#tax calculator

Explore tagged Tumblr posts

Text

Effortless Tax Planning with PNB MetLife's Online Income Tax Calculator

Plan your taxes easily with PNB MetLife’s tax calculator. Calculate your income tax instantly online and make smarter financial decisions. Save time, avoid errors, and stay on top of your tax liabilities with this simple and user-friendly tool.

0 notes

Text

Tax Loopholes 2024: Only Rich People Understand

Introduction Tax Loopholes: Navigating the charges world can be complex and overpowering, mainly when it appears like the wealthiest people have aced procedures that decrease their charge burden more viably than the average citizen. These strategies are frequently called “charge escape clauses,” even though numerous lawful charge procedures are outlined to make the most of the assessment code.…

#1031#1031 exchange#capital gains#charitable#Cra#cryptocurrency taxes#Etax#Income#income tax#interest#internal revenue service#Ird#IRS#irs login#irs.gov#keypoints#mortgage interest#mottgage#offshore accounts#Property Tax#real estate#stock#tax#tax advice#Tax and Finance#Tax and Finance Career#tax calculator#tax compliance#tax filing#tax loopholes

0 notes

Text

UK Income tax Calculator

Use our UK Income Tax Calculator to estimate your take-home pay after taxes, pension contributions, and more. Perfect for budgeting and financial planning.

0 notes

Text

Free Online Tax Calculator: Calculate Your Income Tax | PNB MetLife

Online income tax calculator that helps you calculate your tax liability based on your income. Get a quick update on income tax by using PNB MetLife's calculator.

#income tax calculator#tax calculator#calculator online#income tax calculator online#tax calculator online

0 notes

Text

Top 5 Tips for Choosing the Right Tax Return Service

Navigating the complex world of tax laws and regulations can be daunting, and the consequences of errors or omissions in your tax returns can be costly. To ease this burden, many people turn to tax return services for assistance. However, with numerous options available, choosing the right tax return service can be challenging. In this guide, we'll provide you with the top 5 tips to help you make an informed decision while ensuring your tax returns are handled accurately and professionally.

Evaluate the Service's Reputation When selecting a tax return service, it's crucial to begin by assessing the provider's reputation. Reputation is built over time through consistently delivering reliable and accurate services. Here's how you can evaluate a service's reputation:

a. Read Reviews: Search online for reviews and testimonials from past clients. Websites like Yelp, Google Reviews, and the Better Business Bureau are great places to start.

b. Ask for Referrals: Seek recommendations from friends, family members, or colleagues who have used sales tax return services.gitimacy and expertise in handling tax matters.

A service with a positive reputation is more likely to provide accurate and reliable tax preparation.

Consider the Expertise and Specialization Tax laws are intricate, and they can vary significantly depending on your specific situation, whether you're an individual, a small business owner, or a corporation. Therefore, it's essential to choose a tax return service that specializes in your area of need. Here's how to consider expertise and specialization:

a. Identify Your Needs: Determine the complexity of your tax situation. Are you an individual with straightforward returns, a small business owner with various deductions, or a large corporation with complex financial transactions? Choose a service that aligns with your specific tax requirements.

b. Verify Expertise: Inquire about the qualifications and experience of the tax professionals working at the service. Are they certified public accountants (CPAs) or enrolled agents? Do they have expertise in your industry or situation?

c. Ask About Training: Tax laws change frequently, and professionals need to stay updated. Ask whether the tax return service invests in continuous training for its staff to ensure they are knowledgeable about the latest tax regulations.

Choosing a tax return service with expertise in your specific tax needs increases the likelihood of accurate tax preparation and optimization of deductions and credits.

Evaluate Pricing and Transparency Understanding the cost structure and overall pricing of a tax return service is crucial to avoid unexpected fees and expenses. Pricing can vary significantly among providers, so it's essential to evaluate this aspect carefully:

a. Request a Fee Structure: Ask for a clear breakdown of the service's fees. Some services charge a flat rate, while others have a tiered pricing model based on the complexity of your return. Make sure you understand how and when you'll be charged.

b. Inquire About Additional Fees: Tax return services may charge extra for services like e-filing, amendments, or expedited processing. Ensure you're aware of any potential additional fees that may apply.

c. Compare Prices: Don't hesitate to shop around and compare prices from multiple tax return services. While cost should not be the sole determining factor, it's essential to find a service that offers a fair balance between price and quality.

