#real estate scams

Explore tagged Tumblr posts

Text

And hey, let’s talk ENERGY USE.

Office buildings (and all commercial buildings really) are built to utterly crap standards. They’re the most energy inefficient structures humans currently build. If a regular house and a standard office building had the same square footage, the office building would use at least 3 times more energy every day than the house used daily. And up to 5 million times more energy for buildings like data centers. It’s also worth remembering that office buildings use a minimum of 3 times more energy per square foot are only being used for around 40-50 hours a week, while residential housing is used for at least 12 hours per day, every single day.

The reason office buildings are so inefficient has to do mostly with the HVAC, and the lack of insulation. They simply are not insulated, often at all. Office buildings tend to have a lot of exterior glass which leaks heat like mad in the winter and bakes everything inside during the summer, so they always have a high energy load. Then add in all the stuff that nobody turns off for the night/weekend — the servers, the desktops, the automatic office lights — and it’s easy to see how office/light industrial becomes around 40% of the entire energy use on the planet.

Office buildings have terrible ventilation, plumbing limited to a central core, few internal walls, non-functioning windows and no ceilings, which means they’re not even useful for turning into housing — it would cost more to retrofit housing that’s up to residential code into most office buildings than it would cost to knock the eyesore down and replace it with the same square footage of built to code housing.

Why are these buildings such junk? Because that’s how the commercial real estate investment scam runs. The developer builds the cheapest possible building with enough eye candy to fool the rube, then rents it out and makes the rube take on the energy costs. The developer is rarely/never paying the electric bill, so they can make a crappy building that costs them less, and business owners just look at energy as a cost of doing business. Externalization is the lifeblood of capitalism.

Work from home was a stellar experiment in energy costs — residential energy use went up about 5% in places with a heavy home workforce, while energy use in office/industrial buildings dropped more than 60%. It was clearly a net gain in available energy simply by moving where people worked. And that’s just electricity — that doesn’t even touch the commuting costs and car infrastructure. Getting rid of office buildings and turning them into mixed use neighborhoods with some coworking space is one of the best ways to start hitting carbon reduction goals.

But it’s going to take destroying the commercial real estate investment complex.

by @spavel.bsky.social

#capitalism is killing us#money laundering#Real estate scams#Industrial energy use#Work from home for the planet

21K notes

·

View notes

Text

Protecting Your Investment: How to Avoid Real Estate Scams in Jamaica

The allure of owning a piece of the rock is undeniable, but navigating the real estate market requires caution. Scams are unfortunately a reality, even in a tightly regulated environment. Many news reports and firsthand accounts have highlighted the heartbreaking consequences of real estate fraud, underscoring the need for vigilance and due diligence in the digital age. A Story of Loss and…

#due diligence#Fraud Prevention#Jamaica Property#Property ownership#real estate scam#real estate scams#scam

1 note

·

View note

Text

11 real estate scams that can be very expensive

Businesses like buying, selling and even renting real estate involve a lot of money. And when large amounts of money are involved, many scammers seek to take advantage. Pay attention and to any details to avoid falling into a scam. Like all scams, real estate scams can come in all shapes and sizes, and if you’re not careful, it’s very easy to fall victim to one. Fortunately, if you pay…

View On WordPress

0 notes

Text

UNDER CONSTRUCTION PROPERTY FRAUDS

Under construction property can be a risky as well as a high return investment, so before investing in such properties you have to cautious and take steps accordingly.

Under construction properties-

1. Builders can sell the properties which are not on the actual location which is been shown or properties which they do not own.

2. Sometimes the blueprint is been displayed by builders, then he raises the money from people and then he buys a particular property.

3. Land mortgage fraud where the builders have a mortgage on land and he offers the land to you.

4. Change of the use of the land is not approved by the concerned authority however the builder sells the property to the buyer without disclosing such facts.

