#Tax Preparation

Explore tagged Tumblr posts

Text

remember that you don't have to deal with Turbo Tax or H&R block like I have in the past. last year was my first time doing the IRS free file with the guided software, and it only took me a couple of hours.

#i dont particularly like doing taxes but the guided software makes it so easy that i ended up doing my bfs taxes#because he wasnt in the mindset to do them at all#tax preparation#tax season

3 notes

·

View notes

Text

NSI Accounting: Reliable Financial Reporting You Can Trust

Ensure your financial statements are accurate and compliant with NSI Accounting. We deliver detailed financial reporting that provides a clear picture of your business’s financial health.

3 notes

·

View notes

Text

Join Our Team of Tax Preparers!

Are you in Alabama, Georgia, Memphis, Florida, or Mississippi and interested in becoming a tax preparer? Partner with Unique Tax Solutions for the 2025 tax season!

Limited spots are available! Comment below to learn more and secure your spot.

3 notes

·

View notes

Link

Discover peace of mind with LoneStar Tax Advisor LLC, your best destination for expert Tax preparation service in Terrell TX. Our seasoned professionals specialize in business tax services, offering meticulous income tax return filing and preparation tailored to your unique needs. Conveniently situated nearby, our local tax return preparation services ensure personalized attention and swift assistance for all your tax requirements. Whether you're a budding entrepreneur in need of new business tax consulting or an individual seeking comprehensive tax planning, we're dedicated to optimizing your financial strategy and maximizing your savings. Count on LoneStar Tax Advisor LLC for dependable tax solutions and unwavering support in navigating the complexities of tax legislation. With our unwavering commitment to excellence and client satisfaction, rest assured that your taxes are in capable hands. Contact us today to experience the difference with the leading tax preparation service in your area.

#Corporation tax return#Tax preparation#Tax planning#New business tax consulting#Professional Tax planners#USA

3 notes

·

View notes

Text

The Role of Accounting and Bookkeeping in Tax Industry

Accounting and bookkeeping are tedious and arduous but are necessary for the company to gain an advantage over competitors and to make decisions. Bookkeeping is the recording of financial details of the company in an orderly manner over some time. Bookkeepers are people who maintain the accounts. Ileadtax LLC is one of the best tax preparation and planning companies based in New York, India, and California. It offers accounting and bookkeeping services and are adviser for many companies. This article discloses the importance of accounting and bookkeeping in the tax industry and how it is useful to a company.

Accounting and bookkeeping are dependent on each other. Bookkeeping is a sub-branch of accounting that organizes and summarizes financial data and it has accurate financial data. Bookkeepers have access to all financial data of the company and can track their transactions. They ensure the data is up to date and is complete. Bookkeeping helps the company with decisions related to investing and operations. IleadTax LLC is a global company that consists of tax accounting experts in India, New York, and California. They provide their tax experts for all companies which are in need. The accounting and bookkeeping services provided contain detailed records of past transactions.

The first step in achieving flawless tax preparation is keeping accurate financial records. The foundation of this process is accounting and bookkeeping. These tasks entail the meticulous documentation of financial transactions, which results in an accurate depiction of earnings, outlays, assets, and liabilities. Having structured financial records is essential for tax season. Identification of deductible expenses is made possible for people and organizations through accounting and bookkeeping. Taxpayers can properly minimize their taxable income by accurately categorizing their costs and keeping track of the necessary supporting records. This may lead to significant cost savings and a better tax situation.

Beyond tax time, accounting and bookkeeping are important. They serve as the cornerstone for budgeting, investments, and future tax planning, enabling both individuals and corporations to make well-informed choices. It's advantageous to obtain professional advice when dealing with the complicated realm of tax preparation. CPAs (Certified Public Accountants) and seasoned bookkeepers may provide priceless insights, ensuring that you successfully navigate tax season.