Transparency in pricing demonstrates the service's commitment to honesty and fairness, ensuring you won't encounter unexpected financial surprises during sales tax return.

0 notes

Text

youtube

#income tax act 2023#income tax#how to calculate tax and vat from supply bill#tax rate#tax calculator#vatcalculation#vat calculation#vat consultants in uae#tds rate#tds & vds#what is tds#tds2#tds#contractorbill#contractor#Youtube

0 notes

Text

Tax Calculator

Working out taxes can be an overwhelming undertaking for some people and organizations the same. Notwithstanding, with the assistance of present day innovation and high level tax calculators, this cycle has become altogether more straightforward. In this article, we will give you an extensive tax calculator that will help you in precisely deciding your tax liabilities. Whether you are a worker, an independently employed proficient, or an entrepreneur, this tax calculator will improve on the cycle and guarantee precision. Thus, we should make a plunge and investigate the elements and advantages of this integral asset.

I. Grasping the Tax Calculator:

Outline: In this segment, we will give an outline of the tax calculator, its motivation, and the sorts of taxes it can ascertain.

Key Elements: Investigate the different highlights that make this tax calculator a significant device, including easy to use interface, numerous tax situations, and ongoing updates.

II. Individual Personal Tax Calculator:

Presentation: Comprehend the significance of computing individual annual taxes precisely and the effect it has on your generally monetary preparation.

Parts of Individual Annual Tax: Separate the various parts that make up private personal taxes, including levels of pay, derivations, exclusions, and credits.

Bit by bit Guide: Stroll through a bit by bit course of utilizing the tax calculator to compute your own personal tax, including entering your pay, derivations, and other important subtleties.

III. Independent work Tax Calculator:

Presentation: Feature the particular tax contemplations for independently employed people and specialists.

Independent work Tax: Make sense of what independent work tax is, the means by which it varies from individual annual tax, and why it is fundamental to precisely ascertain it.

Computing Independent work Tax: Give a definite aide on utilizing the tax calculator to decide your independent work tax obligation, covering subjects like net independent work pay, derivations, and the extra Federal health care tax.

IV. Business Tax Calculator:

Presentation: Talk about the intricacies of business taxes and the meaning of exact estimations for entrepreneurs.

Business Design: Make sense of how different business structures (sole ownership, organization, enterprise) influence tax liabilities and how the tax calculator obliges these varieties.

Costs of doing business and Allowances: Investigate the different operational expense and derivations that can be placed into the tax calculator to decide precise tax commitments.

Assessed Tax Installments: Give direction on assessing and working out quarterly tax installments for organizations utilizing the tax calculator.

V. High level Elements and Situations:

Capital Increases Tax: Make sense of how the tax calculator handles capital additions tax computations and the significance of precisely representing venture pay.

Rental Pay: Talk about how rental pay is figured into the tax calculator and give experiences into derivations and contemplations for investment property proprietors.

Various Situations: Delineate how the BMI Calculator can deal with numerous situations, like wards, changing tax regulations, and different pay sources.

VI. Tax Arranging and Improvement:

Tax Arranging Procedures: Investigate different tax arranging strategies to enhance your tax liabilities, including retirement commitments, magnanimous gifts, and tax-proficient ventures.

Future Tax Projections: Examine how the tax calculator can assist you with projecting your future tax liabilities in view of various pay and cost situations, empowering you to settle on informed monetary choices.

VII. Extra Assets:

FAQs: Address normal different kinds of feedback connected with utilizing the tax calculator.

Glossary: Give an extensive glossary of tax-related terms to help clients in understanding the language and ideas utilized in the tax calculator.

Outside Connections: Offer valuable outer assets, like authority tax sites, structures, and distributions, to assist clients with exploring their tax commitments.

