#junk book

Explore tagged Tumblr posts

Text

Beat the quilting desires (for now) by sewing a little junk book.

Assembling the signatures. The yellow paper makes up the bulk of the book; it's the last dozen or so tea-stained pages of a yellow notepad. The rest is some green tissue paper I found and immediately saved, a drawing I did on the back of some job training stuff, cut up trader Joe's paper bag, and a stanped parchment paper bag from a store that I kept largely intact, so it can still hold things.

Ive sewn a lot of chapbooks in my time but just single signature ones as far as I recall. So the signature sewing went fine and the part where I sewed the signatures together went not as well. But it's a junk book, who cares. And I learned valueable lessons like 'even stitches actually matter now just on a structural level' and 'why would you do this with a fan pointed at you'.

Its 46 pages long. The cover is a sparkling canned water box I cut up with bits from the only newspaper I am subscribed to (thru my union), which is a union newspaper. The cover decoration is what I thought was the most interesting article that neatly fit--Amazon union joins Teamster.

I did everything in a very backwards order and put myself in a position where I needed to glue like 20 sticky notes to this thing, and then realized I actually don't have to, and didn't. It would look nicer if I had, but I'm glad I didn't. That's the exact opposite point of this kind of book.

Funnily enough the only thing I didn't add, out of these random scraps I found/saved but hadn't packed yet (I have tons of bits of interesting paper, all of it packed right now) was the one piece that made me do this book anyway; a baffler subscription sticky note that has a stamp of a shoe on a banana peel. I thought it wasn't bad. No idea where it went tho; may well have been one of the sticky notes I folded up and used to spread the glue. Oh well.

It wasn't intended to be labor themed, but at least it's relevant. Idk what I'll write in it, if anything. Good detour altho I didn't really have time for it. I like it though.

#junk book#theres probably another name for these#i havent made one in a long time and i guess i forgot everything id learned#really proud of the binding even tho it looks bad. its way more secure than if id glued it#i did mean to also glue it. just forgot#art

31 notes

·

View notes

Text

Junkbook Shop

In light of my immanent move to South Korea, I am opening an (unofficial) shop for my craft! My hobby is called junkbooking, and it's similar to scrapbooking except each page is based off of a color or a concept. I have pages based on color, as well as some based on different Stray Kids songs or the boys themselves!

If you don't see something you like but would like something like this, feel free to message me and we can work on a commission. When I move to Korea, I won't have my materials so commissions are open until August 18th, 2024. I only have stickers for Stray Kids, so I will be unable to accept K-pop commissions for other groups.

The quantity of each page is exactly one, as each one is unique! To peruse the shop This Link will take you to Google photos where you can see all of the pages up for grabs and the prices attached! Every craft is under $8!

To place an order please fill out this form!

Thank you and happy browsing!

#junkbook#junk book#crafting#stray kids#stray kids craft#south korea#seoul#art commisions#art comms open#sticker#sticker art#kpop art#art shop#sticker shop#yonsei university#yonsei#lizzy talks

14 notes

·

View notes

Text

Oh Mitski you wound me

I did the coloring with face paint crayons admittedly I couldn’t find my poscas

#trans artist#also don’t steal my art i’m broke#traditional art#sketch#sketchbook#junk book#bugs#art#stars#beautiful women#flowers#outer space#face paint#mitski#lyrics#quotes#religious trauma

2 notes

·

View notes

Text

I'm reading "Junk" by Melving Burgess and it's honestly fucking up my mental health because the spirituality from Rob and Lily... I've seen it. When I was severely addicted to weed, all my social interactions were around smoking basically and I've met so many Lilies and Robs and Gemmas. I was kind of a Gemma too, at the time. And I got so heavily engulfed in these fake spirituality bullshit that serves the one and only purpose of enabling your addictions and behaviours. I never got addicted to "harder" drugs than weed and alcohol but the reasoning and way of thinking was the exact fucking same, the "free spirited and loving home" I had who progressively became more and more rotten because of addiction was the same, the "soul sisters" shit... That last thing prevented me from leaving my abusive girlfriend for years because we were "meant to be together".

I love the book so far, for damn, that hits so hard.

