#law firm accountants

Explore tagged Tumblr posts

Text

Professional legal accountants play a crucial role in addressing these challenges and safeguarding the financial health and integrity of law practices. In this comprehensive guide, we delve into eight compelling reasons why law firms need the services of skilled and experienced accountants.

1. Expertise in Legal Accounting

The financial operations of law firms are unique, governed by a distinct set of regulations and compliance standards. Professional accountants specializing in legal accounting possess the requisite expertise to navigate these complexities effectively.

#accounting specialists#financial tax advisor#legal accountants#accountant for lawyers#law firm accounts#law firm accountants#accounting services#financial tax advice

0 notes

Note

Were you serious with the Baobhan Sith x Tametomo comment, because I'm not opposed I just wanna be sure

I am very serious im insane about them actually ive been for a few days

YOU SEE (under cut because i love using the read more thing)

IF YOU OVERTHINGK THESE SCREENSHOTS-

Picture me this, if you will *gets hit by a truck*

Tametomo getting so shocked when he sees Baobhan Sith because she looks so similar to his wife (either Neiwannyo who had the soul of his wife, or to actual Shiranuihime, or both)

Thats all

I have more delusions but thats enough for now

#ask#anon#while i do ship them i am also a firm believer that tametomo should get fck-- by gudao#specifically gudao#...i just had a thought.#im gonna have to put it in my brain for later#oh and yall wont see it because tumblr laws#maybe i'll actually use my priv twitter account

12 notes

·

View notes

Text

Simplify Your Finances with RFZ Accounting

Are you tired of the complexities of managing your business finances? Look no further than RFZ Accounting. As a leading provider of accounting services in Dubai, Sharjah, Abu Dhabi, and across the UAE, we're committed to helping you achieve financial success.

Our Comprehensive Services

Auditing: Ensuring accuracy and transparency in your financial records.

Bookkeeping: Streamlining your financial processes and maintaining accurate books.

Tax Planning and Compliance: Optimizing your tax liability and staying compliant with UAE tax laws.

Financial Advisory: Providing strategic financial advice to help you make informed decisions.

Why Choose RFZ Accounting?

Expertise: Our team of seasoned accountants stays updated on the latest financial regulations.

Efficiency: We utilize cutting-edge accounting software to streamline your operations.

Reliability: We provide timely and accurate financial reports.

Confidentiality: We maintain the highest standards of confidentiality.

Let us handle your financial needs, so you can focus on what matters most - growing your business.

Accounting Services in Dubai

Accounting Services in Sharjah

Accounting Services in Abu Dhabi

#accounting#finance#law firm#bookkeeping#accounting services in dubai#accounting services in sharjah#accounting services in Abu Dhabi

2 notes

·

View notes

Text

Reliance Corporate Advisors (RCA) is a leading professional service firm in Nepal, offering legal services and financial advisory from top lawyers and Chartered Accountants.

INTELLECTUAL PROPERTY AND TRADEMARKS IN NEPAL: PASSING OFF

1. INTRODUCTION

1.1. A significant purpose of trademark registration is protection of your brand in a competitive marketplace whereby your registered trademark provides a unique and distinguished identity to your products or services.

1.2. Section 2(c) of the Patent, Design and Trademark Act, 2022 (1965) (the “PDT Act”) defines a trademark as a word, symbol, or picture or a combination thereof to be used by any firm, company or individual in its products or services to distinguish them with the product or service of others.

1.3. All trademarks registered as per the PDT Act are entitled to protection from passing off and infringement. Section 16(2) of the PDT Act explicitly prohibits the copying or unauthorized use of a registered trademark without ownership transformation or written permission pursuant to Section 21 D of the PDT Act.

1.4. Section 19 of the PDT Act imposes penalties for illegal passing off and infringement, including fines and confiscation of goods, based on the gravity of the offense.

1.5. The Trademark Directives, 2072 (2015) (the “Trademark Directives”) ensure further protection to registered trademarks which are as follows:

1.5.1. To freely use the trademarks registered in their name.

1.5.2. To prevent other firms or companies from using the same trademark without permission in a manner that may cause confusion through display, viewing, speaking, hearing or other presentation.

1.5.3. To grant permission for trademark use to other firms or companies under certain conditions for a specific duration.

