#invoicing compliance

Explore tagged Tumblr posts

Text

Global E-Invoice Requirements: Understanding Compliance Rules

Explore why e-invoice mandatory regulations are being enforced in various countries. This comprehensive guide covers the legal frameworks, benefits, and adoption trends for electronic invoicing across the globe. Learn how businesses can improve efficiency, reduce errors, and ensure compliance with evolving e-invoice requirements in different regions to stay ahead in the market.

#e-invoice mandates#electronic invoicing#digital invoicing#e-invoicing requirements#invoicing compliance#global invoicing standards#e-invoice regulations

1 note

·

View note

Text

Diploma in Taxation

#Title : What is computer accounting course#1. Introduction to Computer Accounting Course#What is Computer Accounting?#In today’s fast-paced world#businesses rely heavily on technology for their financial operations. A computer accounting course teaches individuals how to use computer#prepare reports#and ensure compliance with financial regulations. The shift from traditional manual accounting to computerized accounting has revolutionize#bookkeepers#and financial analysts.#The Importance of Computer Accounting in Modern Business#Computerized accounting has simplified tasks that once took hours or even days to complete. Instead of using paper ledgers and manual entri#businesses can now perform tasks like invoicing#payroll management#financial reporting#and budgeting with the help of accounting software. This digital transformation ensures more accuracy#efficiency#and speed in business operations.#2. Key Features of Computer Accounting Courses#Course Structure and Duration#A computer accounting course typically covers a wide range of topics#from basic accounting principles to advanced financial software applications. The course duration can vary based on the level of depth and#while diploma and degree programs may take months or even years to complete.#Basic Level: Introduction to Accounting Software#Intermediate Level: Managing Accounts#Transactions#and Reports#Advanced Level: Auditing#Taxation#and Financial Planning#Software Covered in the Course

1 note

·

View note

Text

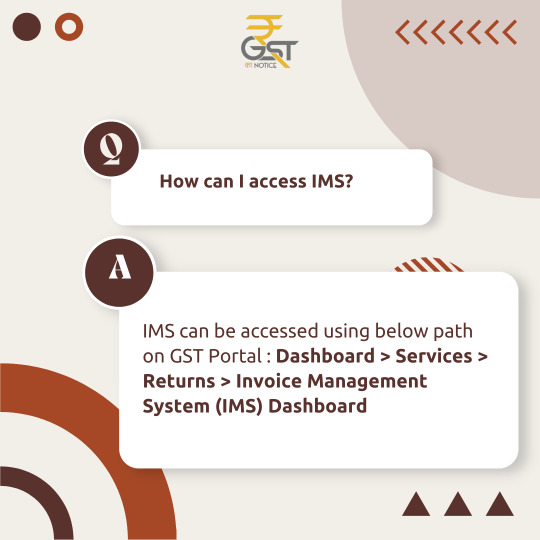

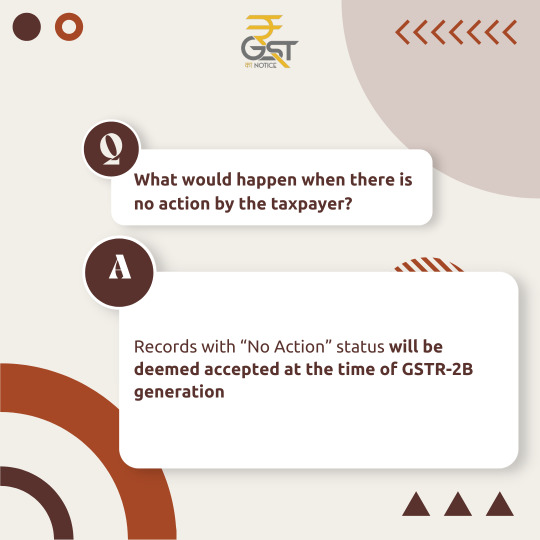

FAQs on Invoice Management System (IMS)... Find your information... For any assistance visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstindia #gstn #gstfact #gstupdates #ims #gstreturn #gstregistration #gstnotice #cbic #dggi #ca #tax #taxlaw #indirecttax #finance #business #budget #gstcouncil #gstcouncilmeeting

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#corporate lawyer in india#gst#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gst services in india#gst services#gstreturns#gst registration#tax#taxation#gstfiling#gst compliance#ims#invoice management system#faq

0 notes

Text

Business Zakat Calculation in ALZERP Cloud ERP Software

Benefits of Using ALZERP for Zakat Calculation

ZATCA Compliant Software: ALZERP is designed to meet all ZATCA requirements, ensuring that Zakat calculations are accurate and compliant with Saudi tax regulations.