#genderqueer#trans#lgbtqiaplus#lgbtqia#book#queer#transgender#books and reading#books#booklr#junk#melvin burgess#junk book#tw drug#tw drugs#drug abuse#spirituality

6 notes

·

View notes

Text

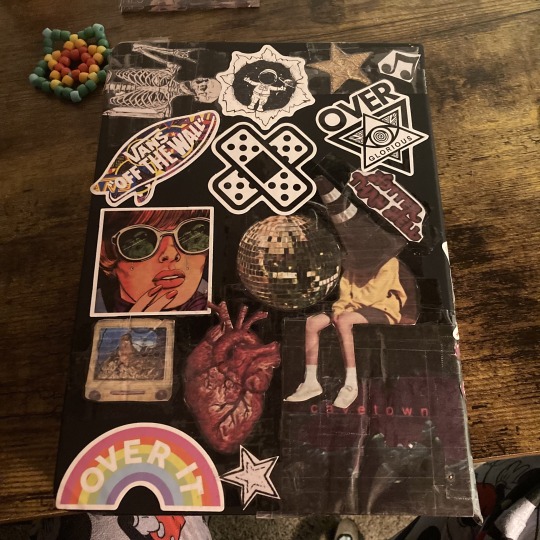

New junk book

3 notes

·

View notes

Text

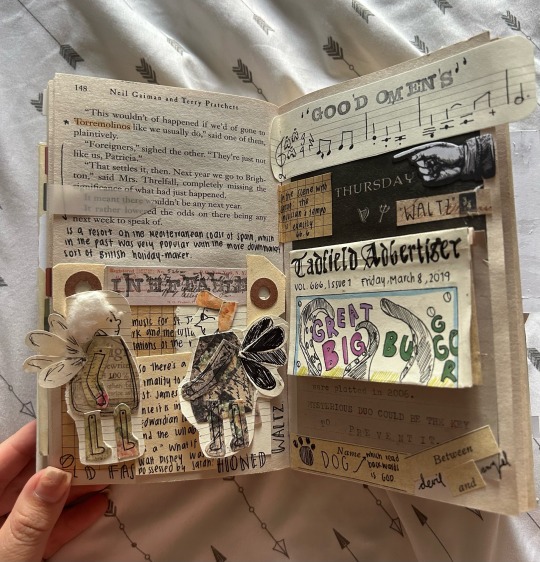

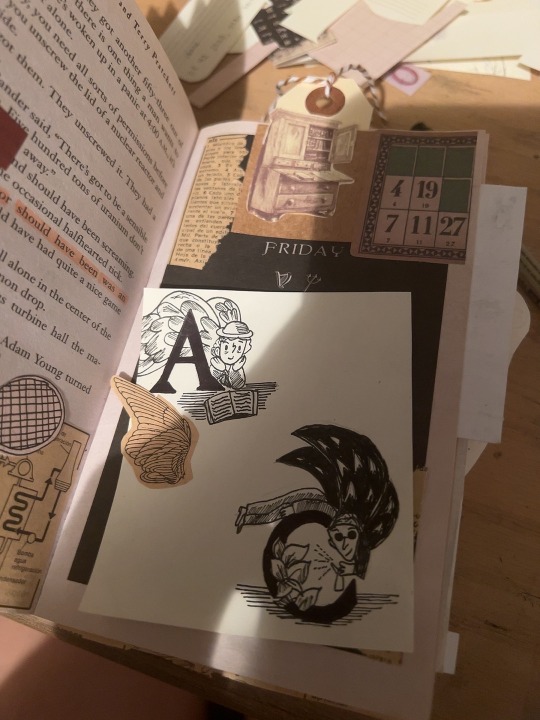

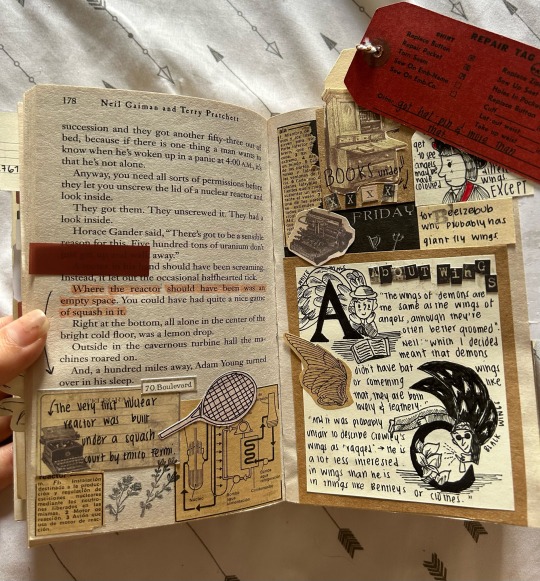

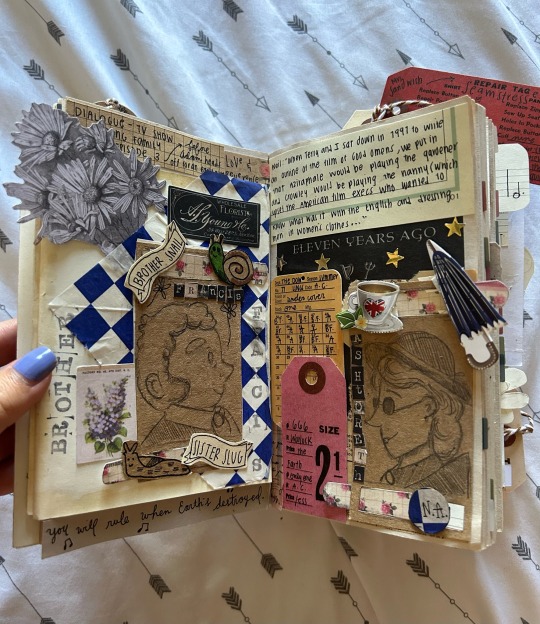

Since it is world book day, I thought I would share once again one of my most heavily annotated, scrapbooked, lived in books- Good Omens.

I usually scrapbook inside my books, but this one is the only one that has things in almost every single page. These are just the pages with double spreads.

To the book that saved me and to Terry Pratchett and @neil-gaiman , thank you 🥂.

I did add some image descriptions. So you get some clues about all the things I put in each spread.

(Because someone asked in the tags: “how can you read it? Reread it??”

Well simple answer: this edition,like many others, happen to have black pages with just the days of the week printed on them, which I left visible, and plenty of empty spaces where I glue/draw everything else, so nothing is covered at all. Plus having so much stuff inside has actually made it easier to open. )

#good omens#crowley#aziraphale#ineffable husbands#neil gaiman#terry pratchett#good omens fun facts#good omens annotations#scrapbooking#junk journal#world book day

3K notes

·

View notes

Text

the sound of rain

#moodboard#aesthetic moodboard#academia aesthetic#art academia#dark academia moodboard#classic academia#dark academia#academics#student life#studying#junk journal#journal#journaling#diary#classic#romantic academia#romantic#dark romanticism#dark and moody#dark aesthetic#dark acadamia quotes#books#old aesthetic#chaotic academia#chaotic academic aesthetic

534 notes

·

View notes

Text

This is not a dream my friend, and it will never end. This one is the nightmare that goes on