0 notes

Text

How To Protect Yourself When Working As A Freelancer

Working as a freelancer offers many advantages, such as flexibility and independence. However, it’s essential to protect yourself both financially and legally to mitigate potential risks. Here are some important steps to consider:

Contracts and Agreements

Always use written contracts or agreements when engaging with clients or entering into any business arrangements. Clearly define the scope of work, payment terms, deliverables, timelines, and any other relevant details. Contracts help establish expectations, protect your rights, and provide a basis for legal recourse if disputes arise.

Set Clear Payment Terms

You should communicate your payment terms to clients from the beginning. Specify the payment schedule, methods of payment, and any late payment penalties. Consider requesting partial or upfront payments for large projects or with new clients to ensure a steady cash flow.

Maintain Professional Liability Insurance

Consider obtaining professional liability insurance (also known as errors and omissions insurance). This insurance protects you if a client claims financial loss due to errors, omissions, or negligence in your work. Insurance coverage can provide peace of mind and protect your financial assets in case of legal claims.

Protect Your Intellectual Property

Understand the ownership and rights associated with your creative work. Consider using contracts or licenses to clearly establish the ownership and permitted use of your intellectual property. If necessary, register trademarks or copyrights to protect your creations from unauthorized use.

Keep Accurate Records

Maintain detailed and organized financial records, including income, expenses, contracts, invoices, and receipts. Accurate records help with tax compliance, provide evidence in case of disputes, and support your financial stability. Consider using accounting software or engaging an accountant to ensure proper record-keeping.

Maintain A Contingency Fund

As a freelancer, your income may fluctuate. Establish an emergency fund to cover unexpected expenses or periods of lower income. Having savings in place can help you navigate financial challenges without jeopardizing your personal or business finances.

The Know Your Dosh Personal Tax Estimator

The "Know Your Dosh" Personal Tax Estimator is a valuable tool for planning tax on personal income. This includes potential tax liabilities on personal income, encompassing sole trade income, salary, and dividends where applicable.

With this estimator, you can gain insights and forecasts to better prepare for tax obligations. It serves as a useful resource in assessing and managing personal tax liabilities for a well-informed financial approach.

#tax calculator#tax estimator#personal finance#asset management#financial management#property management

1 note

·

View note

Text

Going to be selling them on etsy and big cartel!

big cartel is for us orders while etsy is for international orders!(if you are from the us, you can still order from etsy big catel is there as another option if you want)

#philza#qsmp#qsmp fanart#philza fanart#qsmp philza#my art#if your wondering why us can order from big cartel as well it's because big cartel doesn't calculate taxes for international orders#and i don't trust myself to calculate/ deal with that on my own#i am so sorry o(-(

83 notes

·

View notes

Text

When I’m writing my Modern AU but then try to figure out and calculate how the life I gave the Batch is financially possible:

#I’ll be writing#and then I’ll be like wait how do they own a house in the suburbs in this economy?#so then I’ll be like ok 99 was the homeowner so maybe he already paid it off and now they only worry about property tax and bills#but it doesn’t stop there#now I’m looking up the prices of homes in the 80s#then I start looking up details on VA loans#then I’m calculating ok this sibling has this job so this would be what they make in a year after taxes#then I add them up#but wait#Crosshair and tech are in college how are they affording that?#then I remember the GI bill#but then I’m like ok but what if they go on vacation?#so then I’m like ok they give off the vibes that they would choose to drive everywhere they could within reason#BUT THEN I’m like hold up what if they brought Omega to Disney World#so now I’m looking at ticket hotel and airfare costs#and seeing what military and veterans discounts are#meanwhile this fic hasn’t even been fully written I’m just brainstorming and writing all these details in a brainstorming document#I’ll apply suspension of disbelief and ‘don’t worry about it’ to other things like face tattoos in the suburbs and timeline and ages#but for the financial aspect I’m like ‘how can I make this as true to reality as possible’?#star wars tbb#star wars the bad batch#the bad batch#bad batch modern au#sw bad batch

85 notes

·

View notes

Text

btw the Slovene word of the year was also announced just a couple of days ago: genocid

#the second was “energy tax” bc it became a whole scandal when they changed the way it's calculated#> omrežnina#j#slovene#slovenian#lang

27 notes

·

View notes

Text

Screw it, slightly older Ellie pinup under the cut.