Efficient VAT Management: In addition to Zakat, ALZERP manages VAT reporting and compliance, providing an all-in-one solution for tax management.

Zakat Calculation Software: The built-in Zakat calculator simplifies the complex process of determining Zakat obligations, reducing errors and ensuring timely submissions.

Automated Tax Compliance: The software automates the tax compliance process, from calculation to submission, minimizing manual intervention and the risk of errors.

Zakat and Tax Automation: ALZERP integrates Zakat and tax processes, automating calculations, reporting, and compliance tasks.

Real-Time VAT Reporting KSA: The system offers real-time reporting, allowing businesses to stay up-to-date with their tax liabilities.

Saudi Tax Compliance Software: Tailored specifically for the Saudi market, ALZERP ensures businesses meet all local tax and Zakat obligations.

Tax Optimization Tool: By providing insights into Zakat and tax liabilities, ALZERP helps businesses optimize their financial strategies.

VAT Fraud Detection: The system includes features to detect and prevent VAT fraud, ensuring the integrity of financial transactions.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

Save Time and Reduce Cost with Automation

Let’s talk about something we all wish we had more of in the trucking industry: time and money. It’s no secret that running a trucking business is tough. Between keeping up with the endless regulations, dealing with unexpected repairs, and managing all the paperwork, it feels like there are never enough hours in the day. And let’s not even start on the costs piling up. But what if I told you…

View On WordPress

#automated billing trucking#automated dispatching#automated invoicing#automated trucking operations#business#cash flow management#driver behavior monitoring#fleet management automation#Freight#freight automation#freight industry#Freight Revenue Consultants#fuel savings trucking#improve trucking productivity#logistics#logistics automation#maintenance scheduling#optimized trucking routes#reduce costs trucking#save time trucking#small carriers#telematics systems#Transportation#truck performance monitoring#Trucking#trucking automation#trucking business automation#trucking business growth#trucking business solutions#trucking compliance management

0 notes

Text

Contractor: How to Submit and Manage Timesheets?

The "Guides for Vendors" blog on SimplifyVMS provides comprehensive resources for vendors to navigate and optimize their use of the Vendor Management System (VMS). It includes step-by-step instructions, best practices, and expert tips to enhance vendor operations and compliance. These guides aim to support vendors in efficiently managing their workforce, improving collaboration, and maximizing the benefits of the VMS platform.

For more details, visit Guides for Vendors.

#contingentworkforce#vendors#vendor management software#vendor invoice management#vendormanagement#vendor management solutions#vendor management tools#vms#contingentworker#talentacquisition#talent agency#opportunity#compliance#supplychainmanagement#supplychainsolutions#procurement#best vendor replica yupoo#directsourcing#ai tools

0 notes

Text

Marg ERP: Easy Invoicing and Billing Software Marg ERP Limited offers user-friendly invoicing and billing software, simplifying financial processes for businesses. With features like automated invoicing, inventory management and GST compliance, it streamlines operations. Marg ERP ensures efficient tracking of sales, purchases, and payments, enhancing business productivity and financial management.

