Don't wanna be here? Send us removal request.

Text

What is the Best Cloud-Based ERP Software in Saudi Arabia?

For small to medium businesses (SMBs) in Saudi Arabia, finding the right cloud-based ERP system is essential for streamlining operations, boosting efficiency, and managing costs. A standout choice is ALZERP, developed by Al Wajeez Tech, a leading software company based in Jeddah. ALZERP is a modern, affordable, and easy-to-use ERP system designed to meet the needs of SMBs, especially those in…

#ai#business#cloud-based ERP#digital-transformation#erp#saudi arabia#SME#software for small to medium businesses#technology

0 notes

Text

Al Wajeez Tech - A Leading Software Development Company in Jeddah, Saudi Arabia

Al Wajeez Tech has firmly established itself as one of the premier ERP software development companies in Jeddah, Saudi Arabia. Renowned for its commitment to innovation, the company specializes in delivering comprehensive software solutions tailored to the needs of businesses across a range of industries. Expertise in ERP Software Development What sets Al Wajeez Tech apart is its focus on ERP…

0 notes

Text

Business Zakat Calculation in ALZERP Cloud ERP Software

In Saudi Arabia and most of the Islamic Finance based countries, businesses are required by the Zakat, Tax, and Customs Authority (ZATCA) to submit their Zakat amounts every financial year. To ensure compliance with these requirements, ALZERP Cloud ERP Software provides a robust Business Zakat calculation feature. This tool is designed to accurately calculate, moderate, and finalize the Zakat…

View On WordPress

0 notes

Text

Business Zakat Calculation in ALZERP Cloud ERP Software

Benefits of Using ALZERP for Zakat Calculation

ZATCA Compliant Software: ALZERP is designed to meet all ZATCA requirements, ensuring that Zakat calculations are accurate and compliant with Saudi tax regulations.

Efficient VAT Management: In addition to Zakat, ALZERP manages VAT reporting and compliance, providing an all-in-one solution for tax management.

Zakat Calculation Software: The built-in Zakat calculator simplifies the complex process of determining Zakat obligations, reducing errors and ensuring timely submissions.

Automated Tax Compliance: The software automates the tax compliance process, from calculation to submission, minimizing manual intervention and the risk of errors.

Zakat and Tax Automation: ALZERP integrates Zakat and tax processes, automating calculations, reporting, and compliance tasks.

Real-Time VAT Reporting KSA: The system offers real-time reporting, allowing businesses to stay up-to-date with their tax liabilities.

Saudi Tax Compliance Software: Tailored specifically for the Saudi market, ALZERP ensures businesses meet all local tax and Zakat obligations.

Tax Optimization Tool: By providing insights into Zakat and tax liabilities, ALZERP helps businesses optimize their financial strategies.

VAT Fraud Detection: The system includes features to detect and prevent VAT fraud, ensuring the integrity of financial transactions.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software

The ALZERP Cloud ERP Software offers a comprehensive tax return system designed to facilitate the calculation, moderation, and finalization of VAT and tax returns. This system ensures businesses comply with the Saudi Arabian tax regulations set by the Zakat, Tax, and Customs Authority (ZATCA). By automating and streamlining the tax return process, ALZERP helps businesses achieve accuracy and…

View On WordPress

#Automated tax compliance#Real-time tax monitoring KSA#Real-time VAT reporting KSA#Saudi business financial compliance#Saudi business tax management#Saudi corporate tax software#Saudi tax audit software#Saudi tax compliance software#Saudi VAT reconciliation software#Tax analytics for Saudi businesses#tax filing software#Tax management system#tax optimization tool#tax planning software#VAT fraud detection#VAT invoice management#VAT management#VAT management for Saudi SMEs#VAT reporting software KSA#VAT return automation Saudi#Zakat and income tax software#Zakat and tax automation#Zakat and tax consultation tool#Zakat and tax filing deadline alerts#Zakat and tax regulations update#Zakat and VAT calculator#Zakat and VAT compliance check#Zakat assessment tool#Zakat calculation software#Zakat declaration software

0 notes

Text

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software

Key Components of the VAT Return System:

Return Details:

Specifies the return type (Value Added Tax – Quarterly).

Indicates whether it’s a new or existing return.

Assigns a reference number.

Defines the tax period (e.g., Quarter 3 – 2024).

Sets the period from and to dates.

Taxpayer Information:

Captures the taxpayer’s TIN, VAT Account Number, Identification Number, name, and address.