0 notes

Text

'We buy ugly houses' is code for 'we steal vulnerable peoples' homes'

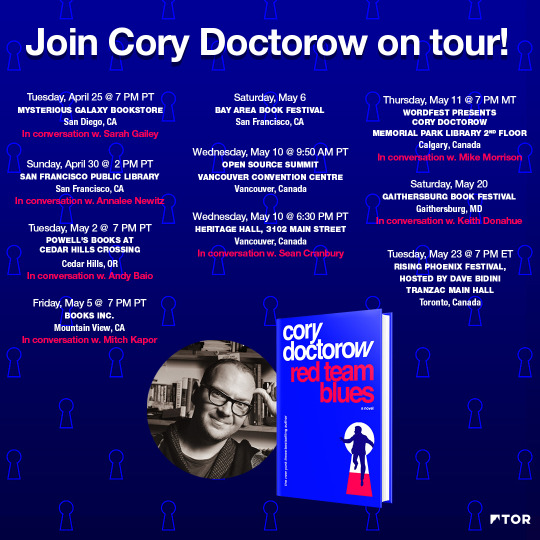

Tonight (May 11) at 7PM, I’m in CALGARY for Wordfest, with my novel Red Team Blues; I’ll be hosted by Peter Hemminger at the Memorial Park Library, 2nd Floor.

Home ownership is the American dream: not only do you get a place to live, free from the high-handed dictates of a landlord, but you also get an asset that appreciates, building intergenerational wealth while you sleep — literally.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

Of course, you can’t have it both ways. If your house is an asset you use to cover falling wages, rising health care costs, spiraling college tuition and paper-thin support for eldercare, then it can’t be a place you live. It’s gonna be an asset you sell — or at the very least, borrow so heavily against that you are in constant risk of losing it.

This is the contradiction at the heart of the American dream: when America turned its back on organized labor as an engine for creating prosperity and embraced property speculation, it set itself on the road to serfdom — a world where the roof over your head is also your piggy bank, destined to be smashed open to cover the rising costs that an organized labor movement would have fought:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Today, we’re hit the end of the road for the post-war (unevenly, racially segregated) shared prosperity that made it seem, briefly, that everyone could get rich by owning a house, living in it, then selling it to everybody else. Now that the game is ending, the winners are cashing in their chips:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

The big con of home ownership is proceeding smartly on schedulee. First, you let the mark win a little, so they go all in on the scam. Then you take it all back. Obama’s tolerance of bank sleze after the Great Financial Crisis kicked off the modern era of corporations and grifters stealing Americans’ out from under them, forging deeds in robosigning mills:

https://www.marketwatch.com/story/us-breaks-down-93-bln-robo-signing-settlement-2013-02-28

The thefts never stopped. Today on Propublica, by Anjeanette Damon, Byard Duncan and Mollie Simon bring a horrifying, brilliantly reported account of the rampant, bottomless scams of Homevestors, AKA We Buy Ugly Houses, AKA “the #1 homebuyer in the USA”:

https://www.propublica.org/article/ugly-truth-behind-we-buy-ugly-houses

Homevestors — an army of the hedge fund Bayview Asset Management — claims a public mission: to bail out homeowners sitting on unsellable houses with all-cash deals. The company’s franchisees — 1,150 of them in 48 states — then sprinkle pixie dust and secret sauce on these “ugly houses” and sell them at a profit.

But Propublica’s investigation — which relied on whistleblowers, company veterans, court records and interviews with victims — tells a very different story. The Homevestor they discovered is a predator that steals houses out from under elderly people, disabled people, people struggling with mental illness and other vulnerable people. It’s a company whose agents have a powerful, well-polished playbook that stops family members from halting the transfers the company’s high-pressure salespeople set in motion.

Propublica reveals homeowners with advanced dementia who signed their shaky signatures to transfers that same their homes sold out from under them for a fraction of their market value. They show how Homevestor targets neighborhoods struck by hurricanes, or whose owners are recently divorced, or sick. One whistleblower tells of how the company uses the surveillance advertising industry to locate elderly people who’ve broken a hip: “a 60-day countdown to death — and, possibly, a deal.” The company’s mobile ads are geofenced to target people near hospitals and rehab hospitals, in hopes of finding desperate sellers who need to liquidate homes so that Medicaid will cover their medical expenses.

The sales pitches are relentless. One of Homevestor’s targets was a Texas woman whose father had recently been murdered. As she grieved, they blanketed her in pitches to sell her father’s house until “checking her mail became a traumatic experience.”

Real-estate brokers are bound by strict regulations, but not house flippers like Homevestors. Likewise, salespeople who pitch other high-ticket items, from securities to plane tickets — are required to offer buyers a cooling-off period during which they can reconsider their purchases. By contrast, Homevestors’ franchisees are well-versed in “muddying the title” to houses after the contract is signed, filing paperwork that makes it all but impossible for sellers to withdraw from the sale.