#inventory software#billing software#billing solutions#inventory management#bussiness#pos software#business#management#technology#Invoicing software#automated invoicing#erp solution#GST compliance#sales tracking#payment tracking#business productivity

0 notes

Text

#Tally ERP-9#GST accounting software#Tally GST module#GST compliance#Tally ERP-9 features#GST invoicing#Tally GST integration#Tally GST implementation#Tally ERP-9 for GST returns#GST billing in Tally

0 notes

Text

Boost efficiency and compliance with our cloud-based GST Billing Software. Simplify invoicing with ease. #Nammabilling For more information, please visit our website: bit.ly/3Atg5q0

#Boost efficiency and compliance with our Cloud Based GST Billing Software. Simplify invoicing with ease.#Nammabilling#For more information#please visit our website: bit.ly/3Atg5q0#.#GSTbilling#CloudSoftware#EfficiencyBoost#InvoicingSimplified#Nammabillingy#SmallBusiness#AccountingSolution#DigitalInvoicing#BusinessManagement#ProductivityTools#InvoiceAutomation#TaxCompliance#CloudTechnology#BusinessSoftware#SMBs#Entrepreneurs

0 notes

Text

Simplifying OCR Data Collection: A Comprehensive Guide -

Globose Technology Solutions, we are committed to providing state-of-the-art OCR solutions to meet the specific needs of our customers. Contact us today to learn more about how OCR can transform your data collection workflow.

#OCR data collection#Optical Character Recognition (OCR)#Data Extraction#Document Digitization#Text Recognition#Automated Data Entry#Data Capture#OCR Technology#Document Processing#Image to Text Conversion#Data Accuracy#Text Analytics#Invoice Processing#Form Recognition#Natural Language Processing (NLP)#Data Management#Document Scanning#Data Automation#Data Quality#Compliance Reporting#Business Efficiency#data collection#data collection company

0 notes

Text

Mastering Accounts Payable: 15 Common Interview Questions and Expert Answers

Preparing for an Accounts Payable (AP) interview is a crucial step in securing a position in this vital finance function. To help you excel in your interview, we’ve compiled a comprehensive guide that covers the 20 most common AP interview questions, each paired with expert answers. In this article, you’ll gain valuable insights into the world of AP and enhance your chances of acing your…

View On WordPress

#Accounting#Accounting Software#Accounting Standards#Accounts Payable#Accuracy in AP#AP Interview#Cost Savings#data security#Disputed Invoices#Financial Regulations#Foreign Currency Transactions#Fraud Prevention#High Invoice Volume#Invoice Processing#Payment Methods#Tax Compliance#Urgent Payments#Vendor Onboarding#Vendor Relationships

0 notes

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

Bakugou would listen to you rant all about work. Even though he’s the one out on the streets with more exciting stories to tell, one of his favorite things is to hear you talk about your own work. He follows and nods along with whatever work story you have for him for the day, always attentive but never telling you what you should do to handle it (as he had learned from a prior relationship).

“I can tell he fuckin’ hates me, you know?” You continue on about your current work events as you sit on the countertop and watch Bakugou cut vegetables, “He keeps on bringing up my old manager as if she has anything to do with it now. Like, no motherfucker! You answer to me now and I’m saying pay your stupid invoice!”

The vegetables for dinner are set aside while the oven is still preheating. Two pieces of pork chop are taken from the fridge and is set aside on a clean plate as Bakugou looks for spices to rub into the meat. “So what happened baby? Did he pay? Y’said you were dealing with this for almost two weeks.” He asks you, genuinely curious if your annoying client is actually complying with you. The thought in his head is wondering how you handled it.

“I have to read you this email that I wrote. I gotta say the professional ways of dissing someone in email is something I finally understand now.” You laugh as you pull up your work email on your phone. Word for word you read out your well thought out response to your difficult client, not backing down and upholding work policy as you are expected to. Bakugou had never really bothered with any type of skill of being professional through communication in his job; it’s what his team is for while he gets the really privilege to cuss as he pleases and have his team handle it for the public. “Here is how I signed off, I think it’s probably my most eloquent and business-like ‘fuck you’ I’ve written so far.”

You clear your throat first before reading aloud, “‘I hope that the explanations of how to navigate your account has cleared up any confusion you may have and that you are able to move forward in compliance with our company policy, if you have any further questions then please let me know.’ God I know he’s going to hate me as soon as he reads it!”

He chuckles, happy that you know how to stand your ground in such a manner that Bakugou knows he struggles in. “You tell him, baby.”