VAT Return Form:

Calculates VAT on sales and purchases.

Includes sections for standard rated sales, sales on which the government bears the VAT, zero-rated domestic sales, exports, exempt sales, standard rated domestic purchases, imports, zero-rated purchases, exempt purchases, and total purchases.

Determines the VAT payable amount by considering total VAT due, corrections from previous periods, and VAT credit carried forward.

VAT-Return History:

Provides a summary of previous VAT & Tax Return submissions to ZATCA.

#zatca#VATManagement#SaudiTax#ZakatSoftware#TaxCompliance#ERPZATCA#eInvoicing#VATreporting#ZakatCalculator#TaxAutomation#SaudiSME#RealTimeVAT#TaxAudit#ZATCAintegration#taxplanning#VATfraudDetection#zakatchallenge#Declaration#TaxAnalytics#SaudiFinance#vatinvoice#taxreturn

0 notes

Text

Efficient VAT data processing is essential for businesses operating in Saudi Arabia to comply with ZATCA (Zakat, Tax, and Customs Authority) regulations. ALZERP Cloud ERP Software offers comprehensive features for VAT data processing, ensuring accurate VAT reporting and compliance. This article explores the capabilities of ALZERP Cloud ERP Software in VAT data processing, from connecting with the…

0 notes

Text

VAT Data Processing in ALZERP Cloud ERP Software

Efficient VAT data processing is essential for businesses operating in Saudi Arabia to comply with ZATCA (Zakat, Tax, and Customs Authority) regulations. ALZERP Cloud ERP Software offers comprehensive features for VAT data processing, ensuring accurate VAT reporting and compliance. This article explores the capabilities of ALZERP Cloud ERP Software in VAT data processing, from connecting with the…

#Automated tax compliance#Saudi business tax management#Saudi tax audit software#Tax analytics for Saudi businesses#tax filing software#Tax management system#tax planning software#VAT invoice management#VAT management#ZATCA e-invoicing solution

0 notes

Text

VAT Data Processing in ALZERP Cloud ERP Software

Key Features of ALZERP’s VAT Data Processing:

ZATCA Server Integration: ALZERP seamlessly connects with the ZATCA server using the business identification number, enabling real-time data exchange and synchronization.

Data Synchronization: The software automatically synchronizes various data points, including opening balances, purchase and LC details, VAT sales, item returns, expenses, voucher data, and data corrections.

VAT Return and Zakat Return Calculation: ALZERP accurately calculates VAT and Zakat return amounts based on the synchronized data, ensuring compliance with tax regulations.

Separate Invoice Management: Invoices from sales are created in a separate table, allowing for efficient tracking and management.

Non-VAT Invoice Processing: ALZERP automatically processes non-VAT invoices with the applicable 15% VAT amount.

Invoice Item Synchronization: Any changes made to items in VAT invoices are reflected in the corresponding non-VAT invoices, maintaining consistency.

Opening Balance Synchronization: ALZERP synchronizes opening balances for products, stock, parties, and accounts heads as of December 31, 2022.

Purchase and LC Synchronization: The software synchronizes purchase and LC data within specified date ranges, capturing all relevant transactions.

VAT Sales Synchronization: VAT sales data is synchronized, including the option to enable automatic ZATCA submission.

Sold Item Returns Synchronization: Returned items are recorded in a separate table, and existing data within the same date range is replaced.

Voucher Data Processing: ALZERP processes expenses and bookkeeping vouchers, excluding non-VATable items and focusing on relevant payment, receipt, and journal vouchers.

Data Correction and Reprocessing: The software allows for rechecking and correcting synced data, processing bank statements, and reprocessing sales as needed.

#ZATCA compliant software#VAT management#Zakat calculation software#Tax management system#ZATCA e-invoicing solution#Saudi tax compliance software#Zakat and tax automation#VAT reporting software KSA#ZATCA approved ERP#tax filing software#Zakat assessment tool#VAT return automation Saudi#ZATCA integration software#Saudi business tax management#Zakat and income tax software#Real-time VAT reporting KSA#ZATCA electronic invoicing#Saudi tax audit software#Zakat and VAT calculator#Automated tax compliance#ZATCA digital reporting platform#Saudi VAT reconciliation software#Zakat declaration software#Tax analytics for Saudi businesses#ZATCA-compliant e-invoicing system#tax planning software#Zakat and tax consultation tool#VAT management for Saudi SMEs#ZATCA data submission software#Saudi corporate tax software

0 notes

Text

Manage Customers, Suppliers, Customs Clearing Agents & Other Vendors in ALZERP Cloud ERP Software

ALZERP, a leading ERP solution in Saudi Arabia, simplifies business operations through its comprehensive Party Setup feature. This essential tool effectively manages relationships with Customers, Suppliers, Customs Agents, and Other Vendors. Designed for wholesale, retail, and distribution businesses, Party Setup streamlines processes and ensures seamless interaction with external parties. By…

View On WordPress

0 notes

Text

How to manage Customers, Suppliers, Customs Clearing Agents & Other Vendors in ALZERP Cloud ERP Software?

