#Compliance Reporting

Explore tagged Tumblr posts

Text

Efficient Payroll Management Solutions for Accurate and Timely Employee Compensation

Efficient payroll management is essential for maintaining employee trust and ensuring compliance with financial regulations. Payroll software simplifies the process by automating salary calculations, tax deductions, and payment scheduling. This technology reduces errors, saves time, and provides detailed reports for compliance and transparency. A modern payroll solution integrates seamlessly with other HR functions, offering scalability and customization to meet the unique needs of businesses. Streamline your payroll process to enhance accuracy, reduce administrative burden, and ensure timely employee payments.

More info: https://ahalts.com/solutions/hr-services/complete-payroll

#Payroll Management#Payroll Software#Salary Processing#Tax Deductions#Employee Compensation#Wage Calculation#Automated Payroll#Compliance Reporting#Payment Schedules#HR Payroll Solutions

0 notes

Text

Simplifying OCR Data Collection: A Comprehensive Guide -

Globose Technology Solutions, we are committed to providing state-of-the-art OCR solutions to meet the specific needs of our customers. Contact us today to learn more about how OCR can transform your data collection workflow.

#OCR data collection#Optical Character Recognition (OCR)#Data Extraction#Document Digitization#Text Recognition#Automated Data Entry#Data Capture#OCR Technology#Document Processing#Image to Text Conversion#Data Accuracy#Text Analytics#Invoice Processing#Form Recognition#Natural Language Processing (NLP)#Data Management#Document Scanning#Data Automation#Data Quality#Compliance Reporting#Business Efficiency#data collection#data collection company

0 notes

Text

Quality Control & Cpap Compliance Reporting Services | WCA

Our comprehensive quality control and compliance reporting services ensure quality, safety, and compliance in a variety of industries.