“I fucking did Katsuki!” You boast with a proud little smile as you hop off the countertop and go to his side as he heats oil in a pan. “Sorry, I’ve been going on about this annoying client for a while. I wanna hear about your work today Tsuki.”

Bakugou shakes his head though and urges you to talk about what else happened at your work. The meat sizzles as he presses it into the pan, crackling and sizzling in a way that’s reminiscent of his quirk but to a much lower degree. The oven beeps to indicate that preheating is finished and you move to put all the vegetables into the glass pan and stick it in for him, already setting a timer before he can even ask. “What about that other guy? The one who keeps on saying that he’s getting investors so he wants to make you wait a little longer?” He asks you when he recalls another client you complained of a few days ago.

You excitedly pop off about your work again, unknowing how you calm Bakugou down with your own work stories. Your series of responsibilities that he wouldn’t know the first clue how to handle are interesting to him to hear how you handle yourself. It’s simple compared to what he does but in no way is it easy either. To see you struggle sometimes with your own career wasn’t easy for him but you were also strong enough to handle it all the same.

And he liked to think that he made it easy for you to handle because he wanted to hear anything and everything about your job that’s so different from his. “Tell me about the parking permits, did that get solved yet?” He asks as he starts to set food on the plates.

“No! I’m on week three of dealing with it and it’s ridiculous! I sent everything in so early and they deal with it so late!!”

Bakugou listens with a happy heart to hear you talk, never wanting you to apologize over the things that frustrate you. And by the end of your rants, even he feels a little lighter as he readies to get in bed with you.

And the next day as he’s just about to enter a meeting in his agency, Bakugou gets a text from you.

[1:57 pm] omg i need to tell you what this mofo emailed me when we’re home

He looks forward to it, letting a little smile come onto his face. He can see you all cute and puffed up and mad, and he can’t wait to hear about it.

[1:58 pm] can’t wait baby. love you.

You text him back within seconds.

[1:58 pm] love you!!!

Bakugou can’t wait to be home and listen to you.

1K notes

·

View notes

Text

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software

The ALZERP Cloud ERP Software offers a comprehensive tax return system designed to facilitate the calculation, moderation, and finalization of VAT and tax returns. This system ensures businesses comply with the Saudi Arabian tax regulations set by the Zakat, Tax, and Customs Authority (ZATCA). By automating and streamlining the tax return process, ALZERP helps businesses achieve accuracy and…

View On WordPress

#Automated tax compliance#Real-time tax monitoring KSA#Real-time VAT reporting KSA#Saudi business financial compliance#Saudi business tax management#Saudi corporate tax software#Saudi tax audit software#Saudi tax compliance software#Saudi VAT reconciliation software#Tax analytics for Saudi businesses#tax filing software#Tax management system#tax optimization tool#tax planning software#VAT fraud detection#VAT invoice management#VAT management#VAT management for Saudi SMEs#VAT reporting software KSA#VAT return automation Saudi#Zakat and income tax software#Zakat and tax automation#Zakat and tax consultation tool#Zakat and tax filing deadline alerts#Zakat and tax regulations update#Zakat and VAT calculator#Zakat and VAT compliance check#Zakat assessment tool#Zakat calculation software#Zakat declaration software

0 notes

Text

GPDA post - financial transparency

okay something I wanted to talk about (because I work in finance and have first hand experience with a sports association) is the lack of transparency regarding the fines. this will probably get long so I'll put it under the cut.

so first of all let's start with how these associations work. they are a non-profit organization, therefore all the money they make should be put back into the association - meaning the owners cannot pay dividends. associations keep themselves afloat by receiving subsidies, by selling marketing and broadcast rights, and from fines and membership fees being paid. generally speaking these associations don't make profit, because they have more expenses than income.

the only financial report I could find of the FIA is the consolidated one which combines the French and the Swiss FIA results (though it does not really go in depth with the notes, and afaik, associations are required to publish their full financial statements publicly, but it might be different under Swiss law, under which the FIA is). the statements are audited, which, in theory, should make sure that everything in the books is accounted for, as for the 2022 and 2023 financial years the auditor issued an unqualified opinion, which means that they've found everything in compliance with the Swiss laws. I find it interesting that it's under Swiss law, but not surprising, considering what kinda money is being kept in Swiss banks. anyway.

