mask up#pandemic#public health#wear a mask#covid#covid 19#wear a respirator#still coviding#coronavirus#sars cov 2#us politics#us election#harris walz 2024#joe biden#democratic party

35 notes

·

View notes

Text

#tax lawyer consultation#tax settlement attorney#irs payroll tax audit#sales and use tax attorney#irs debt attorney#la tax attorney#personal tax attorney

0 notes

Note

Heya!! If it were easy to make $100k+/yr after 8 years as a craftsperson, wouldn’t you think more folks would go that route?

There are far more opportunities to get a doctorate and after about 8 years you are almost guaranteed to make out with a $100k+/yr salary, whereas you need to search hard to find a master glassblower, let alone a master open to apprentices, and then you are going to need to spend dozens of years learning, and after that you can’t even be sure whether your works will be appreciated enough to get you a proper living-wage salary.

So yes, it’s much harder to become a master of the arts than a doctor of the sciences.

(source: How Much Do Doctors Really Earn? | BMJ Careers) - important to note that this is pre-tax, so a doctor who has been working for 3 years will take home (before loans and rent and groceries and clothes) between £23,000-£37,200. while this isn't a measly salary by any means, i find it incredibly dismissive to assume that doctors are easy millionaires. (perhaps 8-10 years post-graduation, yes, but that's a long time. a decade of time is not a light commitment.)

medical school in the UK is typically 5 years, during which medical students amass on average £50,000 to £90,000 in debt (source - highly recommend reading this) depending on whether they live in London and whether they studied for 4 years (which means they would need to have a prior degree, at least 3 years long), the average, or 6 years. tuition fees go up next year to £9535 yearly, student accommodation is not cheap, and cost of living is quite frankly, horrendous.

source: Medical students plunged into financial hardship as BMA urges Government to fix ‘broken’ student finance system - BMA media centre - BMA

not to mention the sheer emotional burden of being a medical student & later a doctor. forget the fact that if i fail my end-of-year exams, i'll have to retake the year = more spending, if i'm a bad doctor, i will kill people. people will die.

okay, sure. but glassblowing and artisan jobs are dying out! (important to note that they are still occurring, because the products of those labours aren't dying out, it's just all happening in China where labour costs are low and conditions for workers are abysmal and allowed to be. also important to note that this is the fault of capitalism, not medical students?) we are also very much in need of doctors!

source: NHS 'dangerously' short of 100,000 staff - BBC News

oh, but then surely the yearly addition of all 9140 medical graduates will fill that gap? not if over 3000 consultants and GPs retire annually, and 4800 doctors move abroad to work for better pay.

to your point: "If it were easy to make $100k+/yr after 8 years as a craftsperson, wouldn’t you think more folks would go that route?" yes. yes i do. i do think that this would be the case, and i might have even been one of them. the fact of the matter is that it's not, and the thing i take offence at is the implication that people shouldn't be doctors to allow craft professions to blossom, especially when doctors - famously actually, have also been campaigning for fair wages. we got a cosmetic change and are still campaigning. and i don't know, i think perhaps being responsible for entire wards of actual, real people deserves to be fairly compensated. but maybe that's just me.

14 notes

·

View notes

Text

A Comprehensive Guide to Choosing the Best Option for Your Financial Situation

It can be hard to deal with tax debt when the IRS has a lot of complex rules to follow. However, IRS tax relief programs make it possible for people and businesses that are having trouble paying their taxes. It is essential to pick the tool that works best for you in order to handle your tax work well. You can use this guide to help you figure out what your options are by focusing on essential things to think about, the benefits of getting professional help, and the different types of aid programmes.

Being Aware of Your Options

It's essential to know about all the different IRS tax relief programs out there. The IRS gives people a number of options, each of which is best for their financial situation:

Instalment Agreements

Through this scheme, people can pay off their debt over time by making monthly payments. Some people can only pay their taxes, some at a time, but they can make smaller amounts every month.

Offer to Make Peace (OIC)

This scheme lets people settle their tax bill for less than the total amount if they can show that they can't pay the total amount. It helps people who are having trouble with money.

Currently Not Collectible (CNC)

If you can't pay your taxes because you don't have enough cash, the IRS might wait to take the money until situations get better. This means that the IRS can only go after you once you can pay.

Penalty Abatement

Under this plan, people who can show a good reason for not paying their taxes on time, like a natural disaster or a severe illness, can get less or no fees.

Evaluating Eligibility Criteria

For each tax aid scheme, there are different rules about who can apply. You need to know these standards to make the right choice for your situation. That's why, for the Offer in Compromise plan, the IRS has to check your finances carefully to make sure you can only pay part of the amount. It includes income, bills, the value of assets, and the chance to make money in the future. Within installment Agreements, the IRS checks your money to see if you can pay the regular amounts each month.