A thorough and accurate bookkeeping procedure gives businesses a reliable way to assess their success. It also serves as a benchmark for its income and revenue targets and information for general strategic decision-making. A trustworthy source for businesses to gauge their financial performance is bookkeeping. Accounting and bookkeeping are more than simply administrative duties; they are also effective instruments that can lessen the strain of tax season and enhance your financial security. A sound accounting and bookkeeping system can result in significant savings, compliance, and financial peace of mind whether you're a business owner or an individual taxpayer. So, as tax season draws near, keep in mind that having a solid financial foundation is the key to success. ILeadTax LLC attempts to deliver results that meet the expectations of the client.

#Accounting and bookkeeping#tax preparation#tax accounting experts in India#accounting and bookkeeping services

5 notes

·

View notes

Text

youtube

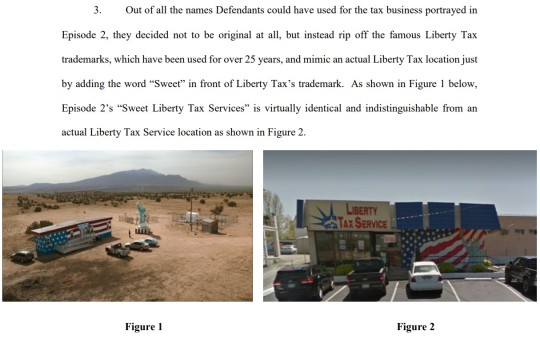

Better Call Saul was SUED IN REAL LIFE by an actual tax company! 👨🏻⚖️

#better call saul#bcs#breaking bad#brba#tv#tv show#tv shows#tv series#did you know#trivia#tv trivia#fun fact#fun facts#sued#lawsuit#liberty tax#taxes#tax preparation#tax services#true story#Youtube

4 notes

·

View notes

Text

The Increasing Use of Artificial Intelligence (AI) in Tax Preparation

The tax code is complex and constantly changing, making it difficult for taxpayers to file their taxes correctly. This is where artificial intelligence (AI) comes in. AI is being used to automate many of the tasks involved in tax preparation, such as data entry and calculations. This is helping to make tax preparation faster and more efficient.

How AI is used in Tax Preparation

There are many ways that AI is being used in tax preparation. Here are a few examples:

Automating data entry: AI can be used to automatically enter taxpayer data into tax preparation software. This saves time and reduces the risk of errors.

Performing calculations: AI can be used to automatically perform complex calculations, such as depreciation and interest deductions. This ensures that taxpayers are taking advantage of all of the deductions and credits that they are eligible for.

Identifying potential errors: AI can be used to identify potential errors in tax returns. This helps to prevent taxpayers from making mistakes that could lead to penalties or interest charges.

Providing personalized advice: AI can be used to provide taxpayers with personalized advice on their tax situation. This can help taxpayers to make the best decisions for their individual needs.

The Benefits of AI in Tax Preparation

There are many benefits to using AI in tax preparation. Here are a few of the most important benefits:

Speed: AI can help taxpayers to file their taxes faster. This is because AI can automate many of the tasks involved in tax preparation, such as data entry and calculations.

Accuracy: AI can help taxpayers to file their taxes more accurately. This is because AI can identify potential errors in tax returns.

Cost-effectiveness: AI-powered tax prep services can be more cost-effective than hiring a human tax preparer. This is because AI-powered tax prep services typically charge a flat fee, which can be much lower than the hourly rate of a human tax preparer.

Accessibility: AI-powered tax prep services are available 24/7, so taxpayers can file their taxes whenever it is convenient for them.

The Future of AI in Tax Preparation

The use of AI in tax preparation is still in its early stages, but it is growing rapidly. As AI technology continues to develop, it is likely to have an even greater impact on the way that taxes are prepared.

In the future, AI is likely to be used to automate even more of the tasks involved in tax preparation. This could include tasks such as interpreting tax laws, researching tax deductions, and preparing tax returns. AI could also be used to provide taxpayers with more personalized tax advice.

The increasing use of AI in tax preparation is likely to have a major impact on the tax prep services industry. As AI-powered tax prep services become more sophisticated, they are likely to pose a threat to traditional tax preparation firms. However, traditional tax preparation firms can adapt to this new technology by offering their own AI-powered tax prep services.

