#personal loan no credit

Explore tagged Tumblr posts

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

469 notes

·

View notes

Note

Incorrect, the fact that Biden has dropped out and a candidate with history of supporting medicare for all and being more receptive to a ceasefire in the I/P conflict has made me go from "I cannot morally support the Democratic nominee" to "I am voting for the Democratic nominee despite the fact she isn't perfect in every respect." I'm really happy this played out. The Dems for the most part abandoned the old Obama platform and it feels like its possible an actual progressive agenda could come to pass in my lifetime.

Kamala 2024!

If you weren't going to vote Democratic in this election before Biden dropped out you're a dorkass loser who does not care about any of the issues you're yammering about here and also a fundamentally bad person, and I hope you get run over by a bus.

But you got one thing right in all of this gibberish, Kamala 2024.

#personal#answered#anonymous#i mean let's be clear here no president is gonna attempt to be progressive ever again within my lifetime#because joe biden tried to do like 25% of that and got ZERO fucking credit#he did so much on healthcare on reform on loans on so many social issues and for all his litany of failings on i/p#he has been distinctly harsher on netanyahu than a good chunk of dems and certainly the entire republican party#for the first time since i was four we are not involved in any wars as americans and that is thanks to joe biden#but the thing is that he gets no credit for any of it!#him pulling out of afghanistan caused his approvals to tank in a way that never recovered#and leftists gave him FUCK ALL for it#they gave him nothing they just continued whining that even tho he cancelled a bajillion in student loans#he didn't actually cancel a QUADRILLION dollars so both parties are the same and voting is the most arduous task known to man#no democrat who is running is going to forget that catering to leftist/progressive policies gets them zero leeway with those supporters#that it not only tanks numbers but you still get constant haranguing about it anyway#so they're not gonna do it#we are gonna get fuckall for at least a good fifty years#and anything we get will be utterly in SPITE of people like you anon it will happen in spite of everything you've done#mostly because of people like me and mine who understand that voting is the bare minimum#and that for the democratic process to work the way you want it to you need to participate and not pitch a fucking fit#like a four year old who was told they can't go to disney this weekend#like i know you ratfuckers are happy this played out because this is all a game to you and you don't actually care#but that's why i've got zero faith in you people and why i'm glad it's my kind of folks#actual die hard democrats who have always been hardliners for supporting democrats in every possible election#who are picking up the slack and donating to harris and supporting her agenda#which is the exact same as biden's because she's his vice president and they share they same platform#because that's what they were both running on! twice!#anyway fuck you please feel free to find a necktie and test how tall your doorframe is

360 notes

·

View notes

Text

Okay, lovelies. Remember when I said the good vibes you were sending me may have tipped the scales in my favor? Well, buckle in because I'm about to get personal. 😂❤️

Like many people out there, I have student loan debt. My hubby has student loan debt. Hundreds and hundreds of dollars a month. Not only do we have student loan debt with terrible interest rates, we also had medical bills and credit card debt to take care of unexpected emergencies over the last few years. It's stressful. Many of you understand.

My family has never had much and hasn't been able to help, which I don't expect them to. I work hard to do what I can. I still had 10 years to pay on my loans when I checked a month ago. 10 years. There has been no end in sight.

Until now.

After a lot of hard work and working with a financial advisor, we paid off our two major credit cards today. I am paying the remainder of my student loans in full tomorrow. And within the next year, the remainder of my husband's student loans will be paid in full. Not only that, we will have a true emergency savings account opened by the end of the year.

Lovelies, I sobbed. Full on sobbed. Ugly cried until my chest and head hurt. The stress of this debt has weighed on me and kept me up at night. I worried for my kids. I worried for myself. And now I can actually put some of this money toward both their future and mine. It's an amazing feeling.

Now, we're not out of the woods. 😂 My hubby still has that last student loan, along with a car payment and our mortgage. But, fuck, the weight is so much lighter and I feel like I can finally breathe. We needed this win.

Appreciate the good vibes, lovelies. I'm sending them back your way. I hope any weight you have weighing down on you is lifted. I hope you can breathe a bit easier.

Love you all. ❤️

PS - The advisor also said no big spending, but my teammate said I should buy myself something nice and that candles don't count. ☠️ Can I buy a fictional husband? 🤣

#navybrat rambles#personal#student loans#credit cards#debt#small victories#a win#weight lifted#love you lovelies#are you reading my tags?#go drink some water#stay hydrated my friends

157 notes

·

View notes

Text

I hate banks I hate money I hate credit scores I hate loan applications I hate

#if anyone was wondering#I'm gonna rip out someone's throat with my teeth#I was denied a real small personal loan for a car because i don't have enough credit history#my brother in Christ that is what the small personal loan is for#anyways if anyone is looking for a sugar baby i know a guy

329 notes

·

View notes

Text

.

