#not cool @Economic Times :/

Explore tagged Tumblr posts

Text

Idk if whoever wrote this knew what they were doing but...

the way my heart *stopped*

the actual title is "Dead Boy Detectives season 2 on Netflix cancelled? Check latest renewal status", but the damn Economic Times had to play us like that...

#dead boy detectives#dbda#and the use of “was”#not cool @Economic Times :/#manifesting season 2 so hard rn#🔮🕯🤞✨#sam rambles#edwin payne#charles rowland#chedwin#payneland#edwin x charles#edwin x monty#which is not hugely releevant#but let it be known that im still a strong shipper

80 notes

·

View notes

Text

guy in mabinogi rolled up on a vespa and began polling

#mostly posting this cuz. i want it to be public LOL so theres a chance he may ever see it <3#it was a sweet interaction#a lot of the time i find in that game i can go weeks without another player even seeming to be like... active in the same space as u#especially if u dont play on the popular channels#aka channel 1 LOL#rolled up and was like “how many meals do u eat in a day”#and i was like. 1-2 im not good at it </3#and he was like “is this a choice or is it economic”#and i went . i guess . kinda both LOL its kinda a big question#he was like “whats your job”#i answered “artist <:3 but im not very popular”#and he asked if he could google my name. i told him he could#since my ign is vehemourn :3#he said it was cool and then invited me to a dungeon ive never ever even seen before LOL (im still under like. 1k cumulative levels)#anyways. that was nice. i enjoy passing interactions with players#i had this other one where a player showed me how they heal :3#and another where me and another player were silently cats moving around each other...#fun :3#mabinogi#mabinogi fanart#k#my art#mabinogi game#nexongames#nexon#for all 7 mabinogi tumblr users <3

16 notes

·

View notes

Text

*Sweating throwing up nauseous dizzy*

What if vox is Asian American

#Hazbin hotel#vox#hcs#musings#idk I just think it would be cool#i feel like there aren’t a lot of East Asian villains that are allowed to be sloppy boisterous and vulgar outside of media made by Asian#people#I know a lot of people draw his human form white as a sheet but i dunno#I also think that would explain why he initially clicks with Alastor so much#both of them are part of marginalized groups in their respective time periods#swamped by the expectation to be subservient to their white peers#but they both rise above it with their passion for the innovation of entertainment#to describe that dynamic it’s basically that Alastor is the burr to vox’s hamilton . except in this version burr wins on most levels#this also gives context to vox’s raging inferiority complex bc. if his parents were immigrants at the time compounded with the economic#and war time struggles then that probably made him feel pressured to succeed quick and hard#vox would definitely be disconnected from his culture and obsessed with pursuing the American dream#whereas Alastor i think would be v in tune with creole based language and culture as evidenced by his close relationship with his mother#near the end of Alastor and vox’s friendship Alastor would likely mock him for abandoning his roots in search of prominence#it would actually be quite sad

37 notes

·

View notes

Text

i gotta kinda laugh either at the. People talking about it or the system that produces it that “society that can produce so much cheap delicious, shelf stable, dense, food” is like. A problem. I very much understand that u can have nutrient deficits eating that kinda stuff. Belief me my body often craves the healing aura of a vegetable. But like. L + ratio are u listening to these words. That fucking rules. Clown.

#Some shit#i simply think if the problem is. Ppl make money of selling food that will kill u to poor people who have no time to cook.#U should say that that instead.#Cause otherwise u are making these scienctific advancements sound cool as fuck#Me seeing a system problem that so closes aligns with the economic systems at play:#You know if we all got orthorexia that’s probably gonna fix this. I think.#^cause the SYSTEM also includes. All the exploitation that affects the prices there. U get me.#Okay thats enough watching youtuber i think

4 notes

·

View notes

Text

being really into things like old y2k futurism and the whole like 90s-2000s movement of "y2k" in general is very frustrating sometimes when you're old enough to really internalize not trying to sound like you're saying "remember GOOD capitalism???" when talking about how things used to look cool and they don't right now.

#you also tend to find a lot of people doing the whole 'IT WAS A BETTER TIME IN THE WORLD' and like#it wasnt#america just had a lot of cool cultural/economic exchange going on with japan after they rebuilt their economy after we fucking bombed them#idk its frustrating sometimes#ive never been one to be content with just the 'aesthetique' of a movement of art#maybe im just some stuck up poser#I was 4 in 2002#so like#I wasnt there

5 notes

·

View notes

Text

important part of my relationship is that my girlfriend isn't subscribed to money stuff, so when we walk to work together i can just describe really good money stuff bits to them

#Real Big Computer Has Never Been Tried.#then in return they explain facts they learned from the odd lots episodes i found too boring to listen to#you can really understand our fundamentally different natures this way#my girlfriend likes things in proportion to how useful and helpful they are which is why they do vaccine design research#and read about cobalt exports and climate energy policy as their personal economics information hobby#i mostly like things in proportion to how conceptually satisfying and fun they are to think about#which is why im studying an application-free cell bio question that is essentially 'Wouldnt It Be Cool If This Worked'#and the finance-related things i read about r hilarious crypto exploits and the fact that everything is securities fraud.#now of course my girlfriend also possesses gr8 aesthetic sensibilities and i guess i managed to have useful practical outputs#when i was a union contract writer that one time#but these are our respective instinctual tendencies.#box opener#girlfriend tag

11 notes

·

View notes

Text

I should’ve made the fortunes favor chapters shorter. like split them up more, not write less. then I would’ve had more of a backlog and may not have just stopped writing. which I didn’t do I’m definitely still writing it

#everyone’s cool with once a year updates right? right?#I’m thinking about that one chapter that was like 9k ……. that could’ve been like three chapters if I was more economical#but I had an Outline! and I wanted the traveling to only be one chapter#but I had so much Relationship development to squeeze into that time#and the. dhsksjs. the contrivedness of essek leaving and then being found again#just so I didn’t have to write the gnoll cave#secretly. every part where essek isn’t with the nein is just because I don’t want to write some part of canon#not because it’s not interesting but I just have nothing to add or change#so it would just be rewriting shit we already know#this has been a post

8 notes

·

View notes

Text

you ever read a paper that has such a bad faith-take on a female main character that you know without looking that it’s by a male author

#besides being really bad faith he’s also. breaking every rule of literary analysis I’ve ever learned#like yes absolutely you’re allowed to do biographical readings#but he’s mixing his readings in a way where he’s reading jane eyre as not only autobiographical for Brontë#but is also dragging in the main characters of all her other works? and reading jane through them?#without ever differentiating between reading the book psychoanalytically fo bronte or reading it as part of the oeuvre#furthermore he’s acting like jane is the author. newsflash she’s a character and a narrator#additionally! he’s treating jane as a person with free will instead of as a character#paradoxically he’s doing all of the above at the same time#and this is all in addition to reading Jane as duplicitious selfish and evil#and blaming her for being afraid of poverty as a physically emotionally and economically abused nine year old#cool story bro I’m not sure we read the same book 👍

11 notes

·

View notes

Text

Olympic Games reporting taking the place of the rest <<<<<<<<<<<

#olympic games#olympics#french politics#not sure about the panem but he really thinks the circenses are helping his non-existent popularity#every time an anglo refers to the Revolution as beheading rich people climate change accelerates think of the climate don't say bullshit#based on what i've heard it is very much a Choice when you're that intent on increasing economic disparities#to throw that much money into Looking Cool For The International Press And Tourists

3 notes

·

View notes

Text

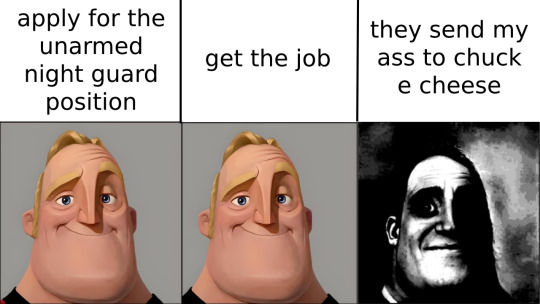

every single time without fail this is what goes through my head when i see the unarmed night guard listing

#diary#it never closes because the company is always looking for people#<- applying for a second part time job to hopefully maybe afford becoming full time at my first job#cool economic system we live in

2 notes

·

View notes

Text

Survivorship bias. We think of older media as inherently superior to new media because the only older media still around is the stuff people thought was good. When really, older media has simply been curated by time.

i do think theres something sad about how largely only the literature that's considered especially good or important is intentionally preserved. i want to read stuff that ancient people thought sucked enormous balls

#Things being curated by time also applies to generations of people#But more often in reverse#There are really cool boomers#Boomers who fought tooth and nail for civil rights#For lgbt rights#For women's rights#To disentangle capitalism from politics#To oppose unjust wars and american imperialism#And they were killed by cops#By economic oppression#By lack of healthcare#By the very issues they fought against#Over time a given generation trends towards conservatism#Not because people turn evil as they get older#But because those members of a generation empowered by the oppressive power structures#Have a longer life expectancy than those they oppress

99K notes

·

View notes

Text

kill the worldbuilder inside your head

#no okay i complain about this a lot but i have seen enough scifi/fantasy criticisms that are purely dumb#worldbuilding bullshit that I now have this fucking r/worldbuilding dweeb who lives in my head#and every time i am writing and go 'oh i can come up with a cool scifi technology with thematic relevance here' this redditor#springs up and goes 'oh but how would that make more sense than just doing this? why does that other thing still exist then?#clearly you don't understand economics' etc#i have to look at that one 'my highly realistic world has no life because the drake equation' post to feel better lol

0 notes

Note

Hey, Lemony! I was wondering if u consider doing commissions as a full time, or if u r planning to graduate in a different field and keep ur art as a hobby?

Bdw, I love your work-/srs-, dude! Ur drawings make me want to keep each one in little jars just to keep them safe-/pos-.

Also-really long ask, sorry/srs- u should really play firewatch, its not free, but u find it in some steam sales at a good price. I dont want to spoil to u-cause its a pretty story based game-, but u will be standing jaw drop-/pos- almost the whole game.

hi anon!! Tbh I’m still thinking about my future in general but my plan for now is to stay in art since it’s pretty much one of the only things I can do aixbwkxbam

right now I can’t really take commissions for a few reasons and I haven’t had time to draw anything aside from the silly doodles I’ve been posting for a while but I’m hoping to get time to draw again soon and be able to maybe start a portfolio and improve on some things

ALSO THANK YOU AGH it makes me so happy that you like my art <33 /gen

ooh I’ve heard of firewatch but I didn’t know it was a story based game… I’ll definitely check it out and play it whenever I can, it looks really cool!! Thank you for the rec :D

#lemon man talks#I don’t necessarily plan on working only with commissions but I do wanna keep my work somewhere in the illustration field#Honestly the dream job is being an illustrator full time and having a little shop to sell prints and trinkets#Along with taking commissions eventually#I really wish I could just like have the time and economic stability to work on whatever I want#I’ve thought of making comics also… that’d be really cool…#I have a lot of stories and I’d love to actually develop them and bring them life and get money to survive from them as a bonus#Not to mention it’d make me insane to see people enjoying my stories /pos#I put so much of myself into them I think I’d cry forever if people enjoyed them#Thinking about the future is really hard for me bc of anxiety and paranoia etc etc but a guy can also dream <3

1 note

·

View note

Text

lol I recently saw a reblog chain of this post with some even more overt shaming of people for ~laziness and I almost wrote a response but turns out I already did that! but I guess I'm going to write... more response

like. what I think you should take away from "you have to love the process" is that you DON'T have to do an art if you DON'T love the process. and it's NOT a chore and it's NOT an obligation it is SUPPOSED TO BE FUN AND JOYFUL so if you want to do art then you should do cool art that you like instead of painful art that hurts you!

idk how you can turn that message into... like... art is bad and worthless unless it was really really hard to make. like if you feel bitter and aggrieved that someone else isn't doing your process then maybe you don't love that particular process as much as you think you do?

this is not specifically about people's opinions on AI art by the way there are many paths that can lead to this stupid conclusion. but I do wish people would not take their dislike of AI art in this direction. I'm not going to address whether AI art is good or bad because this post is already long and the question is pretty boring to me anyway but if it's bad this isn't why!!

#opinion post#I make handmade lace do I wish that was still the only way you could get pretty lace for a sewing project?#NO! I FUCKING DON'T! oh my god why would I want that??#machine made lace is great it's pretty it's affordable#it's COOL that we came up with a way to make lace with a million times less effort#with the result that today I get to make lace for fun and not because of economic necessity#now does this mean that industrialized textile production is great and doesn't have any problems#lol no#but NONE of those problems are that it's TOO EASY??#wtf it should be more easy!#there's nothing wrong with things being easy!

59K notes

·

View notes

Text

one of our dogs almost ran away. It was so. fucking. terrifying. What is this, the summer of nearly losing people and pets I care about and love dearly?!

0 notes

Text

Donald Trump Is Not Joking About Annexing Canada: A Fucking Timeline

December 3, 2024: Trump's quip about Canada becoming 51st state was a joke, says minister who was there (CBC News 🇨🇦) <- This is when it could have feasibly been a joke

January 7, 2025: Donald Trump is quoted in a press conference directly stating his intentions to annex Canada (New York Times, timestamp 0:45 🇺🇸) <- This is where Americans should have stopped telling Canadians it's just a joke

REPORTER 1: Are you also considering military force to annex and acquire Canada? DONALD TRUMP: No. Economic force.

February 7, 2025: Trudeau says Trump threat to annex Canada 'is a real thing' (BBC 🇬🇧) <- This is where the Commonwealth starts to take it seriously

Trudeau suggested Trump has floated the idea of taking over Canada and making it the "51st state" because he wants to access the country's critical minerals. "Mr Trump has it in mind that the easiest way to do it is absorbing our country and it is a real thing," the prime minister said.

February 9, 2025: "Trump's national security adviser: 'I don't think there's any plans to invade Canada'" (NBC News 🇺🇸) <- CANADIANS NOTICE THAT THIS IS NOT A VERY STRONG DENIAL OF POSSIBLE MILITARY FORCE

February 10, 2025: Trump Confirms He’s Serious About Wanting Canada As 51st State (Forbes 🇺🇸)

Fox News host Bret Baier asked Trump whether Trudeau was right in telling business leaders the U.S. president’s threat to absorb Canada is a “real thing,” to which Trump agreed with Trudeau and responded, “Yes it is.”

February 12, 2025: ‘Trump effect’: How US tariffs, ’51st state’ threats are shaking up Canada (Al Jazeera 🇶🇦) <- This is where the rest of the fucking world outside America starts to take it seriously

February 18 2025: CBC releases podcast episode: "What if the U.S. invaded Canada?" (CBC's Front Burner 🇨🇦)

March 4, 2025: Canada Eyeing NATO Ally's Nukes To Deter Trump 'Threat': Candidate (Newsweek 🇺🇸), British nuclear weapons can protect Canada against Trump, says Trudeau party candidate (The Telegraph 🇬🇧)

“I would be working urgently with [European Nato allies] to build a closer security relationship… in a time when the United States can be a threat,” said [Canada's] ex-foreign minister and finance minister at the final Liberal leadership debate last week.

March 4, 2025: Prime Minister Trudeau: "What he wants is to see a total collapse of the Canadian economy, because that’ll make it easier to annex us” (CTV News 🇨🇦)

March 7, 2025: BC Premier David Eby: “We know the president in back rooms with Canadian officials has said he wants to redraw the border" (Global News 🇨🇦)

Eby: "If this president wants to annex Canada, he should save his breath to cool his soup, it is never going to happen.”

March 7, 2025: How Trump’s ‘51st State’ Canada Talk Came to Be Seen as Deadly Serious (New York Times 🇺🇸) <- This is where American news media starts to treat this as maybe possibly not a joke

March 9, 2025: U.S. Congress bill aims to prevent funding of invasion of Canada (CTV News 🇨🇦) <- This is where you should understand that military force is ON THE TABLE

March 11, 2025: Canadian opinion of U.S. falls sharply; 63% take Trump's threats 'very seriously' (National Post 🇨🇦)

March 13, 2025 (TODAY): Trump threatens to acquire Canada, Greenland while next to NATO chief (Global News 🇨🇦)

“To be honest with you, Canada only works as a state...This would be the most incredible country visually,” [Trump] said. “If you look at a map, they drew an artificial line right through it, between Canada and the U.S., just a straight artificial line. Somebody did it a long time ago, many many decades ago, and it makes no sense.” -Donald Trump

And hey, just for fun, let's contrast that with another quote:

First of all, I would like to emphasize that the wall that has emerged in recent years between Russia and Ukraine, between the parts of what is essentially the same historical and spiritual space, to my mind is our great common misfortune and tragedy...I am confident that true sovereignty of Ukraine is possible only in partnership with Russia. -Vladimir Fucking Putin, the year before launching an attack on Ukraine, which everyone also said he was joking about and definitely wouldn't do (2021 essay, Kremlin official website 🇷🇺)

I know you're overwhelmed, Americans, but please stop saying this is a joke. Canadians are anticipating an invasion, possibly within the year. This is not a fucking drill.

5K notes

·

View notes