fun fact: in 2021 and 2022, the financial result was a staggering 31.2 million EUR and a 15.2 million EUR loss, respectively. compared to that, in 2023 they achieved a 7.1 million EUR income. just based on a quick look, it's not because the operations turned profitable (they just got less loss-making), but because financial results and non-operating results got better. interestingly, non-operating management expenses decreased by 15 million EUR, which is pretty significant imo considering that's what they made in loss the previous year.

now onto the fines. fines should be accounted for between other income, however, other income is just one line on the income statement and I haven't found any breakdown, and I likely won't unless I somehow find the full financial statement and not whatever there's posted on the site. regardless, sadly, if these fines do get paid to members, there is absolutely no way to tell unless it's something extraordinarily obvious. one way I can see these being paid, and even these would be a red flag to me, is through subcontracting or consultancy fees, especially the latter. with these there is not really a good way to tell whether there's been actually a service behind them. auditors should be able to flag these, however I live in a country where there is definitely money being passed through sport associations and they get audited as well, so these might get overlooked, likely intentionally.

sports in general, and from what I've seen motorsports especially are a way to get money from one place to another without being too blatant. the accounting itself can get super messy, if it's paid in cash then it's even harder to trace, even if there's an invoice to go with it, if it's vague enough then the tax and financial authorities cannot find fault in it, and afaik you can make a contractual deal with the Swiss tax authorities regarding taxes (now idk if that applies to associations and companies as well or just to individual people).

in conclusion, I'm glad they called the lack of transparency out because it does damage not only the integrity, but also the reputation of the sport, and if there's any foul play that comes to light later on, it will be a very, very bad look on the FIA.

#f1#formula 1#formula one#fia#gpda#sorry this got super long but occupational hazard and me being nosy got the best of me

14 notes

·

View notes

Text

Hospital Management Software: Transforming Healthcare with Grapes IDMR

Author : Jerald Nepoleon

In the dynamic healthcare landscape, technology plays a crucial role in streamlining operations, improving patient care, and reducing administrative burdens. Grapes IDMR, a leading provider of hospital management software, offers cutting-edge solutions designed to elevate hospital efficiency and ensure seamless management across departments. With the rise of digital transformation in healthcare, implementing a robust hospital management system (HMS) is no longer an option but a necessity. Let's explore how Grapes IDMR’s software stands out and drives excellence in hospital administration.

Why Hospital Management Software Matters

The primary objective of any healthcare facility is to provide superior care to patients while maintaining operational efficiency. Managing multiple departments, scheduling, billing, inventory, and patient records manually is time-consuming and prone to errors. Hospital management software simplifies these processes, offering a unified platform for tracking every aspect of a hospital’s operations, from patient registration to discharge.

In an era where patient care and experience are paramount, hospital management software optimizes workflows and ensures that healthcare providers can focus more on patients and less on administrative tasks. Here's where Grapes IDMR makes a remarkable difference.

Grapes IDMR Hospital Management Software: A Game-Changer

Grapes IDMR’s hospital management software is a complete, integrated solution tailored to meet the unique requirements of modern healthcare institutions. By bringing together various modules such as appointment scheduling, patient management, billing, reporting, and inventory control, Grapes IDMR offers a seamless and intuitive platform. Here are the key features that make it a preferred choice:

1. Patient Information Management

Managing patient records, histories, test results, and appointments can be challenging, especially for large hospitals. Grapes IDMR's hospital management software provides a central database for storing and retrieving patient data with ease. This ensures timely access to critical information, improving decision-making and patient care.

2. Appointment and Scheduling

With a highly intuitive scheduling system, Grapes IDMR helps hospitals reduce waiting times and optimize doctor appointments. The system allows real-time updates, ensuring that doctors, staff, and patients are aligned, reducing chances of overbooking or under booking.