The Role of Professional Assistance

Sometimes, it takes effort to figure out how to use the IRS tax relief programs. It can be beneficial to get help from a professional. Tax experts, such as CPAs, tax lawyers, and registered agents, can help you in a way that is ideal for your needs. They can explain how each scheme works, make sure you meet the requirements, and help you get the paperwork together and send it in.

Conclusion

You need to know a lot about your finances, your options, and the requirements for each IRS tax relief programs in order to pick the best one. You can better handle and pay off your tax debt if you think about the pros and cons of each option and get professional help. You can get tax relief that puts you back in charge of your money and eases your financial stress if you give these things a lot of thought.

#tax relief services#tax debt relief#irs tax relief#irs fresh start programs#tax settlement services#irs penalty abatement#free consultation tax attorney

0 notes

Text

Radio Free Monday

Good morning everyone, and welcome to Radio Free Monday!

Ways to Give:

dancing-thru-clouds was recently hit with a surprise tax bill (she didn't realize her town had local income tax, and didn't receive the previous year's notice); she's adjusted her withholding to account for this, but still owes the balance from the past two years and is fundraising to cover the balance. You can give via paypal here.

stemmonade is a disabled Black trans person who relies on crowdfunding for survival since they can't work and their wife is currently unemployed; they are raising a little over $700 to cover rent and essentials in the meantime. You can read more, reblog, and find giving information here.

themerrymutants is a disabled queer man currently living on social security aid; he has recently had to travel to the emergency room several times for possible complications from a recent surgery, and is now short on rent because of the cost of transit. You can read more, reblog, and find giving information here.

Anon linked to a fundraiser for prototrans, a disabled artist who needs help with rent money; he is also offering commissions. You can read more, reblog, and find giving and commission information here.

Recurring Needs:

Anon linked to a fundraiser for a friend whose family has not had a working furnace since November; they've been using space heaters to keep warm but January in Chicago has been brutal and the space heaters aren't sufficient. With vulnerable family members including elderly relatives and children in the home, they need to raise $6K to get the furnace replaced. You can read more and support the fundraiser here.

thelastpyler is raising funds for food and to purchase medication for their family; you can read more and find giving information here.

Eli is a disabled Michigander who cares for their elderly grandmother; they are applying for SSDI, but their car was damaged recently and is undrivable, with estimated $8K-$12K in repairs to make it drivable. They need transportation for doctor's visits and legal consultations for their SSDI appeal, and have no way to get around without the car. You can read more and reblog here or give at the gofundme here.

loversdoom is a college student from the Philippines, studying away from her family, and her parents are unexpectedly unable to support her education; she is in mounting debt and facing eviction from her dorm in her last semester of college. She's raising funds to repair her laptop so she can do her schoolwork and find a remote job that will help her pay rent, and to fund the remainder of her schooling. You can read more and reblog here and support the fundraiser here.

Anon linked to karla-hoshi or Hoshi on TikTok, who is raising funds for cancer treatment for her cat Naku; they caught the cancer early and hope that he can survive it, but can't continue treatment without funding. You can read more and support the fundraiser here, as well as find links to her updates on tiktok.

chingaderita's partner recently lost their job due to a house fire that also destroyed the house; they're raising funds to keep food on the table, to try and get a supply of water to keep clean and do laundry, and for various bills until they can find new work. You can read more, reblog, and support the fundraiser here.

And this has been Radio Free Monday! Thank you for your time. You can post items for my attention at the Radio Free Monday submissions form. If you're new to fundraising, you may want to check out my guide to fundraising here.

55 notes

·

View notes

Text

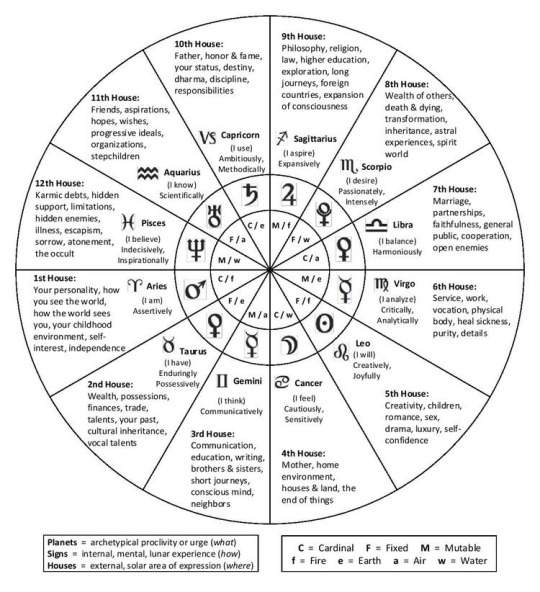

ASTRO 101 - THE HOUSES (PART II)

SEVENTH HOUSE - I BALANCE

(The Seventh House is ruled by Libra and Venus.)