#my art#roberts#inspired from a book of victorian era pinup photos#i'm breaking up again with fabric after this#the sheer mental rendering power of trying to calculate folds and lights/shadows is so taxing#love and respect to you clothing people#but it couldn’t be me

31 notes

·

View notes

Text

Maybe it's cause I'm surrounded by art people all the time but I feel like math as a school subject gets a bad wrap. Like now that I'm not forced to take classes for it, I just start doing it on my own for fun. It gets my brain stimulated. I'm doing calculus like it's a word puzzle; it's a stress reliever and it's rewarding. It's encountering a problem I already know all the steps to even if I've semi-forgotten them. And there's minimal consequences if I get the answer wrong. I think it's fun to go to town with a ballpoint pen on some dirty scrap paper, just letting the scribbly numbers flow.

#i was so disappointed when i found out taxes was mostly filling out a form and less actual calculator action#now i just help my sister with her algebra 2 hw#idk i was stressed ab con stuff earlier so i just started calculating my expenses on paper and it felt really good#this same thing applies to making spreadsheets#i think making and thinking ab art all the time makes academic work like a fun hobby to me sometimes#but i did like math in school anyway hm#wheat rambles

61 notes

·

View notes

Text

Carlos getting arrested for singing his special little sales tax calculating song :(

#wtnv#welcome to night vale#wtnv spoilers#wtnv 229#final full#carlos the scientist#special little sales tax calculating song#carlos' special little sales tax calculating song

326 notes

·

View notes

Text

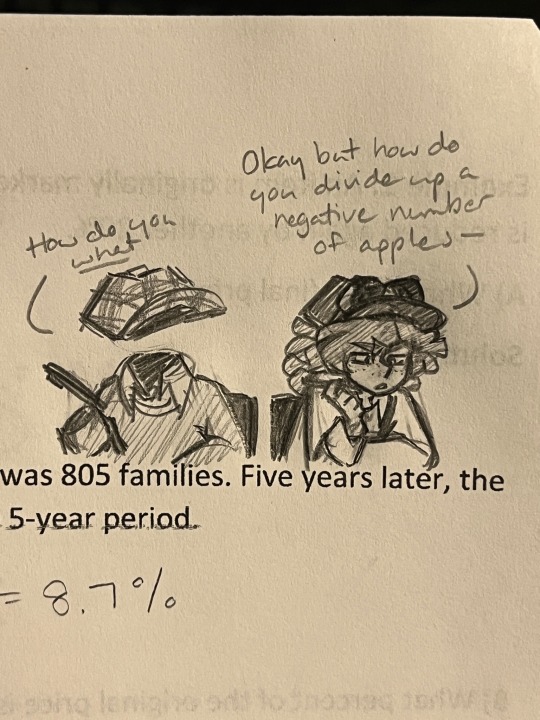

I have no idea why but Hugh just. Feels like the kind of person who just Cannot Do Math

#mphfpc#millard nullings#hugh apiston#hugh x millard#they’re not even doing anything with apples. they’re supposed to be calculating how much tax they’d have to pay in america#dragon’s doodles

89 notes

·

View notes

Text

yesterday my friend was like “today we get our tax returns!! it’s so exciting!” so i checked my email and it said i had to pay $400.

#arambles#I WAS SO EXCITED FOR LITTLE MONEY SURPRISE. THEN TO MY HORROR#not sure if tax return is the right term for this it’s like. the thing u get where it says if you’ve paid too much in taxes. or too little#if you’ve paid too much you get money back but if you’ve paid too little you have to PAY#it’s so dumb because we don’t even like. calculate our taxes here#it’s all done by the tax agency#so THEY calculated wrong#and now i gotta give em FOUR HUNDRED BUCKS

22 notes

·

View notes