Conclusion

The increasing use of AI in tax preparation is having a positive impact on the way that taxpayers file their taxes. It is making tax preparation faster, more efficient, and more accurate. As AI technology continues to develop, it is likely to have an even greater impact on the tax prep services industry.

If you are looking for a way to file your taxes quickly, easily, and accurately, then you should consider using an AI-powered tax prep service. These services are the future of tax preparation, and they are already making a big difference in the way that taxpayers file their taxes.

3 notes

·

View notes

Text

Esmtaxservices has the best service and staff who speak English and Spanish... When contacting them, say they are calling from this Tumblr page. Thank you.

3 notes

·

View notes

Text

I used this service last year and it was not only easy to use, I got to keep all of my refund instead of paying out $50 for tax prep!

127K notes

·

View notes

Text

The Role Of Tax Planning And Preparation In Structuring Business Financing

Experts offering tax planning services in Fort Worth, TX are crucial in structuring business financing. They help minimize tax liabilities, improve cash flow, and enhance loan eligibility. Strategic tax planning ensures compliance while optimizing deductions, reducing borrowing costs, and maximizing available credits. Proper preparation also strengthens financial statements, making businesses more attractive to lenders and investors for sustainable growth.

0 notes

Text

#sales tax#tax accountant#car tax#tax preparation#tax advisor#tax planning#tax consultant#tax filing#tax#finance#accounting

0 notes

Text

Smart Tax Planning for a Stress-Free Future

Managing taxes can feel overwhelming, but with the right approach, you can save money and avoid last-minute stress. At SAI CPA Services, we help individuals and businesses navigate complex tax regulations while maximizing their returns.

Why is tax planning important? ✔️ Reduces tax liabilities ✔️ Ensures compliance with IRS regulations ✔️ Helps you plan for financial growth

Our expert team offers personalized strategies tailored to your needs. Whether it’s year-end tax planning, deductions, or IRS representation, we ensure a seamless experience.

💼 Need help with tax preparation? Let’s simplify the process!

📞 Contact us today!

Connect with us: 🔗 SAI CPA Services 🔗 Facebook 🔗 Instagram 🔗 Twitter 🔗 LinkedIn 🔗 WhatsApp

📍 1 Auer Ct, 2nd Floor, East Brunswick, NJ 08816 📞 908-380-6876

#SAI CPA SERVICES#tax services#tax planning#tax returns#financial success#tax preparation#cpa#accounting services#virtual cfo services#bookkeeping#tax#financial services

0 notes

Photo

Also check with organizations and libraries in your area. They sometimes host Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE), which are IRS programs that offer free basic tax return preparation to qualified individuals.

150K notes

·

View notes

Text

Personal Credit Restoration: Steps to Success

Your personal credit is an assessment of how well you manage debt and repay what you owe. This assessment is represented by a credit score, which considers factors like payment history, credit utilization, length of credit history, and types of credit in use. A good credit score opens doors to better interest rates and loan terms, while a poor score can limit your financial options. It’s essential to understand these elements to take charge of your credit restoration journey effectively. Familiarize yourself with what influences your credit score and the impact it has on your financial opportunities.

Evaluating Your Current Credit Status

To begin your personal credit restoration journey, you must first evaluate your current credit status. Obtain your credit report from the major credit bureaus: Equifax, Experian, and TransUnion. Review your report carefully to identify any errors or discrepancies that may be affecting your credit score. Check for inaccuracies in your personal information, accounts that do not belong to you, and any incorrect late payment listings. Disputing these errors can result in immediate improvements to your credit score. Additionally, assess the age of your accounts and your payment history to get a comprehensive view of your credit health. Identifying these areas for improvement is crucial for developing a successful restoration plan.