House of marriage, personality and character of our partner, partner’s job

Civil partnership, bilateral relations, long and committed relationship, close friends, closely associated with, opposite side, associations, union, consultancy

Terms of relationship and behavior

Joint ventures, hostilities, adversary, rivals, competition

Traits we feel lacking in ourselves, the parts of us that are in us but have not been revealed and that we have difficulty in accepting

Lower back, skin, external sexual organs, bladder, ovaries, blood

International relations, military or civil wars, treatises, arbitrators, illegal criminals, marriage and divorce rates, foreign trade, public relations

EIGHTH HOUSE - I DESIRE

(The Eighth House is ruled by Scorpio, Mars and Pluto.)

House of death - natural or unnatural, accident, suicide, fire, drowning, diseases, corruption, crises, surgery

Sex, sexuality, erotism, desire, fantasies, fetishes, sexual life

Alteration and transformations, sharing

Heritage, money that comes to us beyond of our control, money that comes to us from others, inheritance from husband

Tax, alimony, debt, heritage, loan, lottery, gambling

Robbery, fighting, theft, slaughter, butchers, coroners, harassment, rape

The fears, privacy, feel rage towards, abomination

Psychology, occultism, parapsychology, subconscious, spiritual psychology

Genitals, groin area, colon, sex organs, gall bladder, rectum, urogenital system

International debts, international financial agreements, charges, stock certificates, interest rates, foreign exchanges, credits, fuses, mortgages, pension funds, legacies, mortality, life-critical, suicide

Surgery, morgue, surgeons, laboratories, nuclear forces, sewage, organized crimes, terrorists, detective, demimonde, arms, underground sources, cabalistic subjects

NINTH HOUSE - I ASPIRE

(The Ninth House is ruled by Sagittarius and Jupiter.)

House of wisdom, mastership, higher education, academic trainings

Cults and thoughts, abstract reasoning, moral evidence, philosophizing, religious cult, reflection, abstract thoughts

The house where we deepen the information we get from the 3rd house

Distant relatives

Society's mindset, social law rules, social and moral rules, harmony with society

Expedition, long trips, distant travels, foreign countries, foreigners, exterior, crew, communication instruments, media, broadcast

Hips, thighs, sciatic nerves, lower spine, liver, autonomic nervous system

Foreign relations and trade, courts, laws, judges, minorities, companies, advertising portfolios, religion and clergy, the country's philosophical and religious tendencies, migrations, long-distance communications, fast-moving news, broadcasting, popular culture, foreigners

Universities, airlines and transport, maritime transport, ministry of foreign affairs, flight attendants

TENTH HOUSE - I USE

(The Tenth House is ruled by Capricorn and Saturn.)

House of profession, honor, social status, public esteem, dignity, business, character, reputation and career

Glory, name, fame, recognition, way of life, purpose and power

Social roles, status in society, the part of society that sees us, social identity, prestige and title

Marital status, our partner's family, parents, father, authoritarian leaders

Skin, hair, knees, teeth, bones, joints, skeletal system, reputation

Government, the state's reputation by foreign countries, heads of state, powers, executives, leaders, celebrities, notable personages, public figures, uplands

ELEVENTH HOUSE - I KNOW

(The Eleventh House is ruled by Aquarius, Saturn and Uranus.)

House of friends, groups, associations, endowments, a circle of friends, people around us, hives, social environments and organizations

Goals, future plans, hopes, goals of life, wishes, happy news, wealth, fortune, expectations from life and dreams

Income from career, colleagues, international friendships, audiences we offer ideas, incoming wealth, gains, profits, writings

Social media, mass media and virtual communities

Endowments associations, politics, parties, establishment, the masses

Lower leg, calves, ankles, electrical impulsive of the nerves, circulatory system, elimination

Allied countries, social institutions and administrations, legislative changes, national mobilizations, revolts, revolutions, organizations, erosions

TWELFTH HOUSE - I BELIEVE

(The Twelfth House is ruled by Pisces, Jupiter and Neptune.)

House of tribulations, secret matters, troubles, subconscious, covert and covered topics, privacy, loneliness, ermitage, place of isolation

Thoughts, anxieties, and fears underlying repressed consciousness, spiritual life

The things we hide from others and are afraid to tell, our shadow sides, psychological problems

Karmic transmissions, burdens and problems we brought from the past

Secret enemy, backfriend

What kind of pregnancy our mother had, our condition in the mother’s womb and the emotions transferred to us in the mother’s womb

Fantasies and fetishes

Feet, all bodily fluids, the lymphatic system

Secret enemies, secret organizations, private affairs, spies, psychics, fortune-tellers, wizards, deep and secret affairs, criminals, thefts, assassinations, drugs, addicts, dark business people, unemployment and strikes

Hospitals, prisons, rehabilitation centers, mental hospitals, faith houses, orphanages, clinics, charities, overseas

#aesthetic#astrology#birth chart#astro notes#astroblr#astroloji#girlblogger#seventh house#eighth house#ninth house#tenth house#eleventh house#twelfth house#venus#pluto#mars#jupiter#saturn#uranus#neptune#astro houses#astro101#zodiac signs#astro natal#horoscope#libra#scorpio#saggitarius#capricorn#aquarius

202 notes

·

View notes