2. PASSING OFF AS THREAT TO TRADEMARKS

2.1. The Department of Industries (the “DOI”), a quasi-judicial industrial property authority under the Ministry of Industry, Commerce, and Supplies in Nepal, is responsible for the regulation and protection of all registered trademarks.

2.2. Any allegations of trademark infringement or passing off can be brought before the legal division of DOI. DOI has the authority to conduct hearings and issue rulings akin to those of a District Court in the country. Moreover, if parties are dissatisfied with the DOI’s decision, they have the option to appeal such decision to the High Court and eventually to the Supreme Court of Nepal, if such appeal meets the criteria of law.

2.3. Despite statutory provisions and legal precedents upholding trademark rights, Nepal faces significant challenges with trademark infringements and passing off cases.

2.4. Passing off occurrences, especially with well-known trademarks, are increasing, posing a threat to consumer rights and intellectual property protections.

2.5. “Well-Known Mark” has been defined under Section 2(f) of the Trademark Directives as a mark specified by the Government of Nepal (“GoN”) to be well-known. Nevertheless, as of the present date, GoN has neither released nor clarified the criteria for recognizing a well-known mark. This leaves the definition open to interpretation by the courts and DOI; some instances of courts interpretation have been discussed in paragraph 5 below.

2.6. While case precedents protect well-known trademarks, the lack of clear legal provisions raises doubts and potentially deter multinational corporations from trusting brand protection in Nepal.

3. WHAT CONSTITUTES AS PASSING OFF?

3.1. A trademark passing off is said to have occurred when a party, typically a business or individual, misrepresents their goods or services in a way that creates confusion or deception amongst the consumers, leading them to believe that the goods or services are associated with another party’s established trademark.

3.2. Goodwill, built through consistent branding, production, and advertisement, is a crucial element in passing off cases. When another competitor passes off on this goodwill of another trademark, the consumers are the ones who must face the direct hit as they might end up with subpar products or services under the mistaken belief that they are associated with the legitimate brand.

3.3. Lord Langdale MR, in the case of Perry v Truefitt, said that “a man is not to sell his own goods under the pretence that they are the goods of another trader”.

3.4. From interpretation and as a matter of practice to establish passing off, certain key elements need to be present such as:

3.4.1. The existence of goodwill: Claimant has to showcase the goodwill or reputation that they have built around its brand through its consistent branding, production, supply, and advertisement in a particular market or amongst a niche of consumers.

3.4.2. Misrepresentation: A clear misrepresentation from the alleged infringing party has to be demonstrated, that could deceive or confuse consumers into believing that.

3.4.3. The likelihood of confusion.

3.4.4. Actual or potential damage.

3.5. For instance, producing and selling a cold drink with its packaging, symbols, words, and colour combinations like that of Sprite, (a well-known trademarked soft drink product), with just a few tweaks and changes of letters or adding prefixes or suffixes on the mark construes as passing off.

4. WHAT ARE THE REMEDIES ONE CAN SEEK AGAINST PASSING OFF?

4.1. As a first rule of the thumb, to ensure the protection of a trademark, the crucial step is its registration with DOI. As outlined in Section 21B of the PDT Act, “The title to any patent, design or trademark registered in a foreign country shall not be valid in Nepal unless it is registered in Nepal by the concerned person.” This implies that trademarks registered in foreign jurisdictions, even those within the state parties of the Paris Convention for the Protection of Industrial Property, 1883 (the “Paris Convention”), will not enjoy protection in Nepal unless they are registered locally.

Note: Internationally, recognized well-known marks, as evidenced in case laws (discussed in paragraph 5, below), receive certain protection due to their widespread popularity. However, such protections cannot be guaranteed for well-known marks, if unregistered.

4.2. As per law, the DOI must facilitate the registration of trademarks from foreign countries without conducting elaborate inquiries if an application is filed along with relevant certificates of registration in the foreign country. This is in alignment with the provisions of the Paris Convention, as per Section 21C of the PDT Act.

4.3. However, as a matter of practice DOI conducts its regular investigation (as applicable for local trademarks) even if prior filing right is claimed as per the provision above.

4.4. After the registration of a trademark, if an entity attempts passing off an already registered trademark, an opposition claim can be filed at the Law Division of the DOI within 90 days of the publication of the mark in the Industrial Property Bulletin (“IP Bulletin”). This is in accordance with Section 21A(2) of the PDT Act.

