#real estate investing with no money

Explore tagged Tumblr posts

Text

youtube

The 5 things I wish I knew before becoming a Landlord for the First Time

Becoming a landlord can be a great opportunity for you, but it can also be very challenging. In this video, I'm sharing with you the 5 things I wish I knew before getting started.

These are the 5 things I wish I had known before becoming a landlord, and why learning these NOW can make you a better real estate investor in the long run. Enjoy!

This content is for educational and entertainment purposes only. Georgia does not provide tax or investment advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. All investing involves risk, including the possible loss of principal.

#The 5 Things I wish I knew before becoming a Landlord#real estate investing#real estate#real estate investing for beginners#landlord#landlord tips#investing in real estate#rental property#how to be a landlord#rental property investing#real estate investing with no money#real estate agent#how to invest in real estate#landlording 101#investing#first rental property#house hacking#biggerpockets#bigger pockets#becoming a landlord#landlord tips and tricks#rentals#Youtube

2 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

93 notes

·

View notes

Text

Blackstone Surges to Record High: A Closer Look at Their Impressive Q3 Results

Blackstone, the world's largest commercial property owner, achieved a remarkable milestone on Thursday as its shares surged to a record high. This impressive performance comes on the heels of better-than-expected third-quarter results and an improved real estate investment performance. Let’s dive into the factors driving this success and what it means for the market.

Key Highlights from Q3

In the third quarter, Blackstone invested or committed a staggering $54 billion, marking the highest amount in over two years. This surge in investment activity is attributed to the Federal Reserve’s recent rate cut in September, which significantly reduced the cost of capital. The U.S. central bank’s previous rate hikes had stymied real estate deals and financing, leading to increased defaults in the office market affected by corporate cost-cutting and the rise of hybrid and remote work.

Stephen Schwarzman, Blackstone’s Chief Executive, emphasized the positive impact of the rate cut, stating, “Easing the cost of the capital will be very positive for Blackstone’s asset values. It will be a catalyst for transaction activity.” This sentiment was echoed by Jonathan Gray, President and Chief Operating Officer, who noted that while commercial real estate sentiment is improving, it remains cautious.

Strategic Investments and Areas of Focus

Blackstone has been proactive in planting the “seeds of future value” by substantially increasing its pace of investment. A key area of focus is the revolutionary advancements in artificial intelligence (AI) and the associated digital and energy infrastructure. In September, Blackstone announced the $16 billion purchase of AirTrunk, the largest data center operator in the Asia-Pacific region. This acquisition is part of Blackstone’s $70 billion investment in data centers, with over $100 billion in prospective pipeline development.

Other notable investment themes include renewable energy transition, private credit, and India’s emergence as a major economy. These strategic areas highlight Blackstone’s commitment to innovation and growth.

Recovery in Commercial Real Estate

The Blackstone Real Estate Income Trust (BREIT), a benchmark for the industry, reported a 93% slump in investor stock redemption requests from a peak. This indicates a recovery in investor confidence and a shift towards positive net inflows of capital. BREIT’s core-plus real estate investments, which include stable, income-generating, high-quality real estate, showed a 0.5% decline in Q3 performance, an improvement from a 3.8% drop over the past 12 months. The riskier opportunistic real estate investments posted a 1.1% increase, reversing previous declines.

Student Housing and Data Centers

Among rental housing, student housing has emerged as a significant focus. Wesley LePatner, set to become BREIT CEO on Jan. 1, highlighted the structural undersupply in the U.S. student housing market, emphasizing its potential as an all-weather asset class. BREIT has consistently met investor redemption requests for several months, showcasing strong performance.

Furthermore, the demand for data centers remains robust. QTS, which Blackstone took private in 2021, recorded more leasing activity last year than the preceding three years combined. Such sectors, once considered niche, are now integral to the commercial real estate landscape.

Financial Performance and Outlook

Blackstone’s third-quarter net income soared to approximately $1.56 billion, up from $920.7 million a year earlier. Distributable earnings, profit available to shareholders, rose to $1.28 billion from $1.21 billion. Total assets under management jumped 10% to about $1.11 trillion, driven by inflows to its credit and insurance segment.

The Path Forward

As Blackstone continues to navigate the evolving market landscape, it remains focused on identifying “interesting places to deploy capital.” With a robust investment strategy and a keen eye on emerging trends, Blackstone is well-positioned for future growth.

Join the Conversation: What are your thoughts on Blackstone’s impressive Q3 performance and strategic investments? How do you see these trends impacting the broader real estate market? Share your insights and engage with our community!

#real estate investing#investing#money#investment#danielkaufmanrealestate#real estate#economy#housing#daniel kaufman#homes#ai#artificial intelligence#student housing#commercial and industrial sectors#commercial real estate#self storage#investing stocks

6 notes

·

View notes

Text

Always be investing.

You will normally pay less taxes on it as well.

#wealth#cash#money#rich#earn money online#goals#millionaire#money goals#motivation#investing stocks#investors#real estate investing#investing#investment

6 notes

·

View notes

Text

Think you need a lot of cash to start investing in real estate? Think again! Learn how to use partnerships and joint ventures to invest with zero budget. Start small, grow your wealth, and take control of your financial future.

📖 Download my FREE eBook: Mastering Business Growth & Financial Freedom

🏡 Start investing today with Stake: Get AED 150 ($38) FREE when you sign up! Click here

📖 Read the full guide here: Full Article

The life you want is within reach—one property at a time! 🔥

2 notes

·

View notes

Text

🏡 Smart Investment, Big Returns! 💰

Looking for the perfect investment? Secure your future with a prime plot today and enjoy high returns tomorrow! 📈✨

🔹 Residential & Commercial Plots 🔹 Best Locations for Growth 🔹 Verified Listings & Hassle-Free Transactions

Whether you're buying, selling, or renting, SuGanta.com has got you covered! Start exploring now.

📍 Find your dream property: www.suganta.com

#SmartInvestment #RealEstate #BuyPlot #HighReturns #SuGanta #PropertyInvestment #LandInvestment #DreamHome #RealEstateIndia #PassiveIncome #FinancialFreedom #InvestWisely #PropertyForSale #WealthCreation #LuxuryLiving #HomeBuying #RealEstateMarket #BestDeals

#real estate#property investment#buy land#smart investment#dream home#financial freedom#passive income#wealth creation#luxury living#home buying#high returns#invest wisely#real estate market#property for sale#best deals#future planning#secure your future#money moves#real estate India#SuGanta

4 notes

·

View notes

Text

Recover Your Lost Bitcoins and Non-Spendable Wallets

Have you been struggling to recover your lost bitcoins and non-spendable wallets? We understand how frustrating it can be to lose access to your valuable assets. Fortunately, there is a solution at hand that can help you retrieve your lost bitcoin funds from personal and dormant wallet addresses, and it’s an effective and reliable tool.

Our tool is designed to guide you step-by-step through the process of recovering your lost funds. Here’s how it works:

1. **Access the Tool:** Begin by accessing our state-of-the-art recovery tool designed specifically for this purpose.

2. **Follow the Guidance:** Our platform will provide you with comprehensive instructions on how to initiate the recovery process. These easy-to-follow guidelines are created to ensure that even those with minimal technical knowledge can navigate the process.

3. **Retrieve Your Private Key:** The tool assists in helping you retrieve your private key. This is crucial for regaining access to your lost bitcoins. Rest assured, your information and funds remain secure throughout the process.

4. **Recover the Funds:** Once the private key is retrieved, you can then proceed to recover your lost bitcoin funds. Our tool ensures precision and security in recovering these assets, so you can have peace of mind.

5. **Support and Assistance:** Should you encounter any difficulties, our support team is available to assist you with any questions or problems, ensuring a smooth and effective recovery experience.

Losing access to your bitcoins can be a daunting experience, but with our innovative tool, it doesn’t have to be permanent. We are here to help you reclaim what is rightfully yours. Don’t let your assets remain dormant. Take action today and embark on the journey to recovery with confidence and ease.

To start the recovery process or for any further inquiries, please do not hesitate to contact us. Our team is ready and willing to assist you.

#bitcoin#elon musk#crypto#real estate#investment#investing#forextrading#forex#money#blockchain#stock market#donald trump#trump

2 notes

·

View notes

Text

How to Make Money in Real Estate Without Experience, Cash, or Credit: The Power of Wholesaling

Real estate can seem daunting, especially if you lack experience, cash, or credit. But what if I told you there’s a way to dive into the market and start making money without any of those barriers? Enter real estate wholesaling—a powerful strategy that allows you to profit from property transactions without needing to own any properties yourself.

What is Real Estate Wholesaling?

At its core, wholesaling involves finding distressed properties, securing them under a contract, and then selling that contract to an end buyer, usually an investor or cash buyer, at a higher price. You act as the middleman, leveraging your ability to find good deals and connect buyers with sellers. Here’s how you can get started:

Learn the Market: Research your local real estate market to identify trends and hot neighborhoods. Understanding your market is essential to finding profitable deals.

Find Motivated Sellers: Look for property owners who are eager to sell quickly—this could include homeowners facing foreclosure, landlords tired of managing their properties, or those dealing with inherited properties. Use online platforms, local classifieds, and social media to find these leads.

Negotiate Contracts: Once you find a motivated seller, negotiate a purchase contract. The goal is to secure the property at a price that allows you to make a profit when you sell the contract.

Build a Buyers List: While you’re working on finding properties, you should also be building a list of cash buyers who are interested in purchasing investment properties. This network is crucial for your success as a wholesaler.

Assign the Contract: After securing the property under contract, you can assign that contract to a cash buyer for a fee, typically ranging from a few thousand to tens of thousands of dollars.

Why Wholesaling Works

Wholesaling is particularly appealing because it requires minimal upfront investment. You’re not buying properties; you’re facilitating transactions. This means you can start making money without needing significant cash reserves, credit, or prior experience. All it takes is determination and the willingness to learn.

The Journey Doesn't End Here

If you're serious about starting your wholesaling journey, there are invaluable resources available to help you along the way. WholesalingHousesInfo.com offers expert insights, tools, and a supportive community tailored specifically for new and aspiring wholesalers.

By visiting the site, you can access a wealth of knowledge, including guides and tutorials that break down the wholesaling process. It's designed to empower you with the skills you need to thrive in this market. Whether you're looking for tips on finding motivated sellers or advice on building a strong buyers list, there's something for everyone.

Start your journey today and unlock the full potential of real estate wholesaling!

youtube

#real estate wholesaling#make money in real estate#wholesaling for beginners#no cash no credit#real estate investing#property investment#find motivated sellers#real estate market#wholesaling strategies#how to wholesale#cash buyer leads#real estate tips#financial freedom#real estate opportunities#build buyers list#contract assignment#investment properties#wholesaling houses#wholesale real estate#real estate success#entrepreneurial journey#financial independence#property flipping#wholesaling resources#Youtube#freedomsoft zip finder tool

3 notes

·

View notes

Text

5oz of Engelhard silver bars

Bin:$125 each

#black metal#heavy metal#precious metals#coin slot#coinstats#meme coins#roman coins#ancient coins#my coins#crypto coins#investment#investors#real estate investing#numismatics#silverbars#silver coins#old money#bullion#history

8 notes

·

View notes

Text

Bri's Lookbook 2/? ᠂ ⚘ ˚

modern aesthetic: G. Label by Goop Cardigan $595, / Reiss cotton t-shirt, $60 / Hermès Birkin 35, $28,000 (gifted from mom) / G. Label by Goop Trouser $595 / Gionvito Rossi pumps, $795 x 2 / Cartier watch, $11,500 / Hermès scarf (gifted) / Victoria Beckham dress, $1,290 / Chanel Rouge Allure Lip Color, $48 / Yves San Laurent Desk Agenda, $550 (gifted)

#(( another silly clothing edit of her normal wear#bri comes from old money. her mother is a french real estate heiress. her father's side runs a global investment firm#and she makes a lot of money#gross 1%er wealth#while she is a minimalist (compared to her relatives) all her possessions are luxury brand. she just buys no thought to price#at the same time she has these things for a very long time. been using the same YSL planner for years (just buys refill pages)#a lot are nice gifts from family. the birkin was her mom's prior#+ any pop of color (reds primarily-can you guess why?) are via her scarves ))#( aes & isms ) .#( my edits ) .#v ( modern ) .

7 notes

·

View notes

Text

Mastering Personal Finance and Investing: Your Ultimate Guide to Financial Freedom

Introduction: Understanding the Importance of Personal Finance and Investing Personal Finance and Investing: Your Path to Financial Freedom Importance of Personal Finance and Investing for Wealth Creation The Basics of Personal Finance: Budgeting, Saving, and Debt Management Mastering the Basics: Budgeting, Saving, and Debt Management Budgeting Tips for Effective Personal Finance…

View On WordPress

#personal finance#financial planning#money management#budgeting#savings#debt management#investing#wealth creation#retirement planning#401(k)#IRA#stock market#real estate investing#compound interest#tax planning#financial freedom#financial education#money tips#financial goals#investment strategies#financial literacy#wealth management#financial advice#financial independence#money mindset#financial success

25 notes

·

View notes

Text

2 notes

·

View notes

Text

Stack assets now!

#wealth#cash#money#rich#earn money online#goals#millionaire#money goals#motivation#investing stocks#investors#real estate investing

5 notes

·

View notes

Text

#plz reblog#polls#money#income#investment#investing#stock market#real estate#precious metals#work smarter not harder

18 notes

·

View notes

Text

Dollar daruma. 🟥🟨💵💲

#daruma doll#daruma ikka#daruma256#daruma matsuura#daruma#Chinese brush painting#sumie#sumie painting#dollars#us dollar#dollar bills#nasdaq#stock market#stocks to watch#banking#mortgage broker#bitcoin#bitcoin mining#billionaire#millionaires#wall street#investment#make money online#make money#euro#real estate#real estate investing#dow jones industrial average#pop art#basquiat

4 notes

·

View notes

Text

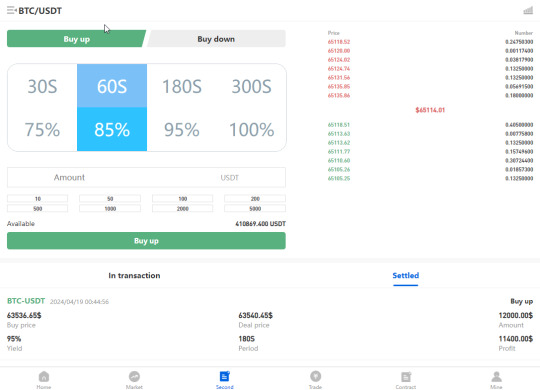

With the latest cryptocurrency trading method, you don’t need to hold it or take risks, you just need to earn income through its increase.

#cryptocurrency#btc#cryptotrading#cryptonews#bitcoinprice#ethereum#make money fast#investment#investors#real estate investing

2 notes

·

View notes