#pension fund

Explore tagged Tumblr posts

Text

Trump, not content with picking MAGA pockets and pay-for-play WH schemes, now set on Americans' nest eggs:

youtube

#boiler room alert

#gambling#bankruptcy#trump#us politics#us pensions#pension fund#usa#us workforce#private equity#stock market#economy#robbing the working class#working class#blue collar#us congress#maga#pay for play#scams#quid pro quo#traitor trump#potus#us presidents#white house#nest eggs#retirement#americans#deregulation#fraud#selling out americans#401(k)

25 notes

·

View notes

Text

A group of British women born in the 1950s are seeking compensation after the government raised the state pension age, leaving many financially vulnerable as the cost of living remains high.

The group Women Against State Pension Inequality (WASPI) is seeking compensation, arguing that women affected by the changes received minimal notice, unlike men, and were therefore unprepared for today’s high cost of living.

WASPI began campaigning in 2015, seeking redress for the UK government’s sudden change to the retirement age, which increased the retirement age for women from 60 to 65 in 1995 and then to 66.

Unlike men, who received six years’ notice of the increase, many women born in the 1950s had only one or two years to prepare for the six-year increase. They argue that this discrepancy leaves them financially vulnerable and unprepared for retirement.

In March, the Parliamentary Health Service Ombudsman (PHSO) admitted that the government had failed to properly inform women about the changes. But despite this finding, the government has yet to introduce a compensation scheme.

WASPI held a rally in Parliament Square in London last week to coincide with the Labour Party’s first budget announcement since coming to power, and called on the government to address their grievances.

Lynne Ruddock, WASPI co-ordinator, said the ombudsman’s findings should be the basis for compensation. She told media, emphasising that the movement intends to continue its campaign:

They’ve been given a varying amounts of compensation that each WASPI woman should be given.

Ruddock criticised the previous Conservative government for skirting the issue, saying they ignored it knowing “they would not be re-elected” in elections earlier this year.

She also accused the new Labour government of not supporting the WASPI case in the past now that it was in power. she said:

Before Labour were re-elected, in opposition, they were massive, massive supporters of our cause. Now they’re in government, they’re not interested.

Barbara Parker, another local WASPI coordinator, emphasised the financial hardship the changes have led to, especially amid the rising cost of living.

For many of the women affected, the financial losses are significant, totalling around £40,000 to £50,000 per person.

Read more HERE

#world news#news#world politics#europe#european news#uk#uk politics#uk news#london#united kingdom#england#uk protest#waspi#pension plan#pension scheme#pension credit#pension fund#pension reform

4 notes

·

View notes

Text

youtube

I love him.

5 notes

·

View notes

Text

Divesting pension fund from companies linked to Israel and occupied Palestinian territories is ‘not possible’, states council report

Westminster Council’s Pension Fund Committee agreed to not take any divestment action. Photo: Westminster Council webcast. A report for a Westminster Council committee says divesting the council’s pension fund from companies linked to Israel and the occupation of Palestinian territories is “not possible” with its current fund manager. The report, which is in response to a request from the trade…

0 notes

Text

Bank of England currency printer De La Rue sold for £300m

Bank of England currency printer De La Rue sold for £300m #authenticationdivision #BankofEngland

#authentication division#Bank of England#corporate restructuring#Crane NXT acquisition#currency printing#De La Rue#debt reduction#pension fund

0 notes

Text

0 notes

Text

food places are like this sandwich was £3 fifteen years ago. now you need to give us £23 for it. Please. no the guy who made it and the guy who grew it aren't making any more money than they were before but um we need taylor swift to perform at the shareholders christmas party this year or our small independent forbes top 100 business will collapse like a black hole and swallow the universe

914 notes

·

View notes

Text

#universal basic income#UBI#social welfare#unconditional transfer payment#means test#guaranteed minimum income#poverty line#full basic income#partial basic income#pilot projects#Mongolia#Iran#child benefit#pension#Bolsa Familia#Thamarat Program#economic crisis#COVID-19 pandemic#direct payments#Alaska Permanent Fund#negative income tax#NIT