4.5. Pursuant to Section 24(2) of the Trademark Directives, the opposition can also be filed in another language, provided that a notarized Nepali translation of the opposition claim is attached.

4.6. Upon the filing of the opposition, the DOI will refrain from issuing a trademark registration certificate for the opposed mark. The opposition will go through a similar process of litigation whereby the Parties will be called for hearings and the DOI will provide its decision on the opposed mark.

4.7. If either party is dissatisfied with the DOI’s decision, they have the option to appeal at the High Court within 35 days from the date of the decision.

4.8. On a different note, Section 25 of the Trademark Directives also provides administrative and judicial bodies for the enforcement of trademark rights. These are:

4.8.1. District Administration Office

4.8.2. Nepal Police

4.8.3. Customs Offices

4.9. These offices have been vested with the responsibility to work individually or collaboratively within their jurisdictions.

4.10. The collaborative efforts of the DOI and the mentioned administrative agencies can significantly enhance the protection of industrial property rights held by businesses, ensuring a healthy market environment for both consumers and competitors.

5. CASE LAWS RECOGNIZING THE PROTECTION OF WELL-KNOWN MARKS:

5.1. Kansai Nerolac Paints Limited v. Rukmani Chemical Industries Pvt. Ltd., NKP: 2077, Decision №10561.

5.1.1. Earlier, Rukmani Chemical Industries had registered the Kansai Nerolac Paint Nepal Pvt. Ltd. at the DOI, leading to the DOI prohibiting Kansai Nerolac Paints Limited, a Japanese multinational corporation, from using the Kansai Nerolac brand. Following an extensive legal battle in the DOI, High Court, and Supreme Court, the Supreme Court ruled in favour of Kansai Nerolac Paints Limited, establishing key principles:

5.1.1.1. “Deceptive similarity” is said to be constituted if a trademark or the words used are identical, or the trademark is displayed with modifications, such as the addition of prefix or suffix, creating a phonetic similarity with minimal dissimilarity and if presented in a similar manner at first glance.

5.1.1.2. Time limitation is not applicable for revoking the registration of a trademark if it is registered with bad faith or the registration process seems malafide.

5.1.1.3. Ownership and right over a trademark of a foreign company does not end only by virtue of the registration of such trademarks by a local company. Even after the registration of a mark copied from a well-known foreign mark by a local company, if the foreign company applies for registration of the mark at a later date, the registration in the name of the local company automatically ends.

5.2. Virgin Enterprises Limited v. Virgin Mobile Pvt. Ltd., 12 June 2023, Department of Industries

5.2.1. An opposition was filed by Virgin Enterprises Limited (“Virgin Enterprises”), a member company of the Virgin Group against Virgin Mobile Pvt. Ltd., a local company for the ownership on the mark “VIRGIN (and logo)”. Virgin Enterprises had registered their mark in Class 9 and 38 whereas the local company Virgin Mobile Pvt. Ltd. (“Virgin Mobile”) was seeking to register the mark in Class 35.

5.2.2. The DOI rejected the application of Virgin Mobile based on the following:

5.2.2.1. The “VIRGIN” mark has been registered and used by Virgin Enterprises in Nepal and other countries and thus is a well-known mark belonging to Virgin Enterprises

5.2.2.2. The mark in question, “VIRGIN (and logo)” did not appear to be the original creation of Virgin Mobile.

5.2.2.3. Virgin Mobile filed the application in bad faith.

5.2.2.4. Allowing registration of the mark in the name of Virgin Mobile will adversely affect the goodwill of Virgin Enterprises and cause confusion among consumers.

5.2.3. The DOI also reiterated its position that a well-known mark shall receive protection not only in the class in which it has been registered but also in other classes as well as in non-competing goods and services where the well-known mark does not have registration.

5.3. Six Continents Hotel Inc. V Holiday Express Travels and Tours Pvt. Ltd., 10 July 2023, Department of Industries.

5.3.1. An opposition was filed at the DOI by Six Continents Hotel Inc. (“Six Continents”) for their trademark “HOLIDAY INN EXPRESS” registered in Class 43 in Nepal against a local company Holiday Express Travels and Tours Pvt. Ltd. (“Holiday Express”) which had filed to register its mark “HOLIDAY EXPRESS TRAVELS AND TOURS (and logo)” in Class 35.

5.3.2. Six Continents opposed this application claiming that “HOLIDAY INN” marks are globally well-known marks and the application was filed in bad faith and can confuse the public.

5.3.3. The DOI made the following determination in the given case:

5.3.3.1. HOLIDAY INN marks have been registered and are used by Six Continents in Nepal and other countries and thus are well-known marks belonging to Six Continents.

5.3.3.2. Holiday Express’s proposed mark does not seem to be its original creation and the application has been made in bad faith.

5.3.3.3. Allowing registration of the “HOLIDAY EXPRESS TRAVELS AND TOURS (and logo)” mark to Holiday Express Nepal can adversely affect the goodwill of Six Continents and therefore shall cause confusion among consumers.

For more details go to: https://reliancecs.co/

#law firm#legal services#financial services#financial consultant#chartered accountant#arbitration#advocate#intellectual property#disputeresolution#corporate law firm#corporate lawyers in nepal#legal advice

3 notes

·

View notes

Text

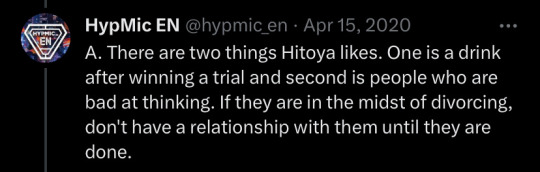

hitoya likes people who are bad at thinking and i assume that’s because it’s easier to steamroll over them to get his desired result and i wish we got to see that side of him more often lol

#vee queued to fill the void#this was a wild question he got asked btw lmao#the bat rep skit where he swindles kuukou and jyushi into his favour is peak grey hitoya lol we should get more#it doesn’t have to be as overt as rei’s general conman schtick or hitoya himself willing to fabricate evidence to get his way lol#just more situations where you see he’s a bit of an asshole too LOL#it would have also been fun to see more of his money grubbing personality too lol#like it’s connected to his high class taste and desire to have the best where the pay off is that he wants to share that with his team#but man he bragged he enjoys looking at his bank account for fun lol pls give us more of that#i like it when bat are visibly chaotic good lol!!!!!!#kuukou making a steam bath for temple patrons but then sabotaging it to show them if they can suffocating steam they can handle anything!!!!#hitoya lowkey shading this girl by saying this is common sense but come to my law firm and i’ll make sure you win!!!!!#and while i’m at it i wish jyushi was Slightly more narcissistic lol!!!!!#he likes looking in mirrors so that makes him narcissistic????? he lacks confidence he’s literally hyping himself up?????#i don’t need terra charisma house levels of narcissism lmao just let jyushi flex sometimes lol#some guy: wow that was amazing jyushi!!!!! jyushi: i know✨#at least that!!!!!!!! confident jyushi in all aspects arc WHEN 😭😭😭😭😭😭

11 notes

·

View notes

Link

Learn how to set up your law firm's chart of accounts with this easy-to-follow guide, designed to help you keep track of your finances and optimize your business operations.

#Law Firm#Chart of Accounts#lawyers#legal professionals#attorneys#in-house counsel#legal counsel#Solicitors

4 notes

·

View notes

Text

on the consideration list for winter 2026 for a mid size firm!!!! yeah!!!

#avery.txt#i love saying firm bc ppl immediately think i'm in law like no girl. sorry. accounting. less interesting

1 note

·

View note

Text

#Lawyers#Attorneys#Bookkeeping#remote bookkeeper#smallbusiness bookkeeping#monthly bookkeeping#outsource bookkeeping#small business bookkeeping#Law Firms#Accounting

0 notes

Text

As a lawyer looking to grow your client base, reaching the right audience at the right time is crucial. Geofencing advertising can be a game-changer for connecting with potential clients in your local area. This innovative strategy offers targeted, location-based marketing that can boost your attorney lead generation efforts effectively. By focusing on these key areas, geofencing helps you deliver timely ads to people who may need your services. This approach is especially effective for practices looking to generate injury leads for lawyers, as it allows you to target people who might require immediate legal assistance.

#attorney lead generation#lawyer lead gen#lawyer leads#lead generation for lawyers#law firm lead generation#family law lead generation#leads for legal#legal leads#accounting#branding

0 notes

Text

A Beginner's Guide to Law Firm Accounting

For new law firm owners, understanding the basics of accounting is crucial for managing finances effectively. Law firm accounting involves unique practices, such as separating trust accounts from operating accounts to ensure compliance with ethical standards. Accurate tracking of income, expenses, and billable hours is essential for transparency and profitability. Regularly reviewing financial reports, including profit-and-loss statements and balance sheets, provides insights into the firm’s financial health. Investing in legal-specific accounting software simplifies invoicing, expense management, and trust account reconciliation. Additionally, mastering cash flow management ensures your firm can cover operational costs and plan for growth. By learning these fundamentals, lawyers can build a financially sound practice and focus on delivering excellent client service.

Understanding the Basics of Law Firm Accounting

Law firm accounting differs from standard business accounting due to specific requirements like managing trust accounts and tracking billable hours. Learning these fundamentals is essential for new law firm owners to maintain ethical compliance and financial stability.

The Role of Trust Accounts in Legal Practices

Trust accounts are used to hold client funds and must remain separate from operating accounts. Lawyers must ensure precise record-keeping, regular reconciliation, and compliance with trust account regulations to avoid legal and ethical issues.

Separating Personal and Business Finances

A key step in effective accounting is keeping personal and business finances distinct. Opening a dedicated business bank account simplifies tracking income and expenses, aids tax preparation, and ensures financial transparency for the law firm.

Tracking Income, Expenses, and Billable Hours

Accurately tracking all income sources, expenses, and billable hours is crucial for understanding a law firm’s financial performance. Implementing systems to record these metrics helps streamline invoicing, monitor profitability, and maintain organized records for tax purposes.

Leveraging Accounting Software for Efficiency

Legal-specific accounting software automates many accounting tasks, such as invoicing, financial reporting, and trust account reconciliation. These tools reduce manual errors, save time, and provide detailed insights into the firm’s financial health, making them invaluable for new law firm owners.

Understanding Financial Reports and Metrics

Financial reports, such as profit-and-loss statements, balance sheets, and cash flow reports, provide a clear picture of your firm’s performance. Regularly reviewing these reports allows lawyers to identify trends, control costs, and make data-driven decisions.

Tax Compliance and Planning for Law Firms

Taxes are a significant aspect of accounting for law firms. Stay informed about allowable deductions, such as office expenses, continuing education, and technology costs. Working with an accountant or tax advisor helps ensure compliance and optimize tax planning strategies.

Conclusion

Accounting is a vital skill for new law firm owners to master. By understanding trust accounts, maintaining accurate records, and leveraging tools like accounting software, lawyers can ensure financial compliance and profitability. A strong accounting foundation not only builds a sustainable law practice but also allows lawyers to focus on providing excellent client service.

0 notes

Text

Private Tax Audits Are Mandatory for Any Business Now

Have you ever hired professionals for private tax audits? In this blog, we have talked about the use of private audits, the benefits we can have, and more. Read the full write-up carefully to learn more.

Visit> https://shorturl.at/n4O7I

0 notes

Text

The Importance of Accurate Billing and Invoicing in Law Firm Accounting

Accurate billing and invoicing are crucial components of law firm accounting, ensuring financial transparency and maintaining client trust. Lawyers must track billable hours meticulously, ensuring that every service is correctly billed to clients. Inaccurate or inconsistent billing can lead to disputes, loss of client confidence, and potential legal consequences. A streamlined invoicing system also helps law firms maintain cash flow and reduce delays in payments. By using specialized legal billing software, law firms can automate invoicing, track time efficiently, and generate accurate statements with ease. In addition, adhering to clear billing practices ensures compliance with professional ethics and standards. Ultimately, accurate billing and invoicing contribute to the financial health and success of a law firm.

Why Law Firm Accounting Is Crucial for Your Practice’s Success?

Law firm accounting is a cornerstone of any successful legal practice. Beyond simply tracking revenues and expenses, it ensures that your practice operates efficiently, remains compliant with legal regulations, and maintains profitability. An effective accounting system helps law firms manage client trust funds, billable hours, and taxes, which are all unique to the legal industry. It also provides a clear financial picture, enabling law firm owners to make strategic decisions and allocate resources effectively. Without proper accounting, law firms may risk running into legal complications, losing track of payments, or experiencing financial instability.

Key Components of Law Firm Accounting Every Lawyer Should Know

To maintain a successful law practice, understanding the fundamental components of law firm accounting is essential. Key areas include managing client trust accounts, tracking billable hours, maintaining accurate invoices, and preparing for taxes. Trust account management is especially critical, as improper handling can result in significant penalties or even the loss of a law license. Moreover, lawyers must keep detailed records of time spent on client matters, which directly influences billing accuracy. Understanding deductions and credits also plays a role in effective tax planning. These components work together to ensure that law firms comply with regulations and operate efficiently.

How to Manage Client Trust Accounts in Law Firm Accounting?

Managing client trust accounts is one of the most important aspects of law firm accounting. Lawyers often hold client funds in escrow for various purposes, such as settlements or retainer fees. These funds must be kept separate from the firm's operating funds, and strict rules govern their use. Inaccurate handling of these accounts can lead to violations of state bar rules, potentially resulting in severe disciplinary actions. To avoid this, law firms must keep detailed records of all transactions, conduct regular reconciliations, and implement specialized trust accounting software to simplify the process and ensure compliance.

Law Firm Billing and Invoicing: Best Practices for Accurate Financial Management

Billing and invoicing are fundamental to law firm accounting, as they directly impact cash flow and client relationships. Lawyers must track billable hours accurately and ensure that their time is recorded in real-time to avoid discrepancies. Once time is recorded, it must be converted into invoices that are clear, accurate, and aligned with client agreements. Transparent invoicing practices help maintain client trust and reduce disputes over charges. Implementing specialized legal billing software can automate these tasks, providing accurate and timely invoices while minimizing human error. By following best practices, law firms can ensure consistent revenue collection and smooth client interactions.

Choosing the Right Law Firm Accounting Software for Streamlined Operations

Investing in the right accounting software is a smart move for any law firm looking to streamline its financial processes. Law firm accounting software can automate several tasks, such as tracking billable hours, managing trust accounts, and generating invoices. Popular software options like QuickBooks, Clio, and Xero are designed specifically for legal practices and include features tailored to the unique needs of law firms. These tools also integrate with other practice management software, making it easier for lawyers to manage both their legal work and financial records in one place. Choosing the right software can save time, reduce errors, and ensure better financial oversight.

Tax Planning and Compliance for Law Firms: Avoiding Penalties and Maximizing Savings

Tax planning is an essential aspect of law firm accounting, and careful attention to tax details can lead to significant savings for your practice. Lawyers must understand the various deductions available to them, such as expenses for continuing education, office supplies, and business-related travel. Additionally, they need to account for taxes on their income, self-employment taxes, and any other applicable fees. Failing to comply with tax regulations can result in hefty fines or audits. By consulting with a tax professional or accountant and implementing an organized accounting system, law firms can minimize their tax liabilities while ensuring compliance with federal and state tax laws.

Financial Reporting and Key Metrics for Law Firm Accounting

Accurate financial reporting is critical for making informed decisions about your law firm’s future. Key metrics in law firm accounting, such as profit margins, client payment cycles, and operating expenses, help evaluate the financial health of your practice. Regular financial reporting ensures that you can track progress against business goals, forecast future growth, and identify areas where cost-cutting or investment might be needed. Lawyers should routinely review financial statements, including balance sheets, income statements, and cash flow reports, to ensure that their law firm is operating within its means and remains profitable in the long term.

Conclusion

In conclusion, law firm accounting is a critical aspect of running a successful practice. From managing client trust accounts to ensuring timely billing and tax compliance, each component plays a vital role in a law firm's financial health. By adopting best practices in financial management, utilizing specialized software, and staying proactive about tax planning, lawyers can streamline their operations, avoid costly errors, and maintain compliance with legal standards. Effective accounting ensures that law firms stay financially stable, allowing them to focus on providing exceptional legal services to their clients. Ultimately, mastering law firm accounting leads to greater profitability, long-term growth, and success.

0 notes

Text

#mainland company formation in dubai#business setup in dubai#business setup services dubai#offshore formation dubai#out source pro services in dubai#law firms in dubai#pro services in dubai#personal bank account opening in dubai#freezone company formation#golden visa services#Personal Account Opening Services Dubai#Account Opening Services#PRO Services#Golden Visa Services in Dubai#Visa Solution Services#offshore company formation services

0 notes

Text

What to do with an accounting degree?