#myart#illustration#gravity falls#stanford pines#fanart#the book of bill#does this count as book of bill spoilers-#if it’s vague enough hopefully it’ll be fineeee#this is WILDLY different from my usual postings BUT!! IN MY DEFENSE!!#…book of bill#and now I’ve dived head first back into Gravity Falls-#will probably post a few sketches an such about GF later#just to keep myself sane while I finish my snm junks#also good luck with those lil codes#don’t worry they’re super easy I ain’t smart enough for anything complicated

2K notes

·

View notes

Text

As a long time httyd fan who has been heavily involved in the fandom since the first movie and who has spent years working in the animation industry, I’d like to share my thoughts on the new httyd movie. Keep in mind, this is just my personal opinion and it's completely fine if you disagree with me. I just want to say a little something about all this that really bothers me.

The core reason that Dreamworks and Universal made this film is that it’s a quick and easy cash grab for them. Thats it. They don’t care about telling a good story or making a “better” version of the original movie for fans or even having an accurate portrayal of the characters/story. It’s purely about money. They know that fans of the original film will go see this movie, whether it’s good or bad. And those guaranteed ticket sales are all that matter to the studios. And with Universal, it has the added bonus of being a cheap promotional and merchandising opportunity for the new HTTYD land in Orlando that opens around the same time that the film is premiering in theaters.

And to help the studios make even more money out of this, they are using non-unionized VFX companies around the world to make this film, so that they can get cheaper labor and push the artists to do more that would be against American union standards. The same thing has probably happened with the costuming and fabrication for the filming, hence why the costumes look un-weathered and the sets look cheap. They don’t want to pay for the extra time and effort that it would take to make the practical bits of the production look good.

On top of all this, Dreamworks has already announced that they’re shutting down all their in-house animation projects in favor of using AI and outsourcing projects to cheaper international non-union studios.

With all this in mind, I just can’t support this film and I will not be seeing it in theaters. And I hope that others will do the same.