🚀 Effortless Management of Customers, Suppliers, and More with ALZERP Cloud ERP! 🚀

Managing business relationships has never been easier! With ALZERP Cloud ERP Software, you can efficiently handle all your key partners, including Customers, Suppliers, Customs Clearing Agents, and Other Vendors.

📝 How It Works:

🔹 Party Setup Form: Simplify the process of adding and managing all your business contacts in one place.

🔹 Streamlined Operations: Keep your wholesale, retail, and distribution business running smoothly by organizing your Customers, Suppliers, and other key partners efficiently.

🔹 Enhanced Collaboration: Improve communication and coordination with your Vendors and Customs Agents.

ALZERP makes it simple to stay organized, boost productivity, and build stronger business relationships. Ready to take your business management to the next level?

📈 Try ALZERP Cloud ERP Software today!

#ALZERP#ERPSoftware#CustomerManagement#SupplierManagement#BusinessEfficiency#CloudERP#VendorManagement#SaudiArabiaBusiness#Wholesale#Retail#Distribution

0 notes

Text

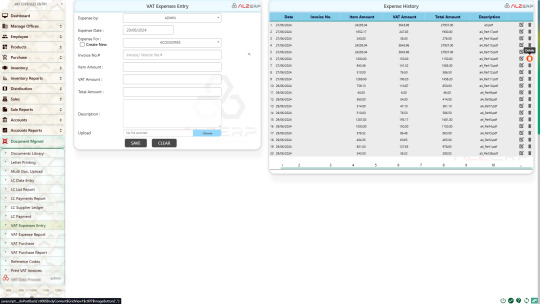

VAT Paid Expenses Posting in ALZERP Cloud ERP Software

Managing VAT-paid expenses is a crucial aspect of maintaining tax compliance and ensuring accurate financial reporting, especially for businesses operating in Saudi Arabia. ALZERP Cloud ERP Software offers a comprehensive solution for recording, tracking, and reporting VAT-paid expenses, fully compliant with the guidelines set by the Zakat, Tax, and Customs Authority (ZATCA). ALZERP is a leading…

View On WordPress

0 notes

Text

VAT Paid Expenses Posting in ALZERP Cloud ERP Software

Key Features of VAT Paid Expenses in ALZERP

Centralized Tracking: Maintain a comprehensive record of all VAT-paid expenses within a single platform.

ZATKA Compliance: Ensure compliance with ZATKA regulations by accurately recording and reporting VAT-related data.

Expense Categorization: Categorize expenses for better analysis and reporting.

Document Uploads: Attach supporting tax invoices to each expense entry for verification.

VAT Calculation: Automatically calculate VAT amounts based on expense values.

Expense History: Access a detailed history of all VAT-paid expenses for auditing and reporting purposes.

#ZATCAcompliant#VATmanagement#SaudiTax#ZakatSoftware#TaxCompliance#ERPZATCA#eInvoicing#VATreporting#ZakatCalculator#TaxAutomation#SaudiSME#RealTimeVAT#TaxAudit#ZATCAintegration#TaxPlanning#VATfraudDetection#ZakatDeclaration#TaxAnalytics#SaudiFinance#VATinvoice

0 notes

Text

Documents Management in ALZERP Cloud ERP Software

In today’s fast-paced business environment, managing and organizing documents effectively is crucial for operational efficiency. ALZERP Cloud ERP Software offers a robust Documents Library or File Storage feature, designed to streamline document management and ensure your business remains agile, compliant, and efficient. This article delves into the comprehensive capabilities of the Documents…

#Affordable Letter Printing Solutions#AI-powered Document Management#Audit Trails#AuditTrail#Automated Letter Generation with Merge Fields#Automated Letter Printing ERP#Best Cloud Document Management Systems#Best Letter Printing System for ERP#Business Letter Automation#Centralized Document Storage ERP#Cloud Document Storage#Cloud ERP Compliance Document Management#Cloud ERP Document Management#Cloud-Based Document Audit Trail#Cloud-Based Document Collaboration#Cloud-Based Document Management#Cloud-based File Management ERP#Cloud-based Letter Printing for ERP#CloudDocumentManagement#Compliance Management#Custom Letter Printing ERP#Customizable Letter Templates in ERP#Digital Document Management#Digital Document Management ERP#Document Generation ERP#Document Lifecycle Management Cloud#Document Management System (DMS)#Document Management System for Finance#Document Management System for Healthcare#Document Process Automation Cloud

0 notes

Text

Documents Library in ALZERP Cloud ERP Software

Key Features of the Documents Library

Automatic Document Uploads: Documents from various ERP modules, such as sales, purchase, vouchers, and employee transactions, are automatically added to the library.

Document Conversion: Image files are automatically converted to PDF format for universal compatibility.

Advanced Search: Easily find documents by date, number, type, or other criteria.

Multiple File Actions: Download single files or merge multiple PDFs for streamlined access.

Document Organization: Categorize documents into folders for better organization and retrieval.

Document Security: Ensure secure storage and access control for sensitive documents.

#Cloud ERP Document Management#Document Management System (DMS)#Cloud-Based Document Management#ERP Document Management#Digital Document Management#Document Storage and Retrieval#Paperless Office ERP#ERP Document Control#Secure Document Management in ERP#Electronic Document Management#Document Workflow Automation ERP#Enterprise Content Management (ECM)#Cloud Document Storage#ERP Integrated Document Management#Digital Document Management ERP#Enterprise document control system#Secure Document Storage Cloud ERP#Cloud-based File Management ERP#Cloud-Based Document Collaboration#Centralized Document Storage ERP#Document Retention#Record Management#Compliance Management#ERP Document Tracking#Audit Trails#Cloud ERP Compliance Document Management#Cloud-Based Document Audit Trail#Document Lifecycle Management Cloud#Document Process Automation Cloud#Best Cloud Document Management Systems

0 notes

Text

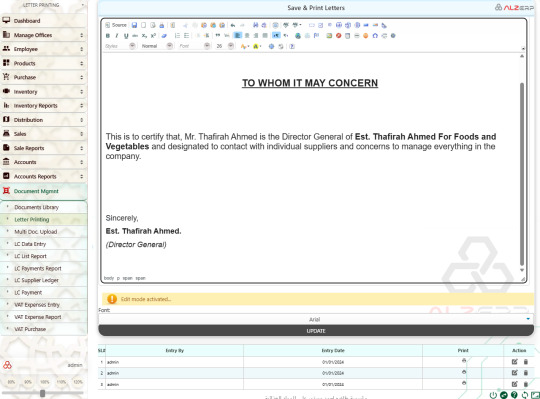

Letter Printing in ALZERP Cloud ERP Software

Efficient communication is a cornerstone of any successful business, especially when dealing with official matters that require formal documentation. ALZERP Cloud ERP Software introduces a powerful and user-friendly Letter Printing feature designed to simplify the creation, management, and retrieval of official letters. This feature is an essential tool for businesses needing to generate formal…

View On WordPress

0 notes

Text

Letter Printing in ALZERP Cloud ERP Software

Key Features of the Letter Printing Feature

MS Word-like Editing Interface: Enjoy a familiar editing experience with features similar to Microsoft Word.

Template Creation: Save frequently used letter templates for future reuse, streamlining the letter-generation process.

Company Letterhead Integration: Automatically include your company’s letterhead and watermark logo for a professional appearance.

Search and Retrieval: Easily find and retrieve letters based on various criteria, such as written date, author, or recipient.

#CloudERP#DocumentManagement#ERPDocumentManagement#CloudDocumentManagement#PaperlessOffice#DigitalDocumentManagement#SecureDocumentManagement#DocumentWorkflowAutomation#EnterpriseContentManagement#CloudDocumentStorage#DocumentControl#ComplianceManagement#DocumentRetention#AuditTrail#DocumentLifecycleManagement#AIpoweredDocumentManagement#ScalableDocumentManagement#DocumentManagementHealthcare#DocumentManagementFinance#LetterPrintingERP#AutomatedLetterPrinting#CustomLetterTemplates#LetterPrintingSoftware#BusinessLetterAutomation#LegalDocumentGeneration#HRLetterTemplates

0 notes