There are a lot of things you can do with an accounting degree. With multiple career paths in public accounting and private industry. You can even start your own business or break into finance.

1. Public Accounting

If you join a large public accounting firm like one of the big four, you'll likely have three paths to choose from: (1) Audit, (2) Tax, and (3) Consulting.

Audit draws heavily on your knowledge of financial accounting. You'll fins yourself doing bank reconciliations, counting inventory, or reviewing depreciation of fixed assets. There's a lot of travel involved and you might find yourself traveling to a different client's office each week.

In tax you'll be using software to prepare clients tax returns and other filings. If you stick with it and get promoted, you'll eventually shift from tax compliance(preparing and submitting forms), to tax advising (proposing strategies to maximize your client's after tax income).

In consulting, there are a bunch of things that you can do. (1) Strategy consulting, (2) Risk management, (3) Technology consulting. You might provide guidance for business restructuring or help clients choose and implement software that will help them analyze their data.

Large public accounting firms like the big four, want their employees to have the highest accounting certification.

2. Private Industry

Whereas with public accounting, your working for an accounting with multiple clients, with private industry, you're working for a single company.

Staff Accountant: Making journal entries, balancing the bank account, or doing payroll

Cost Accountant: Tracking cost, analyzing profitability.

Internal Auditor: Safeguarding the company's assets, and looking for ways to improve the company's operational efficiency.

3. Accounting Firm

It helps if you have an accounting credential like the CPA. However, there are small accounting firms where no one is a CPA. They primarily handle bookkeeping and taxes for small businesses. As your firm grows, you might offer additional services like business evaluation or financial planning.

4. Finance jobs

Most of the students who majored in accounting, took jobs in investment banking.

You can also use your accounting degree to get hired as a financial analyst, credit analyst, or a budget analyst. These positions don't typically require you to have an accounting certification. However, they do require you to have strong knowledge with accounting.

5. Honorable Jobs

Accounts receivable, Accounts payable, Accounting clerk. You'd be overqualified if you have an accounting degree and pursued jobs like that.

You might also hear about forensic accounting. However, it is reserved for people with years of experience. If you're interested in that path, you might start a job in internal auditing.

#career#career path#accounting#finance#audit#firm#accounting firms#accounting services#public accountant#big four#cost accounting#forensics#accounts payable software#accounts receivable#non profit#tax#services#financial#bookkeeping#payroll#cpa#cpafirm#business consulting#business#sales

#career#students#job#employees#career path#personal finance#investing#investors#audit#cpa#payroll#services#business#business consulting#firm#law firm#gains#accounting#startup#finance#accounting services#public accountant#big four#cost accounting#accounts receivable#accounts payable services#accounts payable outsourcing#profit#tax#consulting

1 note

·

View note

Text

Law Firm in Nepal : Reliance Corporate Advisors

Reliance Corporate Advisors (RCA) is a premier professional service firm in Nepal, established as an associate of Reliance Law Firm in 1995, offering a wide range of corporate advisory services. The firm comprises a dedicated team of corporate lawyers and chartered accountants who specialize in various sectors, including foreign investment, corporate litigation, and financial advisory services. RCA is committed to delivering expert legal and financial solutions tailored to meet the unique needs of its clients, ensuring both immediate and long-term success.

Key Points Reliance Corporate Advisors is associated with Reliance Law Firm, established in 1995. The firm offers comprehensive corporate advisory services in Nepal. RCA specializes in areas like foreign investment, business incorporation, and dispute resolution. The firm's expertise extends to sectors such as banking and finance, labor law, and intellectual property law. RCA includes a team of skilled professionals, including some of the top lawyers and advisors in the country. The firm aims to deliver effective legal and financial guidance to meet clients' diverse needs. RCA is committed to helping clients achieve both short-term and long-term objectives.