The only way to stop all these horrible “live action” remakes (which are actually just realistically animated remakes) is to not buy tickets to see them. Money is all that matters to these studios, and if they don’t make any money off of it, then they will stop and try something different. Maybe they'll even go back to focusing on original stories!

That’s the power that we hold as audiences. Our wallets help drive the decisions that the executives make. So support unique storytelling and gorgeous cinematography in movies. Support indie films. Support animators as they're fighting for fair pay and better contracts. But don't support a mediocre shot-for-shot remake riding on the coattails of an already successful film.

And I just want to wrap all this up by saying I have absolutely no hate towards anyone that has worked on the new film. Toothless looks incredible and I know the artists and creatives involved in this project did the best they could with what they were given.

But I also know that those same artists have so many more brilliant ideas that they would’ve loved to be given the creative freedom to do. I just wish hollywood would be willing to take a chance and let them do it.

#they could've made a film following the plot of the httyd books or even a different pov of what happened in Berk from a vikings view#those would've been much better options if they really wanted to utilize this IP in a live action or realistic animation format#but they chose the cheap option of literally copying an already successful film and throwing actors in there to say its new and different#this whole thing bugs me so much#i hope you guys will excuse this rant but I hate what hollywood has become and I hate that creatives are forced to make this junk for them#all while fearing for their jobs because of rampant layoffs#please help put an end to hollywood abusing creatives in the way that they are and don't watch this movie#httyd#how to train your dragon#hiccup#toothless#movie#live action#dragon#astrid#stormfly#cosplay#art#artists on tumblr

679 notes

·

View notes

Text

scrappin'

#junk journal#scrapbooking#journalling#collage#my art#i found this discarded thumbelina book..and like on every page she looks empty inside. makes u think.#journal tag

423 notes

·

View notes

Text

My recent lyrics scrapbook pages :3

*:・゚. ✧* .。.:*・. ゜. (●’◡’●). *:.。. .。

Grey printouts aren’t a stylistic choice , my printer is just broken 💔

#moodboard#collage#kpop moodboard#aesthetic#coquette#kpop#kpop gg#kpop icons#kpop layouts#red velvet#journal#scrapbook#scrapbooking#junk journal#tyler the creator#doechii#lana del rey#chapell roan#charli xcx#fka twigs#lyrics#lyric quotes#lyric book

298 notes

·

View notes

Text

I have to do traditional art for my illustration class this semester, so I got a new sketchbook and this is the first page :)

#doctorsiren#gravity falls#the book of bill#billford#bill cipher#stanford pines#traditional art#my art#I have to reacclimate myself to traditional art since I’ve been doing mainly digital for like 4 years now#at least almost all of my markers and junk still work huzzah!!!#this page is to deter anyone from looking futher!! /silly#also yeah I’m very obsessed with A Human’s Touch being Bill about Ford 😭

455 notes

·

View notes

Text

Holiday Spreads ⋆⁺₊❅.

✸ Saved some wrapping paper to try something new in my journal and love how it turned out. .𖥔 ݁ ˖⋆ ˚❆

#own#commonplace#travelers notebook#commonplace journal#commonplace book#hobonichi#journalling#notebooks#holidays#scrapbook#junk journal#wrapping paper#collage#December#travelers company#Hobonichi weeks