This produces a litany of ghastly horror-stories: homeowners who end up living in their trucks after they were pressured into a lowball sales; sellers who end up dying in hospital beds haunted by the trick that cost them their homes. One woman who struggled with hoarding was tricked into selling her house by false claims that the city would evict her because of her hoarding. A widow was tricked into signing away the deed to her late husband’s house by the lie that she could do so despite not being on the deed. One seller was tricked into signing a document he believed to be a home equity loan application, only to discover he had sold his house at a huge discount on its market value. An Arizona woman was tricked into selling her dead mother’s house through the lie that the house would have to be torn down and the lot redeveloped; the Homevestor franchisee then flipped the house for 5,500% of the sale-price.

The company vigorously denies these claims. They say that most people who do business with Homevestors are happy with the outcome; in support of this claim, they cite internal surveys of their own customers that produce a 96% approval rating.

When confronted with the specifics, the company blamed rogue franchisees. But Propublica obtained training materials and other internal documents that show that the problem is widespread and endemic to Homevestors’ business. Propublica discovered that at least eight franchisees who engaged in conduct the company said it “didn’t tolerate” had been awarded prizes by the company for their business acumen.

Franchisees are on the hook for massive recurring fees and face constant pressure from corporate auditors to close sales. To make those sales, franchisees turn to Homevana’s training materials, which are rife with predatory tactics. One document counsels franchisees that “pain is always a form of motivation.” What kind of pain? Lost jobs, looming foreclosure or a child in need of surgery.

A former franchisee explained how this is put into practice in the field: he encountered a seller who needed to sell quickly so he could join his dying mother who had just entered a hospice 1,400 miles away. The seller didn’t want to sell the house; they wanted to “get to Colorado to see their dying mother.”

These same training materials warn franchisees that they must not deal with sellers who are “subject to a guardianship or has a mental capacity that is diminished to the point that the person does not understand the value of the property,” but Propublica’s investigation discovered “a pattern of disregard” for this rule. For example, there was the 2020 incident in which a 78-year-old Atlanta man sold his house to a Homevestors franchisee for half its sale price. The seller was later shown to be “unable to write a sentence or name the year, season, date or month.”

The company tried to pin the blame for all this on bad eggs among its franchisees. But Propublica found that some of the company’s most egregious offenders were celebrated and tolerated before and after they were convicted of felonies related to their conduct on behalf of the company. For example, Hi-Land Properties is a five-time winner of Homevestors’ National Franchise of the Year prize. The owner was praised by the CEO as “loyal, hardworking franchisee who has well represented our national brand, best practices and values.”

This same franchisee had “filed two dozen breach of contract lawsuits since 2016 and clouded titles on more than 300 properties by recording notices of a sales contract.” Hi-Land “sued an elderly man so incapacitated by illness he couldn’t leave his house.”

Another franchisee, Patriot Holdings, uses the courts aggressively to stop families of vulnerable people from canceling deals their relatives signed. Patriot Holdings’ co-owner, Cory Evans, eventually pleaded guilty to to two felonies, attempted grand theft of real property. He had to drop his lawsuits against buyers, and make restitution.

According to Homevestors’ internal policies, Patriot’s franchise should have been canceled. But Homevestors allowed Patriot to stay in business after Cory Evans took his name off the business, leaving his brothers and other partners to run it. Nominally, Cory Evans was out of the picture, but well after that date, internal Homevestors included Evans in an award it gave to Patriot, commemorating its sales (Homevestors claims this was an error).

Propublica’s reporters sought comment from Homevestors and its franchisees about this story. The company hired “a former FBI spokesperson who specializes in ‘crisis and special situations’ and ‘reputation management’ and funnelled future questions through him.”

Internally, company leadership scrambled to control the news. The company convened a webinar in April with all 1,150 franchisees to lay out its strategy. Company CEO David Hicks explained the company’s plan to “bury” the Propublica article with “‘strategic ad buys on social and web pages’ and ‘SEO content to minimize visibility.’”

https://www.propublica.org/article/homevestors-aims-to-bury-propublica-reporting

Franchisees were warned not to click links to the story because they “might improve its internet search ranking.”

Even as the company sought to “bury” the story and stonewalled Propublica, they cleaned house, instituting new procedures and taking action against franchisees identified in Propublica’s article. “Clouding titles” is now prohibited. Suing sellers for breach of contract is “discouraged.” Deals with seniors “should always involve family, attorneys or other guardians.”

During the webinar, franchisees “pushed back on the changes, claiming they could hurt business.”

If you’ve had experience with hard-sell house-flippers, Propublica wants to know: “If you’ve had experience with a company or buyer promising fast cash for homes, our reporting team wants to hear about it.”

Catch me on tour with Red Team Blues in Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Depression-era photo of a dour widow standing in front of a dilapidated cabin. Next to her is Ug, the caveman mascot for Homevestors, smiling and pointing at her. Behind her is a 'We buy ugly houses' sign.

Image: Homevestors https://www.homevestors.com/

Fair use: https://www.eff.org/issues/intellectual-property

#pluralistic#the rents too damned high#house flipping#llc brain#scams#elder abuse#ripoffs#weaponized shelter#predators#homevestors#we buy ugly houses#ugly houses#real estate#propublica

2K notes

·

View notes

Text

The fact that there used to be a reality show where people competed to be mentored in business by professional conman and 4-times bankruptcy declarer Donald Trump, and it ran for 17 fucking seasons and only got canceled because he became fucking President of the United States.

We're living in the parody timeline.

#like I know people call him reality show host all the time#but I need it to really sink in how that WAS his major success#he was losing billions on real estate#he gained billions by lying about his success on TV#Donald Trump is Donald Trump's only successful product#and it's also a scam#maybe the biggest scam of all

1K notes

·

View notes

Text

the things my nana watches on youtube are so concerning. i fear she is being scammed by real estate bros

#jupiter rambles#she is CONVINCED that she should buy real estate despite being unemployed and having no money#also shes been a mark for so many scams before that it makes me nervous#noooo sweet old grandmother dont buy that crypto noooooooo

6 notes

·

View notes

Text

im not trying to be rude when i say the following—but i thought katy perry was retired fm music once she sold her catalogue last year. like i thought all she was doing till now was scamming old ppl fm their homes with orlando bloom and being a tv show judge. im finding out she dropped a song?? what for??

#I heard the same snippet u all heard#she’s not serious about it#go start a real estate old ppl scam business katy

6 notes

·

View notes

Text

Eh mental health is annoying. Buying & cooking cheap low-FODMAP diet is annoying. My best top note for now is I'm using this blog to practice writing. I need more practice in it. I only know business, accounting & economics stuff. Its stupid stuff. Theres too much actual fraud everywhere that its annoying

Also I use mobile so formatting sucks cause Nvidia GPUs, or Arch dont like tumblr site. Or tumblr site dont like tumbkr site

Also also I 100,000% support all my fellow ones-and-zeros and their identity. Everyone is welcome here.

Except transphobes/zionist/long list of others but you get it. I'll help harrass any of those types endlessly if someone wants to tag me, and bring me in on an argument like that friend you call for backup with fights

Im unhinged so who's to say exactly what will end up here but this is also a completely public blog to me friends, family, hell, even acquaintances i dont give a fuc.

Blog should be expected to be roughly as child-friendly as simpsons or bobs burgers. But also boring like a civics/economics lesson sometimes. Yay

--------

I (and my husband) am ex mormon. Its a weird thing. Look into it if you havent recently. Realllllyyyy look into. Takes time to figure it all out in this fuckin fucked up world.

I just moved a year ago. Didnt watch the US stock market as much as I normally do. Had my first snowstorm 10 weeks ago, that was.. fun to handle while ill prepared. About 6 weeks ago I was hopping back on the market and notice its a huge tech bubble about to pop and all the conditions Ive been warned about my whole career imply this is not good. Just took a little more thinking & digging and I'm a little too confident to stop talking about it now.

(Oh I'm also care-free as fuc so I dont really read or desire to change past posts more than lil-nitpicks. More informative for the reader & myself-in-the-future-reading that way)

And I'm not kidding I do love feedback & questions. Its a very public blog tho so I get that part for sure.

If you search "life story" in my tags I had that pinned for a min Im just moving shit around rn

Being poor sucks. Will write more on that later.

---------------

First of all-- the exact timeline of an "economic shock" is literal insanity. Dont worry about the exact timing of any of this-- just know its doomed to happen soon.

Here are some effects I predict of this upcoming economic downturn

If anyone comes across any sources for these events that support my arguments please feel free to add in comments, reblogs, etc.

This concise list is mainly for my own reference, but it would be great to add to it if any one has something to add!

0.5. US Stock market collapse-- I have no desire to try and predict this one exactly. Too many conspiracies are actually correct about this big guy. Lets just say 7 US Tech stocks are worth 25% of the entire worlds market, roughly. "Too big to fail"-- I believe is the phrase

1. Corporate (slightly later will be residential by extension) real estate crisis: currently way too overvalued. Most of the houses, land, & urban corporate property we see could stand to decrease by about 60-90% from its current price.

2. Bankruptcy crisis: similar to the after-effects of the 70s inflation-- we can expect to see a huge wave of bankruptcies affecting a variety of business: from the micro-self employed; to the small business with leased buildings; to the largest corporations who commit massive accounting fraud & hope to escape accountability in time

3. Bank runs-- there is an extremely high overreliance on the Federal Reserve, who does not have good control over this situation. Once it becomes clear that there is a crisis (we call this a catalyst event)-- bank runs for physical cash are a surety. Hard to say how long a crisis like this might last. I should ask my siblings who lived near the SVB bank crisis hotspot (but those were rich fucks they do their "bank runs" over the phone)

3.5. Global currency collapse, which takes effect in every single local, state, & national economy at slightly different times. This means prices lower. Much lower. But takes time

4. Whatever the fuck the geopolitics is gonna do???. Its weird. You got Russia wanting to invade Europe? (Look at global economic forum 2024) Trump wants to let them. Biden wants to be an establishment corporate ass. North Korea has changed its #1 public enemy to South Korea (dont remember my source but it was a couple months ago). USA is stationing more troops in Taiwan, but probably only because of semiconductor technology?

The scope of our global financial woes are larger than can be explained in any of our lifetimes. Its much, much closer to pre-revolution France or the late 1920s. Big change is coming. Itll be soon

5. More to come

#anti capitalism#economics#geopolitics#real estate#bankruptcy#banks#corporate fucks#pinned post#mental health sucks ball sacks#arch linux#nvidia is a scam bubble like enron#simpsons#bobs burgers#intro post#will change it more later

7 notes

·

View notes

Text

looove when home listings just completely ignore people who, you know, need a house and instead just cater their listing to fucking LANDLORDS

16 notes

·

View notes

Text

feminist icon

#he's speaking up and breaking the cycle!#good on him!#izombie#Crybaby Carl#Don E#I mean sure they're planning to kill off half the human species for some real estate scam but it's a gender inclusive real estate scam

20 notes

·

View notes

Text

Did you know people will shell out thousands of thousands of dollars to live in, stay in, or just visit haunted houses?

So I had this idea for an absolutely horrible Real Estate Scheme.

Step one: Buy a piece of real estate.

House, town house, just some place where you are the person who gets paid rent. Works best with a place older than 30.

Step 2: Make sure everything is up to code/livable/in your name.

Also get the house history.

Step 3: Moving in!

Have a friend move in, move in yourself, or fake it. Just make it look like someone tried to move in.

Step 4: Rumors.

That friend I mentioned? You and them start running the rumor mill. Nothing super big needs to happen to you specifically, but you CAN tell people you heard there was a murder or something there when the house was first built.

Step 5: Flee for your lives!

Have your renter, or fake renter, 'flee for their lives'. Just dip out of nowhere, sudden for sale sign. Pretend nothing is wrong if people ask, be SUPER shady.

Step 6: Repeat steps 3-5

Step 7: Stir Sh*t

While all this is going on stir sh*t on social media. That should be happening with the rumors anyway, but have some fake discourse, show some "proof". Maybe go to an antique store and buy some vaguely creepy items to stash around the house.

Step 8: Bring in a Psychic.

Doesn't need to be a real psychic, but both will give you the same script anyway. It'll help with the rumors to have a "respectable" source.

Step 9: If you think the rumors have gotten enough attention move on to step 10, if not repeat steps 3-5. Keep doing this until either the rumors work, or you decide to give up.

Step 10: Advertise your haunted house!

The fish biting? Reel them in!

Step 11:... Profit!!!

#ghosts#ghost and hauntings#real estate scam#this is a joke#funny#haunted house#scepticism#scam#i dont believe in ghosts#bad jokes#profit!#my bullshit#how to haunt a house#paranormal

2 notes

·

View notes

Text

"INNES HAS A HABIT OF LOSING MONEY," Toronto Star. October 1, 1912. Page 3. --- Second Offence of Dropping Employer's Cash Leads to a Long Term. --- CASES IN POLICE COURT --- Two Men With Two Bags of Potatoes, Which They Say Were Given to Them. --- Though there was little force behind the blow which Thomas Petrie directed at Constable Young's face, Magistrate Denison chose to fine the intent rather than the act when the man came up in the Police Court.

"Was taking his name," Young stated, "when he struck me."

Petrie's two fines, for drunkenness and assault, were a dollar and costs. each, or thirty days, with time to pay.

The Sentences Grow. The sentences of Edward Innes have been somewhat disproportionate. This morning before Magistrate Denison, he admitted that while working as a collector for Joseph McQuilian's liquor store in Queen street west he retained $11.80 from the returns, and offered the defence that if he was given time he would refund the money and have it taken out of his wages.

"I lost it," he suggested.

"It's not the first time he's lost money," Crown Attorney Corley. commented. "A year ago when he was given $400 to buy Exhibition tickets he lost that. His term then was sixty days." Now, for the theft of of the much smaller amount, Innes will go to Central for a much longer term, four months.

Two Bags of Potatoes. Once more Charles Beamish, an aged character well known to the police, is charged with theft. Last night he was taken by Constable Ox-land, who saw him walking away with a bag of potatoes on his shoulder. A few paces behind was Lou Parsons, with a like load. The constable, knowing Beamish, went after the stranger first.

"Parsons dropped his load and ran," Oxland stated, "but I caught them both."

The charge is that the potatoes were stolen from a G.T.R. box car.

"Given to me," declared Beamish, confidently.

"Whom by?"

"Don't know his name."

"Where does he live?" "Don't know."

"Who is the kind man, anyway?" Magistrate Denison demanded, a bit impatiently.

Finally Beamish decided it was either the carmen or an officer of the M.O.H. Department. The couple remain in jail a week until they can give more definite information.

After arresting Mrs. Louisa Fifield as she came out of Eaton's. Detective Wickett want to her home at Prescott avenue, West Toronto, and a large quantity of goods, which the woman is charged with stealing.

When arrested with her 12-year-old daughter Queenie, Mrs. Fifield had an umbrella and six shirt waists which could not be accounted for by sales checks which could not be accounted for.

Ivy, another daughter. aged 15. working at Gillies' factory. 121 Prescott avenue, the police say, has admitted the theft of 11 neck scarfs, 197 neckties, 4 spools of silk, and a spool of brass wire.

The bundle of goods that the police recovered includes ribbons of all recovered in sizes, fancy lace bags, six umbrellas, lace, shirt waists, collars, hat plumes, and numerous small decorative articles. More were recovered this morning but none of the articles have yet been identified as coming from the Eaton Store.

When Mrs. Fifield appeared in Police Court, T. C. Robinette, reserved election and did not obtaining a week's adjournment.

Detective Wickett was with woman most of the morning, but she denies stealing the goods. She came to this country about nine months and ago.

Accused of Burglary Wm. J. Bell is being held in connection with the shopbreaking at 280 Church street on the night of September 14, when the warehouse of the John Sloan Company, wholesale grocers, was broken into and burglarized. Entrance was forced through a rear window, several desks were broken open, and the burglar, whether Bell or another, proved so clever that he found the combination of the be vault. About 260 postage stamps, $28.07 in cash, medals, and a quantity of jewelry was stolen.

Bell was placed under arrest on King street by Detective Mitchell in pawnshop, where it is alleged he was attempting to dispose of jewelry which, the police say, corresponded to the stolen articles.

Bell was remanded a week without bail.

A Real Estate Deal. "If you can't do business better than that you had better not do it at all. You've been here before. If you come again I'll know better how to deal with you." Those were the comments of Magistrate Denison to William Campbell, a real estate dealer, charged with the theft of $320 from Adam McMillan. There was a conviction, with a remand till called upon.

McMillan said that he bought a lot in Brandon for $320, and that when was fully paid for Campbell kept putting him off for several weeks and never furnished the deed.

Campbell's defence was that he had purchased a group of lots and that he hadn't fully paid for them to obtain the deeds himself.

"Carrying them on McMillan's money," the magistrate commented. "That is no way to do business. But you'll be remanded till called on." Campbell will now furnish the deed.

Back to Blue Grass Land. Hyde Nelson, colored, declares he will go back to his Kentucky home, and Robert Beatty is short $5. Beatty said that ten days ago he handed the colored man the amount at the Woodbine, to put on a "sure thing" which really won.

"And I never got my winnings," was the complaint.