207 notes

·

View notes

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

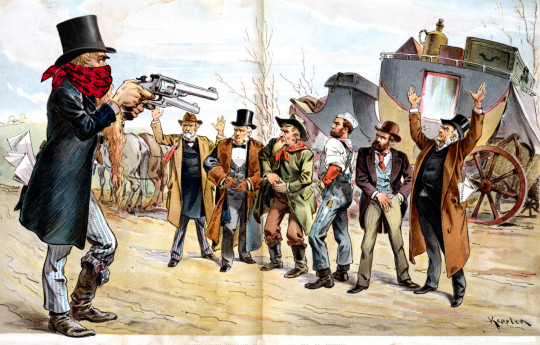

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

310 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

68 notes

·

View notes

Text

amidst the doomposting I really want everyone to clap that Missouri legalized abortion and reproductive rights and the right to bodily autonomy!!!! huge deal for a massively red state !! state funded Medicaid being forced to cover abortions and birth control is a huge step forward for trans healthcare too‼️‼️‼️‼️‼️

also it raised minimum wage, established mandatory sick time accural, and denied raising cop pensions ‼️‼️‼️ small steps in the right direction ‼️‼️

#and it’s incredible that it wasn’t that tight of a margin either!#and it also protects providers so hopefully this means planned parenthood is saved from slashed funding because they provide abortions!!!#cop pensions lost because of unclear language (people see levy and say Absolutely fucking not!) but that’s still a W!#also no new casino yayyyyyy#Missouri#a day in the life of steeve#incredibly funny driving past all the huge NO TO ABORTION NO TO STATE FUNDED BABY MURDER! signs and chuckling#yesssss yesssss… tax funded sex change surgeries for children….. yesssss……

25 notes

·

View notes

Photo

April 6, 2023 - Rail workers protesting the raising of the pension age occupied the French headquarters of investment company Blackrock, saying that the money for workers’ pensions could easily be found if Blackrock and other corporations were taxed properly. [video]

#paris#france#pensions#anti-neoliberalism#unions#occupation#gif#2023#class war#blackrock#anticapitalism#flare#cgt#workers#working class#flag waving#hedge funds

299 notes

·

View notes

Text

Kodak Prepares to Terminate U.S. Pension. U.S. cash to invest in business.

https://www.wsj.com/articles/kodak-prepares-to-terminate-u-s-pension-book-gain-of-more-than-500-million-d0cfb621

#ausgov#politas#australia#kodak#kodak gold 200#kodak portra 400#kodak ultramax 400#kodak film#pension#pensioners#usa#america#usa is a terrorist state#usa is funding genocide#usa politics#usa news#american indian#american#auspol#tasgov#taspol#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#centrelink#welfare#human rights#class war#poverty

6 notes

·

View notes

Text

There are only 12 spots available, so I was not able to include the hidden track, 'Look at Your Game, Girl'.

@greeneyezblackheart @elscaptive @valupuyhol @jakelinestradlin

#guns n roses#axl rose#izzy stradlin#steven adler#duff mckagan#slash#guns n' roses#gnr#slash gnr#the spaghetti incident#'pension fund'#new rose#buick makane#big dumb sex#attitude#raw power#since i don't have you#i don't care about you#hair of the dog#you can't put your arms around a memory#Human Being#ain't it fun#down on the farm#rock n roll#rock music#rock#rocknroll#rock and roll

25 notes

·

View notes

Text

Todays Tesla update

One of the biggest pension funds in Denmark has sold its holding of Tesla shares due to Teslas refusal to sign a collective agreement with IF Metall. The fund owns Tesla shares to a value of 400 million danish kronor (57 800 000 US dollars)

#union#strike#tesla#teslastrike#we stand with the tesla workers#sweden#denmark#you go danish pension fund

9 notes

·

View notes

Text

a situation has presented itself. Today

as you all know I switched to work a minijob in october which is paying very little but like. my mental state is much better

now. one of my supervisors mentioned that if I was working more hours she would suggest to the boss to basically promote me to uhhhh Vault Keeper™. you get some more responsibility and take a step up on the food chain.

NOW. I am. thinking about it? I would go back up to 21 hours probably (I said I would want the least hours I could get away with but I think the boss doesn't go lower than that) and I also said that I wouldn't do it for minimum wage, OBVIOUSLY. it's more tasks and responsibilities so of course I expect there to be more money.

so now the question is if I want to go back to my old hours because I am noticing a significant difference in my general headspace and energy since I cut my hours. my flat is cleaner and I'm less stressed and tired. but I'm also making 500€ a month and drawing out of my savings constantly

if I got a proper wage and more elevated tasks than just sitting at the register, maybe it wouldn't be so bad? I think it would heavily depend on how much pay they'd offer me.

this is also very much hypothetical because my supervisor hasn't even brought this up to the boss yet so he could just say no and that would be that.

she said to think about it a while and let her know and then she would ask. thots and opinions.....?

#i am not enjoying that i need to constantly spend from my savings and had to reduce the amount i pay into my private pension fund#but my mental health..... she is doing better......#this is such a bitch of a situation why can't i just get one million euros a month for being hot and sexy#rayrambles

7 notes

·

View notes