1 note

·

View note

Text

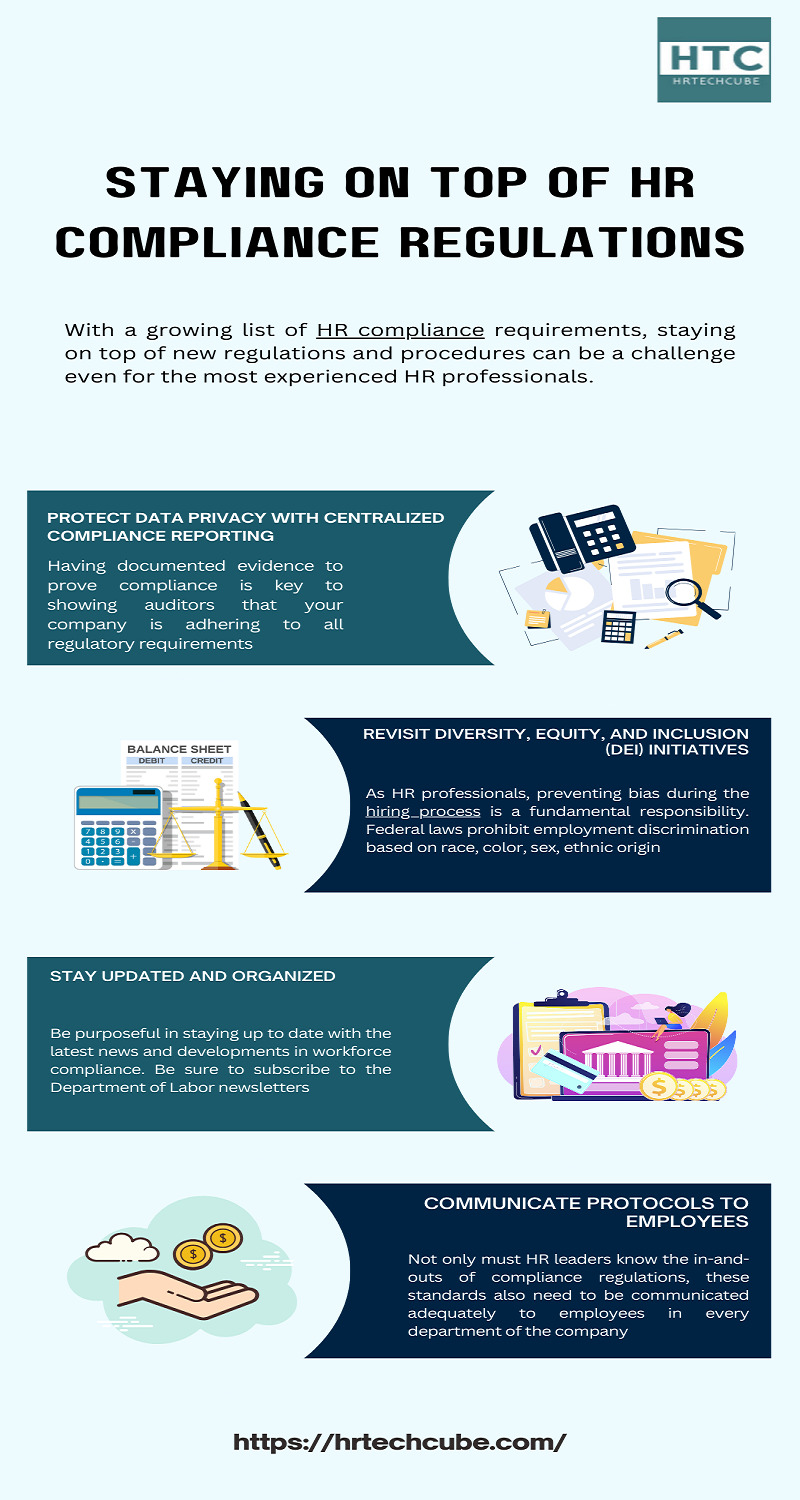

With a growing list of HR compliance requirements, staying on top of new regulations and procedures can be a challenge even for the most experienced HR professionals. Penalties for breaching FLSA, FMLA, OSHA, USERRA, ERISA, COBRA, and others can be costly and time consuming, often leading to expensive lawsuits, fines, and disruptions to business operations. The cost of non-compliance has risen more than 45% in the last 10 years, making it more important than ever to educate employees and examine current compliance efforts. With the world entering the second quarter of 2023, now is the time to brush up on the latest regulations and implement new methods to effectively regulate compliance and maintain data protection.

Read more @ https://hrtechcube.com/staying-on-top-of-hr-compliance-regulations/

0 notes

Text

If you're in the US and underinsured or uninsured and need to get that COVID vaccine without breaking the bank (god this is ridiculous), the Bridge Access Program is giving them out for "free" (using taxes, but like. it's free).

#There are some places not in compliance though who will lie and reject you for not having insurance#Report them. To the local attorney general or the CDC it takes like 5 minutes and now you'll both have a bad day.

137 notes

·

View notes

Text

So Iowa is now requiring parental permission for using nicknames with students. Any nickname that the parent has not pre-approved in the system requires a note home to get permission from the parents. https://www.newsweek.com/iowa-parents-forced-approve-kids-nicknames-1822914

Iowa kids, you know what you have to do, right? You don't want to do them too fast or too regular. Or the teachers will stop enforcing them on just you because clearly you aren't serious. Bonus points if you get other students to call you by that name for the week.

#Iowa#malicious compliance#education#name changes#Trans rights#because let's be real#we know who they're targeting#the malicious compliance here is really more for the teachers who choose to support the protest#gosh the state wants them to report every nickname#so that's what they've got to do

13 notes

·

View notes

Text

E: "Hey you." S: "Hey, so I was thinking about checking out that Casbah art museum. They have a new showing all about musicians. D'ya wanna come with?" E: "I'd love to, really, but there's this basic psychopath editor who wants me to cut down my article about the best place to get falafel down to three places. SanMy has at least twenty really good falafel places! I could see maybe cutting it down to 15, maybe even as low as 10, but three? How? What kind of monster thinks you can choose between three falafel places when there are at least 6 that are equally amazing when compared to one anoth-" S: "Huh, wow, okay, I'll leave you to it! I'll be back in like two hours?" E: "yeah, and maybe I'll have cut it down to 17 by then. What an absolute sadist, I swear..."

#Stormy Nessa Jones#Edgar Isaac Orson#random legacy challenge#sims 4 legacy#Orson family#Gen 1: Orson#san myshuno#sims 4 gameplay#gshade preset: gm lithium#he's actually been in the job since day one and is currently a “beat reporter” (level 3) by this post#but i figured I should show evidence of compliance to the rules for this generation

11 notes

·

View notes

Text

I work in teams with people at work and we have a few leads in the team (consulting, project management, analysis and reporting, survey and reporting platforms) and nothing fucks me off more than when I'm trying to delegate a problem to the person responsible for solving it and in response they try to give me advice for how I can solve it.... no buddy this is your problem to solve. I've already done part of your job by defining the problem you've got to solve. you can use your own brain to make decisions I promise it's not that scary.

#analysis and reporting more like nobody else wants to touch data with a bargepole even if it's literally their job#lead analyst... and lead platform analyst chaser and lead project manager wrangler and lead ethics and compliance reminderer#lead analyst like yeah you can lead a platform analyst to the qualtrics installation but you can't make them initiate testing#everyone can fuck off actually

2 notes

·

View notes

Text

HEAD IN HANDS. I LAID DOWN THE CLEAREST TRACKS POSSIBLE FOR THE INTERN. WE WERE LIKE HALFWAY THERE. AND THEY JUST WENT OFF THE RAILS. like listen I’ll set you up for success but I’m not saving you from the consequences.

#my ramblings#the director of the program is like ‘oh… can we have them fix this and take on the responsibilities they want…’#and I am gently placing a hand on my softhearted director’s shoulder#and saying: no.#listen if the intern needed more time or had questions it’s up to the intern to ask#I’m open to extensions#I’m open to clarifications#I’m even open to supervising completion of work (but not doing the work)#however I am not standing in the way of The Boss#and I am not chasing an intern down when I have my own work#anyway I get it with how the intern’s trying to focus on school and has more priority on passing the class#I’ve been there#but also I Did Not Ignore A Supervisor’s Meticulously Detailed Report On Maintaining Compliance#bro my priority is not for you to pass your class. my priority is that you don’t fuck up and screw all of us over.