As Nelson was positive he passed the money along to a third person who misplaced it, the ten days already spent in jail seemed enough, that is, if he keeps nis promise to get town.

Chinese Liquor. "Ing Kopy" was the plain English lettering on a carafe of Chinese wine which was seized upon the the premises of Ing Ding at 192 York street by the police when Inspector Dickson led a search party through the Chinese quarter two weeks ago..The charge was illegal sales and keeping.

"'Ing Kopy' means medicinal wine," explained J. W. Carry, defence counsel. "The proper analysis is printed on the side. That complies with the law."

Not when written in Chinese," Magistrate Denison replied.

Some of the police contended that the while the liquid was labelled "Ing Kopy," it was in reality only whisky colored red. As a test, the magistrate had whiffed a little from a glass, thought it was stronger than rose wise, and demanded an analysis. Ding was accordingly allowed a week's remand.

Lee Dun of 184 York street, was to have sold whitish stuff rice wine, for which his fine was $100 and costs or 3 months.

A Real Estate Deal After several remands, John Hanley, real estate agent, was convicted of false pretences. The complainant was John Bain, who stated he placed Welland and Port McNicol lots in Hanley hands for sale.

"He told me he had a buyer," Bain explained, "so I gave him $35 commission. Then he turned in a $100 check from a bogus buyer, and I couldn't get the money."

The court allowed Hanley three weeks remand to produce this buyer, but when he still failed to do so this morning, he was sent to to jail for 20 days.

John A. Brooker, of 54 Margueretta street, was fined $100 and costs for illegal liquor sales. The case has been on the books since July 20.

#toronto#police court#assaulting a police officer#drunk and disorderly#real estate scam#swindlers#illegal possession of alcohol#chinese canadians#vagrancy#shoplifters#women in the toils#fines and costs#fines or jail#sentenced to prison#central prison#crime and punishment in canada#history of crime and punishment in canada

2 notes

·

View notes

Text

[ DJ Envy Subpoenaed For Alleged Ponzi Scheme ]

#wauln#gaming#nba 2k24#DJ envy#whairhouse real estate#the breakfast club#ponzi scheme#bet#vh1#power 105.1#iheart media#cesar pina#taylor company#flip2dao#fraud#scam#fix and flip#Rick Ross#funk master flex

2 notes

·

View notes

Text

It's gonna be 39C (102.2f) and we don't have an aircon fuckkk I hate Australian summers. Especially since, at least here, it's humid af as well.

#personal#vent#it's 29C today and I'm barely able to function im gonna die tomorrow#plan is to wake up at the asscrack of dawn and go somewhere that does have aircon all day#we can't even fix it ourselves because it's not our house and we don't have permission to like come on#like the mall or something#or the supermarket#just turning around in the frozen food department like a rotisserie chicken to be cooled down instead of heated#There's some places i can sit down and vibe that have at least some aircon#better than none#also fuck our real estate for refusing to fix stuff because it costs them money and they want to “”wait“” to be able to pay it#it's fucking summer and we're quite literally toast while they want to save more for christmas#like bruh#y'all are already rich as fuck at least pay off the investment of SHELTER YOU PROVIDE FOR VERY HIGH PRICES#when honestly shelter should be free but damn gotta buy that extra fucking ham or toy train set lest it spoil christmas#like damn imagine having a low key Christmas to save money while actually paying your bills it's almost like thats always us and for what#so y'all can complain you have it hard that we pay for your shit then act surprised you gotta maintain the thing we pay for??#asshats probably don't even look at their electricity bill and ration the damn aircon and fans as if using too much means losing them ffs#anyway fuck the rich and this system that is centred around making basic shelter a commodity#rent is such a fucking scam and buying is like owning a black hole to throw your living expenses into if you dare to own your own shelter#housing should be free and this cabalistic capitalist system is a fucking nightmare#anyway back to the og point lol#it's fucking hot and i want winter back#Australian winters are so mild and great its like spring in other countries i think#spring here is also a nightmare of rain heatwaves and cold fighting in a parking lot so it's not nice here#but winter??#nice and cool and mild#wish it was always less than 23C all the time that'd be amazing#i don't remember what that is in fahrenheit but yeah

2 notes

·

View notes

Text

Yes queen give us nothing

#alternate title: *Beetlejuice voice* Just pee where you want!#Also why is anyone advertising real estate on Tumblr#I know it's a scam. but still

3 notes

·

View notes