187 notes

·

View notes

Text

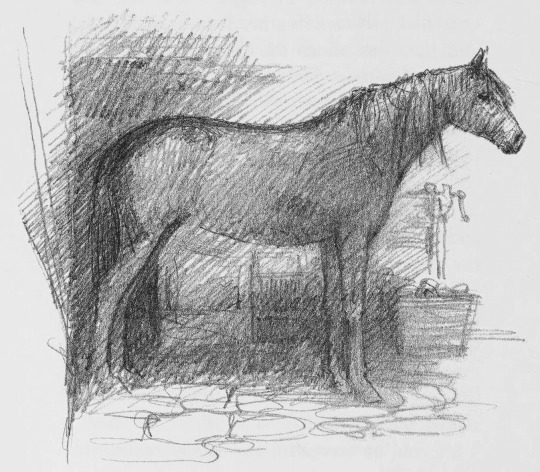

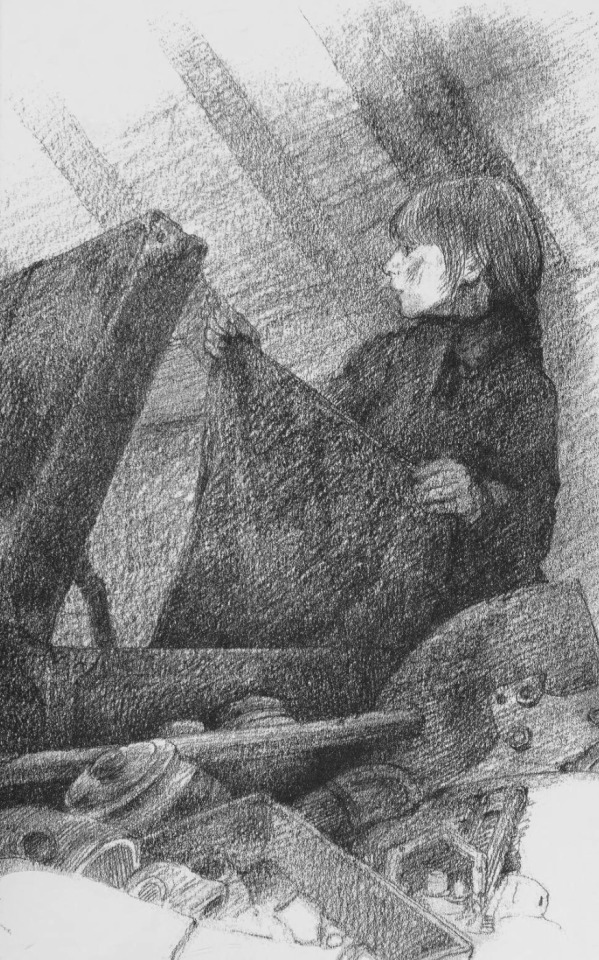

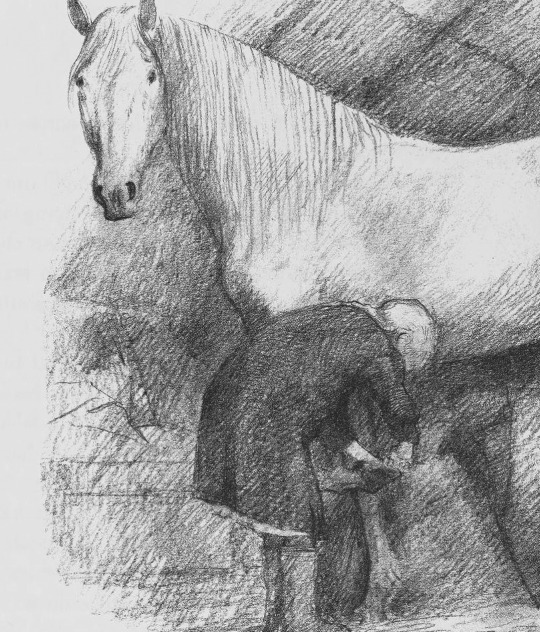

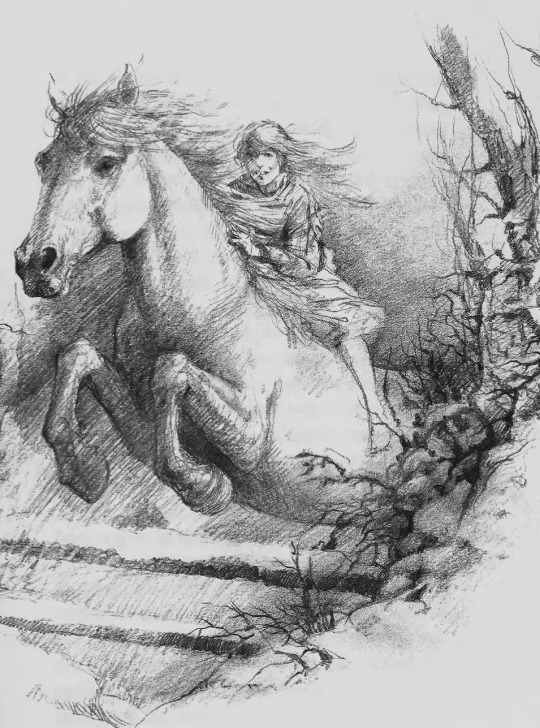

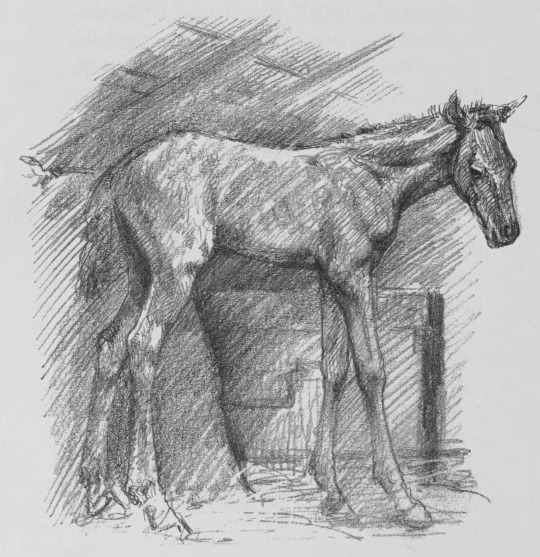

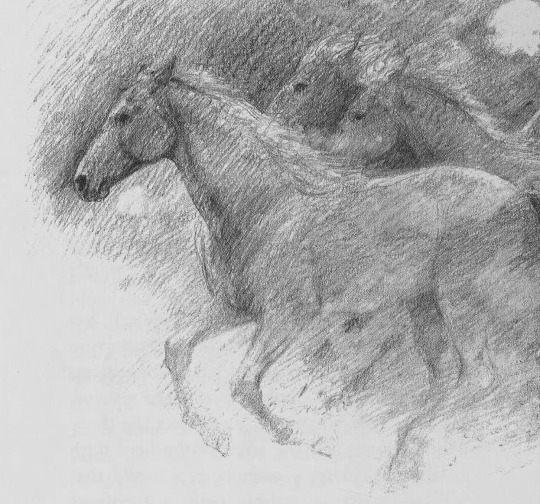

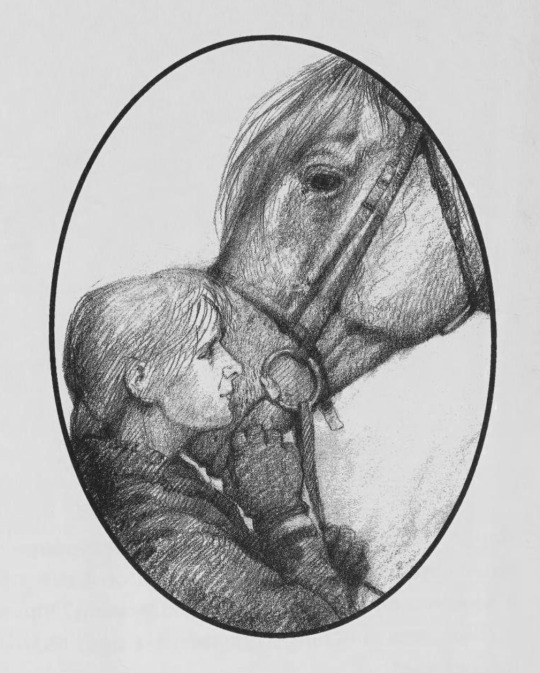

The Enchanted Horse (1992) written by Magdalen Nabb, illustrated by Julek Heller

For @horsefigureoftheday

#this book was so fucking creepy#i think forth grade me would have eaten that shit up#i skimmed the story while looking for the illustrations#and yes i understand its a metaphor for growing up#and it has “values” and “empathy” and such#but the blind man who runs the junk shop has deff killed someone#i say this with love and affection#i do love an impromptu book selection on my part#real tunnel vision after finding it on the#internet archive#and cleaning it up with#photopea#anyways#the enchanted horse#magdalen nabb#Julek Heller#1992#horses#horse art#horse#equids#illustration#1990s#nineties#90s#juvenile fiction#christmas#rural gothic#rural america#rural decay

246 notes

·

View notes

Text

Study break

#gravity falls#book of bill#ford pines#stanford pines#fiddleford hadron mcgucket#fiddleford mcgucket#fiddauthor#fiddleauthor#college fiddauthor#college fiddleford#college stanford#don’t put lit candles on your carpets guys#I just put it there cause it wouldn’t show up on the desk😭#hmmm that sweater looks familiar#thinking of doing a stan one where he’s just all alone#but for now some happiness#he’s studying for his finals#real ones know that roomates go all out for the holidays#what did Fiddleford get him?#idk some nerdy junk

352 notes

·

View notes

Text

moments from my usual journaling session :)

listening to: twin tribes, perdidos

more on my ig: a.rchive98 and YouTube: journalingtapes

#journaling#journal set up#bullet journal#journal spread#bujoinspo#planner#commonplace book#notebooks#junk journal#dark academia#dark academia aesthetics#anne rice#booklr#bookish#spooky#spooky aesthetic#miffy#study setup#journal entry#daily journal#alicja says

120 notes

·

View notes