12 notes

·

View notes

Text

Nvm being in a sorority sucks, the other shoe dropped-

#bunny speaks#bunny vents#HOLY SHIT#GOT AN EMAIL FROM OUR VP OF COMPLIANCE (judge jury and executioner) BC OF A REPORT FROM A MEMBER W A VENDETTA f<3333#as our past and current treasurer. GOD I don't wanna be audited#we could literally get our chapter shut down <333333333333#great great great it's not like this is my whole life and friend group!!!!!!!#if you need me I will literally be vomiting and not eating like a fucking dog#and it's too cold down here to see my friends in person#or be on the roads at all#but I just. really really need a hug

2 notes

·

View notes

Text

Every hospital should have a compliance line available that tracks compliance with evidence based medicine. Ask the front desk about it. If that doesn't work or you can't get to it, file a complaint for patient safety with the joint commission. File a complaint with the JC anyway - hospitals have to deal with JC accreditation and that'll get up their rear. And the JC takes patient safety seriously. I'll leave a link below

https://www.jointcommission.org/resources/patient-safety-topics/report-a-patient-safety-concern-or-complaint/

If anyone needs help filing a complaint against a hospital system and specific staff, reach out. I'm glad to help. :)

The anti-mask brain rot is penetrating the hospital system in a terrifying fashion.

Masks are necessary for accessing central lines, and more and more nurses are starting to have issues with wearing a mask during STERILE PROTOCOL.

These lines are going right into our hearts and nurses are throwing tantrums about having to cover up their faces for 5 minutes.

This has not happened at my infusion center personally but I have mutuals and friends who have had to beg their nurses to put on the mask that literally comes in the sterile access kit.

#i work in pharmacy IT abd compliance#reporting a safety issue should be taken seriously and if it isnt then go to someone who will

46K notes

·

View notes

Text

Streamline Your Business with Year-End Accounts Outsourcing

Simplify your year-end accounts preparation with professional outsourcing services from SAS KPO. We offer efficient, accurate, and timely year-end accounts preparation to ensure your business remains compliant and financially organized. Trust our expert team to handle the complexities of financial reporting, so you can focus on growing your business. Visit: https://saskpo.co.uk/year-end-accounts-outsourcing/

#Year-End Accounts Outsourcing Services#Year-End Accounts#Year-End Accounts Services#Accounting Services#Financial Reporting#Business Compliance#Tax Preparation

0 notes

Text

Elevate Trust and Security with SOC 2 Certification and Compliance

At Univate Solutions, we understand that trust is the foundation of every successful business relationship. In today’s digital age, ensuring data security and compliance isn’t just a necessity—it’s a commitment to your clients. That’s why we specialize in delivering comprehensive SOC 2 reports designed to meet the highest standards of data protection.

Our rigorous and proven processes are tailored to help your organization achieve SOC 2 compliance seamlessly. From assessing your current systems to implementing robust security frameworks, we guide you through every step with expertise and precision. By choosing Univate Solutions, you’re not just opting for compliance but for a partnership that prioritizes your business integrity.

SOC 2 compliance goes beyond a certificate—it’s a declaration that your organization values customer trust, data privacy, and operational transparency. With our end-to-end solutions, you’ll gain more than just a report; you’ll enhance your brand’s reputation, win customer confidence, and strengthen your market position.

We believe that trust isn’t simply earned—it’s maintained. That’s why we go the extra mile to ensure your business remains ahead of evolving compliance requirements. With Univate Solutions by your side, you’ll not only meet but exceed industry standards, giving your clients the confidence they deserve.

Ready to take your security and compliance to the next level? Partner with Univate Solutions today and build a business that thrives on trust, excellence, and reliability.

Secure your success with SOC 2 compliance—because your clients deserve nothing less.

0 notes

Text

#compliance services#regulatory compliance services#financial consultant#regulatory compliance#foreign exchange amendment#cross border investment#financial reporting#financial consulting services#indian corporate news

0 notes

Text

I finished a rare 1st quarter "crunch" last month. I do not want to be in crunch ever again. 10-12 hour days are inhuman. But the project was finished (only two weeks late, wooo) and released into the wild, and now I am clocking out at exactly 5PM on the dot again. Anything that isn't done can get done tomorrow.

"But why didn't they hire another person if you were forced to work 12 hour days?" you may ask? Brook's law came into play for this project. (The amount of time it would have taken to onboard someone and train them to assist me would have delayed the project a whole lot longer than two weeks.)

#I am so glad its over#now I'm back to 7-8 hour days while I cry over ADA compliance reports#the life of a business analyst

21K notes

·

View notes

Text

Best Accounting Firms in Abu Dhabi @0502510288

Accounting and Bookkeeping Company in UAE - We are one of the best Accounting firms in Abu Dhabi, Dubai UAE provides top finance vision etc. Even though there are numerous accounting firms all over Abu Dhabi, this guide for selecting the right partner for your financial management includes top organizations.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes