#SaudiTax

Explore tagged Tumblr posts

Text

ZATCA VAT & Tax Return System in ALZERP Cloud ERP Software

Key Components of the VAT Return System:

Return Details:

Specifies the return type (Value Added Tax – Quarterly).

Indicates whether it’s a new or existing return.

Assigns a reference number.

Defines the tax period (e.g., Quarter 3 – 2024).

Sets the period from and to dates.

Taxpayer Information:

Captures the taxpayer’s TIN, VAT Account Number, Identification Number, name, and address.

VAT Return Form:

Calculates VAT on sales and purchases.

Includes sections for standard rated sales, sales on which the government bears the VAT, zero-rated domestic sales, exports, exempt sales, standard rated domestic purchases, imports, zero-rated purchases, exempt purchases, and total purchases.

Determines the VAT payable amount by considering total VAT due, corrections from previous periods, and VAT credit carried forward.

VAT-Return History:

Provides a summary of previous VAT & Tax Return submissions to ZATCA.

#zatca#VATManagement#SaudiTax#ZakatSoftware#TaxCompliance#ERPZATCA#eInvoicing#VATreporting#ZakatCalculator#TaxAutomation#SaudiSME#RealTimeVAT#TaxAudit#ZATCAintegration#taxplanning#VATfraudDetection#zakatchallenge#Declaration#TaxAnalytics#SaudiFinance#vatinvoice#taxreturn

0 notes

Text

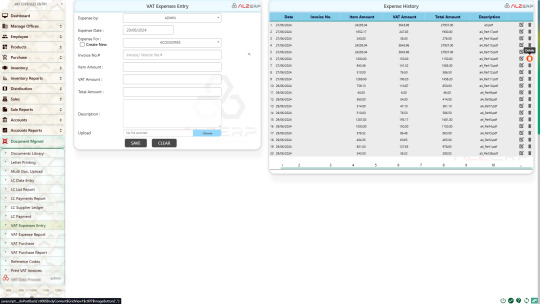

VAT Paid Expenses Posting in ALZERP Cloud ERP Software

Key Features of VAT Paid Expenses in ALZERP

Centralized Tracking: Maintain a comprehensive record of all VAT-paid expenses within a single platform.

ZATKA Compliance: Ensure compliance with ZATKA regulations by accurately recording and reporting VAT-related data.

Expense Categorization: Categorize expenses for better analysis and reporting.

Document Uploads: Attach supporting tax invoices to each expense entry for verification.

VAT Calculation: Automatically calculate VAT amounts based on expense values.

Expense History: Access a detailed history of all VAT-paid expenses for auditing and reporting purposes.

#ZATCAcompliant#VATmanagement#SaudiTax#ZakatSoftware#TaxCompliance#ERPZATCA#eInvoicing#VATreporting#ZakatCalculator#TaxAutomation#SaudiSME#RealTimeVAT#TaxAudit#ZATCAintegration#TaxPlanning#VATfraudDetection#ZakatDeclaration#TaxAnalytics#SaudiFinance#VATinvoice

0 notes