For more details please visit: https://reliancecs.co/

#law firm in nepal#lawyers#chartered accountant#law firm#legal services#financial services#taxes#taxation#accounting

1 note

·

View note

Text

The Complete Guide to Law Firm Accounting for Financial Success

This guide covers essential accounting principles, including billing, trust accounting, expense tracking, and compliance with legal regulations. It helps law firms streamline their financial processes, improve cash flow management, and make informed decisions to boost profitability. With practical advice and expert tips, this guide ensures legal professionals understand how to maintain accurate financial records while maximizing their firm's financial performance, ultimately leading to long-term success and growth in a competitive legal landscape.

Understanding the Basics of Law Firm Accounting

Law firm accounting differs from traditional business accounting due to the unique financial responsibilities law firms handle, including client trust accounts and time billing. Understanding these basics is essential for ensuring compliance and maintaining financial stability. This section introduces key concepts such as accrual vs. cash accounting, legal fee structures, and revenue recognition. By mastering these fundamentals, law firms can build a solid financial foundation that promotes accuracy in reporting and helps avoid costly mistakes.

The Importance of Trust Accounting in Law Firm Accounting

One of the most critical aspects of law firm accounting is trust accounting. Lawyers often manage client funds in trust accounts, which must be handled with extreme precision and transparency. Mishandling these funds can lead to severe legal consequences, including disbarment or lawsuits. This section explains the importance of trust accounting, how to track client funds, and the best practices for maintaining compliance with regulatory requirements. Proper management of trust accounts ensures client confidence and protects the firm from potential financial liabilities.

Managing Expenses and Overhead in Law Firm Accounting

Effective law firm accounting requires careful attention to the firm's expenses and overhead. Managing costs like rent, payroll, software, and operational supplies can significantly impact a law firm’s profitability. This section delves into the strategies for budgeting, tracking, and minimizing overhead expenses without compromising the quality of service. It also explores how law firms can benefit from modern financial software that automates expense tracking, offering greater visibility into spending patterns. Smart expense management is a cornerstone of long-term financial success for any law firm.

Invoicing and Billing: Key Components of Law Firm Accounting

Billing and invoicing are central to law firm accounting. Legal services are typically billed on an hourly, flat fee, or contingency basis, and accurate invoicing is vital to maintaining strong client relationships. This section discusses the different billing structures used by law firms and highlights best practices for creating clear and transparent invoices. It also covers the role of automated billing systems in speeding up payments and improving cash flow management. Ensuring that clients receive accurate, detailed invoices helps prevent disputes and ensures timely compensation for legal services.

Financial Reporting and Analysis in Law Firm Accounting

To ensure long-term financial success, law firms need to generate and analyze financial reports regularly. This section explains the importance of tracking key financial metrics such as revenue, profitability, and cash flow. By understanding these reports, law firms can make informed decisions on resource allocation, client management, and strategic growth. Common financial statements covered include balance sheets, income statements, and cash flow reports. With accurate reporting, firms can identify financial trends, adjust their strategies, and drive sustained profitability.

Ensuring Compliance in Law Firm Accounting

Compliance is a crucial component of law firm accounting. Law firms must adhere to various financial and legal regulations, including IRS requirements, local bar rules, and ethical guidelines related to client trust accounts. Failure to comply with these regulations can result in penalties, sanctions, or damaged reputations. This section covers the common regulatory requirements law firms face and offers practical tips for maintaining compliance. By staying updated with accounting standards and legal regulations, firms can avoid costly penalties and maintain a trusted standing in the legal community.

How Technology is Revolutionizing Law Firm Accounting?

Technology plays an increasingly important role in law firm accounting, helping firms automate processes, reduce errors, and improve efficiency. This section explores the various accounting software options available for law firms, such as time tracking tools, billing systems, and trust account management platforms. The adoption of cloud-based accounting solutions allows law firms to access real-time financial data and collaborate more effectively across teams. By embracing technology, law firms can streamline their financial operations, improve accuracy, and gain valuable insights into their financial performance, leading to better decision-making and long-term success.

Conclusion

The Complete Guide to Law Firm Accounting for Financial Success offers a comprehensive approach to managing your legal practice’s finances with precision and efficiency. This guide covers essential accounting principles tailored for law firms, including trust account management, revenue recognition, and expense tracking. By following the best practices outlined, law firms can improve their financial health, ensure compliance with industry regulations, and maximize profitability. Whether you’re a solo attorney or managing a large firm, this guide provides valuable insights and tools to streamline your accounting processes and achieve long-term financial success in the legal industry.

0 notes