3. Billing and Payment Integration

Hospitals deal with multiple payment methods and insurance claims on a daily basis. Grapes IDMR simplifies the entire billing process by providing automated invoicing, payment reminders, and integration with third-party insurance systems. This reduces billing errors and accelerates the payment cycle.

4. Inventory and Supply Chain Management

Efficient management of hospital inventory is vital for preventing shortages and ensuring that essential medicines and supplies are always available. Grapes IDMR’s hospital management software offers an automated system that tracks inventory levels, alerts on reorders, and ensures that the right supplies are always stocked.

5. Data Security and Compliance

One of the critical concerns in healthcare is data security. Grapes IDMR takes this seriously by offering state-of-the-art encryption and security measures that protect sensitive patient data. Additionally, the software is fully compliant with healthcare regulations, ensuring that hospitals adhere to industry standards and legal requirements.

6. Reporting and Analytics

Having access to real-time data and analytics is crucial for making informed decisions. Grapes IDMR offers a comprehensive reporting module that provides insights into hospital performance, patient outcomes, financial metrics, and more. This allows hospital administrators to track key metrics and identify areas for improvement.

Benefits of Implementing Grapes IDMR Hospital Management Software

Integrating hospital management software like Grapes IDMR into your healthcare facility comes with a wide array of benefits:

1. Improved Patient Care

By automating routine tasks, doctors and healthcare professionals can focus more on delivering high-quality care. Grapes IDMR ensures that patient data is accessible at the click of a button, allowing for quicker diagnoses and treatment plans.

2. Increased Efficiency

With automated scheduling, billing, and inventory management, hospitals can optimize their operations, reduce redundancy, and increase staff productivity. This not only saves time but also cuts operational costs.

3. Enhanced Communication

Grapes IDMR enhances communication between departments and medical staff, ensuring that everyone is on the same page. This is especially useful in critical situations where time-sensitive decisions are required.

4. Cost Savings

By automating various administrative tasks, hospitals can significantly reduce overhead costs. Billing errors, scheduling conflicts, and inventory issues are minimized, leading to overall cost savings.

5. Data-Driven Decisions

Grapes IDMR’s powerful reporting tools enable hospitals to make data-driven decisions, improving both patient outcomes and financial performance. The software provides valuable insights that can help in resource allocation, process improvement, and patient care management.

Why Choose Grapes IDMR?

When selecting hospital management software, it's essential to choose a system that is reliable, scalable, and adaptable to your facility's needs. Here’s why Grapes IDMR is the ideal solution for hospitals:

Customizable: Grapes IDMR can be tailored to suit the specific needs of any healthcare facility, whether it's a small clinic or a large multi-specialty hospital.

User-Friendly Interface: With an intuitive and easy-to-navigate interface, the software is designed for seamless adoption, even by staff with minimal technical expertise.

Comprehensive Support: Grapes IDMR offers 24/7 support and training for hospital staff, ensuring smooth implementation and continuous operation.

Future-Proof Technology: Grapes IDMR stays updated with the latest technological advancements, offering hospitals a future-proof solution that can scale as the facility grows.

Final Thoughts

In today’s healthcare environment, hospitals need to adopt digital solutions to stay competitive and deliver exceptional patient care. Grapes IDMR’s hospital management software provides the perfect blend of innovation, efficiency, and reliability. By automating administrative tasks, enhancing communication, and ensuring data security, Grapes IDMR empowers healthcare providers to focus on what truly matters: patient care.

If your hospital is looking to boost efficiency and improve patient outcomes, Grapes IDMR’s hospital management software is the solution you need.

"Watch This Video Now!"

youtube

#HospitalManagementSoftware#HealthcareTechnology#PatientCare#HospitalEfficiency#GrapesIDMR#MedicalSoftware#PatientRecords#HospitalAutomation#HealthcareInnovation#DataSecurity#HealthTech#DigitalTransformation#HospitalManagement#HealthInformationSystem#HospitalBilling#HospitalInventory#HealthcareSolutions#MedicalDataManagement#PatientExperience#GrapesInnovativeSolutions#HMS#Youtube

7 notes

·

View notes