Formulating a Credit Improvement Strategy

Begin by setting realistic goals for your credit improvement journey. Whether it’s reaching a specific credit score or paying off certain debts, having clear objectives will keep you motivated. Prioritize debt repayment strategies, focusing first on high-interest debts, as they are typically the most costly. Consider employing the snowball or avalanche method to effectively manage your outstanding balances. The snowball method involves paying off the smallest debts first to build momentum, while the avalanche method targets the highest interest debts first. These strategies can help you systematically reduce your debt, improving your credit score over time.

Managing Your Debt Efficiently

Effectively managing your debt is key to personal credit restoration. Understanding your debt types—revolving (credit cards) and installment (loans)—allows you to create a targeted plan. Prioritize paying off high-interest revolving debt first, as it can quickly accumulate and negatively impact your credit score. Consider consolidating your debts into a single lower-interest loan to streamline payments and reduce overall interest. Another option is transferring balances to a credit card offering an introductory 0% APR period, giving you time to pay down the balance without additional interest. Establish a realistic budget that includes all your financial obligations, and stick to it.

Cultivating Positive Credit Practices

Developing positive credit habits is key to maintaining and improving your credit score. Make timely payments by setting up reminders or automatic payments to avoid missed due dates. Use your credit wisely by keeping your credit utilization below 30% of your available credit. Diversify your credit mix by responsibly managing different types of credit, such as credit cards and installment loans. Limit the number of hard inquiries on your credit report by only applying for new credit when necessary. Regularly monitoring your credit report ensures you stay aware of your progress and any potential issues. By adopting these practices, you build a robust foundation for a healthier credit profile.

Tracking Your Credit Restoration Progress

Consistently reviewing your credit report helps you monitor your progress and identify any issues that need attention. Pay close attention to changes in your credit score and note any improvements or setbacks. Track your payment history to ensure all payments are reported accurately and on time. Adjust your debt repayment plan if you encounter unexpected financial changes or if some strategies aren’t delivering the desired results. Regularly update your budget to reflect your current financial status, and make any necessary adjustments to stay on track with your goals. Using credit monitoring tools can provide alerts for significant changes, helping you stay informed and proactive in your credit restoration efforts.

Getting Professional Assistance if Required

Navigating the complexities of personal credit restoration can be challenging, and professional assistance may be beneficial. Credit counseling services offer expert advice on financial management and debt repayment strategies. A certified counselor can help you devise a budget and create a tailored debt management plan that suits your financial situation. Alternatively, credit repair services specialize in identifying and disputing errors on your credit report. When choosing a credit repair service, ensure it is reputable by checking for transparency in fees and positive customer reviews. Be cautious of any service that promises instant or unrealistic results. Professional help can provide the guidance and support you need to handle complex credit issues and accelerate your credit restoration journey.

Summary

Navigating the complexities of personal credit restoration can be challenging, and professional assistance may be beneficial. Credit counseling services offer expert advice on financial management and debt repayment strategies. A certified counselor can help you devise a budget and create a tailored debt management plan that suits your financial situation. Alternatively, credit repair services specialize in identifying and disputing errors on your credit report. When choosing a credit repair service, ensure it is reputable by checking for transparency in fees and positive customer reviews. Be cautious of any service that promises instant or unrealistic results. Professional help can provide the guidance and support you need to handle complex credit issues and accelerate your credit restoration journey.

Contact Us:

Address - 115 W. 2nd Ave Unit 1A Roselle, NJ 07203

Email - [email protected]

Website - RAP Financial Services

Blog - Personal Credit Restoration: Steps to Success

0 notes

Text

#Accounting#Bookkeeping#Startups#Founder’s Guide#tax preparation#Outsourcing#Accounting System#Reconcile#outstanding invoices#payments#Tax returns

0 notes

Text

Tax Filing Habits For Child Care Business Owners

Photo by Nataliya Vaitkevich on Pexels.com As I write this post we are only 30 days from the April 15th tax deadline. However, before you file your taxes, I want share with you five ways to get organized and share a lost of items that you may deduct as a business owner. A childcare business comes alonvg with lots of expenses or as some would say, a very large over head. In fact, as a childcare…

View On WordPress

0 notes