#personal post#will delete later#lol i may have just fucked up my credit#oh well#i need to take a step back and breathe#surgery is like. days away.#and to be fair insurance covered like.....99% of it#but bills + credit + this medical cost now i'm just like.#my head is spinning.#how am i supposed to save for my goals with *waves hands at debt pile* all of this#and i'm not even talking about /you/ *points accusatory finger at mountain of student loans*#anyway. guess i'll buy a powerball ticket later#that'll fix it#(it will most likely not fix it)

9 notes

·

View notes

Text

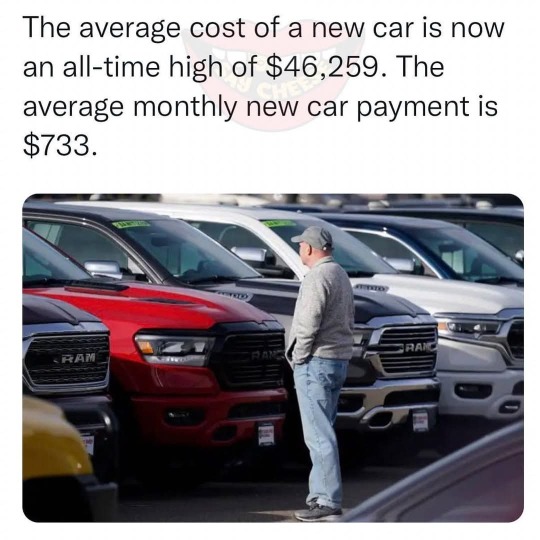

It's getting real out there ...

#cars#automotive#autos#suv#money management#money problems#old money#money making#money#debt consolidation#debt relief#debtmanagement#debt#credit cards#credit score#business loan#home loan#personal loans#student loans#loans#spending#bankers#banks#interest rates#the fed#central bank#payments#wtf#wth#huh

7 notes

·

View notes

Text

Do you need a personal, business, student or more loans at the comfort of your home?

Well at Financial Bridge our mission is to empower people from all walks of life to make informed financial decisions.

We believe that everyone deserves access to the resources they need to achieve their financial goals, and we’re committed to providing the most comprehensive and accessible loan information available.

Our team is made up of experienced financial experts, dedicated to helping you navigate the complex world of loans. Whether you're looking for a personal loan, auto loan, mortgage, or business loan, we're here to provide the support and guidance you need to make the best possible choices.

At Financial Bridge, we’re more than just a loan website—we're a community. We're here to answer your questions, provide expert advice, and help you find the perfect loan for your unique needs. Our goal is not just to provide you with the information you need, but to empower you to take control of your financial future.

Follow us on our social account today, and let's work together to make your financial dreams a reality.

#personal loans#student loans#loans for bad credit#business loan#home loan#loans#cash advance#mortgage#same day loans online#instant personal loan#financial planning#banking#personal finance

5 notes

·

View notes

Text

What is the difference between credit card and debit card? - Credit card

Credit card and debit card - In today's fast-paced world, financial transactions...

#credit card benefits#credit card rewards#credit card holder#credit card processing#credit card debt#credit#loans#banking#investments#personal finance

39 notes

·

View notes

Text

Building credit or Business Credit profiles to get an 800 credit score does not not happen overnight…

But it’s very simple when you understand how the credit algorithms work!

Love helping people!!!

#student loan#student loans#students#canada#finance#personal finance#financial#financial freedom#banking#cash#money#credit score#credit repair#bad credit#credit card#credit#bad credit loans#credit cards#credit karma

3 notes

·

View notes

Text

I'm so fucking broke. I'm on my honeymoon and I can't even buy my beloved a fucking cup of coffee or my mother a postcard. I fucking hate myself.

#into the void#i don't know what to fucking do anymore#i have applied to so many jobs and just....nothing#i just feel so useless#i wish i could afford to go back to school but i just defaulted on a school loan and i can't access my university transcript im fucked#i cant get a credit card or a loan or pay my own fucking bills#im such a pathetic burden and a dead wait#why did they marry me im feel like nothing i can ever do will make up for how much of a financial weight i am#i cant do anything right#because they do nothing but show me love and support and that im not a burden but i know it's hard for them#i know they're feeling the weight and feeling tired#i feel like ive scrambled to gain my footing for my whole life and ive never found it#personal#magpie chitters

3 notes

·

View notes

Text

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

Did we just help you out? Tip us!

8 notes

·

View notes

Text

can someone please tell me why my ssn got leaked by data breaches at two different organizations in february and they only told me in october and november,,,,,

#someone in california is now using my ssn ✌️😔#and like i couldn't have not given the organizations my ssn#it was my old uni and doctor's office#and now that i'm home idk i might go to the police in report that someone is using it?#but i feel bad bc my dad told me it's probably an undocumented person who didn't have an ssn#and i am so sympathetic to that and don't want anything bad to happen to anyone in a situation like that#but that's my ssn#and like identity theft and all that jazz#i put a fraud alert on my credit so idk#uh for any non-americans ssn is a social security number and that's like the super secret number the government gives you#and my whole identity is tied to it#like officially (credit loans etc)#it proves i am who i am and i need it for things like passports and loans and credit cards etc#zip quips

5 notes

·

View notes

Text

God my mom is so bad with money

#was looking at her list of credit card payments/totals and girl.#even if i gave her all my emergency savings it wouldnt be a dent#anyway money stresses me out and this is why i dont do anything ever#personal#and none of this is considering our student loan debt which we both are just like#well that's never getting paid off so who cares

3 notes

·

View notes

Text

Need Money Fast? Discover How ASAP Finance Can Assist You

Need Money Fast? Discover How ASAP Finance Can Assist You

In our fast-paced world, financial emergencies can strike when you least expect them. Whether it’s a sudden medical bill, car repair, or an unexpected expense, having access to quick cash can make all the difference. That’s where ASAP Finance comes into play. At 15MFinance, we specialize in providing speedy financial solutions tailored to your needs.

What is ASAP Finance?

ASAP Finance offers a variety of short-term loan options that are easy to apply for and quick to obtain. With a user-friendly online process, you can fill out your application in just a few minutes and get the funds you need without the hassle.

Why Choose ASAP Finance?

Fast Application Process: Complete your loan application quickly and easily.

Quick Access to Funds: Receive your money within the same day or 24 hours after approval.

Flexible Loan Options: Choose from payday loans, installment loans, and cash advances.

No Credit Check Options: Even if you have bad credit, you can still apply for certain loans.

How to Get Started

Visit 15MFinance.us: Fill out the simple online application.

Select Your Loan: Choose the loan option that suits your financial situation.

Get Approved: Receive quick approval and finalize your loan.

Receive Your Cash: Get the funds directly deposited into your account!

Don’t let unexpected expenses take control of your life. With ASAP Finance, you can handle emergencies without stress.

👉 Ready to take action? Apply now with 15MFinance and get the cash you need!

CLICK HERE TO APPLY NOW

#payday loan#bad credit emergency loans#finance#asap loan#asapfinance#no credit check loans#payday loans#personal loans#15mfinance#asaploans#smallloans#easyloans#fastloans

2 notes

·

View notes

Text

We’ll explore the challenges faced by individuals with bad credit scores in Australia and how expert home loan mortgage brokers at VOXFIN can assist them in achieving their dream of homeownership.

#bad credit loans in australia#bad credit loans#bad credit score#australia#melbourne#bad credit car loans#bad credit#finance#mortgage broker#home loan broker#investing#personal loans

3 notes

·

View notes

Text

I’m really frustrated my card got locked on Friday - I’ve been going through donating $5 to roughly 12-14 campaigns for weeks now but this week it gets flagged as potential fraud? Not only that the company is closed on the weekends so I have to wait until Monday to unlock my card (if I was still living alone and had to buy my own groceries/pay for gas I would be in trouble).

#ra speaks#personal#me: *living at home again* okay my cost of living has decreased by $50-$75 bucks a week let’s donate it all every week -#the credit card company who I’ve never once wronged: FUCK YOU STOP SPENDING YOUR OWN MONEY LIKE THAT ITS SCARING THE FRAUD SYSTEM#last time my card got locked (sending money to a group doing a bus ride to dc for Palestine protesting) I didn’t get a notification/case no#and I remember that being a problem so then this time I call and the 1800 person asks for my case no. and it’s like.#¯\ _(ツ)_/¯ fuck me I guess#I’ll ask abt it when I call the local office on monday cause like I think they could unlock my card if I had the damn case no.#but I’ve literally never been contacted. which is weird bc they 100% have my phone/email on file#like I get emails abt my loans through them and when I make a payment and shit. why not emails abt locked card? who knows

4 notes

·

View notes